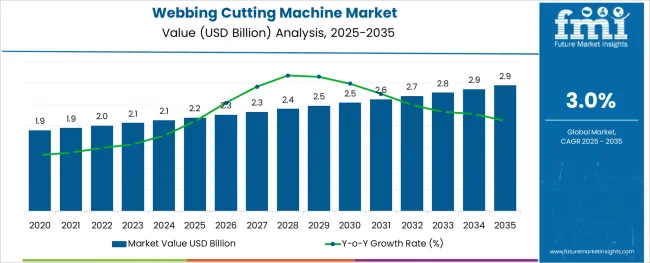

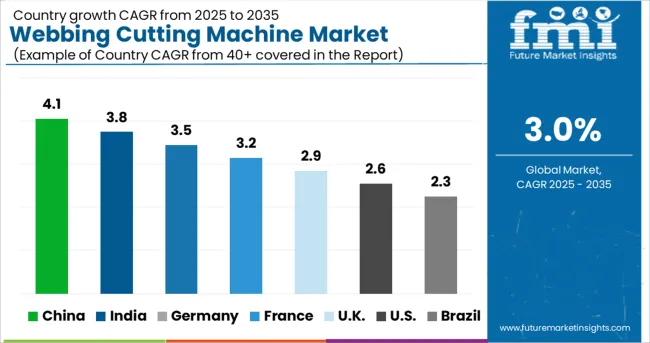

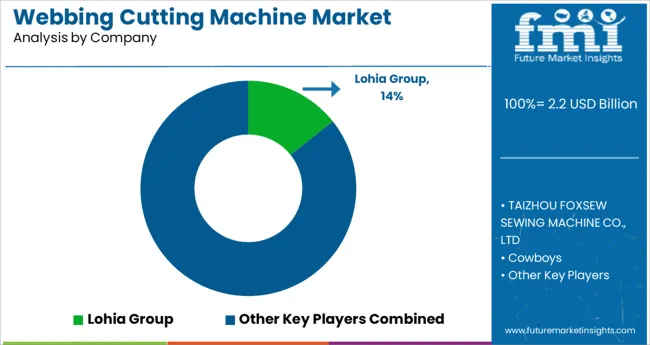

The Webbing Cutting Machine Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

The webbing cutting machine market is witnessing notable growth as industries including automotive, apparel, military, and packaging increasingly depend on precision fabric cutting technologies to improve productivity and reduce material waste. Automation has become central to the evolution of these machines, as manufacturers seek to enhance output consistency, minimize human error, and meet diverse order specifications with minimal downtime.

The demand for faster changeovers, smart control systems, and digitally calibrated feed mechanisms is accelerating, particularly in high-mix production environments. Additionally, integration with vision systems and programmable logic controls is enabling manufacturers to achieve tighter tolerances across various textile and synthetic materials.

Emerging application areas such as wearable technology and smart textiles are also encouraging investment in highly adaptable cutting equipment. As global supply chains become more reliant on efficiency and precision, future growth will be shaped by machines that offer high throughput, minimal material degradation, and compatibility with sustainable production practices.

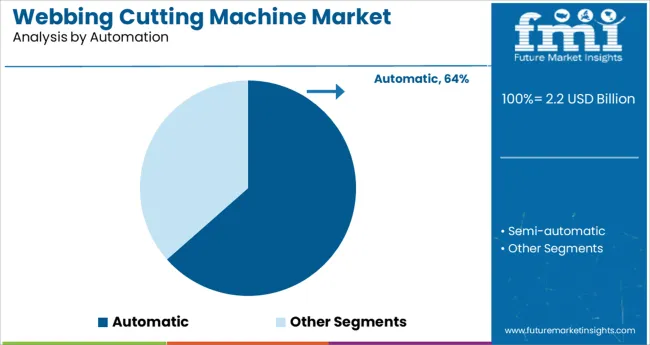

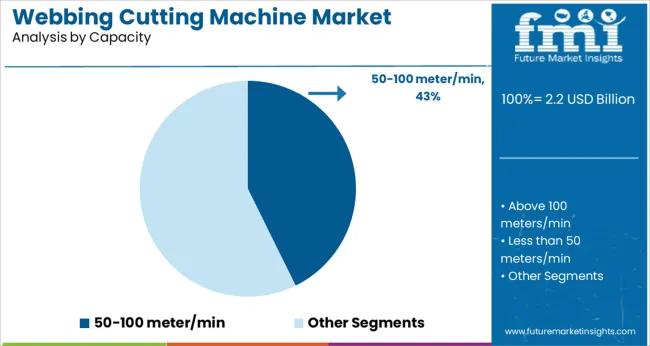

The market is segmented by Automation, Capacity, and Application and region. By Automation, the market is divided into Automatic and Semi-automatic. In terms of Capacity, the market is classified into 50-100 meter/min, Above 100 meters/min, and Less than 50 meters/min.

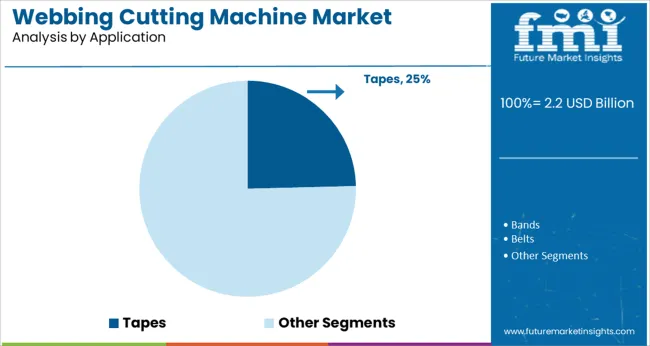

Based on Application, the market is segmented into Tapes, Bands, Belts, Labels, and Zippers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic segment is projected to command 63.50% of the total market revenue in 2025, establishing it as the dominant category within the automation segment. This leadership is driven by increasing demand for machines that offer continuous operation with minimal manual intervention.

Automatic webbing cutting machines are equipped with features such as digital length setting, heat sealing, and tension control, which enhance cutting accuracy and reduce edge fraying. These machines are particularly valued for their role in streamlining operations in mass production environments, where high repeatability and reduced setup time are critical.

With rising labor costs and the need for lean manufacturing, adoption of automatic systems has accelerated across both established and emerging economies. Furthermore, their ability to integrate into larger production lines and support smart factory initiatives has reinforced their position as the preferred automation type in the webbing cutting machine market.

The 50 to 100 meter per minute capacity range is anticipated to hold 42.70% of market revenue in 2025, making it the leading segment by capacity. This range has emerged as the optimal balance between operational speed and control, particularly in industries requiring mid-volume production with high dimensional accuracy.

Machines in this capacity bracket are favored for their versatility, enabling manufacturers to process a wide variety of webbings such as nylon, polyester, and cotton with consistent quality. Their compatibility with both manual and automated feeding systems has further expanded their utility across small and medium-sized enterprises.

Additionally, lower energy consumption and compact machine footprints make them suitable for space-constrained production floors. These characteristics have led to widespread adoption, particularly in textile and accessories manufacturing, positioning this capacity range as the most commercially viable in the segment.

In the application segment, tapes are expected to account for 24.60% of total market revenue in 2025, making it the leading application area for webbing cutting machines. This growth is being propelled by the expanding use of woven and non-woven tapes in sectors such as automotive interiors, safety equipment, apparel reinforcement, and packaging. Precision and clean-edge cutting are critical in tape production, especially when dealing with specialty adhesives, heat-sensitive fabrics, and reflective materials.

Webbing cutting machines designed for tape applications often feature hot knife or ultrasonic options to meet these requirements. The increasing demand for customized widths, batch production flexibility, and high-speed order fulfillment has driven adoption in this segment.

Moreover, advancements in coating and lamination techniques have created new performance expectations, which these machines are being designed to meet. As tape usage diversifies across industries, its status as a core application for webbing cutters is expected to remain strong.

With growing advancements in the textile industry, the demand for web-cutting machines is expected to increase. Also, the increasing need for automation among various manufacturers to reduce labor and wastage of materials will create new avenues for the market.

The rising demand for precise and efficient webbing cutting is another factor expected to trigger the ongoing advancements in webbing cutting machines. This is likely to promote growth in the market.

This, surging applications of webbing cutting machines in the packaging industry are spurring. Sales are increasing due to the high consumption of processed or canned food & beverages along with the rising use of pharmaceuticals and cosmetics products.

Constantly changing fashion trends and the influence of social media is boosting the textile industry. This is anticipated to further increase the sales of webbing cutting machines in the apparel and textile industry.

According to Future Market Insights (FMI), large capital investments and high maintenance costs of webbing cutting machines are expected to pose as a challenge for new across underdeveloped regions.

This, a shortage of skilled professionals and a lack of knowledge regarding webbing cutting machines in developing countries such as China, Brazil, India, and others are likely to restrain the growth.

Also, the increasing energy consumption owing to the use of automated technologies in various industries might impede the demand during the forecast period.

According to FMI, Asia Pacific is estimated to exhibit the fastest growth rate during the forecast period. Growth is attributable to the growing emergence of entrants and expansion of the apparel industry in China, Japan, and India.

Additionally, rapid urbanization and improvement in per capita income coupled with changing lifestyles will spur the application of webbing cutting machines in textile and food & beverage sectors.

Growing awareness regarding the advantages of using webbing cutting machines in the automotive industry will further stoke sales in the Asia Pacific.

Europe is anticipated to witness steady growth in webbing cutting machines during the forecast period (2025 to 2035). Growing food, consumer goods, and packaging industries in the region are projected to boost the sales of webbing cutting machines in the coming years.

Besides this, the need for minimal human intervention to avoid unwanted variations in products in several manufacturing companies will accelerate the sales in Europe's webbing cutting machine market.

Also, the growing adoption of eco-friendly cutting practices and techniques in the packaging, textile, electronic, construction, and automotive industries is also pushing the sales of webbing cutting machines in Europe.

Key manufacturers in the global webbing cutting machines market include Lohia Group, DEMA Sewing Solutions, Seattle Fabrics Inc., John Howard Company, PIX Transmissions Ltd., Kingsing Auto Co. Ltd., Honggang Cutting Machine Co. Ltd., Hightex Special Sewing Machine Inc., Brother Industries Ltd., among others.

Leading players are advancing their manufacturing technologies to gain a competitive edge in the market, as well as to reduce material wastage and human interference.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR 3.0% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Machine Type, Product Type, Cutting Type, Fabric Type, End-Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia-Pacific Excluding Japan (APEJ); Japan; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Lohia Group; DEMA Sewing Solutions; Seattle Fabrics Inc.; John Howard Company; PIX Transmissions Ltd.; Kingsing Auto Co. Ltd.; Honggang Cutting Machine Co. Ltd.; Hightex Special Sewing Machine Inc.; Brother Industries Ltd. |

| Customization | Available Upon Request |

The global webbing cutting machine market is estimated to be valued at USD 2.2 billion in 2025.

It is projected to reach USD 2.9 billion by 2035.

The market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types are automatic and semi-automatic.

50-100 meter/min segment is expected to dominate with a 42.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Tubular Webbing Market Size and Share Forecast Outlook 2025 to 2035

Flat Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Aramid Flame Retardant Webbing Market Size and Share Forecast Outlook 2025 to 2035

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Cutting Tool Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cutting Boards Market Size and Share Forecast Outlook 2025 to 2035

Cutting Balloons Market Insights – Growth, Demand & Forecast 2025 to 2035

Cutting Fluid Market Growth – Trends & Forecast 2025-2035

Cutting and Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Die Cutting Machine Market

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Frame Cutting Jib Miner Market Size and Share Forecast Outlook 2025 to 2035

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Glass Cutting Machine Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA