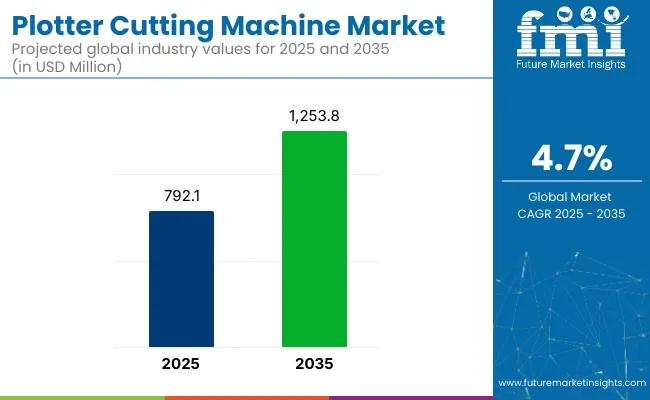

The global plotter cutting machine market is valued at USD 792.1 million in 2025 and is slated to reach USD 1,253.8 million by 2035, which shows a CAGR of 4.7%. Growth is being driven by increasing automation adoption in textiles, packaging, and automotive sectors. Additionally, the integration of AI and machine learning technologies to enhance precision and efficiency is expected to boost market expansion. Rising demand for sustainability-focused production solutions is also contributing to industry growth globally.

| Metric | Value |

|---|---|

| 2025 Market Value | USD 792.1 million |

| 2035 Market Value | USD 1,253.8 million |

| CAGR (2025 to 2035) | 4.7% |

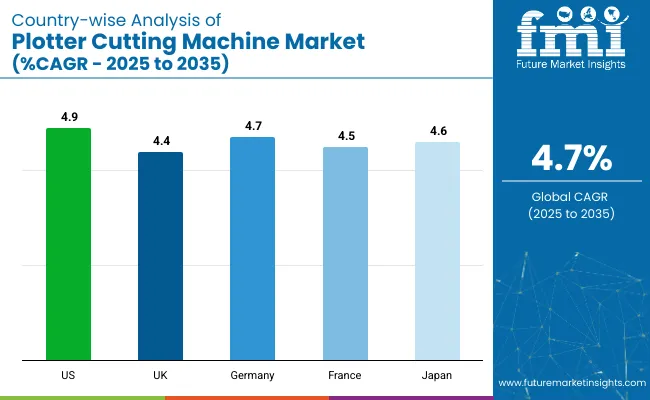

USA is expected to grow at a CAGR of 4.9% from 2025 to 2035, driven by the strong adoption of automated cutting technologies. Germany is projected to grow at a CAGR of 4.7%, supported by industrial automation. Japan is anticipated to expand at a CAGR of 4.6% due to advancements in precision engineering.

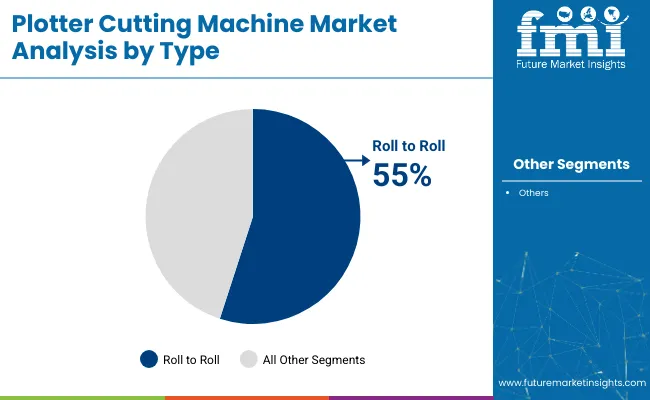

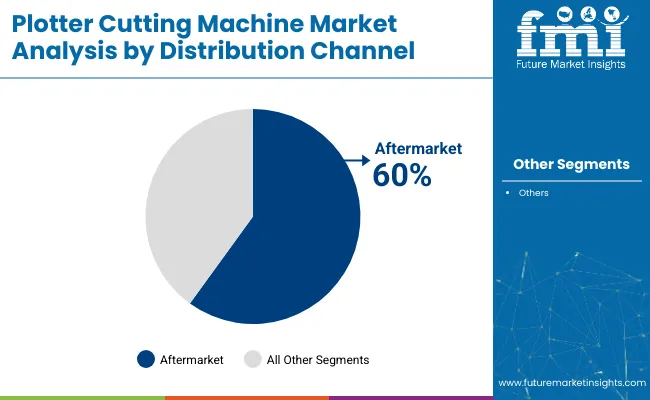

The aftermarket segment is forecasted to maintain dominance in the distribution channel with a 60% market share in 2025. Roll to roll machines are expected to lead the type segment with a 55% market share in 2025, driven by increasing demand for precision cutting and rising automation adoption in manufacturing processes.

Plotter cutting machines hold approximately 25% to 30% share in the signage and graphics equipment market, driven by demand in advertising, printing, and vinyl cutting. Within the die cutting machines market, they account for around 20%, particularly in packaging and labeling.

In the printing and cutting equipment market, their share is estimated at 15% to 18%, supported by their dual functionality. In the broader CNC machines market, their contribution is about 5% to 7%, due to specialization. For the textile and apparel machinery segment, they hold 8% to 10%, where precision cutting of patterns and designs is essential.

Governments around the world have set rules to keep plotter cutting machines safe, energy-efficient, and eco-friendly. In the USA, OSHA makes sure machines follow safety standards, while the EPA sets rules to control emissions.

Europe requires CE marking for safety, RoHS for safe materials, and Ecodesign rules to save energy. Japan uses PSE and JET certifications for safety and energy-saving standards. China enforces CCC certification and GB standards for quality. South Korea requires KC certification and supports eco-friendly machines.

The plotter cutting machine market is segmented into type, application, distribution channel, and region. By type, the market is categorized into roll to roll, flat bed, and others (including hybrid laser-waterjet cutting machines, desktop plotters, and multifunction plotter-cutter printers used by SMEs and design studios).

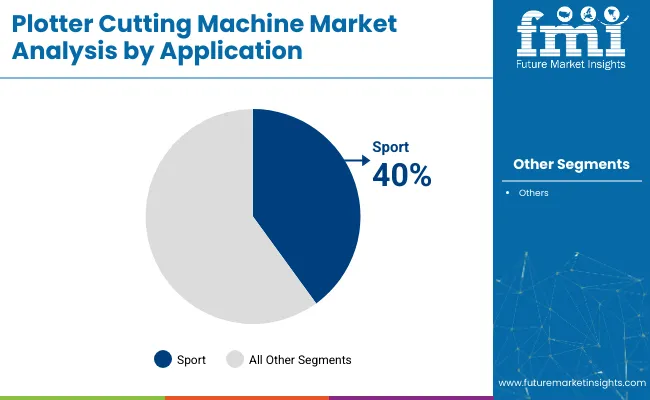

Based on application, the market is segmented into sport, decoration, and construction. By distribution channel, the market is classified into OEM and aftermarket. Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East and Africa (MEA), East Asia, and South Asia and Pacific.

The roll to roll segment is expected to be the most lucrative in the plotter cutting machine market, holding an expected 55% market share from 2025 to 2035.

The sport segment is expected to be the most lucrative in the plotter cutting machine market, likely to hold 40% market share from 2025 to 2035.

The aftermarket segment is expected to be the most lucrative in the plotter cutting machine market, holding a forecasted 60% market share from 2025 to 2035.

The global plotter cutting machine market is growing steadily, driven by rising adoption of automation, AI-integrated cutting technologies, and precision manufacturing across industries.

Recent Trends in the Plotter Cutting Machine Market

Key Challenges in the Plotter Cutting Machine Market

The USA leads the plotter cutting machines market with a projected CAGR of 4.9% from 2025 to 2035, driven by Industry 4.0 adoption and digital manufacturing incentives. Germany follows with a 4.7% CAGR, supported by AI-driven solutions and applications in automotive and design sectors. Japan, at 4.6%, emphasizes compact, high-speed machines and smart automation in fashion and décor.

France is set to grow at 4.5%, fueled by digital transformation in signage and customization industries. The UK posts a 4.4% CAGR, focusing on energy-efficient machines for signage and advertising. Across all countries, digitalization and sustainability are key growth drivers.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA plotter cutting machine market is projected to grow at a CAGR of 4.9% from 2025 to 2035. Growth is driven by strong demand for automation in the printing, textiles, and signage sectors.

Theplotter cutting machine revenue in the UK is expected to register a CAGR of 4.4% from 2025 to 2035.

Germany’s plotter cutting machine demand is projected to grow at a CAGR of 4.7% from 2025 to 2035.

Sales of plotter cutting machines in Franceare anticipated to expand at a CAGR of 4.5% from 2025 to 2035.

Japan’s plotter cutting machine revenuesare expected to grow at a CAGR of 4.6% from 2025 to 2035.

The plotter cutting machine market is fragmented, with multiple global and regional players competing across industrial and consumer segments. Major companies include Graphtec Corporation, Roland DG Corporation, and Mimaki Engineering Co., Ltd., which hold significant shares through industrial-grade precision and automation offerings.

Top companies are competing through product innovation, pricing strategies, technological upgrades, and strategic partnerships. For example, Graphtec Corporation focuses on developing high-speed plotters with AI integration to enhance precision and productivity. Roland DG is expanding its portfolio with sustainable and energy-efficient machines aligned with global environmental trends.

Recent Plotter Cutting Machine Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 792.1 million |

| Projected Market Size (2035) | USD 1,253.8 million |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD millions/Volume in units |

| By Type | Roll to Roll, Flat Bed, Others (hybrid laser-waterjet machines, desktop plotters) |

| By Application | Sport, Decoration, and Construction |

| By Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Graphtec Corporation, SRJ Technical Solution, Global 5 Technologies, SH Electronics Co., Mimaki Engineering Co., Ltd., Roland DG Corporation, Summa NV, USCutter , GCC (Great Computer Corporation), Silhouette America, Inc., Secabo GmbH, KNK Force ( Klic -N- Kut ), ARISTO Graphic Systeme GmbH & Co. KG, Zünd Systemtechnik AG, Gerber Technology LLC, Skycut (Shenzhen Teneth Technology Co., Ltd.), Brother International Corporation, Teneth . |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

By type, the market is segmented into roll to roll, flat bed, and others.

In terms of application, the market is segmented into sports, decoration, and construction.

By distribution channel, the market is segmented into OEM and aftermarket.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The market size is expected to reach USD 792.1 million in 2025.

The market is projected to reach USD 1,253.8 million in 2035.

The roll-to-roll segment holds the largest market share with an expected 55% share due to its bulk material cutting efficiency.

The market is projected to grow at a CAGR of 4.7% from 2025 to 2035.

The USA is expected to record the fastest CAGR of 4.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pattern Cutting Plotter Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cutting Tool Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cutting Boards Market Size and Share Forecast Outlook 2025 to 2035

Cutting Balloons Market Insights – Growth, Demand & Forecast 2025 to 2035

Cutting Fluid Market Growth – Trends & Forecast 2025-2035

Cutting and Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Die Cutting Machine Market

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Frame Cutting Jib Miner Market Size and Share Forecast Outlook 2025 to 2035

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Glass Cutting Machine Market Size, Growth, and Forecast 2025 to 2035

Laser Cutting Machine Market Growth – Trends & Forecast 2024-2034

Cloth Cutting Machines Market

Manual cutting equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Plasma Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA