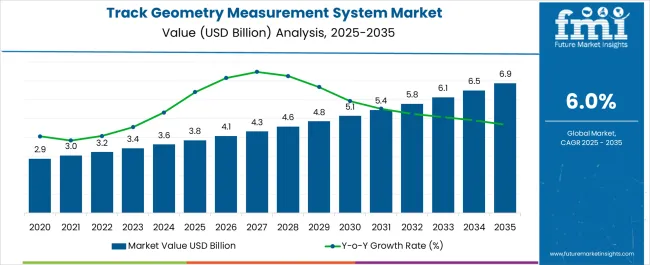

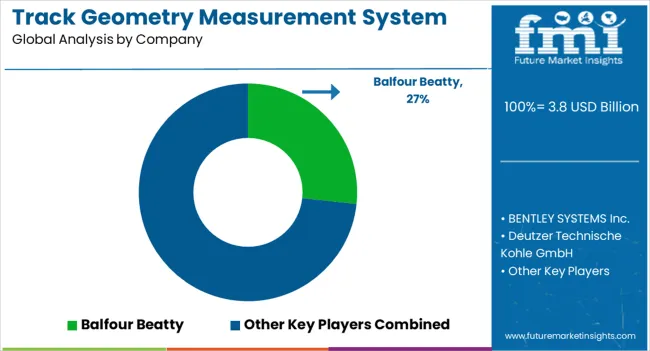

The Track Geometry Measurement System Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 6.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Track Geometry Measurement System Market Estimated Value in (2025 E) | USD 3.8 billion |

| Track Geometry Measurement System Market Forecast Value in (2035 F) | USD 6.9 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The track geometry measurement system market is expanding steadily as railway operators prioritize safety, efficiency, and modernization of rail infrastructure. Increasing investments in high speed rail projects, along with rising passenger and freight traffic, are driving the need for advanced monitoring systems capable of ensuring track integrity and minimizing operational risks.

Governments and railway authorities are focusing on predictive maintenance strategies, supported by digital technologies and automation, to reduce downtime and extend the lifecycle of assets. Technological advancements in sensors, imaging, and real time analytics are improving accuracy, enabling operators to identify potential issues before they escalate into failures.

The market outlook remains favorable as infrastructure upgrades, smart railway initiatives, and growing urbanization continue to accelerate adoption across both passenger and freight rail segments.

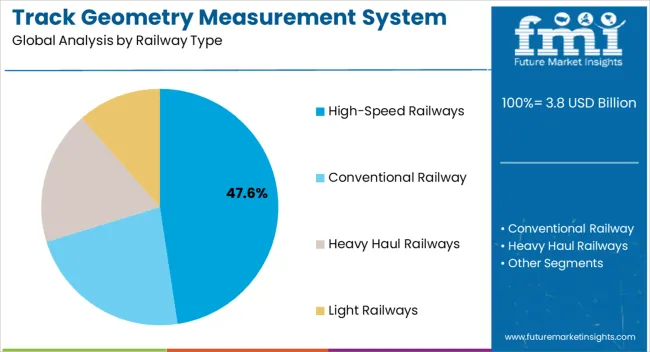

The high speed railways segment is projected to hold 47.60% of the total market revenue by 2025 within the railway type category, positioning it as the leading segment. This dominance is being driven by rising global investments in high speed rail networks and the critical requirement for advanced monitoring to maintain stringent safety standards.

With trains operating at significantly higher speeds, even minor deviations in track geometry can pose substantial risks, prompting the deployment of sophisticated measurement systems. Increased focus on passenger comfort, reduced maintenance costs, and regulatory compliance has further reinforced adoption.

As high speed rail continues to expand across developed and emerging economies, the segment’s share remains supported by its integral role in delivering safe and reliable operations.

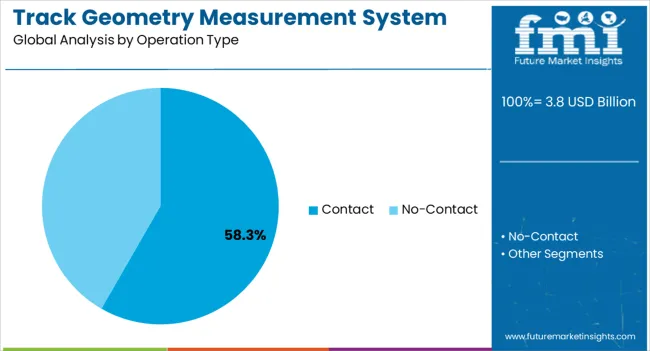

The contact operation type segment is expected to account for 58.30% of total revenue by 2025, establishing itself as the most prominent operation method. This is attributed to the proven reliability, cost effectiveness, and precision offered by contact based measurement systems.

Rail operators value the ability of these systems to provide consistent and accurate measurements under diverse track conditions. While non contact technologies are emerging, the familiarity, robustness, and established standards associated with contact methods have sustained their preference among railway authorities.

The segment’s continued leadership is supported by its balance of affordability, dependability, and wide scale deployment across both passenger and freight lines..

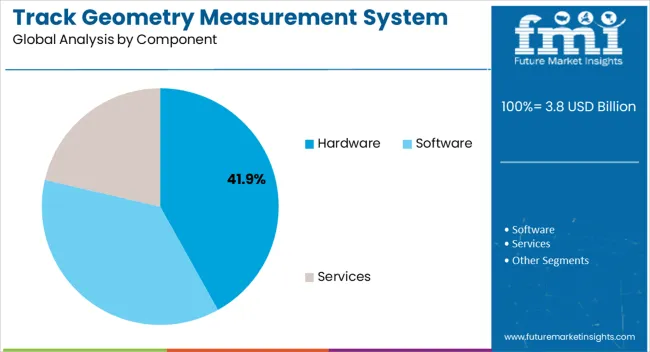

The hardware segment is projected to contribute 41.90% of the overall market revenue by 2025, making it the leading component category. This growth is driven by the reliance on specialized equipment including sensors, lasers, and imaging systems that form the backbone of track geometry measurement solutions.

Hardware investments are critical to ensuring accuracy, durability, and functionality in field applications. Continuous upgrades and integration of innovative devices have further enhanced system performance.

The need for ruggedized components capable of operating in varied climatic and geographic conditions has reinforced hardware’s importance. As operators continue to focus on deploying advanced systems, the hardware segment sustains its dominance as the essential enabler of reliable track monitoring.

According to the FMI analysis, the market for track geometry measurement systems garnered revenue of about USD 2.9 billion in 2020, with a CAGR of 7.1% from 2020 to 2025.

The outlook for the track geometry measurement system industry from 2025 to 2035 is projected to exhibit significant growth compared to the period from 2020 to 2025.

This anticipated growth can be attributed to several factors, including the increasing emphasis on railway safety and efficiency, the need to comply with evolving industry standards and regulations, and the rising demand for advanced maintenance planning tools.

Adopting TGMS solutions is expected to expand as railway authorities and operators recognize their crucial role in ensuring track safety and optimizing maintenance operations.

Technological advancements, such as integrating artificial intelligence and data analytics into TGMS systems, are likely to further drive market growth by enhancing measurement accuracy and efficiency.

Overall, the 2025 to 2035 timeframe presents a promising landscape for the market, with an anticipated growth rate of 6.9%, reaching USD 6.9 billion by 2035.

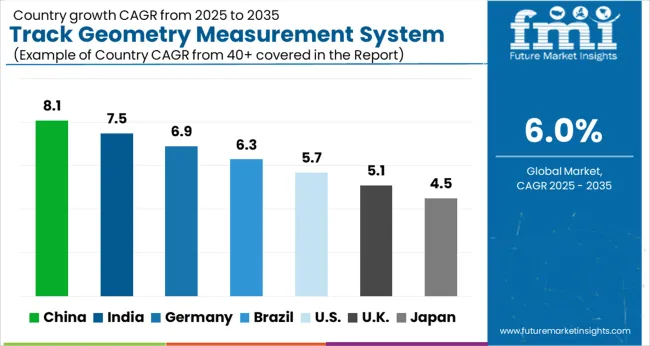

The China track geometry measurement system market is witnessing a surge in growth driven by several factors fostering the country's projected market size of USD 3.8 billion, growing at a 7.7% rate from 2025 to 2035.

The rapid expansion of China's extensive high-speed rail network, renowned for its extensive coverage, has created a strong demand for precise track measurements to ensure safety and operational efficiency.

The government's prioritization of railway infrastructure development and modernization initiatives has further fueled investments in TGMS solutions. Compliance with stringent safety standards and regulations has also led to an increased need for accurate track geometry measurements.

The integration of advanced technologies, including artificial intelligence and data analytics, has played a significant role in improving measurement accuracy and efficiency.

These factors collectively contribute to the surging growth of the China track geometry measurement system market, positioning it for continued expansion and innovation in the foreseeable future.

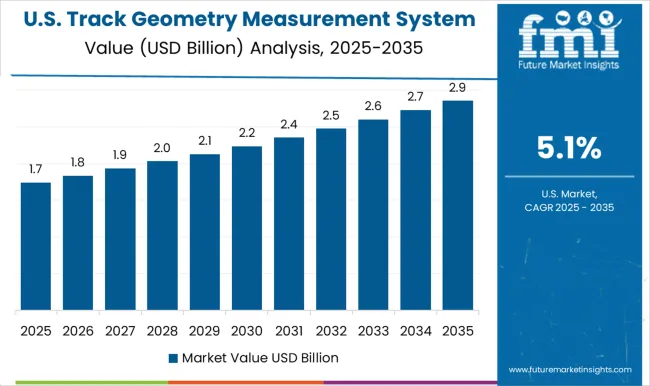

The growth outlook for the track geometry measurement system industry in the United States is highly favorable. With ongoing investments in railway infrastructure, the expansion of high-speed rail projects, and a strong emphasis on safety regulations, the demand for accurate track geometry measurements is increasing.

The integration of advanced technologies, such as artificial intelligence and data analytics, is driving improved measurement accuracy and efficiency in TGMS solutions.

The growing recognition of the benefits of proactive maintenance and the need to optimize operational performance are driving the adoption of TGMS in the United States, where the country is predicted to get hold of USD 6.9 million share by 2035 at 5.1% CAGR from 2025 to 2035.

The no-contact sub-segment is poised to experience significant growth of 6.2% during the forecasted period. The no-contact sub-segment is expected to be the top operation type in the track geometry measurement system industry as it offers higher measurement accuracy compared to contact-based methods.

By utilizing advanced technologies such as laser scanning and LiDAR, the no-contact approach can capture precise and detailed track geometry data, ensuring better assessment of track conditions.

The no-contact sub-segment minimizes the need for physical contact with the track, reducing wear and tear on both the measurement equipment and the track itself. This leads to lower maintenance costs and extends the lifespan of the infrastructure.

The no-contact approach improves safety by reducing the risks associated with personnel working directly on the tracks. Eliminating the need for workers to be present during measurements helps mitigate potential accidents or disruptions to rail operations.

The hardware sub-segment is poised to lead the industry by component in the track geometry measurement system industry as it plays a pivotal role in enabling accurate and reliable data collection for track geometry measurements.

As per the FMI study, this sub-segment is expected to secure a 6.1% CAGR from 2025 to 2035 owing to the advancements in sensor technologies, which have improved the precision and efficiency of these components, driving their prominence in the industry.

The growing demand for integrated TGMS solutions further emphasizes the need for robust and advanced hardware.

The hardware sub-segment benefits from a continuous market demand due to the periodic upgrades and replacements required for these components, ensuring its sustained leadership in the TGMS industry.

The track geometry measurement system industry exhibits a high level of competition, where market growth and expanding opportunities attract both established players and new entrants, leading to a diverse range of companies offering TGMS solutions.

Technological advancements and innovation play a crucial role in gaining a competitive edge, with companies striving to develop cutting-edge TGMS systems that offer improved accuracy, efficiency, and integration capabilities.

Customer preferences and requirements also drive competition as companies aim to meet evolving demands and provide tailored solutions.

Market players engage in extensive research and development efforts, strategic partnerships, and marketing initiatives to establish their position and differentiate themselves in this competitive landscape.

Recent Developments in the Market:

The global track geometry measurement system market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the track geometry measurement system market is projected to reach USD 6.9 billion by 2035.

The track geometry measurement system market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in track geometry measurement system market are high-speed railways, conventional railway, heavy haul railways and light railways.

In terms of operation type, contact segment to command 58.3% share in the track geometry measurement system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Track and Trace Solutions Market Trends - Growth & Forecast 2025 to 2035

Track and Trace Packaging Market Report – Trends & Innovations 2025-2035

Market Share Breakdown of Track And Trace Packaging Manufacturers

Track Laying Equipment Market

Track Mounted Gangway Market

GPS Tracker Market Growth – Trends & Forecast 2024-2034

Eye Tracking Solutions Market

Eye Tracking System Market Forecast and Outlook 2025 to 2035

Mini Track Machinery Market Size and Share Forecast Outlook 2025 to 2035

Sleep Tracking and Optimization Products Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Laser Trackers Market - Growth, Demand & Forecast 2025 to 2035

Solar Trackers Market Trends & Forecast 2025 to 2035

Tumor Tracking Systems Market

Rubber Track for Defense and Security Market Size and Share Forecast Outlook 2025 to 2035

Vessel Tracking Market Size and Share Forecast Outlook 2025 to 2035

Mobile Tracking Solution Market Size and Share Forecast Outlook 2025 to 2035

Stress Tracking Devices Market - Demand & Forecast 2025 to 2035

Facial Tracking Solution Market by Component, Technology Type, Industry & Region Forecast till 2035

NB-IoT Trackers Market Analysis – Growth & Industry Trends through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA