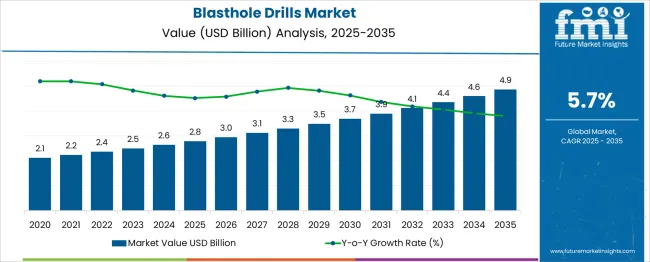

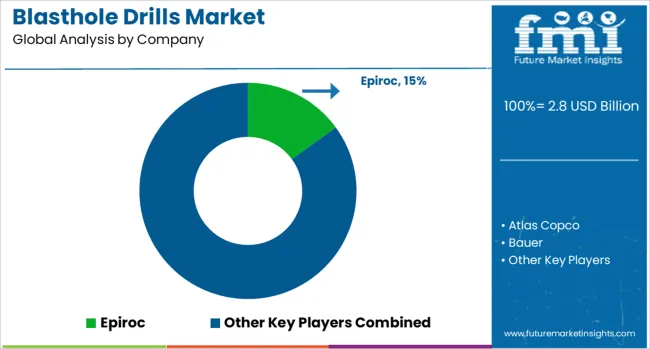

The Blasthole Drills Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.9 billion by 2035. The compound annual growth rate of 5.7% indicates stable market demand, largely aligned with mature industry segments in mining and construction equipment.

Between 2025 and 2028, the market grows from USD 2.8 billion to USD 3.3 billion, reflecting incremental gains of around USD 0.2 billion annually. This early phase signifies market steadiness, with existing manufacturers maintaining competitive positions. The period from 2028 to 2031 sees a rise from USD 3.3 billion to USD 3.9 billion, marking a continuation of consistent expansion.

The limited volatility in annual growth suggests minimal disruption from emerging technologies or substitute drilling methods, preserving traditional players’ shares. From 2031 to 2035, the market expands further from USD 3.9 billion to USD 4.9 billion, with annual gains gradually reaching USD 0.3 billion.

The absence of aggressive upswings or downturns implies a market structure with relatively fixed player positioning and no evident erosion in market control. The decade-long performance supports the interpretation of market share retention with marginal gains, underpinned by enduring applications in surface mining, quarrying, and infrastructure projects.

| Metric | Value |

|---|---|

| Blasthole Drills Market Estimated Value in (2025 E) | USD 2.8 billion |

| Blasthole Drills Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The blasthole drills market is undergoing steady expansion, supported by sustained demand from surface mining operations and infrastructure-driven resource extraction. Increasing global metal and mineral consumption, particularly in energy transition sectors, has intensified drilling activities in both greenfield and brownfield mining zones.

Advancements in machine automation, operator assistance systems, and telemetry integration are reshaping equipment expectations, favoring high-efficiency and precision-capable drills. Investments in fleet modernization and environmental compliance have LED mining firms to adopt newer drilling technologies with lower fuel consumption and improved safety profiles.

Government support for domestic mining and critical mineral exploration, combined with increased capital inflow from the private sector, is anticipated to reinforce growth. Looking forward, digital connectivity, predictive maintenance platforms, and hybrid-electric drill developments are expected to drive innovation and global equipment upgrades.

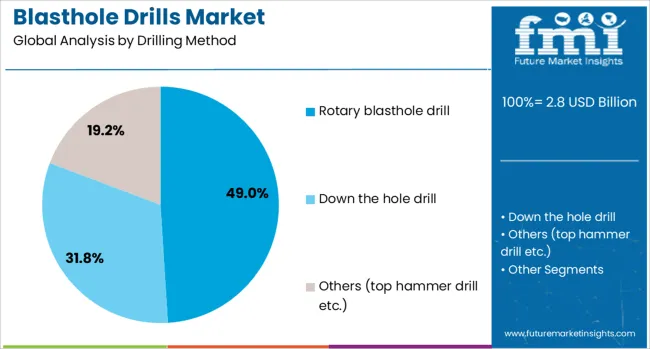

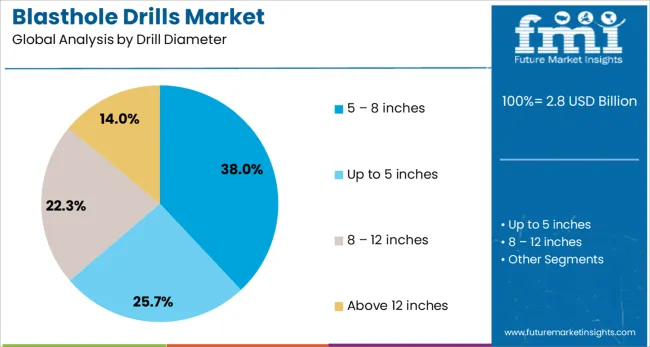

The blasthole drill market is segmented by drilling method, drill diameter, power transmission, mode of operation, application, end-use industry, and geographic regions. By drilling method, the blasthole drill market is divided into Rotary blasthole drill, Down the hole drill, and others (top hammer drill, etc.). In terms of drill diameter, the blasthole drill market is classified into 5 - 8 inches, up to 5 inches, 8 - 12 inches, and above 12 inches.

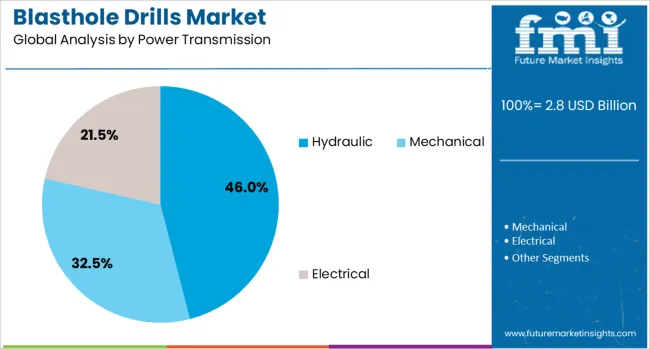

Based on power transmission, the blasthole drill market is segmented into Hydraulic, Mechanical, and Electrical. The mode of operation of the blasthole drill market is segmented into Automatic and Manual. By application, the blasthole drill market is segmented into Surface and Underground.

By end-use industry, the blasthole drill market is segmented into Mining, Construction, Oil, and gas. Regionally, the blasthole drill industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Rotary blasthole drilling is expected to capture 49.0% of total market revenue in 2025, making it the leading drilling method. Its dominance is attributed to superior performance in large-diameter drilling applications and consistent penetration rates in soft to medium rock formations.

The method supports high productivity over extensive bench lengths, which aligns with operational goals in large-scale open-pit mining. Lower operating costs per meter and reduced bit wear, compared to percussive methods, have made rotary drilling favorable for long-term deployment.

Additionally, integration with GPS-based drill navigation and semi-autonomous features has further optimized efficiency and depth accuracy. The method’s compatibility with both down-the-hole and rotary tricone bits offers versatility for varying geologies, cementing its lead position in high-volume operations.

The 5 - 8 inches drill diameter range is anticipated to account for 38.0% of the blasthole drills market revenue in 2025, ranking it as the most widely used diameter category. This preference stems from its adaptability in mid-scale mining operations where blast fragmentation, ore recovery, and cost balance are critical.

The range allows for optimized explosive loading while maintaining manageable overburden removal, which is essential in both coal and metal mining. Manufacturers have focused on refining bit design and wear resistance in this diameter class, enhancing operational lifespan and lowering consumable costs.

Increased adoption of automated drill rigs and real-time monitoring systems in this segment has improved fragmentation consistency and safety, further promoting its widespread use across global mines.

Hydraulic power transmission is projected to command 46.0% of the market revenue in 2025, positioning it as the leading power source in blasthole drilling. Its dominance is being driven by the need for reliable torque, enhanced control, and smooth operation in demanding terrain.

Hydraulic systems enable higher force-to-weight ratios and responsive modulation, which are vital for maintaining bit pressure during deep drilling cycles. Improvements in hydraulic circuit design, fluid monitoring, and load-sensing pumps have significantly reduced energy waste and maintenance intervals.

These factors have contributed to the broader acceptance of hydraulically powered drills across rugged and remote mining environments. As sustainability pressures intensify, hybrid hydraulic-electric systems are also emerging as transitional solutions to enhance energy efficiency while preserving the performance advantages of hydraulic drive platforms.

The market has expanded due to increased demand for efficient rock fragmentation in mining and quarrying operations. These machines have been essential in preparing sites for explosive placement, allowing for controlled and optimized material breakage. Demand has risen from both surface mining and infrastructure development sectors that require bulk material removal. Innovations in automation, drill monitoring, and fuel-efficient powertrains have enhanced the precision, durability, and performance of blasthole drills. Operators have prioritized high penetration rates, machine uptime, and reduced operating costs, influencing procurement trends globally.

The integration of automation technologies has played a critical role in increasing productivity and precision in blasthole drilling operations. Automated rigs have enabled remote operation, minimizing human exposure to hazardous environments. Features such as auto-leveling, depth control, and GPS-based guidance systems have been incorporated to ensure uniform hole spacing and depth consistency. Real-time data monitoring and fault diagnostics have improved maintenance planning and operational visibility. Fleet management platforms have allowed multiple drills to be coordinated centrally, optimizing blasting patterns and minimizing downtime. Automation has also supported better fuel efficiency by regulating drill energy and reducing idle times. These capabilities have become increasingly important as mining companies pursue higher output and cost control.

Surface mining has remained the largest contributor to blasthole drill demand due to its reliance on large-scale material removal techniques. Open-pit mining for iron ore, copper, gold, and coal has required consistent use of high-capacity drills to maintain production throughput. In such operations, drills must operate continuously across harsh terrain and abrasive rock formations. Drill models designed for rotary and down-the-hole applications have been favored depending on rock hardness and fragmentation goals. High-horsepower diesel engines and heavy-duty undercarriages have been selected to ensure reliability in demanding conditions. Equipment durability, low maintenance requirements, and simplified control interfaces have been prioritized. Continued investment in mining exploration and expansion has supported the long-term demand for advanced blasthole drilling equipment.

The shift toward more energy-efficient and environmentally compliant equipment has influenced the development of hybrid and electric-powered blasthole drills. These systems have aimed to reduce fuel consumption and lower emissions without compromising performance. Electric drives have offered greater control over drilling torque and speed, enhancing hole quality and reducing mechanical wear. In remote mines where grid power is accessible, electric-powered rigs have been deployed to lower operational costs. Hybrid models combining diesel engines with energy recovery systems have been introduced to improve energy utilization and reduce maintenance intervals. As regulatory frameworks tighten around mining emissions and sustainability goals, the adoption of alternative power solutions in blasthole drills is expected to rise.

The importance of equipment uptime has driven demand for comprehensive aftermarket services and predictive maintenance capabilities. Blasthole drill operators have increasingly relied on OEMs and third-party service providers for component replacement, technical support, and field repairs. Telematics systems integrated into modern drills have enabled real-time monitoring of operating parameters, wear indicators, and fault codes. Predictive analytics tools have utilized this data to forecast component life, allowing for timely part replacements and service scheduling. This has minimized unplanned downtime and extended equipment life. Service contracts and equipment-as-a-service models have emerged, offering customers access to performance-based maintenance and support. These developments have improved total cost of ownership metrics and supported operational resilience across mining sites.

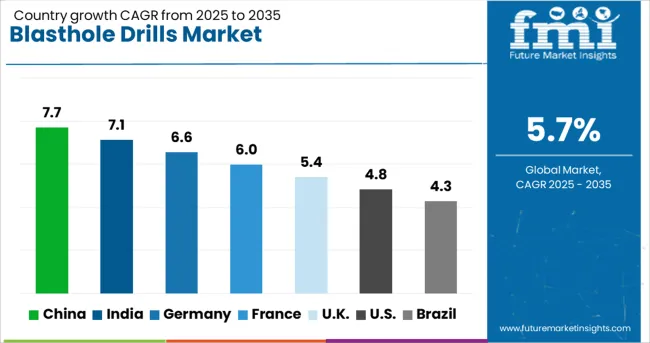

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

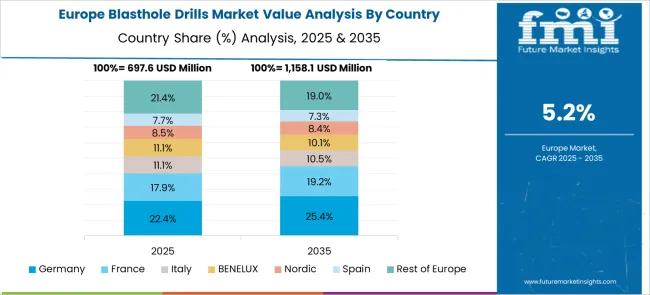

The blasthole drills market is anticipated to register a CAGR of 5.7% from 2025 to 2035, propelled by continued demand for mineral extraction and infrastructure development. China is projected to grow at a CAGR of 7.7%, driven by its dominance in coal and metal mining sectors and state-backed exploration projects. India follows with 7.1%, supported by rapid industrial expansion and rising investment in surface mining. Germany, at 6.6%, reflects increased quarrying operations and upgrades in drilling technology. The UK shows a 5.4% CAGR, supported by construction material extraction and regulatory initiatives. The USA, with a 4.8% growth rate, maintains steady performance due to domestic mining activities and technological upgrades. This report includes insights on 40+ countries; the top markets are shown here for reference.

The blasthole drills market in China is anticipated to expand at a CAGR of 7.7% between 2025 and 2035. This growth is attributed to aggressive mining sector expansion, especially in coal and metallic mineral extraction zones across Inner Mongolia, Shanxi, and Xinjiang. Chinese OEMs such as XCMG and SANY have emphasized automation and drill fleet integration with data-driven monitoring systems to improve efficiency. Environmental guidelines have also pushed the development of dust suppression-equipped models.

India is projected to grow at a CAGR of 7.1% in its blasthole drills sector, fueled by intensified open-cast mining for iron ore, bauxite, and limestone. The adoption of hydraulic crawler drills is expanding across private-sector mining clusters in Odisha, Chhattisgarh, and Karnataka. Domestic manufacturers such as Revathi Equipment and international players including Sandvik have extended after-sales networks, helping reduce downtime in harsh terrains.

Germany’s blasthole drills market is expected to register a 6.6% CAGR, with focus shifting to low-emission drilling technologies in compliance with European emission mandates. Surface mining operations in lignite and salt mines have begun retrofitting conventional drills with electrified drive systems and intelligent telemetry tools. Equipment upgrades are driven by stricter workplace safety regulations and the need for energy efficiency.

In the United Kingdom, the blasthole drills market is forecast to grow at a CAGR of 5.4%, primarily influenced by small-scale quarrying, tunnel boring, and specialized blasting projects. The market favors compact and transportable drills that fit confined urban or sub-urban job sites. Emphasis has been placed on GPS-aided depth control and operator training programs tailored to the nation's mineral permitting landscape.

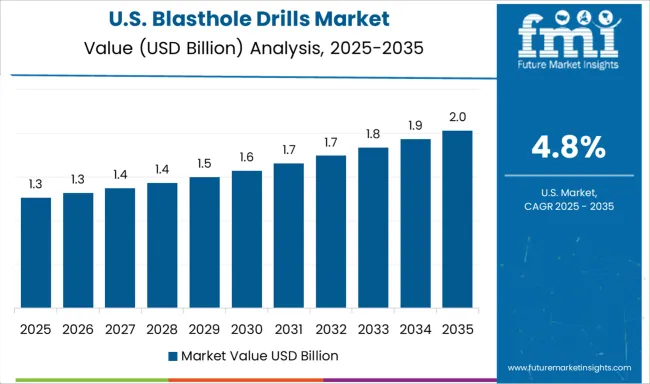

The United States is projected to grow at a CAGR of 4.8% in the blasthole drills market. Key developments are focused on hard rock mining in Nevada, Arizona, and Utah, with a pivot toward autonomous rigs for consistent output. Manufacturers such as Epiroc and Caterpillar have introduced AI-driven control modules and real-time performance analytics to support efficiency and safety. Large mining firms have invested in fleet-wide digitalization initiatives for predictive maintenance and blast pattern optimization.

The blasthole drills market remains driven by the global demand for high-efficiency drilling systems across mining, quarrying, and construction applications. Epiroc and Sandvik lead the industry with comprehensive fleets of surface and underground drilling rigs equipped with automation, data logging, and energy-efficient designs for large-scale open-pit mining.

Atlas Copco, having spun off Epiroc, retains legacy influence through its historic designs and innovation leadership. Caterpillar offers powerful rotary blasthole drills integrated with telematics for fleet optimization and mine productivity. Komatsu and Furukawa Rock Drill provide high-performance hydraulic systems and rugged drill rigs tailored for heavy-duty operations in hard rock formations.

Bauer supports niche geotechnical drilling requirements while focusing on machine stability and precision. Indian manufacturers like KGR Rigs, KLR Universal, PRD Rigs, and Revathi Equipment serve domestic and international markets by offering adaptable, mid-sized rigs focused on cost-effective drilling.

Companies such as Taiye Drill Machinery and Velson emphasize modularity and aftermarket service, enabling operators to adjust to diverse geological conditions. Servotechnik and Kennametal contribute specialized components and tooling systems critical to the efficiency and longevity of drill operations.

Success in this sector is shaped by demand for deeper penetration rates, fuel-efficient systems, and real-time performance monitoring. Market leaders are advancing toward autonomous, electric-powered drills and data-enabled systems capable of enhancing both productivity and safety in extreme environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Drilling Method | Rotary blasthole drill, Down the hole drill, and Others (top hammer drill etc.) |

| Drill Diameter | 5 - 8 inches, Up to 5 inches, 8 - 12 inches, and Above 12 inches |

| Power Transmission | Hydraulic, Mechanical, and Electrical |

| Mode of Operation | Automatic and Manual |

| Application | Surface and Underground |

| End Use Industry | Mining, Construction, and Oil and gas |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Epiroc, Atlas Copco, Bauer, Caterpillar, Furukawa Rock Drill, Kennametal, KGR Rigs, KLR Universal, Komatsu, PRD Rigs, Revathi Equipment, Sandvik, Servotechnik, Taiye Drill Machinery, and Velson |

| Additional Attributes | Dollar sales by drill type and mining application, demand dynamics across surface mining, quarrying, and construction activities, regional trends in deployment across North America, Asia-Pacific, and Latin America, innovation in automation systems, telemetry integration, and energy-efficient propulsion, environmental impact of fuel consumption, noise emissions, and dust control measures, and emerging use cases in autonomous drilling fleets, data-driven blast optimization, and remote-controlled excavation systems. |

The global blasthole drills market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the blasthole drills market is projected to reach USD 4.9 billion by 2035.

The blasthole drills market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in blasthole drills market are rotary blasthole drill, down the hole drill and others (top hammer drill etc.).

In terms of drill diameter, 5 – 8 inches segment to command 38.0% share in the blasthole drills market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA