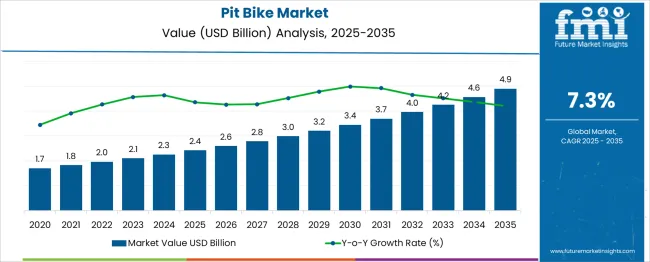

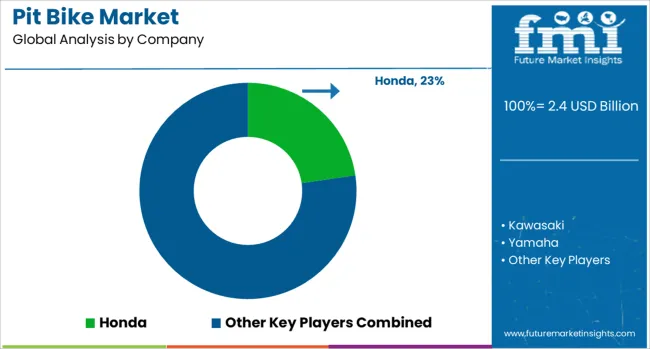

The Pit Bike Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 4.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

| Metric | Value |

|---|---|

| Pit Bike Market Estimated Value in (2025 E) | USD 2.4 billion |

| Pit Bike Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The pit bike market is expanding steadily due to increasing interest in recreational motorsports, off-road events, and accessible two-wheeler alternatives for short-distance travel. These bikes are valued for their compact size, lightweight frame, and affordability, making them attractive to beginners, hobbyists, and younger riders. Rising disposable incomes and growing popularity of motorsport training schools have contributed to sustained demand.

In particular, aftermarket customization options and social media-driven motorsport culture have strengthened consumer engagement. The market outlook remains positive, supported by consistent sales in emerging economies and a trend toward weekend and leisure riding. Manufacturers are expected to focus on improving safety features, fuel efficiency, and ergonomics, while also exploring hybrid and electric options to align with shifting environmental regulations.

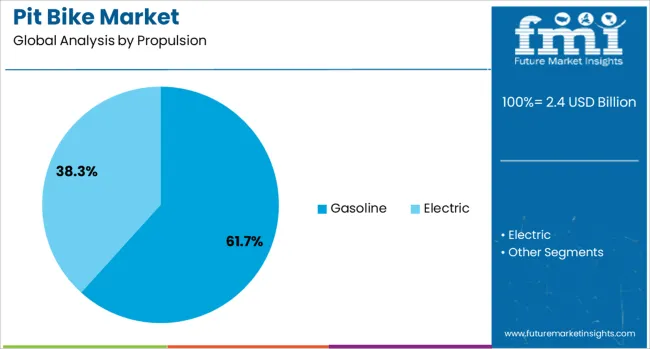

However, gasoline-powered variants remain dominant, driven by performance reliability and infrastructure compatibility.

The pit bike market is segmented by propulsion, application, bike type, sales channel, and age group and geographic regions. The pit bike market is divided into Gasoline and Electric. In terms of application, the pit bike market is classified into Utility, Sports, and Recreation. Based on the bike type, the pit bike market is segmented into Minibikes, Standard bikes, and Performance bikes. The pit bike market is segmented by sales channel into Direct sales, Dealerships, and Online retailers. The pit bike market is segmented by age group into Children (up to 12 years), Teenagers (13-25 years), and Adults (25 years and above). Regionally, the pit bike industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gasoline segment holds a dominant 61.7% share in the propulsion category, highlighting its continued relevance in delivering reliable performance for pit bikes across various terrains. Gasoline-powered models are preferred for their robust torque output, quick acceleration, and ability to handle rough environments, which are crucial in racing and off-road settings. The established fueling infrastructure and ease of maintenance further contribute to their popularity among both amateur and seasoned riders.

Despite growing environmental concerns, manufacturers continue to invest in engine refinement and emission-reduction technologies to comply with regulatory standards. The segment’s strength is reinforced by its deep-rooted user base and competitive pricing, especially in markets with limited access to electric alternatives.

As recreational biking and motorsport culture expand, gasoline-powered pit bikes are expected to maintain their dominant share due to their durability and widespread acceptance.

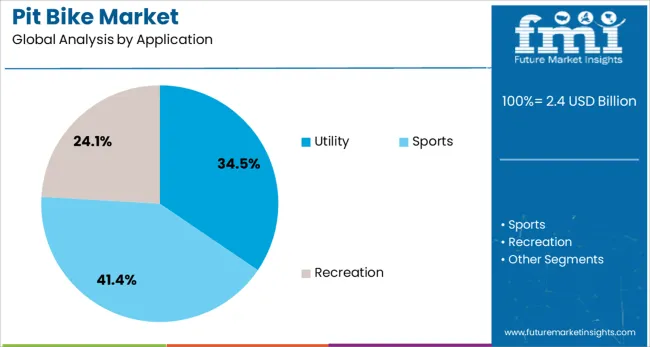

The utility segment leads the application category with a 34.5% market share, reflecting the evolving use of pit bikes beyond competitive sports into functional and transport-based roles. These bikes are increasingly utilized for on-site transportation in farms, construction areas, racing paddocks, and event logistics, where their small size and maneuverability offer operational advantages. Utility-focused models are designed with features such as cargo racks, reinforced suspension, and low-maintenance components that enhance their practicality.

The need for affordable and compact mobility solutions in semi-rural and industrial areas drives the segment’s growth. Additionally, rising demand from agricultural and security sectors in developing economies is reinforcing this trend.

Continued innovation in rugged design and fuel efficiency is expected to support segment expansion as users seek durable and cost-effective alternatives for daily operational tasks.

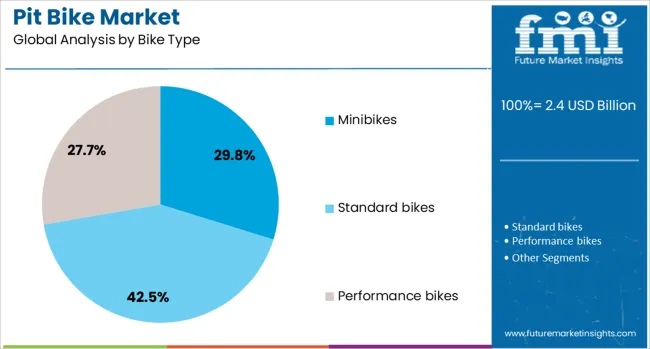

The minibikes segment accounts for 29.8% of the bike type category, owing to its strong appeal among entry-level users, younger riders, and recreational hobbyists. These bikes are favored for their approachable design, low seat height, and ease of handling, making them ideal for training and casual use. The segment has gained momentum from the rise of youth motorsports events and the availability of affordable models in both developed and emerging markets.

Manufacturers have capitalized on this demand by offering customizable minibikes with enhanced safety features and aesthetic options, increasing their appeal to parents and beginners alike.

The growth of online motorsport communities and content sharing has further elevated the popularity of minibikes. Moving forward, the segment is expected to benefit from brand partnerships, product endorsements, and evolving safety standards that support responsible youth riding.

Operational efficiency and cost control have driven the adoption of automated, scalable solutions to improve productivity and reduce waste. Simultaneously, strict regulatory requirements have increased demand for compliance-oriented systems with real-time monitoring and reporting to ensure risk mitigation and long-term resilience.

The industry has been driven by the growing emphasis on operational efficiency and cost optimization. Businesses are adopting advanced process automation and integrated systems to reduce waste and improve output consistency. Strong preference has been observed for solutions that ensure accuracy in real-time operations, particularly in sectors such as manufacturing and energy. Market participants have been focusing on providing scalable and adaptive platforms to support diverse operational requirements. The adoption of automated solutions is viewed as a critical enabler for productivity enhancement, making it a top priority for enterprises seeking competitive advantages in cost-sensitive environments.

The competitive landscape has been influenced by stringent regulatory norms, which have accelerated the adoption of compliance-oriented solutions. Organizations have been prioritizing risk mitigation by implementing systems that maintain accurate documentation and traceability across processes. Regulatory frameworks across multiple regions are becoming more stringent, pushing companies to integrate compliance tools into their workflows. This shift has created opportunities for vendors offering solutions that combine real-time monitoring with comprehensive reporting features. Such capabilities are increasingly considered essential for securing long-term operational resilience and avoiding potential penalties in highly regulated sectors.

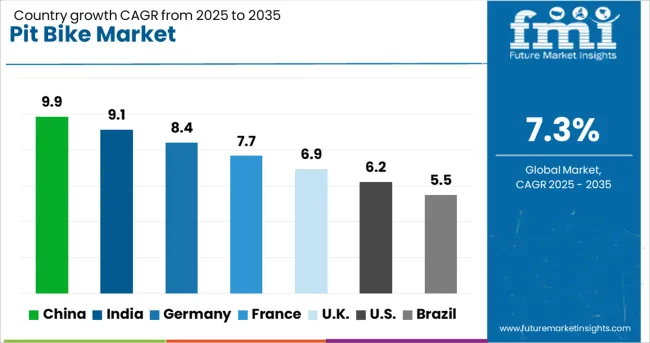

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

The pit bike industry, projected to grow at a global CAGR of 7.3% from 2025 to 2035, shows notable variations across leading markets. China, a BRICS member, is registering the highest CAGR at 9.9%, driven by increasing production capacity and exports supported by competitive pricing strategies. India, also a BRICS member, follows closely with a 9.1% CAGR, supported by expanding motorsport activities and rising adoption of off-road recreational bikes. Germany, an OECD member, is recording an 8.4% CAGR as demand from premium sports enthusiasts strengthens across Europe. The United Kingdom, another OECD member, is observing moderate growth with a 6.9% CAGR, supported by niche racing events and local manufacturing interest. The United States, an OECD member, stands at 6.2%, maintaining a stable base through established recreational biking culture. The report evaluates over 40 countries, and the top five performers have been highlighted for reference.

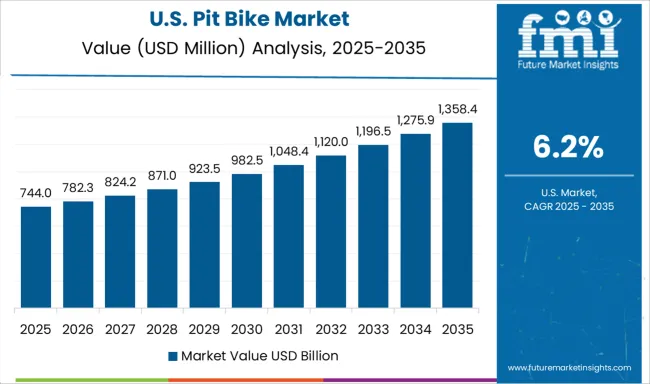

The United States is projected to grow at a 6.2% CAGR, maintaining steady demand through an established culture of recreational biking and motorsport events. Off-road bike clubs and organized racing circuits contribute to consistent adoption among enthusiasts. Leading brands focus on offering feature-rich models with robust engines and advanced braking systems for competitive users. Aftermarket customization trends remain strong, creating ancillary revenue for component suppliers. E-commerce and dealership networks facilitate wide distribution of both entry-level and premium bikes. Opportunities in youth-oriented models and electric pit bikes indicate emerging segments, driven by consumer preference for innovative, sustainable alternatives.

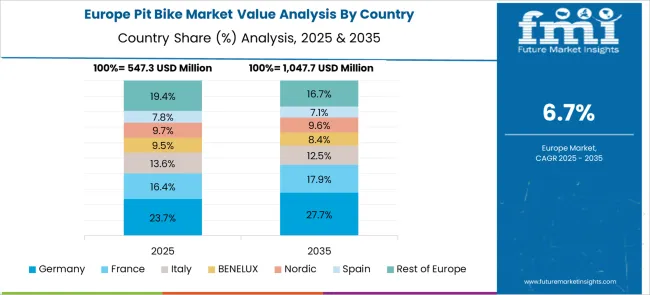

Germany is expected to grow at an 8.4% CAGR, driven by high adoption among premium sports enthusiasts and expanding recreational racing events across Europe. Pit bikes are increasingly used in indoor and outdoor racing circuits, supported by robust dealer networks. German OEMs focus on advanced engine technology and ergonomic design for competitive biking, while imports from Asia cater to entry-level users. E-commerce sales for customized pit bike components are rising, aligning with Germany’s strong DIY motorcycle culture. Government emphasis on safety regulations ensures demand for compliant, high-performance bikes, particularly in organized racing segments.

The United Kingdom is anticipated to grow at a 6.9% CAGR, supported by niche racing events and growing interest in off-road recreational activities. Regional motorsport clubs are introducing pit bike racing as an accessible entry point for amateur riders. Manufacturers emphasize durable designs with advanced suspension systems suited for challenging terrains. Local assembly operations are expanding to reduce import costs, particularly for budget and mid-range models. Digital retail channels and specialty stores strengthen aftermarket service accessibility. Opportunities exist in electric pit bikes, with several startups exploring battery-powered models for environmentally conscious consumers.

China is projected to grow at a 9.9% CAGR, the fastest globally, driven by large-scale production capabilities and competitive pricing that strengthen both domestic and export markets. Local manufacturers leverage cost advantages to capture demand in Asia, Europe, and North America. Government-backed manufacturing incentives and rapid component standardization support high-volume production. Growing popularity of recreational biking among younger demographics and the integration of lightweight, fuel-efficient engines enhance product adoption. Export-focused strategies by OEMs targeting emerging off-road markets, coupled with increasing e-commerce penetration for two-wheelerse consoliates China’s dominance in this segment.

India is forecast to grow at a 9.1% CAGR, supported by increasing motorsport participation and the expansion of recreational biking clubs. Affordable pit bikes are gaining popularity in Tier I and Tier II cities as off-road sports events gain sponsorship from automotive associations. Local manufacturing initiatives under “Make in India” boost domestic production and reduce import dependency. Manufacturers introduce budget-friendly bikes with improved suspension systems and lightweight frames to attract first-time users. Demand for customized and electric pit bikes is emerging in niche urban markets, presenting growth opportunities for new entrants and OEM partnerships.

In the global pit bike industry, leading manufacturers are focusing on delivering robust performance models, optimized handling, and advanced suspension systems to meet the demands of recreational and competitive riders. Companies like Honda, Kawasaki, Yamaha, Suzuki, and KTM dominate the market with established product lines and global dealership networks. These brands emphasize durability, engine efficiency, and race-proven technology, making them preferred choices for enthusiasts and professionals alike. Brands such as Pitster Pro cater to niche segments by offering affordable, customizable options with strong aftermarket support. Strategic investments in electric pit bike variants are being prioritized by leading players to capture emerging demand. Collaborations with motorsport clubs and expansion into digital retail channels have strengthened distribution, ensuring better reach among younger riders and first-time buyers.

In May 2024, Honda announced its 2025 lineup of CRF motocross bikes, including the updated CRF450R and CRF250R models designed with improved chassis rigidity, suspension, and engine performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Propulsion | Gasoline and Electric |

| Application | Utility, Sports, and Recreation |

| Bike Type | Minibikes, Standard bikes, and Performance bikes |

| Sales Channel | Direct sales, Dealerships, and Online retailers |

| Age Group | Children (up to 12 years), Teenagers (13-25 years), and Adults (25 years and above) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honda, Kawasaki, Yamaha, Suzuki, KTM, and Pitster Pro |

| Additional Attributes | Dollar sales by bike segment (125 cc, 150 cc, 200 cc) and price tier (entry‑level, mid‑range, premium); demand dynamics across recreational users, youth learners, and off‑road training schools; regional trends led by North America with Asia‑Pacific emerging as the fastest‑growing market; innovation in electric pit bike variants, lightweight chassis, and ride‑by‑wire throttle systems; and regulatory considerations around emissions standards, helmet safety certifications, and age‑based licensing requirements. |

The global pit bike market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the pit bike market is projected to reach USD 4.9 billion by 2035.

The pit bike market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in pit bike market are gasoline and electric.

In terms of application, utility segment to command 34.5% share in the pit bike market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pitch Coke Market Size and Share Forecast Outlook 2025 to 2035

Pit and Fissure Sealant Market Size and Share Forecast Outlook 2025 to 2035

Pituitary Stalk Interruption Syndrome Treatment Market - Growth & Outlook 2025 to 2035

Hospital Bedsheet & Pillow Cover Market Size and Share Forecast Outlook 2025 to 2035

Hospital Service Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hospitality Mattress Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospitality Staffing Market Size and Share Forecast Outlook 2025 to 2035

Hospital Stretchers Market Size and Share Forecast Outlook 2025 to 2035

Hospital Surgical Disinfectant Market Size and Share Forecast Outlook 2025 to 2035

Hospital Supplies Market Size and Share Forecast Outlook 2025 to 2035

Hospital Disinfectant Products & Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Hospital Workforce Management Market is segmented by product, and end user from 2025 to 2035

Hospital-Acquired Infection (HAI) Control Market – Prevention & Growth Trends 2025 to 2035

Hospital Consumables Market Analysis - Growth, Demand & Forecast 2025 to 2035

Hospital Capacity Management Solutions Market Insights - Growth & Forecast 2024 to 2034

Hospital Resource Management Market

Hospital Information System Market

Hypopituitarism Diagnostics Market Outlook - Growth & Future Trends 2025 to 2035

Cockpit Display Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA