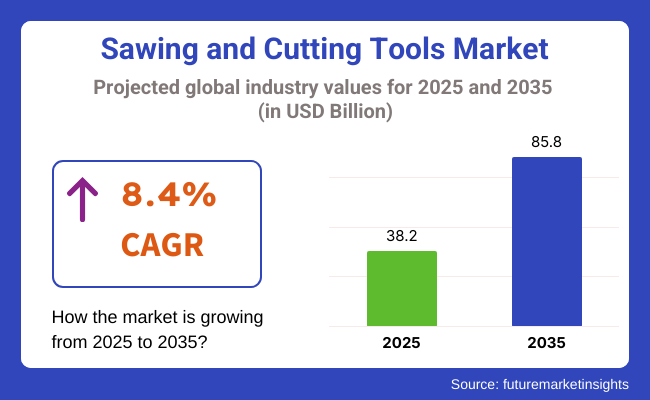

In 2025, the size of the sawing and cutting tools market was valued at USD 38.2 billion and, during the period between 2025 and 2035, is expected to grow at an 8.4% CAGR. The size of the global industry is likely to be at USD 85.8 billion in 2035. An essential key driver of this expansion is the increased adoption of automation technologies in metalworking, construction, and automotive production. This leads to a higher demand for high-precision and long-lasting cutting solutions.

Technical innovation in tool material, for example, carbide-tipped and diamond-coated blades, has greatly improved cutting efficiency and life. These technologies are especially favored in aerospace and heavy engineering industries where functionality and material endurance are of utmost importance. Furthermore, digitalization in industrial processes has required cutting tools with programmable accuracy and smart machinery compatibility.

The sustained global focus on infrastructure construction, mainly in emerging industries, continues to be one of the major growth drivers for industrial strength cutting and sawing solutions. Urbanization and smart city initiatives translate into increased consumption of building materials; this again translates into an increase in demand for high-performance tools that provide faster and cleaner cuts through concrete, steel, and composite materials.

In the household industry, DIY trends and domestic renovation works have also generated accelerating sales of ergonomic and lightweight hand-operated saws. Handheld power tools, with improved safety and multi-surface applicability, are gaining significant industry influence in retail and internet commerce, especially in Western Europe and North America.

The industry is supported by diversified applications in end-user segments as well as a global trend toward cleaner, environmentally sound, and energy-efficient cutting. This also stimulates tool suppliers to invest in R&D activities for vibration-free cutting, minimization of kerf width, and recyclability, setting up the industry for sustainable growth in the long run.

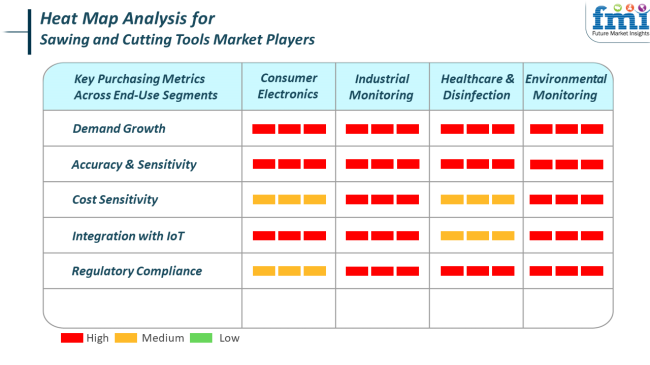

Sawing and cutting tools play diverse roles across sectors, with demand trends varying based on precision needs and regulatory frameworks. In consumer electronics, miniaturization drives the need for extremely precise and delicate cutting tools, often integrated with automated processes. These tools must align with medium regulatory compliance and moderate cost sensitivity, given rapid innovation cycles and competitive pricing.

In industrial monitoring and production, cutting tools are part of broader automation systems, often embedded with IoT sensors to monitor wear, performance, and output. These segments demand High accuracy and integration capability, especially as lean manufacturing techniques become widespread. High regulatory standards around safety and consistency also drive tool innovation.

Meanwhile, healthcare and environmental monitoring place emphasis on clean, efficient, and contamination-free cutting. While healthcare tools must comply with strict regulatory conditions, environmental applications are shaped by the need for field-deployable, robust tools capable of precise action under varying conditions. Across all segments, there is an overarching trend toward digital-enabled, low-maintenance, and high-efficiency cutting systems.

The industry faces a series of strategic risks stemming from global supply chain vulnerabilities and raw material cost volatility. The dependence on specific alloys, carbides, and advanced composites makes the industry highly sensitive to disruptions in mining and metallurgy sectors, particularly in geopolitically unstable regions. Price fluctuations of tungsten, cobalt, and other critical elements can affect production costs and tool pricing unpredictably.

Moreover, the industry is exposed to technological displacement risks. As laser, plasma, and waterjet cutting technologies evolve, they may replace traditional mechanical cutting tools in high-precision industries. Companies that fail to adapt to hybrid or multi-technology solutions may lose competitive relevance, especially in sectors where automation and digitization are evolving rapidly.

Environmental regulations and sustainability mandates also pose significant compliance challenges. Increasing pressure to minimize energy usage, reduce industrial waste, and shift to recyclable tool components may necessitate significant capital expenditure and redesign of manufacturing practices. Businesses unable to align with these green transitions risk reduced industry access and reputational setbacks in environmentally conscious regions.

Between 2020 and 2024, the Industry experienced sustained growth owing to the increasing demand from industries such as automotive, construction, and electronics. Tool material and coating improvements served to enhance cutting performance and tool durability, leading to higher productivity.

The emergence of Industry 4.0 technologies and automation also affected the industry because manufacturers needed equipment that would smoothly fit into automated production lines. Moreover, increased focus on accuracy and quality during manufacturing processes further drove demand for high-performance sawing and cutting tools.

Prospects from 2025 to 2035 project that the industry will see rapid developments. Smart cutting tools with sensors and IoT technology will be developed, allowing real-time monitoring and predictive maintenance, minimizing downtime, and optimizing operational efficiency.

Sustainability will be a prime consideration, with more usage of green materials and energy-efficient production processes. Furthermore, additive manufacturing and composite material innovation across industries will create demand for specialist cutting tools to machine these next-generation materials.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Industrial development, precision requirements , and automation integration | Intellect-driven technologies, green revolution, and advanced material processing |

| Enhanced coating and material improvement for wear-resistance | Internet-of-things (IoT)-enabled tools, live tracking, and prescriptive analysis |

| Legacy material high-performance tools | Composites- and additive-material-specialist tools |

| Reliability, precision, and affordability | Innovation, sustainability, and new material adaptability |

| Tool wear, material constraint, and integration with legacy systems | Accelerated technology developments and the need for constant innovation |

Industrial applications lead the industry, with an estimated 65-70% of total demand. The tools are vital in industries like automotive, aerospace, construction, metal fabrication, and shipbuilding, where precision and strength are essential.

Industry titans such as Stanley Black & Decker, Bosch, Hilti, and Makita produce a broad range of cutting tools ranging from band saws, circular saws, and abrasive cutters, which are designed for continuous and heavy-duty cutting applications. Increasing use of automated and CNC-based cutting solutions in manufacturing also stimulates industrial demand.

Between 2025 and 2035, this segment is anticipated to record a CAGR of 5.7% on the growth of global infrastructure spending as well as growing smart manufacturing in advanced and emerging countries. DIY (Do-It-Yourself) application constitutes the second segment with a share of approximately 30-35% of industry demand.

The increase in this segment is largely dominated by growing interest in house enhancement, woodworking, and small-sized production, more particularly in North America and Western Europe. Segments like these are targeted by brands such as Ryobi, WEN, and Craftsman with their light, handheld, and cheap tools such as hand saws, jigsaws, and small-sized table saws.

DIY culture also has achieved mass popularity via online tutorials, maker communities, and online marketplaces. While being smaller in terms of volume, this segment will expand at a slightly improved CAGR of 6.4% during the recovery phase as consumers pick up spending on hobby tools and home workshop configurations after the pandemic.

Western Europe and North America are the largest regional markets, together making up around 45-50% of global sales. North America, with the United States predominating, boasts a powerful building sector, a general do-it-yourself culture, and the need for professional tools.

Western Europe, in Germany, the UK and France, emphasizes industrial productivity and precision engineering applications in automotive and precision cutting. Large production companies have huge distribution systems and spend on cordless and battery technology.

In both areas, the industry is expected to grow at a CAGR of 5.2% through 2035, owing to residential refurbishment, innovative manufacturing, and customer demand for sustainability-focused equipment. East Asia and South Asia & the Pacific are rapidly evolving high-growth markets, together accounting for a market share of 30-35%.

China, India, and Southeast Asia drive demand owing to booming construction activity, urban growth, and industrial development. Local companies such as HiKOKI (Japan) and local distributors are making affordable sawing equipment available to all.

Simultaneously, the Middle East & Africa (MEA) and Latin America, though smaller (combined approx. 10-15%), are seeing growth in infrastructure as well as consumption of tools at the consumer level. Asia-Pacific will grow at a CAGR of 6.8%. In comparison, Latin America and MEA will grow at 5.5% due to the stimulus provided by industrialization and the wider availability of power tools in emerging economies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

| UK | 4.7% |

| France | 4.4% |

| Germany | 4.6% |

| Italy | 4.2% |

| South Korea | 5.1% |

| Japan | 4.8% |

| China | 6.5% |

| Australia-NZ | 4.5% |

The USA industry will grow at 5.9% CAGR throughout the study. Increasing investments in infrastructure and construction, as well as the constant growth of residential remodeling activities, are key drivers of demand for sawing and cutting tools. A strong DIY culture supports the industry, as customers often buy hand tools and electrical cutting tools to use in personal endeavors.

Additionally, USA professional woodworking and construction sectors are increasingly embracing technologically sophisticated and ergonomically optimized precision cutting tools. Metal fabrication and automotive industry growth are driving the continued utilization of high-performance sawing and cutting machinery.

Efficiency and longevity are enhanced through tool advancements in materials like carbide and diamond-tipped blades, favoring productivity across the board. Also, cordless and battery-powered cutting tools are gaining popularity due to increased mobility and safety features. The changing environment of smart manufacturing and automation also creates new demand for CNC-integrated cutting solutions, which are becoming common in advanced production units throughout the nation.

The UK industry will grow at 4.7% CAGR during the forecast period. An increase in remodeling and renovation activities in both residential and commercial sectors is the key driver for growth in the sawing and cutting tools segment. The usage of precision hand tools and miniature electric cutters is growing in the country's skilled trades and small-scale production industries.

Also, the consistent movement toward sustainability in the construction industry promotes the use of tools that provide energy efficiency and minimize material loss. The UK manufacturing sector is increasingly incorporating new, automated cutting technology to cater to the demand for precision fabrication, particularly in metal and composite materials.

As demand for skilled workers continues to grow, tool manufacturers are spending money on ergonomically designed products that enhance performance while lowering physical effort. Notably, the increasing popularity of online marketplaces has increased access to tool categories and accessories, allowing professionals and hobbyists alike to obtain sophisticated cutting tools readily. Government programs favoring infrastructure upgrades and energy-efficient buildings are also likely to promote industry growth.

The French industry is forecast to grow at 4.4% CAGR throughout the study. The construction industry's revival, driven by government stimulus and urban redevelopment initiatives, is promoting demand for high-performance sawing and cutting tools.

Lightweight, portable tools for renovation and interior finishing work are gaining popularity, and lithium-ion batteries are increasingly powering them to facilitate cordless operation. France's industrial sector, encompassing automotive and aerospace uses, continues to incorporate precision cutting machinery for high-precision machining and fabrication.

Technology innovations are facilitating increased cutting speeds and greater user control, positioning tools as more efficient and dependable. Also, the growing population of small workshops and craftsmen working in woodworking and house improvement assignments increases revenues in manual and semi-automatic sawing tools.

The focus on workplace efficiency and safety is also fueling the creation of easy-to-use designs and integrated safety features. A growing emphasis on sustainable materials and buildings is also encouraging the use of tools that are compatible with contemporary construction technologies.

The German industry will grow at 4.6% CAGR over the study period. The nation's robust engineering and manufacturing heritage underpins continued demand for cutting and sawing tools across various industries, such as construction, automotive, machinery, and renewable energy.

Germany's focus on quality and precision drives industry demand for advanced cutting technologies, including CNC saws and laser-guided cutting systems, that are critical in high-precision fabrication settings. The residential remodeling industry is also growing, fueled by energy-efficiency requirements and cosmetic improvements, which also promote the use of sophisticated hand and power tools.

Additionally, the advancement of prefabrication construction methods encourages the greater use of saws and cutters in offsite manufacturing centers. German toolmakers are leaders in incorporating IoT capabilities into cutting systems, enabling real-time monitoring and predictive maintenance. Finally, workshops and schools help promote an environment of craft, maintaining continuous interest in durable and professional-class cutting tools regardless of level.

The Italian industry is forecast to develop at 4.2% CAGR over the period of study. A revival in residential and hospitality structures, particularly in historic restoration and rural areas, is driving demand for accurate and versatile cutting tools.

Small- to medium-sized construction companies, which predominate in Italy, are increasingly adopting compact and battery-driven sawing solutions to ensure maneuverability within space limitations and intricate design expectations. Italy's woodworking and stone-cutting heritage continue to be important end-use markets, both of which need high-performance cutting tools with advanced edge retention and accuracy features.

New tool designs that minimize noise and vibration are increasingly common, especially for applications in urban settings. At the same time, initiatives to digitize construction and manufacturing processes are increasingly integrating automated cutting systems into processes. Even though the industry is marginally fragmented, increasing user demand for products with long-term durability and ergonomic design facilitates the shift toward premium product segments.

The South Korean industry is projected to grow at 5.1% CAGR throughout analysis. South Korea's strong industrial base and increasingly developing smart city infrastructure are the keys to increasing the use of technologically superior sawing and cutting tools.

Demand for energy-efficient and high-speed tools is seen in electronics, automotive, and heavy equipment industries, which depend on cutting operations in precision assembly and component manufacturing. Portable, high-capacity equipment is preferred due to its simplicity of use in small spaces, particularly in city buildings and interior fit-outs.

The popularity of DIY and home improvement culture, particularly among the young, has also increased retail demand for multifunctional manual and cordless equipment. There is also a favorable domestic manufacturing system, which enhances material innovation with improved blade durability and low maintenance requirements.

Government incentives for smart manufacturing techniques and automation implementation motivate industry stakeholders to adopt CNC cutting systems and other digital technologies for efficiency and cost savings.

The Japanese industry is anticipated to expand at 4.8% CAGR over the period of study. Japan's emphasis on industrial automation and precision engineering drives demand for cutting tools with high technical specifications. In industries like automotive, electronics, and aerospace, there is continuous investment in high-speed and highly precise cutting technologies, such as robotic saws and programmable laser cutters.

The aging workforce has created a trend towards ergonomically shaped tools that are simple to use, resulting in breakthroughs in light materials and power tools that are portable. Urban renewal and earthquake-resistant construction also spur the use of portable, effective cutting tools for on-site alterations and structural changes.

Additionally, the do-it-yourself industry does not end, fueled by consumer enthusiasm for craft and customization. Focus on product durability and quality guarantees demand for high-end tool brands and accessories. The incorporation of energy-saving technologies and low-vibration technology is in line with Japan's focus on workplace safety and environmental regulations.

The Chinese industry is forecast to grow at 6.5% CAGR over the period of study. A thriving construction sector, coupled with large-scale industrial manufacturing, positions China as one of the most dynamic sawing and cutting tool industries. Urban infrastructure development supported by the government, such as smart city initiatives, is providing long-term opportunities for tool deployment in residential and commercial segments.

Sudden industrialization and a robust export-based economy are fueling the mass adoption of automated and semi-automated cutting technologies. Right from metal processing to high precision cutting in consumer electronics, there is a range of industries that necessitate tools that provide precision, speed, and maintenance simplicity.

Moreover, the increased growth in e-commerce business and home DIY culture has substantially pushed the retail tool industry. Local producers are responding with low-cost, high-performance alternatives, while multinationals are penetrating the industry with sophisticated, feature-packed products. Measures to contain carbon emissions and increase energy efficiency also promote the use of battery-powered and low-waste-cutting technology.

The Australia-New Zealand industry will grow at 4.5% CAGR over the period under study. Demand is propelled regionally by growth within the construction, mining, and agriculture industries, which all depend on durable and transportable sawing and cutting tools in their daily activities.

Specifically, the tools are widely utilized in metalworking, landscaping, fencing, and building interior purposes. Residential renovation growth and an increasing interest in off-grid and remote living options also favor the use of battery-powered and lightweight hand tools.

The growing popularity of do-it-yourself activities and hobbyist woodworking contributes to retail demand throughout urban and semi-rural regions. Both nations stress safety, sustainability, and product durability, leading to the adoption of certified tools with low environmental footprint and extended service life.

Technical advancements in blade and tool ergonomic development are being incorporated rapidly, but demand for portable workshops and module equipment is increasing the requirements for compact, multifunctional cutting tools.

The industry continues to evolve with a blend of legacy manufacturers and innovation-led challengers. These major companies include Stanley Black & Decker, Robert Bosch, and Makita Corporation, which are building themselves into global leaders.

Bosch tantalizes cutting tools with the added integration of IoT-enabled diagnostics as well as safety sensors. At the same time, Stanley Black & Decker has invested heavily in AI-powered predictive maintenance combined with ergonomics-enhanced tool design. Hilti Corporation and Techtronic Industries (TTI) have remained strong in the professional contractor industry.

TTI's Milwaukee Tool brand aggressively introduced high-torque cordless saws featuring the fastest blade changes available, whereas Hilti focused on modular, durable saw systems used in large-scale construction.

Apex Tool Group, Snap-on Incorporated, and Ingersoll-Rand serve the industrial and automotive industries with precision-engineered cutting and grinding tools. Meanwhile, KOKI Holdings (parent of HiKOKI) pursues expansion in Asia-Pacific by introducing cost-effective, high-performance electric saws.

Atlas Copco is focusing on pneumatic cutting systems for heavy-duty applications, particularly those in mining and infrastructure. The same trend can be seen in incremental consolidation and regional OEM collaboration, again primarily in India and Southeast Asia.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Stanley Black & Decker | 14-17% |

| Robert Bosch | 12-15% |

| Makita Corporation | 10-13% |

| Techtronic Industries | 9-11% |

| Hilti Corporation | 7-9% |

| Other Players | 35-42% |

| Company Name | Offerings & Activities |

|---|---|

| Stanley Black & Decker | Smart saws and cutting tools with ergonomic design; integration of AI and IoT diagnostics. |

| Robert Bosch | Advanced electric saws with safety sensors and efficiency-focused design. |

| Makita Corporation | Compact cordless saws with brushless motors are expanding in emerging industrie s. |

| Techtronic Industries | High-performance cordless saws under Milwaukee focus on rapid blade change systems. |

| Hilti Corporation | Construction-grade modular saws have strong service networks for professional contractors. |

Key Company Insights

Stanley Black & Decker (14-17%)

Leading global footprint, driven by innovation in connected tools, lightweight materials, and aggressive M&A strategies.

Robert Bosch (12-15%)

The strong industry holds through continuous engineering enhancements and user-centric product redesign.

Makita Corporation (10-13%)

Focuses on cordless versatility and compact design, with rapid deployment in fast-growing construction zones.

Techtronic Industries (9-11%)

Leverages Milwaukee brand to dominate the professional-grade cordless cutting segment in North America and Europe.

Hilti Corporation (7-9%)

Prioritizes modular tool systems and robust after-sales service tailored for infrastructure and heavy industry use.

By application, the industry is segmented into industrial and DIY applications.

By region, the industry is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is slated to reach USD 38.2 billion in 2025.

The industry is predicted to reach a size of USD 85.8 billion by 2035.

Key companies include Stanley Black & Decker, Robert Bosch, Makita Corporation, Techtronic Industries, Hilti Corporation, Apex Tool Group, Atlas Copco, Ingersoll-Rand, KOKI Holdings, and Snap-on Incorporated.

China, slated to grow at 6.5% CAGR during the forecast period, is poised for the fastest growth.

Industrial applications are being widely used.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 5: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 6: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Western Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 16: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 20: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 24: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 28: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 32: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 3: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 4: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 11: Global Market Attractiveness by Application, 2023 to 2033

Figure 12: Global Market Attractiveness by Region, 2023 to 2033

Figure 13: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 14: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 15: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 16: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 17: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 19: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 20: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 21: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 22: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 23: North America Market Attractiveness by Application, 2023 to 2033

Figure 24: North America Market Attractiveness by Country, 2023 to 2033

Figure 25: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 26: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 27: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 28: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 29: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 30: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 32: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 33: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 34: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 35: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 36: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 37: Western Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 38: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 39: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 40: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 41: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 42: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 43: Western Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 44: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 45: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 46: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 47: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 48: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 49: Eastern Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 50: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 51: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 52: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 53: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 54: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 55: Eastern Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 56: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 57: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 58: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 59: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia and Pacific Market Value (US$ million) by Application, 2023 to 2033

Figure 62: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 63: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 64: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 65: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia and Pacific Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 68: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 69: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 70: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 71: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 72: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 74: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 75: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 76: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 78: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 80: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 81: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 82: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 83: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 84: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 85: Middle East and Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 86: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 87: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 88: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 89: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 90: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 91: Middle East and Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 92: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 93: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 94: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 95: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 96: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Dandruff Control Shampoos Market Size and Share Forecast Outlook 2025 to 2035

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Hand & Arm Protection (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Handwheels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA