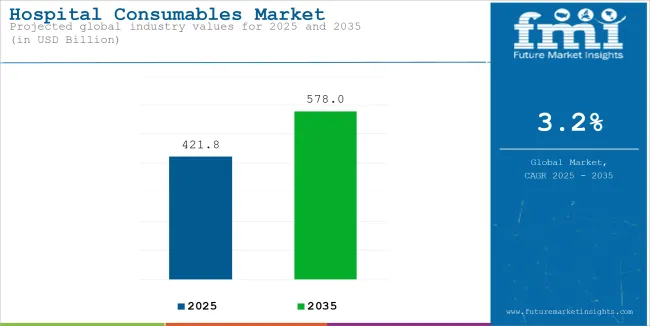

The global sales of hospital consumables are estimated to be worth USD 421.8 billion in 2025 and anticipated to reach a value of USD 578.0 billion by 2035. Sales are projected to rise at a CAGR of 3.2% over the forecast period between 2025 and 2035. The revenue generated by hospital consumables in 2024 was USD 408.8 billion.

The growing demand for effective treatment of chronic and acute wounds is driving companies to develop innovative therapies in the market. Rising unmet needs for novel treatments in developing nations are fueling research into wound healing. Increased R&D investments and the approval of new devices are boosting market growth.

Ongoing research enhances existing wound healing assessment processes, improving efficiency and reducing costs. This progress also enables the development of new products and services, helping the market stay competitive. Manufacturers are addressing challenges identified during extensive studies and regulatory approvals.

For example, Ivenix, Inc. invested over 400 hours of usability testing to improve infusion pump safety, while new water-assisted insertion methods in colonoscopy show promising results and are easy to learn.

Global Hospital Consumables Industry Analysis

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 408.8 billion |

| Estimated Size, 2025 | USD 421.8 billion |

| Projected Size, 2035 | USD 578.0 billion |

| Value-based CAGR (2025 to 2035) | 3.2% |

The hospital consumable industry is continuously evolving to incorporate both emerging technology and leading medical practices. Leading players are focusing on patient safety.

While there is always a risk for infection during any operation, there is interest in the medical community to investigate whether single use devices reduce infection risk compared to reprocessed devices. One significant advantage that single use devices offer from a product traceability standpoint is that each device is used only once on a single patient.

A risk management strategy is used in infection prevention and control to reduce or stop the spread of infection. Patients, healthcare professionals, and other individuals in healthcare settings are highly protected by the two-tiered strategy of standard and transmission-based measures.

Hospital consumables innovation is driven largely by the need for better solutions and for greater technological capabilities, and also by promising ideas, scientific interest and economic concerns.

In addition, healthcare consumables innovation is mainly targeted at high-resource countries. To better align with innovation with public health needs, increased funding and improved infrastructure are necessary.

In addition, better networking among stakeholders may help. Choosing medical supplies is complex and requires a transparent process based on reason, evidence, and assessment of prioritized public health needs. Poor choices lead to inappropriate use or non-use of medical supplies and a waste of resources.

The below table presents the expected CAGR for the global outlook for hospital consumables over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.9%, followed by a slightly lower growth rate of 3.6% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 3.9% (2024 to 2034) |

| H2 | 3.6% (2024 to 2034) |

| H1 | 3.2% (2025 to 2035) |

| H2 | 2.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.2% in the first half and decrease moderately at 2.7% in the second half. In the first half (H1) the market witnessed a decrease of 70.00 BPS while in the second half (H2), the market witnessed an increase of 90.00 BPS.

Increasing Prevalence of HAIs (Healthcare-Associated Infection) Drives the Demand for Hospital Consumables

As the CDC says, out of every 31 patients within hospitals, one has been experiencing at least one HAI while most of those are preventable. Therefore, raising awareness and significant investments in control of infections, within the context of healthcare sectors, increase consumption for consumables which may help control HAI risk factors.

The demand for disposable equipment includes sterile gloves, gowns, syringes, and surgical instruments because of the necessity to have quite high standards of hygiene and minimize infection transmission in hospitals.

There is also a demand for consumables that facilitate disinfection, sterilization, and control contamination as health care institutions try to eliminate HAIs and make patients safer.

Single-use, disposable goods are increasingly used in healthcare settings as a way to prevent danger from cross-contamination and the transmission of infection.

This trend is expected to continue as hospitals seek to improve infection prevention practices, decrease patient damage, and mitigate the costs of HAI consequences. With the infection control as a core element in all health care delivery sites, this industry of consumables in the hospitals continues growing.

Technology-Driven Manufacturing Presents a Significant Opportunity for Growth in the Disposable Medical Products Market

The quality of a product is highly dependent on manufacturing processes. The recent development of industrial information technologies has empowered the digitalization of manufacturing processes and promoted the concept of the Digital Twin (DT).

The emphasis in manufacturing is on technological developments (CPS, robotics and additive manufacturing) and in the service sector, there is a focus on data (AI, data analytics and big data). What is lacking is research on the importance of quality management within these developments.

The incorporation of the latest technology and tools reduces the manufacturing cost of disposable medical products. Bulk production is becoming easier without compromising quality standards. With the development of inexpensive manufacturing technology, more medical disposable products will be made easily available to medical facilities.

The demand and supply of disposable medical products are going to grow at an encouraging rate during the upcoming years. The Coronavirus pandemic situation has also grown the concern regarding the general health of common people and the robustness of the healthcare system.

The disposable medical products manufacturing industry needs to understand and grab the situation. By following quality-oriented and technology-driven manufacturing, growth can be made sustainable and there is a huge opportunity for the market players.

Sustainable Innovations Drive Growth in the Market

The increasing demand for single-use medical disposables, including gloves, face masks, needles, and blood bags, has presented the healthcare industry with a double-edged sword: the indispensable consumption and environmental disposal of these items.

This issue has encouraged tremendous innovation in the field of consumables used within hospitals, particularly eco-friendly alternatives. In fact, manufacturers are hugely into developing medical consumables made from biodegradable materials that reduce environmental harm without compromising on product performance in preventing HAIs.

The most promising solution uses biodegradable materials taken directly from natural sources, including corn, algae, and mushrooms. Most of these materials have a smaller carbon footprint during production, hence being viewed as more sustainable along the product life cycle.

As such, Inovenso developed nanofiber face mask media using its open-surface electrospinning technology, serving as an eco-friendly alternative to traditional personal protective equipment.

Other companies, like Precision Textiles, are pushing harder into the development of even more sustainable products. In 2021, the company unveiled EcoGuard - a sustainable disposable medical isolation gown fabric that combines a reduction of waste with improving patient safety.

These innovative concepts indicate the wave of sustainability taking place in the hospital consumables market, with a rise in demand for sustainable products alongside other successful healthcare-related products.

Growing Concerns Over Biomedical Waste Management Restricting Market Growth

Advances in medical technologies and more modern facilities within hospitals for offering better healthcare services have contributed to the subsequent rise in the volume of waste that is produced by healthcare facilities.

"Bio-Medical Waste" is the term used to describe all of the disposable trash from medical procedures in hospitals, labs, and research institutes. Inadequate biomedical waste segregation and disposal can pollute groundwater and release dangerous airborne particles that can contaminate our air.

Needle stick injury and sharps injury incidents increase risk exposure to employees every day. The risk of HIV, hepatitis B, and C pathogens by contamination is of major concern to healthcare workers within the health facilities.

The growth in the medical industry sector along with more usage of disposable medical commodities increases the extensive scale of produced waste.

Other challenges include lesser information about harmful aspects of the diseases associated with waste from hospitals; inadequate proper instruction on efficient health waste; scarcity of safe means of hospital healthcare waste generation as well as of disposal is more common regarding such healthcare wastefulness issues.

The disposal of medical wastes is expected to raise environmental concerns, which will restrain the growth of the market in the forecast period.

The global hospital consumables industry recorded a CAGR of 2.8% during the historical period between 2020 and 2024. The growth of hospital consumables industry was positive as it reached a value of USD 408.8 Billion in 2024 from USD 364.9 billion in 2020.

The hospital consumables market has flourished in the last couple of years due to the increasing demand for disposable products to maintain hygiene and prevent HAIs. Several innovative consumables have been manufactured by the producers, including syringes, surgical masks, sterile gloves, and medical gadgets that would help in treating the patients safely and effectively.

One of the leading reasons for market growth has to do with the COVID-19 pandemic, increasing the demand for disposable items like PPE and all other items impeding the viruses from spreading.

Manufacturing technologies that have undergone complete automation and digitization over the years have further contributed to developing the market for consumables, owing to cost reduction of production without compromising high-quality standards.

This also facilitated bulk production of medical consumables without compromising safety. Increasing focuses on infection control in hospitals drive up the demand for consumables within hospitals.

With innovation in technology, such as integration of digital health into the healthcare tool and analytics that help to bring efficiency in the supply chain, enhancing product quality is likely to further push this market ahead. Additionally, a higher environmental awareness can steer the market to ecologically friendly disposable products.

Therefore, ongoing reformations within the health sector will also raise the bar of quality, affordable consumables, thereby providing great potential for the manufacturing firms in the Global market.

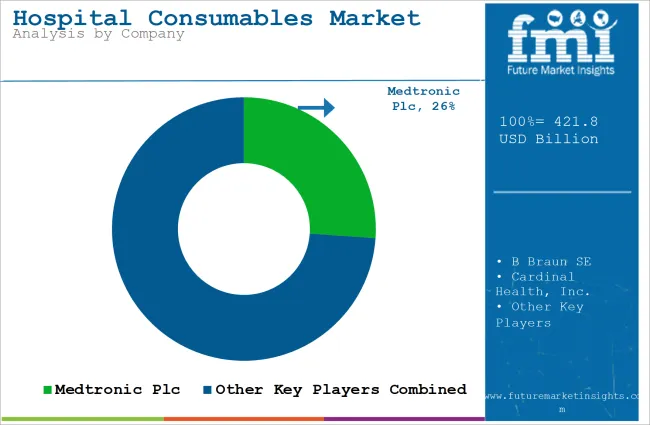

Tier 1 companies comprise market leaders with a significant market share of 56.6% in global market. Tier 1 players are the largest and most established companies in the hospital consumables market. They have a broad product portfolio, strong brand recognition, and a significant global presence.

These companies dominate the market due to their extensive distribution networks, large-scale manufacturing capabilities, and financial strength to invest in research and development (R&D). Prominent companies in tier 1 include Medtronic Plc, B Braun SE, 3M, Johnson & Johnson

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market and holds around 27.2% market share.

Tier 2 players are smaller companies or regional leaders that have a more focused product range compared to Tier 1 players. These companies often target specific markets or niche segments within the hospital consumables industry.

While they may not have the same level of global reach or financial resources, Tier 2 players often differentiate themselves through specialized products, regional expertise, or cost-effective solutions. Prominent companies in tier 2 include Cardinal Health, Inc., Mölnlycke Health Care AB, NIPRO Corporation, Ansell Healthcare LLC

The section below covers the industry analysis for the hospital consumables market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle Ease & Africa, is provided.

The United States is anticipated to remain at the forefront in North America, with higher market share through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 5.8% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 1.5% |

| Germany | 1.7% |

| China | 5.4% |

| France | 2.2% |

| India | 5.8% |

| Spain | 2.9% |

| Australia & New Zealand | 3.1% |

| South Korea | 4.2% |

United States’ market for hospital consumables is expected to grow at a CAGR of 1.5% between 2025 and 2035. Currently, it holds the highest share in the North American market, and the trend is expected to continue during the forecast period.

The United States performs an extensive volume of surgeries consisting of both scheduled operations and emergency procedures besides more advanced surgical procedures.

Its 48 million inpatient surgical procedures annually translate to a significant number of surgical consumables that need to be provided. These include drape, gloves, sutures, and surgical gowns, among others, required for the maintenance of sterility in surgical processes.

Advanced surgical techniques, such as robotic assisted and minimally invasive surgeries, have further increased the demand for specialized consumables.

For example, precision instruments, disposable trocars, and advanced suturing materials are selectively used in minimally invasive techniques, while single-use components designed specifically for robotic systems are used in robotic surgeries.

Besides, increased cases of chronic diseases and illnesses such as heart disease and cancer are more responsible for high procedure rates that further entrench dependence on consumables. The three reasons work in harmony to push high demand levels and rapid growth for hospital consumables in the United States.

China’s market for hospital consumables is poised to exhibit a CAGR of 5.4% between 2025 and 2035. Currently, it holds the highest share in the East Asia market, and the trend is expected to continue during the forecast period.

China has the strongest manufacturing system in the world and is the leader in producing syringes, catheters, wound care products, and surgical disposables. This allows China to manufacture in scale and stay cost-effective, hence enabling it to maintain competitive prices, which stimulates consumption at home and export growth.

China's domestic market benefits from its high-volume manufacturing to a large populace and the developing healthcare infrastructure within the country. At the same time, due to its strengths in export-oriented manufacturing, the country has become essential for consumable supplies in various international markets in times of international health crises, such as the COVID-19 pandemic.

Advanced manufacturing technologies, government incentives, and partnerships with global healthcare companies have improved product quality, enabling Chinese manufacturers to meet stringent international standards. This dual demand-driven by local needs and export opportunities-continues to propel market growth while solidifying China's role as a key player in the global hospital consumables industry.

India’s market for hospital consumables is poised to exhibit a CAGR of 5.8% between 2025 and 2035. Currently, it holds the highest share in the South Asia & Pacific market, and the trend is expected to continue during the forecast period.

High patient volumes are seen in the public and private healthcare sectors in India, and this is a major driving factor for the hospital consumables market. Large numbers of patients visit hospitals, diagnostic centers, and outpatient facilities for treatment, thus consistently demanding consumables such as syringes, gloves, IV sets, and diagnostic kits.

High patient flow, especially in urban settings, requires single-use, disposable items to avoid contamination and ensure hygiene. Consumables are also largely used in hospitals dealing with chronic conditions, surgery, and trauma cases for efficient management.

Increased health awareness and availability of health services have resulted in people seeking medical care in time and thus leading to increased hospital admission and outpatient attendances. A continually increasing patient population fuels the growing demand for consumables, further fueling growth in the hospital consumables industry in India.

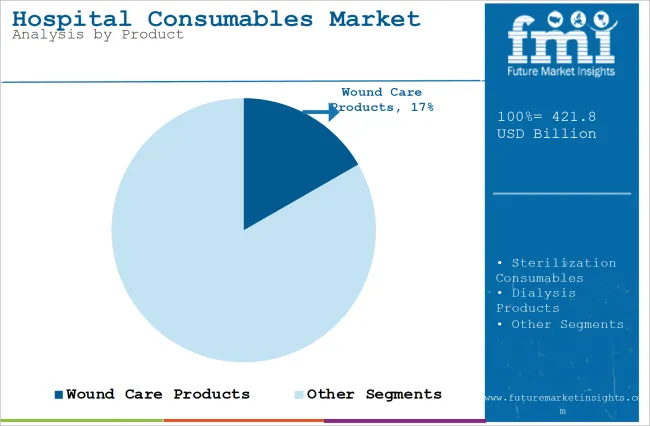

The section contains information about the leading segments in the industry. By product, the wound care products segment is estimated to hold the highest market share of 16.7% in 2025.

| By Product | Wound Care Products |

|---|---|

| Value Share (2025) | 16.7% |

A dominating factor in demand is the prevalence of surgical, trauma cases and chronic conditions in the form of diabetes and cardiovascular diseases, mainly leading to a chronic wound and the growing demands of wound care due to aged populations in those countries.

Advances in product development in the form of hydrocolloid, foam, and antimicrobial dressings that provide enhanced healing benefits are also driving this segment. The trend for increased outpatient care and home healthcare has also hastened the use of wound care products beyond traditional hospital sites.

With continued advances in wound care technology, coupled with a growing emphasis on infection prevention, wound care products are certain to be a source of continued market growth.

| By End User | Hospitals |

|---|---|

| Value Share (2025) | 26.1% |

As the majority of consumable usage, a large share in the consumable usage is majorly acquired by hospitals which are the source of primary care. Surgical drapes, gloves, syringes, diagnostic kits, and many more consumable products are primarily used in providing wound care as a result of the high admission of patients under emergency and elective treatments.

Moreover, hospitals are always the first to adopt new technologies and surgical techniques, such as robotic surgeries and minimally invasive procedures, which require special disposable products. The increasing incidence of chronic diseases, an aging population, and an increasing number of surgeries further enhance hospital consumables usage.

In addition, growth in critical care units and intensive care settings creates a greater demand for consumables such as infusion products, respiratory supplies, and blood management tools. Hospitals, with their size and variety of patient needs, continue to be the largest market for consumables.

To improve their business strategies and strengthen their presence around the globe, the key players are involved in various product launches, expansions, collaborations, and mergers and acquisitions. Below are the top key promotional strategies adopted by the key players in the market:

Recent Industry Developments in Hospital Consumables

In terms of product, the industry is divided into- sterilization consumables, wound care products, dialysis products, infusion products, hypodermic & radiology products, intubation & respiratory supplies, surgical procedure kits & trays, blood management & diagnostic supplies and general disposable products.

In terms of application, the industry is segregated into- cardiovascular, cerebrovascular, dental, laparoscopy, gynecology, urology, orthopedics and others.

In terms of end user, the industry is segregated into- hospitals, ambulatory surgical centers, clinics, diagnostic centers, long term care centers and nursing facilities.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global hospital consumables market is projected to witness CAGR of 3.2% between 2025 and 2035.

The global hospital consumables sales stood at USD 408.8 billion in 2024.

The global hospital consumables outlook is anticipated to reach USD 578.0 billion by 2035 end.

India is set to record the highest CAGR of 5.8% in the assessment period.

The key players operating in the global hospital consumables market include Medtronic Plc, B Braun SE, Cardinal Health, Inc., 3M, Johnson & Johnson, Mölnlycke Health Care AB, NIPRO Corporation, Ansell Healthcare LLC, Halyard Health, Inc., Medline Industries Inc., McKesson Corporation and others.

Table 1: Global Market Value (US$ million), By Product Type, 2017 to 2021

Table 2: Global Market Value (US$ million), By Product Type, 2022 to 2032

Table 3: Global Market, By Region, 2017 to 2021

Table 4: Global Market, By Region, 2022 to 2032

Table 5: North America Market Value (US$ million), By Product Type, 2017 to 2021

Table 6: North America Market Value (US$ million), By Product Type, 2022 to 2032

Table 7: North America Market, By Country, 2017 to 2021

Table 8: North America Market, By Country, 2022 to 2032

Table 9: Latin America Market Value (US$ million), By Product Type, 2017 to 2021

Table 10: Latin America Market Value (US$ million), By Product Type, 2022 to 2032

Table 11: Latin America Market, By Country, 2017 to 2021

Table 12: Latin America Market, By Country, 2022 to 2032

Table 13: Europe Market Value (US$ million), By Product Type, 2017 to 2021

Table 14: Europe Market Value (US$ million), By Product Type, 2022 to 2032

Table 15: Europe Market, By Country, 2017 to 2021

Table 16: Europe Market, By Country, 2022 to 2032

Table 17: Asia Pacific Market Value (US$ million), By Product Type, 2017 to 2021

Table 18: Asia Pacific Market Value (US$ million), By Product Type, 2022 to 2032

Table 19: Asia Pacific Market, By Country, 2017 to 2021

Table 20: Asia Pacific Market, By Country, 2022 to 2032

Table 21: MEA Market Value (US$ million), By Product Type, 2017 to 2021

Table 22: MEA Market Value (US$ million), By Product Type, 2022 to 2032

Table 23: MEA Market, By Country, 2017 to 2021

Table 24: MEA Market, By Country, 2022 to 2032

Table 25: Global Market Incremental $ Opportunity, By Product Type, 2017 to 2021

Table 26: Global Market Incremental $ Opportunity, By Region, 2022 to 2032

Table 27: North America Market Incremental $ Opportunity, By Product Type, 2017 to 2021

Table 28: North America Market Incremental $ Opportunity, By Country, 2022 to 2032

Table 29: Latin America Market Incremental $ Opportunity, By Product Type, 2017 to 2021

Table 30: Latin America Market Incremental $ Opportunity, By Country, 2022 to 2032

Table 31: Europe Market Incremental $ Opportunity, By Product Type, 2017 to 2021

Table 32: Europe Market Incremental $ Opportunity, By Country, 2022 to 2032

Table 33: Asia Pacific Market Incremental $ Opportunity, By Product Type, 2017 to 2021

Table 34: Asia Pacific Market Incremental $ Opportunity, By Country, 2022 to 2032

Table 35: MEA Market Incremental $ Opportunity, By Product Type, 2017 to 2021

Table 36: MEA Market Incremental $ Opportunity, By Country, 2022 to 2032

Figure 1: Global Market Value (US$ million) and Year-on-Year Growth, 2017-2032

Figure 2: Global Market Absolute $ Historical Gain (2017 to 2021) and Opportunity (2022 to 2032), US$ million

Figure 3: Global Market Share, By Product Type, 2022 to 2032

Figure 4: Global Market Y-o-Y Growth Projections, By Product Type - 2022 to 2032

Figure 5: Global Market Attractiveness Index, By Product Type - 2022 to 2032

Figure 6: Global Market Share, By Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth Projections, By Region - 2022 to 2032

Figure 8: Global Market Attractiveness Index, By Region - 2022 to 2032

Figure 9: North America Market Value (US$ million) and Year-on-Year Growth, 2017-2032

Figure 10: North America Market Absolute $ Opportunity Historical (2017 to 2021) and Forecast Period (2022 to 2032), US$ million

Figure 11: North America Market Share, By Product Type, 2022 to 2032

Figure 12: North America Market Y-o-Y Growth Projections, By Product Type - 2022 to 2032

Figure 13: North America Market Attractiveness Index, By Product Type - 2022 to 2032

Figure 14: North America Market Share, By Country, 2022 to 2032

Figure 15: North America Market Y-o-Y Growth Projections, By Country - 2022 to 2032

Figure 16: North America Market Attractiveness Index, By Country - 2022 to 2032

Figure 17: Latin America Market Value (US$ million) and Year-on-Year Growth, 2017-2032

Figure 18: Latin America Market Absolute $ Opportunity Historical (2017 to 2021) and Forecast Period (2022 to 2032), US$ million

Figure 19: Latin America Market Share, By Product Type, 2022 to 2032

Figure 20: Latin America Market Y-o-Y Growth Projections, By Product Type - 2022 to 2032

Figure 21: Latin America Market Attractiveness Index, By Product Type - 2022 to 2032

Figure 22: Latin America Market Share, By Country, 2022 to 2032

Figure 23: Latin America Market Y-o-Y Growth Projections, By Country - 2022 to 2032

Figure 24: Latin America Market Attractiveness Index, By Country - 2022 to 2032

Figure 25: Europe Market Value (US$ million) and Year-on-Year Growth, 2017-2032

Figure 26: Europe Market Absolute $ Opportunity Historical (2017 to 2021) and Forecast Period (2022 to 2032), US$ million

Figure 27: Europe Market Share, By Product Type, 2022 to 2032

Figure 28: Europe Market Y-o-Y Growth Projections, By Product Type - 2022 to 2032

Figure 29: Europe Market Attractiveness Index, By Product Type - 2022 to 2032

Figure 30: Europe Market Share, By Country, 2022 to 2032

Figure 31: Europe Market Y-o-Y Growth Projections, By Country - 2022 to 2032

Figure 32: Europe Market Attractiveness Index, By Country - 2022 to 2032

Figure 33: MEA Market Value (US$ million) and Year-on-Year Growth, 2017-2032

Figure 34: MEA Market Absolute $ Opportunity Historical (2017 to 2021) and Forecast Period (2022 to 2032), US$ million

Figure 35: MEA Market Share, By Product Type, 2022 to 2032

Figure 36: MEA Market Y-o-Y Growth Projections, By Product Type - 2022 to 2032

Figure 37: MEA Market Attractiveness Index, By Product Type - 2022 to 2032

Figure 38: MEA Market Share, By Country, 2022 to 2032

Figure 39: MEA Market Y-o-Y Growth Projections, By Country - 2022 to 2032

Figure 40: MEA Market Attractiveness Index, By Country - 2022 to 2032

Figure 41: Asia Pacific Market Value (US$ million) and Year-on-Year Growth, 2017-2032

Figure 42: Asia Pacific Market Absolute $ Opportunity Historical (2017 to 2021) and Forecast Period (2022 to 2032), US$ million

Figure 43: Asia Pacific Market Share, By Product Type, 2022 to 2032

Figure 44: Asia Pacific Market Y-o-Y Growth Projections, By Product Type - 2022 to 2032

Figure 45: Asia Pacific Market Attractiveness Index, By Product Type - 2022 to 2032

Figure 46: Asia Pacific Market Share, By Country, 2022 to 2032

Figure 47: Asia Pacific Market Y-o-Y Growth Projections, By Country - 2022 to 2032

Figure 48: Asia Pacific Market Attractiveness Index, By Country - 2022 to 2032

Figure 49: US Market Value (US$ million) and Forecast, 2022 to 2032

Figure 50: US Market Share, By Product Type, 2021

Figure 51: Canada Market Value (US$ million) and Forecast, 2022 to 2032

Figure 52: Canada Market Share, By Product Type, 2021

Figure 53: Brazil Market Value (US$ million) and Forecast, 2022 to 2032

Figure 54: Brazil Market Share, By Product Type, 2021

Figure 55: Mexico Market Value (US$ million) and Forecast, 2022 to 2032

Figure 56: Mexico Market Share, By Product Type, 2021

Figure 57: Germany Market Value (US$ million) and Forecast, 2022 to 2032

Figure 58: Germany Market Share, By Product Type, 2021

Figure 59: The United Kingdom Market Value (US$ million) and Forecast, 2022 to 2032

Figure 60: The United Kingdom Market Share, By Product Type, 2021

Figure 61: France Market Value (US$ million) and Forecast, 2022 to 2032

Figure 62: France Market Share, By Product Type, 2021

Figure 63: Italy Market Value (US$ million) and Forecast, 2022 to 2032

Figure 64: Italy Market Share, By Product Type, 2021

Figure 65: BENELUX Market Value (US$ million) and Forecast, 2022 to 2032

Figure 66: BENELUX Market Share, By Product Type, 2021

Figure 67: Nordic Countries Market Value (US$ million) and Forecast, 2022 to 2032

Figure 68: Nordic Countries Market Share, By Product Type, 2021

Figure 69: China Market Value (US$ million) and Forecast, 2022 to 2032

Figure 70: China Market Share, By Product Type, 2021

Figure 71: Japan Market Value (US$ million) and Forecast, 2022 to 2032

Figure 72: Japan Market Share, By Product Type, 2021

Figure 73: South Korea Market Value (US$ million) and Forecast, 2022 to 2032

Figure 74: South Korea Market Share, By Product Type, 2021

Figure 75: GCC Countries Market Value (US$ million) and Forecast, 2022 to 2032

Figure 76: GCC Countries Market Share, By Product Type, 2021

Figure 77: South Africa Market Value (US$ million) and Forecast, 2022 to 2032

Figure 78: South Africa Market Share, By Product Type, 2021

Figure 79: Turkey Market Value (US$ million) and Forecast, 2022 to 2032

Figure 80: Turkey Market Share, By Product Type, 2021

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hospital Service Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hospitality Mattress Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospitality Staffing Market Size and Share Forecast Outlook 2025 to 2035

Hospital Stretchers Market Size and Share Forecast Outlook 2025 to 2035

Hospital Surgical Disinfectant Market Size and Share Forecast Outlook 2025 to 2035

Hospital Supplies Market Size and Share Forecast Outlook 2025 to 2035

Hospital Disinfectant Products & Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Hospital Workforce Management Market is segmented by product, and end user from 2025 to 2035

Hospital-Acquired Infection (HAI) Control Market – Prevention & Growth Trends 2025 to 2035

Hospital Capacity Management Solutions Market Insights - Growth & Forecast 2024 to 2034

Hospital Bedsheet & Pillow Cover Market Analysis - Size, Trends & Forecast 2024 to 2034

Hospital Resource Management Market

Hospital Information System Market

Non-Hospital-Based Point-Of-Care Diagnostic Products Market Size and Share Forecast Outlook 2025 to 2035

Smart Hospitality & Coworking Spaces Market Trends - Growth & Forecast 2025 to 2035

Smart Hospitality Management Market

Micro-Hospitals Market

Europe Hospital Capacity Management Solution Market Growth – Trends & Forecast 2025 to 2035

Bedless Hospitals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA