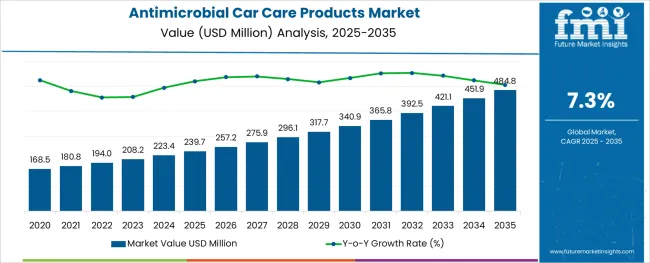

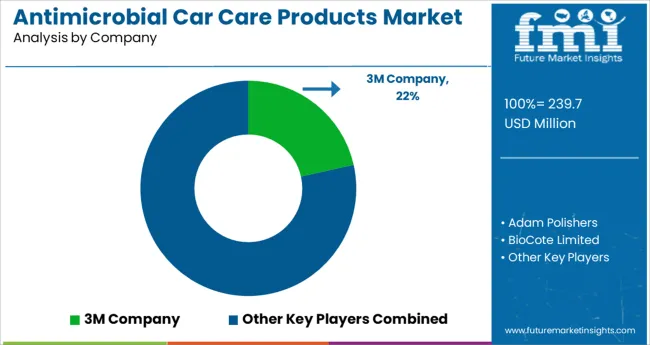

The Antimicrobial Car Care Products Market is estimated to be valued at USD 239.7 million in 2025 and is projected to reach USD 484.8 million by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

The antimicrobial car care products market is expanding due to increased consumer focus on vehicle hygiene and protection against germs. Growing awareness about maintaining clean interiors and surfaces in vehicles has led to higher demand for specialized cleaning products. Fabric and surface cleaners that effectively eliminate bacteria and viruses have become essential, especially as consumers prioritize health and safety.

The surge in passenger car ownership globally has contributed significantly to product demand, as individual car owners seek reliable cleaning solutions to maintain their vehicles. Retail channels, particularly offline stores, continue to play a crucial role in product availability due to their convenience and consumer trust.

Marketing efforts by manufacturers and retailers emphasizing hygiene benefits and ease of use have further driven sales. The market is expected to grow steadily as vehicle hygiene remains a priority, supported by ongoing product innovation and increasing penetration in emerging markets. Growth is expected to be led by fabric and surface cleaners, passenger cars as the main vehicle type, and offline sales channels.

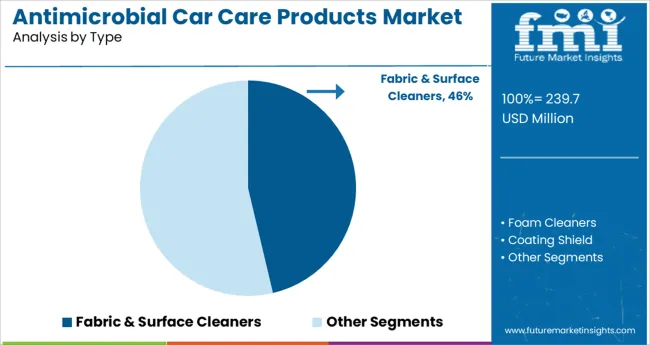

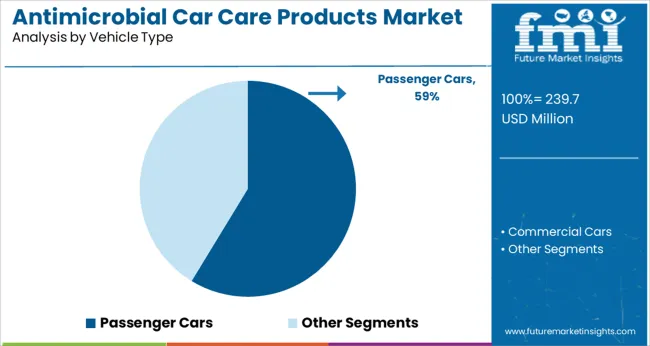

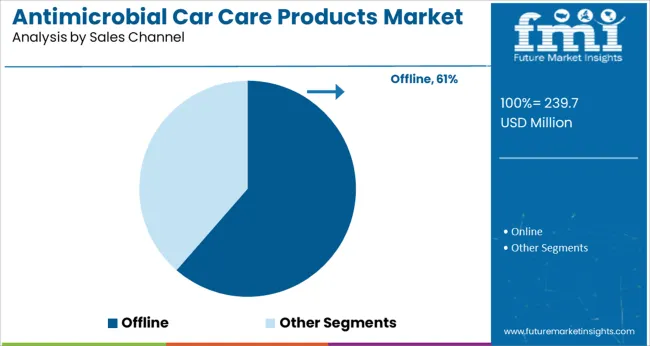

The market is segmented by Type, Vehicle Type, and Sales Channel and region. By Type, the market is divided into Fabric & Surface Cleaners, Foam Cleaners, and Coating Shield. In terms of Vehicle Type, the market is classified into Passenger Cars and Commercial Cars. Based on Sales Channel, the market is segmented into Offline and Online.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Fabric & Surface Cleaners segment is expected to account for 46.3% of the antimicrobial car care products market revenue in 2025. This segment’s expansion is driven by its ability to clean and disinfect multiple vehicle surfaces, including upholstery, dashboards, and door panels. Consumers prefer these products for their multifunctionality and proven antimicrobial properties that help maintain a healthy vehicle environment.

The growth of this segment has been reinforced by product innovations offering quick-dry formulas, pleasant fragrances, and non-toxic ingredients. As awareness about germs and allergens increases, fabric and surface cleaners have become essential for routine vehicle maintenance.

The ease of application and visible cleanliness further encourage frequent use, supporting the segment’s leading market share.

The Passenger Cars segment is projected to hold 58.7% of the antimicrobial car care products market revenue in 2025, making it the largest vehicle type category. This dominance is linked to the widespread ownership of passenger cars across urban and suburban areas. Individual car owners tend to invest more in cleaning and care products to maintain the appearance and hygiene of their vehicles.

The segment benefits from a broad user base that ranges from daily commuters to car enthusiasts, all seeking effective antimicrobial solutions. The frequency of cleaning is higher in passenger cars due to their extensive use and the diversity of passengers.

The segment’s growth is further supported by increasing disposable incomes and awareness about personal and vehicle hygiene.

The Offline segment is expected to contribute 61.4% of the antimicrobial car care products market revenue in 2025, retaining its position as the dominant sales channel. Despite the rise of online retail, offline stores such as automotive specialty shops, supermarkets, and convenience stores continue to be the preferred point of purchase for many consumers.

The ability to physically examine products, immediate availability, and in-store promotions contribute to the sustained preference for offline channels. Additionally, many consumers seek expert advice in physical stores, which helps in selecting appropriate antimicrobial products.

The presence of well-established distribution networks ensures product accessibility across urban and rural regions, reinforcing the offline segment’s leadership. As brand awareness and product education grow, offline sales channels are expected to remain critical for market expansion.

| Market Statistics | Details |

|---|---|

| H1,2024 (A) | 6.8% |

| H1,2025 Projected (P) | 7.1% |

| H1,2025 Outlook (O) | 7.0% |

| BPS Change : H1,2025 (O) - H1,2025 (P) | (+) 22 ↑ |

| BPS Change : H1,2025 (O) - H1,2024 (A) | (-) 12 ↓ |

Future Market Insights estimated a comparison analysis for the Antimicrobial car care products market. Key factors responsible for driving the global antimicrobial car care products market are an increase in vehicle sales, a rise in customer awareness of the importance of maintaining automobile hygiene and conditions, technological developments in car washing and others.

To maintain their cars hygiene, automobile owners are increasingly using antimicrobial car care products. These items prevent the development of germs, hence extending the lifespan of automobiles. In addition, they take away the chance of cross-contamination.

According to FMI analysis, the change between the BPS points in the Antimicrobial Car Care Products market in H1, 2025 - Outlook over H1, 2025 Projected shows an increase of 32 units. Notably, compared to H1, 2024, the market is expected to lose 12 BPS points in H1 -2025.

One of the key reasons responsible for a slight decrease in growth rate is due to increasing regulation related to DIY car/vehicle wash and cleaning, which use antimicrobial car care products.

Materials like plastic, steel, aluminum, and leather among others are significantly used for making automobile components. When these materials are close to microorganisms, they can begin to harbor these organisms. These materials can be degraded by bacterial growth, which reduces the lifespan of autos. These microbes can also cause fatal diseases and infections in humans.

Vehicle owners regularly employ antimicrobial car care products for the interior and outside of their vehicles to combat this problem. During the projected period, the market is anticipated to grow as customers become more aware of the value of utilizing these auto care products.

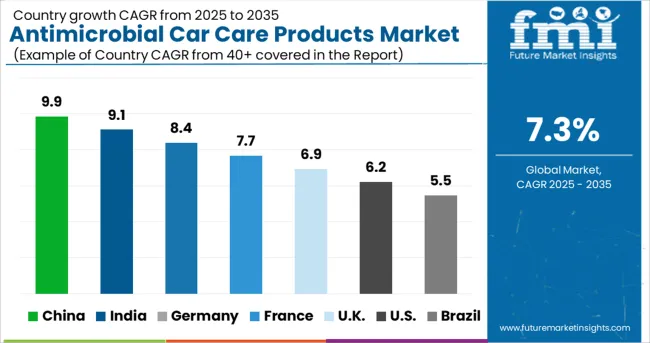

The global antimicrobial car care products market is anticipated to expand at a CAGR of 7.3% between 2025 and 2035, in comparison to 5.8% CAGR registered between 2020 to 2024.

Increasing sales of vehicles, rising consumer awareness regarding the importance of maintaining car hygiene/conditions and advancements in car washing technologies are some of the major factors driving sales in the market.

Antimicrobial car care products are being increasingly used by car owners to keep their vehicles safe and hygienic. These products inhibit the growth of microorganisms and thus help to extend the life of vehicles. Besides this, they eliminate the risk of cross contamination.

Rising sales of automotive worldwide is a major force behind the expansion of antimicrobial car care products market. This is anticipated to create lucrative growth avenues within the antimicrobial car care products market during the forecast period.

Leading market players are introducing new products and technologies to increase sales and to expand their footprint. They are focusing on developing ecofriendly products with zero impact on human health.

In addition to this, growing sales of used cars (secondhand cars) is anticipated to further accelerate the growth of antimicrobial car care products market during the assessment period. Spurred by the aforementioned factors, the market volume for antimicrobial car care products market is set to expand 1.76X through 2035.

Most of the automotive parts are made from materials like plastic, steel, aluminum, leather etc. These materials can harbor microorganisms once they come into close contact with them. Growth of microorganisms like bacteria can degrade these materials and thus shorten the life span of cars. In addition to this, these microorganisms can infect people and cause lethal diseases.

To address this issue, car owners continuously use antimicrobial car care products for both car interior and exterior protection. Growing awareness among consumers regarding the importance of using these car care products is expected to bolster the market during the forecast period.

With increasing threat of disease transmission during passenger movement in public transport, people prefer to travel in their personal vehicles. As a result, there has been a rise in the sales of passenger vehicles.

Growing Consumer Awareness Spurring Antimicrobial Car Care Products Sales in the UK

The UK is expected to emerge as a lucrative pocket Europe, owing to the growing consumer awareness for car maintenance, rising sales of vehicles, innovations in car cleaning technology and the presence of leading market players.

During the last few decades, there has been a significant rise in the cases of nosocomial infections and other life-threatening diseases across the country. This is compelling consumers to take various precautionary measures like adoption of antimicrobial car care products.

Moreover, increasing adoption of passenger vehicles coupled with rising number of car wash service providers will further expand the U.K. antimicrobial car care products market during the forecast period.

A market share of 36.1% has been projected for the Europe antimicrobial car care products market, spearheaded by the U.K. in 2025.

Booming Automotive Industry in China is Fueling Antimicrobial Car Care Products Demand

China has been at the forefront for the production and sales of passenger vehicles. According to the International Organization of Motor Vehicle Manufacturers (OICA), total vehicle production in China reached around 25,225242 in 2024. Rise in production and sales of passenger cars is creating a conducive environment for the antimicrobial car care products manufacturers in the country and the trend is likely to continue in the forthcoming years.

Besides this, consumers are spending large amounts on car care products for maintaining the hygienic condition of their vehicles. This is boosting the growth of antimicrobial car care products in the country.

Leading players in China are introducing low-cost products into the market to improve sales. As per FMI, the East Asia antimicrobial car care products market, led by China, will account for around 15.0% of the total market share in 2025.

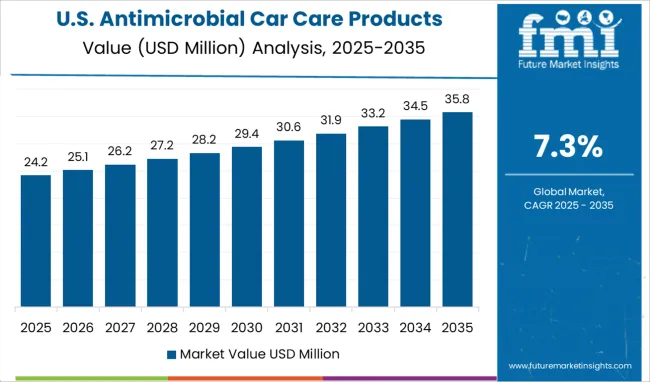

Presence of Car Wash Centers Across the USA is Boosting Sales of Antimicrobial Car Care Products

As per FMI, the USA will continue to dominate the North America antimicrobial car care products market. Increasing sales of passenger cars, growing adoption of car care products by customers and the presence of various car wash centers across the country are expecting to continue driving sales over the forecast period.

A market share of 28.2% has been projected for North America antimicrobial car care products market spearheaded by the USA in 2025.

With heavy presence of automotive giants and growing popularity of electric vehicles, the USA has become an attractive market for antimicrobial car care products manufacturers. Car owners are using these products to inhibit the growth of microorganisms. Maintaining proper car hygiene has become a top priority for vehicle owners.

The country is witnessing a rapid surge in the number of automated car wash service stations which provide antimicrobial cleaning solutions to car owners. This is anticipated to boost the sales of antimicrobial car care products like foam cleaners and surface cleaners.

Similarly, increasing penetration of online sales channels is supporting the growth of the market. Thanks to these online platforms, people can now choose any car care product based on their needs from their homes.

Attractive Features of Fabric and Surface Cleaners Making Them Highly Sought-After Car Care Products

Based on type, the fabric & surface cleaners segment is expected to dominate the antimicrobial care products market while foam cleaners segment is anticipated to grow at a considerable pace over the forecast period.

Fabric & surface cleaners have become the most commonly used antimicrobial car care products across the globe to prevent cross contamination. These products are widely being adopted due to their cost effectiveness and ease of accessibility.

Increasing Private Vehicle Ownership To Spur Demand for Antimicrobial Car Care Products

As per FMI, the sales in the passenger car segment will account for a dominant share in the market in 2025. Expanding passenger car fleet across the globe is boosting the sales of antimicrobial car care products and the trend is likely to continue in the forthcoming years.

With rising disposable income and changing lifestyle, people are shifting their preference from public transport to private transport. As a result, sales of passenger cars are rising at a prolific rate. Similarly, rental car services are gaining momentum. This is anticipated to create demand for antimicrobial care products during the assessment period.

Amid rise in private vehicle ownership, it is estimated that about 7 out of 10 antimicrobial car care products would be used in passenger cars throughout the forecast period.

Easy Availability and Timely Delivery is Fueling Sales of Antimicrobial Car Care Products Online

In terms of sales channel, sales in the online sales channel will command a lion’s share in 2025.

Online sales channels provide umpteen benefits such as easy selection from a wide range of products and overall cost reduction. The impact of the COVID-19 pandemic is also compelling customers to shift their preference from offline sales platforms to online ones.

Rising trend of purchasing car care products through online shopping platforms is expected to boost the market in the forthcoming years. To capitalize on this trend, market players are moving towards online sales platforms.

Besides this, they are offering various discounts to attract more customers. This is anticipated to boost the growth of antimicrobial car care products market during the forecast period.

Leading players operating in the antimicrobial car care products market are introducing innovative products at affordable prices. Besides this, they are adopting various organic and inorganic strategies such as partnerships, advanced product launches, collaborations, and acquisitions to gain a competitive edge in the market. For instance:

| Attribute | Details |

|---|---|

| Historical Data Available for | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Market Analysis | Units for Volume and million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific and MEA |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, UK, France, Italy, Spain, Russia, Poland, China, Japan, South Korea, India, ASEAN, Turkey, Saudi Arabia and South Africa |

| Key Segments Covered | Type, Vehicle Type, Sales Channel and Region |

| Key Companies Profiled | Biocote Ltd.; 3M Company; Microban International; Sanitized AG; Clean Control Corporation; Adam’s Polishes; GardGroup Inc.; Ziebart International Corporation; Biopledge LLC; Dow Chemical Company; Clariant AG, Addmaster (UK) Ltd.; Clorox Professional Products Company |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global antimicrobial car care products market is estimated to be valued at USD 239.7 million in 2025.

It is projected to reach USD 484.8 million by 2035.

The market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types are fabric & surface cleaners, foam cleaners and coating shield.

passenger cars segment is expected to dominate with a 58.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Nail Care Products Market Growth, Trends and Forecast from 2025 to 2035

Facial Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Products Filling System Market Size and Share Forecast Outlook 2025 to 2035

The Dementia Care Products Market is segmented by Memory Exercise & Activity Products, Daily Reminder Products and Dining Aids from 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Pregnancy Care Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Post Shave Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Care Products Market Growth, Trends and Forecast from 2025 to 2035

Antimicrobial Wound Care Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Incontinence Care Products Market Size and Share Forecast Outlook 2025 to 2035

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Baby Personal Care Products Market Analysis - Size & Growth 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA