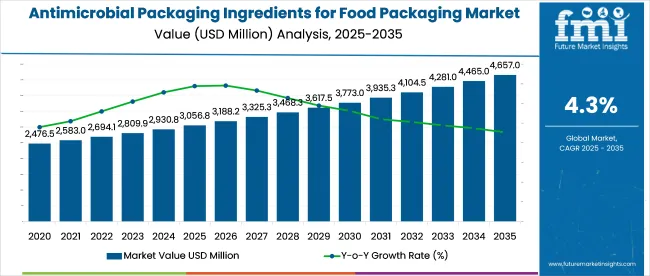

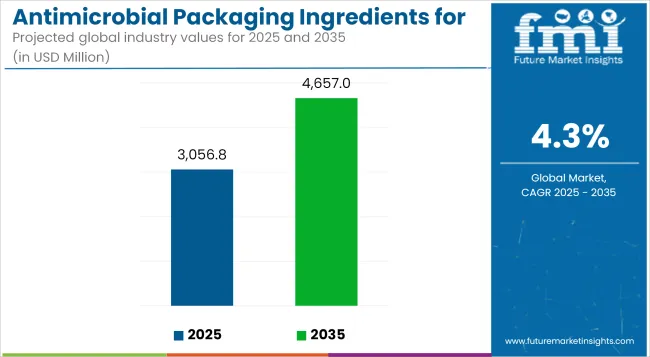

The global Antimicrobial Packaging Ingredients for Food Packaging market is forecast to reach USD 3,056.8 million in 2025 and grow to USD 4,657.0 million by 2035, registering a CAGR of 4.3% during the period.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 3,056.8 million |

| Market Size (2035) | USD 4,657.0 million |

| CAGR (2025 to 2035) | 4.3% |

Growth is being driven by the increasing need to extend food shelf life, reduce microbial contamination, and comply with evolving food safety regulations across key economies. In 2025, this market will represent approximately 2.1% of the broader food packaging industry, which continues to prioritize freshness-retention and spoilage-prevention functionalities.

Market expansion is supported by strong demand for extended shelf-life packaging across perishable food categories, with antimicrobial films gaining traction due to ease of integration into existing production lines. Regulatory alignment with global food safety standards, particularly in the EU and China, has created a compliance-driven push for embedded antimicrobial ingredients.

However, growth is tempered by high cost premiums on bio-based or functional additives, which can inflate packaging unit costs by 12-18%, limiting adoption among mid-tier food processors. Technical challenges around material compatibility and migration testing also continue to slow scalability in developing economies.

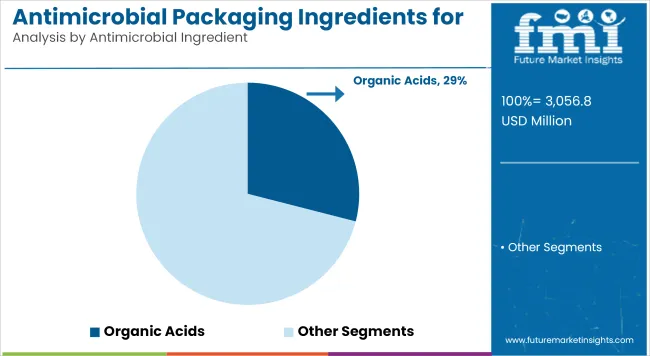

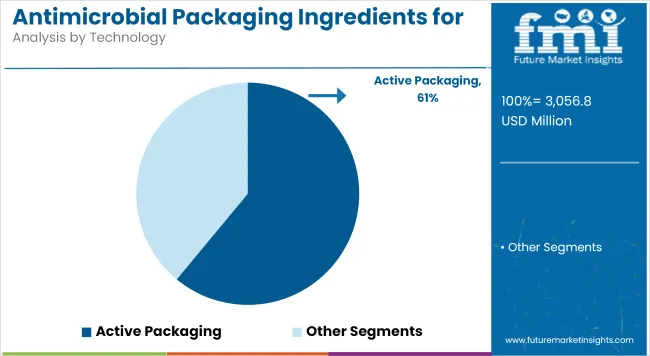

The Antimicrobial Packaging Ingredients for Food Packaging market is segmented into organic acids; bacteriocins; essential oils; enzymes; metal ions & oxidizers; and others by antimicrobial ingredient; controlled release packaging and active packaging by technology; pouches; cartons; trays; bags; films; and cups & lids by packaging applications; food & beverage; cosmetics & personal care; consumer electronics; and healthcare by end use; North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; and Middle East & Africa by region.

Organic acids will lead in 2025 with a 29.1% share, driven by their wide regulatory acceptance and broad-spectrum activity across dairy, meat, and ready-to-eat food packaging. Their low migration rates and effectiveness at lower concentrations give them a clear margin advantage, especially in film-based formats.

Growth is supported by two factors

However, essential oils are emerging as a potential disruptor. With a CAGR of 4.9% over 2025 to 2035, their penetration is improving in premium segments, especially for active packaging in fresh produce. Their volatility remains a limitation, but microencapsulation tech could raise adoption and offset loss rates.

Active packaging will dominate the technology segment in 2025, accounting for 61.2% of total market value. Its leadership stems from superior compatibility with antimicrobial films, bags, and trays used for fresh-cut produce, bakery, and dairy categories. The integration of antimicrobial agents directly into packaging layers extends shelf life by up to 30%, driving adoption in short-cycle food supply chains.

Two primary forces sustain this lead

Controlled release packaging is lagging in share, currently at 38.8%, but is gaining visibility in export packaging. It’s particularly suited for long-haul chilled meat and seafood, though slower commercial rollouts in Asia-Pacific restrain uptake.

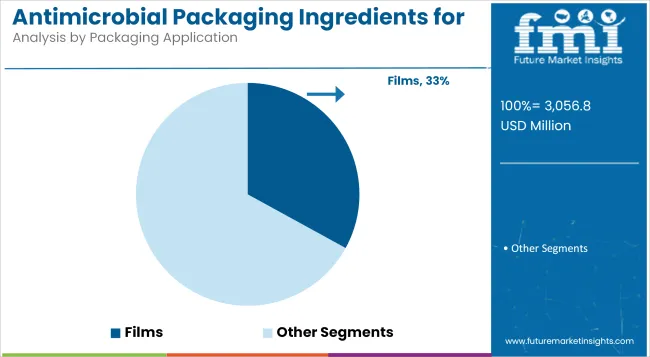

Films will lead the packaging application segment with a 33.1% share in 2025. Their dominance is tied to widespread use in both flexible and rigid formats across high-turnover food categories such as bakery, dairy, and fresh produce. Films allow seamless embedding of antimicrobial ingredients, with low material disruption and scalable printability-key for high-speed FMCG operations.

Two structural levers underpin growth

However, trays and pouches are gaining share in chilled meat and ready-to-eat segments. These formats offer deeper cavity protection and controlled gas exchange, enabling antimicrobial integration for high-protein, short-shelf-life SKUs.

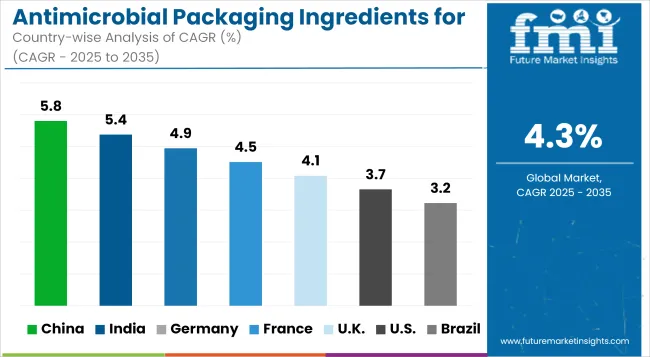

Growth trajectories for Antimicrobial Packaging Ingredients for Food Packaging diverge sharply across key markets, shaped by national food safety mandates, local processing scale, and innovation uptake in packaging tech.

In the United States, growth will be steady as FDA-compliant antimicrobial packaging gains traction in large-scale food processors. High consumer awareness of foodborne risks, along with tech-forward adoption in meat and produce categories, sustains demand.

China is set to lead global growth, driven by its dual mandate of food waste reduction and hygiene enforcement post-pandemic. Local manufacturers are scaling active packaging faster than peers, aided by provincial subsidies on functional packaging lines. Germany and France will maintain a regulatory-led pace, where EU alignment on migration limits and clean-label packaging favors organic acids and essential oils. However, SME adoption remains uneven due to cost hurdles.

The UK market is adapting slower post-Brexit, with delayed regulatory harmonization and fragmented retailer guidelines, though niche innovations in pouches and trays are emerging in chilled and organic foods. Japan shows stable growth anchored in high retail hygiene standards and R&D-backed tech collaborations, especially in antimicrobial films for convenience and ready-meal packaging.

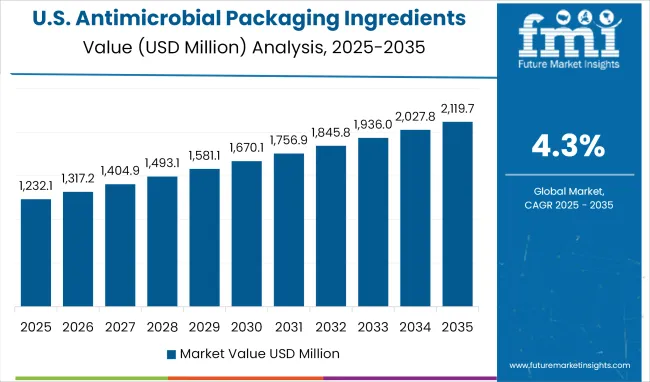

The USA Antimicrobial Packaging Ingredients for Food Packaging market is projected to reach USD 792.6 million in 2025 and USD 1,169.5 million by 2035, registering a CAGR of 4.0%. Growth remains tied to institutional demand from meat and dairy processors operating under USDA and FDA mandates for microbial safety.

Margins are protected by vertical integration among major players and high-volume adoption of active packaging. However, uptake among mid-size processors is constrained by testing costs-antimicrobial packaging adds 10-14% to unit cost.

Federal grants under FSMA Section 204 have supported digitized traceability pilots that indirectly favor antimicrobial packaging. Consumer surveys (USDA, 2025) show 63% of shoppers associate antimicrobial labels with freshness and hygiene.

The UK market is valued at USD 188.1 million in 2025 and will grow to USD 277.2 million by 2035, expanding at a 4.0% CAGR. Post-Brexit divergence in safety standards has slowed rollout among small and mid-sized packaging firms.

Although chilled meats and dairy dominate application areas, testing and dual-standard compliance inflate costs by 7.4%. Retailer demand is inconsistent, further delaying large-scale adoption.

FSA guidance on antimicrobial migration is advisory, not enforceable, creating hesitation in investment. BRC reports show 44% of private-label food brands delaying adoption until after 2027.

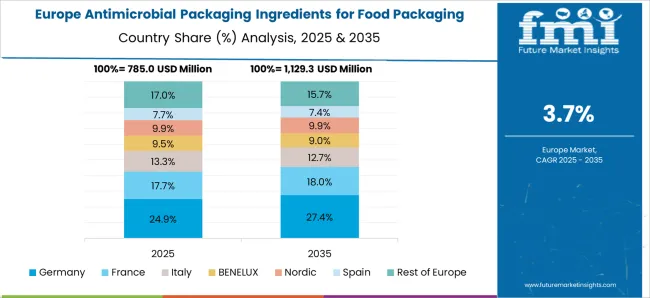

France’s market is expected to hit USD 213.7 million in 2025 and USD 316.9 million by 2035, with a CAGR of 4.1%. Regulatory alignment with EU migration and safety directives makes France a high-compliance market, favoring ingredients like organic acids and essential oils.

Antimicrobial films have gained traction in cheese, salad, and bakery chains. INRAE trials showed spoilage cuts of up to 26%-prompting chain-wide deployment by 2026.

Still, artisanal producers show resistance due to margin constraints and limited technical expertise. National grants for circular packaging exclude many antimicrobial solutions, adding friction.

Germany’s market stands at USD 237.5 million in 2025, reaching USD 353.6 million by 2035, with a CAGR of 4.1%. Food-grade antimicrobials are widely accepted under EU law, especially in meat, deli, and dairy applications.

Retailers lead demand, but implementation across supply chains remains cautious. Strict testing under BfR and EFSA rules elongates time-to-market, slowing innovation cycles for smaller packaging converters.

Consumer trust remains high: over 70% of surveyed shoppers express confidence in antimicrobial-labeled packaging. However, technical interoperability with recycling systems remains a minor drag.

Japan’s market is estimated at USD 192.0 million in 2025 and projected to reach USD 284.8 million by 2035, expanding at a 4.0% CAGR. Growth is powered by urban convenience chains and strong retail hygiene mandates.

Antimicrobial films are used across bento, chilled noodles, and bakery items. R&D partnerships between packaging firms and food majors continue to drive innovation in active packaging with precision-dose antimicrobial delivery.

Cost sensitivity is minimal in high-end formats, though rollout in mid-tier supermarkets remains cautious. Consumer awareness campaigns by Japan Packaging Institute show 61% recognition of antimicrobial labeling by 2025.

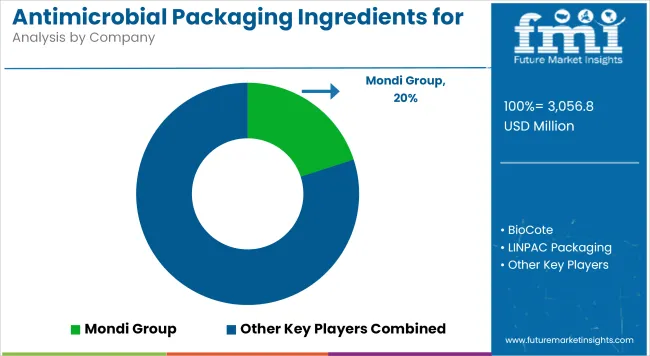

The players in the Antimicrobial Packaging Ingredients for Food Packaging market are focusing on ingredient-function integration and scalable active packaging formats to meet evolving safety mandates and shelf-life demands. Mondi Group, BioCote, and LINPAC Packaging have expanded their antimicrobial portfolios through vertical integration and cross-sector collaborations with food processors and packaging machinery manufacturers.

Mondi Group holds a leading position, with an estimated 20% share in 2025, driven by its antimicrobial film lines tailored for dairy, bakery, and produce. BioCote has strengthened its additive business by partnering with packaging OEMs across North America and Europe. LINPAC Packaging’s focus on ready-meal and meat trays with built-in antimicrobial layers has helped it secure contracts with Tier-1 European retailers.

Market expansion is also supported by regional players such as Uflex Ltd. and Coveris Holdings S.A., who are developing controlled-release solutions for emerging Asian markets. Regulatory tightening in China and the EU has pushed Reynolds Group and Dunmore Corporation to invest in migration-tested antimicrobial barrier coatings.

Over 2025 to 2028, companies that can demonstrate EU-compliant antimicrobial efficacy and recyclability will gain faster traction. Players lacking in-house R&D or regulatory testing capabilities risk being marginalized.

| Metric | Details |

|---|---|

| Market Name | Antimicrobial Packaging Ingredients for Food Packaging for Food Packaging Market |

| Base Year | 2024 |

| Forecast Period | 2025 to 2035 |

| 2025 Market Size | USD 3,056.8 million |

| 2035 Market Size | USD 4,657.0 million |

| CAGR (2025-2035) | 4.3% |

| Units | Revenue (USD Million) |

| Segments Covered | Antimicrobial Ingredient, Technology, Packaging Application, End Use, Region |

| Antimicrobial Ingredient | Organic Acids, Bacteriocins, Essential Oils, Enzymes, Metal Ions & Oxidizers, Others |

| Technology | Active Packaging, Controlled Release Packaging |

| Packaging Application | Pouches, Cartons, Trays, Bags, Films, Cups & Lids |

| End Use | Food & Beverage, Cosmetics & Personal Care, Consumer Electronics, Healthcare |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Key Countries | United States, United Kingdom, France, Germany, Japan, China, South Korea, India |

| Top Companies | Mondi Group, BioCote, LINPAC Packaging, Reynolds Group, Dunmore Corporation, Uflex Ltd., Coveris Holdings S.A., PacMoore Products Inc., B&G Products Ltd., ALUF Plastic Inc., Hexis S.A., WestRock Company |

The global antimicrobial packaging ingredients for food packaging market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the antimicrobial packaging ingredients for food packaging market is projected to reach USD 4.6 billion by 2035.

The antimicrobial packaging ingredients for food packaging market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in antimicrobial packaging ingredients for food packaging market are organic acids, bacteriocins, essential oils, enzymes, metal ions & oxidizers and others.

In terms of technology, active packaging segment to command 61.0% share in the antimicrobial packaging ingredients for food packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Antimicrobial Packaging Ingredients for Food Packaging

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Tester Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Food Packaging Film Providers

Food Packaging Equipment Market

Food Tub packaging Market Size and Share Forecast Outlook 2025 to 2035

Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seafood Packaging Market Size, Share & Forecast 2025 to 2035

Evaluating Seafood Packaging Market Share & Provider Insights

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Food Grade Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Food Powder Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Food Powder Packaging Machine Market Share & Industry Trends

Baby Food Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PVDC Food Packaging Market

Fresh Food Packaging Market Forecast and Outlook 2025 to 2035

Smart Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA