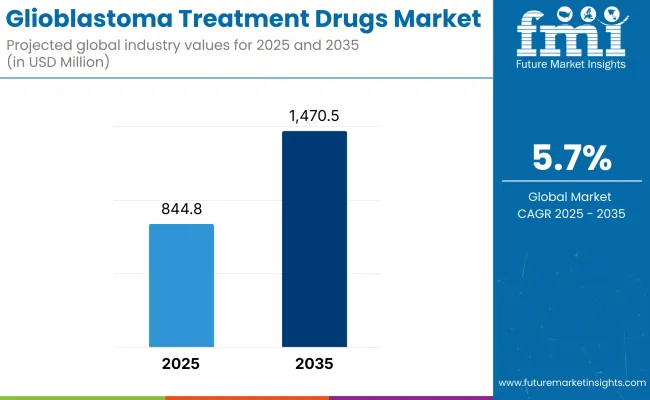

The Glioblastoma Treatment Drugs Market is projected to generate USD 844.8 million in revenues by 2025 and is expected to reach approximately USD 1,470.5 million by 2035, expanding at a CAGR of 5.7%.

The glioblastoma treatment drugs market remains one of the most active and high-need oncology spaces, driven by limited survival outcomes, high relapse rates, and the urgent need for novel therapeutic options. Current treatment regimens remain limited, creating opportunities for targeted therapies, immunotherapies, and combination approaches. Growing understanding of glioblastoma’s molecular heterogeneity is leading to the development of biomarker-guided treatment strategies, including IDH mutation inhibitors, VEGF-targeted agents, and checkpoint inhibitors.

Emerging platforms such as oncolytic viruses, personalized neoantigen vaccines, and CAR-T cell therapies are reshaping the therapeutic pipeline. Rising clinical trial enrollment, expanding academic-pharma partnerships, and significant venture investment are fueling pipeline innovation.

Key manufacturers such as Roche, Novartis, Bayer, Bristol Myers Squibb, Merck, and Carthera are advancing glioblastoma pipelines through targeted therapies, immuno-oncology, and combination regimens. The growth is supported by partnerships with academic brain tumor centers and orphan drug regulatory incentives. In 2024, USA FDA Accelerated Approval for OJEMDA™ (tovorafenib) for the treatment of for Relapsed or Refractory BRAF-altered Pediatric Low-Grade Glioma.

“OJEMDA ushers in a new day for children living with relapsed or refractory pLGG, and we are pleased that we can deliver a new medicine for these patients in desperate need of new treatment options. Moreover, OJEMDA is the first and only FDA-approved medicine for children with BRAF fusions or rearrangements, which are the most common molecular alteration in pLGG,” said Jeremy Bender, Ph.D., CEO of Day One Biopharmaceuticals, Inc. There is robust pipeline for Glioblastoma drugs with novel therapies which will change the dynamics over the forecast years.

North America dominates the glioblastoma treatment drugs market due to high patient enrollment in clinical trials, strong academic-pharma collaborations, and aggressive regulatory support via FDA’s breakthrough and orphan drug designations. USA cancer centers lead in CAR-T, vaccine, and oncolytic virus trials specifically targeting glioblastoma’s immune-evasive microenvironment. The 2024 FDA adaptive approval pathway has enabled accelerated access to novel therapies for biomarker-selected patients.

Europe’s glioblastoma treatment market is expanding, fueled by EMA’s increased conditional approvals for rare biomarker-targeted drugs and growing clinical collaboration under EU-funded brain cancer consortia. Germany, France, and the UK are leading enrollment in vaccine, gene therapy, and blood-brain barrier penetration studies for glioblastoma. Increasing investment in molecular neuro-oncology research infrastructure across academic hospitals is enhancing Europe’s capacity to rapidly adopt next-generation glioblastoma therapies once they achieve regulatory approval.

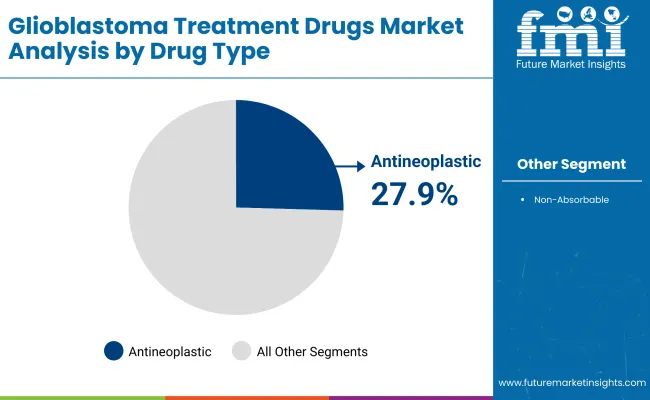

In 2025, antineoplastic agents are expected to capture 27.9% of the revenue share in the glioblastoma treatment drugs market. This segment's leadership is driven by the established efficacy of antineoplastic agents in controlling tumor growth and prolonging patient survival. Glioblastoma, a highly aggressive and difficult-to-treat brain tumor, has limited treatment options, making antineoplastic drugs a cornerstone of therapy.

These agents, including temozolomide and other alkylating agents, have shown effectiveness in reducing tumor size and preventing recurrence when used in combination with radiation therapy. The growth of this segment has been fueled by ongoing clinical trials and research exploring novel antineoplastic drug combinations and dosing regimens.

Additionally, advancements in drug delivery systems, such as the use of nanoparticles and focused drug delivery methods, have enhanced the penetration of these agents into the blood-brain barrier, improving their therapeutic efficacy. The availability of newer, targeted antineoplastic therapies has further driven this segment’s growth, establishing antineoplastic agents as a vital component in glioblastoma treatment strategies.

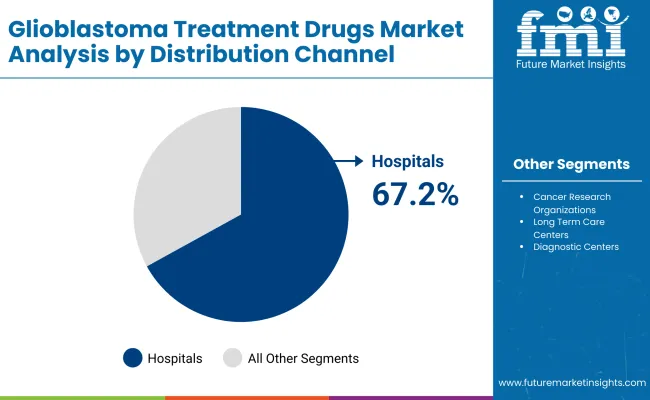

In 2025, Hospitals accounted for nearly 67.2% of total market revenue within the distribution channel segment. This dominance was enabled by the presence of specialized oncology departments and the infrastructure required for complex treatment administration. Most glioblastoma therapies, including chemotherapy, radiopharmaceuticals, and immunotherapies, were delivered in hospital settings under strict clinical supervision. Higher patient footfall and real-time monitoring needs further supported this channel.

Additionally, favorable reimbursement structures and procedural capabilities, such as neuronavigational drug delivery, were provided by hospitals. Consequently, hospitals were positioned as the most reliable and centralized points for administering advanced glioblastoma treatments.

Breaking Down Market Barriers: Aggressive Nature Of GBM, High Recurrence Rates

The glioblastoma drug market is hampered by numerous barriers, including GBM's highly aggressive nature, high recurrence rates, and very low-efficacy therapies. Furthermore, the blood-brain barrier blocks drug entry, making most conventional chemotherapy drugs less effective. Costly new drugs, lengthy regulatory cycles for approval, and side effects of current agents are other obstacles to uptake.

And on top of it, resistance to conventional treatments that include temozolomide is another great challenge, and this results in unfavorable patient outcomes. Lack of standard treatment regimes and a far smaller number of clinical trial facilities in some parts of the geography are also impairing the treatment availability and advancements. On top of all these is the complicating factor offered by glioblastoma biology with many gene mutations that defies efforts towards developing a single-fits-all solution.

The increasing adoption of targeted therapies and personalized treatment

Growing adoption of targeted therapy and personalized treatment regimens are of huge growth potential within the glioblastoma treatment drug market. Advances in technical technologies in gene therapy, oncolytic viruses, and RNA medicines are improving treatment outcomes. Integration of AI and machine learning into drug development is accelerating the process of developing new glioblastoma drugs.

Apart from this, increased investments in combination therapies, i.e., immunotherapy with chemotherapy or radiation, are also enhancing the effectiveness of the treatments. Growth in precision oncology, liquid biopsy diagnostics, and glioblastoma companion diagnostics is also driving market growth.

Favorable government schemes for research into rare cancers and increased access for patients to clinical trials is also boosting innovation in treatment approaches. The surge of patient-centered model drug development through the focus on quality-of-life and symptom control is also impacting the marketplace.

The years between 2014 to 2021 witnessed the introduction of immune checkpoint inhibitors and CRISPR gene-editing technology, which are transforming the therapeutic landscape of glioblastoma by improving survival rates and decreasing toxicity to a considerable extent. Results are also encouraging by creating vaccines-based therapies against glioblastoma-specific antigens to increase patients' survival.

A tech innovation could be found in the development of the Tumor Treating Fields (TTFields) methodology. The growing practice of utilizing TTFields therapy to interrupt cancer cell division by electrical field application provides alternative non-surgical treatment options to enhance survival for glioblastoma patients. Innovations in wearable TTFields devices are increasing convenience and compliance among patients.

Regulatory/Policy Changes: Due to accelerated drug approvals for glioblastoma, funding for brain tumor research, and fast-track designations for promising experimental therapies aimed at improving patient access, governments and regulatory bodies are perhaps playing a larger role lately. Also, initiatives for global clinical trial network creation for rare cancers such as glioblastoma are fostering rapid innovation and quick patient enrollment.

Integration of Precision Medicine and AI in Glioblastoma Drug Development: Optimal drug discovery with the aid of AI is helping identify new drug targets, optimize clinical trial designs, and enable more personalized treatment planning in glioblastoma patients. AI-enhanced radiomics and molecular phenotyping are being applied increasingly to predict treatment response and assist with therapy selection.

Monitoring for combination therapies because of improved outcomes of treatments: The more we mix therapies, immunotherapy with chemotherapy or target drugs, the higher survival rates are improved while at the same time managing drug resistance in glioblastoma patients.

Market Outlook Very strong growth will be seen for the glioblastoma treatment drugs market in the United States due to the high prevalence of glioblastoma multiforme (GBM) and to the progressive development of therapeutic interventions.

Market Growth Factors

Market Forecast

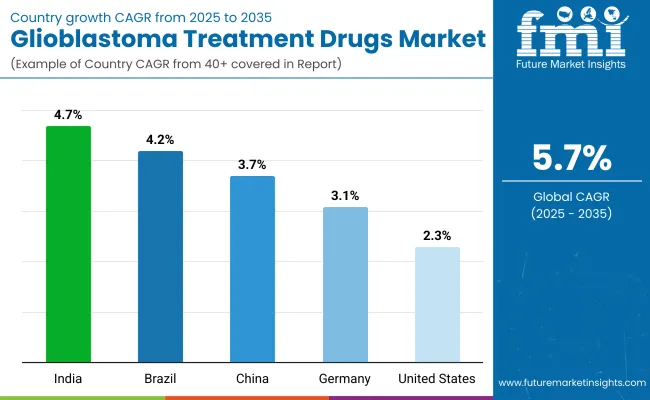

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.3% |

Market Outlook

The Chinese market for glioblastoma treatment drugs is likely to grow extensively with the fast growth in healthcare investment and rise in brain tumors.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 3.7% |

Market Outlook The robust growth in the glioblastoma treatment drugs market can be attributed to increasing disease awareness and improving healthcare infrastructure in India.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.7% |

Market Outlook Germany's glioblastoma treatment drugs market is poised for steady growth, thanks to a well-equipped healthcare system and continued research in neuro-oncology.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.1% |

Market Outlook The gleobalstoma treatment drugs market is witnessing advancements in Brazil due to increased investments in health care and the concomitant increase in brain tumors' prevalence.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.2% |

The highly competitive market of glioblastoma treatment drugs is attributed to the aggressive nature of the disease, few choices of treatment available, and further research in targeted as well as immunotherapy-based treatments.

Competition is mainly on the use of chemotherapies, kinase inhibitors, and tumor treating fields for the companies to edge over others in the competitive market. The market is shaped by well-established pharmaceutical firms, biotech innovators, and emerging oncology-focused companies, where every company is contributing to the evolving landscape of glioblastoma treatment.

Other Major Players

The remaining companies outside the leading ones contribute significantly to the marketplace, increasing product diversification and technology advancement.

These include:

These companies focus on expanding the reach of glioblastoma treatment options, offering competitive pricing and cutting-edge innovations to meet diverse patient and healthcare provider needs.

Antineoplastic, VEGF/VEGFR Inhibitors, Alkylating Agents and Miscellaneous Antineoplastic

Hospitals, Cancer Research Organizations, Long Term Care Centers and Diagnostic Centers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Glioblastoma Treatment Drugs Market was USD 844.8 million in 2025.

The Glioblastoma Treatment Drugs Market is expected to reach USD 1,470.5 million in 2035.

Growing Preference for Glioblastoma has significantly increased the demand for Glioblastoma Treatment Drugs Market.

The top key players that drives the development of Glioblastoma Treatment Drugs Market are Merck & Co., Inc., Roche Holding AG, Bristol-Myers Squibb, Novartis AG and Bayer AG.

Alkylating Agents leading is Glioblastoma Treatment Drugs Market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 13: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 14: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 28: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 29: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Drug Class, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Drug Class, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Water Treatment System Market Growth - Trends & Forecast 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA