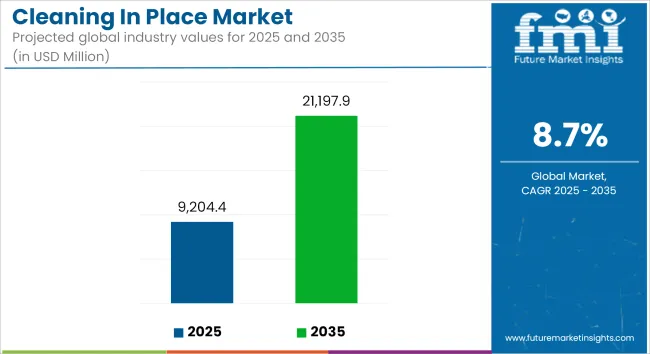

The global Cleaning In Place (CIP) market is expected to expand significantly, increasing from USD 9,204.4 million in 2025 to USD 21,197.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 8.7% over the forecast period. This robust growth trajectory is being shaped by the growing adoption of automated cleaning technologies in industries where hygiene, safety, and process integrity are paramount.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9,204.4 million |

| Industry Value (2035F) | USD 21,197.9 million |

| CAGR (2025 to 2035) | 8.7% |

CIP systems play a central role in industries such as food and beverage, pharmaceuticals, and personal care, where the need to ensure equipment cleanliness without dismantling operations is a regulatory and operational imperative. These systems provide a closed-loop cleaning process that minimizes manual intervention, enabling faster turnaround times and consistent sanitation outcomes. Key standards such as those set by the FDA, EU GMP, and 3-A SSI are reinforcing the deployment of CIP across manufacturing units globally.

Growth is being reinforced by increased investment in digital and intelligent CIP technologies. Smart CIP systems integrated with Internet of Things (IoT) sensors, cloud-based analytics, and artificial intelligence are offering real-time insights into cleaning performance. These systems are enabling operators to monitor parameters such as chemical concentration, temperature, flow rate, and cleaning cycle time-resulting in precise control and reduced variability.

In the food and dairy sectors, where allergen control and cross-contamination risks are high, the demand for CIP solutions that offer validated cleaning assurance and compliance with HACCP protocols is accelerating. Similarly, pharmaceutical facilities are expanding their use of automated CIP for bioreactors, vessels, and pipelines to ensure batch integrity and minimize downtime between production runs.

Operational cost-efficiency is also supporting the adoption of next-generation CIP systems. These platforms are designed to reduce water, energy, and detergent use through optimized cleaning cycles and feedback-based process control. As sustainability initiatives gain momentum across industrial value chains, CIP technologies that support chemical recovery and wastewater reduction are receiving greater attention.

Key players are responding by developing modular CIP skids, AI-based contamination prediction models, and plug-and-play systems tailored for small and mid-sized manufacturing plants. As industries continue to upgrade legacy equipment to meet modern production demands, the CIP market is expected to witness sustained investment and continuous product innovation. The emphasis on food safety, pharmaceutical hygiene, and clean manufacturing environments is expected to keep CIP solutions at the center of industrial process design.

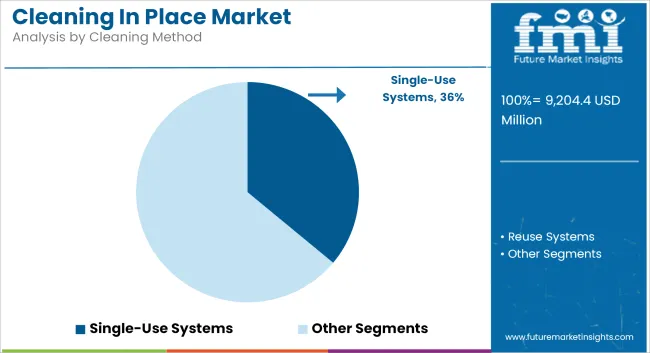

Reuse systems are projected to account for approximately 61% of the global Cleaning in Place market share in 2025 and are expected to grow at a CAGR of 8.6% through 2035. These systems recirculate cleaning solutions multiple times, significantly reducing water and chemical consumption per cycle.

They are widely adopted in continuous and batch manufacturing environments such as food processing, brewing, and biopharma facilities where sanitation cycles are frequent and critical. Technological advancements in flow monitoring, sensor-based validation, and CIP automation are enhancing process consistency and resource recovery. As sustainability and regulatory compliance become central to industrial operations, reuse systems are being favored for their operational efficiency and environmental benefits.

The food and beverage segment is estimated to hold approximately 38% of the global Cleaning in Place market share in 2025 and is projected to grow at a CAGR of 8.9% through 2035. CIP systems are essential for cleaning pipelines, tanks, and mixers in dairy, beverage, confectionery, and brewing facilities without dismantling equipment.

The industry's focus on allergen control, microbial safety, and cross-contamination prevention is accelerating the adoption of fully automated, validated CIP systems. Manufacturers are also integrating data analytics and real-time monitoring into CIP infrastructure to optimize cleaning cycles, improve traceability, and reduce downtime. As consumer demand for hygienic and certified food production intensifies, the food and beverage sector will remain the largest contributor to CIP system deployment.

High Initial Investment & Integration Complexity

One of the most prominent concerns in the market for Cleaning In Place (CIP) systems is the full automation CIP systems requiring significant outlay of capital. In contrast to manual cleaning processes, CIP solutions mandate individual components like piped networks, computerized control panels, metering of chemicals, temperature regulation systems, and automated contamination detection mechanisms.

These auxiliary elements are responsible for the increased upfront costs, which results in small and medium-sized enterprises (SMEs) facing affordability issues regarding full-fledged CIP adoption.

The financial aspect is apart from the technical side of the issue that is closely connected with retrofitting CIP systems into the proper production lines. Plenty of factories quite a lot-in the food & beverage, pharmaceutical, and dairy sectors-are still operating on older machines that were not meant to be usable with automated cleaning practices.

Inserting these machines to install CIP requires individualized designs, pipeline restructuring, upgraded programming’s, and a lot of time for personnel. The requisite downtime for installation and system tests to be carried out for the plant can also lead to minute corner-cuts on production which only strengthens the reasons for CIP adoption to be averse.

Water & Chemical Consumption Concerns

The CIP industry is operating under strict rules, especially in the areas of cleanliness, sterility, and contamination treatment where these are top priorities like pharmaceuticals, food & beverage processing, dairy, and biotechnology.

These regulatory firms are like FDA (Food and Drug Administration), WHO (World Health Organization), GMP (Good Manufacturing Practices), and HACCP (Hazard Analysis and Critical Control Points) which bind the above industries with strict requirements on cleaning verification, microbial safety, and chemical residue limits.

In adequacy to the sanitation strategies and abuse of hygiene protocols, the results can be turbulence breakage, lawsuit, the product recall, and long-term reputational damage. A good illustration of the dairy and beverage sector will be the wrong CIP operations that might result in the appearance of bacteria, yeast, and biofilm which will eventually affect the safety and duration of the product.

As it is in the case of the pharmaceutical sector where the inadequate validation of washing can be a risk factor for the quality of the medicine, the patient, and the lagging regulatory process.

Advancements in AI, IoT & Smart CIP Technologies

Artificial intelligence (AI), the Internet of Things (IoT), and machine learning are now retained in the CIP market archetype. Classical Cleaning in Place systems are time-based, usually predefined periodic cleaning, overuse resources, downtimes, and so on. Similarly, on the other hand, intelligent cleaning in place systems utilize real-time contamination sensors, logistics matrix from machine learning and online cloud monitoring to optimize cleaning cycles dynamically.

These systems augmented with AI, which have the capability to: Real-time analysis of contamination levels and consequently scale the cleaning challenge. On the basis of historical data, predict equipment fouling trends and refine chemical dosing. Facilitate cloud sourcing of diagnostics and also troubleshoot thus doing away with on-site inspections. Ensure re-validation and keep track by automating cleaning validation reports and digital records.

IoT-controlled CIP systems are also present, which enable plant managers to supervise washing operations from anywhere in the world guaranteeing that every step executed is as required by the industry. Companies that invest in self-learning CIP algorithms, obtain instant real-time data analytics, and drive the AI procedure for cleaning will stand to gain substantially.

Growth of the Food & Beverage and Pharmaceutical Sectors

Unprecedented growth is being witnessed globally in the food & beverage segment surging toward demand for ready-to-eat meals, packaged beverages, dairy products, and plant-based allocates that are more on-resources.

At the same time, the pharmaceutical field is also on the rise, with increasing healthcare needs, production of vaccines, and the advent of biologics. These two industries heavily lean on CIP systems to ensure sterility, regulatory compliance, and optimal production.

The dairy sector, which is more likely to be the target of cross-contamination, the manufacturers are investing to upgrade to cutting-edge CIP systems with real-time microbial detection and residue monitoring to assure longer product shelf life and spoiled prevention.

Likewise, the precision cleaning was very much needed in the case of the pharmaceutical industry where the cross-contamination of drug batches is the main issue and maintaining the FDA compliance is what they have to be mindful of.

With the government enforcing comprehensive regulations and consumer preference for premium, contamination-free, products the demand for Automated, AI, and IoT-driven CIP systems has seen a breakneck rise inviting profit-making prospects for CIP solution providers.

Sustainability-Driven Innovations & Eco-Friendly Cleaning Agents

The mission for eco-friendly cleaners is the driving factor behind the development of low-water, low-energy, and chemical-free CIP technologies. More enterprises are innovating with a shift to: Recovering mechanism-based Water-recycling CIP systems that are smart enough to overcome the water shortage through circular recovery of about 50% of water discharge.

The mission is alone while the other is substrate nitrogen that replaces the corrosive alkaline and acidic chemical. There are Dry CIP forms that use ozone, ultraviolet (UV) disinfection, or superheated steam instead of liquid-based cleaning solutions.

The first priority in promoting environmental protection has led to the launching of low-temperature CIP processes that put back energy savings alongside offering high sterilization effectiveness. The movement for eco-friendly manufacturing practices is amplified by government and industry regulators who are not only offering help in such endeavors but also economic boosts for such companies.

The CIP market in the United States is booming with the increasing trend of the usage of automated cleaning solutions in the food processing, pharmaceutical, and dairy industries. The strict regulatory landscape that is being enforced by the FDA and USDA concerning the issues of sanitation and hygiene is one of the factors that is pushing the demand for the CIP systems to the next level.

Manufacturers are making efforts to develop green environmental friendly and cost-effective CIP systems, while using real-time monitoring with the IoT-support for better operational efficiency. The rise in the importance of sustainability and the emphasis on the consumption of less water and fewer chemicals in industrial cleaning processes are the other aspects that PHP is working on.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.5% |

The UK CIP market has been steadily growing due to the increasing care for hygiene in food & beverage manufacturing, pharmaceuticals, and the brewing sector. The UK’s most strict sanitation and environmental regulations, which entail being compliant with the British Retail Consortium (BRC) and the Hazard Analysis and Critical Control Points (HACCP) guidelines, are the reasons for the market demand.

The move towards sustainability and the more efficient use of resources is substantiating the clientele's preference for the deployment of water-efficient and energy-saving approaches in CIP technologies. Furthermore, the rise in manufacturing facilities that utilize automation and the undertaking of smart factory initiatives is correlating positively with the integration of CIP systems through the use of advanced data analytics and remote monitoring features.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.6% |

The European Union CIP market is rising substantially due to the rigid food safety norms, higher automation, and investment in wash technologies that are environmentally friendly. There are many pharmaceutical and food processing companies in countries such as Germany, France, and Italy that are driving this market.

With the EU's commitment to environmental issues, many industries are adopting eco-friendly must CIP solutions that utilize less water and energy while adhering to strict hygiene standards. The increased use of advanced CIP systems in breweries, dairy processing, and biotech which is the biotechnology sector is another fact supporting the growth of the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.7% |

Japan’s CIP market is undergoing a consistent development that is owing to the technology advancements in the automation field, the strict hygiene regulations & the increased uptake of smart factory technologies in the food processing and pharmaceutical industries. The country focused on maintaining the high-quality manufacturing standards and environmental sustainability leads the way for the development of innovative CIP systems.

The growth of AI-powered cleaning technologies as well as IoT-enabled monitoring systems are the major forces behind the improvement of resources efficiency in CIP processes. On top of that, Japan’s development in biotechnology and precision medicine is the driving force behind the implementation of the ultra-modern CIP solutions in pharmaceutical manufacturing plants.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.4% |

The South Korea's CIP market is developing fast, which is because of the significant investments in the areas of food safety, pharmaceutical production, and semiconductors. The government's determined approach towards a smart manufacturing system and the long-term effects of high-efficiency industrial cleaning solutions are helping in widely adopting the CIP solutions in various economic sectors.

The cloud-connected CIP that provides monitoring and remote operation, is growing significantly in the South Korea's industries. Moreover, the improved hygiene standards in the production of dairy products and beverages have led to the acceleration of the application of automated CIP solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.8% |

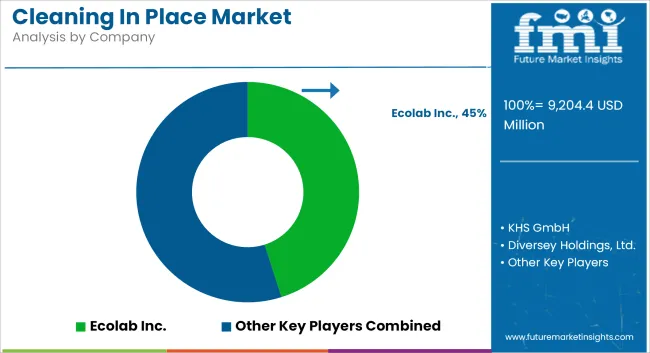

The CIP system market is growing more competitive as companies focus on flexible, cost-effective solutions for the food and beverage industry. Recent innovations, such as mobile and compact CIP systems, are designed to improve cleaning efficiency, reduce water and chemical usage, and ensure compliance with sanitation standards. Key players are offering scalable, automated solutions that cater to both large and small facilities, minimizing downtime and simplifying operations.

In terms of System Type, the industry is divided into Single-Use CIP Systems, Multi-Tank CIP Systems, Modular CIP Systems, Automated CIP Systems, and Recirculating CIP Systems.

In terms of Cleaning Method, the industry is divided into Single-Use Systems and Reuse Systems.

In terms of End-Use Industry, the industry is divided into Food & Beverage, Pharmaceuticals & Biotechnology, Cosmetics & Personal Care, Chemical & Petrochemical, Dairy & Dairy Alternatives, and Others (Textile, Agriculture, etc.).

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global cleaning in place (CIP) market is projected to reach USD 9,204.4 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.7% over the forecast period.

By 2035, the cleaning in place (CIP) market is expected to reach USD 21,197.9 million.

The automated CIP systems segment is expected to hold a significant share due to increasing demand for efficient, time-saving, and resource-optimized cleaning solutions across food & beverage and pharmaceutical industries.

Key players in the cleaning in place (CIP) market include GEA Group, Alfa Laval, Tetra Pak, KHS GmbH, SPX Flow, Sani-Matic Inc., Krones AG, Ecolab Inc., Diversey Inc., and Veolia Water Technologies.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Drain Cleaning Equipment Market Growth - Trends & Forecast 2025 to 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Joint Replacement Market Trends - Growth & Forecast 2025 to 2035

Instrument Cleaning Chemistries Market – Trends, Size & Growth 2025-2035

Industrial Cleaning Solvent Market Growth – Trends & Forecast 2024-2034

Interdental Cleaning Products Market Trends - Growth & Forecast 2025 to 2035

India Drain Cleaning Equipment Market Report – Demand, Innovations & Forecast 2025-2035

Wet Cleaning Ozone Water System Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

GMP Cleaning Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dry-Cleaning and Laundry Services Market Growth, Trends and Forecast from 2025 to 2035

China Drain Cleaning Equipment Market Analysis – Size, Trends & Innovations 2025-2035

Cured-in-Place Pipe (CIPP) Lining Services Market Size and Share Forecast Outlook 2025 to 2035

Self-Cleaning Bottle Market Analysis - Trends, Growth & Forecast 2025 to 2035

Hand Cleaning Accessories Market

Beer Line Cleaning Kit Market Trend Analysis Based on Product, End-User, Type, and Region 2025 to 2035

Sewer Cleaning Hose Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaning and Mopping Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA