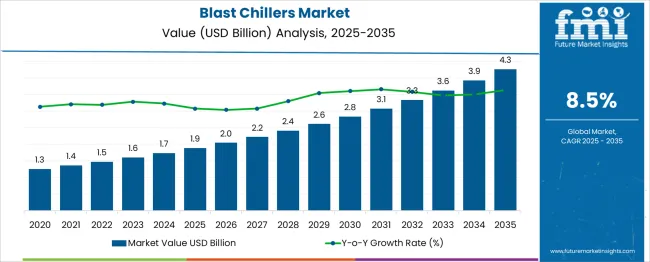

The Blast Chillers Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Blast Chillers Market Estimated Value in (2025 E) | USD 1.9 billion |

| Blast Chillers Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The blast chillers market is growing steadily, supported by rising demand in commercial kitchens and foodservice establishments for rapid cooling solutions that maintain food quality and safety. Increasing awareness of food safety regulations and the need to reduce bacterial growth have pushed foodservice operators to adopt blast chillers.

The hospitality industry, especially hotels and restaurants, is emphasizing efficiency and hygiene to meet customer expectations and regulatory standards. Technological advancements have improved chiller performance and energy efficiency, making them more attractive investments for commercial kitchens.

The growing trend of meal prepping and catering services is further driving demand for blast chillers. Looking ahead, the market is expected to expand due to rising urbanization, expanding foodservice sectors, and stricter food safety enforcement. Segment growth is projected to be led by reach-in blast chillers favored for their capacity and versatility and hotel and restaurant applications which form the core demand base.

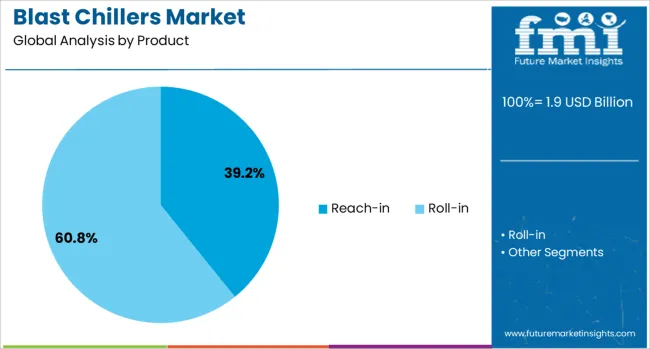

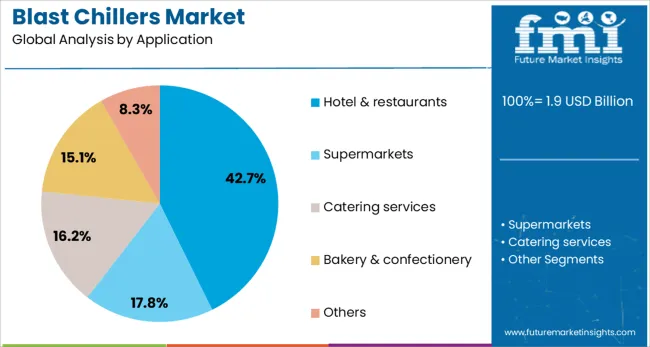

The blast chillers market is segmented by product and application and geographic regions. By product of the blast chillers market is divided into Reach-in and Roll-in. In terms of application of the blast chillers market is classified into Hotel & restaurants, Supermarkets, Catering services, Bakery & confectionery, and Others. Regionally, the blast chillers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The reach-in blast chillers segment is projected to account for 39.2% of the market revenue in 2025, maintaining its position as the leading product type. These chillers are preferred for their ability to handle large volumes of food and fit into compact kitchen layouts. Foodservice operators value reach-in chillers for their ease of access and efficient cooling cycles, which help preserve food texture and taste.

Their design supports frequent use in busy kitchens and allows multiple trays to be processed simultaneously. As hotels and restaurants strive to meet hygiene standards and reduce food waste, reach-in blast chillers are increasingly deployed.

The segment benefits from continuous improvements in temperature control and energy consumption, enhancing operational efficiency.

The hotel and restaurant segment is expected to hold 42.7% of the blast chillers market revenue in 2025, solidifying its lead as the primary application area. Growth is driven by the rising number of dining establishments aiming to optimize kitchen workflows and ensure food safety. Blast chillers have become essential in managing food preparation schedules, enabling chefs to prepare dishes in advance without compromising freshness.

Increasing consumer demand for high-quality food and quick service has also encouraged hotels and restaurants to adopt rapid cooling technologies. This segment benefits from expanding hospitality sectors in urban centers and growing awareness of food safety regulations.

With these factors in play, hotel and restaurant applications will continue to be the major revenue contributor in the blast chillers market.

Blast chillers are being adopted by foodservice operators and retail networks to achieve rapid cooling for prepared meals and perishable goods. In 2024, large catering kitchens and central production facilities increased installations to preserve food quality and reduce waste. In 2025, supermarket chains and frozen food manufacturers were observed deploying blast chillers before freezing processes to enhance product consistency. Opportunities are expanding into energy-efficient models featuring smart controls. Suppliers delivering high-capacity, programmable units with minimal footprint and precise cooling profiles are positioned to lead this essential commercial refrigeration segment.

The imperative to maintain freshness and food safety has been identified as a key driver for blast chiller adoption. In 2024, central kitchens began deploying rapid-cool systems to bring cooked meals to safe holding temperatures and comply with food-safety regulations. In 2025, deli and prepared-food manufacturers adopted modular blast chiller units ahead of freezing or packaging operations, citing improved texture retention and flavor capture. These developments indicate that compliance-driven preservation not merely speedis informing capital investment decisions. Providers offering consistent chilling performance with user-programmable cycles and HACCP traceability are thus being positioned to capture priority among foodservice and retail operators.

In 2024, blast chiller manufacturers began offering high-efficiency units with variable-speed compressors and intelligent defrost cycles to reduce energy consumption. In 2025, these systems were being trialed in dark kitchens and large bakery facilities to balance high usage with lower utility expenses. These implementations demonstrate that when blast chillers are optimized for energy performance, food operators can achieve both operational savings and reduced total cost of ownership. Suppliers capable of delivering fully insulated, low-energy blast chambers with smart controls and green refrigerants are being positioned to attract buyers focused on long-term operational efficiency.

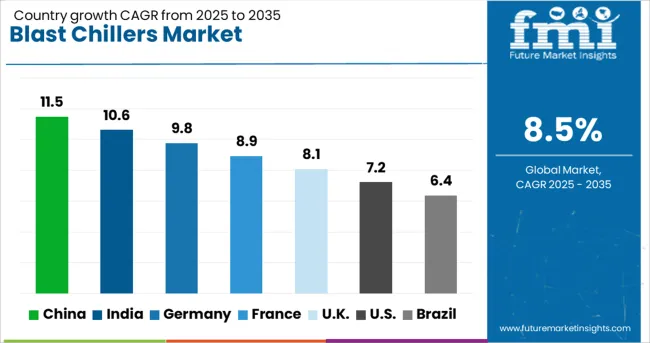

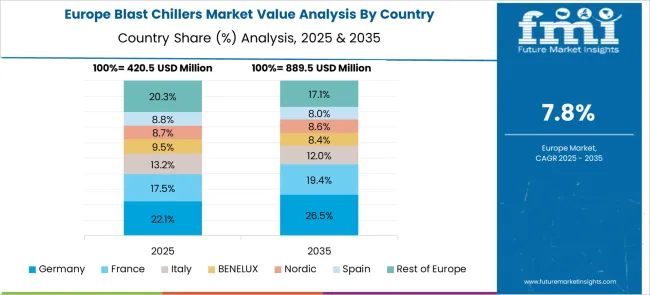

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The global blast chillers market is projected to grow at a CAGR of 8.5% from 2025 to 2035. China leads with 11.5%, followed by India at 10.6% and Germany at 9.8%. France records 8.9%, while the United Kingdom posts 8.1%. Growth is driven by stringent food safety regulations, demand for rapid cooling solutions in foodservice and catering, and the rising popularity of ready-to-eat meals. China and India dominate with high adoption in commercial kitchens and quick-service restaurants, while Germany focuses on energy-efficient, high-capacity chillers. France and the UK emphasize compact, smart-controlled units for urban hospitality sectors.

China is forecast to grow at 11.5%, driven by the rapid expansion of foodservice chains and frozen food processing units. Manufacturers are launching high-capacity chillers equipped with advanced airflow technology for uniform cooling. IoT-enabled monitoring systems improve operational reliability in large catering facilities. Government enforcement of HACCP and food safety standards accelerates adoption in industrial kitchens.

India is projected to grow at 10.6%, supported by rising demand from hotels, restaurants, and organized food retail. Compact, energy-efficient blast chillers gain traction in urban commercial kitchens. Domestic manufacturers emphasize cost-effective models integrated with programmable cycles for diverse food categories. Increasing adoption in central kitchens and catering services strengthens growth opportunities.

Germany is forecast to grow at 9.8%, driven by EU food safety regulations and consumer preference for premium ready-to-eat products. Energy-efficient chillers equipped with advanced heat recovery systems dominate the market. Manufacturers prioritize stainless steel construction and ergonomic designs for commercial kitchens. Smart chillers integrated with digital interfaces improve efficiency in large-scale catering operations.

France is expected to grow at 8.9%, driven by the expansion of bakery, patisserie, and gourmet restaurant sectors. Blast chillers with multi-functionality, such as shock freezing, are gaining popularity in premium kitchens. French manufacturers emphasize compact models with advanced airflow distribution systems. Growing demand for chilled gourmet desserts accelerates deployment in artisanal production units.

The UK is projected to grow at 8.1%, supported by increasing adoption in catering and institutional foodservice sectors. Demand for blast chillers with advanced energy-saving modes is rising to meet sustainability targets. Manufacturers focus on easy-to-install modular designs for small kitchens. Connectivity features enabling remote monitoring and predictive maintenance enhance efficiency and reduce downtime.

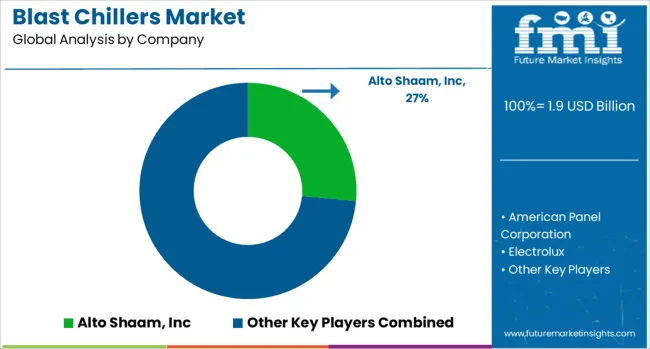

The blast chillers market is moderately consolidated, led by Alto Shaam, Inc. The company holds a dominant position through its advanced chilling technologies, HACCP-compliant systems, and strong penetration in commercial kitchens and foodservice operations. Dominant player status is held exclusively by Alto Shaam, Inc. Key players include American Panel Corporation, Electrolux, Hobart Dayton Mexicana, Illinois Tool Works, Inc., and Master-Bilt Products, each offering blast chillers with features such as rapid cooling cycles, energy efficiency, and modular designs for diverse food processing environments. Emerging players remain limited in this segment due to strict food safety regulations, high capital requirements, and established brand dominance in the commercial refrigeration sector. Market demand is driven by the rising need for food safety compliance, extended shelf life for prepared foods, and growing adoption of advanced chilling systems in hotels, restaurants, and catering services.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Product | Reach-in and Roll-in |

| Application | Hotel & restaurants, Supermarkets, Catering services, Bakery & confectionery, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alto Shaam, Inc, American Panel Corporation, Electrolux, Hobart Dayton Mexicana, Illinois Tool Works, Inc., and Master-Bilt Products |

| Additional Attributes | Dollar sales by unit type (shock, blast, spiral), regional demand trends, competitive landscape, buyer preferences for capacity and energy efficiency, integration with HACCP compliance systems, innovations in rapid-cooling cycles, energy-efficient compressors, and IoT-enabled temperature monitoring for food safety and operational optimization. |

The global blast chillers market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the blast chillers market is projected to reach USD 4.3 billion by 2035.

The blast chillers market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in blast chillers market are reach-in, _capacity, roll-in and _capacity.

In terms of application, hotel & restaurants segment to command 42.7% share in the blast chillers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blast Freezing for Frozen Food and Feed Market Size and Share Forecast Outlook 2025 to 2035

Blasthole Drills Market Size and Share Forecast Outlook 2025 to 2035

Sandblasting Media Market Size and Share Forecast Outlook 2025 to 2035

Glioblastoma Treatment Drugs Market Size and Share Forecast Outlook 2025 to 2035

Sand Blasting Machines Market Size and Share Forecast Outlook 2025 to 2035

Global Fibroblast-Derived Protein Market Size and Share Forecast Outlook 2025 to 2035

Shot Blasting Machine Market - Size, Share, and Forecast 2025 to 2035

Fibroblast Growth Factor Receptor (FGFR) Inhibitor Market - Growth & Forecast 2025 to 2035

Retinoblastoma Treatment Market Size and Share Forecast Outlook 2025 to 2035

Nephroblastoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Vapour Blasting Equipment Market Growth - Trends & Forecast 2025 to 2035

Abrasive Blasting Nozzles Market

Countertop Blast Chiller Market Size and Share Forecast Outlook 2025 to 2035

Human Osteoblasts Market – Growth & Forecast 2024-2034

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

Data Center Chillers Market Size and Share Forecast Outlook 2025 to 2035

Instant Wine Chillers & Refreshers Market

Aquarium Heaters and Chillers Market - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA