The antimicrobial hospital textile market is witnessing strong growth, driven by the increasing focus on infection control, patient safety, and hygiene management in healthcare settings. Rising hospital-acquired infection rates and stricter regulatory standards have encouraged the integration of antimicrobial properties into fabrics used in hospitals and clinics.

The market benefits from the growing adoption of advanced coating technologies and biocidal agents that inhibit microbial growth while maintaining fabric comfort and breathability. Additionally, sustainability trends have prompted research into natural antimicrobial materials and reusable textiles to minimize medical waste.

The expansion of healthcare infrastructure, particularly in developing economies, is further supporting market growth. With ongoing innovation and increasing awareness of hygiene compliance, the antimicrobial hospital textile market is projected to experience sustained demand in the forecast period.

| Metric | Value |

|---|---|

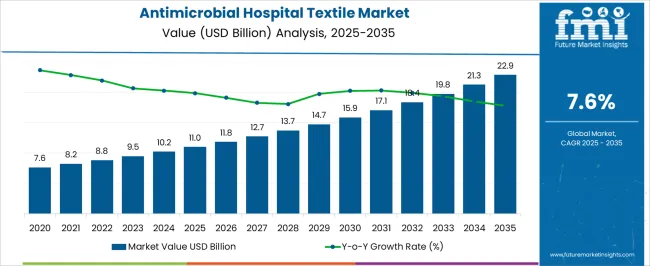

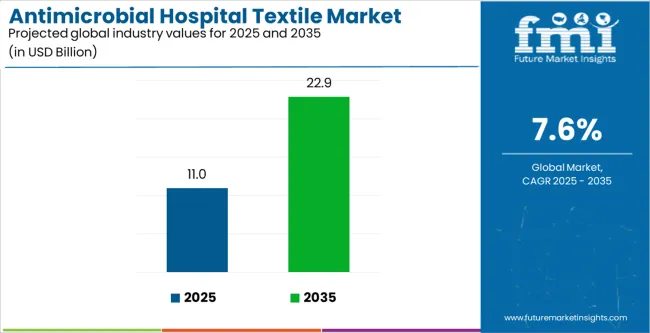

| Antimicrobial Hospital Textile Market Estimated Value in (2025 E) | USD 11.0 billion |

| Antimicrobial Hospital Textile Market Forecast Value in (2035 F) | USD 22.9 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

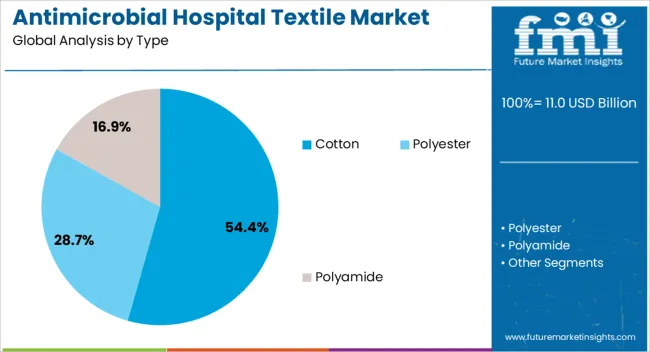

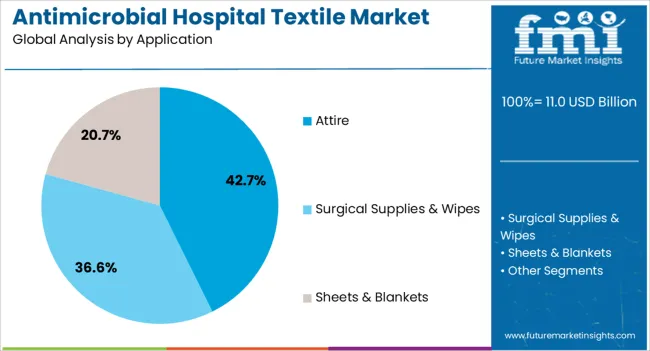

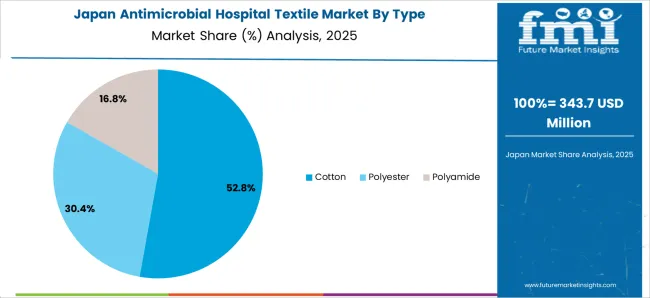

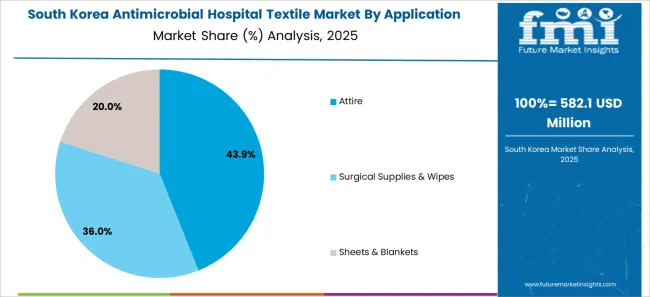

The market is segmented by Type and Application and region. By Type, the market is divided into Cotton, Polyester, and Polyamide. In terms of Application, the market is classified into Attire, Surgical Supplies & Wipes, and Sheets & Blankets. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cotton segment leads the type category with approximately 54.4% share, owing to its widespread availability, softness, and compatibility with antimicrobial treatments. Cotton fabrics provide comfort, breathability, and durability, making them suitable for patient apparel, bed linens, and surgical textiles.

The material’s natural absorbency enhances the effectiveness of antimicrobial finishes, ensuring prolonged protection against pathogens. Demand has been further boosted by advancements in treatment methods such as silver ion infusion and quaternary ammonium coatings.

With hospitals increasingly preferring textiles that combine comfort and hygiene, the cotton segment is expected to maintain its dominance across global healthcare facilities.

The attire segment holds approximately 42.7% share within the application category, driven by the essential use of antimicrobial fabrics in medical uniforms, gowns, and scrubs. The segment’s growth is closely tied to infection prevention protocols that mandate protective clothing for healthcare personnel.

The use of antimicrobial-treated attire reduces the risk of pathogen transmission between staff and patients while enhancing fabric durability through repeated sterilization cycles. Rising healthcare worker awareness and demand for high-performance, comfortable apparel have reinforced adoption.

With increasing investments in hospital safety infrastructure and personal protective innovations, the attire segment is expected to sustain its leading position throughout the forecast period.

| Historical CAGR | 8.7% |

|---|

The historical CAGR of 8.7% reflects a period of robust market awareness and educational initiatives. Companies invested significantly in educating healthcare professionals about the benefits of antimicrobial hospital textiles, leading to widespread adoption.

During this period, substantial technological advancements in textile manufacturing resulted in highly effective antimicrobial fabrics. These innovations contributed to the increased efficacy and durability of the textiles, positively influencing market growth. As the market matured during this period, achieving sustained high growth became progressively challenging. Saturation in certain segments or regions could have contributed to a slight decrease in the CAGR.

| Forecast CAGR | 7.6% |

|---|

The historical CAGR of 8.7% signifies a phase of significant growth, while the forecasted CAGR of 7.6% suggests a moderation in the pace of expansion. The market is likely entering a phase of maturity where sustained growth requires strategic adaptation to economic and competitive challenges.

Companies continue to invest in research and development, aiming to bring forth even more advanced and cost-effective antimicrobial textile solutions. Continued innovation may counterbalance the factors contributing to the forecasted decline. As international markets adopt more stringent infection control measures, the demand for antimicrobial textiles could experience a resurgence.

Community Health Initiatives Fuels Adoption of Antimicrobial Hospital Textile

Antimicrobial textiles extend beyond hospitals, with companies promoting their use in community settings such as schools and public spaces. This trend aligns with a broader focus on community health and infection prevention. The application of antimicrobial textiles in diverse environments contributes to overall public health and creates new market opportunities beyond traditional healthcare settings.

Antimicrobial Textiles in Telemedicine Environments

With the rise of telemedicine, there is a growing trend to integrate antimicrobial textiles into home healthcare setups. Companies are developing textiles for patient wear and home furnishings that contribute to infection control in remote healthcare environments. The expansion of antimicrobial textiles beyond traditional hospital spaces aligns with the evolving healthcare delivery, emphasizing the importance of infection prevention in diverse settings.

Nanotechnology in Antimicrobial Textiles

An emerging trend involves the application of nanotechnology to enhance the antimicrobial properties of textiles. Companies are exploring nanomaterials that can provide more effective and long-lasting protection against pathogens. The integration of nanotechnology not only improves the performance of antimicrobial textiles but also opens avenues for developing fabrics with self-cleaning and self-renewing capabilities.

Biodegradable Antimicrobial Textiles

A sustainable trend involves the development of biodegradable antimicrobial textiles. Companies are exploring materials that not only combat infections but also have minimal environmental impact, addressing concerns about textile waste. Biodegradable antimicrobial textiles resonate with the growing demand for sustainable solutions, appealing to environmentally conscious healthcare providers and institutions.

This section provides detailed insights into specific categories in the antimicrobial hospital textile industry. Cotton reigns supreme in the antimicrobial hospital textile market, boasting a CAGR of 8.5% between 2020 and 2025 and a projected 7.5% CAGR until 2035.

| Top Type | Cotton |

|---|---|

| CAGR % 2020 to 2025 | 8.5% |

| CAGR % 2025 to 2035 | 7.5% |

With a projected CAGR of 7.5% from 2025 to 2035, cotton maintains its position as the top material choice. Its affordability, comfort, and widespread adoption in hospital settings cement its leadership.

| Dominating Application Segment | Attire |

|---|---|

| CAGR % 2020 to 2025 | 8.3% |

| CAGR % 2025 to 2035 | 7.1% |

The attire segment, boasting a 7.1% CAGR through 2035, is poised to lead application areas. As hygiene concerns remain paramount, demand for antimicrobial medical uniforms, scrubs, and patient gowns continues to soar.

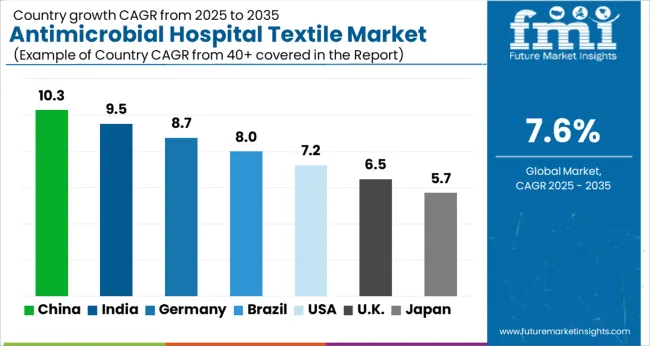

The section analyzes the antimicrobial hospital textile market across key countries, including the United States, United Kingdom, China, Japan, and South Korea. The analysis delves into the specific factors driving the demand, adoption, and sales of antimicrobial hospital textiles in these countries.

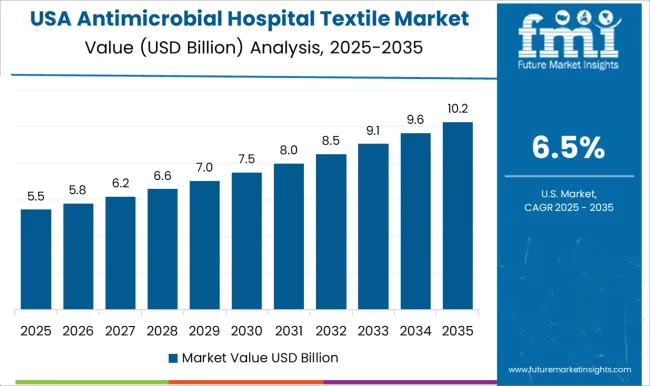

The antimicrobial hospital textile industry in the United States is anticipated to rise at a CAGR of 8.1% through 2035.

The antimicrobial hospital textile industry in the United Kingdom is projected to rise at a CAGR of 7.8% through 2035.

China’s antimicrobial hospital textile industry is likely to witness expansion at a CAGR of 7.9% through 2035.

Japan's antimicrobial hospital textile industry is projected to rise at a CAGR of 8.2% through 2035.

The antimicrobial hospital textile industry in South Korea is poised to witness expansion at a CAGR of 8.8% through 2035.

The antimicrobial hospital textile industry is a hotbed of competition, with established players defending their turf while innovative startups strive for a foothold. Players constantly refine existing solutions and explore new frontiers, offering ever-more effective and user-friendly antimicrobial textiles. Functionality reigns supreme, with textiles boasting targeted properties like specific pathogen resistance or enhanced breathability.

Balancing cost with value is a constant tightrope walk. Healthcare facilities, ever mindful of budgets, demand affordability, leading to intense price competition. However, players can't simply slash prices. They must demonstrate the unique value proposition of their textiles, highlighting long-term cost savings through infection prevention or superior durability.

Regulatory hurdles add another layer of complexity. Stringent safety and efficacy standards can create entry barriers for new players, while established players must navigate compliance requirements. Adapting quickly and ensuring products meet the highest standards is crucial for survival.

The growing focus on environmental responsibility is transforming the competition. Players are adopting eco-friendly practices, utilizing recycled materials, and minimizing their environmental impact. This shift presents both challenges and opportunities, with sustainable solutions potentially attracting environmentally conscious buyers and commanding premium prices.

Recent Developments in the Antimicrobial Hospital Textile Industry:

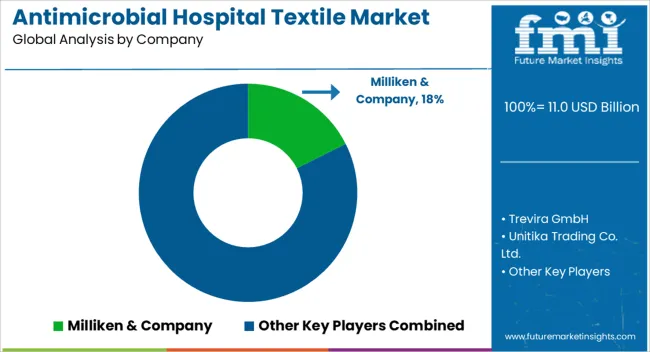

The global antimicrobial hospital textile market is estimated to be valued at USD 11.0 billion in 2025.

The market size for the antimicrobial hospital textile market is projected to reach USD 22.9 billion by 2035.

The antimicrobial hospital textile market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in antimicrobial hospital textile market are cotton, polyester and polyamide.

In terms of application, attire segment to command 42.7% share in the antimicrobial hospital textile market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antimicrobial HVAC Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Forecast and Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobials Cosmetic Preserving market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Packaging Ingredients for Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wound Care Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Additives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Car Care Products Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Susceptibility Tester Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wipes Market - by Product Type, Material Type, Sales Channel, End-User, and Region - Trends, Growth & Forecast 2025 to 2035

Antimicrobial Nanocoatings Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Antimicrobial Packaging Ingredients for Food Packaging

Antimicrobial Regenerative Wound Matrix Market - Growth & Forecast 2025 to 2035

Antimicrobial Coil Coating Market Growth - Trends & Forecast 2025 to 2035

Antimicrobial Susceptibility Testing Market Growth – Industry Forecast 2025-2035

Antimicrobial Polymer Films Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA