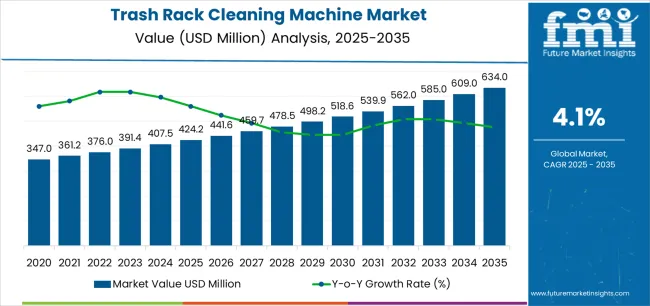

The global trash rack cleaning machine market is projected to reach USD 634.0 million by 2035, recording an absolute increase of USD 209.8 million over the forecast period. The market is valued at USD 424.2 million in 2025 and is set to rise at a CAGR of 4.1% during the assessment period. The overall market size is expected to grow by nearly 1.5 times during the same period, supported by increasing demand for automated water intake systems worldwide, driving demand for efficient debris removal solutions and increasing investments in hydropower modernization and water treatment infrastructure projects globally. However, high initial capital costs and maintenance complexity may pose challenges to market expansion.

Between 2025 and 2030, the trash rack cleaning machine market is projected to expand from USD 424.2 million to USD 518.6 million, resulting in a value increase of USD 94.4 million, which represents 45.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for hydropower efficiency optimization and automated water intake operations, product innovation in remote monitoring systems and intelligent cleaning algorithms, as well as expanding integration with renewable energy infrastructure and municipal water treatment facilities. Companies are establishing competitive positions through investment in advanced hydraulic control technologies, corrosion-resistant material solutions, and strategic market expansion across hydroelectric installations, pumping stations, and industrial water intake applications.

From 2030 to 2035, the market is forecast to grow from USD 518.6 million to USD 634.0 million, adding another USD 115.4 million, which constitutes 55.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized cleaning systems, including predictive maintenance-enabled machines and IoT-integrated debris monitoring solutions tailored for specific site requirements, strategic collaborations between equipment manufacturers and hydropower operators, and an enhanced focus on operational reliability and energy efficiency optimization. The growing emphasis on renewable energy maximization and water infrastructure resilience will drive demand for advanced, high-performance trash rack cleaning solutions across diverse water intake applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 424.2 million |

| Market Forecast Value (2035) | USD 634.0 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The trash rack cleaning machine market grows by enabling hydropower operators and water utility managers to achieve superior intake efficiency and operational reliability while reducing manual intervention and safety risks. Power generation facilities face mounting pressure to maximize turbine availability and prevent debris-related shutdowns, with automated trash rack cleaning systems typically providing 95-98% uptime improvement over manual cleaning methods, making mechanized debris removal essential for continuous operation economics. The renewable energy expansion movement's need for hydropower optimization creates demand for advanced cleaning solutions that can handle varying debris loads, operate in harsh conditions, and ensure consistent water flow to turbines across diverse hydrological environments.

Government initiatives promoting renewable energy capacity additions and aging infrastructure modernization drive adoption in hydro power plants, pumping stations, and water treatment facilities, where intake protection has a direct impact on generation efficiency and equipment longevity. The global shift toward automated infrastructure operations and remote facility management accelerates trash rack cleaning machine demand as operators seek alternatives to manual cleaning that creates safety hazards and operational inefficiencies. However, high capital investment requirements and specialized installation expertise may limit adoption rates among small-scale hydropower facilities and regions with budget-constrained water utility operations.

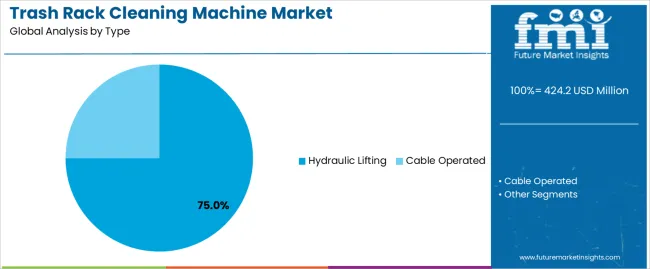

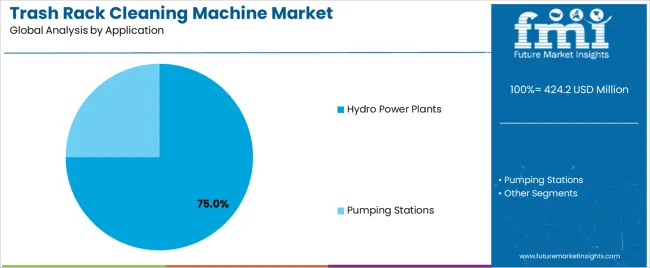

The market is segmented by type, application, and region. By type, the market is divided into Hydraulic Lifting and Cable Operated. Based on application, the market is categorized into Hydro Power Plants and Pumping Stations. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

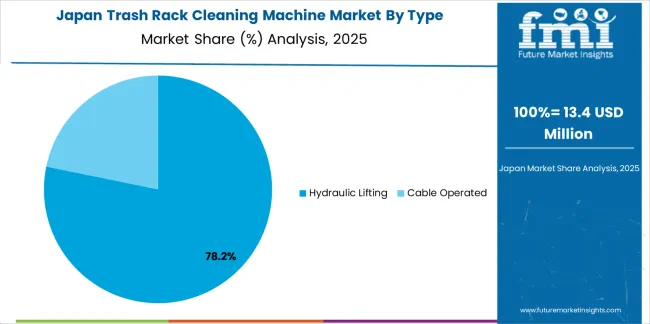

The hydraulic lifting segment represents the dominant force in the trash rack cleaning machine market, capturing approximately 75.0% of total market share in 2025. This advanced category encompasses systems featuring hydraulic power units with precise lifting control, delivering comprehensive debris removal capabilities with enhanced operational reliability for demanding water intake applications. The Hydraulic Lifting segment's market leadership stems from its exceptional cleaning efficiency, automated operation capabilities, and compatibility with large-scale hydropower installations that prioritize continuous availability and minimal operator intervention.

The cable operated segment maintains a substantial 25.0% market share, serving facilities that require cost-effective cleaning solutions through mechanical cable-drive systems for smaller hydropower plants, irrigation pumping stations, and industrial water intake structures where moderate debris loads justify simpler technology approaches.

Key advantages driving the Hydraulic Lifting segment include:

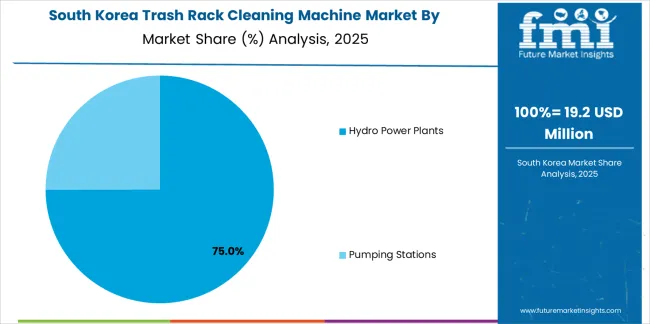

Hydro power plants applications dominate the trash rack cleaning machine market with approximately 75.0% market share in 2025, reflecting the critical role of automated debris removal in maintaining turbine efficiency and preventing costly generation outages throughout hydroelectric operations. The Hydro Power Plants segment's market leadership is reinforced by widespread adoption across run-of-river facilities, reservoir-based installations, and pumped storage projects, which provide essential intake protection suitable for maximizing generation capacity and equipment reliability.

The Pumping Stations segment represents 25.0% market share through applications including municipal water supply intakes, irrigation system pump houses, and industrial process water facilities requiring reliable debris screening protection. This segment benefits from growing water infrastructure modernization programs and increasing emphasis on operational automation in water utility operations.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to operational efficiency and renewable energy development. First, hydropower capacity expansion creates increasing requirements for reliable intake protection systems, with global hydroelectric additions averaging 20-30 GW annually across emerging markets, requiring automated trash rack cleaning infrastructure for optimal turbine availability and generation economics. Second, existing facility modernization accelerates adoption of mechanized cleaning equipment, with aging manual systems being replaced to improve worker safety and reduce maintenance costs by 40-60% while ensuring consistent debris removal performance. Third, water treatment plant capacity increases drive pumping station equipment upgrades, with automated cleaning systems enabling unmanned operation and remote monitoring supporting 24/7 water supply reliability in growing metropolitan areas.

Market restraints include high upfront capital investment requirements affecting project economics, particularly for small hydropower installations where equipment costs can represent 5-8% of total plant investment compared to 1-2% for large facilities with economies of scale. Technical complexity regarding site-specific customization creates implementation challenges, as trash rack geometries, debris characteristics, and flow conditions vary significantly requiring engineering design and specialized installation capabilities. Maintenance expertise limitations pose operational barriers in remote locations and developing markets where skilled hydraulic technicians and replacement component availability may constrain system reliability over multi-decade service lifetimes.

Key trends indicate accelerated adoption of IoT-enabled monitoring systems, with sensor integration providing real-time debris accumulation data enabling predictive cleaning cycles that optimize energy consumption while preventing intake blockage events. Technology advancement trends toward corrosion-resistant materials including duplex stainless steel and specialized coatings extend equipment service life in aggressive water chemistry environments, reducing lifecycle costs and improving long-term reliability. However, the market thesis could face disruption if alternative screening technologies including traveling water screens or passive fine-mesh systems prove more cost-effective for certain applications, or if climate change impacts alter seasonal debris patterns requiring fundamentally different intake protection approaches beyond conventional trash rack cleaning methodologies.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| USA | 3.9% |

| UK | 3.5% |

| Japan | 3.1% |

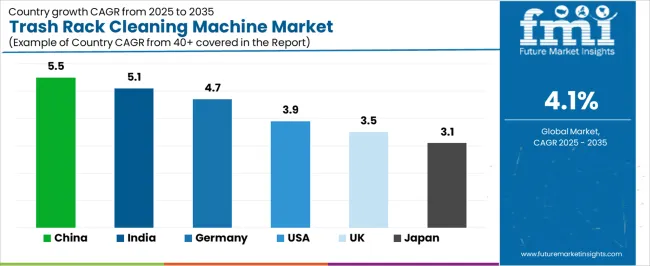

The trash rack cleaning machine market is gaining momentum worldwide, with China taking the lead due to aggressive hydropower expansion and water infrastructure modernization programs. Close behind, India benefits from renewable energy targets and irrigation system upgrades, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where hydropower refurbishment projects and environmental compliance requirements strengthen its role in European water infrastructure supply chains. The USA demonstrates robust growth through aging dam modernization and pumping station automation initiatives, signaling continued investment in water intake protection systems. Meanwhile, the UK stands out for its water utility modernization and hydropower optimization programs, while Japan continues to record steady progress driven by infrastructure resilience enhancement and automation technology integration. Together, China and India anchor the global expansion story, while established markets build stability and innovation into the market's growth path.

The report covers an in-depth analysis of 40+ countries, with op-performing countries are highlighted below.

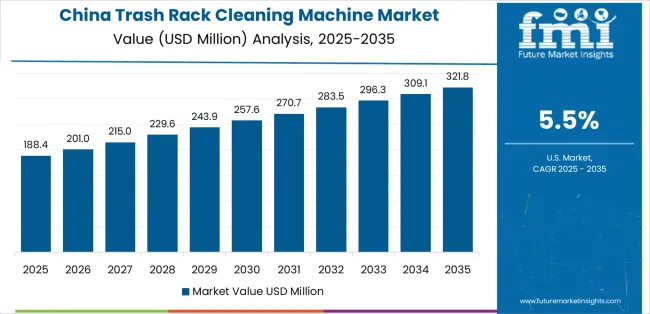

China demonstrates the strongest growth potential in the Trash Rack Cleaning Machine Market with a CAGR of 5.5% through 2035. The country's leadership position stems from comprehensive hydropower capacity expansion, intensive water infrastructure development, and aggressive renewable energy targets driving adoption of automated intake protection systems. Growth is concentrated in major hydropower regions, including Sichuan, Yunnan, Hubei, and Guangxi, where run-of-river installations, cascade developments, and pumped storage facilities are implementing mechanized cleaning programs for operational efficiency and equipment protection. Distribution channels through hydropower engineering companies, equipment installation contractors, and direct utility relationships expand deployment across renewable energy projects and municipal water supply infrastructure. The country's 14th Five-Year Plan provides policy support for clean energy development, including investments in hydropower modernization and pumping station automation.

Key market factors:

In major river basins, irrigation command areas, and hydropower zones, the adoption of trash rack cleaning systems is accelerating across small hydropower projects, lift irrigation schemes, and water treatment plants, driven by renewable energy expansion and agricultural modernization initiatives. The market demonstrates strong growth momentum with a CAGR of 5.1% through 2035, linked to comprehensive renewable energy development and increasing focus on water infrastructure reliability solutions. Indian operators are implementing automated cleaning programs and remote monitoring systems to improve facility availability while meeting generation targets across domestic hydropower expansion and irrigation modernization programs. The country's National Hydropower Policy creates sustained demand for intake protection equipment, while growing emphasis on unmanned operations drives adoption of mechanized systems replacing labor-intensive manual cleaning.

Advanced hydropower sector in Germany demonstrates sophisticated implementation of trash rack cleaning systems, with documented case studies showing integration of automated equipment achieving 99% turbine availability through optimized debris management protocols. The country's water infrastructure in major river basins, including Rhine, Danube, Elbe, and Weser watersheds, showcases integration of premium cleaning technologies with existing hydroelectric facilities, leveraging expertise in hydraulic engineering and precision manufacturing. German operators emphasize environmental compliance and operational efficiency, creating demand for reliable cleaning systems that support fish protection requirements and ecological flow regulations while maintaining generation economics. The market maintains strong growth through focus on facility modernization and environmental stewardship, with a CAGR of 4.7% through 2035.

Key development areas:

The USA market leads in hydropower fleet modernization based on integration of automated cleaning equipment with aging dam infrastructure supporting improved generation economics and safety compliance. The country shows solid potential with a CAGR of 3.9% through 2035, driven by infrastructure rehabilitation funding and increasing emphasis on renewable energy optimization across major hydropower regions, including the Pacific Northwest, Southeast river systems, and Great Lakes watersheds. American utilities are adopting modern trash rack cleaning systems for compliance with FERC relicensing requirements and operational efficiency mandates, particularly in run-of-river facilities requiring continuous debris removal and in pumped storage projects demanding intake reliability. Distribution channels through specialized hydropower contractors, equipment distributors, and engineering firms expand coverage across diverse water intake applications.

Leading market segments:

The UK's trash rack cleaning machine market demonstrates mature implementation focused on water utility operations and small hydropower optimization, with documented integration achieving improved intake reliability and reduced maintenance intervals through automated cleaning protocols. The country maintains steady growth momentum with a CAGR of 3.5% through 2035, driven by water company asset management programs and renewable energy development supporting operational excellence. Major water supply regions, including Thames Valley, Northwest England, and Scotland, showcase advanced cleaning equipment applications where systems integrate with existing pumping station infrastructure and river abstraction facilities aligned with environmental abstraction licenses and drought resilience planning.

Key market characteristics:

Trash rack cleaning machine market in Japan demonstrates sophisticated implementation focused on hydropower reliability and water infrastructure resilience, with documented integration of advanced control systems achieving precise cleaning cycle optimization for varying seasonal debris conditions. The country maintains steady growth momentum with a CAGR of 3.1% through 2035, driven by infrastructure modernization priorities and emphasis on unmanned facility operations supporting operational cost reduction. Major hydropower regions, including Chubu, Tohoku, and Hokkaido, showcase advanced deployment of hydraulic cleaning equipment with remote monitoring capabilities that integrate seamlessly with existing plant control systems and automated operation protocols.

Key market characteristics:

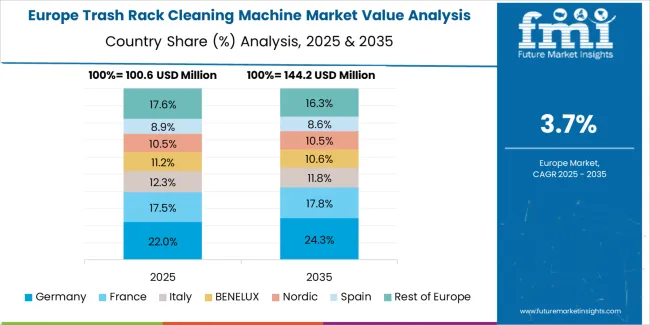

The trash rack cleaning machine market in Europe is projected to grow from USD 112.8 million in 2025 to USD 166.5 million by 2035, registering a CAGR of 4.0% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 28.2% by 2035, supported by its extensive hydropower infrastructure and major river basin installations, including Rhine, Danube, and Elbe watershed facilities.

The United Kingdom follows with a 16.3% share in 2025, projected to reach 16.0% by 2035, driven by comprehensive water utility modernization programs and small hydropower development implementing automated intake protection standards. France holds a 14.8% share in 2025, expected to rise to 15.0% by 2035 through ongoing Alpine hydropower refurbishment and pumping station automation.

Italy commands a 12.2% share in both 2025 and 2035, backed by northern Italy hydroelectric operations and water infrastructure upgrades. Spain accounts for 10.5% in 2025, rising to 10.8% by 2035 on reservoir management modernization and irrigation pumping automation. Switzerland maintains 6.7% in 2025, reaching 6.9% by 2035 on hydropower optimization and environmental compliance investments. The Rest of Europe region is anticipated to hold 11.0% in 2025, expanding to 11.4% by 2035, attributed to increasing adoption in Nordic hydropower facilities and emerging Balkan hydroelectric development programs.

The Japanese trash rack cleaning machine market demonstrates a mature and reliability-focused landscape, characterized by sophisticated integration of automated hydraulic systems with existing hydropower plant infrastructure across major river basins and water supply facilities. Japan's emphasis on operational continuity and disaster resilience drives demand for robust cleaning equipment that supports unmanned facility operations and remote monitoring commitments in mountainous hydropower regions.

The market benefits from strong partnerships between international equipment suppliers and domestic engineering companies including major trading houses, creating comprehensive service ecosystems that prioritize earthquake-resistant design and typhoon-proof construction standards. Hydropower installations in Chubu, Tohoku, Hokkaido, and other major regions showcase advanced cleaning implementations where equipment programs achieve 99.5% availability through predictive maintenance protocols and redundant hydraulic system configurations.

The South Korean trash rack cleaning machine market is characterized by growing international equipment supplier presence, with companies maintaining significant positions through comprehensive technical services and automation capabilities for hydropower facilities and pumping station applications. The market demonstrates increasing emphasis on smart monitoring systems and predictive maintenance platforms, as Korean utilities increasingly demand advanced cleaning equipment that integrates with domestic SCADA infrastructure and sophisticated facility management systems deployed across major hydroelectric complexes and water treatment plants.

Regional engineering companies are gaining market share through strategic partnerships with international equipment manufacturers, offering specialized services including Korean regulatory compliance support and customized hydraulic system design programs for demanding site conditions. The competitive landscape shows increasing collaboration between multinational equipment companies and Korean automation specialists, creating hybrid service models that combine international hydraulic technology expertise with local installation capabilities and operational support networks.

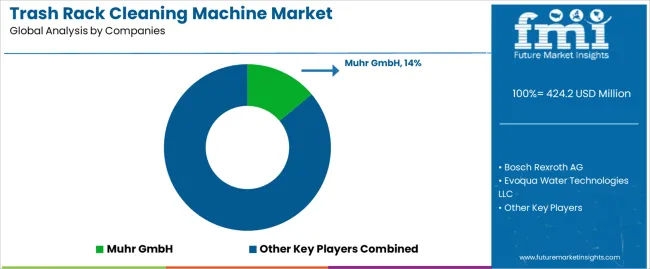

The trash rack cleaning machine market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 35-40% of global market share through established engineering capabilities and proven installation track records. Competition centers on system reliability, site-specific customization expertise, and after-sales service quality rather than price competition alone. Muhr GmbH leads with approximately 14% market share through its comprehensive trash rack cleaning equipment portfolio serving global hydropower markets.

Market leaders include Muhr GmbH, Bosch Rexroth AG, and Evoqua Water Technologies LLC, which maintain competitive advantages through decades of hydraulic system engineering experience, global project execution capabilities providing installation expertise across diverse site conditions, and comprehensive service networks ensuring spare parts availability and maintenance support throughout equipment lifecycles, creating reliability and performance advantages with hydropower operators and water utilities. These companies leverage research and development capabilities in automation technology and ongoing technical support relationships to defend market positions while expanding into IoT integration and predictive maintenance innovations.

Challengers encompass FRIULAIR S.R.L. and Jash Engineering Ltd., which compete through specialized equipment designs and strong regional presence in key hydropower markets. Product specialists focus on specific system types or application segments, offering differentiated capabilities in custom engineering, extreme condition designs, and niche market expertise.

Regional players and emerging automation technology providers create competitive pressure through localized engineering advantages and rapid response capabilities, particularly in high-growth markets including China and India, where proximity to hydropower development zones provides advantages in site assessment costs and commissioning support. Market dynamics favor companies that combine proven hydraulic system reliability with comprehensive project execution capabilities including civil integration expertise, electrical control system design, and long-term maintenance agreements that address complete facility lifecycle requirements across hydropower generation and water intake protection operations.

Trash rack cleaning machines represent automated hydraulic systems that enable hydropower operators to achieve 95-98% turbine availability improvement compared to manual cleaning methods, delivering superior operational reliability and safety enhancement with proven debris removal performance in demanding water intake applications. With the market projected to grow from USD 424.2 million in 2025 to USD 634.0 million by 2035 at a 4.1% CAGR, these mechanized cleaning systems offer compelling advantages - operational efficiency, worker safety improvement, and generation maximization - making them essential for Hydro Power Plants applications (75.0% market share), Pumping Stations operations, and water infrastructure facilities seeking alternatives to manual debris removal that creates safety hazards and operational inefficiencies. Scaling market adoption and technology advancement requires coordinated action across hydropower policy, equipment standards, manufacturers, facility operators, and renewable energy investment capital.

| Item | Value |

|---|---|

| Quantitative Units | USD 424.2 million |

| Type | Hydraulic Lifting, Cable Operated |

| Application | Hydro Power Plants, Pumping Stations |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Muhr GmbH, Bosch Rexroth AG, Evoqua Water Technologies LLC, FRIULAIR S.R.L., Jash Engineering Ltd. |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with equipment manufacturers and installation networks, facility integration requirements and specifications, integration with hydropower modernization programs and water infrastructure initiatives, innovations in hydraulic technology and automation systems, and development of specialized cleaning equipment with enhanced reliability and remote monitoring capabilities. |

The global trash rack cleaning machine market is estimated to be valued at USD 424.2 million in 2025.

The market size for the trash rack cleaning machine market is projected to reach USD 634.0 million by 2035.

The trash rack cleaning machine market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in trash rack cleaning machine market are hydraulic lifting and cable operated.

In terms of application, hydro power plants segment to command 75.0% share in the trash rack cleaning machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trash Bag Market Size and Share Forecast Outlook 2025 to 2035

Trash Bag Industry Analysis in Europe Forecast Outlook 2025 to 2035

Trash Bag Market Leaders & Competitive Insights

Türkiye Trash Bag Market Trends & Growth Forecast 2024-2034

Trash Can Liner Market Growth – Trends & Forecast through 2034

Trash Can Market

Scented Trash Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Scented Trash Bags Companies

Rack And Pinion Market

Track Geometry Measurement System Market Size and Share Forecast Outlook 2025 to 2035

Fracking Fluids And Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Track and Trace Solutions Market Trends - Growth & Forecast 2025 to 2035

Track and Trace Packaging Market Report – Trends & Innovations 2025-2035

Market Share Breakdown of Track And Trace Packaging Manufacturers

Track Laying Equipment Market

Track Mounted Gangway Market

Eye Tracking System Market Forecast and Outlook 2025 to 2035

Flat Rack Containers Market Size and Share Forecast Outlook 2025 to 2035

Wine Racks Market Size and Share Forecast Outlook 2025 to 2035

GPS Tracker Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA