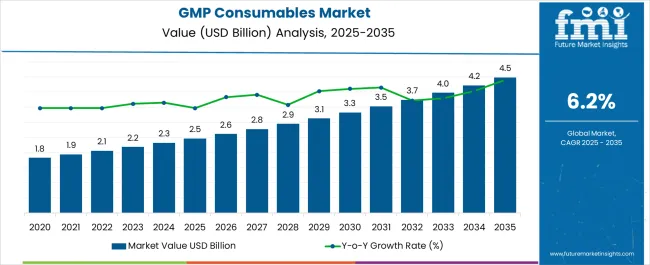

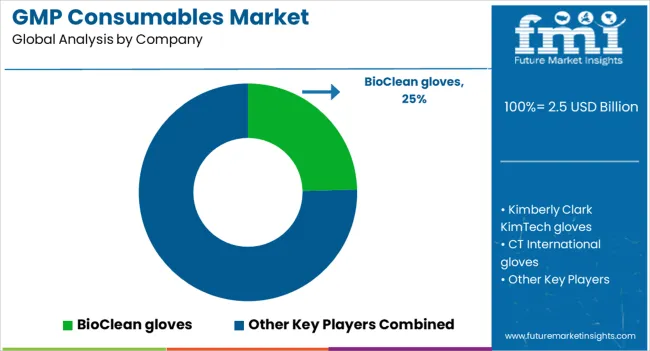

The GMP Consumables Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 4.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| GMP Consumables Market Estimated Value in (2025 E) | USD 2.5 billion |

| GMP Consumables Market Forecast Value in (2035 F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The GMP consumables market is experiencing robust growth driven by stringent regulatory standards, increasing investment in biologics manufacturing, and expanding focus on contamination control. Rising adoption of advanced therapeutics including monoclonal antibodies, vaccines, and cell and gene therapies has intensified the demand for consumables that ensure compliance with good manufacturing practices.

Clean room environments are being prioritized as critical spaces where quality and sterility must be maintained, prompting manufacturers to allocate higher budgets toward certified consumables. The integration of automation, digital monitoring, and sustainable cleaning solutions is also shaping procurement strategies.

As global pharmaceutical and biopharmaceutical companies scale production capacity, demand for consumables that enhance efficiency, regulatory compliance, and operational safety is expected to remain strong, supporting steady market expansion in the years ahead.

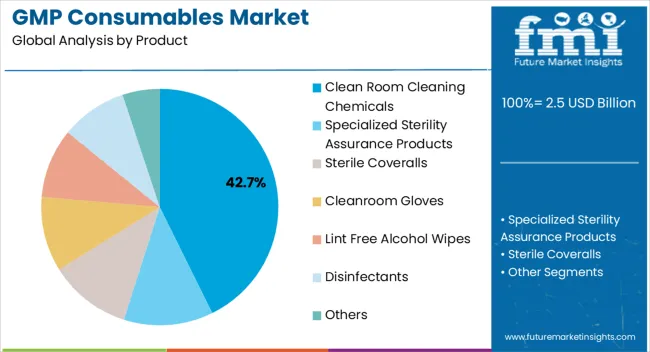

The clean room cleaning chemicals segment is projected to account for 42.70% of total revenue by 2025 within the product category, positioning it as the leading segment. This dominance is attributed to the increasing importance of contamination prevention and stringent sterility standards across pharmaceutical and biopharmaceutical production sites.

Cleaning chemicals specifically formulated for clean room applications have gained traction due to their ability to maintain validated hygiene protocols and compliance with regulatory audits. Consistent product innovation in disinfectants and sterilants that are compatible with sensitive biologics production has further reinforced adoption.

As production volumes and quality assurance requirements intensify, reliance on effective clean room cleaning chemicals has strengthened their role as the foremost product segment.

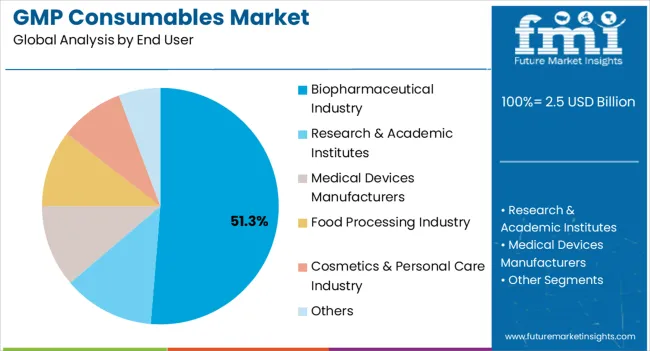

The biopharmaceutical industry segment is expected to represent 51.30% of total market revenue by 2025, making it the dominant end user. This growth is being driven by the expanding pipeline of biologics, biosimilars, and personalized therapies that require highly controlled GMP environments.

Large scale investments in biomanufacturing facilities and increasing regulatory oversight have compelled biopharmaceutical companies to prioritize high quality consumables. Additionally, the sector’s reliance on contamination free production for sensitive cell and protein based therapies has elevated the adoption of validated cleaning and monitoring solutions.

With global expansion of biologics capacity and rising therapeutic complexity, the biopharmaceutical industry continues to lead demand for GMP consumables, underpinning its dominant position in the end user segment.

From 2020 to 2025, the global GMP consumables experienced a CAGR of 5.9%, reaching a market size of USD 2.5 billion in 2025.

From 2020 to 2025, the global GMP consumables industry has been driven by various factors, including the expansion of the pharmaceutical and biotechnology industries, increasing regulatory requirements, advancements in manufacturing technologies, and the growing emphasis on quality and safety. While specific historical growth rates can vary over time and across regions, the overall trend has been positive.

The industry's focus on quality and safety has led to increased investments in GMP consumables that help maintain clean and controlled manufacturing environments. The use of specialized gloves, wipes, and disinfectants designed for GMP applications has become essential to meet the strict hygiene and contamination control requirements.

Future Forecast for GMP Consumables Industry:

Looking ahead, the global GMP consumables industry is expected to rise at a CAGR of 6.5% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 4.5 Billion by 2035.

The GMP consumables industry is expected to continue its growth trajectory from 2025 to 2035, driven by increasingly incorporating sustainable practices into their operations to reduce waste, conserve energy, and minimize the environmental impact of their products. This trend creates opportunities for the development of eco-friendly GMP consumables made from biodegradable materials and utilizing energy-efficient manufacturing processes.

| Country | The United States |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 4.5 billion |

| CAGR % 2025 to End of Forecast (2035) | 5.6% |

The GMP consumables industry in the United States is expected to reach a market size of USD 4.5 billion by 2035, expanding at a CAGR of 5.6%. The United States has strict regulatory standards set by regulatory bodies such as the Food and Drug Administration (FDA) to ensure the safety, efficacy, and quality of pharmaceutical products.

Compliance with these regulations requires the use of GMP-compliant consumables to maintain clean and controlled manufacturing environments. The adherence to these standards drives the demand for GMP consumables in the country.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 217.9 million |

| CAGR % 2025 to End of Forecast (2035) | 5.0% |

The GMP consumables industry in the United Kingdom is expected to reach a market size of USD 217.9 million, expanding at a CAGR of 5.0% during the forecast period. The United Kingdom has a strong pharmaceutical and biotechnology sector, with a significant presence of research institutions, pharmaceutical companies, and contract manufacturing organizations.

The continuous growth and investments in these industries drive the demand for GMP consumables, including gloves, wipes, disinfectants, and cleanroom apparel.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 241.7 million |

| CAGR % 2025 to End of Forecast (2035) | 7.2% |

The GMP consumables industry in China is anticipated to reach a market size of USD 241.7 million, moving at a CAGR of 7.2% during the forecast period. The Chinese government has implemented policies to promote the development of the pharmaceutical industry and improve healthcare infrastructure.

Initiatives such as the Healthy China 2035 plan and the Made in China 2025 strategy aim to enhance domestic pharmaceutical manufacturing capabilities and ensure product quality and safety. These policies create a conducive environment for the growth of the GMP consumables market.

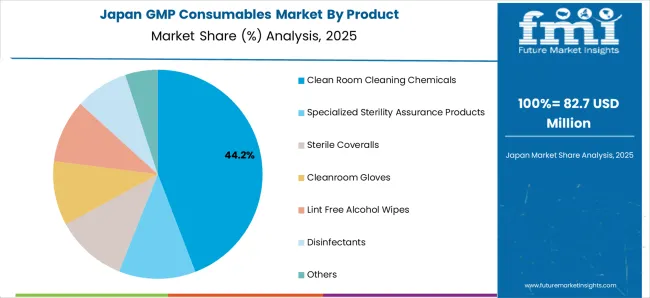

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 180.4 million |

| CAGR % 2025 to End of Forecast (2035) | 6.3% |

The GMP consumables industry in Japan is estimated to reach a market size of USD 180.4 million by 2035, thriving at a CAGR of 6.3%. Japan has a well-established and thriving pharmaceutical industry. The country is known for its advanced research and development capabilities, innovative drug discovery, and a strong focus on healthcare. The growth of the pharmaceutical industry in Japan drives the demand for GMP consumables.

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 55.9 million |

| CAGR % 2025 to End of Forecast (2035) | 8.1% |

The GMP consumables industry in South Korea is expected to reach a market size of USD 55.9 million, expanding at a CAGR of 8.1% during the forecast period. South Korea is known for its technological advancements and automation in various industries, including pharmaceutical manufacturing. The adoption of advanced manufacturing technologies, robotics, and digitalization in GMP processes improves efficiency, precision, and product quality. The integration of these technologies requires the use of specialized GMP consumables, driving market growth.

Cleanroom cleaning chemicals is expected to dominate the GMP consumables industry with a CAGR of 6.1% from 2025 to 2035. This segment captures a significant market share in 2025 due to its comphrehensive cleaning chemical & cleaning action.

Clean room cleaning chemicals are specifically formulated to meet the stringent cleanliness and disinfection requirements of controlled environments, such as clean rooms. They are designed to remove contaminants, including particles, microorganisms, and residues, from surfaces and equipment within the clean room. These chemicals help ensure compliance with GMP regulations and maintain the integrity of the manufacturing process and the quality of the final product.

Biopharmaceutical industry is expected to dominate the GMP consumables industry with a CAGR of 6.5% from 2025 to 2035. GMP guidelines are crucial in the biopharmaceutical industry to ensure the consistent production of safe, pure, and effective biopharmaceutical products.

GMP encompasses a set of quality standards and regulatory requirements that govern various aspects of manufacturing, including facility design, equipment, processes, personnel, and consumables. Compliance with GMP regulations is essential to meet regulatory approval, maintain product quality, and protect patient safety.

The GMP consumables is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must develop effective cleaning techniques.

Key Strategies Used by the Participants

Product Development

Companies invest heavily in research and development to deliver novel products that improve efficiency, dependability, and cost-effectiveness. Product innovation allows businesses to differentiate themselves from their competition while also catering to the changing demands of their cleanrooms.

Strategic Alliances & Collaborations

Key industry leaders frequently develop strategic partnerships and collaborations with other companies in order to harness their strengths and increase their market reach. Companies might also gain access to new technology and markets through such agreements.

Expansion into Emerging Markets

The GMP Consumables is expanding rapidly in emerging regions such as China and India. Key firms are enhancing their distribution networks and developing local manufacturing facilities to increase their presence in these areas.

Acquisitions and mergers

Mergers and acquisitions are frequently used by key players in the GMP consumables business to consolidate their market position, extend their product range, and gain access to new markets.

Key Developments in the GMP Consumables:

The global GMP consumables market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the GMP consumables market is projected to reach USD 4.5 billion by 2035.

The GMP consumables market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in GMP consumables market are clean room cleaning chemicals, specialized sterility assurance products, sterile coveralls, cleanroom gloves, lint free alcohol wipes, disinfectants and others.

In terms of end user, biopharmaceutical industry segment to command 51.3% share in the GMP consumables market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GMP Cleaning Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

GMP Cleaner Market Trends - Growth, Demand and Forecast 2025 to 2035

GMP Testing Services Market

Dental Consumables Market Insights by Product, End-Users, and Region through 2035

Welding Consumables Market Growth - Trends & Forecast 2025 to 2035

Brazing Consumables Market

Hospital Consumables Market Analysis - Growth, Demand & Forecast 2025 to 2035

Orthopedic Consumables Market Trends – Industry Growth & Forecast 2024 to 2034

Mass Finishing Consumables Market Size and Share Forecast Outlook 2025 to 2035

Lawn and Garden Consumables Market Size and Share Forecast Outlook 2025 to 2035

Mining Explosives Consumables Market Growth – Trends & Forecast 2025 to 2035

Demand for Welding Consumables in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Welding Consumables in USA Size and Share Forecast Outlook 2025 to 2035

Retail Printers and Consumables Market Growth - Trends & Forecast 2025 to 2035

Barcode Printers & Consumables Market Growth - Trends & Forecast 2025 to 2035

Welding Equipment And Consumables Market Size and Share Forecast Outlook 2025 to 2035

Histology and Cytology Consumables Market Size and Share Forecast Outlook 2025 to 2035

Chromatography Accessories & Consumables Market Growth – Trends & Forecast 2025 to 2035

Two-Wheeler Aftermarket Components & Consumables Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA