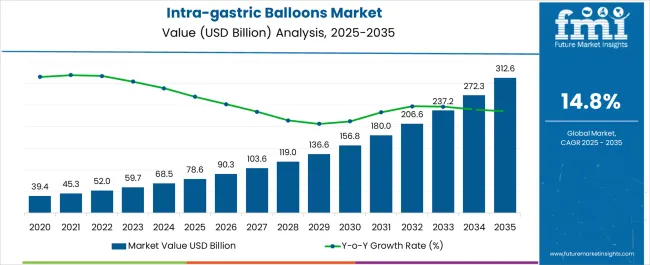

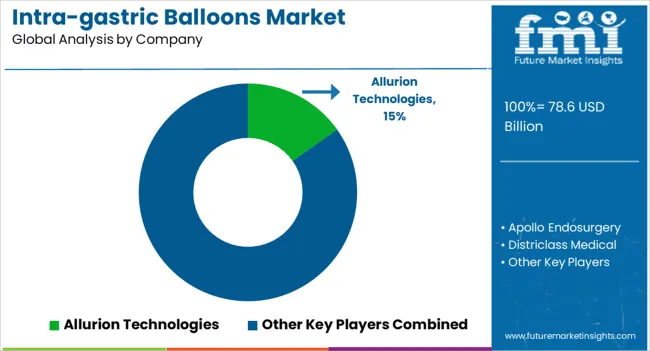

The Intra-gastric Balloons Market is estimated to be valued at USD 78.6 billion in 2025 and is projected to reach USD 312.6 billion by 2035, registering a compound annual growth rate (CAGR) of 14.8% over the forecast period.

| Metric | Value |

|---|---|

| Intra-gastric Balloons Market Estimated Value in (2025 E) | USD 78.6 billion |

| Intra-gastric Balloons Market Forecast Value in (2035 F) | USD 312.6 billion |

| Forecast CAGR (2025 to 2035) | 14.8% |

The intra-gastric balloons market is experiencing steady expansion, supported by the rising prevalence of obesity and the growing adoption of minimally invasive weight-loss solutions. Demand is being driven by increasing awareness about the health risks associated with obesity, including cardiovascular disease, diabetes, and gastrointestinal complications. The growing preference for endoscopic procedures that offer safety, reversibility, and shorter recovery times is boosting acceptance among patients and healthcare providers.

Advancements in balloon technology, including improvements in material durability and adjustable volume features, are enhancing treatment outcomes and patient compliance. Regulatory approvals in key markets and the inclusion of these devices in multidisciplinary obesity management programs are further supporting adoption.

With rising healthcare expenditures and growing emphasis on reducing obesity-related healthcare costs, intra-gastric balloons are gaining prominence as an alternative to bariatric surgery As global obesity rates continue to climb and healthcare systems prioritize preventive interventions, the market is expected to maintain strong growth momentum, supported by innovation and broader clinical acceptance.

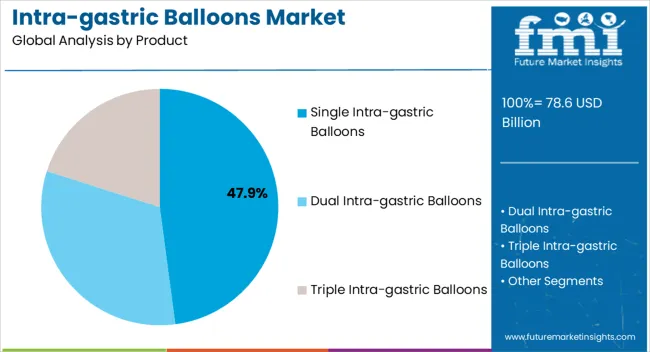

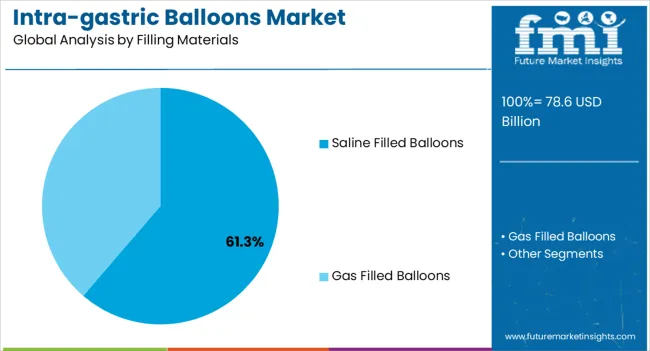

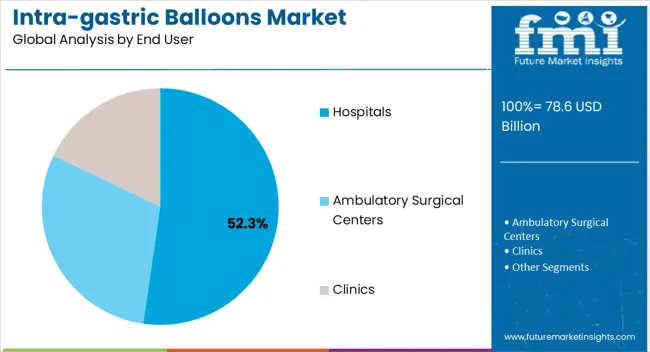

The intra-gastric balloons market is segmented by product, filling materials, end user, and geographic regions. By product, intra-gastric balloons market is divided into Single Intra-gastric Balloons, Dual Intra-gastric Balloons, and Triple Intra-gastric Balloons. In terms of filling materials, intra-gastric balloons market is classified into Saline Filled Balloons and Gas Filled Balloons. Based on end user, intra-gastric balloons market is segmented into Hospitals, Ambulatory Surgical Centers, and Clinics. Regionally, the intra-gastric balloons industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single intra-gastric balloons segment is projected to hold 47.9% of the intra-gastric balloons market revenue share in 2025, positioning it as the leading product type. Its dominance is being supported by simplicity in insertion, cost-effectiveness, and proven efficacy in achieving weight reduction. The relatively straightforward deployment procedure and shorter procedural times compared to multiple-balloon systems make it a preferred option for physicians and patients.

Increased clinical evidence highlighting the effectiveness of single-balloon systems in reducing body mass index and improving comorbid conditions has further reinforced adoption. Accessibility and affordability are playing a crucial role in expanding utilization, particularly in healthcare systems that seek efficient and scalable solutions for obesity management.

The segment’s success is also being supported by its ability to integrate into outpatient care models, which reduce hospital stays and associated costs As obesity treatment continues to shift toward minimally invasive approaches, single intra-gastric balloons are expected to retain their leadership position, supported by strong clinical outcomes and favorable economics.

The saline filled balloons segment is expected to account for 61.3% of the intra-gastric balloons market revenue share in 2025, making it the leading filling material category. This leadership is being reinforced by their widespread acceptance among clinicians due to enhanced safety, biocompatibility, and ease of monitoring. Saline filled devices allow for early detection of balloon leakage through changes in urine color, which improves patient safety and reduces complication risks.

The segment is also benefiting from lower manufacturing complexity compared to gas-filled systems, which makes them more cost-efficient and accessible across healthcare settings. Increased adoption is being supported by robust clinical evidence demonstrating consistent performance and significant weight-loss outcomes with saline filled balloons.

Healthcare providers favor this category for its reliability and ability to be easily managed in both inpatient and outpatient environments As demand for safe, effective, and affordable obesity management devices continues to rise, saline filled balloons are anticipated to maintain their dominant role in the market.

The hospitals segment is anticipated to represent 52.3% of the intra-gastric balloons market revenue share in 2025, making it the largest end-use category. Its dominance is being driven by the availability of advanced endoscopic facilities, skilled healthcare professionals, and comprehensive patient monitoring systems within hospital settings. Hospitals are preferred for intra-gastric balloon procedures due to their ability to provide safe insertion, manage potential complications, and deliver multidisciplinary care involving dieticians, gastroenterologists, and bariatric specialists.

Rising hospital-based obesity treatment programs and increasing collaborations between device manufacturers and healthcare institutions are contributing to segment growth. Patient preference for hospitals is also being reinforced by the perception of higher safety standards and the availability of post-procedure support.

As obesity-related healthcare demands increase globally, hospitals are expected to continue playing a central role in the adoption and utilization of intra-gastric balloons This segment is likely to maintain its leadership as healthcare providers emphasize comprehensive care models that ensure patient safety, treatment effectiveness, and improved long-term outcomes.

Studies reveal that over 2 billion people are suffering from obesity and about 3 million people lose their lives each year due to obesity. Intra-gastric balloons have emerged as a boon for shedding weight and reducing obesity.

The healthcare sector is increasingly shifting towards non to minimally invasive procedures from surgical weight loss treatments, keeping patient convenience at top.

Faster approvals from regulatory bodies such as the US FDA and its associated treatment followed by the American Society for Metabolic and Bariatric Surgery are further standardizing the application of intra-gastric balloons.

High adoption of minimally invasive surgeries by obese patients, owing to increased risks from invasive weight-loss treatments, is fueling the demand for intra-gastric balloons. Intra-gastric balloons are gaining a good reputation as they are cost-effective.

According to the American Society for metabolic and Bariatric Surgery (ASMBS), after receiving approval from the US FDS, more than 5000 implantation of intra-gastric balloon have been successfully processed.

Involvement of robotics to help doctors for minimal invasive procedures is proving to be a perk in the healthcare sector. With the help of robots, pace of surgical operations has risen from 1.8% to 15%.

Moreover, the JAMA Network Open has discovered that colon operations conducted with help of robots were safer than open operations. Furthermore, market players are innovating intra-gastric balloons to further reduce the cost of expensive surgeries.

Case in point, Allurion technologies has developed the world's first swallowable non-invasive intra-gastric balloons.

Several medical insurance companies do not involve endoscopic intra-gastric balloons in their reimbursement policies, restricting from undergoing this procedure. Side effects caused due to intra-gastric balloons such as gastric ulcers, erosions, and nausea are a major challenge for market players. Further, patients have to stick to strict diet rules while the balloon is in place.

The COVID-19 pandemic is having an adverse impact on the intra-gastric balloons market. With governments across the world imposing nationwide lockdowns, several healthcare units have been shut down.

Gastroenterologists are kept away from frontline operations for COVID-19 treatment. Healthcare professionals, especially in Italy, are in process to carry out the removal of intra-gastric balloons which are in their maturity period, states the NCBI.

Healthcare professionals are taking utmost care for treatment at their personal clinics and are serving emergency patients to stop the spread of coronavirus. According to the British Journal of Surgery (BJS) Society, gastrointestinal surgeries have dropped by 90% during the pandemic.

Such notable decline in demand are hitting the profit margins of intra-gastric balloon manufacturers.

North America continues to remain in the vanguard of the intra-gastric balloons market, owing to rising cases of obesity and increasing adoption of bariatric procedures.

The region is tech center for healthcare center. Furthermore, rising investments in advanced healthcare in tandem with favorable reimbursement policies are creating conducive grounds for market players.

Asia Pacific (APAC) is projected to emerge as the most lucrative region in intra-gastric balloons market in coming years. Increasing government investments in healthcare sector in emerging countries such as India, and China are fueling market growth.

Additionally, rising trend of medical tourism and minimally non-invasive technologies in the region are attracting stakeholders.

The intra-gastric balloons market is fairly consolidated and lead by few market players. These market players are continuously focusing upon product development. For instance,

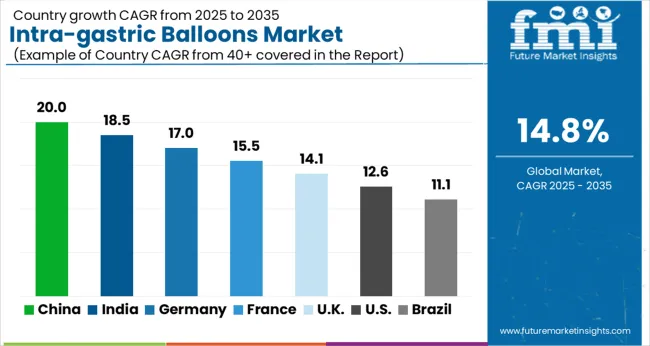

| Country | CAGR |

|---|---|

| China | 20.0% |

| India | 18.5% |

| Germany | 17.0% |

| France | 15.5% |

| UK | 14.1% |

| USA | 12.6% |

| Brazil | 11.1% |

The Intra-gastric Balloons Market is expected to register a CAGR of 14.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 20.0%, followed by India at 18.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 11.1%, yet still underscores a broadly positive trajectory for the global Intra-gastric Balloons Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 17.0%. The USA Intra-gastric Balloons Market is estimated to be valued at USD 26.9 billion in 2025 and is anticipated to reach a valuation of USD 88.0 billion by 2035. Sales are projected to rise at a CAGR of 12.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 4.3 billion and USD 2.0 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 78.6 Billion |

| Product | Single Intra-gastric Balloons, Dual Intra-gastric Balloons, and Triple Intra-gastric Balloons |

| Filling Materials | Saline Filled Balloons and Gas Filled Balloons |

| End User | Hospitals, Ambulatory Surgical Centers, and Clinics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allurion Technologies, Apollo Endosurgery, Districlass Medical, Helioscopie Medical Implants, Silimed, Lexel, Medsil, Obalon Therapeutics, ReShape Medical, Spatz, Life Partners Europe, and Tulip Medical |

The global intra-gastric balloons market is estimated to be valued at USD 78.6 billion in 2025.

The market size for the intra-gastric balloons market is projected to reach USD 312.6 billion by 2035.

The intra-gastric balloons market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in intra-gastric balloons market are single intra-gastric balloons, dual intra-gastric balloons and triple intra-gastric balloons.

In terms of filling materials, saline filled balloons segment to command 61.3% share in the intra-gastric balloons market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cutting Balloons Market Insights – Growth, Demand & Forecast 2025 to 2035

Middle East and Africa Latex Foil Balloons Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA