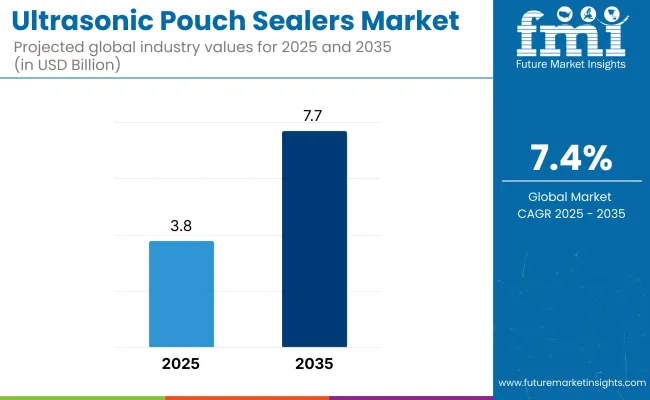

The ultrasonic pouch sealers market is projected to grow from USD 3.8 billion in 2025 to USD 7.7 billion by 2035, resulting in a total increase of USD 3.9 billion over the ten-year period. This represents a 102.6% overall expansion, with the market advancing at a compound annual growth rate (CAGR) of 7.4%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.8 billion |

| Industry Value (2035F) | USD 7.7 billion |

| CAGR (2025 to 2035) | 7.4% |

By 2035, the market will have expanded by a 2 multiple. In the first half of the decade (2025-2030), the market rises from USD 3.8 billion to USD 5.4 billion, adding USD 1.6 billion, or 41.0% of the total decade’s growth. This period sees strong adoption in food & beverage, pharmaceutical, and medical device packaging due to ultrasonic sealing’s ability to deliver airtight, contamination-free seals even with product residues in the seal area. Compact, high-speed sealing units gain traction among co-packers and flexible packaging converters.

In the second half (2030-2035), the market grows from USD 5.4 billion to USD 7.7 billion, contributing USD 2.3 billion, or 59.0% of the total growth. Expansion is driven by integration of IoT-enabled seal quality monitoring, energy-efficient transducers, and multi-lane ultrasonic systems in automated pouching lines. Sustainability initiatives boost demand for ultrasonic sealers compatible with mono-material and recyclable films, supporting the global shift away from mixed-material laminates.

From 2020 to 2024, the ultrasonic pouch sealers market grew from USD 2.6 billion to USD 3.5 billion, driven by hardware-centric adoption in food, beverage, and medical packaging operations seeking hermetic seals with reduced material usage and improved energy efficiency.

During this period, the competitive landscape was dominated by equipment manufacturers controlling nearly 70% of market revenue, with leaders such as Sonics & Materials, Inc., RoopUltrasonix, and Matrix Packaging Machinery, LLC focusing on high-speed, low-heat ultrasonic sealing systems compatible with multi-layer films. Competitive differentiation relied on seal integrity across diverse substrates, cycle time optimization, and line integration, while software-enabled features for real-time seal validation were typically bundled with equipment rather than offered as standalone revenue streams.

Demand for ultrasonic pouch sealers will expand to USD 7.7 billion in 2035, and the revenue mix will shift as smart diagnostics, predictive maintenance, and process optimization services grow to over 40% share. Traditional sealing system providers face increasing competition from automation-first players offering cloud-based performance monitoring, AI-driven seal quality analytics, and remote parameter control.

Growing demand for high-integrity, energy-efficient, and contamination-free sealing in food, pharmaceutical, and personal care packaging is driving the growth of the ultrasonic pouch sealers market. These systems use high-frequency ultrasonic vibrations to generate heat at the seal interface, creating strong bonds without direct heat application to the entire pouch. The technology supports faster sealing cycles, reduced material distortion, and superior seal quality in moisture-sensitive or heat-sensitive products.

Portable benchtop units and fully automated inline ultrasonic sealers have gained popularity due to their ability to seal through small product residues, reduce film waste, and lower operating costs compared to conventional heat sealing. The absence of preheating requirements enhances production efficiency, while reduced energy consumption aligns with sustainability initiatives.

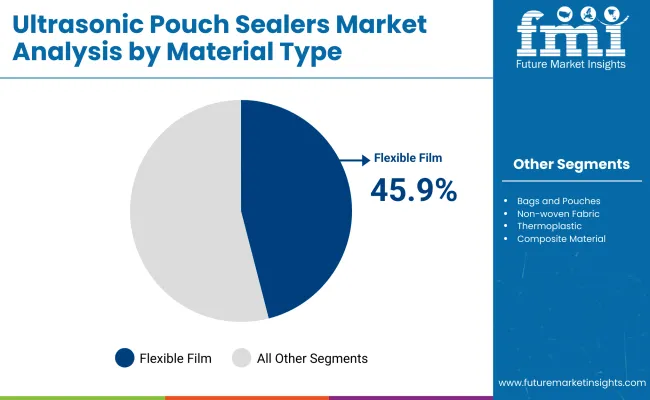

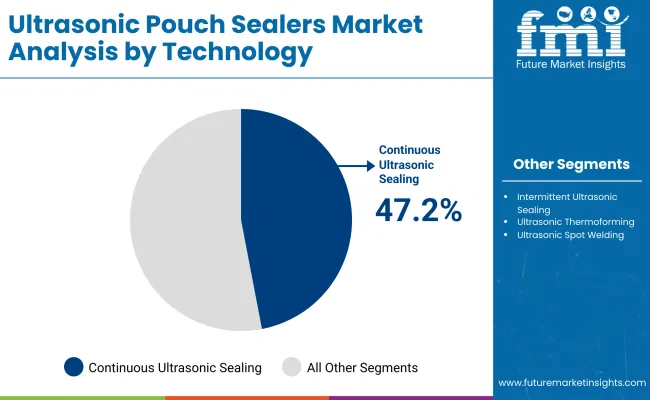

The market is segmented by material type, technology, equipment type, application, end-user industry, and region. Material type includes flexible films, bags and pouches, non-woven fabrics, thermoplastics, and composite materials, offering diverse sealing capabilities for varying product protection and barrier requirements. Technology segmentation comprises continuous ultrasonic sealing, intermittent ultrasonic sealing, ultrasonic thermoforming, and ultrasonic spot welding, enabling precision, speed, and material compatibility in sealing operations.

Equipment type includes ultrasonic sealing machines, handheld ultrasonic sealers, automated ultrasonic sealers, and ultrasonic fusing equipment, catering to production scales from portable units to fully integrated lines. Application areas span medical packaging, food packaging, textile bonding, electronics packaging, and automotive components, each demanding strong, contaminant-free, and heat-sensitive sealing performance.

End-user industries include pharmaceuticals, food & beverage, consumer goods, aerospace, and construction, where ultrasonic sealing supports regulatory compliance, durability, and efficiency. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The flexible films segment is set to hold the largest market share of 45.9% by 2025, driven by their adaptability across multiple pouch formats and compatibility with ultrasonic sealing processes. These films provide robust protection against moisture, oxygen, and light, preserving product freshness and quality. The material’s lightweight structure reduces transportation costs while maintaining high tensile strength for secure sealing.

Manufacturers are focusing on integrating recyclable and compostable layers into flexible film designs to align with global sustainability mandates. The combination of flexible films and ultrasonic sealing reduces material waste and improves packaging integrity, making them an industry standard in high-speed production lines. This adaptability is encouraging adoption across diverse sectors, from snacks to pharmaceuticals, ensuring steady demand growth.

The food & beverage segment is projected to command a 50.8% market share in 2025 due to rising consumer expectations for safe, tamper-proof, and visually appealing packaging. Ultrasonic sealing technology offers a contactless sealing process that minimizes contamination risks, ensuring compliance with stringent food safety standards.

Growth in convenience food, frozen products, and ready-to-eat meals is fueling the demand for secure pouch formats. Food manufacturers are increasingly adopting refillable and eco-friendly packaging solutions compatible with ultrasonic sealing, meeting sustainability goals while preserving freshness. The segment’s dominance is further supported by packaging innovations that integrate easy-open features without compromising seal integrity.

Continuous ultrasonic sealing technology is expected to capture a 47.2% share in 2025, driven by its ability to deliver consistent, high-quality seals in high-speed production environments. Unlike thermal sealing, ultrasonic technology applies precise mechanical vibrations, generating localized heat to bond materials without damaging sensitive contents.

The reduced sealing time and lower energy consumption of continuous ultrasonic systems appeal to manufacturers seeking both efficiency and sustainability. Industries handling heat-sensitive products such as dairy, frozen foods, and nutraceuticals are increasingly adopting this technology for its precision, reduced material distortion, and improved seal strength.

Automated ultrasonic sealers are projected to hold a 39.3% market share by 2025, owing to their ability to optimize labor costs while boosting production output. These machines streamline sealing operations by integrating automated feeding, alignment, and sealing functions, minimizing human intervention and error.

In sectors where packaging volumes are high such as beverages, snacks, and pet food automation reduces downtime and improves overall line efficiency. Coupled with IoT-enabled monitoring, automated ultrasonic sealers offer real-time performance tracking, predictive maintenance alerts, and quality control data, making them a strategic investment for competitive manufacturers.

Food packaging is set to represent 36.1% of the application segment by 2025, supported by the growing consumption of packaged, portable, and portioned food products. Ultrasonic pouch sealing ensures airtight closures, preventing leaks, spoilage, and contamination during storage and transportation.

As urban lifestyles drive demand for convenient meal solutions, brands are investing in innovative pouch designs such as resealable, spout, and stand-up pouches that pair well with ultrasonic sealing technology. This ensures both product protection and consumer convenience, helping food brands meet evolving expectations for freshness and sustainability.

Equipment cost, operator training needs, and sealing compatibility limitations restrain wider adoption, even as demand grows across food, pharmaceuticals, and personal care for energy-efficient, high-speed sealing systems that deliver leak-proof, tamper-evident pouches without excessive heat exposure.

High-precision Sealing for Sensitive and High-value Products

Ultrasonic pouch sealers are increasingly adopted in industries requiring precise, hermetic seals without compromising product integrity. Using high-frequency vibrations to generate localized heat, these machines enable sealing through contaminants, moisture, and product residues a critical advantage in powdered foods, dairy, and liquid medications.

High Capital Investment and Skill-intensive Operation

Despite their advantages, ultrasonic pouch sealers face adoption challenges due to their high initial cost compared to conventional heat sealers. The technology requires specialized transducers, control systems, and robust tooling, driving up equipment prices. Operators must be trained in frequency tuning, amplitude adjustment, and troubleshooting, making onboarding more complex.

Integration with Automated Packaging Lines and Sustainable Film Innovations

A key trend in the ultrasonic pouch sealers market is the integration of fully automated, servo-driven sealing heads with inline filling and inspection systems. This allows for real-time seal quality verification, adaptive sealing pressure, and faster changeovers between pouch formats. Manufacturers are also aligning ultrasonic sealing technology with recyclable mono-material films and compostable laminates, enabling brands to meet sustainability targets without compromising seal integrity.

The ultrasonic pouch sealers market is witnessing steady expansion across global packaging sectors, driven by sustainability goals, demand for precision sealing, and growing adoption in high-hygiene industries. This technology delivers minimal heat transfer, rapid sealing cycles, and excellent compatibility with recyclable mono-materials, making it well-suited for food, pharmaceutical, personal care, and electronics applications. Additionally, the integration of automation, real-time quality inspection, and Industry 4.0 systems is strengthening operational efficiency while meeting stringent safety and sustainability standards.

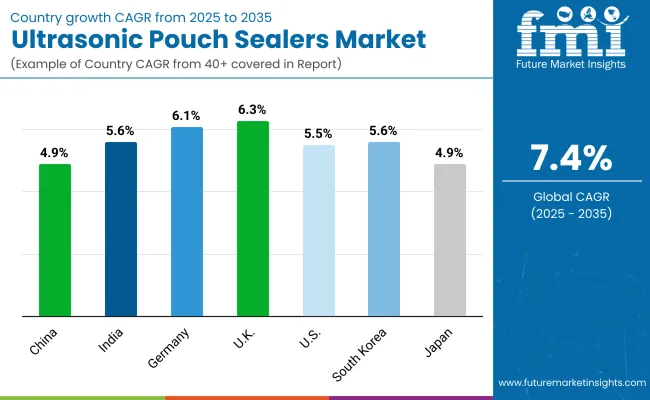

The ultrasonic pouch sealers market in the United States is expected to grow at a CAGR of 5.5% from 2025 to 2035, supported by the adoption of advanced sealing solutions across food, healthcare, and electronics manufacturing. Regulatory focus on reducing energy consumption and ensuring packaging integrity is driving the transition from heat-based sealing to ultrasonic technology. Manufacturers are increasingly offering automated, sensor-enabled systems to enhance precision, reduce material waste, and meet cleanroom standards for sensitive products.

The ultrasonic pouch sealers market in Germany is forecast to grow at a CAGR of 6.1% between 2025 and 2035, propelled by strong adoption in precision packaging for food, medical, and industrial applications. Sustainability commitments under EU directives are accelerating the use of ultrasonic sealing for recyclable mono-material pouches. German manufacturers are also innovating with modular, Industry 4.0-enabled sealing units that allow quick format changes and data-driven quality control.

The ultrasonic pouch sealers market in the United Kingdom is projected to expand at a CAGR of 6.3% from 2025 to 2035, supported by rising demand for energy-efficient sealing technologies in food, beverage, and healthcare packaging. Manufacturers are integrating advanced sensors, automation, and Industry 4.0 systems to enhance sealing precision while complying with hygiene regulations. Sustainability-focused initiatives are also replacing heat-sealing methods with ultrasonic solutions.

The ultrasonic pouch sealers market in China is projected to grow at a CAGR of 4.9% through 2035, driven by increased automation in food, pharmaceutical, and electronics sectors. Government sustainability programs and industrial modernization initiatives are promoting the use of energy-efficient sealing technologies. Domestic manufacturers are scaling production of cost-effective ultrasonic systems tailored for high-volume operations.

India’s ultrasonic pouch sealers market is forecast to grow at a CAGR of 5.6% between 2025 and 2035, bolstered by demand in processed food, dairy, and pharmaceuticals. Government initiatives to improve food safety and packaging hygiene are supporting market adoption. Local suppliers are expanding portfolios with affordable ultrasonic sealing machines for SMEs.

The ultrasonic pouch sealers market in Japan is projected to expand at a CAGR of 4.9% through 2035, led by high adoption in pharmaceuticals, cosmetics, and electronics. Precision sealing requirements in ultra-clean environments are encouraging integration of ultrasonic technology. Manufacturers are enhancing product offerings with real-time quality monitoring and compact footprint designs.

The ultrasonic pouch sealers market in South Korea is set to grow at a CAGR of 5.6% between 2025 and 2035, driven by its strong electronics, food, and biotech industries. Demand for contamination-free, precision sealing is boosting the transition to ultrasonic technology. Integration with smart factory solutions and robotics is further enhancing operational efficiency.

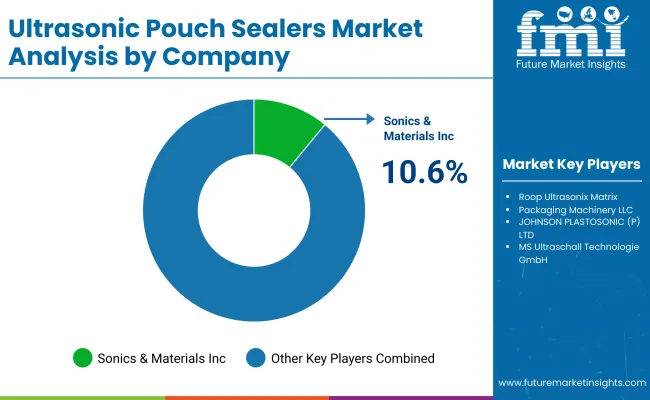

The ultrasonic pouch sealers market is moderately fragmented, with ultrasonic welding technology leaders, packaging automation specialists, and niche sealing equipment providers competing across food, medical, and specialty packaging sectors. Global leaders such as Sonics & Materials, Inc. and MS UltraschallTechnologie GmbH hold significant market share, driven by advanced high-frequency sealing systems, precision energy control, and integration with high-speed form-fill-seal lines. Their strategies increasingly emphasize eco-friendly sealing of mono-material films, reduced energy consumption, and compatibility with compostable and recyclable substrates.

Established mid-sized players including Roop Ultrasonix and Matrix Packaging Machinery, LLC are expanding adoption through modular ultrasonic sealing heads, retrofit-friendly systems, and enhanced sealing consistency for flexible pouches. These companies target applications in dairy, ready meals, pet food, and medical device packaging where seal integrity and contamination prevention are critical.

Specialized providers such as JOHNSON PLASTOSONIC (P) LTD. focus on application-specific ultrasonic pouch sealers for regional converters and SMEs. Their competitive strength lies in cost-effective custom tooling, localized technical support, and the ability to handle diverse laminate structures while maintaining strong, hermetic seals.

Key Development of Ultrasonic Pouch Sealers Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| By Material Type | Flexible Films, Bags and Pouches, Non-woven Fabrics, Thermoplastics, and Composite Materials |

| By Technology | Continuous Ultrasonic Sealing, Intermittent Ultrasonic Sealing, Ultrasonic Thermoforming, and Ultrasonic Spot Welding |

| By Equipment Type | Ultrasonic Sealing Machines, Handheld Ultrasonic Sealers, Automated Ultrasonic Sealers, and Ultrasonic Fusing Equipment |

| By Application | Medical Packaging, Food Packaging, Textile Bonding, Electronics Packaging, and Automotive Components |

| By End-User Industry | Pharmaceuticals, Food & Beverage, Consumer Goods, Aerospace, and Construction |

| Key Companies Profiled | Sonics & Materials, Inc., Roop Ultrasonix, Matrix Packaging Machinery, LLC., JOHNSON PLASTOSONIC (P) LTD., and MS Ultraschall Technologie GmbH |

| Additional Attributes | Rising adoption of ultrasonic sealing for contamination-free, airtight packaging, increasing preference for energy-efficient sealing technology over heat sealing, growth in medical and pharma pouch sealing applications, improved sealing integrity for multilayer flexible films, rapid adoption in food packaging for reduced material waste, expansion of automated ultrasonic sealers in high-volume lines, rising demand for composite material sealing in automotive and aerospace sectors, handheld models gaining traction for small-batch and R&D applications, integration with smart sensors for precise seal quality monitoring, and strong growth prospects in North America, Europe, and Asia-Pacific |

The global ultrasonic pouch sealers market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the ultrasonic pouch sealers market is projected to reach USD 7.7 billion by 2035.

The ultrasonic pouch sealers market is expected to grow at a CAGR of 7.4% between 2025 and 2035.

The key material segments in the ultrasonic pouch sealers market include flexible films, multi-layer laminates, co-extruded films, and paper-based laminates.

In terms of material, the flexible films segment is expected to account for the highest share of 45.9% in the ultrasonic pouch sealers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultrasonic Jewelry Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic NDT Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Air Bubble Detectors Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Electrosurgical Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Sensors Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Homogenizer Machines Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Cleaning Market Analysis - Size, Growth, and Forecast 2025 to 2035

Ultrasonic Flaw Detector Market – Trends & Forecast 2025 to 2035

Ultrasonic Flowmeters Market Trends – Growth & Forecast 2025 to 2035

Ultrasonic Pulse Velocity Tester Market Growth – Trends & Forecast 2018-2027

Ultrasonic Surgical Cutters Market

Ultrasonic Diathermy Market

Ultrasonic Testing Market

Ultrasonic Technology Market

Ultrasonic Tissue Ablation System Market

Ultrasonic Flow Meter Market

Ultrasonic Dissection Devices Market

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dental Piezoelectric Ultrasonic Unit Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA