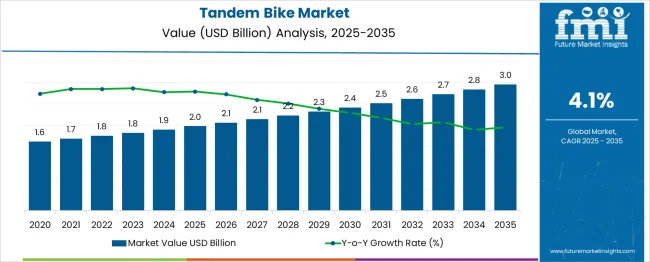

The Tandem Bike Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

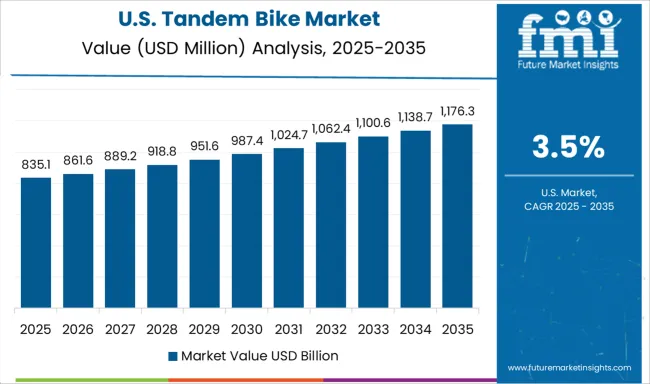

An assessment of the Growth Rate Volatility Index (GRVI) using the provided values indicates a stable and predictable growth pattern with minimal annual fluctuations. Between 2025 and 2028, annual increments range from USD 0.0 to USD 0.1 billion, with year-on-year growth rates hovering between 2.5% and 4.7%. This narrow variation reflects steady demand from recreational cycling communities, tourism operators, and specialty retail channels. From 2029 to 2032, annual growth remains within a similar range, with YoY rates stabilizing around 3.8% to 4.0%, indicating that no significant demand shocks or sudden accelerations are present. The market’s growth in this stage is supported by gradual expansion of cycling tourism, urban leisure activities, and improved availability of premium tandem models. In 2033 to 2035, YoY growth rises slightly to around 4.5%, driven by replacement purchases and niche adoption in competitive and event-based cycling. The low GRVI score points to consistent market behavior, enabling manufacturers to plan production volumes and distribution strategies effectively. The market exhibits a low-volatility growth environment, favoring long-term stability over rapid but unpredictable expansion.

| Metric | Value |

|---|---|

| Tandem Bike Market Estimated Value in (2025 E) | USD 2.0 billion |

| Tandem Bike Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The tandem bike market is viewed as a specialized yet steadily expanding category across its parent industries. It is estimated to account for about 1.6 % of the global bicycle market, indicating niche uptake among recreational and touring cyclists. Within the recreational and sporting goods sector, a share of approximately 2.4 % is assessed, supported by use in leisure cycling and travel experiences. In the outdoor mobility equipment industry around 1.9 % is observed reflecting demand for shared riding solutions among couples, families and adaptive cycling communities. Within the electric bicycle and pedelec systems segment about 1.7 % is evaluated as electric tandem bikes gain awareness for assisted touring. In the specialty adaptive and inclusive cycling market a contribution of roughly 2.3 % is calculated, supported by designs for visually impaired riders and multisensory cycling. Trends in this market have been shaped by rising interest in experiential and inclusive cycling activities. Innovations have been focused on lightweight frame materials including aluminium and carbon tandem models for stronger efficiency and comfort.

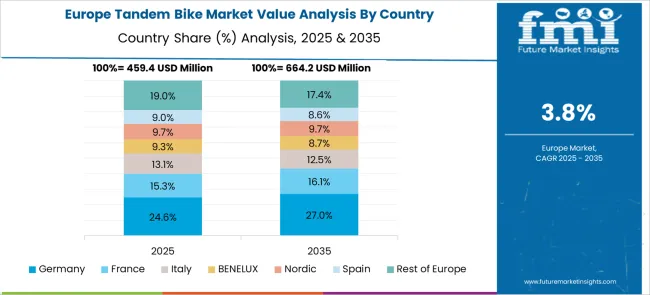

Interest has increased in electric assist tandem variants offering pedal support systems and integrated battery mounting. The Europe region has been observed to show the fastest adoption while North America has maintained strong demand through adventure tourism and rental bike services. Strategic initiatives have included collaborations between tandem bike manufacturers and cycling tour operators to deliver customised tandem fleets, guided multi-day ride packages and modular design systems allowing frame conversion for smaller teams or rider swap options.

The tandem bike market is undergoing a resurgence fueled by rising recreational cycling activities, increased interest in group fitness, and growing awareness around sustainable, people-powered transport. Demand is expanding across tourism trails, cycling clubs, and leisure parks, as riders seek shared, interactive outdoor experiences.

Tandem bikes are also gaining popularity among visually impaired cyclists and senior riders who prefer co-riding options for safety and guidance. Manufacturers are enhancing frame ergonomics, drivetrain compatibility, and modular customization to cater to a wider user base.

With increased infrastructure investment in cycle-friendly zones and eco-tourism circuits, tandem bikes are positioned to become a mainstream choice in niche adventure and leisure biking categories.

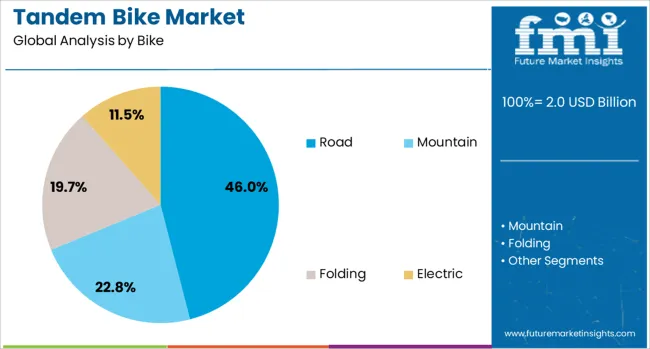

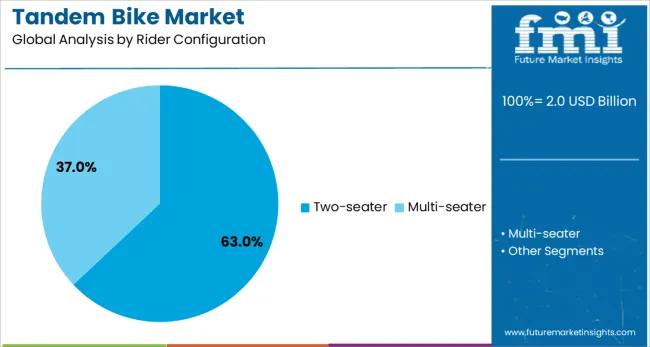

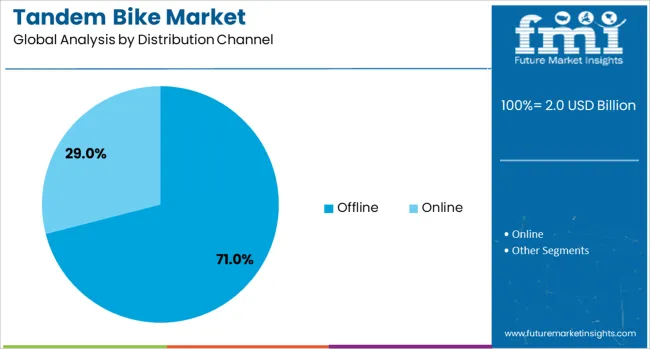

The tandem bike market is segmented by bike, rider configuration, distribution channel, end use, and geographic regions. The tandem bike market is divided into Road, Mountain, Folding, and Electric. In terms of rider configuration, the tandem bike market is classified into Two-seater and Multi-seater. The distribution channel of the tandem bike market is segmented into Offline and Online. The tandem bike market is segmented by end use into Recreational riders, Professional cyclists, and Family/group riders. Regionally, the tandem bike industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The road bike category is projected to lead the tandem bike market with a 46.00% share in 2025. These bikes are preferred for their aerodynamic design, lightweight frame, and efficient transmission, which enhance long-distance speed and performance.

Road tandem bikes are favored by endurance cyclists and club riders due to their stability and streamlined handling over paved terrains. Their adoption is particularly strong in amateur racing events, couple rides, and cross-country tours.

Continued design innovations such as carbon fiber frames, dual disc brakes, and adjustable seat post configurations are driving this segment’s appeal across performance and recreational sub-segments.

The two-seater configuration is expected to dominate the market with a 63.00% share in 2025, establishing it as the most commonly used tandem bike format. Its popularity stems from simplicity, easier handling, and suitability for most recreational and training purposes.

Two-seater tandems are extensively used by families, partners, and adaptive cyclists, allowing one rider to provide support or guidance to the other. This configuration’s balance between length and maneuverability also makes it ideal for retail rental fleets and urban trail use.

Manufacturers are integrating adjustable geometry and comfort features to accommodate diverse rider profiles and improve co-riding ergonomics.

Offline channels are projected to capture 71.00% of the tandem bike market by 2025, making it the dominant distribution method. This segment benefits from the need for physical trials, expert fitting, and in-person customization support, which are especially important in tandem configurations.

Specialty bike retailers, sports stores, and direct-from-manufacturer outlets offer personalized consultation, making them trusted channels for high-value tandem purchases. Offline sales are further supported by repair services, brand loyalty programs, and demonstration rides, which enhance customer confidence.

As tandem bikes require more tailored fittings and adjustments, in-store expertise remains a critical driver for offline channel growth.

Tandem bikes have been gaining attention among cycling enthusiasts, tour operators, and recreational riders for their ability to accommodate two or more riders on a single frame. These bicycles have been favored for group riding experiences, endurance events, and specialized applications such as visually impaired cycling partnerships. Demand has been influenced by the growth of leisure cycling tourism, cycling clubs, and organized events. Manufacturers have been introducing lightweight frames, advanced gearing systems, and comfort-oriented seating to appeal to both casual riders and competitive cycling communities.

Leisure tourism operators have increasingly incorporated tandem bikes into guided cycling tours, allowing couples, families, and friends to share the riding experience. These bikes have been particularly popular in scenic destinations across Europe, North America, and Asia where cycling routes are well-developed. Rental businesses have used tandem bikes to attract tourists seeking unique activities. The shared pedaling mechanism has made tandem bikes accessible for riders with different fitness levels, enhancing inclusivity in group rides. Organized charity rides and recreational cycling events have also promoted tandem bike use. Lightweight alloy frames, comfortable saddles, and reliable braking systems have been prioritized to improve the riding experience. The tourism-driven demand has ensured steady sales for rental operators and direct consumers in both domestic and international markets.

Tandem bikes have been actively used in competitive events, including track cycling, time trials, and Paralympic competitions for visually impaired riders paired with sighted pilots. These specialized bikes have been engineered with aerodynamic frames, high-performance drivetrains, and precision handling to meet competitive standards. Professional cycling teams and training academies have invested in custom-built tandem models to improve coordination and performance. Manufacturers in the United States, the Netherlands, and Australia have been developing carbon fiber tandem frames to reduce weight while maintaining rigidity. Racing-focused tandem bikes have also gained interest in niche cycling clubs where speed and endurance challenges are part of group activities. The integration of advanced materials and component upgrades has enhanced performance, reinforcing the appeal of tandem bikes in competitive cycling environments.

Advancements in tandem bike design have focused on improving ride comfort, maneuverability, and adaptability for different rider needs. Adjustable handlebars, suspension seat posts, and ergonomic saddle designs have been introduced to reduce fatigue during long-distance rides. Step-through frames and adaptive pedal systems have expanded accessibility for senior riders and those with mobility limitations. Electric-assist tandem bikes have gained traction, allowing easier hill climbing and longer rides without excessive strain. Manufacturers in Germany, Canada, and Taiwan have been offering customizable tandem configurations, including folding frames for convenient transport and storage. These innovations have broadened the appeal of tandem bikes to casual riders, tour operators, and inclusive cycling programs, increasing their market reach beyond traditional enthusiast groups.

Despite their benefits, tandem bikes have faced limited mainstream adoption due to higher purchase prices compared to standard bicycles. The extended frame length has required additional storage space, which has been a constraint for urban dwellers with limited room. Transporting tandem bikes on standard car racks has also posed challenges, often requiring specialized carriers. Coordination between riders has been essential for safe operation, which has deterred some casual cyclists. Maintenance costs have been slightly higher due to the need for reinforced components and longer chains. In markets where cycling is primarily used for commuting rather than leisure, demand for tandem bikes has remained niche. Without cost reductions, compact storage solutions, and broader awareness campaigns, market expansion may continue to be centered on tourism, enthusiast, and specialized sports segments.

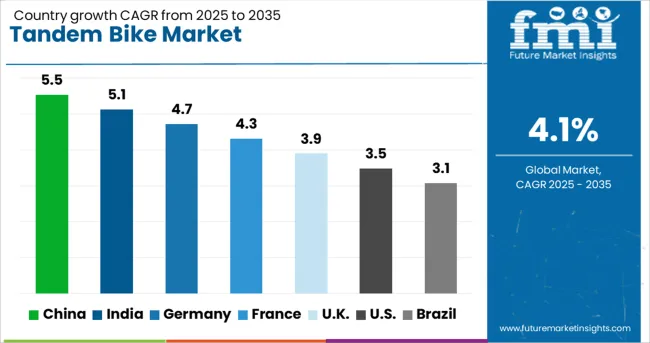

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The tandem bike market is expected to grow at a global CAGR of 4.1% between 2025 and 2035, driven by rising recreational cycling activities, tourism initiatives, and demand for eco-friendly transport options. China leads with a 5.5% CAGR, supported by large-scale bicycle manufacturing and expansion in domestic cycling tourism. India follows at 5.1%, fueled by growing interest in adventure sports and leisure cycling. Germany, at 4.7%, benefits from high-quality engineering and strong cycling culture. The UK, projected at 3.9%, sees steady growth from cycling events and rental services in tourist destinations. The USA, at 3.5%, reflects consistent demand from outdoor recreation and specialty cycling segments. The report provides insights for 40+ countries, with the five below highlighted for their strategic importance and growth outlook.

China is projected to grow at a CAGR of 5.5% from 2025 to 2035 in the tandem bike market, supported by rising interest in leisure cycling, eco-friendly tourism, and group recreational activities. Domestic brands such as Phoenix Bicycles, Forever Bicycle, and Oyama are expanding their product portfolios to include lightweight aluminum and carbon-fiber tandem frames. Growth is being fueled by bike-sharing platforms introducing tandem models for tourist destinations, as well as cycling clubs organizing group rides. Export demand is also notable, with Chinese-made tandem bikes shipped to Southeast Asia and Europe. Integration of advanced gearing systems and ergonomic seating is enhancing product appeal.

India is forecasted to achieve a CAGR of 5.1% from 2025 to 2035, driven by demand from adventure tourism, corporate team-building activities, and fitness-oriented consumers. Local manufacturers such as Hero Cycles, Atlas Cycles, and TI Cycles are introducing affordable tandem bikes targeted at both recreational users and rental operators. Growth in cycling events and community rides is boosting market visibility. Rising popularity of eco-friendly travel in hill stations and coastal tourist spots is also driving demand. Online retail platforms are playing a key role in expanding accessibility to tandem bike models across Tier-2 and Tier-3 cities.

Germany is projected to post a CAGR of 4.7% from 2025 to 2035, supported by strong cycling infrastructure and consumer preference for premium, precision-engineered bikes. Leading brands such as Koga, Hase Bikes, and Riese & Müller are integrating electric-assist motors into tandem models to cater to long-distance touring. The recreational cycling culture in Germany’s countryside and urban parks continues to boost market adoption. Additionally, lightweight frame materials, internal gear hubs, and hydraulic disc brakes are becoming standard in higher-end models. Customization services for frame size and seating configurations are also appealing to niche cycling communities.

The United Kingdom is expected to record a CAGR of 3.9% from 2025 to 2035, driven by leisure tourism, charity cycling events, and rental demand in scenic locations. UK-based manufacturers and retailers such as Orbit Tandems, Dawes Cycles, and Thorn Cycles are introducing models with improved comfort features for mixed-age riders. Growth is also supported by the expansion of cycling routes and trails in national parks and coastal areas. Demand for folding tandem bikes is emerging among urban riders seeking portability. Export interest in British-made tandem bikes is rising in North America and Australia.

The United States is forecasted to grow at a CAGR of 3.5% from 2025 to 2035, with demand driven by recreational cycling clubs, tourism operators, and competitive tandem racing. Key players such as Co-Motion Cycles, Santana Cycles, and Trek Bicycle Corporation are focusing on performance-oriented tandem designs with aerodynamic frames and advanced drivetrain systems. Growth in tandem cycling competitions and charity tours is expanding awareness. Tourism operators in coastal and wine country regions are increasingly adding tandem bikes to rental fleets. Electric-assist tandem bikes are gaining popularity for long-distance and hilly terrain cycling.

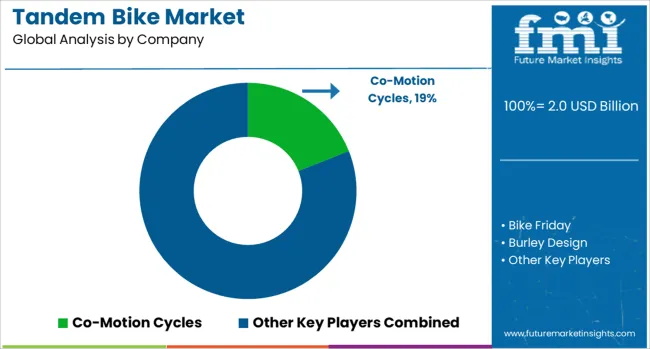

The tandem bike market is led by specialized bicycle manufacturers and niche frame builders catering to recreational riders, touring enthusiasts, and competitive cycling segments. Co-Motion Cycles and Santana Cycles dominate the high-performance and touring tandem segment with custom-built frames, advanced gearing systems, and lightweight materials optimized for long-distance riding. Bike Friday and Burley Design focus on foldable and travel-friendly tandem bikes, appealing to urban riders and adventure travelers. Calfee Design specializes in carbon fiber tandem frames, offering exceptional stiffness-to-weight ratios for competitive cyclists, while Cannondale delivers both alloy and carbon tandem options within broader retail networks. Dawes Cycles and KHS Bicycles serve mid-market consumers with durable, value-oriented models suited for recreational use and entry-level touring. Hase Bikes brings innovation with semi-recumbent and adaptive tandem designs, targeting riders with diverse ergonomic needs. Thorn Bicycles is known for expedition-ready tandems equipped with Rohloff hubs and heavy-duty frames for rugged terrain and extended journeys. Key strategies in this sector include customization for rider fit, integration of advanced drivetrains for smoother pedaling synchronization, and partnerships with specialty bike shops for direct-to-consumer fittings. Competitive differentiation often comes from craftsmanship, frame material innovation, and brand reputation among long-distance cycling communities. Entry into the tandem bike market is challenged by low production volumes, specialized frame geometry expertise, and the need for strong relationships with niche cycling retailers and enthusiast networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Bike | Road, Mountain, Folding, and Electric |

| Rider Configuration | Two-seater and Multi-seater |

| Distribution Channel | Offline and Online |

| End Use | Recreational riders, Professional cyclists, and Family/group riders |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Co-Motion Cycles, Bike Friday, Burley Design, Calfee Design, Cannondale, Dawes Cycles, Hase Bikes, KHS Bicycles, Santana Cycles, and Thorn Bicycles |

The global tandem bike market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the tandem bike market is projected to reach USD 3.0 billion by 2035.

The tandem bike market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in tandem bike market are road, mountain, folding and electric.

In terms of rider configuration, two-seater segment to command 63.0% share in the tandem bike market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bike Sharing Market Size and Share Forecast Outlook 2025 to 2035

Bike And Scooter Rental Market Size and Share Forecast Outlook 2025 to 2035

Bike Saddles Market Trends – Growth & Demand Forecast 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Motors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

E-Bike Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Battery Market Size and Share Forecast Outlook 2025 to 2035

E-bike Market Size and Share Forecast Outlook 2025 to 2035

BMX Bikes Market Size and Share Forecast Outlook 2025 to 2035

Pit Bike Market Size and Share Forecast Outlook 2025 to 2035

Hydrobikes Market Size and Share Forecast Outlook 2025 to 2035

Dirt Bike Market Size and Share Forecast Outlook 2025 to 2035

Cargo Bike Tire Market Growth – Trends & Forecast 2025-2035

Cargo Bike Market Growth - Trends & Forecast 2024 to 2034

Racing Bike Market Size and Share Forecast Outlook 2025 to 2035

Electric Bike Range Extender Market Size and Share Forecast Outlook 2025 to 2035

Electric Bike Market Growth - Trends & Forecast 2025 to 2035

Underwater Bikes Market Size and Share Forecast Outlook 2025 to 2035

Mountain E-Bike Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA