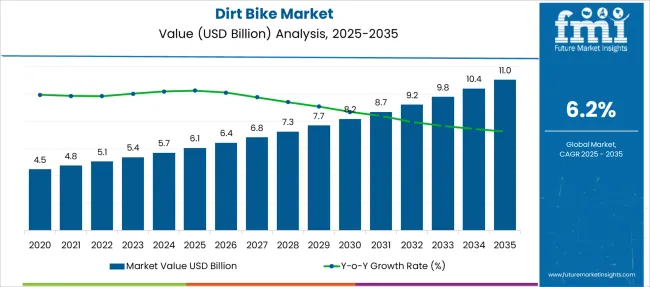

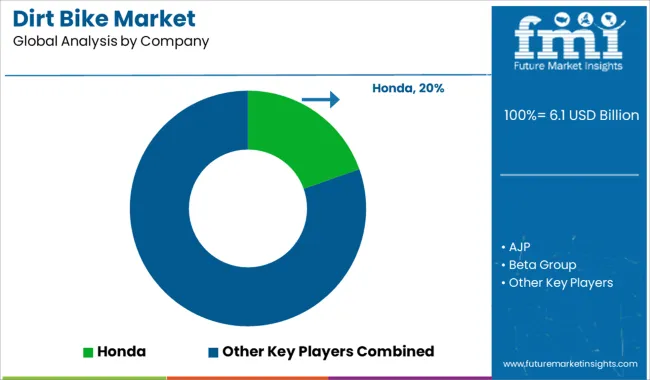

The Dirt Bike Market is estimated to be valued at USD 6.1 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Dirt Bike Market Estimated Value in (2025 E) | USD 6.1 billion |

| Dirt Bike Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The dirt bike market is witnessing strong traction, propelled by rising off-road recreational activities, motocross events, and the growing appeal of motorsport culture among younger consumers. Manufacturers are increasingly focusing on lightweight construction, advanced suspension systems, and improved handling to cater to both amateur riders and professional racers.

The accessibility of financing options and the proliferation of off-road trails and adventure parks have expanded the customer base in developed as well as emerging regions. Additionally, brand-sponsored community events and digital engagement strategies are encouraging broader participation.

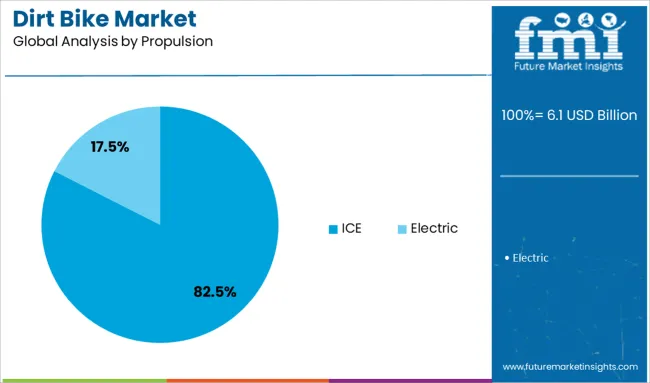

While electric models are gradually emerging, internal combustion engine (ICE) bikes continue to dominate due to their superior performance and extended ride range. Looking forward, demand is expected to remain stable, supported by technology integration, aftermarket customization trends, and rising global interest in outdoor and competitive motorcycling.

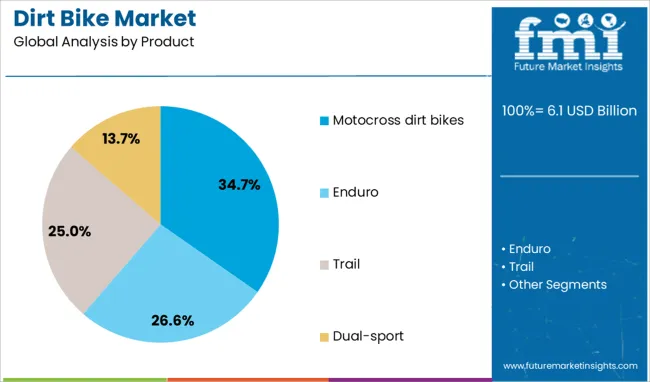

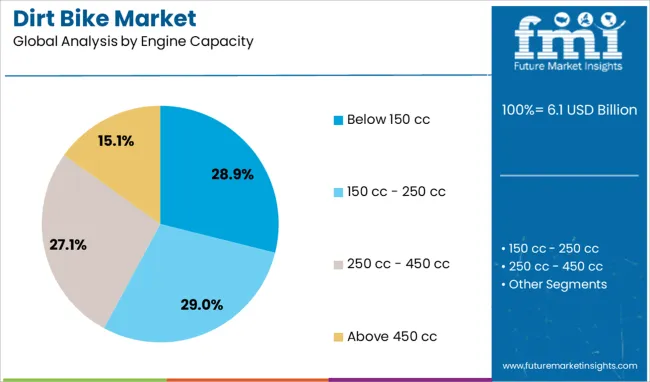

The dirt bike market is segmented by product, engine capacity, propulsion, application, sales channel, and geographic regions. The dirt bike market is divided into Motocross dirt bikes, Enduro, Trail, and Dual-sport. In terms of engine capacity, the dirt bike market is classified into below 150 cc, 150 cc - 250 cc, 250 cc - 450 cc, and above 450 cc. Based on propulsion, the dirt bike market is segmented into ICE and Electric. The dirt bike market is segmented into Recreational, Professional sports, and Adventure and touring. The sales channel of the dirt bike market is segmented into OEM and Aftermarket. Regionally, the dirt bike industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The motocross dirt bikes segment leads the product category with a 34.7% market share, driven by its popularity in competitive racing and high-adrenaline recreational use. These bikes are specifically engineered for rugged terrains and intense acceleration, making them the top choice for riders seeking superior agility and performance.

Their dominance is supported by strong demand across motocross events and a growing consumer shift toward sport-oriented riding. Continuous advancements in chassis design, weight distribution, and engine responsiveness are enhancing rider control and safety, further increasing appeal.

Manufacturers are investing in both two-stroke and four-stroke models to cater to different rider preferences. As organized motocross racing gains more visibility globally and training facilities expand, demand for high-performance motocross dirt bikes is expected to maintain upward momentum.

The below 150 cc engine capacity segment holds a 28.9% market share, reflecting strong demand for entry-level and lightweight dirt bikes among beginners and young riders. These bikes offer easier handling, lower maintenance, and affordability, making them ideal for new entrants to off-road motorcycling.

Their lower fuel consumption and ease of maneuverability are attractive in both recreational and light competition settings. Manufacturers are capitalizing on this segment by offering models with updated styling, improved ergonomics, and safety features tailored to first-time users.

As dirt biking becomes more inclusive and family-oriented, the below 150 cc category continues to serve as a gateway for broader market participation. The segment is expected to grow steadily, supported by riding schools, community trails, and youth-oriented sports initiatives.

The internal combustion engine (ICE) segment dominates the propulsion category with an 82.5% market share, underscoring its entrenched position in the dirt bike market. ICE bikes are favored for their superior torque delivery, quick throttle response, and long operational range, which are critical for high-performance off-road riding.

This propulsion type supports a broad range of engine sizes and configurations, enabling brands to target both casual riders and professional competitors. Continued technological advancements in fuel efficiency, emissions control, and weight reduction have helped ICE bikes maintain relevance despite rising environmental scrutiny.

The widespread availability of parts, service networks, and rider familiarity further bolster segment strength. While electric alternatives are gaining ground, ICE-powered dirt bikes are expected to remain the dominant choice in the foreseeable future due to their proven reliability and unmatched off-road capability.

The dirt bike market is fueled by adventure sports demand, electric model adoption, and customization trends, while global racing events and strategic brand partnerships strengthen its positioning as both a lifestyle and performance-driven segment.

Off-road biking has experienced a surge in popularity, driven by an increasing focus on adventure sports and leisure riding. Enthusiasts are drawn to the thrill of rugged terrains, trail riding, and competitive events that challenge both skill and endurance. Manufacturers are responding with advanced suspension systems, high-torque engines, and durable frames to withstand extreme conditions. The category’s appeal extends beyond professionals, as recreational riders seek experiences that combine adrenaline with outdoor exploration. Event organizers and tourism sectors have leveraged this trend by creating off-road circuits and guided adventure packages. This synergy between product development and experience-based marketing has reinforced dirt bikes as a central element of recreational mobility solutions.

The adoption of electric variants has introduced new momentum within the dirt bike market. These models offer quieter operations and minimal maintenance, appealing to both novice and seasoned riders. Improved battery range and rapid charging infrastructure have enhanced feasibility for long-distance trails. Electric models are being positioned as performance-oriented machines rather than entry-level alternatives, aided by torque-rich motors that outperform some conventional engines. Government incentives and evolving consumer expectations have also strengthened interest in emission-compliant mobility solutions. Analysts view this segment as pivotal in redefining competitive strategies, enabling manufacturers to balance environmental compliance with consumer expectations for high-speed, off-road performance.

Consumer demand for customization has influenced the dirt bike ecosystem significantly. Riders seek personalization options, from upgraded suspension kits and exhaust systems to ergonomic seat adjustments. Aftermarket companies have capitalized on this trend, offering specialized accessories and performance parts tailored to various terrains and riding styles. This creates recurring revenue streams beyond initial sales, strengthening dealer networks and service offerings. Subscription-based maintenance and performance upgrade packages are emerging as innovative approaches to engage loyal customers. Market observers consider this dynamic critical for brand differentiation, as riders perceive customization not just as an aesthetic upgrade but as a functional requirement for maximizing off-road capability and safety.

The global expansion of competitive racing and adventure festivals has transformed dirt biking into a mainstream sporting activity. Regions in North America and Europe have witnessed organized championships attracting large audiences and brand sponsorships. Emerging economies are hosting off-road festivals to boost tourism and sporting culture, thereby expanding market penetration. Manufacturers actively partner with event organizers to showcase product performance under challenging conditions, using these platforms as live demonstrations for potential buyers. The integration of digital broadcasting and influencer marketing around these events further amplifies visibility, creating aspirational value for younger demographics. These strategies have positioned dirt bikes as both a sport and lifestyle element, elevating brand engagement.

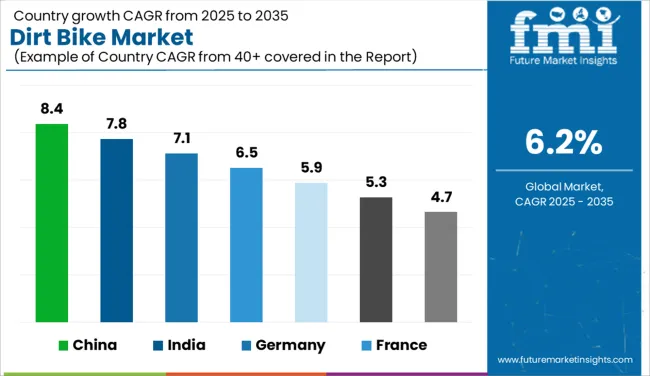

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The dirt bike market is set to expand globally at a 6.2% CAGR, with leading countries showing differing growth dynamics. China, as a dominant player, is projected to maintain an 8.4% CAGR, driven by high production volumes and increasing domestic demand. India follows closely at 7.8%, benefiting from a growing youth demographic and expanding middle class with an appetite for recreational activities. Germany also shows strong performance at 7.1%, fueled by robust demand in both leisure and competitive sectors. The UK and USA exhibit more modest growth rates at 5.9% and 5.3%, respectively. While mature markets continue to hold steady, the demand is stable, bolstered by continued interest in motorsports and outdoor activities. These slower growth trajectories highlight the contrast in emerging versus developed markets. The report provides a comprehensive analysis, examining key regions, their contribution to global supply, and projections for 2025-2035. The report covers a detailed analysis of 40+ countries, with the top five countries highlighted above as a reference.

The CAGR for the dirt bike market in the UK rose from 5.9% during 2020-2024 to 6.2% for 2025-2035. This growth is driven by rising interest in off-road activities and evolving consumer preferences. The launch of advanced dirt bikes with better performance features attracted both new and seasoned riders. Additionally, government support for motorsports and recreational activities further boosted market demand. Increased participation in motocross and off-road sports, along with innovations in bike design, is expected to contribute to steady growth over the forecasted period.

The CAGR for the Dirt Bike market in India is projected to rise from 7.8% during 2020-2024 to 8.2% for 2025-2035. This growth is largely attributed to the country’s expanding youth demographic and increasing disposable incomes, leading to a surge in recreational outdoor activities like dirt biking. The growing popularity of off-road biking events, supported by private and government initiatives, is creating a strong demand. Affordable pricing of entry-level models and the expansion of motorsports infrastructure are expected to further fuel the market's growth.

The CAGR for the dirt bike market in China is expected to grow from 8.4% during 2020-2024 to 8.7% for 2025-2035. This market is driven by a combination of growing interest in motorsports and the increasing availability of affordable dirt bikes. Government-led initiatives to support sports, particularly those that promote outdoor recreational activities, are boosting demand for dirt bikes. As China continues to modernize its transportation and recreational sectors, dirt biking is becoming more mainstream, and domestic manufacturers are expanding their product offerings to meet demand.

The CAGR for the dirt bike market in Germany is projected to increase from 7.1% during 2020-2024 to 7.3% for 2025-2035. Germany's robust motorsports culture and established market for off-road vehicles contribute to the steady demand for dirt bikes. The increasing number of motocross events and the expansion of motorsports tourism are helping sustain growth. Additionally, innovations in bike technology, along with a rising focus on sustainability and eco-friendly options, are attracting environmentally conscious consumers, further stimulating market growth.

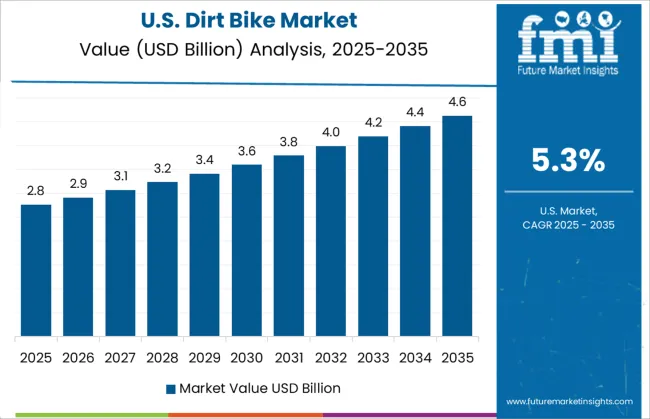

The CAGR for the dirt bike market in the USA is projected to grow from 5.3% during 2020-2024 to 5.5% for 2025-2035. This growth is supported by a strong motorsports culture, particularly in off-road racing and recreational biking. As interest in outdoor adventure sports remains high, dirt bikes are becoming a popular choice among consumers in rural and suburban areas. Continued innovations in product design and safety features are attracting new customers, while seasoned riders continue to support the market. Despite a mature market, the demand remains steady, driven by new entrants and innovations in biking technology.

In the dirt bike market, manufacturers are focusing on advanced engineering, competitive performance, and electric mobility solutions to cater to evolving consumer expectations for off-road experiences. Honda, Yamaha, and Suzuki dominate global sales through extensive product lines covering motocross, trail, and enduro bikes, supported by strong dealer networks and racing sponsorships. KTM is widely regarded for premium performance motorcycles, leveraging technology-rich models designed for professional and competitive riders. Kawasaki continues to strengthen its portfolio with lightweight and high-torque bikes aimed at delivering agile off-road handling. European specialists like Beta Group and Sherco target niche segments by offering competition-oriented dirt bikes with unique frame geometry and suspension tuning. AJP, recognized for producing adventure and enduro models, appeals to enthusiasts seeking lightweight yet durable bikes suitable for challenging terrains. SSR Motorsports has carved a space in entry-level and mid-range categories with cost-effective alternatives, while Hyosung is expanding its footprint by incorporating value-driven designs into recreational off-road segments.

Collectively, these brands are emphasizing innovation in chassis design, engine efficiency, and rider ergonomics, while exploring strategic partnerships in event sponsorship and aftermarket accessories. This multi-tiered approach has positioned them as key players shaping consumer preferences and competitive benchmarks in the global dirt bike industry.

In December 2024, KTM officially launched the 2025 KTM 450 SX‑F and 250 SX‑F Factory Editions.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.1 Billion |

| Product | Motocross dirt bikes, Enduro, Trail, and Dual-sport |

| Engine Capacity | Below 150 cc, 150 cc - 250 cc, 250 cc - 450 cc, and Above 450 cc |

| Propulsion | ICE and Electric |

| Application | Recreational, Professional sports, and Adventure and touring |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honda, AJP, Beta Group, Hyosung, Kawasaki, KTM, Sherco, SSR Motorsports, Suzuki, and Yamaha |

| Additional Attributes | Dollar sales trends, share by engine capacity, growth projections by region, consumer preference insights, competitive pricing benchmarks, aftermarket revenue potential, distribution channel performance, electric model adoption, racing event impact on sales. |

The global dirt bike market is estimated to be valued at USD 6.1 billion in 2025.

The market size for the dirt bike market is projected to reach USD 11.0 billion by 2035.

The dirt bike market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in dirt bike market are motocross dirt bikes, enduro, trail and dual-sport.

In terms of engine capacity, below 150 cc segment to command 28.9% share in the dirt bike market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bike Sharing Market Size and Share Forecast Outlook 2025 to 2035

Bike And Scooter Rental Market Size and Share Forecast Outlook 2025 to 2035

Bike Saddles Market Trends – Growth & Demand Forecast 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Motors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

E-Bike Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Battery Market Size and Share Forecast Outlook 2025 to 2035

E-bike Market Size and Share Forecast Outlook 2025 to 2035

BMX Bikes Market Size and Share Forecast Outlook 2025 to 2035

Pit Bike Market Size and Share Forecast Outlook 2025 to 2035

Hydrobikes Market Size and Share Forecast Outlook 2025 to 2035

Cargo Bike Tire Market Growth – Trends & Forecast 2025-2035

Cargo Bike Market Growth - Trends & Forecast 2024 to 2034

Racing Bike Market Size and Share Forecast Outlook 2025 to 2035

Tandem Bike Market Size and Share Forecast Outlook 2025 to 2035

Electric Bike Range Extender Market Size and Share Forecast Outlook 2025 to 2035

Electric Bike Market Growth - Trends & Forecast 2025 to 2035

Underwater Bikes Market Size and Share Forecast Outlook 2025 to 2035

Mountain E-Bike Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA