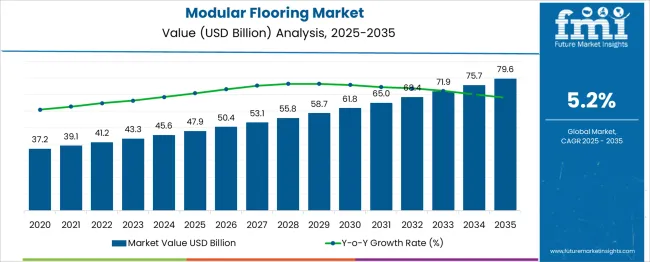

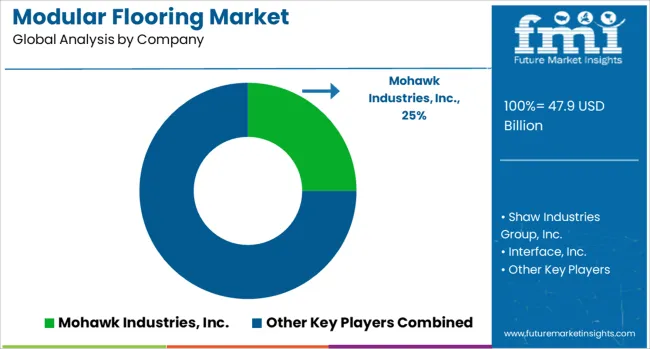

The global modular flooring market is likely to reach from USD 47.9 billion in 2025 to USD 79.6 billion by 2035, recording an absolute increase of USD 31.7 billion over the forecast period. This translates into a total growth of 66.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.2% between 2025 and 2035. The market size is expected to grow by nearly 1.66X during the same period, supported by increasing demand for flexible flooring solutions, rising construction activities in emerging markets, and growing focus on sustainable and eco-friendly flooring materials.

Between 2025 and 2030, the modular flooring market is projected to expand from USD 47.9 billion to USD 61.2 billion, resulting in a value increase of USD 13.3 million, which represents 42.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for quick installation flooring solutions, increasing adoption of modular systems in commercial spaces, and growing penetration of luxury vinyl tile (LVT) products in emerging markets. Construction companies and interior designers are expanding their modular flooring portfolios to address the growing demand for versatile and cost-effective flooring solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 47.9 billion |

| Forecast Value in (2035F) | USD 79.6 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

From 2030 to 2035, the market is forecast to grow from USD 61.2 billion to USD 79.6 billion, adding another USD 18.4 billion, which constitutes 58.0% of the overall ten-year expansion. This period is expected to be characterized by expansion of smart building technologies, integration of advanced manufacturing processes in flooring production, and development of innovative modular flooring systems. The growing adoption of green building standards and energy-efficient construction practices will drive demand for premium modular flooring solutions with enhanced durability and environmental benefits.

Between 2020 and 2025, the modular flooring market experienced steady expansion, driven by increasing demand for flexible workspace solutions and growing awareness of modular flooring advantages. The market developed as construction companies recognized the need for efficient installation methods and cost-effective flooring solutions for commercial and residential projects. Technological advancements and improved product quality began prioritizing the importance of modular flooring systems in modern building construction and renovation projects.

Market expansion is being supported by the increasing demand for flexible and easily replaceable flooring solutions in both commercial and residential sectors. Modern consumers and businesses are increasingly focused on cost-effective installation methods that minimize downtime and disruption during construction or renovation projects. Modular flooring's proven advantages in terms of installation speed, maintenance convenience, and design flexibility make it a preferred choice in contemporary construction and interior design applications.

The growing attention on green construction practices and environmentally friendly materials is driving demand for modular flooring products made from recycled and eco-friendly materials. Consumer preference for customizable flooring solutions that can be easily reconfigured or replaced is creating opportunities for innovative modular systems. The rising influence of green building certifications and energy efficiency standards is also contributing to increased adoption of high-performance modular flooring solutions across different construction segments.

The market is segmented by product type, end use, and region. By product type, the market is divided into carpet tile, rigid LVT, flexible LVT, rubber flooring, and others. Based on end use, the market is categorized into non-residential and residential applications. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The carpet tile product type is projected to account for 43.8% of the modular flooring market in 2025, reaffirming its position as the leading segment in the modular flooring category. Consumers and businesses increasingly prefer carpet tiles for their ease of installation, maintenance benefits, and design versatility in commercial and office environments. Carpet tiles' well-documented advantages in terms of acoustic performance, comfort, and aesthetic appeal directly address modern workspace requirements.

This product type forms the foundation of most commercial flooring projects, as it represents the most versatile and practical solution for office spaces, hospitality venues, and educational facilities. Industry endorsements and ongoing performance validation continue to strengthen confidence in carpet tile installations. With business environments requiring more flexible and adaptable flooring solutions, carpet tiles align with both functional and aesthetic requirements, ensuring sustained market dominance and making them the central growth driver of modular flooring demand.

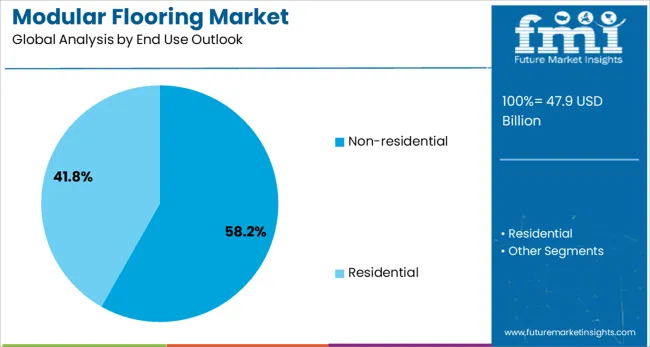

Non-residential applications are projected to represent 58.2% of modular flooring demand in 2025, underscoring their role as the primary market segment for modular flooring installations. Commercial spaces, office buildings, healthcare facilities, and educational institutions gravitate toward modular flooring for its durability, maintenance efficiency, and ability to withstand high traffic volumes while maintaining aesthetic appeal.

The segment is supported by the rising trend of flexible workspace design, where modular flooring plays a central role in creating adaptable environments. The architects and designers are increasingly specifying modular flooring systems that combine functionality with design flexibility, enabling easy reconfiguration of spaces and justifying investment in high-quality flooring solutions. As facility managers prioritize maintenance efficiency and lifecycle performance, modular flooring systems will continue to dominate commercial applications, reinforcing their premium positioning within the construction market.

The modular flooring market is advancing steadily due to increasing demand for flexible flooring solutions and growing adoption of green construction practices. The market faces challenges including raw material price volatility, competition from traditional flooring methods, and varying regional building standards. Innovation in manufacturing technologies and eco-friendly material sourcing continue to influence product development and market expansion patterns.

The growing adoption of green building certifications is enabling manufacturers to develop environmentally friendly modular flooring solutions that meet sustainability requirements. Green building standards offer credibility, detailed environmental impact assessments, and lifecycle performance metrics that influence purchasing decisions. The construction practices and corporate responsibility initiatives are driving adoption of eco-friendly modular flooring systems, particularly among commercial developers who prioritize environmental performance.

Modern modular flooring manufacturers are incorporating advanced production technologies such as digital printing, precision cutting, and automated installation systems to enhance product quality and installation efficiency. These technologies improve the durability and aesthetic appeal of modular flooring while reducing installation time and labor costs. Advanced manufacturing techniques also enable customization options that deliver multiple design possibilities and performance characteristics in single product lines.

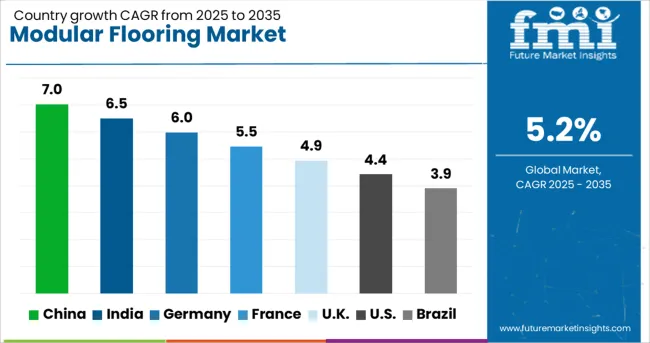

The modular flooring market is set to grow at a global CAGR of 5.2% between 2025 and 2035, driven by rising demand in residential, commercial, and industrial construction, along with increasing adoption of easy-to-install flooring solutions. China leads at 7.0%, approximately 1.35× the global rate, supported by BRICS-driven construction growth, urban infrastructure projects, and export-oriented manufacturing. India follows at 6.5%, 1.25× the global benchmark, reflecting expanding residential and commercial projects and increasing consumer preference for modular solutions. Germany records 6.0%, 1.15× the global CAGR, shaped by OECD-focused innovation, green material adoption, and quality standards. France posts 5.5%, slightly above the global rate, fueled by commercial retrofitting and renovation projects. The United Kingdom stands at 4.9%, just below the global benchmark, driven by selective commercial and residential use. The United States grows at 4.4%, 0.85× the global rate, with adoption concentrated in mid-to-high-end residential projects. Brazil records 3.9%, 0.75× the global CAGR, reflecting emerging infrastructure development and gradual market penetration.

This report includes insights on 40+ countries; the top markets are shown here for reference.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

China is expanding at a CAGR of 7.0%, surpassing the global average due to robust industrialization, urban infrastructure development, and high-rise commercial construction. Modular flooring adoption is high in offices, logistics centers, and manufacturing plants. Manufacturers, including Tarkett China and Shanghai Huashi, focus on anti-slip, wear-resistant, and fire-retardant surfaces suitable for heavy-traffic zones. Investment in automation and smart surface coatings is improving quality and production efficiency. LEO and MEO satellite-linked supply chain monitoring are supporting efficient distribution of modular flooring materials. Growing focus on design diversity, durability, and custom solutions is accelerating industrial and commercial adoption.

India is growing at a CAGR of 6.5%, fueled by industrial park expansion, institutional construction, and commercial facility development. Modular flooring is preferred for hospitals, schools, warehouses, and factories due to easy maintenance, durability, and cost-effectiveness. Domestic manufacturers are introducing scratch-resistant, anti-static, and chemical-resistant surfaces to cater to industrial applications. Partnerships with construction and real estate firms are facilitating efficient installations. Government-backed infrastructure projects, smart city initiatives, and industrial modernization are supporting steady market growth. Adoption in logistics, warehousing, and industrial plants highlights strong growth potential, with increasing use in large-scale construction projects.

Germany is expected to grow at a CAGR of 6 %, supported by demand in industrial, commercial, and residential spaces. Manufacturers prioritize fire-resistant, anti-static, and acoustic-enhanced modular flooring solutions. Adoption is increasing in logistics facilities, office buildings, and industrial plants. Collaboration between manufacturers and design firms is fostering customized solutions and optimized installation processes. Advanced production methods, including automation, digital quality control, and precision engineering, are improving durability and consistency. Industrial operators rely on modular flooring to reduce operational downtime, enhance workplace safety, and support efficient maintenance. Expansion of retrofitting and modernization projects is increasing demand for high-quality modular flooring solutions across Germany.

France is growing at a CAGR of 5.5%, driven by commercial, industrial, and public infrastructure applications. Modular flooring adoption is increasing in hospitals, educational institutions, and retail spaces due to durability and installation efficiency. Manufacturers focus on scratch-resistant and chemical-resistant surfaces to improve longevity and safety. Government investment in public infrastructure, industrial modernization, and renovation of older buildings is enhancing market demand. Integration of modular flooring in eco-friendly projects and high-performance commercial buildings supports long-term growth. Production capacity expansion and adoption of advanced surface technologies further improve quality and efficiency.

The UK is expanding at a CAGR of 4.9%, driven by demand in commercial, educational, and healthcare sectors. Modular flooring is favored for rapid installation, ease of maintenance, and customizable designs. Manufacturers focus slip-resistant and anti-static surfaces for high-traffic environments. The adoption is increasing in offices, hospitals, schools, and industrial facilities. Natural material sourcing and advanced installation methods are enhancing quality and reliability. Regional distribution network expansion and collaborations with construction and design firms support efficient deployment. Modular flooring is increasingly applied in both modern construction and renovation projects to reduce installation downtime and improve safety.

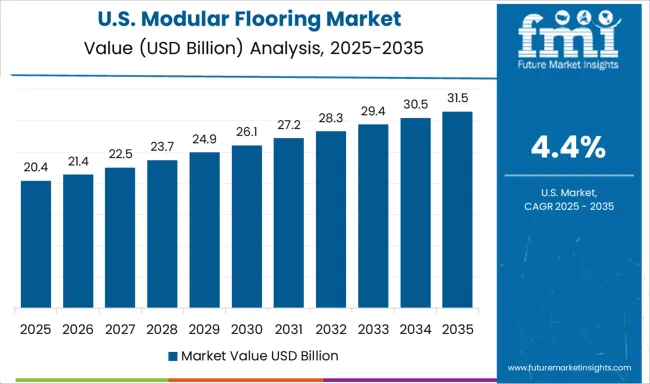

The US is growing at a CAGR of 4.4%, supported by industrial, commercial, and healthcare adoption. Modular flooring is preferred for operational efficiency, low maintenance, and long-term durability. Manufacturers are introducing chemical-resistant, scratch-resistant, and acoustic-enhanced products to cater to high-traffic facilities. Investment in production automation, R&D, and advanced surface technologies supports quality improvements. Adoption in offices, hospitals, factories, and warehouses drives steady growth. Analytics-enabled installation techniques enhance operational efficiency and predictive maintenance, increasing market attractiveness.

Brazil is growing at a CAGR of 3.9%, driven by adoption in commercial, educational, and industrial facilities. Modular flooring is valued for cost-effectiveness, ease of installation, and durability. Manufacturers focus on industrial-grade and affordable products for warehouses, factories, and offices. Government infrastructure programs and industrial modernization initiatives support market expansion. Adoption in logistics, energy, and commercial construction sectors is increasing. Integration of modular flooring in industrial retrofits and high-traffic areas enhances operational efficiency and safety. Market growth is also supported by emerging private-sector construction projects and large-scale public initiatives.

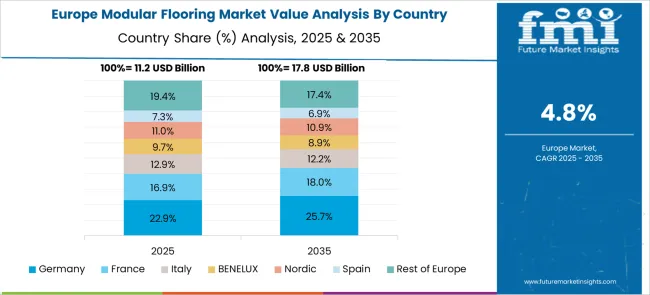

The modular flooring market in Europe demonstrates mature development across major economies with Germany showing strong presence through its advanced construction industry and consumer appreciation for high-quality flooring solutions, supported by manufacturers leveraging engineering excellence to develop effective modular systems that meet stringent building standards and performance requirements. France represents a significant market driven by its sophisticated design culture and architectural innovation, with companies pioneering premium modular flooring solutions that combine French design aesthetics with advanced installation technologies for enhanced performance and visual appeal.

The UK exhibits considerable growth through its embrace of flexible workspace design and modern construction methods, with manufacturers leading the development of efficient modular flooring systems and comprehensive installation services. The country's focus on office modernization and commercial space optimization drives demand for versatile flooring solutions. Germany shows expanding adoption of high-performance modular systems, particularly in premium commercial and institutional applications targeting durability and maintenance efficiency. BENELUX countries contribute through their focus on eco construction and innovative building methods, while Eastern Europe and Nordic regions display growing potential driven by increasing construction activity and expanding access to modern flooring technologies across diverse commercial and residential projects.

Mohawk Industries, Inc., USA-based, provides a broad portfolio of modular flooring solutions with a focus on commercial and residential applications, combining durable materials and customizable designs. Shaw Industries Group, Inc., also headquartered in the USA, delivers innovative flooring products with advanced wear-resistance technologies and diverse installation options for high-traffic environments. Interface, Inc., globally recognized, specializes in ecological modular flooring systems, integrating advanced materials, design flexibility, and industrial-grade performance for corporate and public spaces. Tarkett S.A., operating as Tarkett Group, France, offers comprehensive flooring solutions with modular designs suitable for healthcare, education, and office infrastructure, prioritizing longevity and design adaptability.

AHF Products, USA, provides modular flooring solutions with easy installation systems and durable surface coatings tailored to industrial and commercial applications. Forbo Flooring Systems, headquartered in Switzerland, delivers resilient modular flooring with slip-resistant properties and design versatility for high-traffic areas. Milliken & Company, USA, combines material science and innovative design to provide modular flooring that supports acoustic performance, wear resistance, and aesthetic customization for commercial environments. Gerflor Group, France, offers modular vinyl flooring solutions suitable for healthcare, sports, and commercial spaces, focusing on durability, hygiene, and ease of maintenance.

Beaulieu International Group (B.I.G.), Belgium, provides comprehensive modular flooring products with environmental compliance and design flexibility for various sectors, including hospitality and corporate facilities. LX Hausys, South Korea, delivers high-performance modular flooring with robust wear resistance, easy maintenance, and aesthetic options for both commercial and residential applications. Collectively, these companies shape the modular flooring landscape, offering innovative designs, durable materials, and versatile installation solutions to meet the demands of modern interiors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 47.9 billion |

| Product Type | Carpet tile, Rigid LVT, Flexible LVT, Rubber flooring, Others |

| End Use | Non-residential, Residential |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Mohawk Industries Inc, Shaw Industries Group Inc, Interface Inc, Tarkett SA (Tarkett Group), AHF Products, Forbo Flooring Systems, Milliken & Company, Gerflor Group, Beaulieu International Group (BIG), LX Hausys |

| Additional Attributes | Dollar sales by product type and installation method, regional demand trends, competitive landscape, buyer preferences for commercial versus residential applications, integration with green building practices, innovations in installation technologies, design customization capabilities, and lifecycle performance optimization |

The global modular flooring market is estimated to be valued at USD 47.9 billion in 2025.

The market size for the modular flooring market is projected to reach USD 79.6 billion by 2035.

The modular flooring market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in modular flooring market are carpet tile, rigid lvt, flexible lvt, rubber flooring and others.

In terms of end use outlook, non-residential segment to command 58.2% share in the modular flooring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular Fiber Optical Spectrometers Market Size and Share Forecast Outlook 2025 to 2035

Modular Process Skid Packages Market Forecast and Outlook 2025 to 2035

Modular Robotic Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Modular Substation Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Fitness Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Data Center Market Analysis - Size, Share, and Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Modular Energy Control System Market Growth – Trends & Forecast 2025 to 2035

Modular Construction Market Growth – Trends & Forecast 2025 to 2035

Modular Instruments Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA