The cutting balloons market is valued at USD 469.9 million in 2025. As per FMI's analysis, the cutting balloons industry will grow at a CAGR of 5.6% and reach USD 810.2 million by 2035.

In 2024, the industry witnessed steady growth, primarily driven by an increase in complex percutaneous transluminal angioplasty procedures across developed and emerging economies. The adoption of cutting balloons was particularly strong in hospitals and specialty cardiovascular centres, where physicians preferred their precise incision capabilities in treating in-stent restenosis and heavily calcified lesions.

North America continued to dominate the industry, accounting for a significant share due to favourable reimbursement policies and increased awareness among healthcare professionals. Meanwhile, the Asia-Pacific region showed early signs of rapid adoption, fueled by improvements in healthcare infrastructure and growing incidences of peripheral artery disease.

Another key trend in 2024 was the technological refinement of cutting balloon catheters, with manufacturers introducing devices featuring enhanced trackability and lower profile designs, enabling easier navigation in complex anatomies. Collaborations between medtech companies and healthcare institutions for clinical trials further contributed to industry momentum.

Looking ahead to 2025 and beyond, the industry is expected to benefit from the aging population, the rise in minimally invasive procedures, and broader access to interventional cardiology treatments. Innovation and geographic expansion are likely to be key growth drivers.

Market Value Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 469.9 million |

| Industry Value (2035F) | USD 810.2 million |

| CAGR (2025 to 2035) | 5.6% |

The cutting balloons industry is on a steady growth trajectory, driven by the rising demand for minimally invasive cardiovascular procedures. Increasing cases of complex arterial blockages and advancements in balloon catheter technology are fueling adoption across hospitals and specialty clinics. Medical device manufacturers with innovative, low-profile designs stand to gain, while traditional balloon catheter providers may lose share without product upgrades.

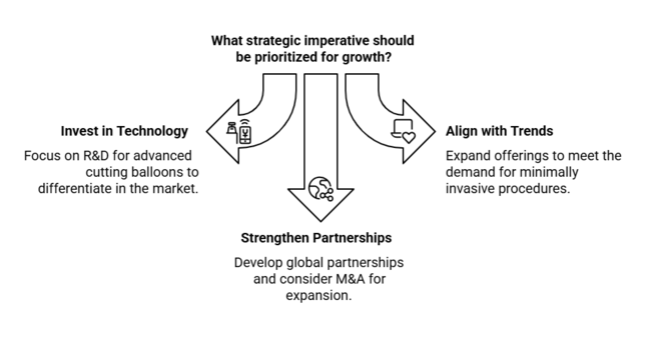

Invest in Next-Gen Cutting Balloon Technology Prioritize R&D to develop lower-profile, highly trackable cutting balloons that cater to complex and calcified lesion cases, ensuring differentiation in a competitive industry.

Align with Minimally Invasive Treatment Trends Expand product portfolios and marketing efforts to align with the global shift toward minimally invasive cardiovascular procedures, particularly in aging populations and emerging economies.

Strengthen Global Distribution and Strategic Partnerships Forge partnerships with hospitals, cardiovascular centres, and local distributors in high-growth regions like Asia-Pacific to expand reach, while considering M&A opportunities to access new technologies or industries.

| Risk | Probability & Impact |

|---|---|

| Technological Advancements by Competitors | High Probability, High Impact |

| Regulatory Hurdles and Compliance Delays | Medium Probability, High Impact |

| Economic Downturn Affecting Healthcare Budgets | Medium Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Next-Gen Balloon Prototypes | Develop and test cutting balloon prototypes with improved trackability and low profile. |

| Clinical Trial Initiation | Initiate clinical trials to assess performance in complex arterial blockages. |

| Distribution Partnerships | Establish distribution partnerships in emerging industries like Asia-Pacific. |

To stay ahead, companies must prioritize innovation in cutting balloon technology, focusing on enhancing catheter precision and minimizing profiles for complex lesions. Expanding clinical trials and establishing strategic partnerships in high-growth regions, especially Asia-Pacific, will be critical for industry penetration.

Furthermore, investing in minimally invasive procedure solutions and aligning with global healthcare trends will position the company as a leader in the evolving cardiovascular industry. This intelligence shifts the roadmap towards accelerating R&D, global distribution, and clinical validation, ensuring the company captures a larger industry share while differentiating from competitors.

| Countries | Regulatory Overview |

|---|---|

| United States | Regulated by FDA; cutting balloons are Class III devices needing Premarket Approval (PMA), clinical trials, and post-market surveillance. |

| United Kingdom | Regulated by MHRA; UKCA marking required post- Brexit. CE marks accepted till mid-2025. Focus on post- industry reporti ng. |

| France | Under ANSM; devices must comply with EU MDR and have CE mark. Emphasis on c linical performance evaluation. |

| Germany | Regulated by BfArM ; CE certification via notified bodies like TÜV. MDR-compliant with focus on safety and traceability. |

| Italy | Requires EU MDR-compliance and CE mark. Products must be registered in national me dical device database (BD/RDM). |

| South Korea | Regulated by MFDS; requires Class III approval, Korean GMP (KG MP), and local representation. |

| Japan | Regulated by PMDA; requires Shonin approval, QMS compliance, and fore ign manufacturer accreditation. |

| China | Regulated by NMPA; Class III status requires local trials, Chin a GMP, and CMDE review. |

| Australia & NZ | Australia’s TGA requires ARTG listing, gradually moving toward local conformity assessments. NZ’s M edsafe aligns closely with TGA. |

Drug-coated cutting balloons are expected to witness the highest growth in the product segment, with a forecasted CAGR of 6.0% between 2025 and 2035. This is mainly due to their capability to directly deliver anti-proliferative drugs to vessel walls, minimizing the use of stents and lowering restenosis rates.

Clinical trials have proven their effectiveness in the treatment of coronary artery disease, resulting in higher adoption by healthcare providers. The synergy between mechanical plaque modification and localized drug delivery makes drug-coated cutting balloons a preferred option in interventional cardiology. By Application:

In the application segment, Peripheral Artery Disease (PAD) is expected to be the most rapidly growing segment with a forecasted CAGR of 6.2% between 2025 and 2035. Growing prevalence of PAD, along with technological advancements in minimally invasive interventions, has contributed to greater use of cutting balloons for this indication.

Their accuracy in remodeling calcified lesions without extensive vessel trauma makes them well suited to PAD procedures. With growing awareness and diagnosis of PAD worldwide, demand for advanced devices such as cutting balloons is likely to grow enormously, driving industry growth.

Among the end users, the highest growth is expected in the case of hospitals, at a CAGR of 5.8% for the period from 2025 to 2035. Hospitals are centrally involved in CAD detection, treatment, and management. They offer varied therapies to patients with CAD, including diagnostic intervention, surgery, and rehabilitation activities. Advanced medical technology, experienced cardiologists, and inter-professional teams are all present in ho

United States sales are forecast to increase at a CAGR of 6.0% between 2025 and 2035. The USA remains the most profitable sector for cutting balloons, aided by an extremely developed interventional cardiology environment and very high rates of percutaneous coronary interventions (PCIs).

Hospitals and cardiac centers are embracing minimally invasive technologies at a fast pace, and cutting balloons are gaining popularity in complex lesion treatment. Favorable reimbursement policies and established R&D presence also contribute to growth. Manufacturer strategic investments and ongoing innovation in balloon design have made the USA a market leader. Growing aging population further drives demand.

Cutting balloons market in the United Kingdom are expected to grow at a CAGR of 5.4% over the forecast period. The UK market is mature but developing steadily owing to heightened awareness and availability of advanced cardiovascular interventions. The National Health Service (NHS) is focusing on value-based care, resulting in the trend toward precision devices such as cutting balloons for lesion preparation.

In spite of post-Brexit regulatory sophistication, innovation-stimulating policy and cardiovascular disease funding support business momentum. Privatization initiatives and cardiac infrastructure development are influencing higher utilization rates of minimally invasive procedures. Urban areas of England are showing a significant spike in PCI volume.

The French market is expected to expand at 5.6% CAGR between 2025 and 2035 in line with overall global averages. France enjoys a growing population and robust public healthcare infrastructure, underpinning steady demand for cardiovascular devices. French cardiac centres and hospitals have high procedural standards, frequently embracing newer devices such as cutting balloons for certain uses like calcified lesions.

Government-backed innovation clusters and collaborations with medtech firms facilitate the launch of advanced devices. The reimbursement scenario continues to be stable, and efforts to debacklog surgery are expected to further drive industry growth, especially in university and tertiary hospitals.

German sales are estimated to expand at a CAGR of 5.9% till 2035. Germany is a significant interventional cardiology hub in Europe with strong representation of medical device companies and high procedure volume. Balloon cutting is becoming increasingly popular as a result of its effectiveness in complicated plaque modification, and German hospitals often lead the way with their clinical introduction.

Favorable insurance coverage, high healthcare expenditure, and national focus on innovation continue to underpin this development. Medical training and technological acceptance are sophisticated, facilitating quicker clinical adoption. Moreover, demand is increasing beyond city centers to more regional hospitals, making Germany a high-potential sector.

In Italy sales are expected to grow at a CAGR of 5.5% over the next decade. The Italian industry is gradually embracing cutting balloons as a tool for lesion preparation, particularly in public hospital systems. Growth is supported by government efforts to modernize hospital infrastructure and integrate minimally invasive cardiovascular procedures.

Although there is some variation regionally in availability and expertise, demand is increasing in both northern and southern Italy. Joint programs with European health programs also facilitate training and acquisition of new cardiac technology. Ongoing population aging and rising cardiovascular burden are main drivers of continuous growth.

The South Korean industry is poised to grow at a CAGR of 5.2% during the period 2025 to 2035. South Korea is a technologically advanced industry, but the cutting balloon sector is still emerging. Growth is moderate because of price sensitivity and comparatively conservative take-up in public hospitals. But private hospitals and tertiary centres in Seoul and Busan are now starting to embrace cutting-edge instruments for the treatment of complex lesions.

Support from the government for domestic medtech innovation and greater focus on non-invasive cardiology solutions are helping positively. Gradual conversion from conventional balloons to specialty devices such as cutting balloons over the next ten years is likely to gain momentum.

Industry of cutting balloons in Japan are expected to register a CAGR of 5.0% between the forecast period. Though Japan boasts one of the world's most well-developed healthcare systems, its expansion in the cutting balloon market is slower with a conservative attitude toward new treatments. Its high rate of aging population and high rate of chronic cardiovascular disease make the potential high.

But cost-effectiveness and clinical evidence dominate adoption. Usage is presently focused within specialized cardiology centres and university hospitals. As procedural guidelines are developed and additional clinical evidence increases cutting balloon effectiveness, Japan should see a constant industry adoption.

Chinese sales are predicted to expand at a CAGR of 6.4%, the highest among leading industries. Such exceptional growth is initiated by enacting health care reforms, growth in per capita spending on health, and growth of hospital infrastructure. Introduction Cardiovascular disease is now a significant public health issue in China and the government is placing high priority on the capacity-building for interventional cardiology.

The growing availability of competitively priced cutting balloon products by local and foreign manufacturers is expected to drive the demand for cutting balloon devices. The transformation in urbanization and access to tertiary services are driving the growth of procedural volume. The application of new but economical devices has rendered China a significantly profitable prospect for cut balloon manufacturers.

The industry within Australia and New Zealand is also anticipated to develop at a CAGR of 5.6% until 2035. The region mirrors global patterns with robust health care systems and considerable awareness of cardiovascular risk management. Australia, it discovers, leads the way in minimally invasive cardiac procedures, with New Zealand close on its heels.

The influence of government initiatives to lower cardiac mortality and enhance access to specialist treatment has been seen in device adoption. Advanced hospital systems and positive reimbursement arrangements make it easier to incorporate new technologies like cutting balloons into clinical practice. The industry is comparatively small but high value per case.

In the competitive landscape of the cutting balloons industry, top companies adopt various strategies to maintain and grow their industry share. One of the primary strategies is pricing, where companies balance competitive pricing to attract a wide range of customers while ensuring high product quality and profitability.

Innovation is another key approach, with companies heavily investing in research and development to enhance the capabilities of cutting balloons, introducing new features, and improving treatment outcomes. This includes the development of advanced technologies for specialized applications in cardiovascular treatments.

Additionally, companies focus on strategic partnerships, collaborating with healthcare institutions, research organizations, and technology providers to expand their industry reach and diversify product applications. By forming alliances, companies can leverage new technologies, expand their product portfolio, and enter new regional industries.

Moreover, many companies are focusing on geographical expansion, entering emerging industries where the demand for cutting-edge medical devices is rising. This includes mergers, acquisitions, and partnerships that help firms scale operations and strengthen their global presence in key industries. By implementing these strategies, companies aim to stay ahead in a competitive and fragmented industry.

Abbott holds a dominant position in the cutting balloon industry, commanding 21.2% of the total market share. This leadership is attributed to its robust portfolio of interventional devices, with its cutting balloon systems being widely adopted in coronary procedures.

The company’s success is underpinned by strong clinical evidence supporting its products and a well-established global distribution network. Abbott continues to invest in next-generation technologies to address increasingly complex vascular lesions, reinforcing its competitive edge.

Boston Scientific Corporation follows closely with a 21.3% industry share, making it Abbott’s nearest rival. Its Flextome and Wolverine cutting balloon systems have set benchmarks in the industry for precision and control during angioplasty. The company’s recent expansions into emerging markets, along with strategic collaborations with healthcare providers, have further cemented its market presence and widened its reach.

B. Braun Melsungen AG commands a 5.8% share of the market, offering cost-effective vascular intervention solutions. Its SeQuent cutting balloon platform has demonstrated particular traction in European markets. B. Braun’s emphasis on physician training and procedural efficiency helps it maintain a strong competitive position despite the dominance of larger players.

Cook Medical holds 4.5% of the industry share and is known for its specialized devices used in peripheral interventions. The company’s approach centers on delivering tailored solutions for challenging anatomical cases, which has built a loyal base among interventionalists. Steady growth continues through strategic entry into developing healthcare markets.

Cordis accounts for 3.9% of the market, maintaining its legacy in cardiovascular devices. While facing intense competition, Cordis continues to hold relevance by delivering reliable product performance and catering to niche clinical applications within specific vascular territories.

Medtronic possesses an 8.7% market share, leveraging its extensive cardiovascular device portfolio. The company integrates cutting balloon systems into a broader ecosystem that includes imaging and navigation tools, providing physicians with end-to-end solutions for managing complex interventions.

MicroPort Scientific Corporation holds 3.2% of the market, with a rising presence across Asian regions. The company’s strategy focuses on competitive pricing and localized manufacturing, which enables it to gain traction in cost-sensitive markets and expand its footprint steadily.

Opto Circuits (India) Ltd. captures 2.1% of the market, primarily serving the Indian subcontinent and nearby regions. The company benefits from favorable government healthcare initiatives and increasing demand for affordable interventional devices within its domestic market.

Spectranetics, a division of Philips Healthcare, represents 4.3% of the market. The company utilizes Philips’ global healthcare infrastructure to enhance its reach. Its cutting balloon systems are further supported by laser-assisted technologies, providing an edge in treating calcified lesions.

Terumo Corporation holds a 6.5% market share and maintains a strong presence across both coronary and peripheral intervention segments. The company’s consistent performance is bolstered by its global manufacturing capabilities and continued focus on minimally invasive treatment technologies.

The industry is segmented into drug-coated, conventional, scoring

The industry is divided into coronary artery disease, peripheral artery disease

The industry is segmented into hospitals, cardiac centers, ambulatory surgical centers

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East and Africa

Growth is driven by complex angioplasty procedures and technological advancements in cutting balloon catheters.

The Asia-Pacific region is growing rapidly, while North America leads due to favourable reimbursement policies.

The aging population increases the demand for minimally invasive cardiovascular procedures.

Innovations include lower-profile, highly trackable cutting balloons for complex lesions.

Companies can focus on R&D, align with minimally invasive trends, and expand through strategic partnerships.

Table 1: Global Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 2: Global Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 3: Global Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 4: Global Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 5: Global Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Region

Table 6: Global Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2022, By Region

Table 7: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 8: North America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 9: North America Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 10: North America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 11: North America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 12: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 13: Latin America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 14: Latin America Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 15: Latin America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 16: Latin America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 17: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 18: Europe Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 19: Europe Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 20: Europe Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 21: Europe Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 22: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 23: South Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 24: South Asia Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 25: South Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 26: South Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 27: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 28: East Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 29: East Asia Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 30: East Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 31: East Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 32: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 33: Oceania Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 34: Oceania Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 35: Oceania Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 36: Oceania Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 37: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 38: Middle East and Africa Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 39: Middle East and Africa Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Product

Table 40: Middle East and Africa Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 41: Middle East and Africa Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Figure 1: Global Market Volume (Units), 2017 to 2022

Figure 2: Global Market Volume (Units) and Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 3: Global Market, Pricing Analysis per unit (US$), in 2022

Figure 4: Global Market, Pricing Forecast per unit (US$), in 2033

Figure 5: Global Market Value (US$ Million) Analysis, 2017 to 2022

Figure 6: Global Market Forecast and Y-o-Y Growth, 2023 to 2033

Figure 7: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023

Figure 8: Global Market Value Share (%) Analysis 2023 and 2033, By Product

Figure 9: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, By Product

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, By Product

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, By Application

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, By Application

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, By Application

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, By End User

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, By End User

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, By End User

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, By Region

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, By Region

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, By Region

Figure 20: North America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 21: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 22: North America Market Value Share, By Product (2023 E)

Figure 23: North America Market Value Share, By Application (2023 E)

Figure 24: North America Market Value Share, By End User (2023 E)

Figure 25: North America Market Value Share, by Country (2023 E)

Figure 26: North America Market Attractiveness Analysis By Product, 2023 to 2033

Figure 27: North America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 28: North America Market Attractiveness Analysis By End User, 2023 to 2033

Figure 29: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 30: United States Market Value Proportion Analysis, 2022

Figure 31: Global Vs. United States Growth Comparison

Figure 32: United States Market Share Analysis (%) By Product, 2023 to 2033

Figure 33: United States Market Share Analysis (%) By Application, 2023 to 2033

Figure 34: United States Market Share Analysis (%) By End User, 2023 to 2033

Figure 35: Canada Market Value Proportion Analysis, 2022

Figure 36: Global Vs. Canada. Growth Comparison

Figure 37: Canada Market Share Analysis (%) By Product, 2023 to 2033

Figure 38: Canada Market Share Analysis (%) By Application, 2023 to 2033

Figure 39: Canada Market Share Analysis (%) By End User, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 41: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 42: Latin America Market Value Share, By Product (2023 E)

Figure 43: Latin America Market Value Share, By Application (2023 E)

Figure 44: Latin America Market Value Share, By End User (2023 E)

Figure 45: Latin America Market Value Share, by Country (2023 E)

Figure 46: Latin America Market Attractiveness Analysis By Product, 2023 to 2033

Figure 47: Latin America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 48: Latin America Market Attractiveness Analysis By End User, 2023 to 2033

Figure 49: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 50: Mexico Market Value Proportion Analysis, 2022

Figure 51: Global Vs Mexico Growth Comparison

Figure 52: Mexico Market Share Analysis (%) By Product, 2023 to 2033

Figure 53: Mexico Market Share Analysis (%) By Application, 2023 to 2033

Figure 54: Mexico Market Share Analysis (%) By End User, 2023 to 2033

Figure 55: Brazil Market Value Proportion Analysis, 2022

Figure 56: Global Vs. Brazil. Growth Comparison

Figure 57: Brazil Market Share Analysis (%) By Product, 2023 to 2033

Figure 58: Brazil Market Share Analysis (%) By Application, 2023 to 2033

Figure 59: Brazil Market Share Analysis (%) By End User, 2023 to 2033

Figure 60: Argentina Market Value Proportion Analysis, 2022

Figure 61: Global Vs Argentina Growth Comparison

Figure 62: Argentina Market Share Analysis (%) By Product, 2023 to 2033

Figure 63: Argentina Market Share Analysis (%) By Application, 2023 to 2033

Figure 64: Argentina Market Share Analysis (%) By End User, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 66: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 67: Europe Market Value Share, By Product (2023 E)

Figure 68: Europe Market Value Share, By Application (2023 E)

Figure 69: Europe Market Value Share, By End User (2023 E)

Figure 70: Europe Market Value Share, by Country (2023 E)

Figure 71: Europe Market Attractiveness Analysis By Product, 2023 to 2033

Figure 72: Europe Market Attractiveness Analysis By Application, 2023 to 2033 203

Figure 73: Europe Market Attractiveness Analysis By End User, 2023 to 2033

Figure 74: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 75: United Kingdom Market Value Proportion Analysis, 2022

Figure 76: Global Vs. United Kingdom Growth Comparison

Figure 77: United Kingdom Market Share Analysis (%) By Product, 2023 to 2033

Figure 78: United Kingdom Market Share Analysis (%) By Application, 2023 to 2033

Figure 79: United Kingdom Market Share Analysis (%) By End User, 2023 to 2033

Figure 80: Germany Market Value Proportion Analysis, 2022

Figure 81: Global Vs. Germany Growth Comparison

Figure 82: Germany Market Share Analysis (%) By Product, 2023 to 2033

Figure 83: Germany Market Share Analysis (%) By Application, 2023 to 2033

Figure 84: Germany Market Share Analysis (%) By End User, 2023 to 2033

Figure 85: Italy Market Value Proportion Analysis, 2022

Figure 86: Global Vs. Italy Growth Comparison

Figure 87: Italy Market Share Analysis (%) By Product, 2023 to 2033

Figure 88: Italy Market Share Analysis (%) By Application, 2023 to 2033

Figure 89: Italy Market Share Analysis (%) By End User, 2023 to 2033

Figure 90: France Market Value Proportion Analysis, 2022

Figure 91: Global Vs France Growth Comparison

Figure 92: France Market Share Analysis (%) By Product, 2023 to 2033

Figure 93: France Market Share Analysis (%) By Application, 2023 to 2033

Figure 94: France Market Share Analysis (%) By End User, 2023 to 2033

Figure 95: Spain Market Value Proportion Analysis, 2022

Figure 96: Global Vs Spain Growth Comparison

Figure 97: Spain Market Share Analysis (%) By Product, 2023 to 2033

Figure 98: Spain Market Share Analysis (%) By Application, 2023 to 2033

Figure 99: Spain Market Share Analysis (%) By End User, 2023 to 2033

Figure 100: Russia Market Value Proportion Analysis, 2022

Figure 101: Global Vs Russia Growth Comparison

Figure 102: Russia Market Share Analysis (%) By Product, 2023 to 2033

Figure 103: Russia Market Share Analysis (%) By Application, 2023 to 2033

Figure 104: Russia Market Share Analysis (%) By End User, 2023 to 2033

Figure 105: BENELUX Market Value Proportion Analysis, 2022

Figure 106: Global Vs BENELUX Growth Comparison

Figure 107: BENELUX Market Share Analysis (%) By Product, 2023 to 2033

Figure 108: BENELUX Market Share Analysis (%) By Application, 2023 to 2033

Figure 109: BENELUX Market Share Analysis (%) By End User, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 111: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 112: East Asia Market Value Share, By Product (2023 E)

Figure 113: East Asia Market Value Share, By Application (2023 E)

Figure 114: East Asia Market Value Share, By End User (2023 E)

Figure 115: East Asia Market Value Share, by Country (2023 E)

Figure 116: East Asia Market Attractiveness Analysis By Product, 2023 to 2033

Figure 117: East Asia Market Attractiveness Analysis By Application, 2023 to 2033

Figure 118: East Asia Market Attractiveness Analysis By End User, 2023 to 2033

Figure 119: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 120: China Market Value Proportion Analysis, 2022

Figure 121: Global Vs. China Growth Comparison

Figure 122: China Market Share Analysis (%) By Product, 2023 to 2033

Figure 123: China Market Share Analysis (%) By Application, 2023 to 2033

Figure 124: China Market Share Analysis (%) By End User, 2023 to 2033

Figure 125: Japan Market Value Proportion Analysis, 2022

Figure 126: Global Vs. Japan Growth Comparison

Figure 127: Japan Market Share Analysis (%) By Product, 2023 to 2033

Figure 128: Japan Market Share Analysis (%) By Application, 2023 to 2033

Figure 129: Japan Market Share Analysis (%) By End User, 2023 to 2033

Figure 130: South Korea Market Value Proportion Analysis, 2022

Figure 131: Global Vs South Korea Growth Comparison

Figure 132: South Korea Market Share Analysis (%) By Product, 2023 to 2033

Figure 133: South Korea Market Share Analysis (%) By Application, 2023 to 2033

Figure 134: South Korea Market Share Analysis (%) By End User, 2023 to 2033

Figure 135: South Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 136: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 137: South Asia Market Value Share, By Product (2023 E)

Figure 138: South Asia Market Value Share, By Application (2023 E)

Figure 139: South Asia Market Value Share, By End User (2023 E)

Figure 140: South Asia Market Value Share, by Country (2023 E)

Figure 141: South Asia Market Attractiveness Analysis By Product, 2023 to 2033

Figure 142: South Asia Market Attractiveness Analysis By Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness Analysis By End User, 2023 to 2033

Figure 144: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 145: India Market Value Proportion Analysis, 2022

Figure 146: Global Vs. India Growth Comparison

Figure 147: India Market Share Analysis (%) By Product, 2023 to 2033

Figure 148: India Market Share Analysis (%) By Application, 2023 to 2033

Figure 149: India Market Share Analysis (%) By End User, 2023 to 2033

Figure 150: Indonesia Market Value Proportion Analysis, 2022

Figure 151: Global Vs. Indonesia Growth Comparison

Figure 152: Indonesia Market Share Analysis (%) By Product, 2023 to 2033

Figure 153: Indonesia Market Share Analysis (%) By Application, 2023 to 2033

Figure 154: Indonesia Market Share Analysis (%) By End User, 2023 to 2033

Figure 155: Malaysia Market Value Proportion Analysis, 2022

Figure 156: Global Vs. Malaysia Growth Comparison

Figure 157: Malaysia Market Share Analysis (%) By Product, 2023 to 2033

Figure 158: Malaysia Market Share Analysis (%) By Application, 2023 to 2033

Figure 159: Malaysia Market Share Analysis (%) By End User, 2023 to 2033

Figure 160: Thailand Market Value Proportion Analysis, 2022

Figure 161: Global Vs. Thailand Growth Comparison

Figure 162: Thailand Market Share Analysis (%) By Product, 2023 to 2033

Figure 163: Thailand Market Share Analysis (%) By Application, 2023 to 2033

Figure 164: Thailand Market Share Analysis (%) By End User, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis, 2017 to 2022

Figure 166: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 167: Oceania Market Value Share, By Product (2023 E)

Figure 168: Oceania Market Value Share, By Application (2023 E)

Figure 169: Oceania Market Value Share, By End User (2023 E)

Figure 170: Oceania Market Value Share, by Country (2023 E)

Figure 171: Oceania Market Attractiveness Analysis By Product, 2023 to 2033

Figure 172: Oceania Market Attractiveness Analysis By Application, 2023 to 2033

Figure 173: Oceania Market Attractiveness Analysis By End User, 2023 to 2033

Figure 174: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 175: Australia Market Value Proportion Analysis, 2022

Figure 176: Global Vs. Australia Growth Comparison

Figure 177: Australia Market Share Analysis (%) By Product, 2023 to 2033

Figure 178: Australia Market Share Analysis (%) By Application, 2023 to 2033

Figure 179: Australia Market Share Analysis (%) By End User, 2023 to 2033

Figure 180: New Zealand Market Value Proportion Analysis, 2022

Figure 181: Global Vs New Zealand Growth Comparison

Figure 182: New Zealand Market Share Analysis (%) By Product, 2023 to 2033

Figure 183: New Zealand Market Share Analysis (%) By Application, 2023 to 2033

Figure 184: New Zealand Market Share Analysis (%) By End User, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis, 2017 to 2022

Figure 186: Middle East and Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 187: Middle East and Africa Market Value Share, By Product (2023 E)

Figure 188: Middle East and Africa Market Value Share, By Application (2023 E)

Figure 189: Middle East and Africa Market Value Share, By End User (2023 E)

Figure 190: Middle East and Africa Market Value Share, by Country (2023 E)

Figure 191: Middle East and Africa Market Attractiveness Analysis By Product, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness Analysis By Application, 2023 to 2033

Figure 193: Middle East and Africa Market Attractiveness Analysis By End User, 2023 to 2033

Figure 194: Middle East and Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 195: GCC Countries Market Value Proportion Analysis, 2022

Figure 196: Global Vs GCC Countries Growth Comparison

Figure 197: GCC Countries Market Share Analysis (%) By Product, 2023 to 2033

Figure 198: GCC Countries Market Share Analysis (%) By Application, 2023 to 2033

Figure 199: GCC Countries Market Share Analysis (%) By End User, 2023 to 2033

Figure 200: Türkiye Market Value Proportion Analysis, 2022

Figure 201: Global Vs. Türkiye Growth Comparison

Figure 202: Türkiye Market Share Analysis (%) By Product, 2023 to 2033

Figure 203: Türkiye Market Share Analysis (%) By Application, 2023 to 2033

Figure 204: Türkiye Market Share Analysis (%) By End User, 2023 to 2033

Figure 205: South Africa Market Value Proportion Analysis, 2022

Figure 206: Global Vs. South Africa Growth Comparison

Figure 207: South Africa Market Share Analysis (%) By Product, 2023 to 2033

Figure 208: South Africa Market Share Analysis (%) By Application, 2023 to 2033

Figure 209: South Africa Market Share Analysis (%) By End User, 2023 to 2033

Figure 210: Northern Africa Africa Market Value Proportion Analysis, 2022

Figure 211: Global Vs North Africa Growth Comparison

Figure 212: North Africa Market Share Analysis (%) By Product, 2023 to 2033

Figure 213: North Africa Market Share Analysis (%) By Application, 2023 to 2033

Figure 214: North Africa Market Share Analysis (%) By End User, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cutting Tool Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cutting Boards Market Size and Share Forecast Outlook 2025 to 2035

Cutting and Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Cutting Fluid Market Growth – Trends & Forecast 2025-2035

Die Cutting Machine Market

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Frame Cutting Jib Miner Market Size and Share Forecast Outlook 2025 to 2035

Glass Cutting Machine Market Size, Growth, and Forecast 2025 to 2035

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Laser Cutting Machine Market Growth – Trends & Forecast 2024-2034

Cloth Cutting Machines Market

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Manual cutting equipment Market Size and Share Forecast Outlook 2025 to 2035

Plasma Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Timber Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Cheese Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA