The ultrasonic jewelry cleaning machine market is expected to grow from USD 393.4 million in 2025 to USD 634.8 million by 2035, reflecting a CAGR of 4.9%. Examining the growth rate volatility index reveals periods of both stable expansion and moderate fluctuation driven by shifts in consumer demand, retail trends, and technological upgrades. From 2025 to 2028, the market experiences steady growth as increasing adoption by jewelry retailers, repair shops, and individual consumers drives demand. The availability of advanced ultrasonic cleaning machines with improved efficiency, multi-functionality, and compact designs contributes to stable growth, producing low volatility in the early years.

Between 2028 and 2032, slight fluctuations emerge as market expansion is influenced by changing consumer spending patterns, periodic promotional campaigns, and regional differences in adoption rates. While demand remains positive, variations in growth reflect differences in penetration across emerging and mature markets. From 2032 to 2035, growth stabilizes again as technological improvements such as energy-efficient units, automated cleaning cycles, and smart integration with other jewelry care solutions reinforce adoption. The growth rate volatility index shows that the market maintains a predominantly steady trajectory with short-term fluctuations influenced by regional trends and product innovations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 393.4 million |

| Forecast Value in (2035F) | USD 634.8 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The ultrasonic jewelry cleaning machine market is divided among retail jewelry stores at 38%, household consumers at 27%, luxury watch and accessory makers at 16%, repair and refurbishment services at 11%, and specialty industrial applications such as gemstone and optical component cleaning at 8%. Retail stores dominate due to the need for rapid, effective, and non-damaging cleaning of high-value items, while household users prefer ultrasonic cleaners for convenience and superior results. Luxury watch makers rely on them for intricate mechanisms, and repair services use them to restore items efficiently. Industry trends include programmable cleaning cycles, eco-friendly solutions, compact tabletop models, advanced ultrasonic frequencies, and multifunction designs. Expansion into e-commerce, luxury watch maintenance, and industrial precision cleaning is fueling steady global growth.

Market expansion is being supported by the increasing global demand for convenient jewelry care solutions and the corresponding need for effective cleaning equipment that can maintain jewelry quality and appearance while providing gentle yet thorough cleaning performance across various jewelry types and materials. Modern consumers are increasingly focused on implementing care solutions that can deliver professional-quality cleaning results, extend jewelry lifespan, and provide convenient maintenance routines for valuable jewelry collections. Ultrasonic jewelry cleaning machines' proven ability to provide superior cleaning performance, gentle material treatment, and versatile application capabilities make them essential equipment for contemporary jewelry care and maintenance applications.

The growing emphasis on jewelry investment protection and appearance maintenance is driving demand for ultrasonic cleaning machines that can support delicate cleaning processes, remove stubborn contaminants, and restore jewelry brilliance through advanced cleaning technology. Consumers' preference for equipment that combines cleaning effectiveness with operational convenience and cost-effectiveness is creating opportunities for innovative cleaning device implementations. The rising influence of luxury lifestyle trends and jewelry collecting activities is also contributing to increased adoption of ultrasonic cleaners that can provide reliable jewelry care solutions without compromising material integrity or aesthetic quality.

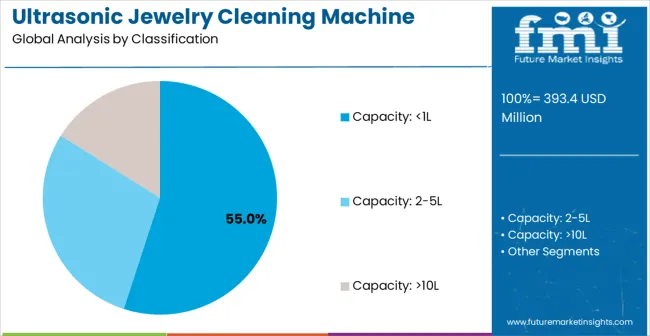

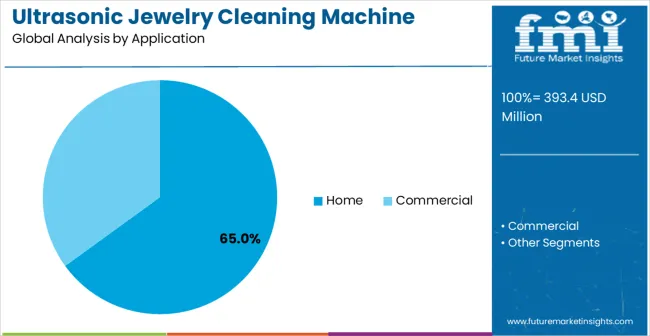

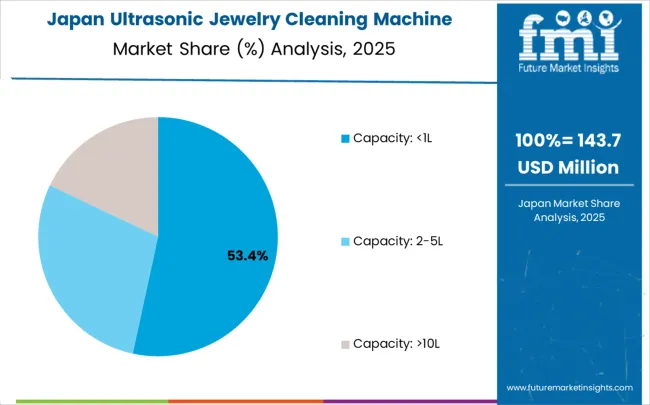

The market is segmented by tank capacity, application, and region. By tank capacity, the market is divided into capacity: <1L, capacity: 2-5L, capacity: >10L. Based on the application, the market is categorized into home and commercial. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The capacity: <1L segment is projected to account for 55.0% of the ultrasonic jewelry cleaning machine market in 2025, reaffirming its position as the leading tank capacity category. Home users increasingly utilize small-capacity ultrasonic cleaners for their compact size, convenient operation, and suitability for personal jewelry cleaning applications, including rings, earrings, watches, and small accessories. Small capacity technology's space-efficient design and user-friendly operation directly address the household requirements for convenient jewelry maintenance and efficient cleaning performance in residential environments.

This tank capacity segment forms the foundation of modern personal jewelry care operations, as it represents the capacity range with the greatest versatility and established market demand across multiple consumer segments and household applications. Manufacturer investments in enhanced compact design technologies and efficient cleaning systems continue to strengthen adoption among home users. With consumers prioritizing convenience and storage efficiency, capacity: <1L ultrasonic cleaners align with both space constraints and cleaning effectiveness objectives, making them the central component of comprehensive home jewelry care strategies.

Home users are projected to represent 65.0% of ultrasonic jewelry cleaning machine demand in 2025, underscoring their critical role as the primary consumers of personal jewelry cleaning equipment for household maintenance and care applications. Home consumers prefer ultrasonic jewelry cleaners for their convenience, cost-effectiveness, and ability to provide professional-quality cleaning results while reducing the need for professional cleaning services and maintenance visits. Positioned as essential equipment for modern jewelry care routines, ultrasonic cleaning machines offer both cleaning advantages and convenience benefits.

The segment is supported by continuous innovation in consumer electronics technologies and the growing availability of user-friendly cleaning devices that enable advanced jewelry care with enhanced safety features and automated operation. The home users are investing in personal care equipment to support comprehensive jewelry maintenance and value preservation strategies. As jewelry ownership becomes more prevalent and care awareness increases, home applications will continue to dominate the application market while supporting advanced cleaning technology utilization and personal care optimization strategies.

The ultrasonic jewelry cleaning machine market is advancing steadily due to increasing consumer awareness about jewelry care and growing demand for convenient cleaning solutions that provide effective contaminant removal and gentle material treatment across diverse jewelry types and applications. The market faces challenges, including price sensitivity among consumers, limited awareness about ultrasonic cleaning benefits, and the need for proper usage education and safety guidelines. Innovation in compact device design and smart cleaning technologies continues to influence product development and market expansion patterns.

The growing adoption of intelligent cleaning control systems and automated operation features is enabling manufacturers to produce advanced ultrasonic jewelry cleaners with enhanced user convenience, optimized cleaning cycles, and improved safety features. Smart cleaning technologies provide better cleaning results while allowing more precise control and consistent performance across various jewelry materials and cleaning requirements. Manufacturers are increasingly recognizing the competitive advantages of automated cleaning capabilities for product differentiation and premium market positioning.

Modern ultrasonic jewelry cleaner producers are incorporating space-efficient designs and multi-functional cleaning capabilities to enhance device versatility, maximize cleaning effectiveness, and provide convenient storage solutions for home users. These technologies improve user experience while enabling new applications, including multiple jewelry type cleaning and diverse accessory maintenance. Advanced compact integration also allows manufacturers to support premium product positioning and enhanced functionality beyond traditional single-purpose cleaning devices.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| USA | 4.7% |

| UK | 4.2% |

| Japan | 3.7% |

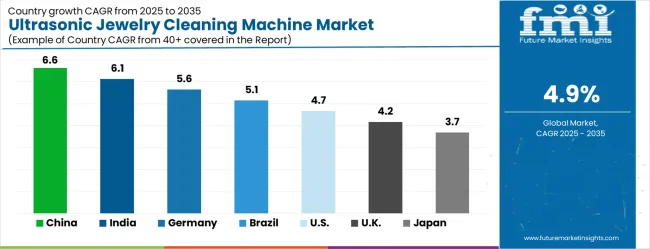

The ultrasonic jewelry cleaning machine market is experiencing moderate growth globally, with China leading at a 6.6% CAGR through 2035, driven by the expanding consumer electronics manufacturing industry, growing middle-class jewelry ownership, and increasing awareness about jewelry care and maintenance solutions. India follows at 6.1%, supported by rising disposable income, a growing jewelry market, and increasing adoption of modern cleaning technologies in households.

Germany shows growth at 5.6%, emphasizing quality engineering and premium cleaning device development. Brazil records 5.1%, focusing on consumer appliance expansion and household modernization. The USA demonstrates 4.7% growth, prioritizing convenience products and home care solutions. The UK exhibits 4.2% growth, with a focus on luxury lifestyle products and household automation. Japan shows 3.7% growth, supported by advanced consumer electronics and precision cleaning technology innovation.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The market for ultrasonic jewelry cleaning machines in China is expanding at a CAGR of 6.6%, above the global average. Growth is supported by increasing demand from domestic jewelry manufacturers, retail chains, and repair workshops. Industrial clusters are integrating high-frequency cleaning machines to improve cleaning precision and efficiency. Suppliers focus on scalable machines capable of handling large batches and delicate gemstones. Pilot projects demonstrate reduced cleaning time and improved quality for high-end jewelry. Research initiatives enhance ultrasonic technology and energy efficiency. Increasing consumer preference for polished and flawless jewelry drives adoption. Local manufacturers collaborate with retailers to supply cost-effective, automated cleaning solutions that meet both production and retail requirements.

India is projected to grow at a CAGR of 6.1%, above the global average. Growth is driven by expanding jewelry production, including gold, silver, and gemstone processing sectors. Ultrasonic cleaning machines are deployed in workshops, retail stores, and small-scale manufacturing units. Machines reduce manual cleaning effort, improve efficiency, and maintain gemstone integrity. Pilot programs show increased output and enhanced surface finish. Suppliers offer mid-sized machines suitable for high-volume operations and cost-sensitive markets. Collaboration with local distributors ensures timely maintenance and operator training. Rising export demand for polished jewelry and expanding domestic retail networks further support growth.

Germany grows at a CAGR of 5.6%, above the global average. Adoption is LED by luxury jewelry manufacturers and precision gemstone processors. Ultrasonic cleaning machines are integrated into production lines for polishing, surface refinement, and cleaning delicate jewelry components. Suppliers focus on precision, durability, and energy-efficient operation. Pilot projects demonstrate higher quality output and reduced product rework. Industrial clusters leverage automation and IoT-enabled monitoring for process optimization. Consumer demand for premium polished jewelry accelerates investment in advanced cleaning solutions. Collaboration with research institutions improves cleaning technologies for high-end jewelry manufacturing.

The Brazilian market grows at a CAGR of 5.1%, slightly above the global average. Growth is supported by domestic jewelry manufacturing, including gold, silver, and gemstone sectors. Ultrasonic machines are used to maintain quality, reduce cleaning time, and improve productivity. Industrial clusters integrate these systems in workshops and retail operations for consistent results. Suppliers offer durable, cost-effective machines suitable for tropical climates and extended usage. Pilot programs demonstrate faster cleaning cycles and improved surface finishing. Local distributors provide training and maintenance services. Rising tourism and luxury jewelry demand also contribute to higher adoption rates.

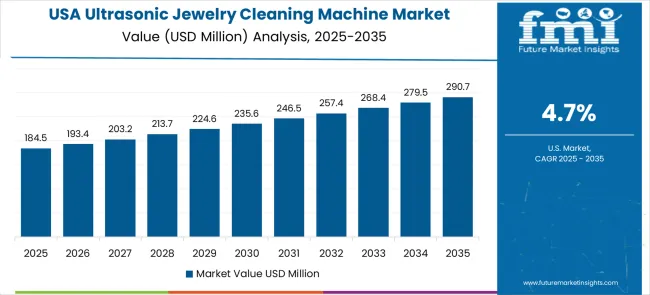

The United States grows at a CAGR of 4.7%, slightly below the global average. Slower growth is influenced by a mature retail sector and widespread adoption of existing cleaning systems. Machines are used in jewelry stores, repair workshops, and production facilities to maintain quality and reduce manual labor. Suppliers provide compact, energy-efficient machines suitable for high-end jewelry cleaning. Pilot programs demonstrate enhanced surface finish and reduced processing time. Industrial hubs integrate ultrasonic machines for both retail and production operations. Rising consumer preference for polished and flawless jewelry drives selective adoption in luxury segments.

The UK market grows at a CAGR of 4.2%, below the global average. Slower growth results from limited expansion of new jewelry manufacturing and reliance on imported solutions. Machines are deployed in retail, repair workshops, and high-end jewelry production. Suppliers provide precise, energy-efficient, and compact systems. Pilot installations demonstrate improved cleaning outcomes and shorter processing times. Adoption is increasing in boutique jewelry stores and specialized workshops. Training programs support operators in handling delicate pieces. Rising consumer demand for premium, well-polished jewelry encourages gradual market expansion.

Japan grows at a CAGR of 3.7%, below the global average. Slower growth is influenced by a mature market and widespread use of conventional cleaning systems. Ultrasonic machines are applied in jewelry workshops, retail stores, and high-end production facilities. Suppliers provide precise and durable machines suitable for small-scale and specialized operations. Pilot installations demonstrate improved cleaning efficiency and surface finishing. Industrial clusters integrate machines into production lines for consistency. R&D initiatives focus on enhancing ultrasonic technology for delicate gemstones and precious metals to maintain high-quality standards.

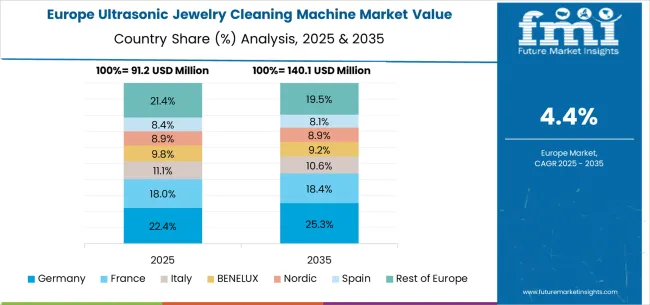

The ultrasonic jewelry cleaning machine market in Europe is projected to grow from USD 86.6 million in 2025 to USD 139.7 million by 2035, registering a CAGR of 4.9% over the forecast period. Germany is expected to maintain its leadership position with a 30.0% market share in 2025, declining slightly to 29.5% by 2035, supported by its strong consumer appliance sector, advanced household technology adoption, and comprehensive cleaning device supply network serving major European markets.

France follows with a 17.5% share in 2025, projected to reach 18.0% by 2035, driven by robust demand for luxury lifestyle products, premium household appliances, and jewelry care solutions, combined with established consumer preferences for quality cleaning devices. The United Kingdom holds a 16.0% share in 2025, expected to decrease to 15.5% by 2035, supported by strong luxury product demand but facing challenges from economic conditions and competitive pressures from continental suppliers. Italy commands a 13.0% share in 2025, projected to reach 13.2% by 2035, while Spain accounts for 9.0% in 2025, expected to reach 9.3% by 2035.

The Netherlands maintains a 4.5% share in 2025, growing to 4.7% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Portugal, Belgium, Switzerland, and Austria, is anticipated to maintain its position, with its collective share remaining stable from 10.0% to 9.8% by 2035, attributed to the steady adoption of household appliances in Nordic countries and growing consumer electronics activities across Eastern European markets implementing lifestyle modernization programs.

The ultrasonic jewelry cleaning machine market is characterized by competition among established consumer appliance manufacturers, specialized cleaning equipment providers, and integrated household product producers. Companies are investing in product design innovation, manufacturing efficiency optimization, user experience enhancement, and comprehensive product portfolios to deliver convenient, effective, and cost-competitive cleaning solutions. Innovation in compact device design, smart cleaning features, and multi-functional capabilities is central to strengthening market position and competitive advantage.

BLITZ MANUFACTURING COMPANY, INC. leads the market with a strong market share, offering comprehensive cleaning solutions with a focus on professional-grade equipment and consumer applications. EraClean provides specialized ultrasonic cleaning technologies with an emphasis on user-friendly design and household convenience. Gtsonic delivers innovative cleaning devices with a focus on compact design and effective cleaning performance. FISA specializes in precision cleaning equipment for jewelry and small item applications. LifeBasis focuses on consumer-friendly cleaning solutions with integrated convenience features. UKOKE offers household cleaning appliances with emphasis on ease of use and reliable performance.

The ultrasonic jewelry cleaning machine market, valued at USD 393.4 million in 2025 and projected to reach USD 634.8 million by 2035 at a 4.9% CAGR, represents a mature consumer appliance segment focused on convenient home jewelry maintenance solutions. Dominated by home applications (65.0% market share) and small capacity units (<1L accounting for 55.0%), the market faces challenges including price sensitivity, limited consumer awareness of ultrasonic benefits, and the need for user education. Growth requires coordinated efforts across appliance manufacturers, retail channels, jewelry retailers, consumer education providers, and technology innovators.

How Governments Could Support Consumer Product Innovation and Market Access?

How Industry Associations Could Enhance Market Development and Consumer Trust?

How Manufacturers and Technology Developers Could Drive Innovation?

How Retailers and Distribution Channels Could Expand Market Reach?

How Investors and Financial Enablers Could Support Market Growth?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 393.4 million |

| Tank Capacity | Capacity: <1L, Capacity: 2-5L, Capacity: >10L |

| Application | Home, Commercial |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | BLITZ MANUFACTURING COMPANY, INC., EraClean, Gtsonic, FISA, LifeBasis, and UKOKE |

| Additional Attributes | Dollar sales by tank capacity and application category, regional demand trends, competitive landscape, technological advancements in ultrasonic cleaning systems, compact device innovation, smart feature integration, and supply chain optimization |

The global ultrasonic jewelry cleaning machine market is estimated to be valued at USD 393.4 million in 2025.

The market size for the ultrasonic jewelry cleaning machine market is projected to reach USD 634.8 million by 2035.

The ultrasonic jewelry cleaning machine market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in ultrasonic jewelry cleaning machine market are capacity: <1l, capacity: 2-5l and capacity: >10l.

In terms of application, home segment to command 65.0% share in the ultrasonic jewelry cleaning machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultrasonic NDT Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Air Bubble Detectors Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Pouch Sealers Market Analysis Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Electrosurgical Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Sensors Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Flaw Detector Market – Trends & Forecast 2025 to 2035

Ultrasonic Flowmeters Market Trends – Growth & Forecast 2025 to 2035

Ultrasonic Pulse Velocity Tester Market Growth – Trends & Forecast 2018-2027

Ultrasonic Surgical Cutters Market

Ultrasonic Diathermy Market

Ultrasonic Testing Market

Ultrasonic Technology Market

Ultrasonic Tissue Ablation System Market

Ultrasonic Flow Meter Market

Ultrasonic Dissection Devices Market

Ultrasonic Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Homogenizer Machines Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Cleaning Market Analysis - Size, Growth, and Forecast 2025 to 2035

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dental Piezoelectric Ultrasonic Unit Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA