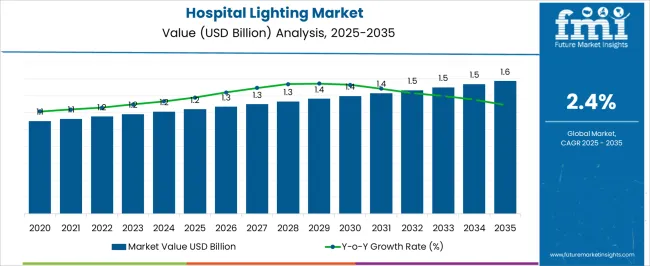

The Hospital Lighting Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 2.4% over the forecast period. This growth, supported by a CAGR of 2.4%, is driven by increasing demand for energy-efficient lighting solutions, improved lighting systems for better healthcare outcomes, and the growing need for enhanced lighting conditions in hospitals.

In the first five-year phase (2025–2030), the market is expected to grow from USD 1.2 billion to USD 1.4 billion, adding USD 200 million, which accounts for 50% of the total incremental growth. The second phase (2030–2035) will contribute USD 200 million, representing 50% of the total growth, driven by stronger momentum from expanding healthcare infrastructure and rising investments in hospital renovations. Annual increments will rise from USD 30 million in the early years to USD 50 million by 2035, signaling a faster pace of growth driven by advancements in smart lighting systems, automation, and energy regulations. Manufacturers focusing on sustainable, energy-efficient, and adaptable lighting solutions will capture the largest share of this USD 400 million opportunity.

| Metric | Value |

|---|---|

| Hospital Lighting Market Estimated Value in (2025 E) | USD 1.2 billion |

| Hospital Lighting Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 2.4% |

The hospital lighting market is undergoing a notable transformation as healthcare facilities prioritize energy-efficient, adaptive, and patient-centric illumination systems. The widespread adoption of smart lighting infrastructure is being driven by the growing emphasis on operational efficiency, sustainability mandates, and the need for controlled lighting conditions in critical care and surgical settings.

Innovations in circadian rhythm lighting, tunable white solutions, and low-glare fixtures have improved visual comfort for both patients and medical professionals. The integration of occupancy sensors, daylight harvesting, and centralized lighting control systems has further aligned with hospital goals for reduced operational costs and enhanced patient recovery environments.

Additionally, regulatory focus on energy conservation in healthcare infrastructure and green building certifications is influencing procurement decisions In the coming years, demand is expected to be supported by hospital expansions, renovations, and the retrofitting of older facilities with next-generation lighting technologies that support hygiene, safety, and remote maintenance.

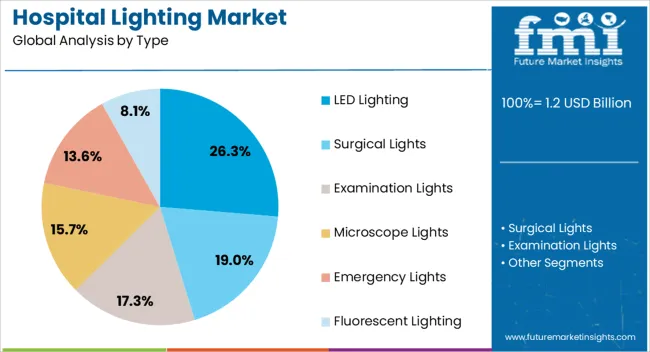

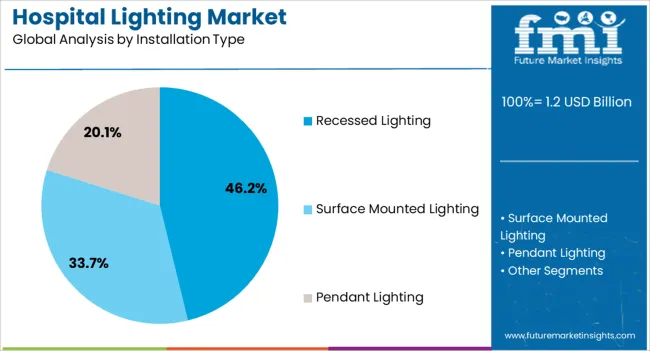

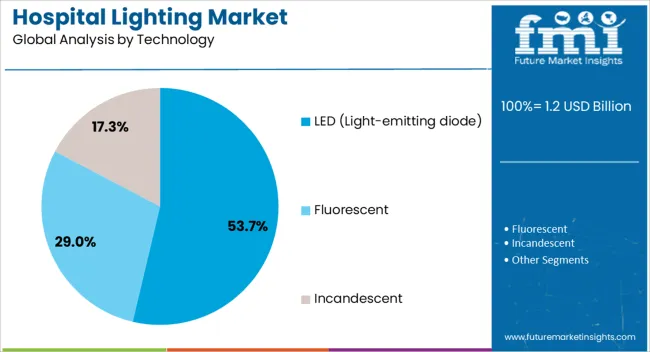

The hospital lighting market is segmented by type, installation type, technology, control system, luminaire type, and geographic regions. By type, the hospital lighting market is divided into LED Lighting, Surgical Lights, Examination Lights, Microscope Lights, Emergency Lights, and Fluorescent Lighting. In terms of installation type, the hospital lighting market is classified into Recessed Lighting, surface-mounted lighting, and Pendant Lighting. Based on technology, the hospital lighting market is segmented into LED (Light-emitting diode), Fluorescent, and Incandescent.

By control system, the hospital lighting market is segmented into Wireless Lighting Control Systems and Wired Lighting Control Systems. By luminaire type, the hospital lighting market is segmented into Panel Lighting, Troffer Lighting, and Downlighting. Regionally, the hospital lighting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The LED lighting segment is anticipated to account for 26.3% of the total revenue share in the hospital lighting market in 2025. The growth of this segment is being influenced by the high energy efficiency, longer operational lifespan, and reduced heat emission characteristics of LED fixtures.

Hospitals have increasingly opted for LED solutions due to their ability to deliver uniform illumination with minimal flicker, contributing to improved patient comfort and reduced visual strain for staff. The adaptability of LED lighting for various hospital zones, including patient rooms, surgical suites, and emergency departments, has further strengthened its appeal.

Additionally, LED fixtures support integration with IoT-enabled systems, allowing remote diagnostics, dimming, and scheduling to optimize energy usage. The reduction in maintenance cycles and total cost of ownership associated with LED technologies has positioned this segment as a sustainable and operationally viable option for both new construction and retrofit applications in healthcare settings.

Recessed lighting is projected to hold 46.2% of the hospital lighting market revenue share in 2025, making it the most prominent installation type. The segment's leadership is supported by its aesthetic integration into hospital ceilings and its ability to provide unobtrusive, evenly distributed illumination across clinical and administrative zones.

Recessed fixtures are widely adopted in patient care areas, examination rooms, and corridors due to their ease of maintenance and compatibility with infection control requirements. The concealed nature of recessed lighting minimizes dust accumulation and supports sterile environmental conditions, which is crucial in surgical and isolation areas.

The growing demand for cleanroom-compliant and anti-glare lighting systems has further contributed to the adoption of recessed installations. Moreover, these fixtures are compatible with LED and tunable lighting technologies, enhancing their functionality while maintaining a low visual profile, making them ideal for modern healthcare interiors.

LED technology is expected to command 53.7% of the hospital lighting market revenue share in 2025, reflecting its dominance as the preferred lighting technology in healthcare environments. The superior energy efficiency, low maintenance requirements, and environmental benefits of LED systems are reinforcing this segment’s growth.

The shift toward sustainable hospital operations has accelerated the phase-out of traditional lighting technologies in favor of LEDs, which offer better control over brightness levels, color temperature, and directional output. The durability and reliability of LED systems make them ideal for mission-critical areas, such as ICUs, operating rooms, and emergency wards, where uninterrupted lighting is crucial.

Furthermore, LED technology supports smart lighting features such as sensor-based activation, automated dimming, and integration with hospital building management systems. The ability to maintain consistent light quality while reducing energy consumption has positioned LED technology as a cornerstone in future-ready hospital infrastructure.

The hospital lighting market is expanding due to rising demand for energy-efficient solutions and opportunities in retrofitting existing facilities. The trend toward smart lighting systems is driving innovation, offering enhanced operational efficiency and improved patient care. However, the high upfront cost of installation poses a significant restraint, limiting adoption, especially in budget-conscious healthcare facilities. Over the next few years, overcoming cost barriers and increasing the adoption of smart lighting technologies will be essential to capturing more of the growing demand in the sector.

The hospital lighting market is experiencing growth driven by an increasing demand for energy-efficient solutions. Hospitals are under constant pressure to reduce operational costs, and energy-efficient lighting solutions like LEDs are emerging as a preferred choice. These solutions not only reduce energy consumption but also offer long-lasting performance, thereby lowering maintenance costs. As the global focus on cost-effective and environmentally-friendly operations intensifies, demand for advanced hospital lighting systems is expected to grow significantly by 2025, particularly in regions focusing on healthcare infrastructure upgrades.

One of the most significant opportunities in the hospital lighting market lies in the retrofitting of existing healthcare facilities with advanced lighting technologies. Many hospitals are now seeking to replace outdated, inefficient lighting systems with modern, energy-efficient alternatives that improve both operational efficiency and patient care environments. The push for retrofit projects, driven by government incentives and growing awareness of energy efficiency, provides a fertile ground for market expansion. This trend is likely to accelerate in 2024-2025, further boosting the demand for hospital lighting solutions.

An emerging trend in the hospital lighting market is the increasing integration of smart lighting systems. These systems, which can be controlled remotely and adjusted based on specific needs, offer hospitals greater flexibility, energy savings, and the ability to create optimal lighting conditions for various activities. Smart lighting not only enhances energy efficiency but also contributes to improved patient comfort and care by adjusting lighting conditions according to the different times of day or specific medical requirements. This trend is expected to grow in 2024-2025 as hospitals adopt more advanced technologies to optimize their operations.

One of the primary market restraints is the high initial investment and installation costs associated with advanced hospital lighting systems. While energy-efficient and smart lighting technologies offer long-term savings, the upfront costs can be a barrier, particularly for smaller healthcare facilities with tight budgets. The initial capital outlay required for system installation can deter some hospitals from upgrading their lighting solutions. As a result, market growth may be limited in certain regions where funding for infrastructure improvements is constrained..

| Countries | CAGR |

|---|---|

| China | 3.3% |

| India | 3.0% |

| Germany | 2.8% |

| France | 2.5% |

| UK | 2.3% |

| USA | 2.1% |

| Brazil | 1.8% |

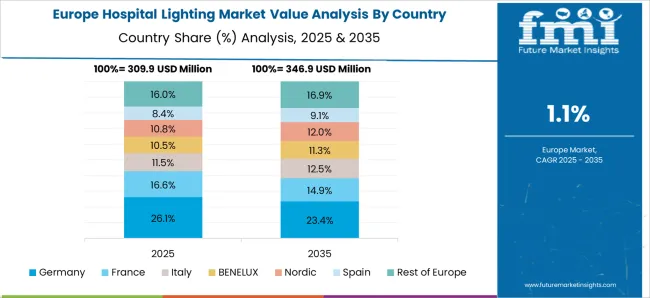

The global hospital lighting market is projected to grow at a 2.4% CAGR from 2025 to 2035. China leads with a growth rate of 3.3%, followed by India at 3%, and Germany at 2.8%. The United Kingdom records a growth rate of 2.3%, while the United States shows the slowest growth at 2.1%. These varying growth rates are driven by increasing demand for energy-efficient, sustainable lighting solutions in healthcare facilities, along with advancements in lighting technologies and regulations promoting patient safety and energy savings. Emerging markets like China and India are experiencing higher growth due to rapid healthcare infrastructure development, government initiatives, and growing awareness of energy-efficient lighting. More mature markets like the USA and the UK see steady growth driven by advanced healthcare standards, sustainability requirements, and the increasing focus on improving hospital environments through lighting solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The hospital lighting market in China is growing rapidly, with a projected CAGR of 3.3%. China’s growing healthcare infrastructure, increasing investments in hospital modernization, and government support for energy-efficient and sustainable technologies are key drivers of market growth. The country’s expanding number of healthcare facilities and rising focus on patient safety and well-being continue to boost the demand for advanced hospital lighting solutions. Additionally, the increasing adoption of LED lighting technologies in healthcare facilities, coupled with China’s push toward environmental sustainability and energy savings, further accelerates the demand for hospital lighting solutions. The focus on improving hospital environments and patient experience continues to fuel market expansion.

The hospital lighting market in India is projected to grow at a CAGR of 3%. India’s expanding healthcare sector, coupled with increasing government investments in healthcare infrastructure, continues to drive the demand for advanced hospital lighting solutions. The rising focus on improving hospital environments, patient safety, and energy efficiency in healthcare facilities contributes to market growth. Additionally, India’s growing adoption of LED lighting and energy-efficient technologies in hospitals further accelerates the demand for hospital lighting solutions. The country’s push towards sustainable healthcare practices, along with a rise in the number of private and public healthcare facilities, continues to fuel market expansion.

The hospital lighting market in Germany is projected to grow at a CAGR of 2.8%. Germany’s strong healthcare infrastructure, along with its commitment to energy-efficient and sustainable solutions, is driving steady market growth. The country’s stringent regulations and standards for hospital lighting, particularly in relation to energy savings, lighting quality, and patient safety, continue to contribute to the adoption of advanced lighting solutions. Additionally, Germany’s focus on sustainable healthcare and reducing carbon emissions in hospital environments further accelerates the demand for energy-efficient lighting solutions. The rising demand for LED lighting in healthcare facilities, combined with ongoing investments in healthcare modernization, continues to fuel market growth.

The hospital lighting market in the United Kingdom is projected to grow at a CAGR of 2.3%. The UK’s increasing demand for sustainable and energy-efficient lighting solutions in healthcare facilities continues to drive steady market growth. The country’s strong healthcare standards, coupled with government regulations promoting sustainability and reducing energy consumption in hospitals, accelerate the adoption of advanced lighting systems. Additionally, the rising focus on improving patient care and hospital environments, along with increasing investments in hospital modernization, further contribute to market expansion. The UK’s focus on LED lighting and eco-friendly solutions continues to drive demand in the hospital lighting sector.

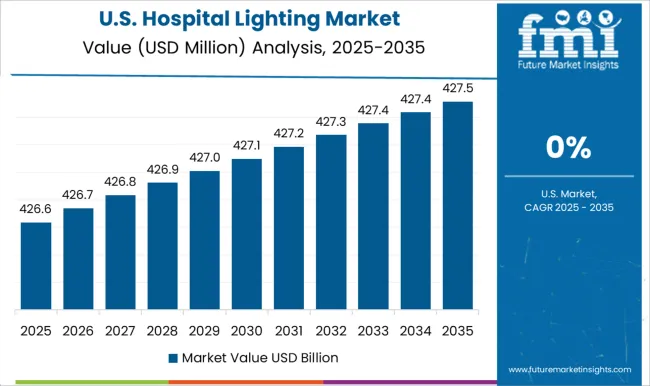

The hospital lighting market in the United States is expected to grow at a CAGR of 2.1%. The USA market remains steady, driven by the increasing demand for energy-efficient and sustainable lighting solutions in healthcare facilities. The country’s focus on improving patient safety, enhancing healthcare environments, and meeting stringent energy regulations continues to drive market growth. Additionally, the adoption of LED lighting technologies in hospitals, coupled with advancements in lighting design for improved patient experience, further accelerates market demand. Government incentives and healthcare facility renovations also contribute to the ongoing expansion of the hospital lighting market in the USA

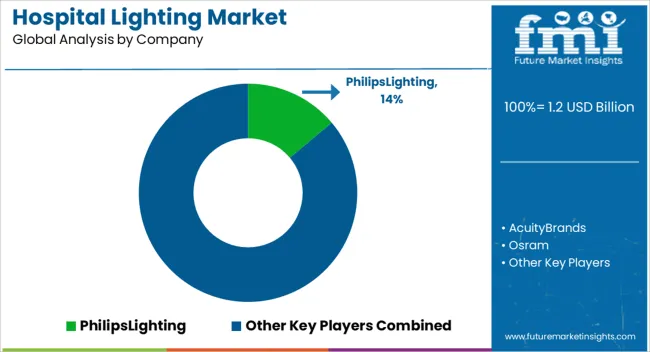

The hospital lighting market is dominated by Philips Lighting, which leads with its energy-efficient, advanced lighting solutions designed for healthcare facilities. Philips’ dominance is supported by its cutting-edge technology, strong brand presence, and a wide range of products that improve visibility, enhance patient well-being, and reduce energy consumption. Key players such as Acuity Brands, Osram, and General Electric maintain significant market shares by offering innovative hospital lighting systems that enhance safety, comfort, and operational efficiency. These companies focus on integrating smart lighting controls, energy-saving features, and customizable lighting designs to meet the specific needs of healthcare environments. Emerging players like Zumtobel Group, Waldmann Lighting, and Helvar are expanding their market presence by providing specialized lighting solutions for niche applications within hospitals, such as surgical rooms, patient wards, and critical care units. Their strategies include focusing on high-quality, glare-free lighting, improving system flexibility, and incorporating sustainable design practices. Market growth is driven by increasing investments in hospital infrastructure, the need for energy-efficient lighting solutions, and the growing emphasis on enhancing patient experience through improved lighting. Innovations in intelligent lighting systems, daylight harvesting, and human-centric lighting are expected to continue shaping competitive dynamics and drive further growth in the global hospital lighting market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Type | LED Lighting, Surgical Lights, Examination Lights, Microscope Lights, Emergency Lights, and Fluorescent Lighting |

| Installation Type | Recessed Lighting, Surface Mounted Lighting, and Pendant Lighting |

| Technology | LED (Light-emitting diode), Fluorescent, and Incandescent |

| Control System | Wireless Lighting Control Systems and Wired Lighting Control Systems |

| Luminaire Type | Panel Lighting, Troffer Lighting, and Downlighting |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PhilipsLighting, AcuityBrands, Osram, GeneralElectric, ZumtobelGroup, CooperLighting, Eaton, LutronElectronics, ThornLighting, HubbellLighting, Leviton, CreeLighting, WaldmannLighting, Helvar, and ERCOLighting |

| Additional Attributes | Dollar sales by lighting type and application, demand dynamics across patient wards, ICUs, and surgical rooms, regional trends in hospital lighting adoption, innovation in energy-efficient and patient-centric lighting solutions, impact of regulatory standards on safety and environmental compliance, and emerging use cases in smart hospital systems and sustainable healthcare facilities. |

The global hospital lighting market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the hospital lighting market is projected to reach USD 1.6 billion by 2035.

The hospital lighting market is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in hospital lighting market are led lighting, surgical lights, examination lights, microscope lights, emergency lights and fluorescent lighting.

In terms of installation type, recessed lighting segment to command 46.2% share in the hospital lighting market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hospital Bedsheet & Pillow Cover Market Size and Share Forecast Outlook 2025 to 2035

Hospital Service Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Hospitality Mattress Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Hospitality Staffing Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Hospital Stretchers Market Size and Share Forecast Outlook 2025 to 2035

Hospital Surgical Disinfectant Market Size and Share Forecast Outlook 2025 to 2035

Hospital Supplies Market Size and Share Forecast Outlook 2025 to 2035

Hospital Disinfectant Products & Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Hospital Workforce Management Market is segmented by product, and end user from 2025 to 2035

Hospital-Acquired Infection (HAI) Control Market – Prevention & Growth Trends 2025 to 2035

Hospital Consumables Market Analysis - Growth, Demand & Forecast 2025 to 2035

Hospital Capacity Management Solutions Market Insights - Growth & Forecast 2024 to 2034

Lighting Contactor Market Growth – Trends & Forecast 2024-2034

Hospital Resource Management Market

Hospital Information System Market

Lighting Fixture Market

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA