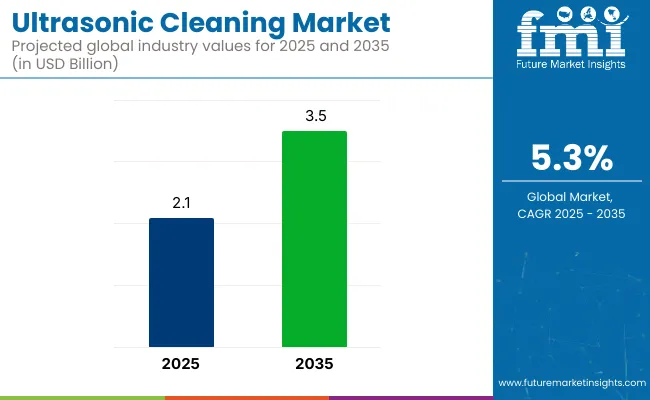

The global ultrasonic cleaning market is valued at USD 2.1 billion in 2025 and is expected to reach USD 3.5 billion by 2035, reflecting a CAGR of 5.3%. Growth is being driven by the rising need for precision cleaning in electronics, automotive, and medical device industries.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 2.1 billion |

| Projected Value (2035) | USD 3.5 billion |

| CAGR (2025 to 2035) | 5.3% |

Increasing regulatory standards related to contamination control and environmental safety are expected to enhance the adoption of ultrasonic cleaning solutions. Furthermore, advancements in programmable and AI-based ultrasonic systems are being leveraged to achieve uniform cleaning in semiconductors, aerospace components, and medical instruments.

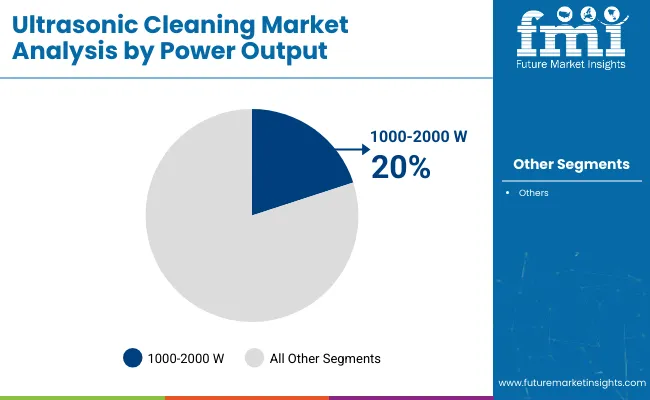

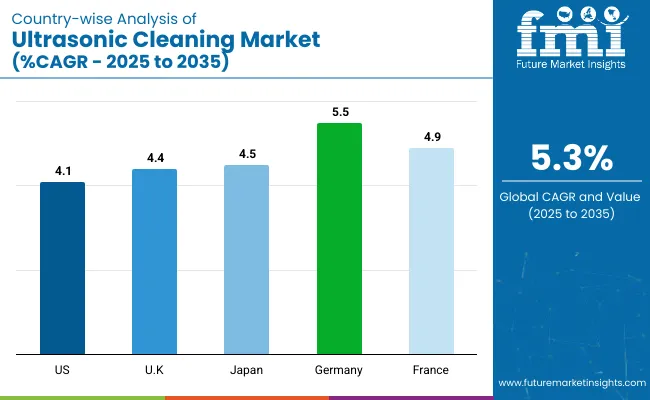

North America is expected to be the largest market, with the USA growing at a significant CAGR of 4.1%. Meanwhile, Europe is also witnessing rapid expansion, with Germany and France growing rapidly with CAGRs of 5.5% and 4.9% respectively. The 1000-2000 W power output segment accounts for 20% of the market share.

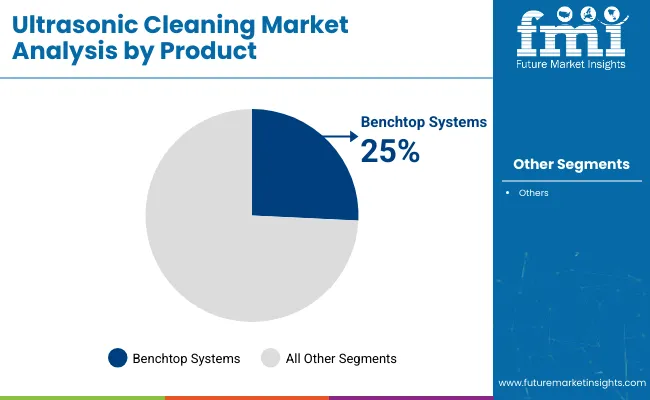

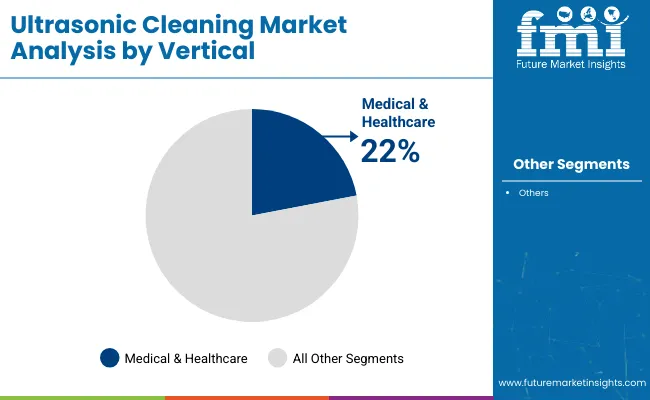

Meanwhile, by product, the benchtop ultrasonic cleaning systems hold the largest share of over 25%. Medical and healthcare verticals continue to lead the market with extensive adoption for surgical tool sterilization, with a prominent share of 22%.

Emerson Electric Co. is witnessing considerable profits driven by its automation-integrated ultrasonic systems portfolio, while smaller regional players in Asia-Pacific are facing challenges due to high capital investment requirements and fluctuating transducer material prices.

Germany and the UK are gaining success through strong sustainability policies promoting eco-friendly cleaning solvents. In contrast, Asia-Pacific countries, including India and China, are focusing on affordable high-volume production to overcome cost barriers. Government regulations such as the EU Green Cleaning Directive and EPA solvent disposal rules in the USA are reshaping the competitive landscape.

The market holds a notable share across its parent markets due to its precision and eco-friendly cleaning capabilities. Within the precision cleaning equipment market, it accounts for approximately 30-35%, given its dominance in delicate component cleaning. In the medical cleaning equipment market, its share is around 25%, driven by demand for sterile and residue-free instruments.

It captures 20-22% of the Electronics cleaning equipment market, especially for PCB and semiconductor cleaning. In the industrial cleaning equipment market, it contributes roughly 10-12%. Overall, ultrasonic cleaning is a critical segment where precision, speed, and non-abrasive methods are essential across industries.

The ultrasonic cleaning market has been segmented by product (benchtop, standalone, multistage-2, multistage-4), by power output (up to 250 W, 250-500 W, 500-1000 W, 1000-2000 W, 2000-5000 W, 5000-10000 W, more than 10000 W), by capacity (up to 5L, 10-50L, 50-100L, 100-150L, 150-200L, 200-250L, 250-300L, more than 300L), by vertical (medical & healthcare, automobile, aerospace, optics, metal & machinery, electrical & electronics, food & beverage, jewelry & gems, pharmaceuticals, others (including marine and textile cleaning)), and by region (North America, Latin America, Europe, Asia Pacific, MEA).

Benchtop ultrasonic cleaning systems are expected to maintain their leading position with a share of over 25% by 2035. This dominance is attributed to their compactness, cost-effectiveness, and high adaptability in laboratories, dental clinics, and small-scale industrial settings. The multistage-4 systems segment is also witnessing rising demand for use in aerospace and electronics manufacturing lines due to their automated programmable cleaning capabilities, which enhance precision and operational throughput for sensitive components.

The 1000-2000 W segment is projected to grow rapidly and hold nearly 20% market share by 2035, driven by increasing applications in automotive parts degreasing, PCB cleaning, and medical device sterilization. The 500-1000 W segment remains significant, while systems above 5000 W are being adopted in heavy industrial cleaning. High-power ultrasonic systems are gaining traction for their ability to clean complex geometries efficiently within reduced operational cycles.

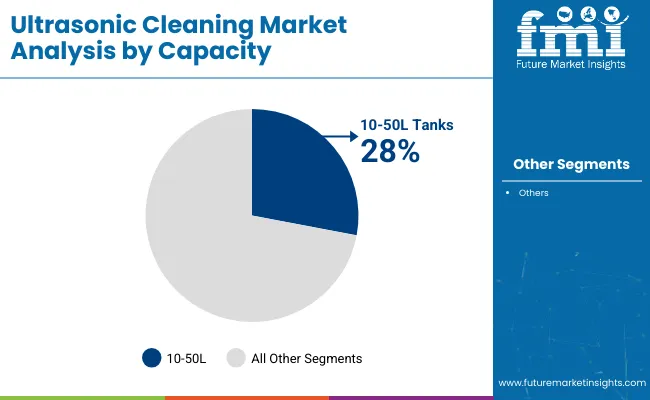

The 10-50L capacity segment is anticipated to maintain its leading position with over 28% share by 2035, driven by widespread use in medical, automotive, and electronics sectors. These tanks are ideal for mid-sized batch cleaning operations and point-of-use cleaning in laboratories and hospitals. The 100-150L and 150-200L capacity segments are witnessing growing demand from the aerospace and metal machinery industries for large-component cleaning applications.

The medical & healthcare segment is projected to retain its leading position with a market share of nearly 22% by 2035. This is due to stringent sterilization standards for surgical tools, dental instruments, and diagnostic devices. The electrical & electronics segment is growing rapidly, driven by semiconductor manufacturing, while aerospace and automotive industries continue to adopt ultrasonic cleaning for engine components, fuel injectors, and precision parts.

Recent Trends in the Ultrasonic Cleaning Market

Challenges in the Ultrasonic Cleaning Market

Germany leads the ultrasonic cleaning market among the listed countries with a projected CAGR of 5.5%, driven by strict VOC regulations and adoption in precision industries. France follows at 4.9%, supported by green legislation and aerospace automation. Japan ranks third with 4.5%, fueled by compact and efficient cleaning unit demand in healthcare.

The UK shows a 4.4% CAGR, driven by medical standards and sustainable practices, while the USA grows at 4.1%, influenced by EPA regulations and AI integration. Overall, Europe dominates with environmentally-driven growth, while Japan and the USA focus on healthcare and semiconductor cleaning innovations.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The ultrasonic cleaning demand in the USA is projected to grow at a CAGR of 4.1% from 2025 to 2035. Growth is being driven by stringent EPA solvent disposal regulations and rising demand in aerospace, automotive, and semiconductor sectors. High adoption of AI-integrated ultrasonic cleaning systems is being observed to improve precision and operational efficiency, despite concerns around semiconductor supply chain disruptions.

The ultrasonic cleaning solution sales in the UK is estimated to grow at a CAGR of 4.4% from 2025 to 2035. UK REACH regulations and medical device sterilization standards are encouraging the adoption of eco-friendly ultrasonic systems. A trend towards localized manufacturing and biodegradable cleaning solvents is being observed, although Brexit-related import duties are posing challenges for cost structures within the industry.

The ultrasonic cleaning market in Germany is expected to expand at a CAGR of 5.5% from 2025 to 2035. Stringent BImSchG VOC emission regulations and TÜV certifications are driving the adoption of AI-driven energy-efficient ultrasonic systems, particularly in the automotive and electronics industries. High operational costs remain a challenge, but investments in intelligent and predictive ultrasonic cleaning technologies are being prioritized.

The ultrasonic cleaning market in France is projected to grow at a CAGR of 4.9% from 2025 to 2035. Growth is being propelled by ANSM medical sterilization regulations and the Green Industry Bill, encouraging eco-friendly solutions. Aerospace applications are seeing increased investments in automated ultrasonic systems, although high equipment costs are limiting adoption among small and medium enterprises.

The ultrasonic cleaning market revenue in Japan is anticipated to grow at a CAGR of 4.5% from 2025 to 2035. Growth is driven by PMDA medical device regulations and the need for high-precision cleaning in manufacturing. Adoption of small, efficient ultrasonic cleaning units is being expanded despite cost pressures and slow technology uptake compared to other advanced markets.

The ultrasonic cleaning market is moderately consolidated, with global leaders accounting for a significant portion of revenues while regional players remain competitive in niche applications. Companies such as Branson Ultrasonic Corporation, Crest Ultrasonics, and Telsonic AG Group are competing through product innovation, pricing flexibility, and strategic OEM partnerships across the medical, semiconductor, and aerospace sectors.

Top companies are focusing on integrating automation, AI-enabled programmable systems, and eco-friendly cleaning technologies to address rising environmental regulations and demand for operational efficiency. Expansion of regional manufacturing footprints, mergers with local distributors, and the development of energy-efficient transducer materials are among the core strategies.

Firms like Branson Ultrasonics and Crest Ultrasonics are investing heavily in AI-driven high-frequency systems, while companies such as Telsonic AG and Elma Schmidbauer are strengthening their sustainable solutions portfolio to comply with stricter European regulations.

Recent Ultrasonic Cleaning Market News

In March 2023, Telsonic announced the expansion of its North American operations with new acquisition of Leading Edge Engineering.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.1 billion |

| Projected Market Size (2035) | USD 3.5 billion |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions /Volume in units |

| By Product | Benchtop, Standalone, Multistage-2, Multistage-4 |

| By Power Output | Up to 250 W, 250-500 W, 500-1000 W, 1000-2000 W, 2000-5000 W, 5000-10000 W, More than 10000 W |

| By Capacity | Up to 5L, 10-50L, 50-100L, 100-150L, 150-200L, 200-250L, 250-300L, More than 300L |

| By Vertical | Medical & Healthcare, Automobile, Aerospace, Optics, Metal & Machinery, Electrical & Electronics, Food & Beverage, Jewelry & Gems, Pharmaceuticals, Others (including marine and textile cleaning) |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, South Korea, Australia |

| Key Players | Branson Ultrasonic Corporation, Cleaning Technologies Group, Telsonic AG Group, Omegasonics , Kemet International Limited, Morantz Ultrasonics , Mettler Electronics Corp., SharperTek , Blue Wave Ultrasonics , Crest Ultrasonics Corporation, GuangDong GT Ultrasonic Co., Ltd, TierraTech , KKS Ultraschall AG, Elma Schmidbauer GmbH, FinnSonic Oy, Sonic Systems Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis, and competitive landscape insights |

The industry is segmented into benchtop, standalone, multistage-2, and multistage-4.

Output it is segmented into up to 250 W, 250-500 W, 500-1000 W, 1000-2000 W, 2000-5000 W, 5000-10000 W, and more than 10000 W.

It is segmented up to 5L, 10-50 L, 50-100 L, 100-150 L, 150-200L, 200-250 L, 250-300 L, and more than 300 L.

It is fragmented into medical & healthcare, automobile, aerospace, optics, metal & machinery, electrical & electronics, food & beverage, jewellery & gems, pharmaceuticals and others.

The industry is fragmented among North America, Latin America, Europe, Asia-Pacific, and Middle East & Africa.

The market is valued at USD 2.1 billion in 2025.

The market is forecasted to reach USD 3.5 billion by 2035, reflecting a CAGR of 5.3%.

Benchtop ultrasonic cleaning systems are expected to lead the market with a 25% share in 2025.

The medical and healthcare sector is expected to hold a 22% share of the market by 2035.

Germany is anticipated to be the fastest-growing market with a CAGR of 5.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultrasonic Jewelry Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic NDT Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Air Bubble Detectors Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Pouch Sealers Market Analysis Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Electrosurgical Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Sensors Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Homogenizer Machines Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Flaw Detector Market – Trends & Forecast 2025 to 2035

Ultrasonic Flowmeters Market Trends – Growth & Forecast 2025 to 2035

Ultrasonic Pulse Velocity Tester Market Growth – Trends & Forecast 2018-2027

Ultrasonic Surgical Cutters Market

Ultrasonic Diathermy Market

Ultrasonic Testing Market

Ultrasonic Technology Market

Ultrasonic Dissection Devices Market

Ultrasonic Flow Meter Market

Ultrasonic Tissue Ablation System Market

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dental Piezoelectric Ultrasonic Unit Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA