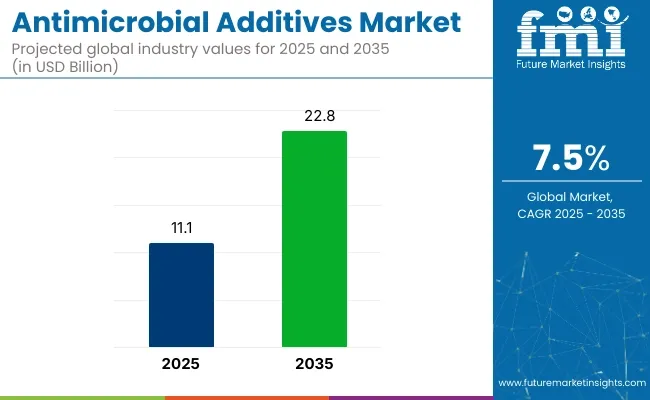

The global antimicrobial additives market is estimated to be valued at USD 11.1 billion in 2025 and is forecast to grow to USD 22.8 billion by 2035, advancing at a CAGR of 7.5% during the forecast period. Growth is primarily driven by increasing awareness regarding hygiene and infection control across sectors such as healthcare, packaging, construction, and consumer goods.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 11.1 Billion |

| Projected Market Size in 2035 | USD 22.8 Billion |

| CAGR (2025 to 2035) | 7.5% |

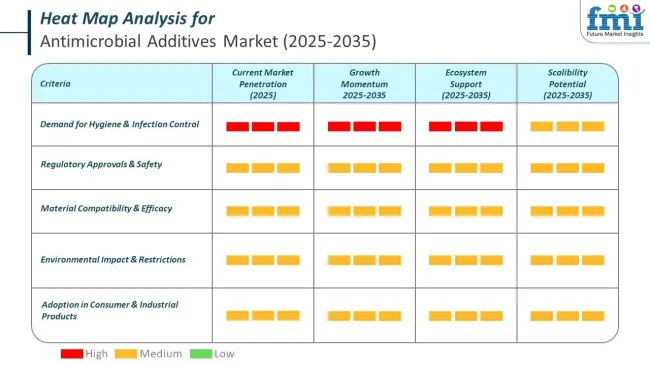

AMR is increasingly impacting the antimicrobial additives market across major economies. In China, rising AMR from overuse of antibiotics is driving demand for antimicrobial-free food products. The economic burden of AMR in the USA. is spurring innovation in healthcare and packaging. In Japan, hygiene awareness and packaging regulations are boosting growth in antimicrobial additives. Germany leads Europe with strict regulations and concerns over microbial contamination. In India, AMR challenges are prompting stricter regulations and growing demand in food safety and healthcare.

The antimicrobial additives market faces challenges in manufacturing, including regulatory hurdles, high production costs, and environmental concerns. Stringent global regulations, such as the Biocidal Products Regulation (BPR) and FIFRA, increase development costs and delay time-to-market. Volatility in raw material prices, like silver, copper, and zinc, affects production costs. Sustainability demands eco-friendly alternatives, but these require expensive R&D. Supply chain disruptions and intense competition further complicate the market, with smaller players struggling to keep up.

Intense competition and the need for continuous technological innovation create barriers for smaller companies, with larger multinational firms leveraging technological advancements to differentiate their products.

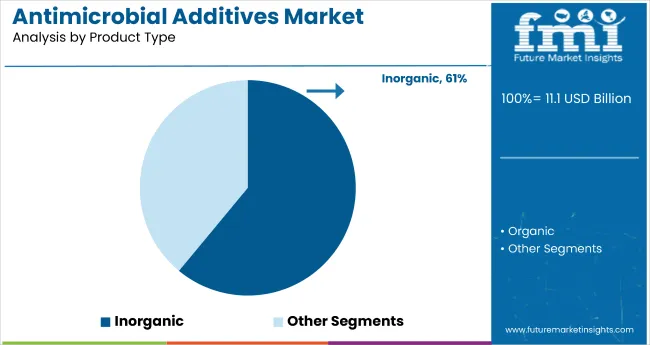

Inorganic antimicrobial additives are set to dominate the product type segment, holding approximately 61% market share in 2025. Over the forecast period, the segment is expected to expand at a CAGR of 7.8%, driven by ongoing technological improvements in nano-formulations and rising demand for durable antimicrobial protection in both high-end and mass-market applications.

These include silver, copper, and zinc-based compounds known for their broad-spectrum antimicrobial efficacy, long-lasting protection, and thermal stability. Silver-based additives, in particular, are widely used in healthcare, packaging, and high-touch surfaces due to their proven ability to prevent microbial growth even under challenging conditions.

Inorganic options are preferred in medical and industrial applications where hygiene, safety, and regulatory compliance are critical. Their growing usage in consumer products, paints, textiles, and construction materials is supported by increased awareness of microbial contamination risks.

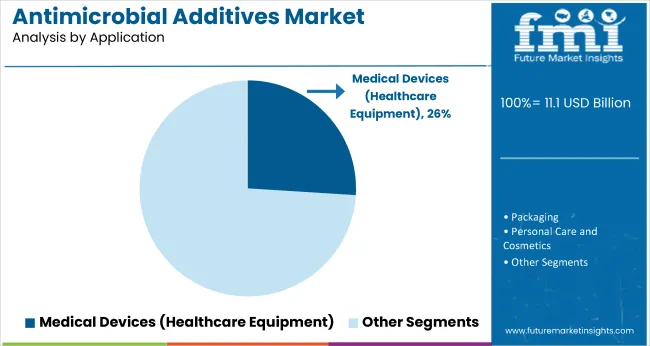

Medical devices are anticipated to dominate the application segment of the antimicrobial additives market, accounting for approximately 26% share in 2025. The segment is projected to grow at a CAGR of 8.3% through 2035, supported by rising global healthcare expenditure, medical infrastructure development in emerging markets, and innovation in biocompatible antimicrobial chemistries tailored for invasive and non-invasive equipment.

The demand surge is driven by a heightened focus on infection control, especially in post-pandemic healthcare systems. Additives are extensively used in surgical tools, ventilators, catheters, hospital beds, and diagnostic devices to prevent healthcare-associated infections (HAIs).

Their integration ensures long-term microbial resistance without altering device functionality or patient safety. Regulatory bodies such as the FDA and EMA are increasingly encouraging the use of antimicrobial technology in high-contact medical environments. Hospitals and clinics are adopting these materials to improve patient outcomes and reduce operational costs linked to infections.

Regulatory scrutiny over the toxicity and long-term ecological effects of some chemical-based antimicrobial agents is among the key drivers in the antimicrobial additives market. With governments implementing stricter restrictions on traditional antimicrobial compounds, manufacturers are forced to seek investment in alternative, safer biocide formulations.

One of the major hurdles to their wide-scale adoption is the high cost of antimicrobial additives, especially silver-based solutions, in regional markets. Moreover, concern of microbial resistance against existing antimicrobial agents may prevent long-term stability of this market unless a new effective product is developed.

The market offers significant growth opportunities, especially in the realm of eco-friendly antimicrobial solutions. Plant-derived, biodegradable antimicrobial agents such as essential oils and enzyme-based biocides, as well as probiotic coatings, are being developed to meet the increased demand for natural consumer products.

The recent presence of antimicrobial additives in smart textiles, food packaging, and 3D-printed medical devices is opening fresh revenue opportunities for industry participants. Moreover, growth in research and development (R&D) spending in antimicrobial nanotechnology and controlled-release antimicrobial coatings will improve the effectiveness, durability, and commercial viability of the products.

The growth in the United States antimicrobial additives market can be traced back to increasing concerns over cleanliness, growing preference for infection control products, and stringent regulations for healthcare and consumer products. A large healthcare infrastructure, such as hospitals, medical device manufacturers, and pharmaceutical companies, in the country is one of the prominent reasons driving the usage of antimicrobial agents in medical plastics, coatings and packaging.

The most important demand for antimicrobial coatings has increased significantly in food processing, textiles, and packaging due to an increasing incidence of antibiotic-resistant bacteria and greater awareness of microbial contamination. FDA & EPA regulations have also been established at the beginning of the use of antimicrobial materials, followed by effectiveness, to encourage companies to bring in new innovative antimicrobial solutions that are safe and provide long-lasting properties.

| Country | CAGR (2025 to 2035) |

|---|---|

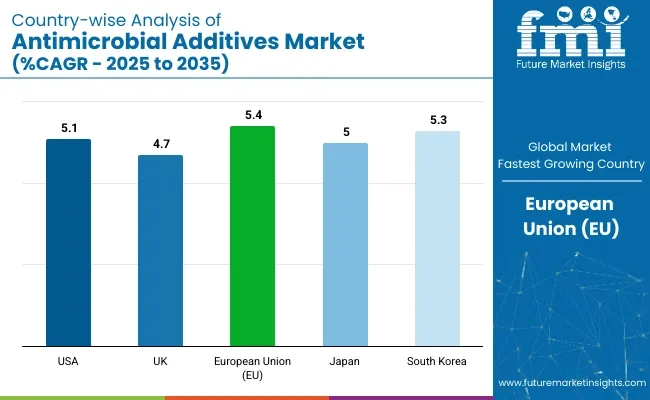

| USA | 5.1% |

The UK antimicrobial additives market is programmed to deliver remarkable growth in this period, largely due to increasing health-conscious consumer behaviour, stringent government hygiene laws, and higher acceptance of antimicrobial additives within the healthcare and food packaging industries.

The National Health Service (NHS) is investing significantly in containment approaches, which are expected to demand significant investments in hospitals, surgical instruments, and clinical machines, residues of which are among the key end-use sections driving demand for antimicrobial coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

However, with Escalating EU regulations concerning food safety, healthcare infection control, and sustainability, the European antimicrobial additives market is relentlessly growing. The REACH regulations in Europe and the European Green Deal are driving enterprises to implement safe and sustainable antimicrobial solutions, which will further spur the growth of the global organic and bio-based antimicrobial agents market.

There is a high demand for antimicrobial plastics, coatings, and textiles in the largest pharmaceutical and medical device manufacturers located in Germany, France, and Italy. A similar trend is also catching up in construction as antimicrobial materials are being used in paint, flooring, and HVAC systems to prevent microbial growth and enhance indoor air quality.

Antimicrobial packaging is beginning to favour biodegradable solutions, most notably for food contact applications in response to consumer choice for safer and longer-lasting materials. Moreover, the textile sector is increasingly utilizing antimicrobial fabrics in sports apparel, medical clothing, upholstery, and other products to increase durability and hygiene.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.4% |

The market for antimicrobial additives in Japan is also rising owing to technological developments, a growing elderly population, and increasing demand for hygiene-driven products. Israel’s R&D sector is working on Nano-coatings, antimicrobial ceramics and self-cleaning surfaces for both industrial and consumer use.

An ageing population and well-developed healthcare infrastructure drive the demand for antimicrobial solutions in hospitals, home care products, and public transportation. Antimicrobial coatings have also been used in the electronics industry for smartphones, touch screens, and appliances in an effort to reduce microbial contamination.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The antimicrobial additives market of South Korea is uplifted due to high investments in the healthcare, technology, and electronics sectors. Tech-driven economy means advancement in antimicrobial solutions in semiconductors, displays, and medical devices.

Biodegradable antimicrobial materials are increasingly used in packaging and textiles, amid greater attention to sustainability. That's why the automotive sector is adopting antimicrobial coatings to create vehicle interiors featuring the latest technology to keep passengers safe.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

The antimicrobial additives market is witnessing competitive intensification as leading players focus on mergers, sustainability, and novel material innovations. Firms are expanding their portfolios to include bio-based and non-toxic alternatives targeting child-safe and food-contact applications. Strategic collaborations between chemical companies and medical institutions are fostering next-generation antimicrobial technologies.

Key players such as BASF SE, Microban International, Sanitized AG, Lonza Group, and LyondellBasell Industries are prioritizing R&D to develop multi-functional additives with UV, odor-control, and anti-fungal properties. Regional market expansion in Asia-Pacific and Latin America remains a central focus as healthcare spending and public sanitation awareness grow rapidly. Amid tightening environmental and safety regulations, compliance and innovation will shape competitive positioning in the decade ahead.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 11.1 billion |

| Projected Market Size (2035) | USD 22.9 billion |

| CAGR (2025 to 2035) | 7.50% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed (Segment 1) | Organic, Inorganic |

| Forms Covered (Segment 2) | Liquid, Powder, Masterbatch Pellet |

| Applications Covered (Segment 3) | Hygiene Chemicals, Packaging, Personal Care & Cosmetics, Consumer Electronics, Commercial & Household Products, Textiles & Fabrics, Toys & Stationery, Paints, Coatings & Inks, Medical Devices, Transportation, High-Touch Surfaces, Others |

| Regions Covered | North America; Latin America; Europe; Asia-Pacific; Middle East & Africa |

| Countries Covered | United States, Germany, China, India, Japan, South Korea, Brazil, Canada, UK |

| Key Players Influencing the Market | BASF SE, DuPont de Nemours, Microban International, Clariant AG, Sanitized AG, Solvay S.A., Ecolab Inc., Evonik Industries AG, Huntsman Corporation, Ashland Inc., Aviant Corporation, Lanxess AG |

| Additional Attributes | Dollar sales by product type and application, trends in bio-based antimicrobials, regulatory impact on additive use, regional growth drivers, innovations in masterbatch technologies |

| Customization and Pricing | Customization and Pricing Available on Request |

The overall market size for Antimicrobial Additives Market was USD 11.1 Billion in 2025.

The market is expected to reach USD 22.9 billion in 2035.

The rising demand for sustainable and environmentally friendly materials in packaging, agriculture, and consumer goods will propel the Antimicrobial Additives Market. Increasing applications in food packaging, medical products, and disposable items further drive growth. Moreover, advancements in biopolymer technology and growing R&D investments will accelerate market expansion.

The top 5 countries which drives the development of Antimicrobial Additives Market are USA, UK, Europe Union, Japan and South Korea.

Silver Ion and Quaternary Ammonium Compounds to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antimicrobial Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobials Cosmetic Preserving market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Packaging Ingredients for Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wound Care Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Car Care Products Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Susceptibility Tester Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wipes Market - by Product Type, Material Type, Sales Channel, End-User, and Region - Trends, Growth & Forecast 2025 to 2035

Antimicrobial Nanocoatings Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Antimicrobial Packaging Ingredients for Food Packaging

Antimicrobial Coil Coating Market Growth - Trends & Forecast 2025 to 2035

Antimicrobial Regenerative Wound Matrix Market - Growth & Forecast 2025 to 2035

Antimicrobial Susceptibility Testing Market Growth – Industry Forecast 2025-2035

Antimicrobial Polymer Films Market Insights – Growth & Forecast 2024-2034

Global Antimicrobial Hospital Textile Market Insights – Trends & Forecast 2024-2034

Antimicrobial Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA