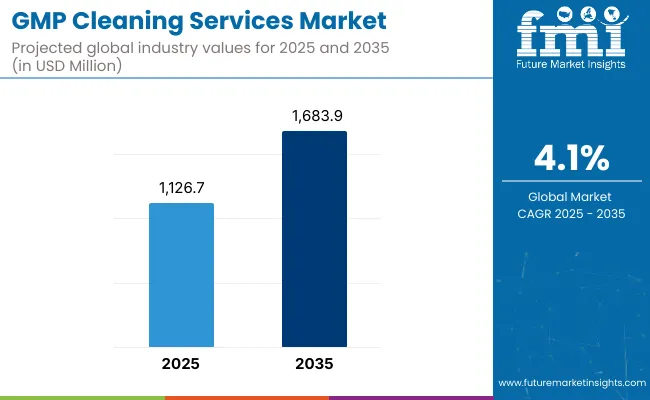

The GMP cleaning services market is expected to record a valuation of USD 1,126.7 million in 2025 and USD 1,683.9 million in 2035, with reflecting a growth of USD 557.2 million across the ten-year span. The overall expansion represents a CAGR of 4.1%.

| Metric | Value |

|---|---|

| GMP Cleaning Services Market in (2025E) | USD 1,126.7 million |

| GMP Cleaning Services Market in (2035F) | USD 1,683.9 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

During the first five-year period from 2025 to 2030, the global GMP cleaning services market is projected to grow from USD 1,126.7 million to USD 1,377.4 million, adding USD 250.7 million in incremental revenue. This growth is primarily driven by pharmaceutical and biopharmaceutical manufacturers upgrading cleaning protocols in response to stricter FDA and EMA inspections. Onsite services remain dominant during this period with a 51.5% share, due to their alignment with GMP-compliant batch manufacturing, real-time validation needs, and risk-based cleaning strategies. Companies like Pfizer and Amgen continue to internalize cleaning of high-grade cleanrooms and aseptic fill lines due to contamination risk. However, a gradual shift toward contractual cleaning partnerships is observed in CDMOs and mid-sized biotech players, who prioritize scalability and cost control through third-party service providers.

From 2030 to 2035, the market is projected to expand from USD 1,377.4 million to USD 1,683.9 million, contributing an additional USD 306.5 million in revenue at a CAGR of 3.4%. Growth during this phase is propelled by the adoption of automation-based cleaning solutions, especially CIP and SIP systems, across new bio manufacturing facilities. Companies like Fujifilm Diosynth, WuXi Biologics, and Samsung Biologics are scaling large-scale biologics manufacturing sites where SIP integration becomes central to batch integrity and continuous production. Despite the rising adoption of managed services and remote GMP cleaning partnerships, Onsite services are projected to hold a ~45.6% market share by 2035, retaining dominance due to continued preference in high-risk sterile injectable plants and cell therapy units where in-house oversight is non-negotiable. The shift, however, marks growing maturity in hybrid cleaning models across CDMO infrastructure.

The GMP cleaning services market experienced steady expansion between 2020 and 2024, growing from USD 950.2 million to USD 1,095.2 million, driven by the rising regulatory stringency on cleaning validation and the expansion of GMP-compliant biologics facilities. The CAGR stood at 2.8%, higher than the upcoming decade due to the post-COVID spike in demand for cleanroom cleaning across vaccine and monoclonal antibody manufacturing plants.

During this phase, the Top manufacturers ABM, The Budd Group, Servicon collectively held ~25-26% of the global market. Their edge came from validated biocidal portfolios, global service coverage, and integration into CDMO cleaning protocols. Ultrasonic cleaning witnessed minimal traction during this time, holding around 6.6% share, due to limited compatibility with large-scale stainless-steel process equipment and closed-loop systems.

The GMP cleaning services market is growing due to a confluence of compliance-driven demand, biologics manufacturing scale-up, and CDMO outsourcing trends. Regulatory bodies such as the FDA, EMA, and PMDA have significantly tightened inspection norms around cleaning validation and aseptic contamination control, particularly after the surge in warning letters post-2020. This has compelled pharma and biotech manufacturers to invest in validated, traceable, and auditable cleaning workflows.

Apart from it the rapid expansion of biologics and cell/gene therapy facilities including high-throughput cleanroom zones, isolators, and modular aseptic suites has made manual cleaning operationally infeasible, accelerating adoption of CIP/SIP systems and contract cleaning services. Furthermore, CDMOs like Catalent, Samsung Biologics, and Lonza are outsourcing non-core services like general GMP cleaning to optimize batch lead times. The shift from product-based cleaning supplies to service-based delivery models, especially through multi-year managed service contracts, is creating a sticky, recurring revenue base amplifying market growth.

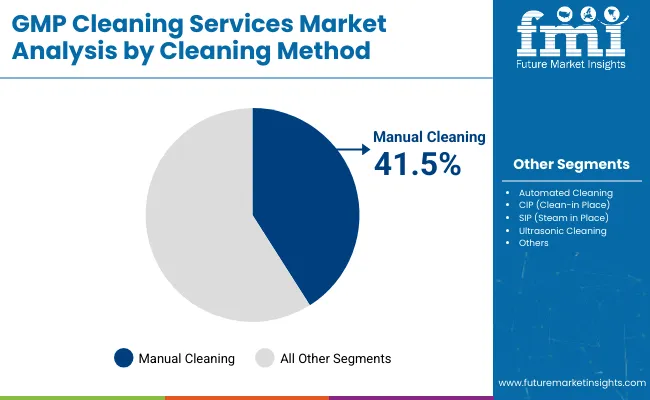

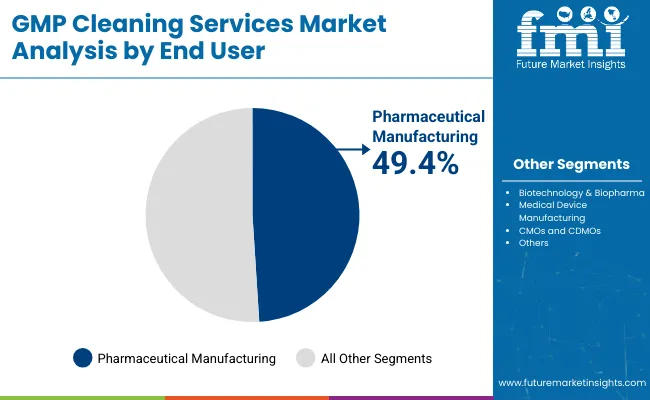

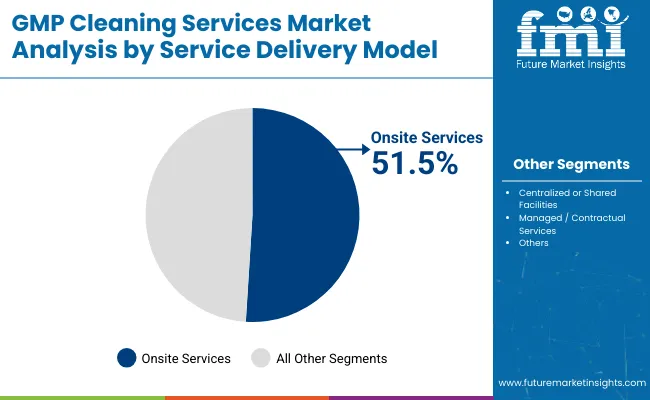

Based on cleaning method the market is segmented into manual cleaning, automated cleaning, CIP (Clean-in‑Place), SIP (Steam‑in‑Place) and ultrasonic cleaning. Based on industry the market is segmented into pharmaceutical manufacturing, biotechnology & biopharma, medical device manufacturing, CMOs and CDMOs. Based on service deliver model the market is segregated into onsite services, centralized or shared facilities and managed / contractual services. Based on the region the market is segmented into North America, Latin America, East Asia, South Asia & Pacific, Western Europe and Middle East & Africa.

| By Cleaning Method | Market Value Share, 2025 |

|---|---|

| Manual Cleaning | 41.5% |

| Automated Cleaning | 18.5% |

| CIP (Clean-in Place) | 21.8% |

| SIP (Steam in Place) | 11.5% |

| Ultrasonic Cleaning | 6.6% |

In 2025, Manual Cleaning holds the largest market share at 41.5%, retaining dominance despite growing industry interest in automated and CIP/SIP systems. This segment’s leadership is attributed to the widespread presence of legacy pharmaceutical manufacturing facilities, especially in developing markets and older sites in Europe and North America, where retrofitting automated systems is cost-prohibitive. Additionally, manual cleaning offers greater flexibility for complex or irregular equipment geometries that cannot be easily integrated into CIP systems.

The practice remains entrenched in oral solid dosage plants, compounding areas, and non-aseptic zones, where human-led visual inspection and cleaning remain viable and auditable. While automation is gaining traction in biologics, the manual approach persists due to its lower capital intensity, ease of validation, and the availability of GMP-trained cleaning personnel under SOP-driven frameworks.

| By End User | Market Value Share, 2025 |

|---|---|

| Pharmaceutical Manufacturing | 49.4% |

| Biotechnology & Biopharma | 26.5% |

| Medical Device Manufacturing | 16.1% |

| CMOs and CDMOs | 7.9% |

In 2025, Pharmaceutical Manufacturing accounts for the largest share at 49.4% of the sterile cleaning services market, making it the leading demand center. This dominance is rooted in the sheer volume of batch-based production across oral solids, injectables, and sterile APIs, all of which require validated cleaning between product changeovers. Regulatory agencies like the FDA and EMA have intensified scrutiny on cleaning validation failures in pharma plants, leading to heightened investment in SOP-driven, auditable cleaning protocols.

Additionally, many large-scale facilities still rely on manual and semi-automated systems, creating sustained demand for on-site, labor-intensive cleaning services. Major players like Pfizer, Novartis, and Sun Pharma continue to operate large, multi-product facilities globally, necessitating frequent cleaning to prevent cross-contamination. The expansion of generic production hubs in India and Southeast Asia further reinforces this segment’s leadership.

| By Service Delivery Model | Market Value Share, 2025 |

|---|---|

| Onsite Services | 51.5% |

| Centralized or Shared Facilities | 14.5% |

| Managed / Contractual Services | 33.9% |

In 2025, Onsite Services command the highest share at 51.5%, making them the preferred service delivery model across pharmaceutical and biologics manufacturing facilities. This dominance is driven by the need for immediate, traceable, and compliant cleaning interventions within GMP-regulated environments. Onsite cleaning enables real-time documentation, deviation tracking, and QA oversight, which are critical in sterile injectable and vaccine production.

Companies like AstraZeneca, Merck, and Lonza maintain dedicated in-house cleaning teams or contract specialists embedded on-site to support their 24/7 manufacturing operations. Onsite models also allow for rapid turnaround between batches and integration with digital cleaning logs, essential for passing FDA and EMA audits. As aseptic processing lines become increasingly sensitive to microbial contamination, manufacturers prioritize on-premise control over shared or offsite alternatives. While managed services are growing, onsite services remain indispensable for high-risk production zones.

Growth is restrained by infrastructure lock-in and the high cost of retrofitting legacy systems for automated cleaning or transitioning to outsourced models, which also require SOP realignment and revalidation. A key trend is the adoption of hybrid cleaning models in CDMO campuses, combining in-house teams for critical zones with outsourced providers for routine tasks, enabling flexibility and cost efficiency.

Stringent GMP Enforcement and Audit Activity

The surge in FDA 483 observations and EMA warning letters related to inadequate cleaning validation has become a major growth catalyst. Between 2020 to 2024, over 30% of sterile drug manufacturing violations cited deficiencies in cleaning protocols. This has compelled pharma and biologics firms to strengthen documentation, adopt validated cleaning agents, and engage professional service providers. Regulatory pressure is especially high for injectables, biosimilars, and high-potency APIs, where cross-contamination can impact patient safety.

As companies face increasing pressure to meet these standards, the need for specialized GMP cleaning services that adhere to detailed protocols has risen, ensuring compliance with hygiene, sterilization, and contamination control requirements.

Infrastructure Lock-In and High Capital Cost

The shift to automated CIP/SIP systems or outsourced cleaning models is slowed by infrastructure lock-in. Many manufacturers-particularly in emerging markets-operate legacy equipment that is not CIP-compatible, making retrofits expensive. Additionally, cleaning service outsourcing involves retraining, SOP alignment, and regulatory revalidation, further deterring transition.

Hybrid Cleaning Models in CDMO Campuses

A notable trend in the GMP cleaning services market is the adoption of hybrid cleaning models in Contract Development and Manufacturing Organizations (CDMOs) and multi-tenant biomanufacturing facilities. In these settings, operators maintain in-house cleaning teams for critical aseptic zones that require strict control over contamination. For routine GMP cleaning tasks, however, they increasingly outsource these services to specialized providers under long-term service level agreements (SLAs). This hybrid approach allows companies to enhance operational agility, reduce overhead costs, and scale cleaning services in line with fluctuating production demands, all while ensuring compliance with stringent GMP standards and improving efficiency.

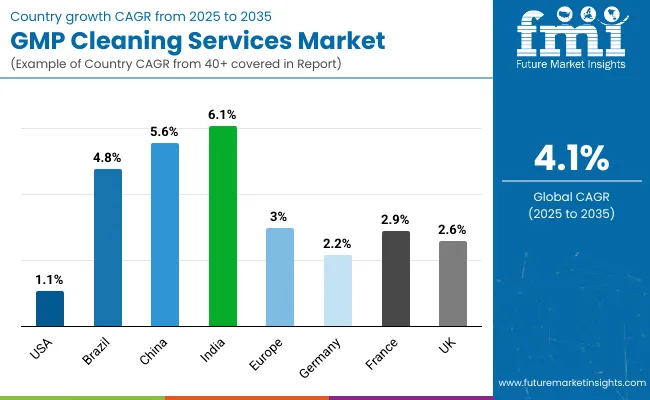

| Country | CAGR (%) |

|---|---|

| USA | 1.1% |

| Brazil | 4.8% |

| China | 5.6% |

| India | 6.1% |

| Europe | 3.0% |

| Germany | 2.2% |

| France | 2.9% |

| UK | 2.6% |

Asia Pacific is emerging as the fastest-growing region in the sterile cleaning services market, projected to expand at a CAGR of 5.8%. Within the region, India (CAGR: 6.1%) and China (CAGR: 5.6%) are the two standout performers. India’s growth is driven by its expanding generic pharmaceutical manufacturing base, with over 3,000 WHO-GMP-certified facilities requiring compliance-grade cleaning services. The rise of domestic CDMOs and exports to regulated markets also mandates higher cleaning validation standards. China’s growth stems from the government-backed scale-up of biologics and vaccine manufacturing under initiatives like “Healthy China 2030.” Companies like WuXi Biologics and BeiGene are commissioning new GMP cleanroom facilities, creating demand for SIP/CIP-based cleaning systems and hybrid cleaning models.

Europe is showing stable growth over the forecast period, led by Germany (2.2%), France (2.9%), and the UK (2.6%). These countries have strict GMP enforcement via EMA and national health authorities, driving consistent investment in cleaning protocols and audit-readiness. Germany leads in biotech innovation, while France and the UK house numerous multi-product pharma facilities, necessitating high-frequency validated cleaning cycles.

North America, led by the USA, continues to hold the largest market share, with the USA projected to grow at a CAGR of 1.1% through 2030. Growth is driven by stringent FDA oversight, adoption of digital cleaning validation systems, and expansion in high-potency sterile manufacturing. Major players like Pfizer, Catalent, and Thermo Fisher are investing in both in-house and outsourced cleaning strategies to support biologics and mRNA facilities, reinforcing demand.

| Year | USA GMP Cleaning Services Market (USD Million) |

|---|---|

| 2025 | 1126.7 |

| 2026 | 1171.3 |

| 2027 | 1218.1 |

| 2028 | 1267.5 |

| 2029 | 1319.2 |

| 2030 | 1373.3 |

| 2031 | 1429.4 |

| 2032 | 1488.5 |

| 2033 | 1550.8 |

| 2034 | 1616.1 |

| 2035 | 1683.8 |

The United States industry is projected to grow at a CAGR of 1.1% between 2025 and 2035, reaching a mature plateau compared to emerging markets. The modest growth reflects the USA market’s already high baseline adoption of validated GMP cleaning protocols and digitalized SOPs. Most large-scale manufacturer ssuch as Pfizer, Bristol Myers Squibb, and Eli Lilly already operate with embedded in-house cleaning teams, validated CIP/SIP systems, and digitized documentation platforms compliant with 21 CFR Part 11.

However, sustained sales are expected due to the expansion of cell and gene therapy facilities, contract manufacturing of sterile injectables, and the need to retrofit aging facilities with validated cleaning solutions. In fact, recent FDA Form 483 findings (2022 to 2024) show cleaning validation gaps in mid-sized injectable drug makers, prompting renewed spending on documentation-compliant sterile cleaning SOPs.

The GMP cleaning services market in the United Kingdom is expected to grow at a CAGR of 2.6% between 2025 and 2035, supported by the restructuring of local manufacturing operations, expansion in biopharmaceuticals, and post-Brexit regulatory alignment efforts. While the UK represents a mature pharmaceutical market, the adoption of outsourced and hybrid cleaning models is increasing, particularly among mid-sized manufacturers and advanced therapy companies (ATMP developers).

The Medicines and Healthcare Products Regulatory Agency (MHRA) has increased audits of cleaning validation documentation, especially for facilities manufacturing sterile injectable products and novel biologics. Moreover, several NHS-linked hospital compounding units and clinical trial supply centers have adopted third-party GMP cleaning providers to reduce cross-contamination risks and maintain compliance with MHRA and EU GMP Annex 1 updates. The UK’s biocluster activity, especially around Cambridge, Steven age, and Oxford, is further boosting demand for facility-specific cleaning SOPs.

India's market for GMP cleaning services is projected to grow at a CAGR of 6.1% from 2025 to 2035, making it the fastest-growing national market globally. This accelerated growth is fueled by India's rise as the largest global supplier of generic drugs, with over 3,000 WHO-GMP-certified manufacturing facilities and more than 1,400 US FDA-approved plants. These facilities are under intensified scrutiny from USA, European, and WHO regulators, which is creating strong demand for validated, audit-ready cleaning processes.

Furthermore, with increased investments in injectables, sterile APIs, and biologics, companies like Biocon Biologics, Sun Pharma, and Cipla are expanding their aseptic fill-finish and biologics plants-demanding sterile cleaning SOPs that meet international compliance. Domestic CDMOs such as Syngene and Gland Pharma are also driving service adoption by outsourcing cleaning of low-risk areas while retaining internal QA oversight for critical equipment and zones.

China’s GMP cleaning services market is projected to grow at a CAGR of 5.6% between 2025 and 2035, fueled by the rapid expansion of domestic biologics manufacturing, rising compliance with international GMP standards, and aggressive government investment in vaccine and API capacity. The country’s pharmaceutical industry is undergoing a transition from volume-based production to quality-focused exports, especially to Europe and the USA, pushing manufacturers to adopt audit-ready cleaning protocols and third-party service partnerships.

The National Medical Products Administration (NMPA) has aligned China’s GMP regulations more closely with EU and WHO standards, making validated cleaning processes mandatory for sterile production facilities. Local giants like WuXi Biologics, BeiGene, and Fosun Pharma are building multi-product sites where hybrid and outsourced cleaning models are gaining traction. Moreover, with government-driven consolidation in the generics industry, mid-tier manufacturers are upgrading infrastructure and outsourcing cleaning functions to meet regulatory expectations without internal overhead.

Germany’s GMP cleaning services market is projected to grow at a CAGR of 2.2% from 2025 to 2035, driven by sustained investments in biopharmaceutical innovation, compliance with EU Annex 1, and the aging of manufacturing infrastructure in legacy sites across Bavaria, Baden-Württemberg, and North Rhine-Westphalia. Despite its status as a mature market, Germany is witnessing a gradual transition from fully in-house cleaning toward hybrid models that integrate external service providers for non-aseptic zones.

The German pharmaceutical ecosystem hosts high-value biologics manufacturing and sterile injectable production, including operations from Boehringer Ingelheim, Bayer, Merck KGaA, and BioNTech. These firms operate under strict EMA oversight, where traceable, validated, and risk-based cleaning protocols are non-negotiable. Additionally, the industry’s push toward automation and digital validation under EU GMP Annex 11 is creating demand for cleaning partners capable of integrating cleaning logs with MES and eQMS platforms.

| Europe Countries Share | 2025 % Share |

|---|---|

| Germany | 21.7% |

| UK | 17.2% |

| France | 14.1% |

| Italy | 11.7% |

| Spain | 8.5% |

| BENELUX | 9.1% |

| Nordic Countries | 7.1% |

| Rest of Western Europe | 10.6% |

| Europe Countries Share | 2035 % Share |

|---|---|

| Germany | 21.3% |

| UK | 16.9% |

| France | 13.8% |

| Italy | 11.5% |

| Spain | 8.4% |

| BENELUX | 8.9% |

| Nordic Countries | 7.0% |

| Rest of Western Europe | 12.3% |

| Cleaning Method | 2025 Share (%) |

|---|---|

| Japan Manual Cleaning | 41.9% |

| Japan Automated Cleaning | 18.7% |

| Japan CIP (Clean-in Place) | 22.1% |

| Japan SIP (Steam in Place) | 11.6% |

| Japan Ultrasonic Cleaning | 5.7% |

Japan’s GMP cleaning services market is characterized by steady institutional demand, driven by the country’s focus on quality assurance, regulatory discipline, and aging facility infrastructure. The market is dominated by Manual Cleaning, which accounts for the largest share within cleaning methods, due to Japan’s long-standing reliance on skilled QA-validated in-house teams and a cultural emphasis on meticulous, human-led processes. Although automation adoption is rising, most sterile injectable and biologic facilities still use manual or semi-automated protocols validated under PMDA guidelines.

Japan’s pharmaceutical industry consists of both domestic giants (e.g., Takeda, Daiichi Sankyo) and hospital-linked compounding units, all of which maintain rigorous batch-level cleaning validation. The market’s moderate CAGR (~2.5%) is supported by high regulatory compliance costs, extended facility life cycles, and limited outsourcing.

| End User | 2025 Share (%) |

|---|---|

| Pharmaceutical Manufacturing | 47.4% |

| Biotechnology & Biopharma | 25.5% |

| Medical Device Manufacturing | 14.1% |

| CMOs and CDMOs | 12.9% |

South Korea’s GMP cleaning services market is experiencing robust growth, fueled by the expansion of biopharmaceutical manufacturing and aggressive investment in cell and gene therapy infrastructure. The Biotechnology & Biopharma segment leads in market share, driven by major players like Samsung Biologics, Celltrion, and SK Bioscience, which are operating large-scale biologics and vaccine facilities requiring high-frequency cleaning in aseptic environments. These facilities often involve multi-product, high-throughput operations, where validated cleaning is critical for avoiding cross-contamination and maintaining international GMP compliance.

The Korean MFDS and international partners (e.g., WHO PQ and EMA) have heightened compliance expectations, pushing biopharma manufacturers to adopt hybrid cleaning models involving in-house QA teams and third-party service providers. The market is forecasted to grow steadily at a CAGR of ~4.2% through 2035.

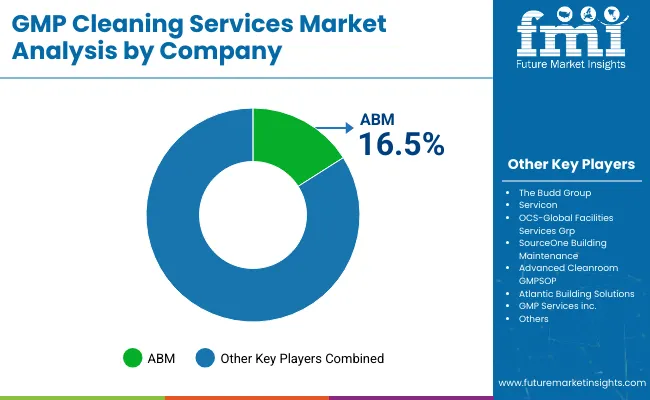

| Key Players | Global Value Share (%) 2025 |

|---|---|

| ABM | 16.5% |

| Other Players | 83.5% |

The GMP cleaning services market is moderately fragmented, with ABM positioned as the top player due to its nationwide reach, regulated facility expertise, and integration with digital facility management platforms. ABM’s strategic focus includes bundled GMP environmental services, investment in electrostatic disinfection systems, and leveraging AI-driven building data to optimize cleaning efficiency-particularly in biopharma and life sciences campuses.

Emerging and mid-sized players like The Budd Group, Servicon, and OCS Global focus on sector specialization, offering tailored SOPs for FDA-regulated manufacturing, validated cleanrooms, and USP compliant environments. Advanced Cleanroom and GMP Services Inc. have gained traction by offering cGMP-trained personnel, residue monitoring systems, and hybrid cleaning partnerships with CDMOs.

GMPSOP differentiates itself via GMP compliance consulting bundled with cleaning protocols, while Pro-Pack Materials and Allied Cleanrooms focus on cleanroom construction and end-to-end cleaning integration, including materials compatibility.

The market is seeing a shift toward digital validation, audit traceability, and multi-year SLAs, as large-scale bio manufacturing becomes the dominant client base.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1,683.9 million |

| Cleaning Method | Manual Cleaning, Automated Cleaning, CIP (Clean-in ‑ Place), SIP (Steam ‑ in ‑ Place) and Ultrasonic Cleaning |

| Industry | Pharmaceutical Manufacturing, Biotechnology & Biopharma, Medical Device Manufacturing and CMOs and CDMOs |

| End User | Onsite Services, Centralized or Shared Facilities and Managed / Contractual Services |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | ABM, The Budd Group, Servicon, OCS-Global Facilities Services Grp, SourceOne Building Maintenance, Advanced Cleanroom GMPSOP, Atlantic Building Solutions, GMP Services inc., Diversified Maintenance, Pro-Pack Materials pte ltd, Cleanroom Facility Services and Allied Cleanrooms |

| Additional Attributes | Dollar sales By End User verticals and global regions show pharmaceutical manufacturing leading total sales, with Asia Pacific and North America accounting for the largest revenue contributions through 2030. The adoption trends of hybrid GMP cleaning models, combining in-house QA teams for aseptic zones with outsourced services for general cleanroom environments, are accelerating in bio manufacturing campuses an d multi-tenant CDMO facilities. |

The global GMP cleaning services market is estimated to be valued at USD 1,126.7 million in 2025.

The market size for the GMP cleaning services market is projected to reach approximately USD 1,683.9 million by 2035.

The GMP cleaning services market is expected to grow at a CAGR of 4.1% between 2025 and 2035.

The cleaning methods in the GMP cleaning services market include Manual Cleaning, Automated Cleaning, CIP (Clean-in‑Place), SIP (Steam‑in‑Place) and Ultrasonic Cleaning.

In terms of service delivery model, the onsite services segment is projected to command the highest share at 51.5% in the GMP cleaning services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GMP Consumables Market Size and Share Forecast Outlook 2025 to 2035

GMP Cleaner Market Trends - Growth, Demand and Forecast 2025 to 2035

GMP Testing Services Market

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Cleaning In Place Market Growth - Trends & Forecast 2025 to 2035

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Wet Cleaning Ozone Water System Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Dry-Cleaning and Laundry Services Market Growth, Trends and Forecast from 2025 to 2035

Self-Cleaning Bottle Market Analysis - Trends, Growth & Forecast 2025 to 2035

Hand Cleaning Accessories Market

Sewer Cleaning Hose Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaning and Mopping Machine Market Size and Share Forecast Outlook 2025 to 2035

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wafer Cleaning Equipment Market Growth - Trends & Forecast 2025 to 2035

Drain Cleaning Equipment Market Growth - Trends & Forecast 2025 to 2035

Medical Cleaning Devices Market Overview - Trends & Forecast 2025 to 2035

Thermal Cleaning System Market Growth - Trends & Forecast 2025 to 2035

Document Cleaning Powder Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA