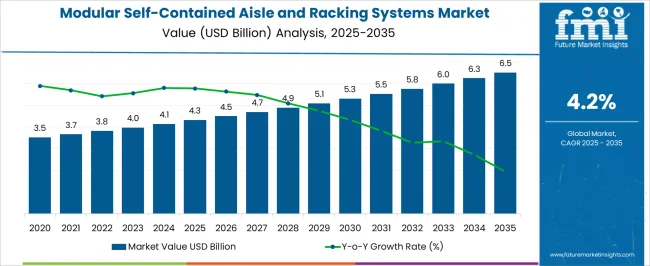

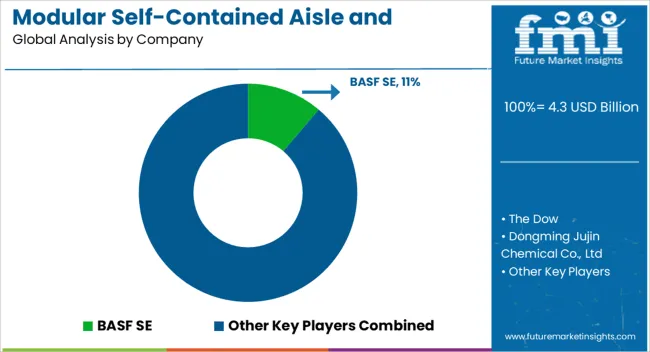

The Modular Self-Contained Aisle and Racking Systems Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 6.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Modular Self-Contained Aisle and Racking Systems Market Estimated Value in (2025E) | USD 4.3 billion |

| Modular Self-Contained Aisle and Racking Systems Market Forecast Value in (2035F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The Modular Self-Contained Aisle and Racking Systems market is experiencing steady growth, driven by the increasing adoption of modular storage and display solutions across retail and commercial sectors. Demand is being fueled by the need for flexible, scalable, and efficient storage systems that optimize space utilization and support high-volume product handling. Advancements in modular design, material engineering, and automated handling systems are enhancing operational efficiency while enabling easy installation and reconfiguration.

The integration of temperature-controlled and cold storage functionalities is further supporting adoption in supermarkets, hypermarkets, and perishable goods storage environments. Growing emphasis on operational cost reduction, energy efficiency, and inventory management is driving market expansion.

Retailers and supply chain operators are increasingly prioritizing modular systems that allow rapid deployment, scalability, and adaptability to changing business requirements As global retail infrastructure continues to modernize, modular self-contained aisle and racking systems are expected to witness sustained growth, driven by technological innovations and increasing demand for optimized storage and display solutions.

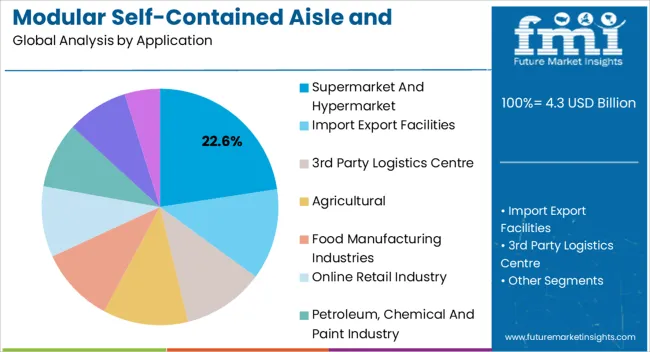

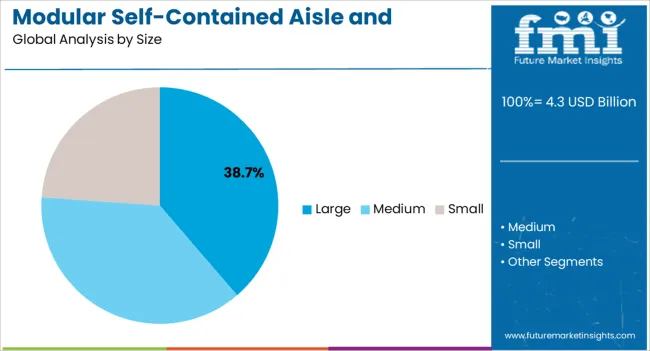

The modular self-contained aisle and racking systems market is segmented by application, size, functionality, and geographic regions. By application, modular self-contained aisle and racking systems market is divided into Supermarket And Hypermarket, Import Export Facilities, 3rd Party Logistics Centre, Agricultural, Food Manufacturing Industries, Online Retail Industry, Petroleum, Chemical And Paint Industry, Information Technology (IT) Industry, and Others (Includes Dairy Facilities, Grocery Storage). In terms of size, modular self-contained aisle and racking systems market is classified into Large, Medium, and Small.

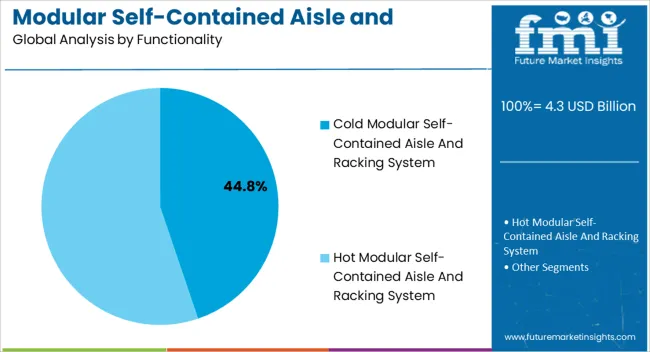

Based on functionality, modular self-contained aisle and racking systems market is segmented into Cold Modular Self-Contained Aisle And Racking System and Hot Modular Self-Contained Aisle And Racking System. Regionally, the modular self-contained aisle and racking systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The supermarket and hypermarket application segment is projected to hold 22.6% of the market revenue in 2025, establishing it as the leading application category. Growth is being driven by the increasing need for efficient product display, storage, and handling solutions in large-scale retail environments. Modular self-contained systems enable retailers to optimize aisle configurations, improve product visibility, and enhance customer shopping experiences.

The flexibility of these systems allows for rapid reconfiguration to accommodate changing product assortments and seasonal variations. Energy-efficient designs and integration with refrigeration or cold storage functionalities further increase their appeal. Retailers benefit from reduced operational costs, improved inventory management, and enhanced space utilization.

As supermarkets and hypermarkets expand in both emerging and developed markets, the demand for modular self-contained aisle and racking systems is expected to remain high Continuous innovation in system design, materials, and operational features is anticipated to further strengthen the segment’s market position and reinforce its revenue share.

The large size segment is expected to account for 38.7% of the market revenue in 2025, making it the leading size category. Its growth is being driven by the need for high-capacity storage and display solutions in large retail stores, distribution centers, and commercial warehouses. Large modular systems enable efficient handling of substantial inventory volumes while optimizing space utilization and operational workflows.

The ability to integrate automated handling, inventory tracking, and temperature control functionalities enhances their effectiveness and reliability. This segment benefits from scalability and adaptability, allowing operators to expand or reconfigure systems according to changing business demands.

The combination of space efficiency, operational flexibility, and ease of maintenance has reinforced preference among large-scale retailers and logistics operators As the demand for efficient, high-capacity modular storage systems increases globally, the large size segment is expected to maintain its leading position, supported by ongoing technological advancements and operational innovations.

The cold modular self-contained aisle and racking system functionality segment is projected to hold 44.8% of the market revenue in 2025, establishing it as the leading functionality category. Growth is driven by the rising demand for temperature-controlled storage solutions in retail, grocery, and perishable goods environments. Cold modular systems enable precise temperature management, ensuring product quality, freshness, and compliance with food safety standards.

Integration with modular racking allows efficient space utilization, improved inventory rotation, and streamlined logistics operations. These systems also reduce energy consumption compared with conventional cold storage setups, enhancing operational efficiency and sustainability. Retailers and supply chain operators benefit from reduced spoilage, cost savings, and optimized workflow management.

As global food retail and cold chain infrastructure expand, demand for cold modular self-contained systems is expected to continue rising Innovations in insulation, refrigeration technology, and modular design are anticipated to further strengthen adoption and reinforce the segment’s leading market share.

Modular self-contained aisle and racking system is all in one solution for a company to manage its respective operations. Growing complexion in data storage servers and inventory system is a crucial issue that can be minimized by modular self-contained aisle and racking system.

Modular self-contained aisle and racking system is used in food and beverage industry, IT industry, agricultural industry, import export industry, retail industry, manufacturing industries and others including pharmaceutical industry. Modular self-contained aisle and racking system market is growing and is also anticipated to grow at a significant rate worldwide in terms of value.

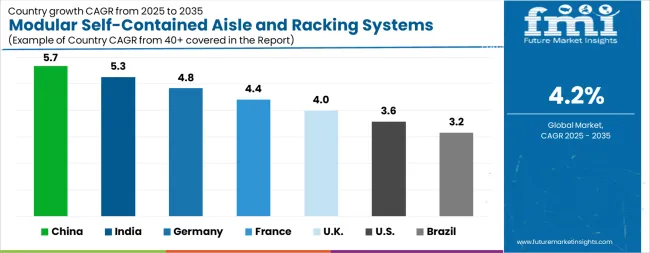

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

The Modular Self-Contained Aisle and Racking Systems Market is expected to register a CAGR of 4.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.7%, followed by India at 5.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.2%, yet still underscores a broadly positive trajectory for the global Modular Self-Contained Aisle and Racking Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.8%. The USA Modular Self-Contained Aisle and Racking Systems Market is estimated to be valued at USD 1.5 billion in 2025 and is anticipated to reach a valuation of USD 2.2 billion by 2035. Sales are projected to rise at a CAGR of 3.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 218.0 million and USD 148.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 Billion |

| Application | Supermarket And Hypermarket, Import Export Facilities, 3rd Party Logistics Centre, Agricultural, Food Manufacturing Industries, Online Retail Industry, Petroleum, Chemical And Paint Industry, Information Technology (IT) Industry, and Others (Includes Dairy Facilities, Grocery Storage) |

| Size | Large, Medium, and Small |

| Functionality | Cold Modular Self-Contained Aisle And Racking System and Hot Modular Self-Contained Aisle And Racking System |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, The Dow, Dongming Jujin Chemical Co., Ltd, Henan GP Chemicals Co.,Ltd, Shanghai Youyang Industrial Co, Stepan Company, Clariant Corporation, Acme-Hardesty Company, Alpha Chemicals Pvt. Ltd., Croda International Plc, The Chemours Company, Huntsman Corporation, Lion Specialty Chemicals Co. Ltd., Galaxy Surfactants Ltd., Henkel AG & Co. KGaA, Solvay S.A, and Evonik |

The global modular self-contained aisle and racking systems market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the modular self-contained aisle and racking systems market is projected to reach USD 6.5 billion by 2035.

The modular self-contained aisle and racking systems market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in modular self-contained aisle and racking systems market are supermarket and hypermarket, import export facilities, 3rd party logistics centre, agricultural, food manufacturing industries, online retail industry, petroleum, chemical and paint industry, information technology (it) industry and others (includes dairy facilities, grocery storage).

In terms of size, large segment to command 38.7% share in the modular self-contained aisle and racking systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular Rolling Mill Market Size and Share Forecast Outlook 2025 to 2035

Modular Fiber Optical Spectrometers Market Size and Share Forecast Outlook 2025 to 2035

Modular Process Skid Packages Market Forecast and Outlook 2025 to 2035

Modular Robotic Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Modular Substation Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Fitness Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Data Center Market Analysis - Size, Share, and Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Modular Energy Control System Market Growth – Trends & Forecast 2025 to 2035

Modular Construction Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA