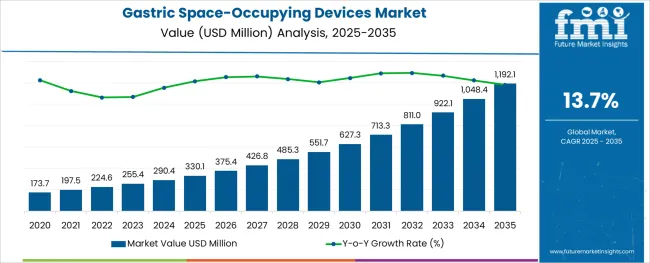

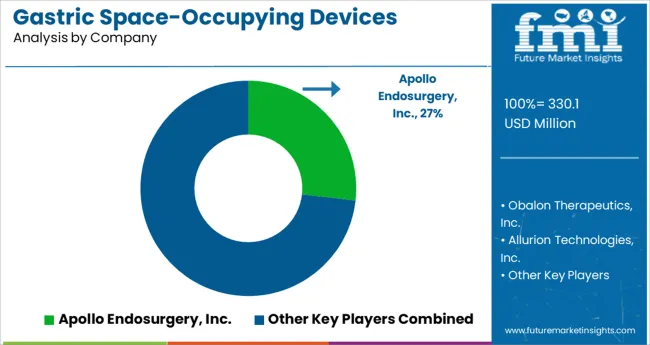

The Gastric Space-Occupying Devices Market is estimated to be valued at USD 330.1 million in 2025 and is projected to reach USD 1192.1 million by 2035, registering a compound annual growth rate (CAGR) of 13.7% over the forecast period.

The gastric space-occupying devices market is expanding steadily, driven by the rising prevalence of obesity and increasing demand for minimally invasive weight management solutions. Growing awareness about obesity-related health risks and the limitations of conventional treatments have directed attention toward effective device-based interventions. Medical professionals are adopting gastric devices as complementary tools that support dietary and lifestyle modifications.

Healthcare infrastructure improvements and expanding bariatric care services have increased access to these treatments. Furthermore, technological advancements have enhanced device safety, comfort, and efficacy, encouraging wider clinical acceptance.

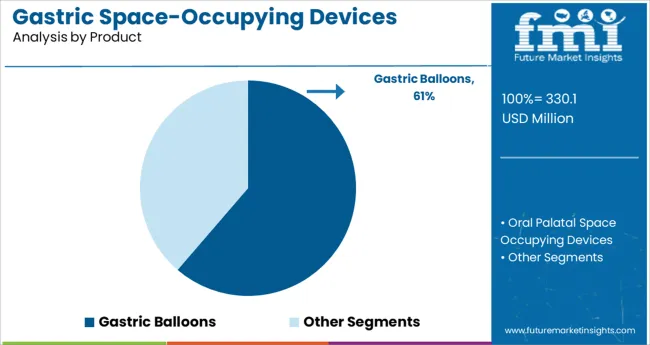

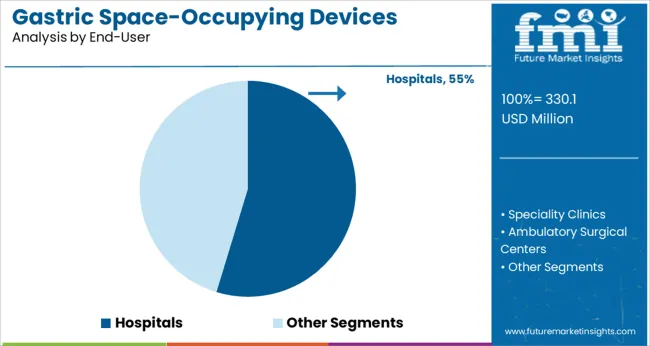

The market outlook remains positive as obesity rates continue to rise globally, driving demand for non-surgical weight loss options. Segmental growth is expected to be led by gastric balloons due to their minimally invasive nature and by hospitals as the primary end-user given their role in patient care and procedure administration.

The market is segmented by Product and End-User and region. By Product, the market is divided into Gastric Balloons and Oral Palatal Space Occupying Devices. In terms of End-User, the market is classified into Hospitals, Speciality Clinics, and Ambulatory Surgical Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product and End-User and region. By Product, the market is divided into Gastric Balloons and Oral Palatal Space Occupying Devices. In terms of End-User, the market is classified into Hospitals, Speciality Clinics, and Ambulatory Surgical Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gastric balloons segment is projected to hold 61.3% of the gastric space-occupying devices market revenue in 2025, retaining its position as the leading product category. This dominance is attributed to gastric balloons’ minimally invasive procedure, which does not require surgery and offers a reversible weight loss solution. Clinicians have favored gastric balloons for their ability to induce early satiety and reduce caloric intake effectively.

The segment has benefited from improvements in balloon materials and design that increase patient comfort and reduce complications. Additionally, the procedure’s shorter recovery time compared to surgical options has made it more appealing to patients.

The widespread adoption of gastric balloons in weight management programs and their inclusion in multidisciplinary care have further contributed to segment growth.

The hospitals segment is projected to represent 54.7% of the market revenue in 2025, maintaining its lead among end users. Growth in this segment has been driven by hospitals’ capability to provide comprehensive bariatric services including device implantation and patient monitoring. Hospitals offer the necessary clinical infrastructure and trained specialists required for safe and effective gastric balloon procedures.

Additionally, hospital settings facilitate multidisciplinary care approaches involving dietitians, psychologists, and physicians, which enhance treatment outcomes.

The expansion of obesity treatment centers within hospitals and increasing referral patterns have further supported market growth. With hospitals serving as key access points for weight loss interventions, this segment is expected to remain the primary channel for gastric space-occupying device deployment.

The market value for gastric space-occupying devices was approximately 5.5% of the overall USD 290.4 Billion worth weight loss management market in 2024. Sales of gastric space-occupying devices increased at a CAGR of 5.4% between 2020 to 2024, owing to high demand for minimally invasive surgeries for obesity management.

The global prevalence of obesity almost tripled between 1975 and 2024. In 2024, globally over 2 billion adults were overweight (body mass index (BMI) > 25) and more than 600 million were obese (BMI > 30). In Europe, nearly 50% of the population is overweight and more than 30% is obese.

Obesity, along with its obesity-related disorders such as diabetes, hypertension, non-alcoholic fatty liver disease, hyperlipidemia, and obstructive sleep apnea has become a global burden. If the incidence of obesity continues on its current trajectory, nearly half of the adult population will have obesity issues by 2035.

Although widely accessible for managing obesity, traditional therapeutic modalities including lifestyle change and dietary counselling are less effective. Contrarily, patients who have not improved after receiving more conventional medical care but prefer not to undergo surgery can consider anti-obesity medical devices.

Gastric space-occupying devices are positioned to bridge the gap between more conservative treatments and more aggressive interventions such as bariatric surgery. Gastric space-occupying device therapy is more advantageous when compared to bariatric surgery, as they are less invasive in nature, and promote ease of performance, and reversibility.

These devices are available upon prescription or as over-the-counter products. Thus, several advantages of these medical devices are expected to increase the demand for gastric space-occupying devices during the forecast period.

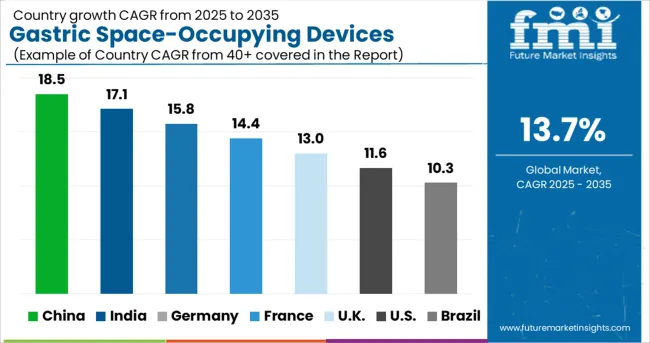

Owing to the rising prevalence of obesity and growing demand for minimally invasive surgical procedures in obesity treatment, demand in the global gastric space-occupying devices market is anticipated to grow at a CAGR of 13.7% during the forecast period.

Endoscopic bariatric therapies can be a sustainable treatment option for obesity management. Along with safety and efficacy of data, these therapies will be the most successful treatment in the next few years. Several researchers are focusing on the tandem and progressive use of a combination of space-occupying endoscopic devices and weight loss drug treatment to enhance the stability of weight loss with a long-lasting effect on obesity and associated diseases.

The global healthcare burden due to obesity accounts for around USD 2 trillion yearly or around 2.8% of GDP. This is approximately equal to the worldwide effect of smoking or armed violence, war, and terrorism (McKinsey Global Institute, 2014). The tax on obesity in healthcare systems alone is between 2% and 7% of all healthcare expenditures in developed countries. These figures indicate that obesity is considered one of the top 3 community problems.

To manage the obesity-related healthcare burden, governments are taking initiatives to create awareness among people which will create opportunities for key players to be actively involved in the development and launch of cost-effective solutions for obesity management.

The key challenges in the development of gastric space-occupying devices are the lack of specific regulatory guidance and inconsistencies in the time and cost of approval processes in different countries.

Awareness is also an obstacle in the adoption of gastric space-occupying devices. In the realm of weight-loss management, they are still relatively unknown to a large part of the population.

Additionally, increasing product recalls are also hampering growth to an extent. Several gastric space-occupying devices have been withdrawn by manufacturers from the market in the USA after approval by the FDA (e.g., ReShape integrated dual balloon system and Garren gastric bubble.

The use of gastric space-occupying devices is a relatively new technology for weight-loss treatment. Lack of reimbursement for such procedures in most countries can potentially hinder growth. Mostly, health insurance plans have fitness criteria of BMI of 35 or 45 for providing reimbursement for obesity management treatments. Though, patients are eligible for gastric space-occupying devices treatment at BMI 27 and are thus not reimbursed.

Furthermore, most countries treat gastric space-occupying devices as a primary procedure which is in the investigational stage. The therapy is not included in the reimbursement policies of Medicaid (CMC) and Medicare in the USA with a similar scenario existing in Australia, Canada, and other countries in Asia and Europe.

High Incidence of Obesity Related Disorders in USA is Spurring Demand for Gastric Space-Occupying Devices

The USA dominated the North America market in 2024, holding about 83.3% of the market share. As per the report, the trend is expected to continue over the assessment period increasing demand for minimally invasive surgeries for obesity management

In 2020, the American Society for Metabolic and Bariatric Surgery (ASMBS) included gastric space-occupying devices in the list of procedures and devices approved by the society as a treatment option. The sanction and endorsements of this treatment by the ASMBS are expected to increase the adoption of gastric space-occupying devices in the USA.

Rapid Adoption of Anti-Obesity Medica Devices in the UK Will Boost Sales

Demand in the UK market is set to increase at a CAGR of 12.5% in the Europe gastric space-occupying devices market during the forecast period.

Non-invasiveness often favoured by both clinicians and patients in the UK Similarly, innovation and techniques to challenge obesity are increasing in the country, and several key players are competing by innovating.

High adoption of obesity management treatments, and the availability of skilled professionals are some of the key factors contributing to the growth in the market.

Rising Preference for Minimally Invasive Surgeries in China Will Fuel Sales

Sales in the China market are expected to increase at a 14.4% CAGR over the assessment period.

In the past four years, the rates of obesity in China have rapidly increased, along with economic growth, urbanisation, and globalisation. According to the Chinese Residents Chronic Diseases and Nutrition report, in China over 50% of adults and 20% of school-age children were found to be obese in 2024. This figure indicates the need for obesity management and increased demand for EBT, which is ultimately fueling demand for gastric space-occupying devices.

Furthermore, several government initiatives to create awareness are also supplementing the growth in the market. For instane, The Obesity Prevention and Control Society of Chinese Nutrition Society (OPCS-CNS) has collaborated with other government bodies to carry out a series of activities to inspire individuals to pay attention to the obesity problem and take more practical actions.

Demand for Gastric Balloons Will Gain Momentum

Based on product type, sales of gastric balloons held the highest market share of about 97.0% in the market in 2024 and are expected to grow at a CAGR of 13.67% over the forecast period. Through endoscopy, gastric balloons are inserted into the body and offer weight loss of up to 7 to 8 pounds.

An average 7-pound weight loss is possible with the Orbera gastric balloon. The Obalon gastric balloon, on the other hand, offers an average of 7.4 pounds, or 3.42 percent of their total body weight.

Adoption of Obesity Management Pharmacotherapies in Hospitals Will Remain High

Hospitals held the highest share of 59.0% in 2024. Rising prevalence of obesity, along with growing healthcare investments across the globe, and government policies for the execution of superior patient care are driving sales in this segment.

Similarly, new clinical trials conducted in multi-speciality hospitals will provide opportunities to the patients to explore new experimental therapies, thus boosting demand.

The gastric space-occupying devices market is fairly consolidated and led by few market players. These players are focusing on product development and expansion strategies to gain traction in the market. For instance:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 330.1 million |

| Projected Market Valuation (2035) | USD 1192.1 million |

| Value-based CAGR (2025 to 2035) | 13.7% |

| Forecast Period | 2020 to 2024 |

| Historical Data Available for | 2025 to 2035 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Argentina, the UK, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC, North Africa, and South Africa |

| Key Market Segments Covered | Product, End User, and Region |

| Key Companies Profiled | Apollo Endosurgery, Inc.; Obalon Therapeutics, Inc.; Allurion Technologies, Inc.; Helioscopie; Endalis; MEDSIL; ReShape Medical, Inc.; Lexel Medical; Scientific Intake |

The global gastric space-occupying devices market is estimated to be valued at USD 330.1 million in 2025.

It is projected to reach USD 1,192.1 million by 2035.

The market is expected to grow at a 13.7% CAGR between 2025 and 2035.

The key product types are gastric balloons and oral palatal space occupying devices.

hospitals segment is expected to dominate with a 54.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gastric Electrical Stimulators Market Growth - Trends & Forecast 2025 to 2035

Gastric Bands Market Analysis – Trends, Share & Forecast 2024-2034

Intra-gastric Balloons Market Size and Share Forecast Outlook 2025 to 2035

HER2 Positive Gastric Cancer Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA