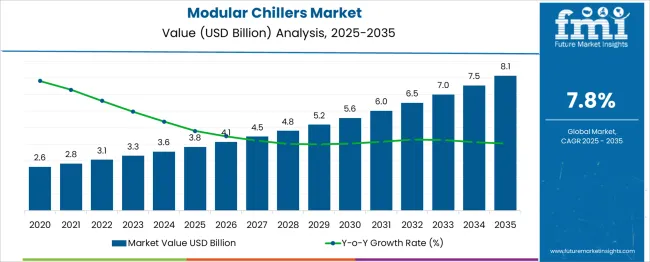

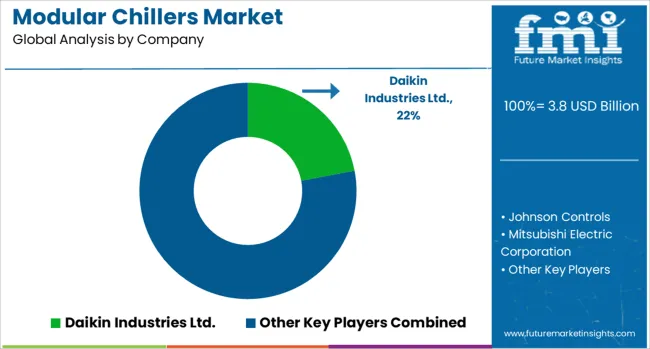

The modular chillers market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 8.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period. Annual gains range from USD 0.3 billion to USD 0.6 billion, with a consistent upward trend across the forecast period. The market does not show sharp discontinuities, but two breakpoints can be identified based on changes in the rate of absolute annual increase. The first breakpoint occurs between 2028 and 2029, where the annual gain rises from USD 0.4 billion to USD 0.5 billion, reflecting a transition from early adoption to broader market acceptance.

This shift is driven by the integration of modular systems in commercial real estate, data centers, and district cooling projects. The second breakpoint appears after 2032, when the market grows from USD 7.0 billion to USD 7.5 billion, and then to USD 8.1 billion in 2035. Here, larger absolute gains indicate strengthening demand for scalable, energy-efficient systems as urban infrastructure expands and building codes tighten efficiency requirements. Both breakpoints reflect a compounded response to technology maturity, operational flexibility, and retrofit potential. These shifts confirm that modular chillers are entering a phase of consistent utility adoption, supported by lifecycle value and ease of deployment.

| Metric | Value |

|---|---|

| Modular Chillers Market Estimated Value in (2025 E) | USD 3.8 billion |

| Modular Chillers Market Forecast Value in (2035 F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

In the commercial and institutional HVAC sector, about 34% of modular chillers are deployed in high-rise offices, schools, and hospitals, where scalable and efficient cooling is essential. The manufacturing sector accounts for nearly 28%, where process-driven cooling requirements demand flexible chiller sizing. Data centers consume roughly 18%, attracted by modular redundancy and energy resilience. District cooling plants and central HVAC installations tap about 12%, distributing capacity across multiple buildings. The hospitality and retail industry absorbs the remaining 8%, favoring modular units for phased expansions or zoned temperature control. Together, these five sectors guide chiller customization, controls, and system architecture.

The modular chillers market is growing rapidly as demand rises for energy efficient scalable cooling in commercial buildings data centers and industrial facilities. Key leaders include Daikin Industries Johnson Controls Carrier Global Trane Technologies Mitsubishi Electric Gree Midea and LG Electronics. These firms focus on smart control systems IoT based monitoring predictive maintenance and ecofriendly refrigerants. Water cooled modules dominate due to superior energy efficiency water availability and large capacity handling while air cooled systems grow in urban retrofit projects. Asia Pacific leads market share supported by infrastructure, smart city mandates and commercial expansion. Middle East and Africa deliver fast growth through green building initiatives.

The modular chillers market is experiencing accelerated growth due to the increasing emphasis on energy efficiency, scalability, and space optimization in HVAC infrastructure. As commercial buildings, healthcare facilities, and data centers seek cost-effective climate control solutions, modular chillers have been adopted for their ability to provide flexible load management and simplified maintenance.

The transition toward sustainable building technologies has also contributed to the market’s expansion, with many governments enforcing environmental regulations that promote low-emission and energy-efficient systems. Technological advancements in compressor designs, intelligent control systems, and integrated heat recovery functions have further enhanced operational efficiency.

Modular systems are being preferred for their redundancy and adaptability, especially in retrofit and phased installation projects. With rising demand for decentralized cooling infrastructure and smart building systems, the modular chillers market is projected to experience sustained growth over the coming years, driven by strong adoption across both new construction and refurbishment projects..

The modular chillers market is segmented by type, capacity, application, and geographic regions. The modular chillers market is divided by type into Air-cooled modular chillers and Water-cooled modular chillers. In terms of capacity, the modular chillers market is classified into below 300 tons, 300–500 tons, and above 500 tons. The modular chillers market is segmented into Commercial, Residential, Industrial, Healthcare, and Others. Regionally, the modular chillers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

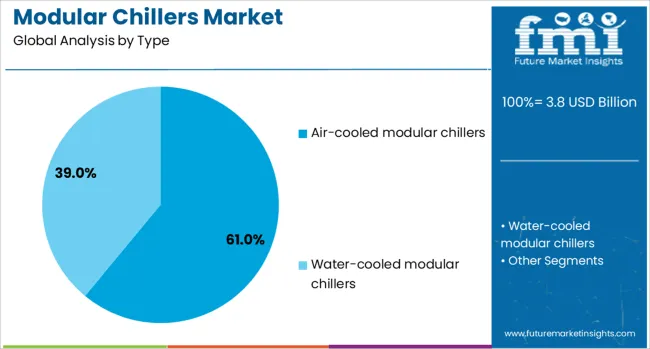

The air-cooled modular chillers type segment is anticipated to hold 61% of the Modular Chillers market revenue share in 2025, marking it as the leading configuration. This dominance has been attributed to the reduced installation complexity and absence of cooling towers, which result in lower upfront and maintenance costs. Air-cooled systems have been favored in locations with water scarcity or where environmental concerns restrict water usage.

Their compact design and flexibility make them ideal for rooftop or outdoor placements, freeing up valuable indoor space in urban buildings. Enhanced with advanced control features and variable-speed compressors, air-cooled chillers offer precise temperature regulation and higher energy efficiency under varying load conditions.

The segment has also been supported by rising preference for plug-and-play solutions in modular HVAC installations. As building owners prioritize ease of integration and minimal system downtime, air-cooled modular chillers have continued to represent the most cost-effective and scalable cooling choice across a broad range of applications..

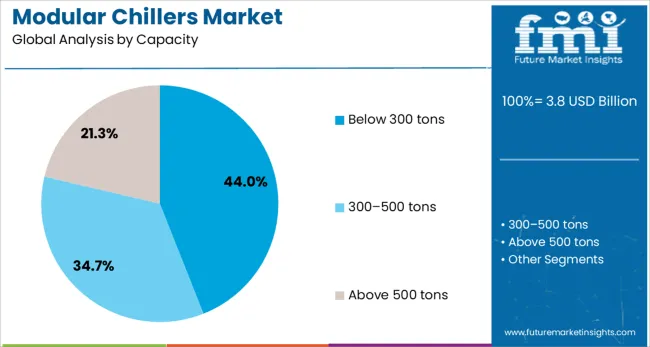

The below 300 tons capacity segment is expected to represent 44% of the Modular Chillers market revenue share in 2025, maintaining its lead among capacity ranges. This growth has been driven by the segment’s alignment with the cooling requirements of small to medium-sized facilities, including office buildings, clinics, and educational institutions. These systems have been selected for their compact footprint, energy-efficient performance, and suitability for distributed load demands.

Installers and facility managers have shown a preference for systems below 300 tons due to simplified logistics, easier handling, and modular expandability. Their compatibility with decentralized HVAC planning has enabled phased deployment, which reduces initial investment and operational risk.

Moreover, lower capacity chillers have become integral to modern energy codes and green building certifications that emphasize right-sized equipment for load optimization. As urban development intensifies and demand rises for tailored, scalable cooling solutions, the below 300 tons segment is expected to retain its position as the backbone of modular chiller installations..

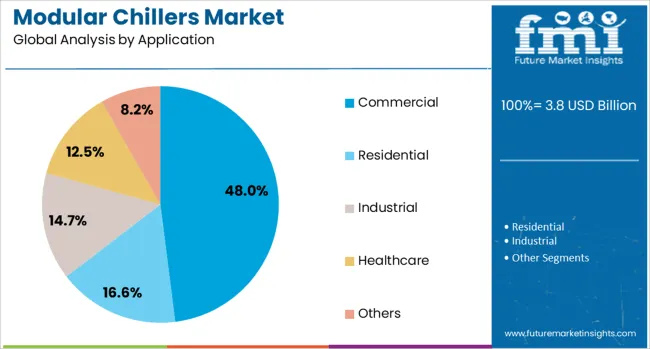

The commercial segment is projected to account for 48% of the Modular Chillers market revenue share in 2025, making it the dominant application category. The increasing demand for energy-efficient cooling in commercial infrastructure such as offices, retail centers, hotels, and entertainment venues has reinforced this leadership. The commercial sector has shown strong interest in modular chillers due to their flexibility in load management, minimal service interruption, and suitability for retrofit applications.

As building owners seek sustainable HVAC systems to meet evolving energy codes and corporate ESG targets, modular solutions are offering a reliable and scalable alternative to traditional central systems. These systems have been particularly valued for enabling phased expansions and decentralized cooling, reducing energy waste and operational costs.

Additionally, advancements in control technologies and predictive maintenance capabilities have enabled commercial facilities to optimize performance and minimize downtime. The continued expansion of commercial real estate and smart building initiatives is expected to solidify the commercial sector’s leading role in driving modular chiller adoption..

Modular chillers are now widely used in commercial HVAC, industrial cooling, and data center applications due to their scalable operation and energy efficiency. These systems accounted for an estimated 42 % of all new chiller deployments in commercial buildings in 2024. Growth has been driven by the need for flexible redundancy and phased capacity expansion, especially in urban high-rise and campus environments. Adoption has expanded in markets with dynamic cooling loads such as Southeast Asia, North America, and Europe. Compact design and digital integration are being preferred for retrofit and new deployments alike. OEMs have introduced standardized plug-and-play modules to simplify installation and commissioning across retrofit and greenfield scenarios.

Demand for modular chillers has been propelled by energy managers seeking load-adaptive cooling capacity. Systems with plug-in chiller modules have enabled capacity adjustment as needed, reducing partial-load inefficiencies by 28 % in graded installation environments. In large commercial centers and mission-critical facilities, nearly 37 % of installed HVAC systems now include modular chillers to support cooling demand peaks without oversizing central plants. Modern modules support virtual staging and load aggregation, allowing operators to achieve up to 20 % lower electricity costs during part-load cycles. These systems also support demand response programs, enabling redundant modules to be offlined during low load periods to reduce operational energy consumption while maintaining service continuity.

Although beneficial for flexibility, modular chiller solutions generally require higher capex than equivalent monolithic installations. Early-stage capital cost increases of around 24 % have been recognized in comparison to traditional central plants. Integration of digital controls, manifold switching systems, and redundancy interlocks adds to mechanical and electrical complexity, elevating installation and commissioning times by up to 15 %. Coordination among multiple modules increases control layering and diagnostic requirements. Maintenance routines also become more complex due to service coordination across multiple small compressors rather than one central unit. These factors have slowed adoption among cost-sensitive mid-size facilities where lifecycle ROI claims have not yet matured.

Emerging opportunities have been identified in retrofit arenas where legacy chillers are supplemented with modular units rather than full-scale replacements. In older commercial buildings undergoing energy upgrade programs, modular chiller adoption captured 23 % of current retrofit installations. Hybrid configurations pairing evaporative cooling towers with modular chillers have improved seasonal efficiency in dry climates, such as Southwest Asia and arid zones. Growth in edge data centers and colocation facilities has also driven the deployment of modular systems due to redundant cooling needs in small rack clusters. Microgrid-integrated cooling and smart energy storage schemes are being piloted with modular chillers to support future demand volatility and load-shifting opportunities.

Recent designs include intelligent controllers integrated with building automation protocols in 34 % of modular chiller packages. Multi-module systems now support dynamic sequencing, fault alerting, and remote firmware updates to ensure continuous operation and predictive maintenance. Pre-fabricated modular skid units are being deployed in over 29 % of installations to minimize onsite fabrication and accelerate implementation. HVAC systems are increasingly being designed around decentralized cooling strategies, with modular chillers positioned close to heat loads to reduce duct losses. Sustainable refrigerants and low-GWP technologies are being offered in 18 % of new modular chiller options. Packaging formats have also optimized service access and footprint efficiency for rooftop and equipment frame integration.

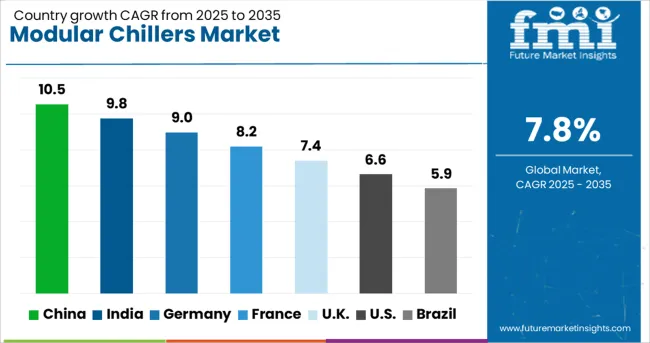

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The global modular chillers market is expanding at a CAGR of 7.8% from 2025 to 2035. China is growing at 10.5%, which is approximately 34.6% higher than the global average, driven by government investments in HVAC infrastructure and district cooling networks. India follows at 9.8%, growing 25.6% above the global CAGR, supported by smart building developments and power-efficient cooling technologies. Germany’s 9.0% rate places it 15.4% higher than global growth, backed by energy optimization in industrial settings. The UK, at 7.4%, trails the global average by 5.1%, while the US lags further behind at 6.6%, 15.4% below the global pace. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China has been experiencing robust expansion in modular chiller installations due to a rise in decentralized cooling strategies across data center and industrial sectors. Market participants have been actively prioritizing energy-efficient chiller units to support emerging smart infrastructure. Rapid industrial expansion combined with increased commercial construction has created new sales channels for local manufacturers. Regional policy support for green building certifications has catalyzed the replacement of conventional cooling systems with modular alternatives. Competitive dynamics are shifting, as Chinese brands increasingly invest in customizable configurations to compete with international OEMs. Localization of component sourcing has also driven down production costs, which is expected to encourage further market penetration in tier-2 and tier-3 cities.

India has emerged as a strategic hub for modular chiller production, driven by rising temperature-sensitive warehousing and pharma manufacturing facilities. The fragmented cold chain industry has encouraged the adoption of scalable HVAC infrastructure, positioning modular chillers as a preferred option. OEMs in India have been leveraging the Make-in-India initiative to localize assembly operations, thereby improving supply agility. Central and state-level incentives for energy-efficient building technologies have positively influenced procurement decisions in the private and public sectors. Despite price sensitivity in mid-sized businesses, demand has remained stable in IT parks, airports, and defense infrastructure segments, which continue to prioritize modular solutions for load adaptability.

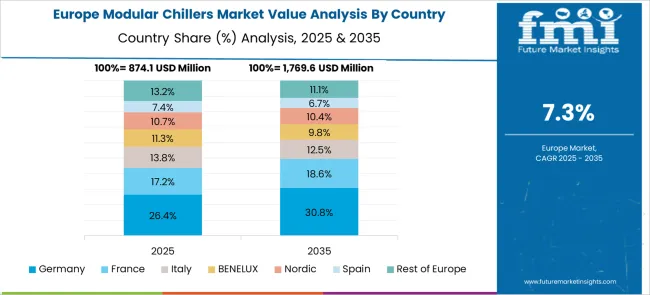

Germany has maintained a technologically mature modular chillers market, with OEMs competing on design precision and energy footprint. A push for digitized HVAC systems in commercial real estate and industrial automation facilities has supported consistent demand. Retrofit projects in legacy buildings are increasingly specified with modular chillers that support remote performance monitoring. German manufacturers have been focused on expanding offerings with inverter-driven screw chillers and hybrid cooling modules. Shifts in regulatory frameworks under the EU F-Gas regulations have further boosted demand for low-emission chiller variants. Facility managers across logistics and food processing sectors have been favoring modular units to improve operational uptime during phased maintenance.

Modular chillers in the United Kingdom have gained traction in government-backed infrastructure upgrades, particularly in education and healthcare sectors. The retrofitting of outdated HVAC systems has been incentivized under energy efficiency grant programs, promoting the switch to modular units with adaptive load capabilities. Engineering firms and M&E consultants have increasingly specified modular designs in mixed-use urban developments to meet strict floor space limitations and emission benchmarks. UK-based installers are forming new partnerships with mainland European component suppliers to overcome lead time challenges. Market consolidation is also shaping vendor strategies as facilities management services seek bundled HVAC solutions for long-term asset management.

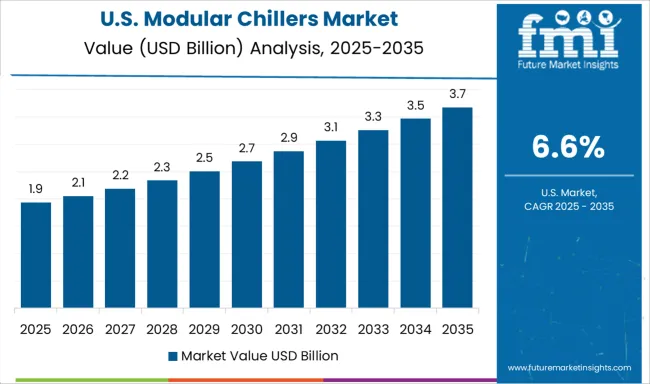

The United States modular chillers market has reflected a shift toward hybrid and digitally optimized systems, especially in high-occupancy buildings and data centers. Federal energy codes have catalyzed equipment upgrades in federal buildings, where phased installation of modular chillers is preferred over traditional centralized systems. HVAC OEMs are prioritizing production of low-noise, smart-capable modules tailored for LEED-certified buildings. Regional disparities persist, with higher deployment in the northeast and Pacific regions due to heating-cooling versatility needs. Market participants are now focusing on IoT-based predictive maintenance features to differentiate in a competitive retrofit market. Large OEMs have also expanded service support networks to cover tier-2 cities.

The modular chillers market includes companies producing scalable cooling systems for buildings, industrial plants, and mission-critical facilities. Daikin Industries Ltd. offers modular air- and water-cooled chillers that allow staged capacity additions and high system reliability. These systems are often selected for large-scale projects requiring flexible expansion. Johnson Controls supplies modular units with intelligent controls, targeting energy management in hospitals, office towers, and mixed-use environments.

Their units are valued for low-GWP refrigerants and adaptive response to variable cooling demand. Mitsubishi Electric Corporation provides compact modular chillers optimized for small to medium-sized facilities, with efficient load matching and quiet operation. These units are often deployed in areas with strict space and noise restrictions. LG Electronics delivers high-efficiency chillers designed for system-wide optimization, offering compatibility with building energy management systems and advanced monitoring features. Their designs focus on long-term operational savings and easy maintenance.

Carrier Global Corporation produces modular units that support both new installations and system retrofits, integrating advanced controls and heat recovery capabilities to improve seasonal performance. Key advantages across the market include minimal on-site assembly, flexible installation, redundancy in case of module failure, and simplified maintenance cycles. Vendors compete on efficiency ratings, refrigerant type, integration features, and ability to support smart HVAC networks with minimal service disruption.

Between 2023 and mid‑2025, the modular chiller market witnessed verified expansion through product launches, facility upgrades, and supplier partnerships. In mid-2023, Airedale introduced its SpiraChill and iChill plug‑and‑play modular chillers with inverter screw compressors. Daikin unveiled compact modular units optimized for data center and smart city applications in early 2025 and expanded its Factory Asia output in mid‑2024.

Johnson Controls brand York rolled out cloud-connected chillers with remote diagnostics and predictive maintenance in late 2024. Mitsubishi Electric expanded Thai manufacturing capacity by early 2024. Major players, including Carrier, Trane Technologies, Midea, and LG, enhanced modular portfolios through strategic collaborations with building automation firms. Asia‑Pacific led installations, driven by high commercial infrastructure demand and scalability needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Type | Air-cooled modular chillers and Water-cooled modular chillers |

| Capacity | Below 300 tons, 300–500 tons, and Above 500 tons |

| Application | Commercial, Residential, Industrial, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daikin Industries Ltd., Johnson Controls, Mitsubishi Electric Corporation, LG Electronics, and Carrier Global Corporation |

| Additional Attributes | Dollar sales by chiller configuration (air cooled, water cooled modular units) and application (commercial buildings, data centers, industrial processes), demand across retrofit projects, new construction, and tech upgrades, led by Asia Pacific with North America catching up, innovation in plug and play scalable modules, digital twin control, smart connectivity, and enhanced energy recovery systems. |

The global modular chillers market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the modular chillers market is projected to reach USD 8.1 billion by 2035.

The modular chillers market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in modular chillers market are air-cooled modular chillers and water-cooled modular chillers.

In terms of capacity, below 300 tons segment to command 44.0% share in the modular chillers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular Rolling Mill Market Size and Share Forecast Outlook 2025 to 2035

Modular Fiber Optical Spectrometers Market Size and Share Forecast Outlook 2025 to 2035

Modular Process Skid Packages Market Forecast and Outlook 2025 to 2035

Modular Robotic Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Modular Substation Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Fitness Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Data Center Market Analysis - Size, Share, and Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Modular Energy Control System Market Growth – Trends & Forecast 2025 to 2035

Modular Construction Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA