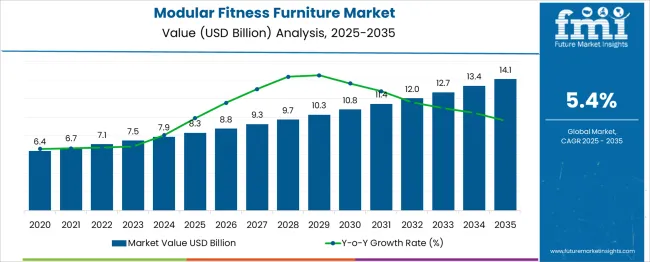

The Modular Fitness Furniture Market is estimated to be valued at USD 8.3 billion in 2025 and is projected to reach USD 14.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. Analysis of acceleration and deceleration patterns shows that the first half of the forecast period (2025–2030) experiences strong acceleration, with market value increasing from USD 8.3 billion to USD 10.8 billion, contributing USD 2.5 billion or 43% of total gains, driven by rising demand for multifunctional home fitness solutions, the growth of compact urban living, and hybrid work trends boosting investment in space-saving designs.

This phase is marked by innovation in foldable systems and smart connectivity for personalized workouts. From 2030 to 2035, the market adds USD 3.3 billion to reach USD 14.1 billion, showing mild deceleration as saturation occurs in developed economies and price competition stabilizes margins. Despite slower growth, opportunities remain significant through premiumization via IoT-enabled designs, sustainable materials, and modular systems for institutional and corporate wellness programs. Companies focusing on ergonomic innovation, customizable configurations, and digital integration will strengthen their position in a market that transitions from rapid adoption to technology-driven differentiation and replacement-oriented demand in the later years.

| Metric | Value |

|---|---|

| Modular Fitness Furniture Market Estimated Value in (2025 E) | USD 8.3 billion |

| Modular Fitness Furniture Market Forecast Value in (2035 F) | USD 14.1 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The modular fitness furniture segment is emerging as a distinct category within both fitness infrastructure and commercial furniture ecosystems. In the fitness and wellness equipment market, it represents 6–8%, where modular benches, racks, and storage systems complement core cardio and strength equipment. Within the modular furniture and commercial interiors market, its share rises to 10–12%, reflecting demand for reconfigurable furniture in multipurpose spaces such as corporate wellness areas and flexible studios. In the home and remote workout furniture segment, it accounts for 4–6%, as consumers adopt compact, multifunctional furniture for at-home fitness, yoga, and mobility space.

Across the health club and studio design market, modular fitness furniture makes up 8–10% of outfitting budgets, enabling flexible layouts and equipment adjacencies that scale for class formats. Within ergonomic and wellness workplace furniture, the share is 3–5%, where fitness-friendly zones integrate modular benches, storage, and movement-support furniture. Demand is driven by rising emphasis on flexible multi-use interiors in both commercial and residential contexts, as well as growing integration of fitness into workspace design. Features such as foldable racks, modular upholstery that doubles as exercise platforms, and reconfigurable layout kits boost utility, support hybrid-use environments, and streamline operational flexibility positioning modular fitness furniture at the intersection of wellness, interior design, and agile workspace strategy.

The growing popularity of home workouts, driven by lifestyle changes and increased health awareness, is encouraging manufacturers to develop equipment that blends functionality with modern aesthetics. Demand has been further fueled by urbanization and shrinking living spaces, prompting a shift toward compact, multipurpose furniture with integrated fitness capabilities.

Technological innovations in design, material engineering, and structural adaptability are playing a key role in shaping market direction. The convergence of fitness, convenience, and home decor is influencing product development, with a focus on customization, sustainability, and ergonomic performance.

As fitness-conscious consumers prioritize both form and utility, modular systems that offer multi-functionality without compromising on design are gaining widespread adoption. The market outlook remains optimistic as investment in product innova.

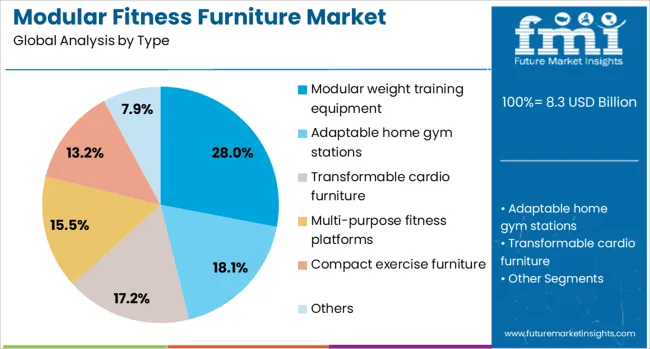

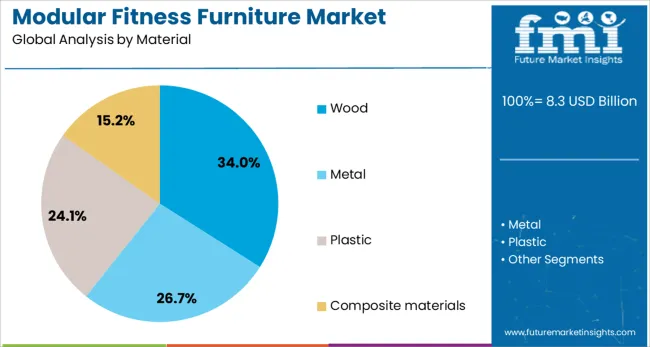

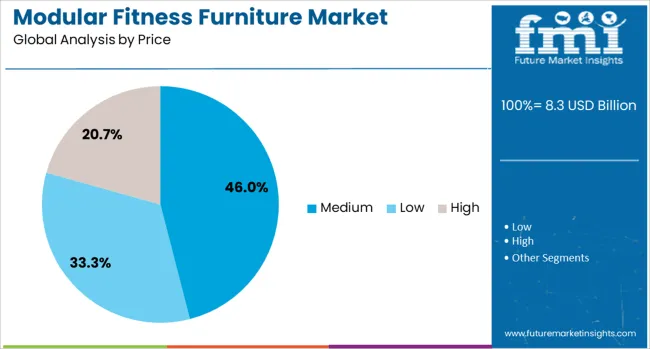

The modular fitness furniture market is segmented by type, material, price, end use, distribution channel, and geographic regions. The modular fitness furniture market is divided by type into Modular weight training equipment, Adaptable home gym stations, Transformable cardio furniture, Multi-purpose fitness platforms, Compact exercise furniture, and Others. The modular fitness furniture market is classified into Wood, Metal, Plastic, and Composite materials. The price of the modular fitness furniture market is segmented into Medium, Low, and High. The end use of the modular fitness furniture market is segmented into Residential and Commercial (gyms, fitness studios, offices). The distribution channel of the modular fitness furniture market is segmented into Online and Offline. Regionally, the modular fitness furniture industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The modular weight training equipment segment is projected to account for 28% of the Modular Fitness Furniture market revenue in 2025, making it the leading product type. Growth within this segment has been supported by rising demand for strength training solutions that can be integrated seamlessly into compact living environments. These systems have been favored for their versatility, allowing users to perform a wide range of exercises using a single consolidated unit.

The modular design has also enabled users to adjust components based on personal fitness levels, enhancing usability and long-term value. Adoption has increased among urban populations who seek high-performance fitness tools without dedicating large spaces to traditional gym setups.

In addition, the shift toward holistic wellness and at-home fitness routines has positioned modular strength equipment as a core offering. Manufacturers have prioritized innovation in form, function, and materials, which has strengthened the appeal of these systems among both amateur users and professional trainers..

The wood segment is anticipated to hold 34% of the Modular Fitness Furniture market revenue in 2025, establishing it as the dominant material category. The growing preference for wood in fitness furniture has been attributed to its aesthetic appeal, eco-friendly characteristics, and structural reliability. Consumers have shown strong interest in furniture that complements interior decor while providing functional workout capabilities.

Wood has emerged as a material of choice due to its ability to support clean, minimalist design without sacrificing durability. As sustainability becomes a core purchasing criterion, wood-based systems made from responsibly sourced materials are gaining favor. Furthermore, manufacturers have leveraged advanced woodworking techniques and finishes to create high-performance, ergonomic designs that withstand regular use.

The tactile and visual warmth of wood has also helped differentiate premium offerings in the market. The integration of craftsmanship with performance requirements has made wood-based modular furniture a standout option among discerning consumers seeking long-term value..

The medium price segment is projected to capture 46% of the Modular Fitness Furniture market revenue in 2025, positioning it as the leading price category. This segment’s prominence has been driven by its balance of affordability, functionality, and aesthetic value, appealing to a broad consumer base. As fitness becomes a lifestyle priority for a wider demographic, demand has grown for modular solutions that deliver quality and innovation at accessible price points.

Products in the medium range have successfully combined high-grade materials with thoughtful design, meeting the expectations of both performance and visual integration. Consumers have shown willingness to invest in durable fitness furniture that enhances their living space without commanding premium costs.

Retailers and manufacturers have responded by expanding offerings in this tier, incorporating value-added features such as modular attachments, adjustable resistance, and sleek finishes. The segment’s scalability and mass-market appeal are expected to continue driving its leadership position in the evolving marketplace..

Modular fitness furniture refers to adaptable workout installations such as foldable benches, stackable plyo boxes, multi-purpose racks, and movable partitions designed for gyms, studios, and home setups. Adoption has been driven by growing demand for space-efficient, customizable exercise environments that can be easily reconfigured. Providers offering durable, wipe-down surfaces, lightweight construction, and adjustable configurations have gained preference. Products that support tool-free setup, modular expansion, and storage consolidation continue to influence procurement decisions by facility operators, boutique studios, and health-conscious homeowners.

Growth has been supported by consumer and operator demand for compact and transformation-friendly fitness environments. Boutique studios, micro-gyms, and home trainers have prioritized adaptable furniture that enables varied workout setups within limited floor areas. Multi-functional modules that can be reconfigured for strength training, yoga, or HIIT routines have attracted interest. Facilities offering customized branding options and easy reconfiguration attract repeat users. Products combining aesthetic design with robust construction deliver visual appeal and practical performance. Accessibility to modular units through online platforms and local suppliers has further boosted adoption among users seeking flexible workout arrangements.

Widespread adoption has been limited by variable durability and stability in lower-cost modular units. Some units may not support heavy loads or aggressive workouts, raising safety concerns. Complexity in multi-part assembly and uncertainty around stability under dynamic motion may deter first-time users. Confusion over compatibility among accessories from different modules may reduce adoption. Repair or part replacement services are frequently inconsistent, weakening user confidence. Customer skepticism may arise when brands lack standardized safety testing or performance certification. Limited retail readiness and lack of user education about safe modular transitions continue to limit penetration in novice user segments.

Opportunities are being created by companies offering customized modules tailored to studio layouts, branded color options, or thematic fitness zones. Subscription-based modular furniture packages supporting evolving gym formats or temporary installations provide recurring operations flexibility. Collaboration with fitness brands and trainers for co-curated modules or signature equipment lines supports immersive experience delivery. Expansion into corporate wellness spaces, educational campuses, and hospitality fitness areas offers additional usage contexts. Development of interchangeable accessory kits, storage-integrated units, and portable module cases enhances convenience. Bundled services including layout consultation, setup assistance, and accessory upgrades further extend product appeal and adoption.

Recent trends highlight the use of composite wood, recycled polymers, and reinforced foam for durability while maintaining lightweight construction. Smart connectivity features such as load sensors and workout tracking integration via mobile applications are gaining momentum. Interactive apps providing guided module setups and digital exercise libraries have improved consumer experience. Aesthetic modular concepts incorporating customizable finishes and branding-friendly surfaces are appealing to studio operators seeking differentiation. Versatile attachment points for accessories like bands, bars, or resistance components enable flexible functionality within a single platform. Ease of cleaning, foldability, and ergonomic refinements remain priorities influencing next-generation modular designs.

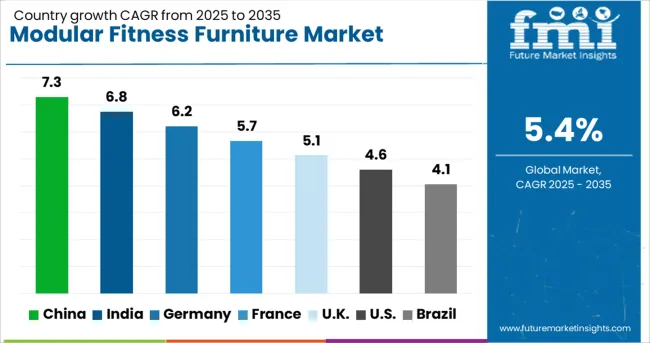

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The modular fitness furniture market is expected to grow at a CAGR of 5.4% from 2025 to 2035, supported by growing consumer interest in multifunctional home fitness solutions and space-saving workout systems. China leads with 7.3%, driven by strong e-commerce adoption and urban housing constraints favoring compact fitness setups. India follows at 6.8%, supported by an expanding middle-class segment and increased home fitness awareness. Among developed markets, Germany records 6.2%, while the United Kingdom posts 5.1% and the United States 4.6%, fueled by premium modular designs, integrated storage features, and personalized workout equipment for residential and commercial spaces. The analysis includes over 40 countries, with the top five detailed below.

China is forecasted to grow at a CAGR of 7.3% through 2035, driven by rising consumer demand for compact, multi-purpose fitness solutions in small living spaces. Increasing disposable income and a focus on home-based wellness contribute to strong adoption of modular fitness furniture in urban households. Domestic manufacturers are innovating with designs that integrate storage solutions and adjustable workout stations, targeting both apartments and villas. E-commerce platforms and social media influencers play a crucial role in shaping consumer preferences and boosting direct-to-consumer sales. Export opportunities are also increasing, with Chinese brands leveraging cost efficiency and design adaptability to target Asia-Pacific markets.

India is expected to achieve a CAGR of 6.8% through 2035, fueled by growing awareness of fitness among millennials and the expansion of compact housing units. Demand for modular furniture with dual functionality for living and workout spaces is rising in urban centers. Domestic suppliers are introducing cost-effective, foldable workout stations targeting small and mid-sized apartments. The popularity of influencer-led fitness programs and e-commerce platforms accelerates product visibility and adoption. Modular setups that include integrated storage and customizable configurations are increasingly preferred by home fitness enthusiasts. Local brands are forming alliances with global players to improve design aesthetics and expand product availability across retail and online channels.

Germany is projected to post a CAGR of 6.2% through 2035, supported by demand for premium modular fitness furniture featuring advanced materials and ergonomic designs. Consumers in metropolitan areas seek furniture that seamlessly blends with interiors while providing multi-functional fitness utility. Manufacturers are incorporating sustainable wood, metal frames, and concealed storage systems to cater to aesthetic and durability requirements. The rise in remote work and home-based fitness trends has boosted investments in versatile workout furniture solutions. German firms emphasize R&D for incorporating smart tracking systems and modular add-ons, enhancing product value for tech-savvy consumers. Export demand within the EU further complements domestic growth.

The United Kingdom is forecasted to grow at a CAGR of 5.1% through 2035, driven by the rising preference for home fitness furniture that combines functionality with minimalistic designs. Compact homes and increased adoption of hybrid work models support strong demand for convertible workout solutions. Domestic brands are focusing on custom designs for loft apartments and shared living spaces, offering products that integrate storage, workout stations, and foldable components. E-commerce channels dominate distribution, while showrooms emphasize premium finishes to appeal to lifestyle-focused consumers. The growing popularity of online fitness subscriptions complements modular equipment purchases, shaping new opportunities for brands in the UK market.

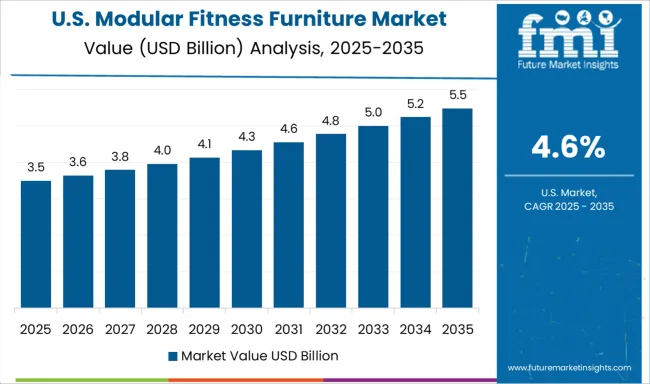

The United States is expected to post a CAGR of 4.6% through 2035, supported by increased investment in premium modular systems featuring smart connectivity and ergonomic design. Growing consumer interest in personalized home gyms is driving demand for furniture with integrated digital fitness platforms and sensor-based performance tracking. Manufacturers are introducing space-saving, multi-configurable systems tailored for apartments and high-density housing units. Partnerships with lifestyle brands and fitness subscription services enhance product appeal for tech-oriented users. Retail and direct-to-consumer sales through online platforms are accelerating adoption, while innovation in material quality and customization options continues to influence competitive positioning.

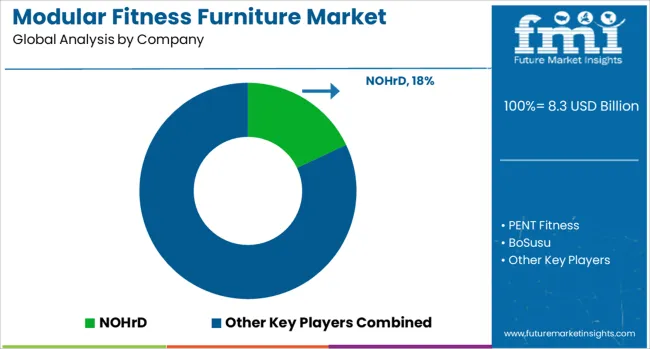

The modular fitness furniture market is a niche yet rapidly evolving segment, with leading brands such as NOHrD, PENT Fitness, BoSusu, FitWood of Scandinavia, and Bench Fitness driving innovation. NOHrD stands out as a premium brand, offering multifunctional wooden fitness furniture that combines aesthetic appeal with functional versatility for home and boutique fitness environments. PENT Fitness caters to the luxury segment, manufacturing handcrafted fitness furniture using high-end materials like natural wood and leather, targeting affluent customers and premium gyms. BoSusu focuses on space-saving, customizable modular setups designed for modern living spaces, appealing to urban customers seeking minimalistic home fitness solutions.

FitWood of Scandinavia emphasizes Nordic-inspired designs with sustainable materials and ergonomic features, creating fitness furniture that blends seamlessly with home interiors. Bench Fitness primarily serves the commercial market with robust, modular systems tailored for heavy-duty strength training environments, providing adaptability for both gyms and home users. Competitive strategies in this market focus on design differentiation, premium material selection, and modularity that allows multifunctional use while optimizing limited space.

Barriers to entry are moderate, with manufacturing quality, brand positioning, and strong online distribution channels acting as key success factors. Leading players are leveraging direct-to-consumer sales, influencer partnerships, and digital marketing campaigns to capture the growing demand for home fitness solutions integrated with lifestyle aesthetics.

The modular fitness furniture market is shaping up through strategies focused on adaptability, user experience, and integrated wellness design. Manufacturers emphasize flexible configurations that allow consumers to rearrange workout stations such as benches, racks, and storage according to varied routines and spaces. Partnerships with fitness brands and interior designers help deliver branded, aesthetic products suited to home and boutique settings.

Companies are enhancing product appeal with smart features like built-in resistance systems or app-guided workouts while ensuring ease of assembly and durability. Sustainability in material selection and logistics efficiency is also prioritized. These approaches aim to make fitness furniture more convenient, stylish, and future ready.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.3 Billion |

| Type | Modular weight training equipment, Adaptable home gym stations, Transformable cardio furniture, Multi-purpose fitness platforms, Compact exercise furniture, and Others |

| Material | Wood, Metal, Plastic, and Composite materials |

| Price | Medium, Low, and High |

| End Use | Residential and Commercial (gyms, fitness studios, offices) |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NOHrD, PENT Fitness, BoSusu, FitWood of Scandinavia, and Bench Fitness |

| Additional Attributes | Dollar sales by product type (modular racks, convertible benches, multifunctional fitness stations) and application (home gyms, boutique studios, commercial fitness spaces), with demand driven by urbanization, smaller living spaces, and the home fitness trend. Regional dynamics indicate strong adoption in Europe and North America due to premium wellness lifestyles, while Asia-Pacific shows increasing interest fueled by apartment-based fitness solutions. Innovation trends include integration of smart features such as app-based workout guidance, quick-assembly modular systems, and premium finishes to blend functionality with interior design aesthetics. |

The global modular fitness furniture market is estimated to be valued at USD 8.3 billion in 2025.

The market size for the modular fitness furniture market is projected to reach USD 14.1 billion by 2035.

The modular fitness furniture market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in modular fitness furniture market are modular weight training equipment, adaptable home gym stations, transformable cardio furniture, multi-purpose fitness platforms, compact exercise furniture and others.

In terms of material, wood segment to command 34.0% share in the modular fitness furniture market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular Rolling Mill Market Size and Share Forecast Outlook 2025 to 2035

Modular Fiber Optical Spectrometers Market Size and Share Forecast Outlook 2025 to 2035

Modular Process Skid Packages Market Forecast and Outlook 2025 to 2035

Modular Robotic Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Modular Substation Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Data Center Market Analysis - Size, Share, and Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Modular Energy Control System Market Growth – Trends & Forecast 2025 to 2035

Modular Construction Market Growth – Trends & Forecast 2025 to 2035

Modular Instruments Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA