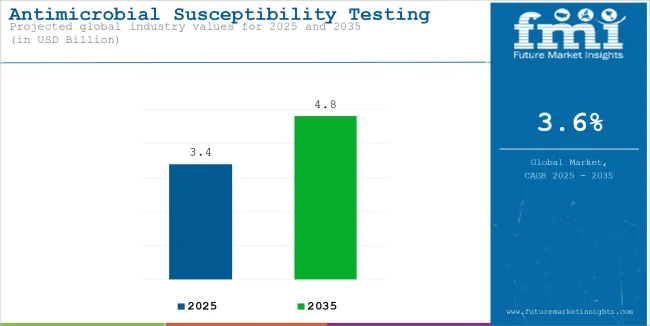

The antimicrobial susceptibility testing market is estimated to reach USD 3.4 billion in 2025. It is anticipated to grow at a CAGR of 3.6% during the assessment period 2025 to 2035 and reach a value of USD 4.8 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Antimicrobial Susceptibility Testing Market Size (2025E) | USD 3.4 billion |

| Projected Antimicrobial Susceptibility Testing Market Value (2035F) | USD 4.8 billion |

| Value-based CAGR (2025 to 2035) | 3.6% |

Antibiotics are used to deal with infections or diseases caused by bacteria. If the antibiotic can deal with the infection, it is classified as effective. By conducting the antibiotic susceptibility test, doctors can choose the most potent antibiotic for treating the patient's bacterial infection. This ensures that the patient gets the most effective treatment.

| Aspect | Definition |

|---|---|

| Susceptible | The antibiotic can effectively inhibit or kill the bacteria at safe concentrations, making it a viable treatment option. |

| Resistant | The bacteria can survive and multiply even in the presence of the antibiotic, rendering the drug ineffective. |

| Intermediate | The bacteria may respond to the antibiotic at higher doses or under certain conditions, but it is not the best option for treatment. |

However, there are some cases where the patient has to undergo treatments with longer antibiotic doses. Due to this, the bacteria tend to become resistant to the antibiotics. With the help of an antibiotic susceptibility test, the healthcare provider can determine what antibiotics are able to fight the bacterial infection. Additionally, resistance monitoring keeps track of the antibiotic resistance level.

Moreover, tracking antibiotic resistance during antibiotic therapy can improve the quality of patient care quality. Samples such as blood or urine need to be collected to conduct the antibiotic susceptibility test. The sample is cultured to identify the bacteria causing the disease, and the pathogenic bacterial strain is then isolated.

Moreover, there are different methods of testing, such as broth dilution, disk diffusion, or automated systems. The bacteria thus tested are classified as susceptible, intermediate, or resistant. This categorization gives direction to the administration of the appropriate dosage for the medication.

Rise in Bacterial Infections

Bacterial infections have been on the rise for a while, and a large population in the world is suffering from some infection or another. People in families with low or moderate incomes are prone to suffering from various diseases. Antimicrobial susceptibility testing is used in hospitals to test out infections such as tuberculosis or those due to hygiene problems, and the results are generally accurate.

Some individuals are given a treatment that may not suit them; therefore, they require a personalized treatment plan. Antimicrobial susceptibility testing helps recommend precision medicines. The government also plays a vital role in increasing research in this field by funding research programs and organizing awareness campaigns. Additionally, the market is getting increasingly competitive.

| Countries | Healthcare Expenditure (% of GDP) |

|---|---|

| United States | 16.80% |

| Germany | 12.50% |

| France | 11.20% |

| Sweden | 11.00% |

| Japan | 10.90% |

| Canada | 10.80% |

| Switzerland | 10.80% |

| United Kingdom | 10.00% |

| Netherlands | 10.00% |

| Austria | 10.00% |

Innovations in Antimicrobial Susceptibility Testing to Propel Adoption

New strains of bacteria and the mechanism of their resistance are being studied, and this will be possible as improvements keep happening in antimicrobial susceptibility testing methods. Incorporating tailored approaches leads to enhanced precision diagnostics, which will be a major driver behind the market growth.

Additionally, steps are expected to be taken in regions with resource constraints. The areas that are not equipped with the best healthcare facilities will also get access to this testing due to faster and cheaper testing methods.

Advancements in Genomic and Molecular Testing

With growing research in the field of molecular and genomic testing, antimicrobial susceptibility testing methodologies have become more advanced. Moreover, technologies, including next-generation sequencing (NGS), PCR, and CRISPR-based diagnostics, allow for quicker detection of strains, which streamlines healthcare processes.

Additionally, these techniques are growing in popularity in antimicrobial susceptibility testing workflows for the formulation of precision medicines. Moreover, CRISPR-based tools can offer results within minimal time, which considerably decreases the diagnostic timeline.

High Initial Investment and Problems with Standardization May Limit Uptake

The laboratories that test for antibiotic susceptibility need a lot of finance due to the requirement for sophisticated testing machines. Thus, it is quite expensive to buy and maintain them. Additionally, the testing time frame might be long because of processing, which might lead to postponement of results, and in certain conditions, the test must be repeated several times for better accuracy. Moreover, upgrades to the processors can also be costly and complicated.

Furthermore, different labs can have different testing protocols, and there is a possibility of errors because of such a lack of standardization. The handling of extensive data can be tedious, too. Additionally, the setup of the labs is quite a challenge in places where the infrastructure and funding are already very poor.

Ongoing Efforts for the Development of Innovative Instruments to Foster Segment Revenue

| Attributes | Details |

|---|---|

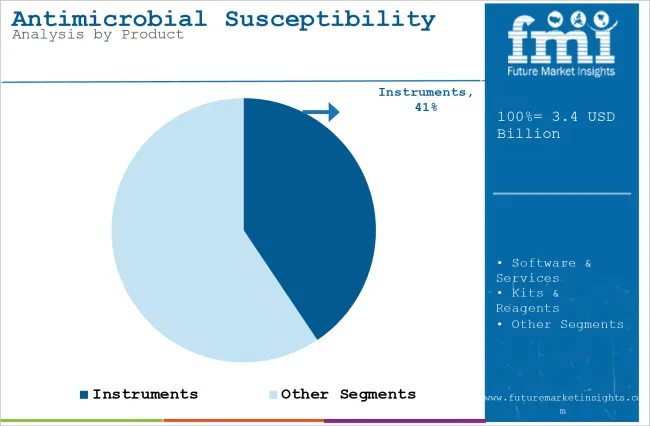

| Top Product Type | Instruments |

| Market Share in 2025 | 40.6% |

By product, the market is segmented into instruments, software & services, and kits & reagents. The instruments segment is expected to account for nearly 40.6% market share in 2025. New-generation antimicrobial susceptibility testing techniques are progressing toward more automatic and less manual labor instruments.

The instruments ensure that the testing happens at high speed and give the doctors a chance to monitor the testing process in real-time. These instruments are vital in big hospitals and labs, where there is a good investment for them. Moreover, there is an ongoing effort to develop more powerful devices that have more advanced features. The instruments would see constant development to gain higher accuracy.

Surging Sepsis Occurrence to Drive Uptake

By application, the market is segmented into sepsis, respiratory infections, gastrointestinal infections, meningitis & encephalitis, endocarditis, and others. The testing method is being widely used for the treatment of sepsis owing to its accuracy in identifying pathogens. Moreover, the higher prevalence of the disease in developed and developing regions globally is contributing to segment expansion.

Rising Hospital Admissions to Bolster Demand

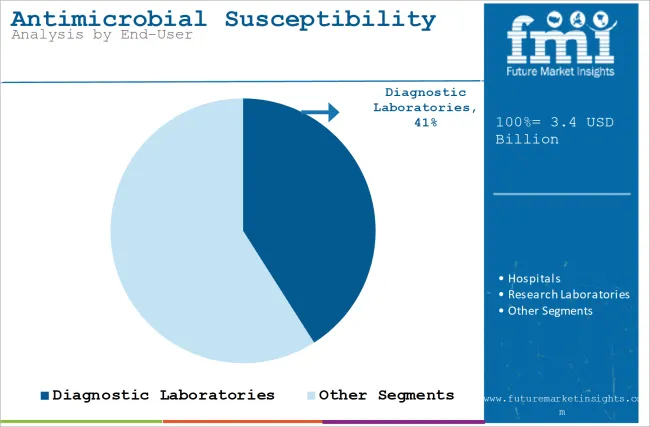

| Attributes | Details |

|---|---|

| Top End User Type | Hospitals |

| Market Share in 2025 | 41% |

By end user, the antimicrobial susceptibility testing market is segmented into diagnostic laboratories, hospitals, and research laboratories. The hospitals segment is expected to account for nearly 41% of the market share in 2025, driven by an increasing number of hospitalizations. Additionally, diagnostic tests are needed by many of the patients, mainly those who suffer from bacterial infections. Sometimes, when infections are severe, the patients also need to be admitted to the intensive care units (ICUs).

In such settings, the patients might need to be tested several times at different times of the day to check if the infection has become less severe. Owing to growing hospital-acquired infections, these settings also have facilities to conduct antibiotic sustainability testing. Even governments keep antimicrobial susceptibility testing as a priority and fund these projects regularly. Due to this, the hospitals contribute to a significant share of revenue in the market.

| Country/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 4.90% |

| UK | 5.80% |

| China | 4.60% |

The antimicrobial susceptibility testing market in the USA is expected to grow at a high growth rate and its CAGR is expected to be 4.9% during the forecast period 2025 to 2035. Antibiotic resistance cases can be seen to be increasing in the country, due to which there is a constant need to develop new treatment strategies to deal with infections.

Additionally, healthcare facilities are very well developed in the USA, and a large amount of money is invested in developing good technologies for diagnosis. Moreover, the government ensures that the research programs are well-funded.

The UK is expected to grow at a CAGR of 5.8% during the forecast period. It can be seen that Europe is well developed in terms of academic and research institutions, and there is a strong motivation for research, as the government funds the research programs pretty well. Hospital-acquired infections are a major issue, and to ensure proper treatment, infections within the hospital need to be tackled. In this regard, constant efforts are being put into reducing them with the help of antimicrobial susceptibility testing.

China is poised to grow at a CAGR of 4.6% during the forecast period, which is the highest among all the Asia Pacific countries under study (the countries from the Asia Pacific include China, India, Japan, Australia, and South Korea). This CAGR is pretty high, given the size and population of the country. China is one of the countries where antibiotic consumption is the highest. Due to this, it is normal to develop resistance to antibiotics.

To ensure that the entire population is healthy, high investments are being made in developing the healthcare infrastructure. China is also experiencing rapid urbanization because of its large population. Due to the integration of artificial intelligence, test results can be analyzed and produced faster, with some parts of the process being automated.

The focus of key market players is on making the testing procedures smoother and more efficient. The profits depend upon the instruments and products associated with testing used in hospitals and laboratories. Because of that, manufacturers supply the best products for testing. Moreover, the antimicrobial susceptibility testing market is expected to expand along with the healthcare sector.

| Key Companies | Area of Focus |

|---|---|

| iFAST Diagnostics | Providing rapid antimicrobial susceptibility testing solutions in under three hours. They do this by analyzing bacteria on a microchip. This technology aims to enhance patient treatment and fight antibiotic resistance. |

| Selux Diagnostics | Started a rapid antimicrobial susceptibility testing platform named Next Generation Phenotyping System. This testing platform provides results that are faster than the current testing procedures. |

| ClinLab International | With the help of digital culture technology, ClinLab delivers the testing results in under four hours, focusing on improving the test accuracy and speed |

Apart from the above-mentioned companies, there are several medical startups that are working tirelessly to provide tools for diagnosis and testing. The focus of these startups is to provide solutions to improve the speed and accuracy of testing. However, more research needs to be conducted as antibiotic resistance is a major problem in the medical sciences.

Globally, the antimicrobial susceptibility testing market is divided into three main segments: product, application, and end user.

By product, the market is segmented into instruments, software & services, and kits & reagents.

By application, the market is segmented into sepsis, respiratory infections, gastrointestinal infections, meningitis & encephalitis, endocarditis, and others.

By end user, the market is segmented into diagnostic laboratories, hospitals, and research laboratories.

The market is poised to reach USD 4.8 billion by 2035.

The market is anticipated to be valued at USD 3.4 billion in 2025.

Some of the major players include Danaher, Bio-Rad, and BD.

North America is a prominent hub for market players.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antimicrobial Hospital Textile Market Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Forecast and Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobials Cosmetic Preserving market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Packaging Ingredients for Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wound Care Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Additives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Car Care Products Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wipes Market - by Product Type, Material Type, Sales Channel, End-User, and Region - Trends, Growth & Forecast 2025 to 2035

Antimicrobial Nanocoatings Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Antimicrobial Packaging Ingredients for Food Packaging

Antimicrobial Regenerative Wound Matrix Market - Growth & Forecast 2025 to 2035

Antimicrobial Coil Coating Market Growth - Trends & Forecast 2025 to 2035

Antimicrobial Polymer Films Market Insights – Growth & Forecast 2024-2034

Antimicrobial Packaging Market

Antimicrobial Peptides Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA