Aquarium Water Treatment Market Industry: Introduction with the rise in demand for effective water purification solution to aquatic animals kept in aquariums, the Aquarium water treatment market is likely to experience a substantial growth during the forecast period of 2025 to 2035. Aquarium water treatment products help keep the levels of such harmful chemicals, toxins and contaminations in the aquarium water to an optimal level. The aquariums are widely evolving both for home and commercial purposes and the growth of water treatment technology has further accelerated the acceptance of water conditioning solutions.

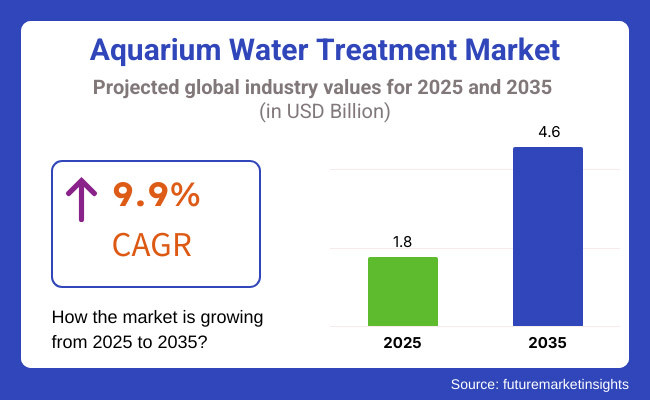

In 2025, the size of the market for Aquarium water treatment was estimated to reach approximately USD 1.8 Billion. By 2035, it is predicted to flourish to USD 4.6 Billion at a decent CAGR of 9.9% from 2025 to 2035. Major factors fuelling the growth of this market include technological advancement of water filtration systems, an increasing adoption of green and organic treatments, and an upsurge in investments in the pet care industry.

North America captures the lion's share of market revenues for aquarium water treatment, underpinned by the presence of a strong pet care landscape, widespread adoption of advanced water filtration systems, and robust research and development initiatives. Next generation water treatment technologies are particularly advanced in the United States and Canada.

The European market for compound aquarium chemicals is governed by a range of factors, including growing inclination towards sustainable aquarium care, stringent regulation-oriented approaches, and technological advancements in aquatic care products. Nations like Germany, France and the UK are emphasizing on sustainable practices and improving product formulations to amplify overall aquarium water quality.

Aquarium Water Treatment Market Segments Affected in Asia-Pacific The fastest growing region for the aquarium water treatment market is Asia-Pacific. In China, India and Japan, huge investments in pet care products and infrastructure development is made to fulfill this increasing demand.

More and more pets have led to steady growth of Latin America for the aquarium and aquarium equipment market, the rapid expansion of the aquarium and aquarium equipment market is mainly driven by the rapid expansion of pet ownership, as well as high-quality aquarium equipment. Brazil and Mexico are major contributors, with a focus on increasing the access to cutting-edge water filtering solutions for aquariums among their populace.

In the Middle East & Africa, the aquarium water treatment market is in the nascent phase, gradually advancing toward a larger footprint with growing investments in pet care, marine conservation projects, and luxury aquariums. The UAE and South Africa are leading the charge to improve product availability and technological development in this industry.

As aquarium water care technologies continue to evolve and expand in both residential and commercial applications, the demand for an effective aquarium water treatment will remain strong well into the next decade, presenting noise opportunities for manufacturers, pet care brands and marine enthusiasts.

Challenges

Complexity in Maintaining Water Quality and Chemical Balance

The water treatment segment in the Aquarium industry is an arduous market owing to the necessity of maintaining abortion-friendly and hospitable aquatic environments for the animals. The parameters like pH level, concentration of ammonia, nitrate and chlorine are species-specific for fish, corals and plants.

Novice aquarists may find it challenging to manage these parameters using a variety of treatments. To address this issue, manufacturers can create user-friendly, multi-functional water treatment products with high-quality dosing guidance and at-home testing kits for more convenient upkeep at home.

Environmental Concerns Regarding Chemical Treatments

A lot of conventional water treatment products use chemical additives to remove harmful compounds, detoxify toxins or stimulate the growth of beneficial bacteria. But when not disposed of properly these chemicals may have unintended environmental effects, such as residual toxicity and bioaccumulation in ecosystems.

Due to strict regulations on the use of chemical-based products the Federal agencies are making stringent rules on it, pressuring manufacturers to look for alternatives that are organic. Stay on top of the eco-market by investing in sustainable, biodegradable water treatment solutions.

Opportunities

Rising Popularity of Planted and Reef Aquariums

The growing interest in nature-enriched freshwater and reef aquariums provides the potential growth of the Aquarium Water Treatment Market. These setups are tailored to specific marine life; corals and aquatic plants require particular water conditions to thrive.

As more hobbyists will set up high-maintenance tanks, premium water conditioners, biological filtration enhancers, and pH stabilizers will also be in increasing demand. By creating specific forms of medication designed for these aquarium types, such as probiotic-based water enhancement medicines and organic nutrient supplements, manufacturers can benefit significantly.

Advancements in Smart Monitoring and Automated Water Treatment

Smart technology is changing the way we treat water and the way we use aquariums in general. IoT-enabled water monitoring devices are capable of monitoring critical parameters in real time, helping aquarists spot potential imbalances before they become problematic.

This could include automated dosing systems that dispense the correct amount of treatment based on data provided by sensors, helping water managers maintain proper quality. The ones who set foot on AI-powered diagnostics, automated dosing systems, and the likes of app-controlled treatment solutions will have an upper hand in the market.

The period from 2020 to 2024 saw steady growth in the Aquarium water treatment market, driven by increasing awareness of proper water management, advancements in biological filtration, and the rise of aquascaping trends. Some of this was driven by concerns over chemical based treatments and the multi-parameter adjustments making it less attractive to a beginner aquarist. Companies responded with the popularization of user-friendly water conditioners and widening their lines of natural and probiotic treatments.

Future predictions 2025 to 2035 show the transformation of the market towards Natural and Organic water treatment solutions, AI based water monitoring systems, Self-regulating aquariums etc. Thus, this will include the rise of eco-friendly dechlorinators and automated microbe-based filtration boosters & biodegradable water conditioner that will reframe the industry.

Recent technology and performance consultancy trends will continue with an expansion of ceramics, including non-toxic purification techniques and plant-derived water treatments, as sustainability becomes a leading focus for manufacturers and consumers alike.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with basic water treatment safety standards |

| Technological Advancements | Growth in liquid water conditioners and beneficial bacteria treatments |

| Industry Adoption | Increased focus on reef and planted aquarium water treatment |

| Supply Chain and Sourcing | Reliance on synthetic chemical-based treatments |

| Market Competition | Dominance of traditional water treatment product manufacturers |

| Market Growth Drivers | Rising popularity of home aquariums and aquascaping |

| Sustainability and Energy Efficiency | Initial steps toward reducing chemical reliance |

| Integration of Smart Monitoring | Limited use of digital water testing tools |

| Advancements in Water Treatment Innovation | Introduction of broad-spectrum chemical conditioners |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of eco-friendly certifications and stricter environmental regulations |

| Technological Advancements | Adoption of AI-powered water monitoring, automated dosing systems, and probiotic-based filtration enhancers |

| Industry Adoption | Widespread use of self-regulating, smart aquariums with real-time water quality adjustments |

| Supply Chain and Sourcing | Shift toward natural, plant-derived, and biodegradable water treatment solutions |

| Market Competition | Rise of startups specializing in organic and AI-integrated water purification solutions |

| Market Growth Drivers | Expansion of automated aquarium maintenance and eco-friendly water treatment innovations |

| Sustainability and Energy Efficiency | Full-scale adoption of carbon-neutral, non-toxic, and biodegradable water treatment solutions |

| Integration of Smart Monitoring | Widespread deployment of IoT-enabled, AI-driven water quality monitoring and treatment systems |

| Advancements in Water Treatment Innovation | Development of self-sustaining water ecosystems and natural microbial filtration technologies |

The aquarium water treatment market in the United States is expected to remain the largest owing to a vast base of aquarium hobbyists and rising need for superior water filtration and conditioning products. This fuels the demand for advanced water treatment solutions and are anticipated to contribute to the market growth.

Increasing awareness regarding optimal water quality coupled with technological advancements in water treatment are Delphin Chem width; ottoman market growth. Moreover, smart water treatment systems that are being introduced in the market with the integration of IoT-enabled real-time monitoring (which are mechanically driven as well) are instigating consumers to adopt automated solutions to clean the aquarium.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.2% |

In the UK, demand for aquarium water care products is driven by the rise in pet ownership and increasing interest in marine and freshwater aquariums. Market growth is indirectly supported by technological advancements in operative chemical and biological filtration systems.

Government policies favoring eco-friendly water treatment solutions and the growing prevalence of smart monitoring systems facilitate growth of the country market. In addition, increasing need for algae management solutions and order control systems are also helping to drive innovation in aquaculture technologies for industrial and residential aquarists.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.5% |

Germany, France, and Italy dominate the European aquarium water treatment market, aided by a burgeoning pet care sector and increasing consumer awareness about proper aquarium care.

Innovation in Aquarium Water Purification Technologies Encouraged in EU for Sustainable Water Treatment Solutions The push towards sustainable and energy-efficient water treatment solutions in the EU encourages a lot of innovation in aquarium water purification technology which encourages supplement demand. Moreover, stringent regulatory policies pertaining to water safety as well as growing 활용 of probiotic based water treatment will continue to drive the demand for advanced filtration systems across this region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 9.7% |

Due to the high prevalence of ornamental fishkeeping and the development of advanced water purification technology, the Aquarium water treatment market in Japan is on the rise. The market is also benefitting from the demand for compact, automated and energy efficient water treatment systems.

The country’s emphasis on technological advancement as well as healthy consumer demand for green and chemical-free water treatment products further contributes to the strong outlook for this country. The proliferation of UV sterilization and advanced bio-filtration techniques has enhanced water quality for highend hobbyists and commercial aquariums.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.0% |

The growing interest in both marine and freshwater aquariums and expansion of public aquariums and aquatic exhibitions in South Korea is further propelling the demand for aquarium water treatment solutions in the country.

In the case of the water treatment market, investment in smart water treatment technology, as well as support from the government for sustainable pet care products, has become a catalyst for the demand for water purification solutions. The market is further boosted by the implementation of AI-based water quality analysis and automated nutrient balancing systems, ensuring appropriate conditions for a broad range of aquatic organisms.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.4% |

Water treatment systems, including filters and ozone-based systems, help keep aquarium water well-maintained. They play a crucial role in mechanical, biological, and chemical filtration, providing a stunningly elaborate means of filtering out debris, toxins, and harmful microorganisms. Technologies like activated carbon filters and bio-media systems have become increasingly popular as they are cheaper to maintain than traditional methods, allowing for stable water parameters.

As home or commercial consumers become more interested in low-maintenance and energy-efficient filtration systems, this trend has led to a surge of innovation in this sector and filters as a popular choice. Improved Filtration Systems: New filtration systems, including aspects like automated self-cleaning filters and AI-powered monitoring systems, have increased the product's reliability and efficiency.

In contrast, Ozone systems have become increasingly widespread due to the strength with which they can purify water. Ozone Treatment: By degrading organic waste, eliminating pathogens, and reducing soluble toxics, ozone treatment increases water clarity and promotes aquatic life. In commercial aquariums and large-scale marine setups where water quality is critical, these systems are often preferred.

The increasing emphasis on sustainable and non-chemical approaches to water treatment has driven the market for ozone systems. Moreover, advanced ozone generators, having precise sensors and auto control features, are becoming more commonly used and effective, ensuring accurate dosage and increased efficiency level.

The filters are used for mechanical, biological, and chemical filtration that removes the debris, toxins, and harmful microorganisms. Cutting-edge filtration technologies, such as activated carbon filters and bio-media systems, have gained popularity because of their efficiency in keeping the water parameters stable. This innovation in the low-maintenance and energy-efficient membrane filtration systems segment is propelling the growth of this market as a preferred option for filtration of municipal water, along with commercial and private aquariums.

On the other hand, ozone systems are recommended for their powerful water disinfection ability. Ozone treatment improves water quality and promotes aquatic health by breaking down organic waste, killing harmful pathogens and destroying dissolved toxins. Good reason why commercial aquariums and large-scale marine setups love these systems. Increasing emphasis on sustainable and chemical-free water treatment solutions has boosted the integration of ozone systems in the market.

Liquid is the most common type of aquarium water treatment because it is the most easy to use and acts quickly. They are widely applied as dechlorination, bacterial balance and pH adjustment agents. Liquid formulations are known for providing accurate dosing to the aquarium and can be used by both novice and experienced aquarists, covering many applications.

The increasing popularity of multi-functional liquid treatments that serve several purposes-including water conditioning, nutrient supplementation, etc.-is another factor fuelling growth in this segment. Additionally, innovations in liquid treatment formulations have given rise to eco-friendly, biodegradable options that reduce environmental impact without compromising water quality.

Due to their ease of use and considerable shelf life, tablet-based treatment has also gained adoption. Slowly dissolving in water, tablets release their active ingredients over time, which is why they're perfect for controlled dosing in both fresh and marine aquariums. This added to their compactness and ease of storage source its popularity among both aquariums hobbyists as well as commercial users.

This segment is anticipated to grow further as manufacturers explore effervescent and time-release tablet formulations. Moreover, the advent of specialized tablets with targeted functions (like ammonia removers and probiotic-infused formulas) has expanded their use and enhanced their functionality for the variety of aquarium needs.

They are frequently employed to help dechlorinate, balance bacteria, and stabilize pH. They provide an easy way for precise dosing and cover a lot of area, thus are ideal, whether you are a beginner or an expert in aquatics. The market for all-in-one liquid treatments that provide multiple solutions (water conditioning, nutrients, etc.) remains the most dynamic segment.

In addition, treatments in the tablet form are gaining traction due to their ease of use and high shelf life. Slowly dissolving tablets provide consistent release of the active ingredient in both freshwater and marine aquariums, making tablets perfectly suited for controlled dosing. These are compact packages that are easy to store, which also increase their popularity with hobbyists and commercial users. This segment is likely to continue growing as producers make effervescent and time-release tablet innovations.

Aquarium water treatment products are obviously used for disinfecting and purifying water to create the right environment for aquatic life. Decontamination treatments remove organisms such as harmful bacteria, viruses and parasites which can lead to diseases in fish and other aquatic species.

There has been increasing recognition of need for fish health and disease prevention, resulting in the increasing adoption of advanced disinfection methods such as UV and ozone. In addition, technologies that were not widely available until recently, such as natural antimicrobial compounds and nanotechnology membranes for purifiers, have vastly improved the proficiency and safety of these solutions.

Aquarists also drive the demand for water purification, as they expect efficient solutions to achieve desired water parameters. Purification processes eliminate toxins, heavy metals and nutrients that can upset the aquatic ecosystem. With a growing awareness of the need for ecological and chemical-free purification solutions, there is a consistent interest in organic filtration media (like strand-fish) tending to probiotic water conditioners.

Aquarium seabed is covered with bio rubble and traps particulate organic matter (POM) that algae feed on during the process of rot. These treatments of disinfection will destroy harmful bacterwand viruses and parasites that causes diseases to fishes and other aquatic organisms. A rise in the importance of fish health and disease prevention has resulted in a greater trend toward implementing perks such as UV sterilization and ozone treatment.

Oligotrophic regulations in aquarids have involved water purification. Purification of these types removes toxins, heavy metals and excess of nutrients that upset the aquatic ecosystem. Existing solutions for natural filtration media and probiotics-based water conditioners are innovating like never before as demand for eco-friendly and chemical-free purification continues to grow.

This segment focuses on affordable solutions for the average aquarium user, thereby controlling the controlling the aquarium water treatment market. These products are accessible via retail stores and online marketplaces and are designed for a general consumer base, which comprises hobbyists and smaller fish tanks.

Expanding assortment of value-priced treatment solutions that offer dependable performance has led to growth in this category. [2] Furthermore, the presence of new, low-cost and multidimensional treatments that offer a mix of benefits within a single product has facilitated their use among cost-conscious consumers looking for convenience and effectiveness.

The premium range segment, however, is gaining traction with advanced aquarists and commercial aquarium operators. These include advanced filtration systems, probiotic-based conditioners, and specialized water enhancers, which offer superior performance and long-term benefits. A continuous demand for scientifically balanced, high-quality treatments in commercial and professional aquariums is contributing to an ongoing upturn in this segment.

Also, the premium segment is experiencing a trend of AI-powered dosing systems and customizable treatment solutions, shaping the evolution of aquarists who demand accuracy and ideal aquatic conditions. Widely available from retailers and online, these products are aimed at a broad consumer segment consisting of hobbyists and small-scale aquariums. This category has prospered as a result of the growing availability of inexpensive treatment solutions that offer dependable performance.

The premium range category, on the other hand, is on the rise among advanced aquarists and commercial aquarium operators. Luxury Water Treatment : Advanced filtration systems or probiotic based conditioners, and specialty enhancers - these high-end treatment solutions deliver better performance and long-lasting benefits. However, the growing demand for high-quality, scientifically prepared treatments in large-scale and professional aquariums will keep boosting this segment.

The commercial segment comprises public aquariums, research institutions, and aquaculture facilities, which together account for a significant share of the aquarium water treatment market. High-performance filtration, disinfection, and conditioning solutions are needed to maintain optimal aquatic environments at large-scale establishments.

Smart water treatment systems over automated ones are also gaining traction in this segment as they can maintain water quality without requiring a lot of manual intervention. The growth of commercial aquaculture operations and sustainable fish farming practices have also emphasized the need for advanced treatment solutions specific to large aquatic systems.

Hobbyists and professional aquascapers are also contributing significantly to growth in the market as private aquarium owners. As aquascaping and home aquarium setups continue to gain momentum, consumers are turning to high-quality water treatment solutions. Moreover, user-friendly, pre-measured treatments designed for various tank sizes have made water maintenance easier for private users, consequently driving demand in this segment.

Additionally, the intelligent integration of the home, such as app-controlled dosing systems and automated water quality tracking, truly optimizes comfort and accuracy for private users. High-performance filtration, disinfection and conditioning solutions are vital in keeping optimal aquatic environments in such large-scale facilities. Constant quality of treated water along with minimal manual intervention in the process creates significant demand for automatic and smart water treatment systems in this sector.

Private aquarium owners, which include both hobbyists and professional aquascapers, are also a great contributor to growth in the market. As aquascaping and home aquarium setups gain traction more consumers have taken an interest in high-end water treatment products. In this segment, the demand is being boosted mainly because the private users find the water maintainance more easier when they gain access to user-friendly, pre-measured, treatment products for various tank sizes.

Some of the main factors driving demand for treatment solutions in the market include growing concerns over the quality of water, aquascaping being basically popularized and advancements in both filtration and treatment technologies. To combat these issues, a lot of companies are investing in green formulations, intelligent monitoring systems, and all-in-one water conditioners to improve the overall health of aquariums. Important trends include the use of bio-filtration, pH stabilizers, and ammonia detoxifiers in marine and fresh water systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Seachem Laboratories Inc. | 20-24% |

| API (Mars, Incorporated) | 15-19% |

| Tetra (Spectrum Brands) | 11-15% |

| Fluval (Hagen Group) | 9-13% |

| AquaClear | 7-11% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Seachem Laboratories Inc. | Leading provider of high-quality water conditioners, ammonia removers, and pH stabilizers for all aquarium types. |

| API (Mars, Incorporated) | Specializes in comprehensive water treatment solutions, including biological filtration enhancers and algae removers. |

| Tetra (Spectrum Brands) | Develops premium aquarium water treatments integrated with stress-reducing and eco-friendly formulations. |

| Fluval (Hagen Group) | Innovates in multi-functional water treatment products that enhance fish health and water clarity. |

| AquaClear | Offers cost-effective and durable filtration media and conditioners designed for various tank sizes. |

Key Company Insights

Seachem Laboratories Inc. (20-24%)

Seachem is the world leader in fresh water treatment with a wide range of revolutionary, high quality products designed to detoxify ammonia, stabilize pH and maintain overall water balance. With State-of-the-Sansan Biological Filtration Technology embedded in its products, the frangrance removal is of the highest standard, refined daily morning and night for long-lasting freshness, and designed for long-term clarity, benefitting both freshwater and marine aquarists alike.

API (Mars, Incorporated) (15-19%)

They offer reliable water treatment products such as biological filtration enhancers and stress-reducing conditioners that help keep your fish healthy. Its probiotic-based water stabilizers and advanced dechlorinators help improve fish immunity and encourage a healthy aquatic ecosystem, and the company is still fine-tuning its formulations.

Tetra (Spectrum Brands) (11-15%)

Tetra is a manufacturer of all-in-one water conditioners that feature sustainable ingredients and aims to enhance water quality and fish health. INFO: The company incorporates plant-based water purifiers and packaging in its carbon-neutral lineup; All the products focus on sustainable aquatics.

Fluval (Hagen Group) (9-13%)

Fluval focuses on innovative, multifunctional water treatments, targeting water clarity and stability, for use in freshwater and marine aquaria. It has pioneered smart digital dosing systems and timed-release chemical delivery for round-the-clock water quality support.

AquaClear (7-11%)

AquaClear also provides pleasant filtration media and supplements at economical costs to help keep your aquarium water in optimal shape. New product innovations include high-capacity biological media and customizable filter cartridges providing maximum adaptability for a variety of tank setups.

Other Key Players (30-40% Combined)

The research and development of aquarium water treatment technology is led by both global and regional players, focusing on eco-friendly, effective, and non-harmful treatment methods. Key players include:

The overall market size for Aquarium water treatment market 1.8 Billion was USD in 2025.

The Aquarium water treatment market expected to reach USD 4.6 Billion in 2035.

Growing acceptance of a home aquarium and commercial aquarium, rising awareness about water quality management, increasing demand for efficient filtration and purification equipment, advanced technologies for water treatment, and an expanding aquascaping and ornamental fish sector will drive demand for the aquarium water treatment market.

The top 5 countries which drives the development of Aquarium water treatment market are USA, UK, Europe Union, Japan and South Korea.

Filters and ozone systems growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Purpose, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Purpose, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Form, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Purpose, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 42: Western Europe Market Volume (Units) Forecast by Form, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 44: Western Europe Market Volume (Units) Forecast by Purpose, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 46: Western Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 54: Eastern Europe Market Volume (Units) Forecast by Form, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 56: Eastern Europe Market Volume (Units) Forecast by Purpose, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 58: Eastern Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 60: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Units) Forecast by Form, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Units) Forecast by Purpose, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 78: East Asia Market Volume (Units) Forecast by Form, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 80: East Asia Market Volume (Units) Forecast by Purpose, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 82: East Asia Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 84: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Units) Forecast by Form, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Units) Forecast by Purpose, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by Purpose, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 31: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Form, 2023 to 2033

Figure 33: Global Market Attractiveness by Purpose, 2023 to 2033

Figure 34: Global Market Attractiveness by Price Range, 2023 to 2033

Figure 35: Global Market Attractiveness by End User, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by Purpose, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 67: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Form, 2023 to 2033

Figure 69: North America Market Attractiveness by Purpose, 2023 to 2033

Figure 70: North America Market Attractiveness by Price Range, 2023 to 2033

Figure 71: North America Market Attractiveness by End User, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by Purpose, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Purpose, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Price Range, 2023 to 2033

Figure 107: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 120: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 124: Western Europe Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 128: Western Europe Market Volume (Units) Analysis by Purpose, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 132: Western Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 136: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Form, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Purpose, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Units) Analysis by Purpose, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Form, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Purpose, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Units) Analysis by Purpose, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Form, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Purpose, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Price Range, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 228: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 232: East Asia Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 236: East Asia Market Volume (Units) Analysis by Purpose, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 240: East Asia Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 244: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Purpose, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Price Range, 2023 to 2033

Figure 251: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Units) Analysis by Purpose, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Purpose, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Price Range, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aquarium Decor Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Hydrometers Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Protein Skimmers Market Growth - Trends & Demand Forecast 2025 to 2035

Aquarium Heaters and Chillers Market - Growth & Forecast 2025 to 2035

Aquarium & Fish Bowls Market Growth - Trends & Forecast to 2035

Aquarium Pumps & Filters Market Demand 2024 to 2034

Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA