The modular robotic market is experiencing strong growth driven by increasing automation demand, flexible manufacturing needs, and rising adoption of robotics across industrial and commercial sectors. Market expansion is being supported by advancements in modular design, interoperability, and scalability, allowing customized deployment across diverse applications. Current market dynamics reflect growing integration of artificial intelligence, machine learning, and adaptive control systems that enhance robot functionality and performance.

Industries such as automotive, electronics, and logistics are accelerating adoption to optimize productivity, reduce downtime, and enable cost-efficient operations. The future outlook remains positive as Industry 4.0 initiatives, rapid prototyping, and smart factory deployments continue to gain momentum.

Growth rationale is underpinned by modular robotics’ inherent adaptability, simplified maintenance, and capability to reconfigure systems based on operational requirements As end-users seek compact, intelligent, and sustainable automation solutions, investments in modular platforms are expected to strengthen, ensuring steady market expansion and technological evolution across global manufacturing ecosystems.

| Metric | Value |

|---|---|

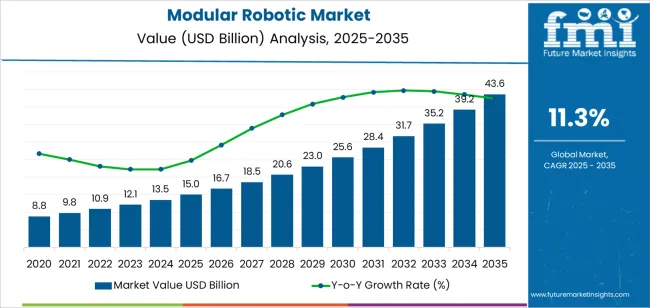

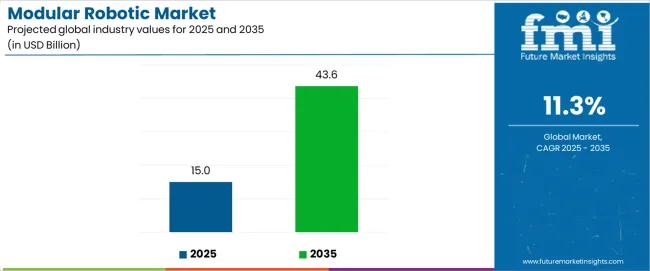

| Modular Robotic Market Estimated Value in (2025 E) | USD 15.0 billion |

| Modular Robotic Market Forecast Value in (2035 F) | USD 43.6 billion |

| Forecast CAGR (2025 to 2035) | 11.3% |

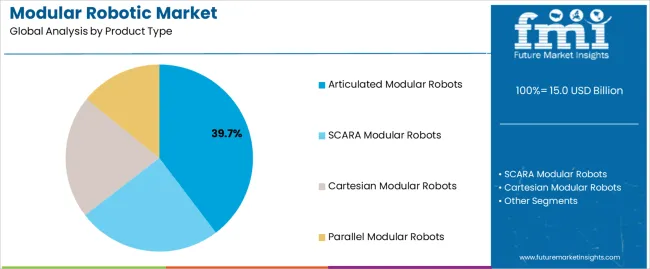

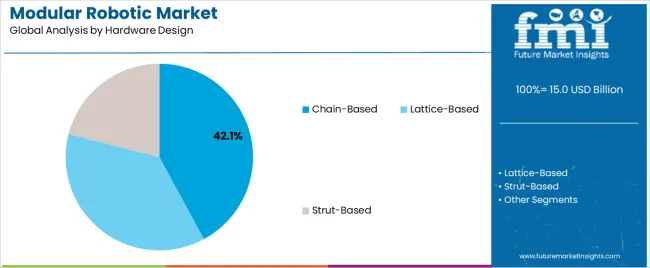

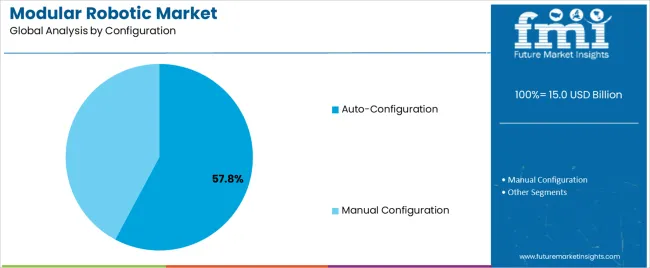

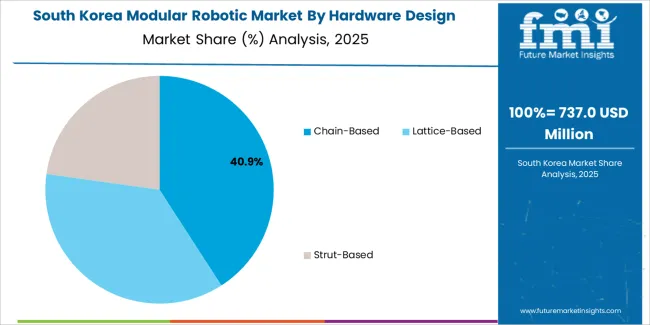

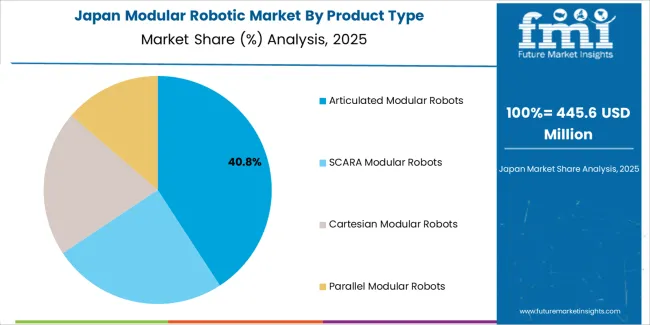

The market is segmented by Product Type, Hardware Design, Configuration, and End Use Industry and region. By Product Type, the market is divided into Articulated Modular Robots, SCARA Modular Robots, Cartesian Modular Robots, and Parallel Modular Robots. In terms of Hardware Design, the market is classified into Chain-Based, Lattice-Based, and Strut-Based. Based on Configuration, the market is segmented into Auto-Configuration and Manual Configuration. By End Use Industry, the market is divided into Automotive, Electronics & Electrical, Chemical, Food & Beverages, Pharmaceutical, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The articulated modular robots segment, accounting for 39.70% of the product type category, has been leading due to its superior motion flexibility, precision, and multi-axis capability that support complex manufacturing operations. The segment’s dominance is reinforced by strong utilization across automotive assembly, electronics production, and material handling applications where adaptability and repeatability are critical.

Continuous advancements in servo control systems and modular joint integration have improved load-bearing capacity and operational efficiency. Manufacturers are emphasizing user-friendly interfaces and simplified programming frameworks to enhance deployment speed.

Growing demand for cost-efficient robotic solutions capable of performing diverse tasks with minimal reconfiguration is expected to sustain the segment’s leading position, while ongoing integration of AI-driven control and predictive maintenance tools further strengthens its market resilience.

The chain-based design segment, holding 42.10% of the hardware design category, has maintained its leadership due to its scalable and flexible architecture that enables reconfiguration and efficient space utilization. The design’s modularity allows easy expansion or retraction of robotic units, enhancing operational versatility in dynamic production environments.

Demand has been bolstered by increased use in industrial automation, warehouse logistics, and research applications where adaptability and modular linkage systems provide significant efficiency gains. Enhanced structural integrity and real-time control synchronization have improved precision and reliability.

The combination of reduced system downtime, simplified assembly, and compatibility with different control platforms has made the chain-based architecture a preferred choice, and continued development in lightweight materials and compact actuators is expected to reinforce its market share.

The auto-configuration segment, representing 57.80% of the configuration category, has emerged as the dominant configuration due to its ability to autonomously detect, align, and calibrate modules during system setup. This capability reduces manual intervention, minimizes setup time, and enhances overall system productivity.

The segment’s growth has been fueled by the increasing demand for self-learning and adaptive robotics within advanced manufacturing environments. Integration of sensor fusion, real-time data processing, and AI-based diagnostics has further strengthened performance consistency and fault tolerance.

Auto-configuration systems also enable higher uptime through predictive maintenance and self-correction mechanisms As manufacturers continue to focus on operational agility and intelligent automation, the adoption of auto-configurable modular robots is expected to expand significantly, ensuring sustained leadership and widespread implementation across multiple industrial domains.

Modular Robotics Spearhead Workplace Security and Efficiency!

The need to augment human workers with robotic assistance, particularly in industries with labor shortages or hazardous working environments, drives the market growth.

Modular Robotics Revolutionized Industry Automation!

Increasing demand for automation across industries, driven by labor shortages, rising labor costs, and the need for operational efficiency, fuels the growth of the modular robotic market.

Customizable Robotics Redefine Industry Solutions!

The market is also driven by the demand for customizable solutions that can be tailored to specific industry needs and applications.

While the market shows promising growth, certain challenges hinder its full potential. Limited standardization across modules complicates seamless integration. Additionally, concerns about cybersecurity and data privacy pose barriers to widespread adoption.

From 2020 to 2025, the modular robotic market showed strong growth as well, boasting a 16.3% CAGR. Different types of modular robot designs have been made. Some robots, called self-reconfiguring modular robots, can change shape by themselves. These robots can reconfigure without needing help from outside. This trend has contributed to the positive outlook of the Modular Robotic industry.

| Attributes | Quantitative Outlook |

|---|---|

| Modular Robotic Market Size (2025) | USD 10.75 billion |

| Historical CAGR (2020 to 2025) | 16.3% |

Short-term Modular Robotic Market Analysis

The modular robotic market global forecast suggests considerable growth owing to the growing demand for modular robots in various sectors. They are being increasingly used in industries such as manufacturing, healthcare, and agriculture. Additionally, there is a trend toward modular robots becoming more affordable and accessible to a wider range of users. Because of this, the modular robot market is anticipated to grow significantly over the next few years.

Long-term Modular Robotic Market Analysis

Global trends in the modular robotic industry spotlight a dynamic landscape. One notable trend is the implementation of modular robots on Industry 4.0 principles, such as automation, data exchange, and smart manufacturing. Industry 4.0 encourages adaptive manufacturing processes that can quickly respond to changes in demand or production requirements.

Modular robots are well-suited for adaptive manufacturing environments. This is expected to have a highly positive impact on the global demand for modular robotics in the long run.

The emergence of modular robotics presents significant opportunities for players in the market. For instance, Modbot's pioneering platform has paved the way for innovation and growth in the global modular robotic market.

By offering a system of reusable modules that can be easily assembled into various robotic configurations, companies can explore new avenues for product development and customization. This allows market players to address a wide range of applications and industries, leading to an increased share in the modular robotic industry.

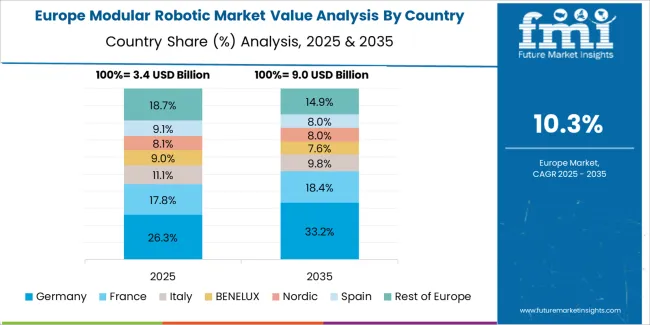

The North America modular robotic market stands out as a moderately performing regional market. Top players are teaming up with different companies that offer gripping systems and similar tech to improve their robot business. Europe is witnessing continuous and steady growth in demand for modular robotics. This can be attributed to the increasing automation needs across industries.

The Asia Pacific modular robotic industry is likely to progress significantly. Rising IT investments supported by government programs in countries like China, Japan, and South Korea are anticipated to boost growth in this region.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

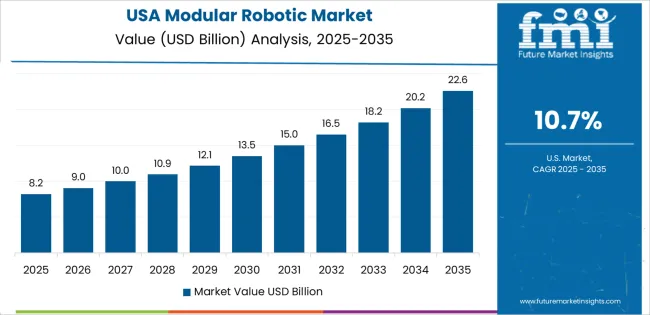

| United States | 16.70% |

| Germany | 19.80% |

| South Korea | 20.20% |

| China | 21.80% |

| Japan | 22.25% |

Demand for modular robotics in the United States is set to rise with an anticipated CAGR of 16.70% through 2035. Key factors influencing the modular robotic market include:

The Germany modular robotic market is expected to surge at a CAGR of 19.80% through 2035. The topmost dynamic forces supporting the modular robotic adoption in the country include:

The market in South Korea is likely to exhibit a CAGR of 20.20% through 2035. Reasons supporting the growth of the modular robotic market in the country include:

The adoption of modular robotics in China is forecasted to inflate at a CAGR of 21.80% through 2035. Prominent factors backing up the growth in the modular robotic industry are:

Sales of modular robotics in Japan are estimated to record a CAGR of 22.25% through 2035. The primary factors bolstering the modular robot market size are:

As far as the product type of modular robotic is concerned, the SCARA modular robots segment is likely to acquire 27.30% modular robotic market share. Similarly, the chain-based segment is expected to gain considerable profit in terms of hardware design, possessing a 38.80% revenue share of modular robotic industry in 2025.

| Segment | Estimated Market Share in 2025 |

|---|---|

| SCARA Modular Robots | 27.30% |

| Chain-based Modular Robotics | 38.80% |

The SCARA modular robots segment is anticipated to perform better than others in the market. Here are a few key factors that contribute to SCARA’s acceptance in the market:

The chain-based segment is set to take more than 1/3rd market share, a trend validated by factors such as:

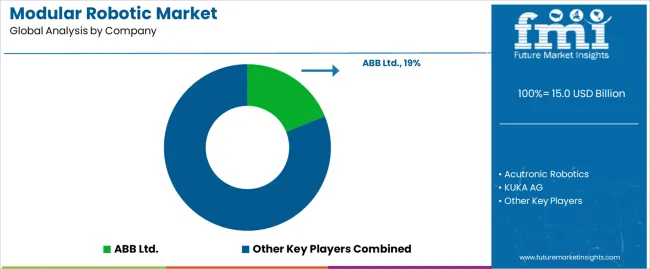

Modular robotic market players implement diverse strategies to gain an edge in this fiercely competitive market. Some focus on offering versatile modular systems adaptable to diverse applications. In the meantime, others prioritize affordability and scalability. Many emphasize top-notch technology integration to enhance functionality and autonomy.

Additionally, market players explore strategic partnerships and collaborations to broaden their reach and leverage complementary expertise. Amidst competition, innovation and differentiation remain key drivers for market leadership.

Recent Developments

The global modular robotic market is estimated to be valued at USD 15.0 billion in 2025.

The market size for the modular robotic market is projected to reach USD 43.6 billion by 2035.

The modular robotic market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in modular robotic market are articulated modular robots, scara modular robots, cartesian modular robots and parallel modular robots.

In terms of hardware design, chain-based segment to command 42.1% share in the modular robotic market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular Trailer Market Forecast and Outlook 2025 to 2035

Modular Substation Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Fitness Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Data Center Market Analysis - Size, Share, and Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Modular Energy Control System Market Growth – Trends & Forecast 2025 to 2035

Modular Construction Market Growth – Trends & Forecast 2025 to 2035

Modular Instruments Market Growth – Trends & Forecast 2025 to 2035

Modular Plating Systems Market

Modular Conveyor System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA