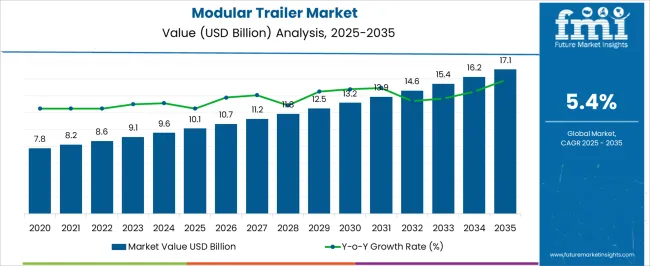

The Modular Trailer Market is estimated to be valued at USD 10.1 billion in 2025 and is projected to reach USD 17.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The Modular Trailer market is witnessing robust growth, driven by increasing demand for flexible, high-capacity transport solutions across construction, infrastructure, and heavy industrial sectors. Growth is supported by the need to transport oversized and heavy equipment safely and efficiently while minimizing operational risks. Technological advancements in trailer design, including modular construction, load distribution optimization, and enhanced suspension systems, are improving operational performance and durability.

The market is further reinforced by infrastructure development initiatives, urban expansion projects, and increasing investment in large-scale construction projects globally. Adoption is also being propelled by regulatory requirements focusing on road safety, axle load distribution, and transportation efficiency. Modular trailers provide customizable configurations that enable seamless adaptation to varying load types, sizes, and weights, which enhances versatility for multiple applications.

Rising preference for scalable transport solutions and the integration of advanced monitoring and control systems are driving market expansion As industries continue to prioritize efficiency, safety, and cost optimization in logistics, the Modular Trailer market is expected to sustain steady growth over the coming decade.

| Metric | Value |

|---|---|

| Modular Trailer Market Estimated Value in (2025 E) | USD 10.1 billion |

| Modular Trailer Market Forecast Value in (2035 F) | USD 17.1 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

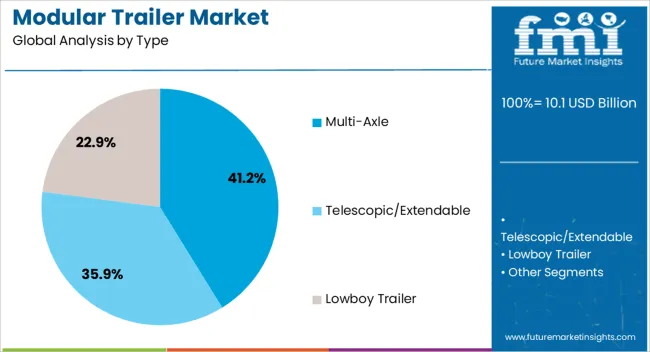

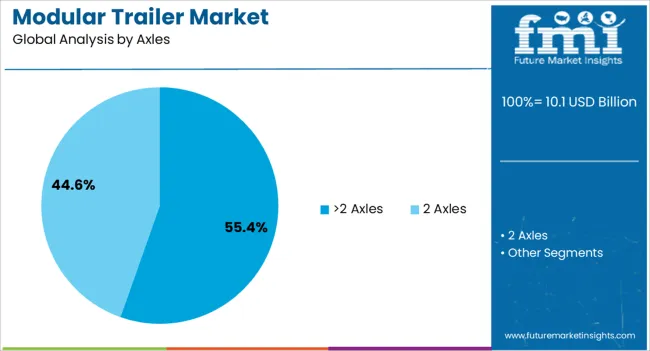

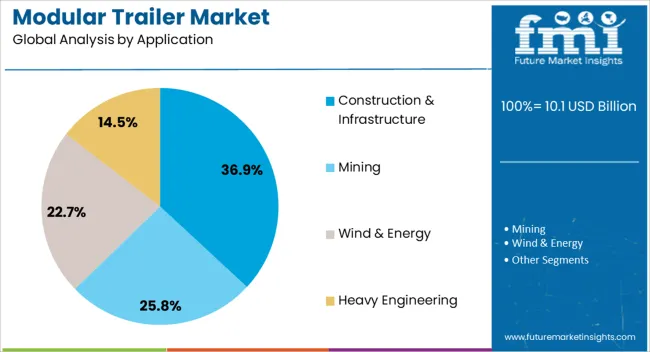

The market is segmented by Type, Axles, and Application and region. By Type, the market is divided into Multi-Axle, Telescopic/Extendable, and Lowboy Trailer. In terms of Axles, the market is classified into >2 Axles and 2 Axles. Based on Application, the market is segmented into Construction & Infrastructure, Mining, Wind & Energy, and Heavy Engineering. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The multi-axle segment is projected to hold 41.2% of the market revenue in 2025, establishing it as the leading type. Growth in this segment is being driven by its ability to distribute heavy loads evenly across multiple axles, reducing stress on individual axles and improving stability during transportation. Multi-axle trailers enhance safety and operational efficiency when handling oversized or exceptionally heavy cargo.

Their versatility allows for deployment across multiple industries, including construction, infrastructure, and industrial logistics, where precise load distribution is critical. Advanced engineering in suspension systems and modular design features further improves maneuverability and reduces road wear, supporting regulatory compliance. The ability to customize configurations to match specific transport requirements provides operational flexibility.

Increasing adoption is also driven by the growing demand for cost-effective, safe, and scalable transport solutions As the need for reliable heavy-duty cargo movement continues to rise, multi-axle trailers are expected to maintain their leading market position, supported by ongoing innovation and infrastructure expansion.

The >2 axles segment is expected to account for 55.4% of the market revenue in 2025, making it the largest axle configuration. Its dominance is being driven by the capacity to handle extremely heavy loads with enhanced stability and reduced road impact. This configuration supports safer and more efficient transport of oversized cargo in construction, mining, and industrial sectors.

Advanced modular design and robust suspension systems improve load management, while compliance with safety and regulatory standards is ensured. The ability to adjust axle count according to load requirements enhances operational flexibility and reduces transport risks.

Adoption is further accelerated by increasing infrastructure development, large-scale construction projects, and the need for cost-effective transport solutions As industries prioritize the safe movement of heavy machinery and equipment, the >2 axles segment is expected to remain a critical driver of market growth, reinforcing the need for modular, scalable trailer solutions.

The construction and infrastructure segment is projected to hold 36.9% of the market revenue in 2025, establishing it as the leading application area. Growth in this segment is being driven by the expanding global construction activities, infrastructure modernization projects, and industrial development initiatives. Modular trailers are increasingly used to transport heavy machinery, prefabricated structures, and construction materials safely and efficiently.

The flexibility and load management capabilities of modular trailers enable timely delivery of large-scale equipment to construction sites, supporting project deadlines and operational efficiency. Regulatory requirements related to road safety and load distribution are further encouraging adoption of modular solutions. Advanced design features, including multi-axle configurations and customizable trailer lengths, are enhancing usability in diverse construction applications.

The integration of monitoring systems, real-time tracking, and automated load balancing is also improving operational reliability As investment in infrastructure and construction projects grows globally, the construction and infrastructure application segment is expected to remain the primary driver of market expansion.

As per the report published by Future Market Insights, the modular trailer ecosystem rose at a 7.1% CAGR from 20110.1 to 2025. Previous analysis of this market revealed a potential of USD 10.1 billion for FY 2025-2025. Comparing the previous’ year’s valuation, the modular trailer market has inclined by 6.7%.

With prospects picking up pace, substantial opportunities for modular trailer manufacturers present themselves on the horizon. The demand for modular trailers has surged in recent years, fuelled by globalization and the rapid expansion of infrastructural projects. Developing countries have heavily invested in infrastructural projects, requiring efficient transportation solutions for heavy and oversized cargo.

Increasing use of modular trailers for transporting heavy machinery and equipment in industries like construction and mining is driving the market growth. Modern construction roadway technology, especially of the modular kind, is advancing with material improvements, modern and durable design, and engineering.

Such innovations contributed to higher ratings of carrying capacity more perfect maneuvering, and increased safety characteristics, which resulted in a higher involvement of industries in adopting drones. Projections indicate that the global modular trailer market is expected to experience a CAGR of 5.4% from 2025 to 2035.

| Historical CAGR (20110.1 to 2025) | 7.1% |

|---|---|

| Forecast CAGR (2025 to 2035) | 5.4% |

The provided table highlights the top five countries in terms of revenue, with China and South Korea leading the list. Based on a comprehensive analysis, South Korea presents a substantial opportunity due to the strong presence of modular trailer manufacturers.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 5.7% |

| The United Kingdom | 6.7% |

| China | 5.9% |

| Japan | 6.8% |

| South Korea | 7.2% |

The modular trailer market in the United States is poised to register a CAGR of 5.7%. The increasing expansion of industries like manufacturing, mining, and energy extraction require the transportation of large and heavy equipment, driving the need for a modular trailer market.

The United States is a major player in the modular trade, with significant import and export of goods. Modular trailers play a significant role in transporting oversized and heavy cargo to and from ports, distribution centers, and manufacturing facilities, supporting the growth of international trade.

The modular trailer market in the United Kingdom is poised to register a CAGR of 6.7%. Increasing investment in renewable energy projects, including solar and wind farm installation.

Modular trailers are utilized to transport components like wind turbine blades, towers, and solar panels to these project sites, stimulating market demand.

The innovative design, components, and technology used in trailers contribute to more efficient, secure, and performance modular trailers. Functionality involved in telematics data management, load capacity improvement, and application of light weight material suits customers' needs drive the market growth.

The modular trailer market in China is expected to register a CAGR of 5.9%. The modular trailer market in China has been experiencing significant growth due to extensive infrastructure development, including the construction of highways, bridges, railways, and energy infrastructure.

The production of goods in China's manufacturing industry still rises, hence the added need to transport capital-intensive equipment between regions. Run-up trailers feature alternative options tailored to the different arrangements of transport within the industry, including the manufacturing, construction, and mining spheres, contributing to the market's expansion.

Japan's market is expected to have a 6.8% CAGR for modular trailers between 2025 and 2035. The ongoing infrastructural projects, including road construction, bridge enhancement, and urban development programs in Japan, drive market growth as modular trailers transport cargo, including (heavy equipment), and construction materials.

Urbanization and population growth in Japan prevail development of public facilities and construction in urban areas. These module trailers are a vital link to relocating building materials, equipment, and manufactured components, which is the solution to urban development nowadays.

Increasing government initiatives promoting economic growth and sustainability through infrastructure investment and transportation improvement also contribute to the demand for modular trailers.

The modular trailer market in South Korea is expected to register a CAGR of 7.2%. International trade network expansion drives demand for modular trailers for cross-border transportation in South Korea.

Increasing investment in renewable energy projects and increasing use of modular trailers to transport components like solar panels, wind turbine parts, and heavy machinery to these project sites stimulate market demand.

The section below shows the leading segment. The multi-axle segment is to rise at a CAGR of 5.2% in 2025. Based on axles, the 2-axle segment is to have a CAGR of 5.0% during 2035.

| Category | Market Share |

|---|---|

| Multi Axle | 5.2% |

| 2 Axles | 5.0% |

The multi-axles segment emerged as the dominant force in the modular trailer market. It is predicted to maintain its position over the forecast period with a CAGR of 5.2% in the global market. Multi-axle trailers can carry much more than one- or two-axle trailers.

These trailers can bear the tensile strength of cargo on several axles, which makes them an alternative for transporting these types of material- oversized and heavy machines, equipment, and spare parts- that weigh a lot.

Such multi-axle road trains offer improved stability and guidance, particularly in trailering big or irregular items. The supplemental axles help in the uniform weight distribution across the vehicle and the process; the chances of turnover, tipping, or jackknifing while moving from one point to another are greatly minimized.

This is particularly beneficial since it serves as a safety guarantee to the trailer's content, the trailer itself and other drivers on the road.

Based on axles, the 2 axles segment is expected to gain a CAGR of 5.0% in 2035. Two-axle trailers are patently versatile and used for all prosaic and momentous tasks.

They possess a wide range of adaptability as they can be equipped with commodity containers with different dimensions to accommodate various sizes of goods or unusually shaped ones. They can amalgamate with other industries or applications they are very popular among manufacturers.

Under the pivot of smaller initial outlays compared to multi-axle trailers, the two axles trailers are viable for a wider range of customers, including small businesses and independent transporters. Less is needed to finance the start-off puts operators in a position to enter the market cap as the fleet is expanded at less cost.

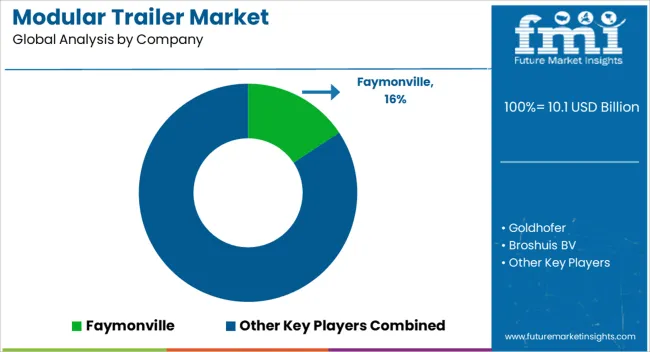

The existing and newly established companies dominate the global modular trailer market. An in-depth analysis of the statistics for the modular trailer manufacturing industry shows that certain companies can lead the market by implementing newer and more cutting-edge technology.

Key companies are strengthening their market positions through product portfolio development and smart mergers and acquisitions.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 10.1 billion |

| Projected Market Valuation in 2035 | USD 17.1 billion |

| Value-based CAGR 2025 to 2035 | 5.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Type, Axles, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Faymonville; K-Line Trailers Ltd; Tidd Ross Todd Limited; Shandong Titan Vehicle Co. Ltd; Demarko Trailers; Hugelron Tech Co. Ltd; VMT Industries; Goldhofer; Tantri; Broshuis BV |

The global modular trailer market is estimated to be valued at USD 10.1 billion in 2025.

The market size for the modular trailer market is projected to reach USD 17.1 billion by 2035.

The modular trailer market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in modular trailer market are multi-axle, telescopic/extendable and lowboy trailer.

In terms of axles, >2 axles segment to command 55.4% share in the modular trailer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular Rolling Mill Market Size and Share Forecast Outlook 2025 to 2035

Modular Fiber Optical Spectrometers Market Size and Share Forecast Outlook 2025 to 2035

Modular Process Skid Packages Market Forecast and Outlook 2025 to 2035

Modular Robotic Market Size and Share Forecast Outlook 2025 to 2035

Modular Substation Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Trailer & Cargo Container Tracking Market Size and Share Forecast Outlook 2025 to 2035

Trailer Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Modular Fitness Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Data Center Market Analysis - Size, Share, and Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA