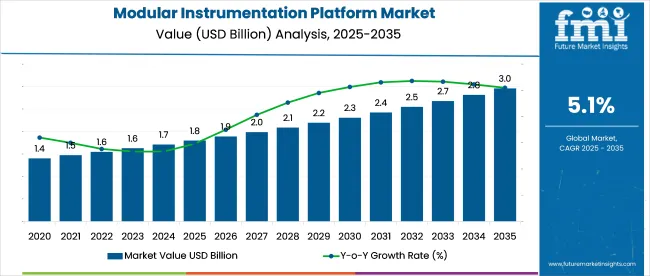

The modular instrumentation platform market is projected to grow from USD 1.8 billion in 2025 to USD 3.0 billion by 2035, expanding at a CAGR of 5.1% over the forecast period. This growth is driven by rising demand for flexible, scalable, and high-performance testing solutions across electronics, aerospace, and automotive sectors.

In 2023, over 45% of newly installed automated test benches in semiconductor fabrication units in the USA and Taiwan adopted PXI-based modular instrumentation platforms.

By 2025, more than 60% of modular platform demand is expected to originate from industries transitioning to Industry 4.0 frameworks, including automotive, telecommunications, and aerospace. Adoption of 5G network infrastructure and EV powertrain validation systems has significantly increased the need for high-throughput, reconfigurable testing environments. National Instruments and Keysight Technologies remain key market players, accounting for over 70% of PXI chassis sales globally.

From 2026 to 2035, sustained investments in RF/microwave testing, power electronics, and digital protocol validation will continue to drive uptake. Emerging economies are expected to see 2x growth in adoption by 2030 as manufacturing digitization accelerates.

The modular instrumentation platform market plays a strategic role across several high-tech verticals. Within the USD 40 billion global test and measurement equipment market, modular systems account for 6-8%, backed by demand for reconfigurable, space-efficient platforms. In the USD 10 billion automated test equipment industry, 10-12% is attributed to modular setups, particularly in semiconductor and telecommunications testing.

Roughly 5-6% of the USD 60 billion industrial automation sector incorporates modular platforms, where custom workflows and faster integration are prioritized. Among laboratory instrumentation tools, which total around USD 25 billion, 4-5% is influenced by modular formats due to flexibility in life sciences and material analysis. Even in aerospace and defense electronics, 8-10% of instrumentation systems are modular, aligned with evolving mission requirements.

The market is gaining momentum as test and measurement systems become increasingly automated and flexible. Rapid adoption across automotive, electronics, and communications sectors is being fueled by advancements in platform architectures like PXI/PXIe and PCIe interfaces.

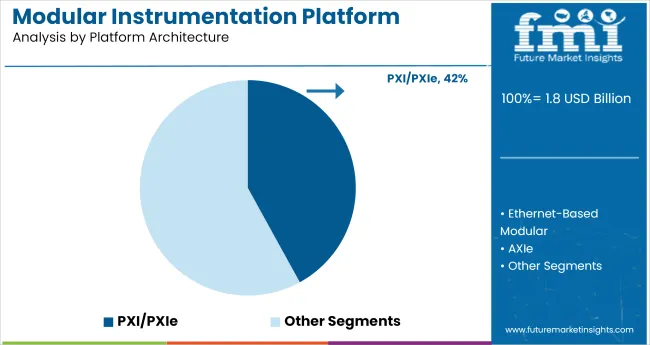

PXI and PXIe platforms are forecast to hold a dominant 42% share in the modular instrumentation platform market by 2025. These architectures offer high-speed data acquisition, low latency, and synchronized measurements, making them ideal for advanced R&D and production testing.

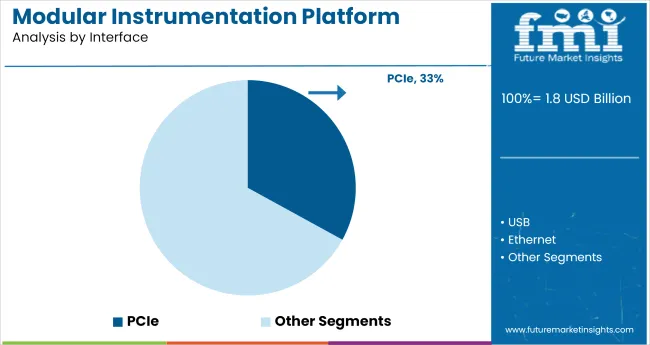

PCIe is projected to capture 33% of the market by 2025, fueled by demand for ultra-fast communication between modules. The interface supports high data throughput and is well-suited for real-time testing environments. Its adoption is rising across telecom, defense, and industrial automation.

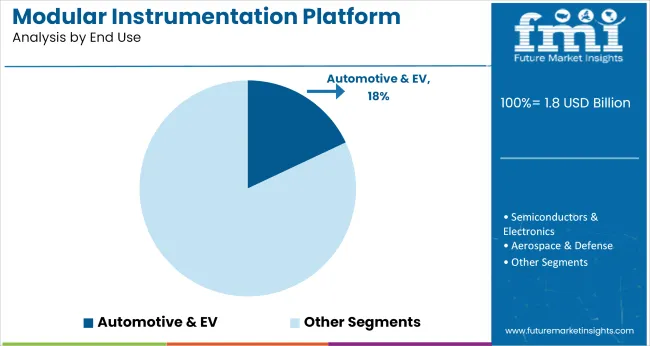

The automotive and EV segment is expected to command an 18% share of the market by 2025. As electric vehicles become mainstream, manufacturers require high-precision systems for battery, motor, and safety component testing.

Demand for modular instrumentation platforms is expanding due to rising test complexity, faster validation cycles, and scalability needs in aerospace, telecom, and semiconductor sectors. PXI and LXI-based systems are driving consolidation of test benches, improving throughput, minimizing footprint, and enabling real-time adjustments in hardware-in-the-loop and functional test environments.

Semiconductor Testing Pushes PXI-Based Integration

PXI modular platform sales in semiconductor test labs rose 34% YoY as fabs scaled up validation for 3 nm and RF chipsets. Labs handling 24/7 validation cycles compressed reconfiguration time by 42% using hot-swappable PXI modules. Test throughput per rack improved 28% with synchronized timing engines supporting ≤10 ns latency. Integration with automated wafer probers enabled dynamic switching, lowering test failure diagnosis times by 19%.

Multi-vendor interoperability improved as open-source driver frameworks gained 31% adoption. Compact PXI setups now displace legacy rack instruments in over 61% of new chip-testing environments, particularly in RF front-end, memory interface, and automotive-grade semiconductor validation.

Aerospace Adoption Driven by Hardware-in-the-Loop Demands

Aerospace test labs expanded modular instrumentation usage by 37% in 2025, led by HIL simulation requirements for flight control systems and avionics. LXI-based platforms cut bench wiring density by 44%, enabling faster fault injection in real-time testing. Modular setups with FPGA-enabled IO modules improved signal emulation accuracy by 23%, critical for UAV and eVTOL subsystem trials.

Recalibration cycles were reduced by 26% due to centralized software control. Defense contractors reported 18% lower testbed commissioning costs by shifting from custom rigs to modular architectures. As design iteration speeds increase, modular platforms are becoming default infrastructure in next-gen aircraft and missile system validation.

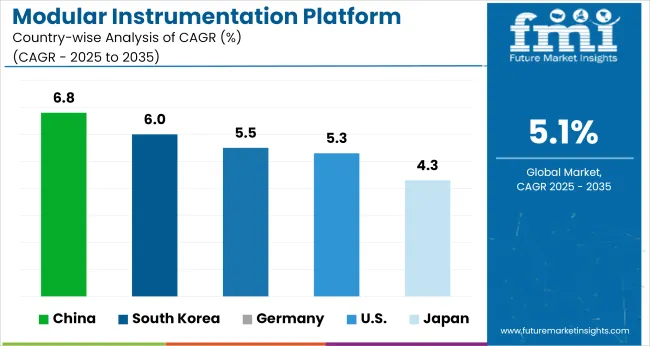

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.8% |

| South Korea | 6.0% |

| Germany | 5.5% |

| United States | 5.3% |

| Japan | 4.3% |

The global market is projected to grow at a 5.1% CAGR between 2025 and 2035. Among the countries tracked, China posts the highest growth at 6.8%, outperforming the global average by 170 basis points, reflecting BRICS-led investments in industrial automation and precision diagnostics.

South Korea also exceeds the benchmark with a 6.0% CAGR, benefiting from ASEAN-centered innovation clusters and strong export orientation. Germany, an OECD manufacturing hub, registers 5.5%, staying modestly above the global trajectory. The USA closely follows at 5.3%, with stable demand from aerospace and medical device testing but slower adoption in public research labs.

Japan trails the group with a 4.3% CAGR, 80 basis points below the global rate, signaling delayed equipment renewal and aging industrial infrastructure. The spread highlights faster modernization in BRICS and ASEAN-aligned nations, while select OECD countries see restrained momentum due to legacy systems and flatter capital expenditure trends.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

The market in China is projected to expand at a CAGR of 6.8% from 2025 to 2035. Between 2020 and 2024, demand stemmed from R&D labs and academic institutions. Growth is now accelerating across automotive testing, semiconductor development, and industrial quality assurance. Strong government incentives for innovation in high-speed rail and 6G prototyping have made modular instrumentation platforms a core requirement.

South Korea is expected to grow at a CAGR of 6.0% through 2035. In the previous cycle (2020 to 2024), sales were driven by universities and government-funded laboratories. Current momentum stems from advanced chip manufacturing, with demand intensifying across wafer-level testing and high-frequency signal analysis. The rise of fabless chip design has also prompted increased modular system integration.

Germany is forecast to expand at a CAGR of 5.5% from 2025 to 2035. During 2020 to 2024, the market was shaped by automation R&D and robotics prototyping. Current growth is fueled by the automotive sector, where modular instrumentation platforms support EV battery testing, ADAS calibration, and EMI/EMC validation. Aerospace applications are also increasingly incorporating modular systems into their testing workflows.

The United States is expected to register a CAGR of 5.3% during the forecast period. From 2020 to 2024, usage was centered around university labs and instrumentation integrators. Since 2025, increased federal R&D budgets and growing demand from defense contractors have fueled adoption of modular instrumentation platforms. Customization and high-speed data acquisition remain key selection factors.

The market in Japan is projected to grow at a CAGR of 4.3% from 2025 to 2035. Between 2020 and 2024, demand was modest, largely coming from traditional electrical labs. The post-2025 period sees greater momentum as electronics manufacturers embrace miniaturized and modular test systems for microcontrollers and optical sensors. Universities are also upgrading outdated analog instrumentation with modular, software-defined alternatives.

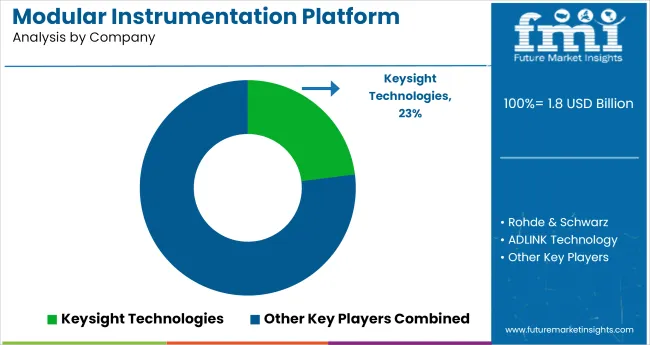

The market is led by a mix of precision test equipment specialists and automation solution providers. Keysight Technologies and National Instruments collectively account for over 23% of global market share, with their PXI-based systems widely used in semiconductor validation, aerospace, and wireless communications testing. Keysight’s focus on 5G and RF testing gives it a strategic edge, while NI emphasizes open platform compatibility and customizable software integration.

Recent Modular Instrumentation Platform Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.8 billion |

| Projected Market Size (2035) | USD 3.0 billion |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Platform Architectures Analyzed (Segment 1) | PXI / PXIe, Ethernet-Based Modular, AXIe, Compact Modular DAQ, Others |

| Interfaces Analyzed (Segment 2) | USB, Ethernet, PCIe, Wireless |

| End Uses Analyzed (Segment 3) | Semiconductors & Electronics, Automotive & EV, Aerospace & Defense, Telecom, Industrial Automation & Robotics |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Keysight Technologies, Rohde & Schwarz, ADLINK Technology, AMETEK, National Instruments |

| Additional Attributes | Dollar sales by architecture and interface, rising demand for real-time data acquisition, expansion of modular testing in EV and telecom sectors, and increasing preference for compact, scalable instrumentation solutions. |

Segmented into PXI/PXIe, Ethernet-based modular, AXIe, compact modular DAQ, and others, based on system design and scalability.

Includes USB, Ethernet, PCIe, and wireless interfaces, supporting diverse connectivity and data transfer protocols.

Adopted across semiconductors & electronics, automotive & EV, aerospace & defense, telecom, and industrial automation & robotics sectors.

Covers North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market is valued at USD 1.8 billion in 2025.

The market is expected to reach USD 3.0 billion by 2035.

The market is anticipated to grow at a CAGR of 5.1% over the forecast period.

PXI/PXIe dominates the platform architecture segment with a 42% share in 2025.

China is forecasted to be the fastest-growing country with a CAGR of 6.8% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Fitness Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Data Center Market Analysis - Size, Share, and Forecast 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Modular Energy Control System Market Growth – Trends & Forecast 2025 to 2035

Modular Construction Market Growth – Trends & Forecast 2025 to 2035

Modular Instruments Market Growth – Trends & Forecast 2025 to 2035

Modular Trailer Market Growth – Trends & Forecast 2024-2034

Modular Substation Market Analysis – Growth & Demand 2024-2034

Modular Robotics Market Growth – Trends & Forecast 2024-2034

Modular Plating Systems Market

Modular Conveyor System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA