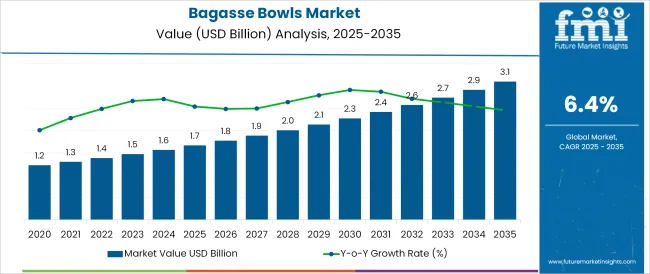

The Bagasse Bowls Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The bagasse bowls market is gaining strong traction amid global efforts to eliminate single use plastics and reduce foodservice waste. Rising regulatory mandates targeting plastic alternatives, alongside consumer preferences for biodegradable packaging, are propelling the adoption of molded fiber products like bagasse. Manufacturers are scaling production to meet increasing demand from QSR chains, institutional catering, and food delivery services.

increasing demand from QSR chains, institutional catering, and food delivery services. Innovations in bowl design focused on heat resistance, leakproofing, and structural durability have enhanced the utility of bagasse in high-traffic commercial settings. In parallel sustainable procurement strategies from multinational food retailers and cloud kitchens have reinforced demand for certified compostable alternatives.

Market expansion is further supported by improvements in pulp sourcing, automation in forming and drying processes and optimized unit economics. As eco-labelling and green compliance become prerequisites across markets, bagasse bowls are expected to become a default standard for responsible scalable, and safe food packaging solutions.

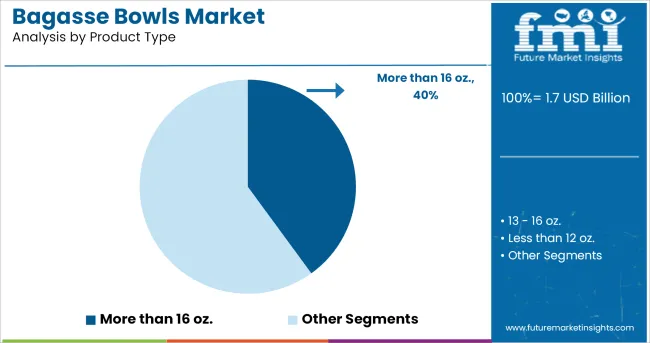

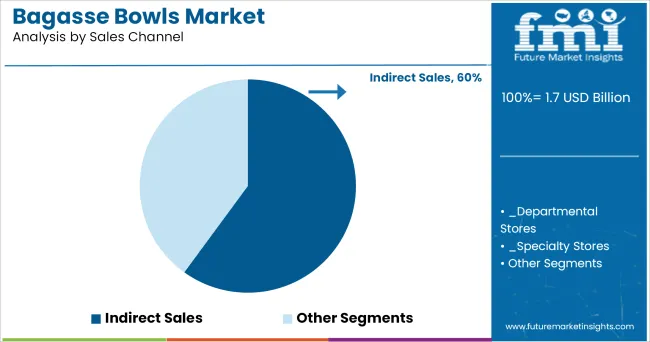

The market is segmented by Product Type, Sales Channel, and End-Use and region. By Product Type, the market is divided into More than 16 oz., 13 - 16 oz., and Less than 12 oz.. In terms of Sales Channel, the market is classified into Indirect Sales, Departmental Stores, Specialty Stores, E-Commerce Sales, Others, and Direct Sales.

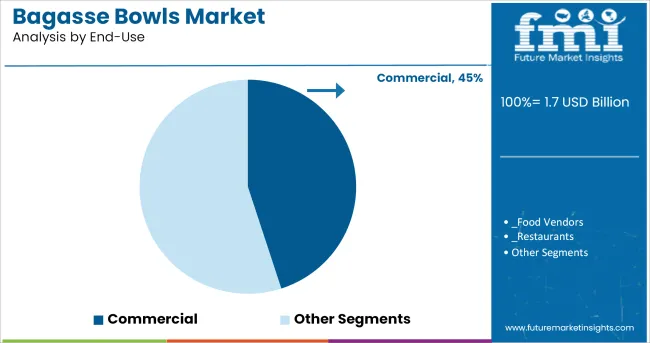

Based on End-Use, the market is segmented into Commercial, Food Vendors, Restaurants, Hotels and Cafes, Catering Purposes, Institutional, Educational Institutions, Hospitals, Airport/ Rail Stations, Offices, and Residential. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The more than 16 oz. segment is anticipated to command 40.0% of total product type revenue share in 2025, emerging as the leading category within the bagasse bowls market. This leadership is attributed to strong demand from foodservice applications requiring high capacity containers for full meals, combo servings, and layered dishes.

The increased use of meal kits, delivery meals, and institutional catering has necessitated durable, larger-volume solutions that are both compostable and structurally resilient. Manufacturers have responded with reinforced bowl designs that maintain integrity under heat and moisture, making them ideal for both dine-in and takeaway scenarios.

Furthermore, bulk buyers in commercial and industrial food segments have standardized larger capacity formats for efficiency and portion control. This growing alignment between operational efficiency and sustainable packaging has solidified the dominance of the more than 16 oz. sub segment.

The indirect sales channel is projected to hold 60.0% of market revenue share in 2025, making it the predominant distribution route for bagasse bowls. This is primarily due to the entrenched role of distributors, wholesalers, and foodservice aggregators in fulfilling bulk procurement needs of commercial buyers.

Indirect channels offer greater scalability inventory management, and logistical reach, particularly for regional and international supply. As foodservice operators and institutional buyers prioritize consolidated sourcing indirect partners have become critical intermediaries in providing reliable supply of certified compostable products.

Moreover, partnerships between manufacturers and sustainability focused distribution networks have expanded access to eco-friendly alternatives across mainstream retail, hospitality, and healthcare sectors. The ability to meet regulatory documentation, green certifications, and consistent lead times has further positioned indirect sales as the preferred channel in the bagasse bowls market.

The commercial end-use segment is expected to represent 45.0% of market revenue in 2025 securing its place as the leading application domain for bagasse bowls. This prominence is being driven by the widespread use of compostable packaging in fast food outlets, cafes, institutional kitchens, and catering businesses.

Regulatory bans on single-use plastic packaging have accelerated the shift toward natural fiber-based alternatives, with commercial foodservice operators adopting bagasse bowls to align with environmental mandates and corporate sustainability goals. The segment has also been bolstered by growing demand for branded, premium eco-packaging that enhances consumer perception while maintaining functional integrity during high-volume service operations.

Operators are increasingly investing in compostable solutions that can withstand hot and greasy foods without leakage or deformation, which has strengthened the case for bagasse in commercial settings. In addition, procurement efficiency, cost-per-unit optimization, and compatibility with automated food packing systems have solidified the segment’s dominant share.

Bagasse bowls are manufactured using the bagasse that is commonly known as sugarcane waste. The bagasse bowls market is witnessing healthy growth in recent years, due to the change in the predicament of people over the negative effect of plastic on the environment.

As the raw material used for manufacturing is plant waste, it creates a low carbon footprint in comparison to its plastic counterpart. In addition to all this, bagasse bowls are eco-friendly in nature and completely biodegradable.

Environment conservation authorities and governments are raising restrictions towards plastic being used as disposable tableware, which in turn will increase tremendous opportunities for prominent players in the market. These factors will augment the demand for bagasse bowls in the forecasted period.

Key changes in environment conservation policies, increasing restrictions on plastic usage, general public becoming aware of their surroundings is causing a drastic shift which is increasing the usage of bagasse bowls in everyday life.

Foodservice providers are changing the trend via shifting towards biodegradable tableware such as wooden cutlery, paper plates and bagasse bowls. Increasing regulations banning plastic usage in food outlets has caused an upshift of change. Manufacturers will see a huge boom in demand for bagasse bowls during the forecast period.

An increase in food takeout and home delivery systems due to the rise of the millennial population and long working hours has resulted in a spike in the usage of biodegradable bagasse bowls. The big change caused due to cultural shift and outdoor eating has increased the usage of eco-friendly tableware which is easy to dispose of.

This change of eating habits not only of the younger generation but across different age groups will exponentially impact the bagasse bowls market in a positive manner.

The demand for eco-friendly and biodegradable solutions for tableware has constructed an optimum path for the bagasse bowls market. The increase in take-out and home delivery facilities in the food & beverage sector are expected to simultaneously impact a positive trend for bagasse bowls in the coming years.

This change is affected due to almost negligible carbon footprint generation from bagasse bowls and their biodegradable nature which in turn will raise the usage of bagasse bowls and this will drive the market growth.

Cheap pricing of plastic ware will always pose a challenge to the bagasse bowls market and the less availability of the product in the market will cause a hindrance in market growth.

However, giving provisions like tax reductions from the government to manufactures will, in turn, raise the production of bagasse bowls and decrease the cost price of a product, which in turn increases profitability for the players in bagasse bowls.

Global Players:

APAC Players:

The key competitors implement various strategies such as product launch, merger & acquisition, expansion, innovation and others to survive and compete in the market:

In September 2020, Herald plastic a well-known tableware manufacturer launched an extensive range of bagasse products which consisted of bagasse cutlery, plates and bowls.

India will hold a major proportion of the bagasse bowls market by the end of the forecast period due to an increasing focus on using biodegradable materials such as bagasse products for the foodservice sector because of its durable, hygienic, safe and eco-friendly nature.

Other factors that will increase the country’s market share in the bagasse bowls market will be its new rules and regulations on plastic usage which are focus on reducing non-recyclable plastic packaging. All these factors considered India will have a significant hold in the Bagasse Bowls market in future.

The global bagasse bowls market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the bagasse bowls market is projected to reach USD 3.1 billion by 2035.

The bagasse bowls market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in bagasse bowls market are more than 16 oz., 13 - 16 oz. and less than 12 oz..

In terms of sales channel, indirect sales segment to command 60.0% share in the bagasse bowls market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

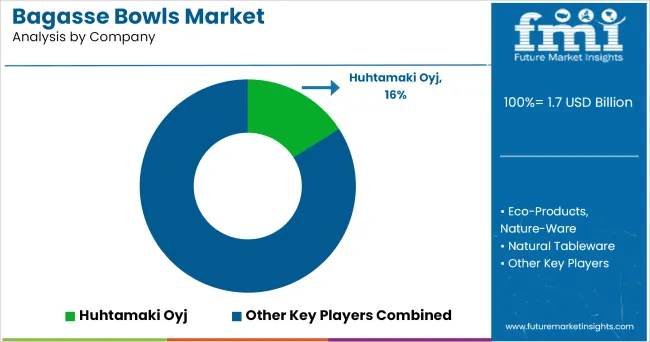

Market Share Insights for Bagasse Bowls Providers

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Bagasse Disposable Cutlery

Understanding Market Share Trends in Bagasse Packaging

Market Share Insights of Bagasse Tableware Product Providers

Eco Bowls Market Analysis - Size and Share Forecast Outlook 2025 to 2035

USA Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Sink Bowls Market Size and Share Forecast Outlook 2025 to 2035

Japan Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

ASEAN Bagasse Tableware Products Market Insights – Growth, Demand & Forecast 2025-2035

Germany Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Sugarcane Fiber Bowls Market – Growth & Demand 2025 to 2035

Aquarium & Fish Bowls Market Growth - Trends & Forecast to 2035

Demand and Trend Analysis of Bagasse Tableware Product in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Bagasse Tableware Product in Korea Size and Share Forecast Outlook 2025 to 2035

Western Europe Bagasse Tableware Market Analysis – Growth & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA