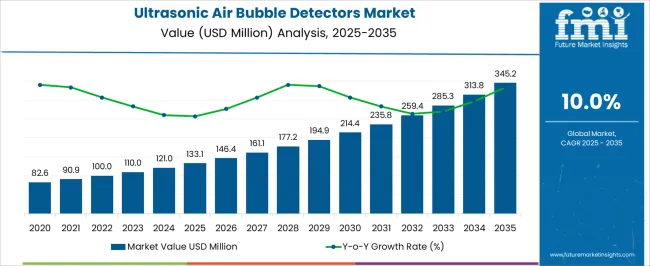

The ultrasonic air bubble detectors market is estimated to be valued at USD 133.1 million in 2025 and is projected to reach USD 345.2 million by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

The 10-year growth comparison shows values increasing from 133.1 million in 2025 to 177.2 million in 2028 and 214.4 million in 2030. This steep progression highlights expanding adoption across medical devices, pharmaceutical processing, and industrial fluid monitoring where precision detection is critical. Analysts argue that the curve underscores a decisive shift, as reliability and accuracy in fluid management systems are prioritized. The comparison reflects resilience and growing value within high-dependency applications.

By 2031, the industry is projected to reach 235.8 million, moving further to 285.3 million in 2033 and closing at 345.2 million by 2035. The 10-year curve shape indicates accelerating adoption, supported by investments in life sciences and diagnostic equipment where ultrasonic sensing plays a vital role. Market observers consider the trajectory as proof of the technology’s indispensability, given its ability to minimize operational risks in sensitive processes. The comparison illustrates how incremental adoption across healthcare, biotech, and industrial automation is shaping a solid long-term growth path, positioning ultrasonic air bubble detectors as an essential niche technology.

| Metric | Value |

|---|---|

| Ultrasonic Air Bubble Detectors Market Estimated Value in (2025 E) | USD 133.1 million |

| Ultrasonic Air Bubble Detectors Market Forecast Value in (2035 F) | USD 345.2 million |

| Forecast CAGR (2025 to 2035) | 10.0% |

The ultrasonic air bubble detectors segment is estimated to contribute nearly 9% of the medical devices market, about 12% of the patient monitoring equipment market, close to 10% of the ultrasonic sensors market, nearly 8% of the diagnostic imaging accessories market, and around 7% of the biotechnology and laboratory equipment market. Collectively, this amounts to an aggregated share of approximately 46% across its parent categories. This proportion highlights the vital role ultrasonic air bubble detectors play in ensuring patient safety and precision in both clinical and laboratory settings. Their application has been strongly tied to infusion pumps, dialysis systems, blood processing equipment, and various lab automation devices where uninterrupted fluid flow must be guaranteed. Analysts regard this segment not only as a supporting technology but as a decisive safeguard that influences the quality standards of medical and research equipment.

Demand has been driven by the need for accurate real-time monitoring and error prevention, which directly reduces risks during fluid administration and critical procedures. Their contribution has also extended into biotechnology, where consistent performance during sample handling and reagent mixing is paramount. The segment has been positioned as indispensable within its parent markets, since it not only enhances safety but also strengthens compliance with stringent healthcare regulations. As a result, ultrasonic air bubble detectors are seen as a crucial enabler in advancing clinical reliability and laboratory efficiency, reinforcing their lasting significance across interconnected parent sectors.

The market is experiencing steady growth, supported by the increasing demand for precise fluid monitoring across critical applications. The current market landscape is shaped by rising adoption in medical devices, industrial automation, and laboratory systems where the presence of air bubbles can compromise safety and performance.

Advancements in non-invasive ultrasonic sensing technology are enabling higher detection accuracy, faster response times, and greater compatibility with a variety of tubing materials and sizes. The shift toward preventive maintenance and quality assurance in fluid handling systems is further enhancing market penetration.

Future growth is expected to be driven by the integration of these detectors with intelligent control systems, allowing real-time analytics and automated responses As industries continue to prioritize operational reliability and patient safety, the market is positioned for sustained expansion, with innovation in sensor sensitivity, miniaturization, and IoT connectivity opening new application possibilities.

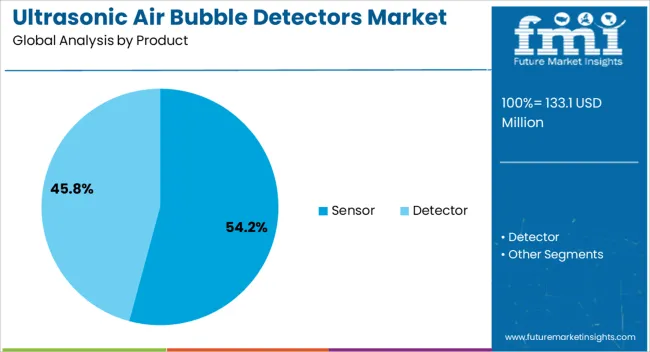

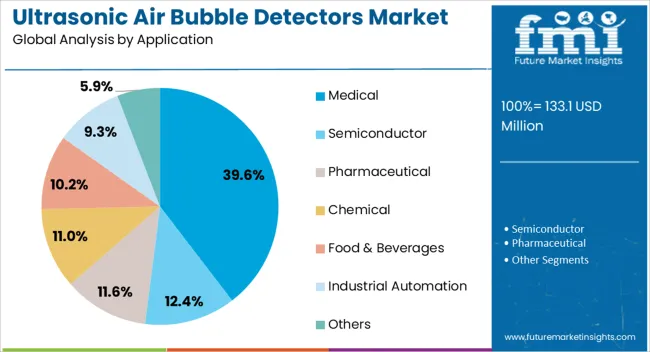

The ultrasonic air bubble detectors market is segmented by product, type, application, and geographic regions. By product, ultrasonic air bubble detectors market is divided into sensor and detector. In terms of type, ultrasonic air bubble detectors market is classified into fixed and adjustable. Based on application, ultrasonic air bubble detectors market is segmented into medical, semiconductor, pharmaceutical, chemical, food & beverages, industrial automation, and others. Regionally, the ultrasonic air bubble detectors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sensor product segment is projected to hold 54.2% of the overall ultrasonic air bubble detectors market revenue in 2025, making it the leading product category. This dominance is being attributed to the ability of sensors to deliver high accuracy in detecting even the smallest air bubbles without making direct contact with the fluid.

Their widespread adoption in both fixed and portable systems has been driven by their compatibility with various tubing materials and fluid types, making them suitable for critical environments where contamination risks must be minimized. The demand for sensor-based solutions has also been supported by the rising need for continuous, real-time monitoring to ensure system integrity.

As manufacturing and healthcare facilities adopt stricter safety protocols, sensor-based detectors are increasingly preferred due to their reliability, ease of integration, and capacity for advanced data output, which supports predictive maintenance and operational efficiency.

The fixed type segment is expected to capture 48.7% of the market revenue in 2025, establishing itself as the leading type. This position is being reinforced by the suitability of fixed detectors for continuous monitoring applications in medical, pharmaceutical, and industrial settings.

Fixed detectors provide consistent performance with minimal maintenance requirements, making them ideal for high-throughput processes where downtime must be minimized. Their robust construction and calibration stability have further enhanced adoption in environments with stringent quality control standards.

The capacity to integrate fixed detectors directly into automated systems has improved operational workflows and reduced the risk of undetected air bubbles in critical processes Growing investment in automated production lines and medical device manufacturing is anticipated to continue driving demand for fixed-type detectors, solidifying their position as a preferred choice for long-term, reliable monitoring.

The medical application segment is anticipated to hold 39.6% of the market revenue in 2025, making it the leading application category. This dominance is being driven by the increasing use of these detectors in infusion pumps, dialysis equipment, and other life-support systems where air bubble detection is essential for patient safety.

The rising prevalence of chronic diseases requiring long-term treatments and the expansion of home healthcare services have further supported adoption in the medical field. These detectors’ non-invasive design and high accuracy make them ideal for ensuring fluid delivery systems operate without interruption or risk.

Additionally, compliance with stringent healthcare safety regulations has compelled manufacturers to integrate air bubble detection into medical devices as a standard feature With the growing emphasis on patient care quality and the ongoing expansion of advanced medical device production, the medical application segment is expected to maintain its leading market position.

The ultrasonic air bubble detectors market is anticipated to expand steadily, driven by critical applications in medical devices, biotechnology, and industrial automation. Demand is reinforced by their role in ensuring fluid integrity in infusion pumps, dialysis machines, and blood processing systems. Opportunities are emerging in pharmaceutical manufacturing, semiconductor processes, and laboratory automation. Trends emphasize compact sensor design, enhanced accuracy, and integration with digital monitoring platforms. However, challenges such as high device costs, calibration complexities, and regulatory compliance requirements continue to restrict faster adoption across cost-sensitive and emerging markets.

Demand for ultrasonic air bubble detectors has been reinforced by their critical role in medical and biotechnology equipment. Infusion pumps, dialysis systems, and extracorporeal blood circulation devices rely on these detectors to prevent air embolism and ensure patient safety. Biotechnology laboratories also use them in liquid handling and bioprocessing equipment to maintain sample integrity. Opinions suggest that demand is strongest in advanced healthcare markets, where stringent safety standards mandate their use in high-risk fluid monitoring. Industrial users have also recognized their importance in applications such as semiconductor wet processes and chemical dispensing. With patient safety and process reliability being non-negotiable, ultrasonic air bubble detectors are viewed as indispensable components in healthcare and industrial systems, reinforcing their consistent demand base despite higher device costs compared to conventional sensors.

Opportunities in the ultrasonic air bubble detectors market are being shaped by pharmaceutical manufacturing, industrial automation, and semiconductor processing. Drug production facilities require precise monitoring of liquids during formulation and filling, creating consistent opportunities for sensor suppliers. Semiconductor manufacturers are also adopting these detectors to eliminate defects caused by trapped air in chemical baths and process liquids. Opinions highlight that opportunities are strongest when detectors are integrated into automated platforms, reducing manual oversight and improving system reliability. Growth in laboratory automation and microfluidic devices presents additional avenues for adoption. Expansion in emerging economies with rising healthcare investments is also unlocking fresh opportunities for suppliers. These factors indicate that beyond traditional medical applications, ultrasonic air bubble detectors are gaining relevance as essential instruments for precision-driven industrial and scientific processes.

Trends in the ultrasonic air bubble detectors market emphasize miniaturization, improved sensitivity, and integration with digital monitoring platforms. Compact designs are trending to support space-constrained medical devices and portable equipment. Enhanced detection accuracy, capable of identifying microbubbles, has become a key trend in advanced healthcare and bioprocessing applications. Opinions suggest that integration with IoT-enabled systems for real-time monitoring and predictive maintenance is gaining visibility, particularly in pharmaceutical and industrial automation. Wireless connectivity features are also trending, allowing remote monitoring and reducing downtime. Another visible trend is the adoption of customized detectors tailored for specific equipment manufacturers, strengthening supplier relationships. Collectively, these trends illustrate a transition from standalone sensors to integrated, intelligent monitoring solutions, highlighting how ultrasonic air bubble detectors are evolving to meet diverse performance and connectivity requirements.

Challenges in the ultrasonic air bubble detectors market include high device costs, calibration complexities, and regulatory barriers. The expense of advanced ultrasonic detectors limits adoption in cost-sensitive healthcare and industrial markets, where cheaper alternatives are often preferred. Calibration and maintenance requirements add complexity, particularly in high-precision applications where accuracy is critical. Opinions emphasize that compliance with stringent healthcare and industrial regulations prolongs approval timelines, restricting rapid commercialization. Supply chain disruptions in sensor components have further delayed production and deployment. Smaller manufacturers face competitive disadvantages due to the high cost of meeting certification requirements. These structural hurdles underscore that while ultrasonic air bubble detectors offer irreplaceable safety and accuracy benefits, widespread adoption will require cost optimization, streamlined compliance, and greater awareness of their long-term operational advantages.

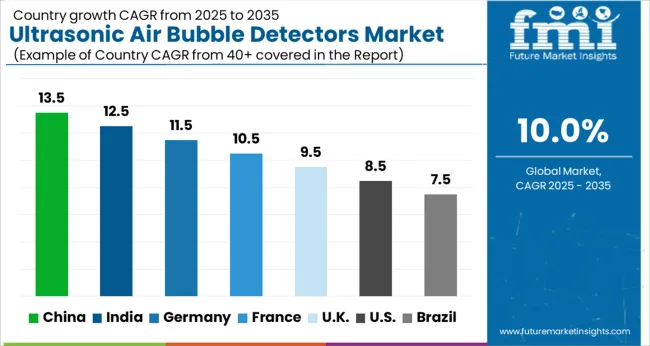

| Countries | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| U.K. | 9.5% |

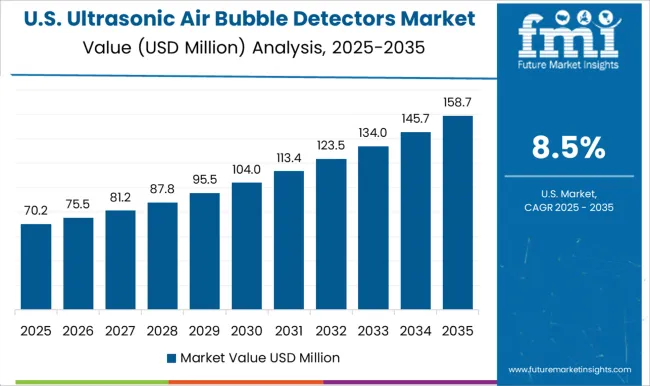

| U.S. | 8.5% |

| Brazil | 7.5% |

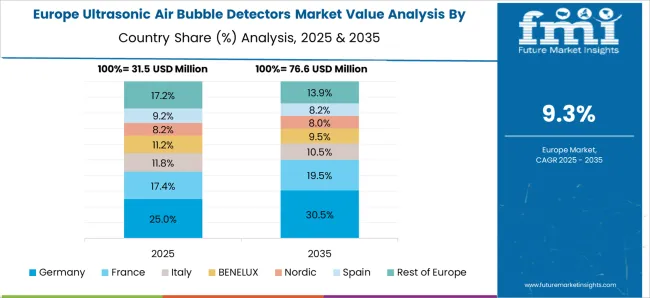

The global ultrasonic air bubble detectors market is projected to grow at a CAGR of 10% from 2025 to 2035. China leads with 13.5%, followed by India at 12.5% and Germany at 11.5%. The United Kingdom is forecast to grow at 9.5%, while the United States trails at 8.5%. Growth is driven by adoption in medical devices, bioprocessing, pharmaceutical manufacturing, and industrial automation where precision fluid monitoring is critical. Asia records stronger growth due to expanding healthcare infrastructure and domestic equipment production, while European countries emphasize compliance with safety standards and advanced R&D. The U.S. market, though slower, remains important in specialized clinical and industrial applications, supported by steady innovation and regulatory approvals. This report includes insights on 40+ countries; the top markets are highlighted here for reference.

The ultrasonic air bubble detectors market in China is projected to expand at a CAGR of 13.5%. Growth is supported by large scale investment in healthcare systems, rising use of infusion pumps, and expansion of biopharmaceutical manufacturing. Domestic producers scale up to meet demand across hospitals and life sciences laboratories. Government policies favoring local medical device manufacturing further accelerate adoption. With increasing exports of low cost detectors, China consolidates its role as a global supplier while strengthening internal healthcare delivery systems.

The ultrasonic air bubble detectors market in India is expected to grow at a CAGR of 12.5%. Expansion is fueled by growth in healthcare facilities, dialysis centers, and broader adoption of infusion therapy. Rising demand for quality monitoring in pharmaceutical and bioprocessing industries also reinforces adoption. Domestic startups and multinational collaborations provide access to advanced technologies and cost efficient devices. With government healthcare initiatives expanding patient access, India is becoming one of the most dynamic markets for ultrasonic air bubble detectors in Asia.

The ultrasonic air bubble detectors market in Germany is projected to grow at a CAGR of 11.5%. Growth is supported by strong R&D in medical technology, strict regulatory frameworks, and emphasis on reliability in clinical applications. German hospitals and biopharmaceutical manufacturers prioritize high precision fluid monitoring systems for patient safety and process optimization. Local engineering companies focus on high end detectors that comply with EU standards, enhancing the market’s reputation for quality. Germany’s central role in Europe ensures demand across healthcare and industrial automation sectors.

The ultrasonic air bubble detectors market in the UK is forecast to grow at a CAGR of 9.5%. Growth is supported by adoption in healthcare, pharmaceutical, and biotechnology facilities. Hospitals rely on detectors integrated into infusion systems to ensure patient safety, while biopharma companies adopt them for process integrity. Import reliance continues, with distributors supplying devices from global manufacturers. The UK’s strong focus on quality standards ensures steady adoption, though growth remains moderate compared to Asia and continental Europe.

The ultrasonic air bubble detectors market in the US is projected to grow at a CAGR of 8.5%. Expansion is steady, reflecting a mature healthcare system but sustained by continuous demand from hospitals, infusion therapy providers, and biotech companies. Strong regulatory oversight encourages use of high precision detectors for patient safety. U.S. firms focus on innovation, developing compact, wireless, and AI integrated detectors to differentiate in the market. While growth is slower compared to Asia, the U.S. remains an important hub for high end, research driven solutions in ultrasonic detection.

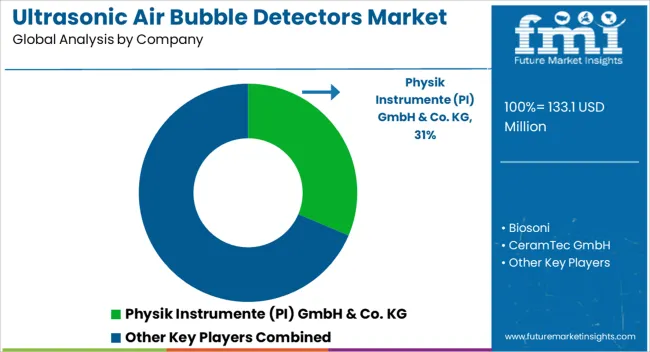

Competition in ultrasonic air bubble detectors has been structured around how product brochures convert technical sensitivity into practical assurance. Introtek International and Strain Measurement Devices present brochures that emphasize medical and biopharma safety, highlighting non-invasive bubble detection with high accuracy across tubing sizes. Physik Instrumente and CeramTec showcase brochures that stress piezoelectric expertise, precision transducers, and modular sensor integration for industrial automation. Moog Inc. leverages its aerospace credibility, presenting brochures that underline rugged designs, continuous monitoring, and fail-safe performance. PendoTECH focuses brochures on single-use bioprocessing, stressing clamp-on sensor designs, calibration simplicity, and GMP compliance.

Piezo Technologies and Sensaras frame brochures around advanced piezo materials and compact detectors, highlighting sensitivity and low false alarm rates. Shenzhen Dianyingpu Technology and Siansonic compete with cost-efficient brochures that stress OEM customization, quick delivery, and integration flexibility. Biosoni positions brochures on diagnostic-grade sensitivity for laboratory systems. Strategy across the market has been simple: present brochures as technical proof rather than promotional gloss. Buyers compare parameters such as detection sensitivity in microliter ranges, clamp compatibility, sterilization tolerance, and electronic integration formats. Brochures often display line drawings, sensitivity charts, and compliance statements (ISO, CE, FDA) that shorten qualification cycles.

Advantage is secured when brochures clearly map application fit, from dialysis machines to bioreactors, without requiring secondary documentation. Competition is less about brand familiarity and more about credibility in brochures that translate microbubble detection into quantified safety outcomes. The decisive edge comes from literature that demonstrates reliability in critical environments, where any undetected air bubble could mean costly downtime or compromised patient safety. In this market, the brochure itself functions as the battlefield where companies win trust by presenting precision data in clear, verifiable form.

| Item | Value |

|---|---|

| Quantitative Units | USD 133.1 million |

| Product | Sensor and Detector |

| Type | Fixed and Adjustable |

| Application | Medical, Semiconductor, Pharmaceutical, Chemical, Food & Beverages, Industrial Automation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Physik Instrumente (PI) GmbH & Co. KG, Biosoni, CeramTec GmbH, Introtek International LP, Moog Inc, PendoTECH, Piezo Technologies, Sensaras LLC, Shenzhen Dianyingpu Technology Co., Ltd., Siansonic, and Strain Measurement Devices |

| Additional Attributes | Dollar sales by product type (non-invasive clamp-on, inline, benchtop), Dollar sales by application (medical devices, bioprocessing, industrial automation, pharmaceuticals), Trends in demand for real-time fluid monitoring and precision flow control, Role of detectors in ensuring patient safety and protecting equipment, Growth in usage within dialysis machines, infusion pumps, and bioreactors, Regional adoption patterns across North America, Europe, and Asia Pacific. |

The global ultrasonic air bubble detectors market is estimated to be valued at USD 133.1 million in 2025.

The market size for the ultrasonic air bubble detectors market is projected to reach USD 345.2 million by 2035.

The ultrasonic air bubble detectors market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in ultrasonic air bubble detectors market are sensor and detector.

In terms of type, fixed segment to command 48.7% share in the ultrasonic air bubble detectors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultrasonic Jewelry Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic NDT Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Pouch Sealers Market Analysis Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Electrosurgical Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Sensors Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Homogenizer Machines Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Cleaning Market Analysis - Size, Growth, and Forecast 2025 to 2035

Ultrasonic Flaw Detector Market – Trends & Forecast 2025 to 2035

Ultrasonic Flowmeters Market Trends – Growth & Forecast 2025 to 2035

Ultrasonic Pulse Velocity Tester Market Growth – Trends & Forecast 2018-2027

Ultrasonic Surgical Cutters Market

Ultrasonic Diathermy Market

Ultrasonic Testing Market

Ultrasonic Technology Market

Ultrasonic Tissue Ablation System Market

Ultrasonic Flow Meter Market

Ultrasonic Dissection Devices Market

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dental Piezoelectric Ultrasonic Unit Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA