Aquarium & Fish bowls Market Overview Individuals in urban areas are leading a hurried life today, where their house speaks more about their culture and tradition along with their personalities and interests.

With the pet industry booming, and as pets with low maintenance needs, fish have seen a rise in adoption rates, further driving sales of aquariums and fish bowls. All (and more) are the result of new aquarium technologies that are coming as DIY self-cleaning fish bowls, LED, lighting, and filtration improvement.

The increasing prominence of aquascaping, in which fish tanks are arranged as pieces of art, is additionally driving market growth. The demand for high-quality aquariums made of glass and acrylic is increasing, as consumers demand custom-made aquariums required to suit their interiors.

Luxury resorts, offices, and restaurants are additionally helping drive the market as they introduce aquariums into their premises to improve the aesthetic of a place as well as relieve stress.

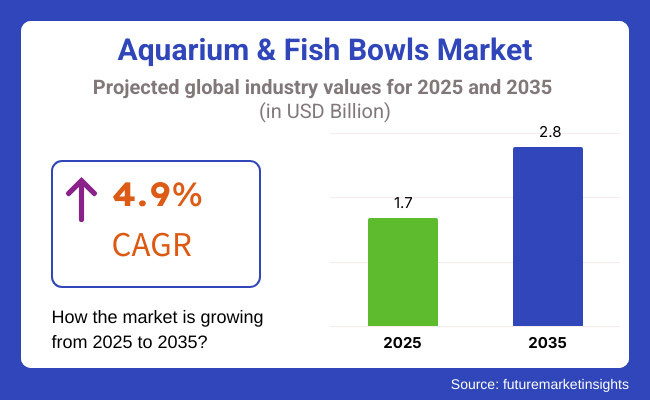

An estimated compound annual growth rate (CAGR) of 4.9% from 2025 to 2035 showcases a steady rise in the market, buoyed by changing consumer preferences and advancements in aquarium design and materials.

North America is still a significant market for the aquarium and fish bowl, with a mature pet industry and an increasing population of hobbyist fishkeepers. Growing demand for premium and customized aquariums in North American urban homes & commercial establishments.

A growing movement toward biophilic design, which incorporates natural elements into indoor environments, is creating demand for high-end, well-designed, technologically advanced aquariums. Pet stores, and online retailers are also branching out to offer tired and tested varieties of fish bowls, aquariums, and other useful accessories that will appeal to first-timers and seasoned aquarists alike.

The European market, in particular, has a strong fishkeeping culture, with one of the highest levels of demand for aquariums and fish bowls coming from Germany, France and the UK. Sustainability trends in the general market are affecting the aquarium sector as well, with increasing preference for eco-friendly materials, energy-efficient aquarium lighting, and sustainable filtration systems.

Furthermore, nano aquariums, which are compact space-saving living collections, cater to urban consumers working with limited space. Moreover, the increasing number of specialty aquarium retailers and aquascaping communities are propelling the growth of the market.

The aquarium and fish bowls market in Asia-Pacific region is expected to record highest growth, owing to a growing disposable incomes, urbanization, and a strong cultural appreciation of aquariums in China and Japan. Rising fish ownership in households and expanding aquarium trade markets are fuelling growth.

The supply of aquarium fish and accessories, too, is being affected by government regulations on sustainable fishing and captive breeding programs for ornamental fish. The local players, who are manufacturing affordable aquarium products, is bringing fishkeeping and aquaria to the masses.

Challenges

Sustainability Concerns and Ethical Sourcing of Aquatic Life

The market for aquarium and fish bowls comes under growing scrutiny regarding the ethical sourcing of fish and aquatic plants. Marine biodiversity is under threat from overfishing, habitat destruction and unsustainable practices in the ornamental fish trade. Many species of fish are caught from the wild instead of being farmed, causing population collapses and ecological imbalance.

At the same time, fish industry safeguards have also been criticized for being too lenient, provoking calls for stricter regulation of the industry,it's not uncommon to hear occasionally about not using aquarium bowls that have little or no filtration systems, for instance.

Ornamental fish transport and sale provide logistical difficulties too. Import/export bureaucracies, quarantine necessities, disease prevention guidelines need to be watched diligently to keep a healthy stock. To tackle these, there needs to be more consumer awareness and a pledge by manufacturers and suppliers to develop sustainable sourcing and ethical breeding programs.

Opportunity

Rising Popularity of Home Aquariums and Advanced Filtration Systems

However, you can take steps to ensure that aquarium water does not become toxic by using an aquarium water filter, cleaning fish regularly, and maintaining fish bowls based on alternative ecology principles. This rise in popularity is because of the therapeutic benefits of aquariums, such as reducing stress and improving mental well-being leading to a higher demand among residential properties, offices and public spaces.

The market is additionally profiting from technological innovations, including automated water filtration systems, LED lighting, and smart monitoring tools that simplify and enhance aquarium care.

Trends in sustainability are also influencing product innovations. From bioactive filtration systems to energy-efficient equipment, manufacturers are taking pages from the social responsibility playbooks to attract environmentally savvy consumers.

The healthy rise of aquascaping which combines elements of aquarium-keeping with artistic landscape design has also widened the market, as demand for live plants, natural decorations and high-end tanks has grown. As more pet owners are becoming educated on responsible fishkeeping practices, businesses that focus on sustainability, ethical breeding, and outreach will have in this growing market.

Between 2020 and 2024, the aquariums and fishbowls market grew steadily, thanks to an increasing interest from consumers in indoor aquariums and decorative fish. Demand for low-maintenance fish species and small, decorative tanks soared during that period, especially among urban dwellers and first-time fish keepers.

However, sustainability issues, such as overfishing and plastic waste from single-use fish tanks, drew scrutiny and sparked calls for regulation over ethical sourcing. E-commerce has driven fishkeeping in many spheres, allowing anyone access to tools, artificial coral and even live freshwater species via the web.

Going forward, and up till the 2025 to 2035 period, the market will be moving towards more sustainable and technological products. Also, the popularity of smart aquarium systems with automated feeding, water quality monitoring, and remote control features will grow. Fish tanks and accessories will utilize biodegradable and recycled materials as per the global environmental goals.

Also, new captive breeding programs will reduce our dependence on wild-caught fish and promote responsible aquarium keeping. As aquascaping increases in popularity, so will the demand for high-end, customized aquariums and rare aquatic plant species.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Discussions on sustainable fish sourcing and ethical pet trade laws |

| Technological Advancements | Growth of LED lighting, basic filtration systems, and automatic feeders |

| Industry Adoption | Rising consumer interest in aquariums as home décor |

| Supply Chain and Sourcing | Continued reliance on wild-caught ornamental fish |

| Market Competition | Dominance of mass-market aquarium brands |

| Market Growth Drivers | Increased demand for small aquariums and easy-to-maintain fish species |

| Sustainability and Energy Efficiency | Limited focus on eco-friendly materials and energy-efficient systems |

| Consumer Preferences | Preference for compact, decorative fish bowls |

| Aquatic Life Conservation | Concerns over habitat destruction due to ornamental fish trade |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on wild-caught fish imports and sustainable breeding standards |

| Technological Advancements | Advanced water quality monitoring, smart aquarium controls, and AI-driven filtration |

| Industry Adoption | Expansion of high-end, customizable aquascapes and luxury fish tanks |

| Supply Chain and Sourcing | Widespread adoption of captive breeding programs and sustainable fish farming |

| Market Competition | Growth of niche, premium aquarium manufacturers and eco-friendly brands |

| Market Growth Drivers | Expansion of aquascaping, reef tanks, and high-tech aquarium systems |

| Sustainability and Energy Efficiency | Greater use of biodegradable tank materials and solar-powered filtration |

| Consumer Preferences | Growing demand for large, aesthetically designed, and naturalistic aquariums |

| Aquatic Life Conservation | Stronger conservation efforts, ethical breeding, and education programs |

The United States aquarium and fish bowl market continues to expand with the increase in pet ownership and a growing interest in aquascaping at home. It is propelling the market growth due to the high disposable income and steady inclination toward customized aquariums with advanced lighting and filtration systems.

Demand across the country is stimulated by the presence of major pet retail chains, large online platforms like Chewy and Amazon, and a wide availability of aquarium products.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

Aquarium and fish bowl market in the UK is majorly influenced by the increasing popularity of ornamental fish as low-maintenance pets. The growing popularity of biophilic design in homes and offices is increasing the demand for ornamental aquariums. And eco-friendly aquarium products, including self-cleaning fish tanks, are increasingly being used by environmentally responsible customers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

The leading markets in this territory are Germany, France, and Italy, and freshwater and saltwater aquarium players are widely consumed in the region. Key factors contributing to growth are the presence of highly established aquarium brands and the rise in adoption of automated tank maintenance systems.

Consumers in Europe are increasingly purchasing premium aquariums with smart technologies integration, like automated fish feeding and water quality monitoring systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

Japan’s aquarium market is shaped by its rich swimming aesthetic culture, such as a focus on Zen-style aquaristics and breeding of exotic fish. There is special demand for small aquariums made for life in tighter urban living quarters. Furthermore, advancements in water filtering systems and automated feeding devices are also creating easier environments for maintaining aquariums that are projected to boost the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

In South Korea, there is demand for more modern, sleek-looking aquariums, especially in urban dwellings and commercial settings. An increasing trend of fishkeeping as a leisurely hobby, coupled with high quality imported aquarium products, is driving the growth of the market. Sales are further driven by e-commerce platforms, which provide a variety of fish bowls and aquarium accessories.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The residential and commercial segments make up the major market share of aquarium & fish bowls, with consumers and businesses looking for visually pleasing, low maintenance, and ecologically-friendly options.

These applications improve the interior designs, offer relaxation, and create interest in aquatic pet care which contributes to the growth of the aquarium products market among homeowners, corporate offices, hotels, and educational institutes.

Residential Segment Leads Market Demand as Home Aquariums Gain Popularity

Afterward, based on the type of end-user customer, the residential segment has been predicted as one of the fastest-growing categories of the aquarium & fish bowls market, as manufacturers introduce a wide range of solutions to satisfy hobbyists, pet enthusiasts, & interior décor trends.

Contrary to traditional pet care, maintaining aquariums requires a special skill set, and as a result, there will always be high demand for quality aquariums, fish bowls, filtration systems, and aquascaping accessories.

Market adoption is bolstered by the rising demand for personalized home aquariums, such as Nano tanks, wall-mounted fish bowls, and self-sustaining ecosystems as urban homeowners seek compact and decorative aquatic solutions. Research shows that over 65% of residential aquarium owners have their aesthetics as their top concern, thus ensuring continuous demand for new and customizable designs.

The growing smart aquarium sector, equipped with automated filtration, LED illumination, and AI-based feeding systems, has augmented market demand for this device, ensuring easy maintenance and better fishkeeping experience.

The rise of sustainable fishkeeping solutions that focus on eco-friendly bio-filtration, energy-efficient pumps and natural aquascaping materials, has given adoption a further push, offering both improved environmental responsibility and more engaging ways for consumers to interact with fisheries and aquaculture.

The introduction of multifunctional aquarium designs, such as those integrated into furniture, terrarium-aquarium hybrids, and modular fish habitats has optimized market growth thus allowing greater versatility and appealing to formats used in modern living-oriented spaces.

While the residential sector is growing thanks to the benefits of adding a water feature to your home for interior décor, stress relief, or diversification of pet ownership, of course, there are many challenges, including how to manage water quality, fish welfare issues, and urban housing spatial constraints.

But new methods, like compact aquaponic systems, AI-backed tank monitoring, and a self-cleaning aquarium system, are making it more efficient, sustainable, and user-friendly, thus providing solid growth prospects for the global residential aquarium market.

Commercial Segment Drives Market Growth as Businesses Integrate Aquatic Displays for Aesthetic and Wellness Benefits

This growth also extends to our commercial segment in which we have seen strong market adoption among hospitality businesses, corporate offices, healthcare facilities, and public attractions as businesses become more aware than ever of the psychological and aesthetic benefits aquariums can have. Commercial installations trend towards large-scale designs focused on maintenance efficiency and interactive engagement, in contrast to their residential aquarium counterparts.

A longer-term trend is the increased demand for public-facing aquariums: everything from big hotel lobby fish tanks, to feature aquariums in restaurants, to aquascapes in office relaxation areas all have seen adoption as businesses seek to add unique, engaging touches to their interiors. Research shows that over 50% of 5-star hospitality spaces include aquariums as key design elements, assuring solid demand for commercial aquatic builds.

Market demand has also been augmented by the proliferation of corporate wellness programs in the form of office aquariums as well as fish tanks in meditation zones and aquascapes in health care facilities, which ensure enhanced mental wellbeing and employee productivity through visually soothing aquatic environments.

In addition, the combination of interactive aquarium features, including touch-sensitive displays, augmented reality marine education, and sensor-based aquatic lighting effects, has also added to the adoption, driving increased customer engagement and distinguishing the brand.

Closed-loop water system with automated filtration and eco-friendly aquatic life sourcing are all sustainable commercial aquarium solutions that are being developed to streamline market growth, guaranteeing responsible and long-term business practices.

While commercial aquariums can achieve advantages such as competitive edge through branding, improved customer experience, and wellness properties, they also encounter issues with high initial investment needs and continuing maintenance, as well as ethical concerns over marine life captivity.

But emerging innovations in AI-assisted water quality management systems and robotic cleaning systems as well as artificial coral reef installations are enhancing operational efficiency, environmental sustainability and visitor engagement, paving the way for commercial aquarium installations around the world to keep expansion alive.

The two global segments of the aquarium market segmented by material include glass and acrylic, which are two of the major market drivers as aquarium manufacturers continue to innovate with the materials they use for better durability, visibility and design flexibility.

Glass Aquariums Lead Market Demand as Scratch-Resistant and Affordable Solutions Gain Popularity

The glass aquarium section has become one of the most common choices for the domestic and business zone as it provides better clarity, scratch resistance, and cost-effective production. Glass aquariums, unlike acrylic tanks, offer long-term durability and resistance to discoloration.

The increasing trend for frameless, ultra-clear glass aquariums with low-iron glass compositions, seamless joints, and strengthened structural integrity has been the driving force behind market adoption, as customers are now focusing on aesthetic design and longevity.

Although durable and less expensive than the other types, the glass aquarium segment suffers from disadvantages such as greater weight and prone to breakage during transportation and limited shape customisation capabilities.

Nonetheless, the development of new technologies in lightweight tempered glass, shock-resistant coatings, and the modular design of individual panels are enhancing durability, installation, and design flexibility, leading to a sustained growth trajectory for glass-based aquariums globally.

Acrylic Aquariums Expand as Lightweight and Customizable Solutions Gain Traction

These factors have resulted in strong market penetration of the acrylic aquarium segment due to their increased design flexibility, improved impact resistance, and lower weight, particularly when targeting custom tank manufacturers, large-scale commercial installations, and the latest trends in residential designs.

Adoption is driven by the increasing demand for seamless acrylic fabrication, panoramic viewing experiences, and integrated lighting solutions in curved and cylindrical aquarium designs, which ensure increased design versatility and user engagement.

While acrylic aquariums have the benefits of a lightweight construction, are highly customizable and easier to shape; the market segment faces difficulties like scratch susceptibility, more expensive manufacturing process, and yellowing over time.

Recent advancements in scratch-resistant coatings, UV-stabilized acrylic pools and seamless adhesive boding technology have been improving the durability, optical clarity and product life span for acrylic aquariums and is expected to sustain the growth of the acrylic aquarium market over the globe.

Consumer interest in home aquascaping, increasing demand for decorative and functional fish tanks, and technological advancements in sustainable, low-maintenance aquarium systems are some of the major drivers of the aquarium and fish bowls market.

The company has areas in need of transformation, which consist of sustainable materials, intelligent filtration systems, and modular aquarium systems for use by hobbyists and professional aquarists. Companies develop sophisticated and durable aesthetic products designed to simplify user convenience while maintaining the well-being of the fish.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hagen Group (Fluval, Marina) | 20-25% |

| Spectrum Brands Holdings (Tetra, Marine land) | 15-20% |

| Central Garden & Pet (Aqueon, Oceanic) | 12-16% |

| OASE GmbH | 8-12% |

| Penn-Plax, Inc. | 5-9% |

| Other Companies (combined) | 35-45% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Hagen Group (Fluval, Marina) | Fewer canisters, fish tankstrero or acrylic aquariums with integrated filtration and LED lighting systems for freshwater and marine setups. |

| Spectrum Brands Holdings (Tetra, Marineland) | Offering high-tech aquariums, professional fish bowls, and smart filtration systems designed for different fish species. |

| Central Garden & Pet (Aqueon, Oceanic) | With over a decade of expertise in aquarium design, they specialize in energy-efficient heating and water circulation systems |

| OASE GmbH | Specializes in high-end aquascaping aquariums using premium filtration and water treatment technologies. |

| Penn-Plax, Inc. | Produces budget-friendly fish bowls, Nano tanks, and themed aquarium designs for hobbyists. |

Key Company Insights

Hagen Group (Fluval, Marina) (20-25%)

They are the market leader in aquariums with unique filtration and low-power lighting designs to cater to aquarium requirements.

Spectrum Brands Holdings (Tetra, Marine land) (15-20%)

The highlight is the fancy aquariums and technology-wise filtration systems that they provide which are said to provide a better ecosystem for fishes.

Central Garden & Pet (Aqueon, Oceanic) (12-16%)

Offers an aquaristic all-in-one solution in an easy to maintain, economical, useful and sustainable manner in water conservation & sustainable fishkeeping solutions.

OASE GmbH (8-12%)

A high-end market player, selling professional grade aquariums for aquascaping hobbyists and marine specialists

Penn-Plax, Inc. (5-9%)

Concentrates on inexpensive and decorative fish bowls, small aquariums and accessories for casual hobbyists and first-time fish owners.

The aquarium & fish bowls market encompasses innovative orientation, eco-friendly options and customizable solutions provided by various companies. These include:

The Aquarium & Fish Bowls Market was valued at approximately USD 1.7 billion in 2025.

The market is projected to reach USD 2.8 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.9% from 2025 to 2035.

The demand for Aquarium & Fish Bowls Market is expected to be driven by the increasing popularity of ornamental fish as pets, rising consumer interest in home aquascaping, advancements in durable and lightweight materials, and growing availability of customized aquarium designs.

The top 5 countries contributing to the Aquarium & Fish Bowls Market are the United States, China, Germany, Japan, and the United Kingdom.

The Glass and Acrylic Materials segment is expected to lead the Aquarium & Fish Bowls market, driven by the demand for scratch-resistant glass aquariums, the rising adoption of lightweight and impact-resistant acrylic tanks, and increasing innovations in transparent, high-clarity materials for enhanced aesthetics.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Global Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 14: Global Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 25: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 27: North America Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 28: North America Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 37: Latin America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 38: Latin America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 39: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: Latin America Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 42: Latin America Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 48: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 49: Western Europe Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 50: Western Europe Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 51: Western Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 52: Western Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 53: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: Western Europe Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 56: Western Europe Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 62: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 63: Eastern Europe Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 64: Eastern Europe Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 65: Eastern Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 66: Eastern Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 67: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 69: Eastern Europe Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 70: Eastern Europe Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 76: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 77: South Asia and Pacific Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 78: South Asia and Pacific Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 79: South Asia and Pacific Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 80: South Asia and Pacific Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 81: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 82: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 83: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 84: South Asia and Pacific Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 85: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 87: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 88: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 89: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 90: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 91: East Asia Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 92: East Asia Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 93: East Asia Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 94: East Asia Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 95: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 96: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 97: East Asia Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 98: East Asia Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 99: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 100: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 101: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 102: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 103: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 104: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 105: Middle East and Africa Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 106: Middle East and Africa Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 107: Middle East and Africa Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 108: Middle East and Africa Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 109: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 110: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 111: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 112: Middle East and Africa Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Shape, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 17: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 21: Global Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 22: Global Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 23: Global Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 24: Global Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 25: Global Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 26: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 27: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 28: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 29: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 30: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 31: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 32: Global Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 33: Global Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 34: Global Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 35: Global Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 36: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 37: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 38: Global Market Attractiveness by Shape, 2023 to 2033

Figure 39: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 40: Global Market Attractiveness by Application, 2023 to 2033

Figure 41: Global Market Attractiveness by Sales Channels, 2023 to 2033

Figure 42: Global Market Attractiveness by Region, 2023 to 2033

Figure 43: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 45: North America Market Value (US$ Million) by Shape, 2023 to 2033

Figure 46: North America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 47: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 49: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 50: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 51: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 52: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 53: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 54: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 55: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 59: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 60: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 61: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 62: North America Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 63: North America Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 64: North America Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 65: North America Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 66: North America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 67: North America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 68: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 69: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 70: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 72: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: North America Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 75: North America Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 76: North America Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 77: North America Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 78: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 79: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 80: North America Market Attractiveness by Shape, 2023 to 2033

Figure 81: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 82: North America Market Attractiveness by Application, 2023 to 2033

Figure 83: North America Market Attractiveness by Sales Channels, 2023 to 2033

Figure 84: North America Market Attractiveness by Country, 2023 to 2033

Figure 85: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 86: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) by Shape, 2023 to 2033

Figure 88: Latin America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 89: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 92: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 93: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 97: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 98: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 101: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 102: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 103: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 104: Latin America Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 105: Latin America Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 106: Latin America Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 107: Latin America Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 108: Latin America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 109: Latin America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 110: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 111: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 112: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 114: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Latin America Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 117: Latin America Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 118: Latin America Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 119: Latin America Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 120: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 121: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 122: Latin America Market Attractiveness by Shape, 2023 to 2033

Figure 123: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 124: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 125: Latin America Market Attractiveness by Sales Channels, 2023 to 2033

Figure 126: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 129: Western Europe Market Value (US$ Million) by Shape, 2023 to 2033

Figure 130: Western Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 132: Western Europe Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 133: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 134: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 135: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 136: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 137: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 138: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 139: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 140: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 141: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 142: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 143: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 144: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 145: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 146: Western Europe Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 147: Western Europe Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 148: Western Europe Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 149: Western Europe Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 150: Western Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 151: Western Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 152: Western Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 153: Western Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 154: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 155: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 156: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 157: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 158: Western Europe Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 159: Western Europe Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 160: Western Europe Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 161: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 162: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 163: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 164: Western Europe Market Attractiveness by Shape, 2023 to 2033

Figure 165: Western Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 166: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 167: Western Europe Market Attractiveness by Sales Channels, 2023 to 2033

Figure 168: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 169: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) by Shape, 2023 to 2033

Figure 172: Eastern Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 173: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 174: Eastern Europe Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 175: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 176: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 177: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 178: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 179: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 180: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 181: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 182: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 183: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 184: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 185: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 186: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 187: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 188: Eastern Europe Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 189: Eastern Europe Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 190: Eastern Europe Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 191: Eastern Europe Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 192: Eastern Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 193: Eastern Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 194: Eastern Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 195: Eastern Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 196: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 197: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 198: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 199: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 200: Eastern Europe Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 201: Eastern Europe Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 202: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 203: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 204: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 205: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 206: Eastern Europe Market Attractiveness by Shape, 2023 to 2033

Figure 207: Eastern Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 208: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 209: Eastern Europe Market Attractiveness by Sales Channels, 2023 to 2033

Figure 210: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 211: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 213: South Asia and Pacific Market Value (US$ Million) by Shape, 2023 to 2033

Figure 214: South Asia and Pacific Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 215: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 216: South Asia and Pacific Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 217: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 220: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 221: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 222: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 223: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 224: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 225: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 226: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 227: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 228: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 229: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 230: South Asia and Pacific Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 231: South Asia and Pacific Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 232: South Asia and Pacific Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 233: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 234: South Asia and Pacific Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 235: South Asia and Pacific Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 236: South Asia and Pacific Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 237: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 238: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 239: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 240: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 241: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 242: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 243: South Asia and Pacific Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 244: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 245: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 246: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 247: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 248: South Asia and Pacific Market Attractiveness by Shape, 2023 to 2033

Figure 249: South Asia and Pacific Market Attractiveness by Capacity, 2023 to 2033

Figure 250: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 251: South Asia and Pacific Market Attractiveness by Sales Channels, 2023 to 2033

Figure 252: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 253: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 254: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 255: East Asia Market Value (US$ Million) by Shape, 2023 to 2033

Figure 256: East Asia Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 257: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 258: East Asia Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 259: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 260: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 261: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 262: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 263: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 264: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 265: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 266: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 267: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 268: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 269: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 270: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 271: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 272: East Asia Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 273: East Asia Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 274: East Asia Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 275: East Asia Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 276: East Asia Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 277: East Asia Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 278: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 279: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 280: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 281: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 282: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 283: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 284: East Asia Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 285: East Asia Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 286: East Asia Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 287: East Asia Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 288: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 289: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 290: East Asia Market Attractiveness by Shape, 2023 to 2033

Figure 291: East Asia Market Attractiveness by Capacity, 2023 to 2033

Figure 292: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 293: East Asia Market Attractiveness by Sales Channels, 2023 to 2033

Figure 294: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 295: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 296: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 297: Middle East and Africa Market Value (US$ Million) by Shape, 2023 to 2033

Figure 298: Middle East and Africa Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 299: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 300: Middle East and Africa Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 301: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 302: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 303: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 304: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 305: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 306: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 307: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 308: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 309: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 310: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 311: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 312: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 313: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 314: Middle East and Africa Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 315: Middle East and Africa Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 316: Middle East and Africa Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 317: Middle East and Africa Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 318: Middle East and Africa Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 319: Middle East and Africa Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 320: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 321: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 322: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 323: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 324: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 325: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 326: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 327: Middle East and Africa Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 328: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 329: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 330: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 331: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 332: Middle East and Africa Market Attractiveness by Shape, 2023 to 2033

Figure 333: Middle East and Africa Market Attractiveness by Capacity, 2023 to 2033

Figure 334: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 335: Middle East and Africa Market Attractiveness by Sales Channels, 2023 to 2033

Figure 336: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Decor Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Hydrometers Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA