This report on Global aquarium heaters and chillers market, provides analysis on the key factors like increasing demand, potential opportunities, sales analysis, market definition and market growth. Heaters and chillers are essential devices to keep the water at suitable temperatures for the aquarium inhabitants.

The rising trend towards advanced aquarium technologies and the increasing popularity of aquariums among hobbyists have contributed to the high demand for heating and cooling systems with high heating/cooling efficiency.

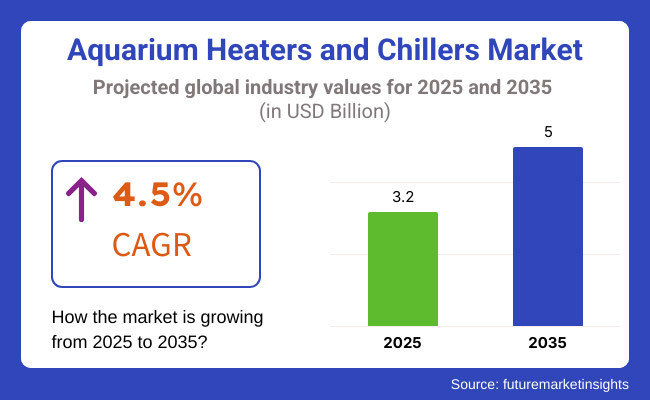

The aquatic heaters and chillers market was estimated to be worth around USD 3.2 Billion in 2025. It is estimated to reach USD 5.0 Billion by 2035 at a CAGR of 4.5% during the period 2020 to 2035. Market drivers for this growth include developments in temperature control instruments, a rise in smart and energy-efficient tank gear, and increasing outlays in pet retailing.

North America is a leading market for aquarium heaters and chillers, backed by a well-established pet care industry, high adoption of advanced aquarium equipment, and substantial investments in R&D. Aquarium temperature regulation technology is developed and commercialized the most in next generation in these countries- USA & Canada.

The European market features growing demand for energy-efficient aquarium systems, strict regulatory standards, and advances in aquatic care technologies. For example, countries like Germany, France, and the UK concentrate on sustainability and better product designs to increase the performance of the aquarium.

Japan, China, and India are famous places in this field, owing to their quick urban development, rising disposable incomes, and growing number of the aquarium lovers. Pet care products and infrastructure development in countries such as China, India, and Japan are high in demand and being heavily invested in.

The market in Latin America has witnessed gradual expansion, owing to a rise in pet ownership as well as demand for high-quality aquarium equipment. Brazil and Mexico play an important part by providing more advanced heating and cooling solutions that are available in aquariums.

The market for aquarium heaters and chillers in the Middle East & Africa region is slowly but surely gaining a foothold, thanks to increasing investments in pet care, marine conservation projects, and luxury aquariums. For advancing technological developments and product availability in this space, efforts are being led by UAE and South Africa respectively.

The aquarium heaters and chillers market is poised to witness exponential growth over the next decade, owing to continuous innovations in aquarium temperature regulation technologies and their increasing adoption in residential and commercial applications, creating new opportunities for manufacturers, pet care brands, and aquatic enthusiasts.

Challenge

High Energy Consumption and Operational Costs

Energy consumption related to heating and cooling systems poses several challenges to the overall growth of the Aquarium Heaters and Chillers Market. Fiercelies, breams, trouts, or bowls of aquaponics that change with fish depending on the seasons can not only continue burning electricity to keep waters at the appropriate temperature, which drives electricity costs to end consumers up.

As energy efficiency and sustainability become increasingly important, manufacturers are under pressure to design solutions that operate at low power and high efficiency. Firms need to concentrate on energy-efficient innovations including, but not limited to, smart thermostats, automatic temperature types, and eco-friendly refrigerants to help mitigate energy use and running costs.

Material Durability and Corrosion Resistance

Aquarium heaters and chillers work in aquatic environments that subject them to the harshness of water corrosion, mineral deposits, and temperature effects, degrading their lifespan and effectiveness. Inferior quality materials and inadequate design may result in product failure, leakage, and safety hazards.

A solution to this problem is to use higher quality, rust-resistant materials, including titanium, stainless-steel, and high-grade plastics, which will alternatively lead to increased production costs. Strengthening quality assurance processes and fabricating self-cleaning/self-passivating coating technologies will increase product lifespan and reliability.

Opportunity

Growth in Marine and Reef Aquarium Popularity

The increasing interest in marine and reef aquariums will help improve the demand for aquarium heaters and chillers market. Advanced heating and cooling solutions are in demand because saltwater aquariums need precise temperature regulation to ensure that their sensitive coral and marine life are taken care of.

There is untapped opportunity in this growth category for manufacturers that introduce innovative features such as specialized temperature control systems, remote monitoring capabilities, with smart home ecosystems integration. Company specialize in providing customizable solutions, with solutions that can be as well precise as aesthetic, this can allow suclus use with both hobbyists and professional aquarist and allow them to know the exact temperature.

Advancements in Smart and Automated Temperature Control

With the growing prevalence of smart home technology, the creation of intelligent aquarium heating and cooling devices is possible too. In order to maintain ideal aquarium conditions, IoT-enabled heaters and chillers may offer remote control, mobile app connectivity, and real-time monitoring capabilities.

Integrating these AI-based temperature adjustments with predictive maintenance alerts can enhance user experience as well as ensure aquatic life is not compromised. While developing smart, automated solutions will give manufacturers an edge in the market.

Aquarium Heaters and Chillers Market: Snapshot Changes: From 2020 to 2024 Current Market Opportunity: Between 2020 and 2024, the Aquarium Heaters and Chillers Market was growing steadily, owing to the growing pet ownership, increasing interest in aquascaping, and energy-efficient heating and cooling technologies advancements.

Yet supply chain disruptions, raw material price volatility, and regulatory compliance requirements continued to challenge manufacturers. Companies responded by making their products more durable, efficient and by using refrigerants that were less harmful to the environment.

Trends: The 2025 to 2035 period will see several transformations within the market, such as AI-driven temperature regulation, smart home integration, and sustainable energy solutions. Compact, Portable, and Modular:

As the trend towards smaller, portable, and lightweight designs continues, novelty in heating systems will be driven by the use of nanotechnology, which will provide enhanced corrosion resistance, and the development of heating elements designed specifically to interact with their chemical environment for longer-lasting performance. In addition, regulatory frameworks supporting for energy-efficient solutions will urge manufacturers to create eco-friendly option.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency standards and safety regulations |

| Technological Advancements | Growth in energy-efficient heating and cooling systems |

| Industry Adoption | Increased popularity of freshwater and saltwater aquariums |

| Supply Chain and Sourcing | Dependence on conventional manufacturing and distribution channels |

| Market Competition | Dominance of traditional aquarium heater and chiller manufacturers |

| Market Growth Drivers | Rising interest in home aquariums and aquascaping |

| Sustainability and Energy Efficiency | Initial adoption of eco-friendly refrigerants and low-energy solutions |

| Integration of Smart Monitoring | Limited adoption of remote-controlled and programmable heaters/chillers |

| Advancements in Heating & Cooling Innovation | Introduction of digital thermostats and high-precision chillers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter energy consumption limits and widespread adoption of eco-friendly refrigerants |

| Technological Advancements | Expansion of AI-driven, self-adjusting temperature control solutions |

| Industry Adoption | Widespread use of smart aquarium systems with integrated heating and cooling |

| Supply Chain and Sourcing | Expansion into localized production, sustainable sourcing, and recyclable materials |

| Market Competition | Rise of tech-focused startups specializing in smart aquarium solutions |

| Market Growth Drivers | Surge in demand for precision temperature control systems for marine and reef aquariums |

| Sustainability and Energy Efficiency | Full-scale transition to solar-powered, low-carbon footprint temperature regulation systems |

| Integration of Smart Monitoring | Widespread use of IoT-enabled, AI-assisted monitoring systems for automated aquarium temperature control |

| Advancements in Heating & Cooling Innovation | Development of self-cleaning, anti-corrosive, and nanotechnology-enhanced heating and cooling systems |

North America accounts for the largest share in the aquarium heaters and chillers market as the largest base of aquarium enthusiasts is located in the region and demand for smart mode of temperature control systems is increasing in North America. The growth of the market can be attributed to the presence of major manufacturers of pet care products and advanced technologies for building aquariums.

Market expansion is further propelled by growing demand for customized and energy-efficient aquarium heating and cooling systems, coupled with rising awareness about aquatic pet health.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

The United Kingdom aquarium heaters and chillers market is driven due to rising pet ownership coupled with increasing demand for marine and freshwater aquariums. Value of aquarium temperature control through technological advancements boosts the market growth.

The country's market growth is further enhanced by government regulations promoting sustainable energy-efficient aquarium devices and the rising demand for smart aquarium solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

Germany, France, and Italy dominate the European species aquarium heaters and chillers market due to the growing pet care industry and increasing demand for high-grade aquarium accessories.

European Union's emphasis on energy-efficient home appliances and innovative aquatics management systems is facilitating advancements in temperature control solutions for aquariums which will bolster growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.4% |

Japan possesses a rich tradition of ornamental fishkeeping and sophisticated aquarium technology advancements, which drives its booming market for aquarium heaters and chillers. Market growth is further bolstered by the rising need for compact, efficient, and automated temperature control systems.

The growth of the market is supported by innovations in eco-friendly and smart aquarium equipment, and government incentives for energy-efficient products.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea is also a crucial market for aquarium heaters and chillers due to the increasing popularity of marine and freshwater aquariums and the growing number of aquarium cafés and aquatic exhibitions.

The growth of high-performance heating and cooling solutions is supported by strong smart aquatics technology investments and government support for sustainable pet care products.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

In the world of aquariums, submersible heaters are becoming more popular, in part because they are effective at keeping water temperatures consistent. Why these heaters work heat by embed directly into the water, thus providing heat through direct contact and evenly distributed. These are widely used in saltwater and freshwater aquariums, as such, they are commonly utilized by both professionals and hobbyists.

That’s why the market for submersible heaters is booming, as aquarium owners - as well as commercial consumers - seek out fixed, efficient heating solutions. Moreover, new heating technologies, like set-point thermostats and smart controls, have ushered in advanced temperature accuracy, which have drawn further consumer attention.

As a result, manufacturers are offering aquarium heating solutions that utilize advanced materials, automation features, and technologies to ensure durability and longevity of the product.

Chillers are also critical in maintaining proper water temperatures, particularly in commercial and large aquariums that possess sensitive sea life. Unlike a submersible chiller, in-line chillers attach externally to filtration systems and feature precision temperature controls without seizing precious tank real estate.

Chillers are essential to sustaining sensitive marine species, such as coral reefs and exotic fish species, which flourish in cooler waters and need stable environments. This growth is ascribed to the increasing adoption rate for advanced in-line cooling systems in public aquariums and marine research facilities.

Industry 4.0 solutions focus on large-scale aquarium efforts, with Digital Monitoring Systems or even automated and digital cooling adjustments that allow for precision-saving energy. Moreover, regulatory requirements pertaining to temperature management in conservation centers and commercial breeding industry further contribute toward the growth of aquaculture temperature control equipment market.

As more aquatic life enthusiasts get serious about home aquarium care and regular maintenance, chillers and other quality hot and cold equipment is on the rise. It is becoming common among the home aquarium enthusiasts to use water heaters and chillers controlled by smart devices to save energy and enjoy greater convenience.

As aquascaping out of the home, or even building quality setups for aquariums, became more of a norm and hobby, naturally the need for temperature regulation in a more professional manner was much requested. Consumers are demanding quieter, low-maintenance solutions with digital interfaces that provide real time temperature monitoring.

Moreover, the rise of nano and planted aquariums has bolstered demand for specialized heating and cooling systems that are designed for small, delicate aquatic environments and for which precision temperature regulation is an absolute criterion among buyers.

Another key market element is the commercial sector, in which large aquariums and aquatic research centers pay large sums of money for industrial-grade temperature control systems. Industrial-grade heating and cooling systems need to be installed for megafauna aquariums to help with biodiversity of aquatic life.

Public aquariums, marine research centers, and fish breeding farms rely on elaborate heating and chilling systems to emulate natural conditions and develop sustainable environments for marine species. The rising market preference for temperature-sensitive marine organisms that are used in the commercial breeding industries is expected to continue to spur the demand for aquarium heaters and chillers that are efficient and of high-performance.

Moreover, new remote monitoring devices allow commercial users to automate how they manage temperature and salinity levels, keeping stable climates for a manager's diverse marine offering. The growing adoption of eco-friendly aquaculture and sustainable practices also drive the market, as manufacturers create energy-efficient and environment-friendly products to ensure sustainable commercial operations.

Based on the material type, plastic-based systems dominate the aquarium heater and chiller market because they are economical, lightweight, and rust-proof, making them suitable for aquatic applications. Most submersible heaters and in-line chillers feature durable plastic casings that help stave off water damage, which means they can operate reliably for long periods of time.

In addition, the advancement of new polymers to the present one are superior in insulating properties and heat resistance of plastics, which makes it an ideal choice in chillers and heaters used in aquariums. Recent advancements in moral and biodegradable plastics also affect customers choices, as sustainability has become an important need and point for both producers and customers.

Advancements in high-temperature coatings and durable plastic structures have been added to make these systems long lasting and efficient, providing reliable operation in a wide range of aquatic environments.

High-grade aquarium heaters and chillers are typically made of metal alloys like stainless steel and titanium to offer more resistance, conductivity, and protection against seawater corrosion. Metal-alloy-based heating and cooling solutions are typically chosen for use such as commercial aquariums and research facilities that have equipment that needs to have a longer life and that can withstand extreme conditions.

Titanium based systems are especially appreciated for their higher durability in marine environments, where prolonged exposure to salt water can quite literally eat away at lesser materials. The growing utilization of hybrid material designs, combining metal and high-grade polymers, guarantees a balance between durability and economical factors.

Furthermore, enhanced energy efficiency and fast heat-transformation mechanisms have cemented metal-based systems as one of the most favored choices for high-end and industrial aquarium plants, where precision and reliability are vital.

Online stores have also emerged as an important sales channel in the aquarium heaters and chillers market, where a common platform helps compare various product offerings with a number of reviews and ratings for the same to check side-by-side. For private consumers and smaller commercial buyers alike, e-commerce provides convenience, competitive prices and home delivery.

App-based controls on heat pumps and chillers are gaining steam, and as millennials and Gen Z emerge as a primary target consumer group, so has the online promotion and sales of app-enabled equipment that monitors and adjusts temperature remotely.

Dozens of popular sites like Amazon, eBay and specialized aquarium supply sites offer smart heating and cooling options to consumers looking for automation and real-time control over their environment. Furthermore, subscription-based maintenance and replacement services are emerging, which enable aquarium owners to access reliable equipment upgrades with little hassle.

Segmentally clean retailers are a critical channel, particularly in providing distribution channels for premium and bespoke heating and cooling devices in aquariums. For the needs of the hobbyists, many call on specialized aquarium retailers who can provide expert advice, help with personalized product demonstration, and give suggestions to help drop the right system in the right tank.

There are certainly boutique retailers that sell or partner with premium brands and offer installation and maintenance of systems for the hobbyist or professional aquarist. Over the years, with the increasing demand for specialized aquarium devices, specialty stores became the focal point for product awareness and beacons of customer trust, forming long-term relations with customers that according, to which quality and expertise matter.

In addition, also, the establishment of in-store experience centers, where customers can interact with live heating and cooling system demonstrations, has enhanced engagement and created confidence in these high-end products. With an growing demand for tailored and interactive purchasing experiences, specialty stores remain vital drivers for premium and advanced aquarium equipment.

However, factors such as growing demand for advanced temperature regulation systems, increasing popularity of aquascaping, and rising commercial and residential aquarium installations are expected to augment the growth of global aquarium heaters and chillers market.

Firms are concentrating on energy efficient designs, smart temperature control tech, and sustainable materials. Major trends: IoT-based temp. management, compact and efficient chillers, anticorrosive heating elements.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Eheim GmbH & Co. KG | 20-24% |

| Fluval (Hagen Group) | 15-19% |

| Hydor Group | 11-15% |

| JBJ Aquarium | 7-11% |

| AquaTop | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Eheim GmbH & Co. KG | Leading provider of precision aquarium heaters and efficient water chillers with smart temperature regulation. |

| Fluval (Hagen Group) | Specializes in digital heaters and advanced cooling systems for marine and freshwater aquariums. |

| Hydor Group | Develops innovative submersible heaters and inline chillers with energy-saving features. |

| JBJ Aquarium | Focuses on compact and high-efficiency aquarium chillers for commercial and home use. |

| AquaTop | Offers cost-effective and durable heating and cooling solutions for various aquarium sizes. |

Key Company Insights

Eheim GmbH & Co. KG (20-24%)

Eheim is the grandmaster of aquarium heating and cooling market and its real showing is the test of energy masters, durable, precision-controlled, enduring temperature management systems.

Fluval (Hagen Group) (15-19%)

Fluval incorporates smart digital control technology into its heaters and chillers to help ensure that aquatic ecosystems maintain the correct temperature.

Hydor Group (11-15%)

Hydor focuses on energy-conscious heating and cooling equipment for aquarium environments, built crowd-resistant for the long haul.

JBJ Aquarium (7-11%)

JBJ offers high-end aquarium chillers that tend to be compact to suit both home setups and commercial aquariums.

AquaTop (5-9%)

AquaTop is known for breeding affordability and reliable products at the same time, so with their wide range of aquarium heating and cooling products, you can feel sure that there is an ideal option amongst them for you.

Global and regional players invest in research and development for efficient, durable, and smarter controls systems in aquarium temperature management. Key players include:

The overall market size for Aquarium Heaters and Chillers Market3.2 Billion was USD in 2025.

The Aquarium Heaters and Chillers Market expected to reach USD 5.0 Billion in 2035.

Factors that drive the demand for aquarium heaters and chillers market include the increasing popularity of aquascaping, increasing adoption of aquarium in homes and commercial, increasing awareness of watering habitat conditions for aquatic animals, technological advancement in energy saving temperature control system and increasing trends of freshwater and marine fishkeeping.

The top 5 countries which drives the development of Aquarium Heaters and Chillers Market are USA, UK, Europe Union, Japan and South Korea.

Submersible heaters and In-line chillers growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by End-User, 2023 to 2033

Figure 28: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by End-User, 2023 to 2033

Figure 58: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aquarium Decor Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Hydrometers Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Protein Skimmers Market Growth - Trends & Demand Forecast 2025 to 2035

Aquarium Water Treatment Market Growth - Trends & Forecast 2025 to 2035

Aquarium & Fish Bowls Market Growth - Trends & Forecast to 2035

Aquarium Pumps & Filters Market Demand 2024 to 2034

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Heaters Market Trends and Forecast 2025 to 2035

Fuel Operated Heaters Market

Packaging Machine Heaters Market Growth – Trends & Forecast 2025 to 2035

Industrial Solar Water Heaters Market Growth – Trends & Forecast 2025 to 2035

Blast Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Data Center Chillers Market Size and Share Forecast Outlook 2025 to 2035

Instant Wine Chillers & Refreshers Market

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA