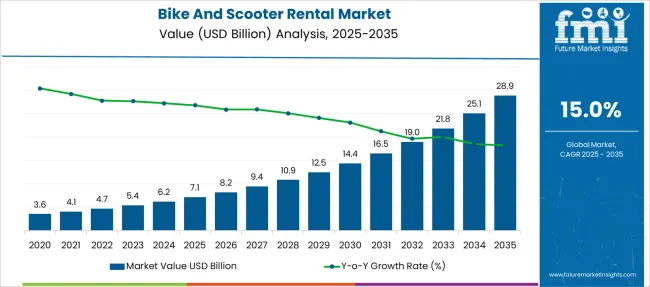

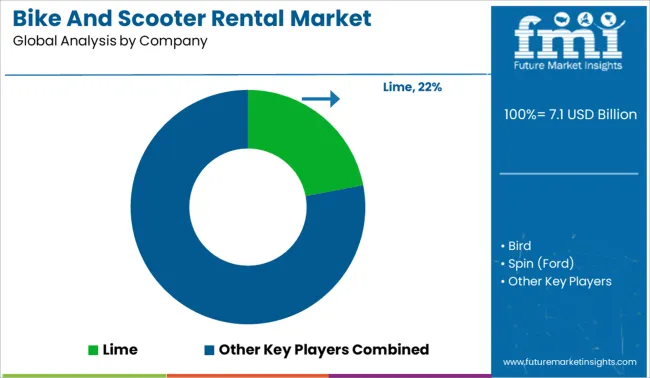

The Bike And Scooter Rental Market is estimated to be valued at USD 7.1 billion in 2025 and is projected to reach USD 28.9 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

| Metric | Value |

|---|---|

| Bike And Scooter Rental Market Estimated Value in (2025 E) | USD 7.1 billion |

| Bike And Scooter Rental Market Forecast Value in (2035 F) | USD 28.9 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The Bike and Scooter Rental market is undergoing significant transformation as urban mobility solutions continue to evolve in response to rising traffic congestion, increasing fuel costs, and heightened environmental awareness. This growth is being sustained by a shift in consumer preferences toward shared, affordable, and sustainable transportation modes that can seamlessly integrate with public transit. Advancements in mobile app-based booking, real-time GPS tracking, and digital payment systems have further enabled widespread adoption of rental services across metropolitan regions.

Policymakers and municipal authorities are actively encouraging micromobility initiatives to reduce urban emissions and promote last-mile connectivity. The presence of a large base of environmentally conscious consumers, especially in densely populated cities, is creating fertile ground for expansion.

Continuous investments from private operators, infrastructure development, and regulatory support are all contributing to long-term market stability. As consumer behavior increasingly aligns with on-demand transportation and shared mobility, the bike and scooter rental industry is expected to witness sustained growth through technology-driven innovation and operational scalability..

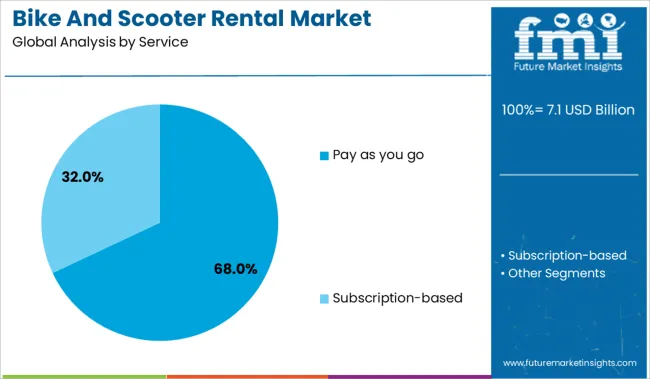

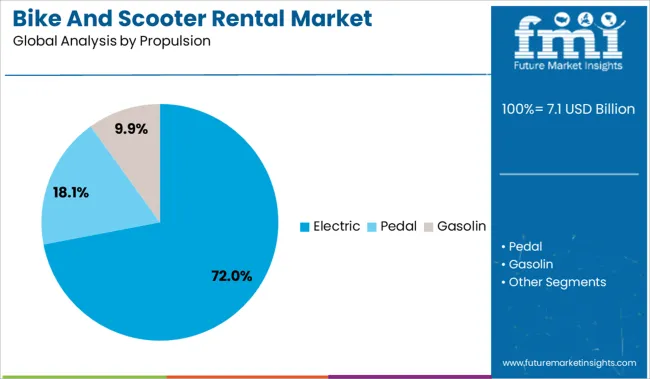

The market is segmented by Service, Propulsion, Operation Model, Vehicle, and Rental Duration and region. By Service, the market is divided into Pay as you go and Subscription-based. In terms of Propulsion, the market is classified into Electric, Pedal, and Gasolin.

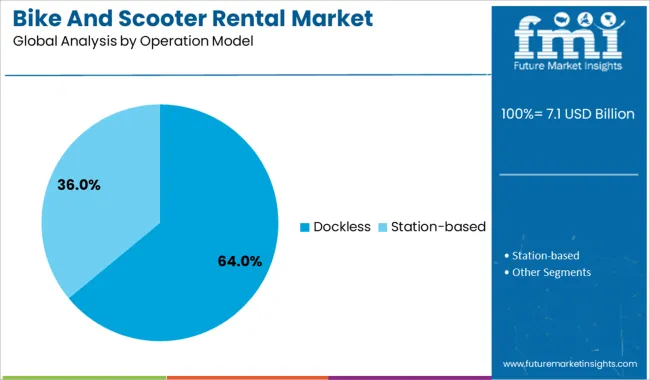

Based on Operation Model, the market is segmented into Dockless and Station-based. By Vehicle, the market is divided into Scooter and Bike. By Rental Duration, the market is segmented into Short term, Pedal, Electric, Gasoline, Long term, Pedal, Electric, and Gasoline. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pay as you go service segment is projected to account for 68% of the Bike and Scooter Rental market revenue share in 2025, making it the dominant service model. The segment’s popularity has been driven by its flexible pricing structure, which allows users to rent vehicles on a per-minute or per-trip basis without long-term commitment. This approach has appealed especially to casual riders, tourists, and commuters seeking affordable and short-duration travel solutions.

Ease of access through smartphone applications and the absence of subscription fees have contributed to greater adoption. Operators have favored this model due to its low customer acquisition cost and high user turnover, leading to improved fleet utilization rates.

Pay as you go services have also enabled service providers to penetrate new markets without deploying complex pricing infrastructures. As consumers continue to prioritize convenience, transparency, and cost efficiency, the pay as you go service format has remained the preferred choice across both mature and emerging urban centers..

The electric propulsion segment is expected to command 72% of the Bike and Scooter Rental market revenue share in 2025, establishing it as the leading propulsion type. Growth in this segment has been influenced by increasing demand for zero-emission transportation and rising fuel prices, which have accelerated the shift toward electric alternatives. Electric bikes and scooters offer a quiet, efficient, and low-maintenance alternative to traditional combustion-powered vehicles.

Supportive government policies, including incentives, subsidies, and relaxed regulations for electric mobility, have encouraged both service providers and consumers to transition to electric fleets. Additionally, advancements in battery technology have extended travel ranges and reduced charging times, enhancing the user experience and operational efficiency.

The environmental sustainability of electric vehicles has also aligned with the growing commitment of cities to reduce air pollution and carbon emissions. The combination of environmental, economic, and policy-driven factors has ensured the continued dominance of electric propulsion in the micromobility ecosystem..

The dockless operation model segment is forecasted to capture 64% of the Bike and Scooter Rental market revenue share in 2025, positioning it as the leading operational framework. This model has been adopted widely due to its unmatched convenience, allowing users to pick up and drop off vehicles at any legal public location without requiring fixed docking stations. The ease of access provided by GPS-enabled mobile applications has enhanced user flexibility and led to greater trip volumes per vehicle.

From an operator’s perspective, the dockless model has enabled faster scaling and reduced infrastructure investment compared to station-based systems. Urban planners and transport authorities have supported this model due to its minimal space requirements and adaptability across different city layouts.

While the model has required careful management of fleet distribution and parking compliance, advances in geofencing and real-time fleet monitoring have mitigated these challenges. The dockless approach continues to gain traction as cities and consumers alike prioritize agile and user-centric mobility solutions..

The bike and scooter rental market has revealed strong opportunities through tourism integration and institutional partnerships. From 2023 to 2025, services were embedded into travel packages, hotel bookings, and campus transit systems, allowing rentals to move beyond commuter use. These models enabled providers to capture predictable, high-frequency demand across leisure and organizational segments. As shared mobility becomes embedded in travel and corporate routines, rental operators are positioned to scale through targeted, contract-based deployment strategies.

Rapid expansion of bike and scooter sharing systems was observed in 2023, with a notable rise in ride volumes that highlighted sustained reliance on micromobility options. In 2024, dockless electric scooters and e-bikes were more widely integrated into public transport corridors, improving access to first- and last-mile connectivity across cities. By 2025, extensions of government-supported rental trials were introduced in several countries to develop regulatory blueprints and scale up shared mobility operations. These developments have shown that rising commuter volume, paired with structured municipal involvement, has fueled market expansion. The shift toward flexible, short-distance mobility is no longer experimental—it has become a recurring demand, reinforced by transit system gaps.

The infusion of bike and scooter rental services into tourism offerings was leveraged in 2023 when guided micromobility tours were introduced in major European and Asian destinations. In 2024, partnerships with hotels and travel agencies were being formalized to provide rental fleets directly at booking touchpoints. By early 2025, integrated booking platforms were facilitating on-demand access via vacation packages, boosting usage among international travelers. These initiatives have shown that micromobility can evolve from general urban transport into curated sightseeing experiences. Providers positioned within the travel ecosystem are thus poised to capture value by offering convenient, accessible mobility bundles tailored to visitor preferences and trip itineraries.

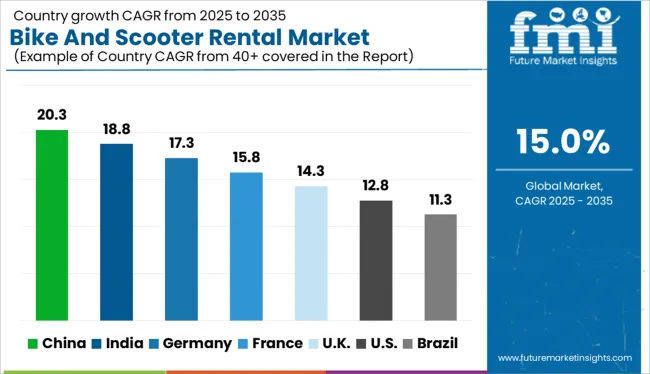

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

The RF smart electric meter market is projected to expand globally at a CAGR of 10% from 2025 to 2035. China leads the growth with a 13.4% CAGR, followed by India at 12.4% and Germany at 11.4%. France records a steady 10.4%, while the United Kingdom trails slightly at 9.4%. China and India are accelerating rollout through nationwide grid modernization and wireless AMI programs. Germany's emphasis on energy data privacy and interoperability standards supports strong expansion. France invests in meter digitalization via utilities-backed programs, while the UK reflects a more phased approach influenced by consumer pushback and infrastructure constraints.

China is projected to lead the global bike and scooter rental market with a 20.3% CAGR, supported by aggressive government backing and the dominance of app-integrated platforms. Operators like Meituan and HelloBike continue to expand fleets with AI-enabled demand tracking and smart lock features. High ridership in Tier-1 and Tier-2 cities stems from congestion avoidance and flexible fare systems. Integration with local transit apps drives higher consumer retention.

India is expected to grow at an 18.8% CAGR in the bike and scooter rental segment, driven by dense city networks and demand for low-cost urban mobility. Startups and EV-first platforms are deploying battery-swappable scooters across tech parks, metro stations, and university zones. State incentives for electric mobility expansion further support rental infrastructure. Companies are offering micro-leasing options for college students and gig workers.

Germany’s bike and scooter rental market is forecast to grow at a 17.3% CAGR, supported by green transport policies and digital infrastructure integration. Municipal partnerships in Berlin, Hamburg, and Munich enable fleet co-management with urban planners. Shared mobility providers integrate with Deutsche Bahn apps to offer seamless first- and last-mile options. Subscription-based access models are rising in usage, particularly for scooters in younger urban populations.

France is projected to expand its bike and scooter rental market at a 15.8% CAGR, backed by public funding for shared mobility and eco-transportation targets. Cities like Paris and Lyon have adopted large-scale scooter regulation frameworks while promoting public-private stationless bike deployments. Multimodal fare cards now include bike access through regional transit passes. Domestic firms and international entrants compete on pricing and vehicle durability.

The United Kingdom is forecast to grow its bike and scooter rental market at a 14.3% CAGR, with adoption rising through campus mobility pilots, tourism hubs, and business districts. Providers like Lime, Voi, and Tier operate under trial zones with strict compliance requirements. Helmet accessibility, geo-fencing, and speed restrictions remain core focus areas. Rental use is especially strong during events and in travel corridors underserved by public transit.

The bike and scooter rental market is moderately consolidated, led by Lime. The company holds a dominant position through its global fleet of electric scooters and bikes, strong app-based ecosystem, and extensive municipal partnerships across North America, Europe, and Asia. Dominant player status is held exclusively by Lime. Key players include Bird, Spin (Ford), TIER Mobility, and Lyft — each offering app-integrated shared mobility services with a focus on fleet optimization, multimodal integration, and urban mobility contracts. Emerging players such as Vogo, Bounce, and Yulu focus on regional markets through dockless systems, cost-sensitive two-wheeler fleets, and collaborations with smart city initiatives. Market demand is driven by rising need for last-mile connectivity, shifting commuter preferences, and supportive policies favoring micro-mobility adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.1 Billion |

| Service | Pay as you go and Subscription-based |

| Propulsion | Electric, Pedal, and Gasolin |

| Operation Model | Dockless and Station-based |

| Vehicle | Scooter and Bike |

| Rental Duration | Short term, Pedal, Electric, Gasoline, Long term, Pedal, Electric, and Gasoline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lime, Bird, Spin (Ford), TIER Mobility, Vogo, Bounce, Yulu, and Lyft |

| Additional Attributes | Dollar sales by rental type (bike vs scooter), Dollar sales by propulsion (pedal vs electric vs gasoline), Dollar sales by service model (pay‑as‑you‑go vs subscription), Trends in IoT/GPS tracking and remote unlocking, Use of electric-powered micromobility in urban commuter programs, Growth driven by ESG and last‑mile integration, Regional adoption highest in Asia‑Pacific and North America |

The global bike and scooter rental market is estimated to be valued at USD 7.1 billion in 2025.

The market size for the bike and scooter rental market is projected to reach USD 28.9 billion by 2035.

The bike and scooter rental market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in bike and scooter rental market are pay as you go and subscription-based.

In terms of propulsion, electric segment to command 72.0% share in the bike and scooter rental market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bike Sharing Market Size and Share Forecast Outlook 2025 to 2035

Bike Saddles Market Trends – Growth & Demand Forecast 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Motors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

E-Bike Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Battery Market Size and Share Forecast Outlook 2025 to 2035

E-bike Market Size and Share Forecast Outlook 2025 to 2035

BMX Bikes Market Size and Share Forecast Outlook 2025 to 2035

Pit Bike Market Size and Share Forecast Outlook 2025 to 2035

Hydrobikes Market Size and Share Forecast Outlook 2025 to 2035

Dirt Bike Market Size and Share Forecast Outlook 2025 to 2035

Cargo Bike Tire Market Growth – Trends & Forecast 2025-2035

Cargo Bike Market Growth - Trends & Forecast 2024 to 2034

Racing Bike Market Size and Share Forecast Outlook 2025 to 2035

Tandem Bike Market Size and Share Forecast Outlook 2025 to 2035

Electric Bike Range Extender Market Size and Share Forecast Outlook 2025 to 2035

Electric Bike Market Growth - Trends & Forecast 2025 to 2035

Underwater Bikes Market Size and Share Forecast Outlook 2025 to 2035

Mountain E-Bike Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA