The trash bag industry in Europe is experiencing consistent demand growth, influenced by rising urban waste generation, evolving municipal waste management standards, and consumer preference for convenience in household waste disposal. Regulatory pressure to maintain hygiene and sanitation in residential, commercial, and industrial settings has led to widespread adoption of standardized trash bag solutions.

European Union directives aimed at improving waste segregation and reducing landfill dependency have driven demand for specific bag capacities and material types that align with local compliance requirements. While sustainability remains a central theme across packaging and waste products, the market continues to see significant traction in conventional non-degradable products due to cost-efficiency and higher tensile strength.

Retail channels and private label brands have diversified their offerings to meet varied end-user needs, supported by packaging innovations and scalable production. Moving forward, the market is expected to benefit from ongoing investments in domestic manufacturing, automation in bag conversion technology, and regional supply chain optimization, even as future shifts toward biodegradable alternatives gain policy and public backing.

sis

sis

| Metric | Value |

|---|---|

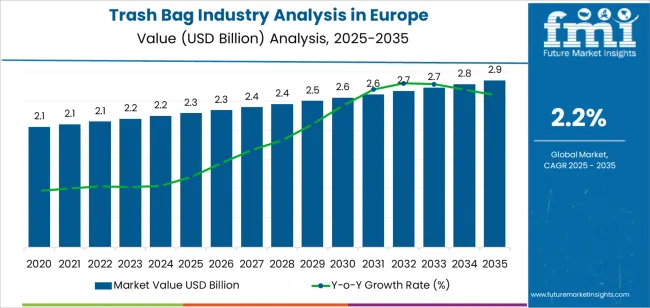

| Trash Bag Industry Analysis in Europe Estimated Value in (2025 E) | USD 2.3 billion |

| Trash Bag Industry Analysis in Europe Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 2.2% |

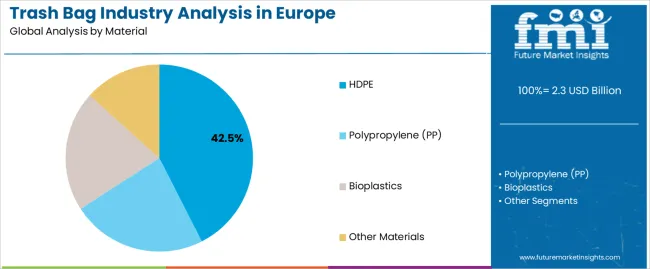

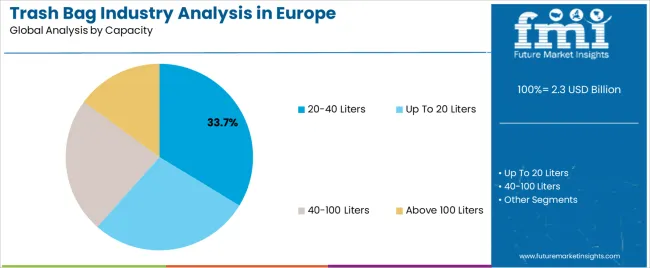

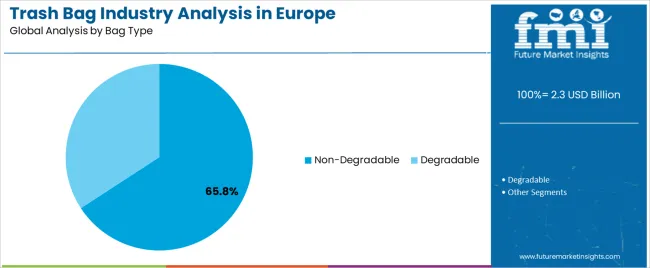

The market is segmented by Material, Capacity, Bag Type, Sales Channel, and End Use and region. By Material, the market is divided into HDPE, Polypropylene (PP), Bioplastics, and Other Materials. In terms of Capacity, the market is classified into 20‑40 Liters, Up To 20 Liters, 40‑100 Liters, and Above 100 Liters. Based on Bag Type, the market is segmented into Non‑Degradable and Degradable. By Sales Channel, the market is divided into Retail Sales, Manufacturer / Direct Sales, and E‑Commerce. By End Use, the market is segmented into Retail, Hotels, Restaurants & Cafes (HoReCa), Public‑Sector / Services, Building & Construction, Healthcare, and DIY / Household. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The HDPE segment is projected to contribute 42.50% of the trash bag industry revenue in Europe in 2025, establishing itself as the leading material category. This growth has been driven by HDPE’s favorable strength-to-weight ratio, flexibility, and superior puncture resistance, which make it ideal for a wide range of waste disposal applications.

Waste management providers and retailers have consistently favored HDPE for its balance of cost-effectiveness and performance in both commercial and residential settings. Additionally, its moisture barrier properties make it particularly suitable for containing wet and organic waste.

HDPE’s compatibility with automated bag production lines and its recyclability under current EU plastic directives have further strengthened its adoption. While there is rising consumer interest in compostable materials, HDPE remains the material of choice for applications requiring durability and volume efficiency, particularly in regions with established recycling systems.

The 20–40 Liters capacity segment is expected to account for 33.7% of the trash bag industry revenue in Europe in 2025, retaining its position as the most widely used capacity range. This segment’s dominance has been attributed to its widespread application in household, office, and small commercial environments.

Municipal waste programs across several European countries have standardized this range for daily household collection, supporting routine adoption across urban and suburban areas. Consumers have shown a preference for this size due to its balance between handling convenience and sufficient capacity for single-day or bi-daily waste disposal.

Retail packaging trends have supported this segment’s growth with multipack and drawstring variants targeting ease of use. With this capacity range aligning well with standard trash bins and disposal infrastructure, the 20–40 Liters segment is expected to remain central to both residential and institutional waste collection systems.

The Non-Degradable segment is projected to contribute 65.8% of the trash bag industry revenue in Europe in 2025, continuing its lead despite policy shifts toward eco-friendly alternatives. This dominance has been sustained by the cost competitiveness, mechanical durability, and moisture resistance offered by non-degradable materials such as HDPE and LDPE.

Commercial waste handlers and cleaning services have preferred non-degradable bags due to their ability to handle heavier loads, wet waste, and abrasive materials without failure. While EU regulations and public opinion are increasingly favoring biodegradable products, the availability and affordability of non-degradable trash bags remain key factors for mass adoption.

Additionally, existing recycling infrastructure across parts of Europe has been optimized to handle non-degradable plastic waste, reducing environmental backlash in regulated disposal streams. As long as durability and load-bearing performance are prioritized in everyday waste management, non-degradable bags are expected to retain majority market share in the near term.

The table below presents the expected CAGR for the Europe trash bags market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the business is predicted to grow at a CAGR of 2%, followed by a slightly higher growth rate of 2.3% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 2% (2025 to 2035) |

| H2 | 2.3% (2025 to 2035) |

| H1 | 2.1% (2025 to 2035) |

| H2 | 2.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 2.1% in the first half and remain relatively moderate at 2.5% in the second half. In the first half (H1), the market witnessed an increase of 10 BPS, while in the second half (H2), the market witnessed an increase of 20 BPS.

Technological Advancement Such as Antimicrobials in Trash Bags

Technological advancements and the growing, dynamic consumer demands are fueling the sales of the trash bags market. With the evolving trends, collaboration and partnerships amongst various stakeholders such as trash bag manufacturers, raw material suppliers, as well as end-user industries took a strategic initiative.

These include keeping the consumer demands in focus and developing an antimicrobial technology for trash bags that offers continuous product protection against bad odor, which may result in bacterial growth.

Antimicrobial technology or coating is a treatment infused with anti-microbial agents such as silver ions or specific compounds added to plastics that liquidate the growth of bacteria, making it useful for applications in the healthcare and food industry where hygiene is primarily focused.

The rise in demand for hygienic and odorless solutions boosted the demand for scented trash bags. Trash bag manufacturers and coating developers are forming strategic partnerships for innovating antimicrobial and scented linings and incorporating them within the bags.

For instance, In April 2025, Microban International and Berry Global underwent a strategic partnership and together launched a line of color scent scented bags that have built-in antimicrobial technology.

Government Recycling Programs to Boost Sales of Trash Bag Industry

Total waste generated in Europe is exceeding the average rate. This amount of waste generated in Europe gives rise to proper waste management systems for collection and disposal. Several local and national governments in Europe have designed and promoted integrated waste management systems to facilitate the collection, sorting, and recycling of waste.

Germany has effective waste management and recycling because of their effective sorting and waste management policies for trash disposal and collection. Europe has effectively implemented policies like the Deposit Refund Scheme, the Packaging Ordinance, the Closed Substance Cycle, and the Waste Management Act, that will create the demand for sturdy trash bags in the region.

Further, to gain active participation from the government, manufacturers designed specific labeled and colored trash bags for separate collections of waste materials such as paper, plastic, glass, and organic matter. These initiatives by various country's governments of Europe are expected to boost sales of the trash bags market.

Stringent Regulations May Hamper Industry Growth

The stringent rules and regulations applied by the various European countries for particular products of plastic bags, focusing on a circular economy by reducing waste, reusability of materials, and recycling existing products, may create challenges for the manufacturers in the trash bags market.

For instance, according to the paper bag organization, in Germany, retailers are not allowed to sell lightweight plastic carrier bags with thicknesses of 15 to 50 μm from the start of 2025. The government of Germany introduced a ban on single-use plastic to prohibit manufacturers from using and importing them. This has created an obstacle to market growth.

Imposition of such regulations by the European countries is pushing manufacturers to shift towards alternatives such as bio-based trash bags which at first may increase the production costs.

Bio-plastics are made from renewable materials such as corn, sugarcane, and starch that reduce the dependence on fossil fuels further promoting sustainable agriculture practices. Further, the rising demand from consumers for sustainable and eco-friendly solutions may create opportunities for manufacturers in the long run.

The trash bag industry in Europe recorded a CAGR of 0.4% during the historic period between 2020 and 2025. The positive demand trajectory for trash bags led to a gain of USD 2,206.6 million in 2025 from USD 2,173 million in 2020.

Manufacturers in Europe in the past decade manufactured trash bags made of plastics. The growing need and demand from consumers for sustainable and eco-friendly solutions created a demand for sustainable and eco-friendly trash bags in Europe.

Stringent regulations are imposed by the European Union and various countries of Europe, such as Germany, the United Kingdom, and others, to further push manufacturers within Europe to shift towards bio-degradable and compostable materials.

This shift towards bio-degradable and compostable materials is further creating opportunities for the trash bags market. Many manufacturers have started manufacturing bio-degradable trash bags in Europe, complying with various regulations followed by a reduction of carbon footprint and to fulfill growing demand from consumers for sustainable products.

For instance, Walki Plasbel offers compostable bags made of plant-based polymers that comply with the European standard EN13432 and are certified OK COMPOST seal by TUV Austria.

Many European countries have adopted and implemented various schemes for waste recycling, such as the ‘Deposit Refund Scheme’ and strategies like ‘Mandatory waste sorting policies’ to boost the market for trash bags.

The growth of e-commerce platforms expands market accessibility, while the tourism and hospitality sectors drive bulk purchases of trash bags in hotels and restaurants. Furthermore, heightened concerns regarding hygiene and sanitation amid public health crises prioritize reliable trash bags for safe waste disposal, amplifying market demand.

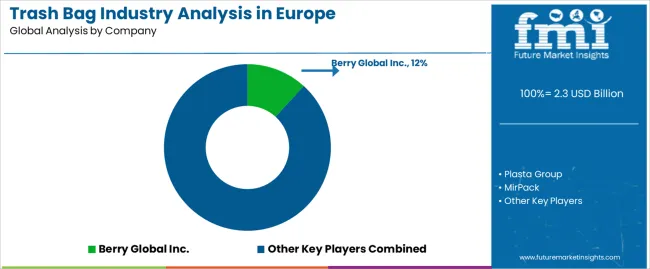

Tier 1 companies comprise market leaders with market revenue of above USD 30 million capturing a cumulative market share of 5% to 10% in the Europe market. These market leaders are characterized by maximum market share, high production capacity, strong brand recognition, and a wide product portfolio.

These market players are distinguished by their extensive expertise in manufacturing across multiple types of trash bags and a broad geographical reach not only in Europe but also worldwide presence, underpinned by a robust consumer base.

These companies are significantly investing in research and development activities for innovation. Prominent companies within Tier 1 include CEDO Ltd., Berry Global Inc., and Pack-It BV.

Tier 2 companies include mid-size players with revenue of USD 1 to 30 million, having a presence in specific regions and highly influencing the local market. These are characterized by a selected presence in specific countries, catering to selected trash bag products, moderate investment in research, and well-maintained market knowledge.

Prominent companies in tier 2 include Plasta Group, Novolex Holdings LLC, Sphere Group Polipak Sp. z o.o, Leedan Packaging Ltd, SIMPAC UK, Primax d.o.o., Dagoplast AS, and Novplasta, S.R.O.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 1 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the future forecast for the Europe trash bags market, specifically for European countries. Germany is anticipated to consume prominent trash bags, recording CAGRs of 1.5% through 2035. The United Kingdom is projected to reach a 7.4% value share by 2035 end.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Germany | 1.5% |

| United Kingdom | 2.4% |

| France | 2.6% |

| Italy | 1.6% |

| Benelux | 3.3% |

Germany has a large and well-developed healthcare industry, one of the largest in Europe. The industry is expected to continue growing in the coming years, driven by an aging population and increasing demand for medical services. This growth is likely to lead to an increased demand for trash bags, as hospitals and other healthcare facilities generate a large amount of medical waste.

Hospitals and other healthcare facilities in Germany are required to comply with strict regulations for the disposal of medical waste. This waste is typically segregated into different categories, such as infectious waste, hazardous waste, and sharps. Trash bags are used to collect and transport this waste safely.

There are a variety of trash bags available for medical waste, each designed to meet the specific needs of the type of waste being collected. For example, infectious waste bags are typically red in color and made of puncture-resistant material. Hazardous waste bags may be yellow or orange and have special labels to warn of the hazards of the contents.

German medical device market is approximately USD 42 billion annually i.e., 25% of the total European market. This growth in the healthcare industry gives rise to healthcare waste, which can be infectious to human health, boosting the demand for biohazard waste bags.

These biohazard waste bags are linear low-density liners with a sealed bottom, which protects the handler from the inside hazardous material.

Further anti-leakage and anti-pollution properties of the medical waste bags prevent the leakage and spread of medical waste boosting the sales of medical waste bags. The German trash bags market is expected to reach a market valuation of USD 518.1 million with a growing CAGR of 1.5% during the forecast period.

The United Kingdom’s construction industry is predicted to incline at a rapid pace.

The various activities of construction like renovation, new construction, and demolition of existing structures require handling and proper disposal of disused materials such as iron, bricks, wood, and old tiles, boosting the demand for big bulk bags that are also applicable and capable of collection, storage, and transportation of rubbles like rocks, cement, stones, and sands safely to the construction site and from construction sites to disposal grounds.

Heavy-duty trash bags are strong, durable, and capable of holding carrying tools. These trash bags are eco-friendly can be reused multiple times are predicted to fuel the sales of big bulk trash bags. The United Kingdom’s trash bags market is poised to gain an incremental opportunity worth USD 108.3 million with an expansion of 1.3 times the total market value during the forecast period.

The section contains information about the leading segments in the industry. Polyethylene trash bags are anticipated to hold a 45% market share by 2025 and are predicted to grow with a CAGR of 1.6% during the forecast period. DIY/ Households are expected to gain more than 25% share in 2025, reaching a valuation of USD 2.3 million in 2025.

| Segment | Retail Sales |

|---|---|

| Value Share (2035) | 71.2% |

A rising number of retail stores in Europe such as hypermarkets, supermarkets, and convenience stores, are contributing to the trash bag sales. Retail stores have established brands that provide reliable trash bags and competitive prices to attract consumers. Households require regular kitchen trash bags for waste management, which boosts the retail sales of kitchen trash bags.

Retail sales of trash bags are projected to reach the valuation of USD 1,983.9 million reaching 71.2% of value share by 2035. eCommerce, on the other hand, is predicted to gain an incremental opportunity worth USD 123.8 million with a CAGR of 2.5%.

| Segment | DIY/Household |

|---|---|

| Value Share (2035) | 23.8% |

The growing urge for renovations in Europe and various DIY projects is predicted to raise the demand for heavy-duty trash bags required for the collection of paint cans, construction debris, and other renovation waste. Further innovations in bag materials making it leak-proof, convenient closures, and others enhanced its usability in the household and DIY sectors.

DIY/Households are currently capturing more than 25.8% of the market share in 2025, generating an incremental opportunity of USD 88.8 million during the upcoming decade. DIY/Household is projected to grow at 1.4% during the assessment period.

Key players in the industry are further developing trash bags with the help of recyclable materials and implanting eco-friendly manufacturing processes. Leading companies are expanding their reach by expansion of products and acquisitions.

Recent Developments in Europe Trash Bag Industry

Based on material, trash bags are segregated into polyethylene, polypropylene (PP), bioplastics, and other materials. Further, polyethylene is categorized into low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), and high-density polyethylene (HDPE).

In terms of capacity, the trash bag is divided into up to 20 litres, 20 to 40 litres, 40 to 100 liters, and above 100 liters.

Trash bags are subdivided into the following types degradable, and non-degradable.

By sales channel, the trash bags market is classified into manufacturer/direct sales, retail sales and e-commerce. Retail sales are further sub-categorized into hypermarkets & supermarkets, convenience stores, and specialty stores.

Trash bags are classified into retail, hotels, restaurants & cafes (HoReCa), public -sector/services, building & construction, healthcare, and DIY/household.

Industry analysis has been carried out in key countries such as Germany, France, Spain, Italy, United Kingdom, BENELUX, Nordics, Russia, Hungary, Poland, and Rest of Europe.

The global trash bag industry analysis in europe is estimated to be valued at USD 2.3 billion in 2025.

The market size for the trash bag industry analysis in europe is projected to reach USD 2.9 billion by 2035.

The trash bag industry analysis in europe is expected to grow at a 2.2% CAGR between 2025 and 2035.

The key product types in trash bag industry analysis in europe are hdpe, _low‑density polyethylene (ldpe), _linear low‑density polyethylene (lldpe), _high‑density polyethylene (hdpe), polypropylene (pp), bioplastics and other materials.

In terms of capacity, 20‑40 liters segment to command 33.7% share in the trash bag industry analysis in europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trash Can Market

Trash Can Liner Market Growth – Trends & Forecast through 2034

Trash Rack Cleaning Machine Market Size and Share Forecast Outlook 2025 to 2035

Trash Bag Market Size and Share Forecast Outlook 2025 to 2035

Trash Bag Market Leaders & Competitive Insights

Türkiye Trash Bag Market Trends & Growth Forecast 2024-2034

Scented Trash Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Scented Trash Bags Companies

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

Bag Sealer Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Bag Market Insights - Growth & Demand 2025 to 2035

Bag Clips Market Insights – Demand, Trends & Forecast 2025 to 2035

Baggage Scanner Market Growth, Trends & Forecast 2025 to 2035

Bag Re-sealer Market Growth – Size, Trends & Forecast 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA