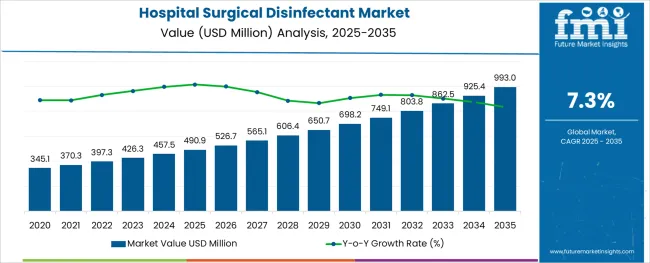

The Hospital Surgical Disinfectant Market is estimated to be valued at USD 490.9 million in 2025 and is projected to reach USD 993.0 million by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

The hospital surgical disinfectant market is experiencing sustained growth due to heightened awareness around infection prevention, rising surgical volumes, and stringent hygiene protocols across healthcare facilities. The global surge in hospital acquired infections and post operative complications has emphasized the critical role of pre surgical skin preparation and surface disinfection.

As hospitals prioritize patient safety and regulatory compliance, demand has increased for high efficacy disinfectants that provide broad spectrum antimicrobial action while being gentle on skin and surfaces. Advances in formulation technologies have enabled longer residual effects and faster kill times, meeting the demands of high pressure operating room environments.

Additionally, increased surgical activity across developing regions and expansion of outpatient surgical centers are supporting continued market expansion. The outlook remains positive as surgical care settings increasingly integrate standardized and evidence based disinfection practices to reduce risk and improve clinical outcomes.

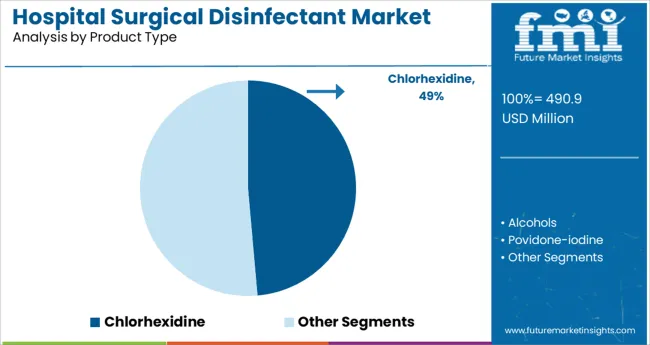

The market is segmented by Product Type and region. By Product Type, the market is divided into Chlorhexidine, Alcohols, Povidone-iodine, Octenidine, Hydrogen Peroxide, and Other Product Types. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The chlorhexidine segment is projected to hold 48.60% of total market revenue by 2025 within the product type category, making it the leading segment. This dominance is driven by its well established efficacy in reducing skin microbial load, long lasting antimicrobial action, and broad acceptance in surgical protocols.

Chlorhexidine is widely used for pre operative skin preparation, catheter site cleaning, and hand hygiene due to its safety profile and effectiveness against a broad range of pathogens including gram positive and gram negative bacteria. Its compatibility with alcohol based formulations has further enhanced its performance in surgical scrub and antiseptic applications.

Hospitals have favored chlorhexidine for its proven clinical outcomes, minimal resistance risk, and cost effectiveness. As surgical care providers focus on reducing infection rates and improving procedural safety, chlorhexidine continues to be the disinfectant of choice, sustaining its leadership in the hospital surgical disinfectant market.

As per the Hospital Surgical Disinfectant market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Hospital Surgical Disinfectant market increased at around 6.3% CAGR, wherein, North America held a significant share in the global market.

Healthcare-associated infections (HAI) are a serious issue for both patients and healthcare staff worldwide. With an increase in the number of hospitalizations and HAIs globally, the demand for surgical tool disinfection is increasing to reduce the risk of microbial contamination.

According to WHO, hundreds of millions of patients worldwide get HCAIs each year. In rich nations, 7 out of every 100 hospitalized patients have at least one HAI, whereas 10 in underdeveloped countries have at least one HAI. Owing to this, the Hospital Surgical Disinfectant market is projected to grow at a CAGR of 7.3% over the coming 10 years.

According to the Healthcare Cost and Utilization Project (HCUP), approximately 457.5 million operations were done in ambulatory care settings in the United States in 2024. In the event of operations, one of the most important needs in healthcare facilities is the use of surgical disinfection solutions.

These products are more typically used in hospitals and other medical settings to lower the risk of infection during surgery and other operations because they prevent or limit the development of germs on the skin. As a result, such occurrences are projected to boost the market throughout the forecast period.

Surgical and diagnostic procedures may be required, which may require medical consumables Surgical Disinfectant. Hospitalization rates are predicted to rise as the frequency of chronic illnesses such as cardiovascular disease, cancer, diabetes, and other autoimmune disorders rises.

The adoption of unhealthy and sedentary lifestyles, as well as antibiotic resistance, are the key factors to the increased prevalence of chronic diseases. According to the National Center for Health Statistics, an estimated 345.1 million Americans suffer from chronic sickness, with 81 million suffering from several conditions, as of 2020.

Because of the rising frequency of chronic diseases, hospital admissions have skyrocketed. Surgical disinfectants are needed in hospitals to keep humans and non-living materials germ-free. Such factors are predicted to drive demand for hospital surgical disinfectants throughout the forecast period.

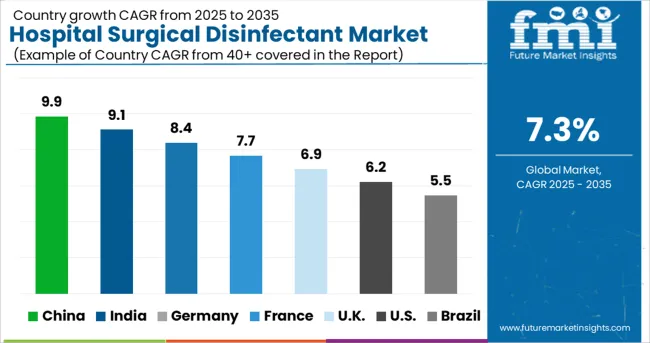

Hospital Surgical Disinfectant market revenue is estimated to expand at the fastest rate in APAC from 2025 to 2035, with around 8.9% and 9.9% projected growth rates in China and Japan, respectively. Some of the significant corporations, that have manufacturing units in all major APAC locations, have begun to extend their production units to other APAC sites in order to boost the speed of distribution.

While this suggests a shift in global geographical diversification, it represents a substantial potential for the market.

Hospital-acquired illnesses and advancements in healthcare infrastructure contribute to the increased use of hospital surgical disinfectants. Furthermore, regulatory regulations aimed at providing safe and high-quality healthcare services are expected to drive market expansion throughout the projection period.

For example, the Chinese regulatory authority, the National Medical Products Administration, declared that it will expedite the registration of medical disinfectants that fulfill applicable requirements in the United States, Japan, and the European Union.

As a result, these factors are projected to drive market expansion throughout the forecast period. Furthermore, rising illnesses and surgeries in the region are likely to drive market expansion even further. The area's highest number of procedures and surgeries is also propelling the industry in this region. Medical tourism is popular in Asian nations such as China, India, and Thailand.

The USA dominated the North America Hospital Surgical Disinfectant market and is poised to reach USD 993 million by 2035. The favorable factors in USA market growth are reimbursement and technological advancement facilities in the country. The growing number of hospital admission and the ease of medicare reimbursement policy favors the market growth.

In the United States, according to the American Hospital Association, there were 6,090 community hospitals, 208 Federal Government hospitals, and 625 nonfederal psychiatric hospitals. The number of admissions for chronic diseases has significantly increased, raising product demand and accelerating market expansion. The availability of strong transportation and easy access to healthcare facilities are two fundamental contributors to the market expansion.

According to the United States Department of Health and Human Services, 0.4% of the roughly 150 million Americans who get admitted to a hospital on any given day are contaminated by an HAI. The loss of health insurance is likely to cause more people to seek medical care, along with the number of snakebites, dengue fever, tuberculosis, malaria, and typhoid, as well as the anticipated increase in cases of COVID-19 in the USA, which are predicted to expand the market.

The market in the United Kingdom is projected to grow from USD 490.9 million in 2025 to reach a valuation of USD 41.1 million by 2035. From 2025 to 2035, the market is projected to garner an absolute dollar opportunity of USD 23.4 million, growing at a CAGR of 8.9%.

The market in Japan is projected to reach a valuation of USD 32.6 million by 2035, growing at a CAGR of 9.9% from 2025 to 2035. The market in Japan is likely to garner an absolute dollar opportunity of USD 19.7 million from 2025 to 2035.

The market in South Korea is projected to reach a valuation of USD 13.3 million by 2035, growing at a CAGR of 5.8%. The market in the country will witness an absolute dollar opportunity of USD 5.8 million from 2025 to 2035.

The market for hydrogen peroxide solutions is expected to grow at 5.8% CAGR during the forecast period. The rising demand for hydrogen peroxide-based solutions to be merged with other additives, such as iodine and alcohol, is stimulating market development. In addition, the demand for hydrogen peroxide has grown as a result of a rise in the demand for hand wash products, such as sanitizers, which are efficient against many germs.

To increase knowledge and use among patients of surgical disinfectants prior to and during surgical procedures, the CDC recommends that patients shower with a detergent containing hydrogen peroxide prior to undergoing treatment.

The global hospital surgical disinfectant market is estimated to be valued at USD 490.9 million in 2025.

It is projected to reach USD 993.0 million by 2035.

The market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types are chlorhexidine, alcohols, povidone-iodine, octenidine, hydrogen peroxide and other product types.

segment is expected to dominate with a 0.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hospital Bedsheet & Pillow Cover Market Size and Share Forecast Outlook 2025 to 2035

Hospital Service Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hospitality Mattress Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospitality Staffing Market Size and Share Forecast Outlook 2025 to 2035

Hospital Stretchers Market Size and Share Forecast Outlook 2025 to 2035

Hospital Supplies Market Size and Share Forecast Outlook 2025 to 2035

The Hospital Workforce Management Market is segmented by product, and end user from 2025 to 2035

Hospital-Acquired Infection (HAI) Control Market – Prevention & Growth Trends 2025 to 2035

Hospital Consumables Market Analysis - Growth, Demand & Forecast 2025 to 2035

Hospital Capacity Management Solutions Market Insights - Growth & Forecast 2024 to 2034

Hospital Resource Management Market

Hospital Information System Market

Hospital Disinfectant Products & Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Hospital-Based Point-Of-Care Diagnostic Products Market Size and Share Forecast Outlook 2025 to 2035

Smart Hospitality & Coworking Spaces Market Trends - Growth & Forecast 2025 to 2035

Smart Hospitality Management Market

Micro-Hospitals Market

Europe Hospital Capacity Management Solution Market Growth – Trends & Forecast 2025 to 2035

Bedless Hospitals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA