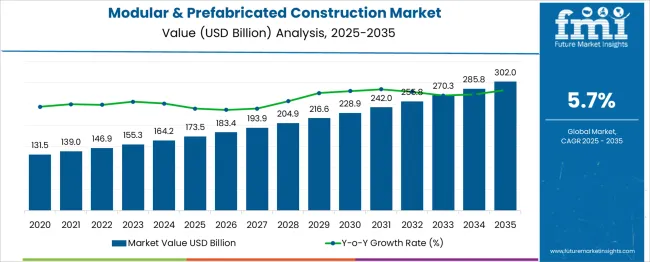

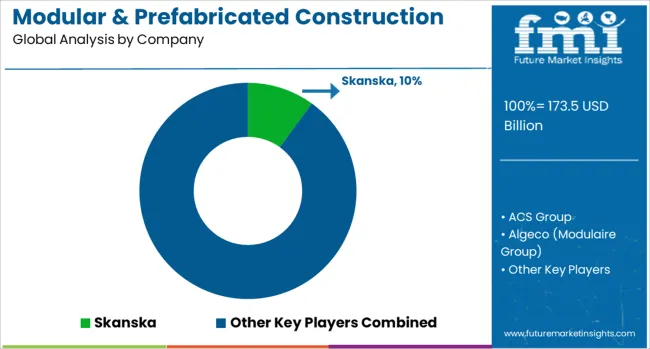

The Modular & Prefabricated Construction Market is estimated to be valued at USD 173.5 billion in 2025 and is projected to reach USD 302.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. From 2025 to 2030, the market is expected to expand from USD 173.5 billion to USD 228.9 billion, showing steady progress supported by large-scale adoption in residential, commercial, and industrial projects.

Year-on-year data reveals a gradual rise, reaching USD 183.4 billion in 2026 and USD 193.9 billion in 2027, driven by cost efficiencies, reduced project timelines, and improved quality control in off-site construction methods. By 2028, the market is forecasted at USD 204.9 billion, increasing further to USD 216.6 billion in 2029 and USD 228.9 billion in 2030.

Growth will likely be reinforced by rising demand for sustainable building materials and integration of digital tools like BIM (Building Information Modeling) in modular design. Expanding applications in healthcare and education infrastructure, combined with government incentives for affordable housing, are expected to drive further momentum. This trajectory positions modular and prefabricated construction as a transformative solution for reducing construction waste, accelerating delivery schedules, and enhancing scalability in global infrastructure development.

| Metric | Value |

|---|---|

| Modular & Prefabricated Construction Market Estimated Value in (2025 E) | USD 173.5 billion |

| Modular & Prefabricated Construction Market Forecast Value in (2035 F) | USD 302.0 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The modular and prefabricated construction market represents a growing segment within the global construction landscape. In the construction industry market, its share stands at approximately 6–8%, as traditional methods still dominate despite rising interest in offsite techniques. Within the building materials market, it accounts for about 4–5%, primarily because prefabrication relies on standardized components compared to conventional material usage.

The offsite construction market sees the highest share, close to 60–65%, since modular solutions form the core of this category. In the residential and commercial real estate development market, its contribution is nearly 5–6%, reflecting gradual adoption for housing, offices, and hospitality projects. For the infrastructure development and civil engineering market, the share remains smaller at 2–3%, as large-scale infrastructure projects still rely on traditional site-built techniques.

This sector is gaining momentum due to its ability to reduce project timelines, minimize labor costs, and ensure consistent quality through controlled factory environments. Rising demand for affordable housing, urban infill solutions, and rapid deployment in disaster-prone regions further supports this trend. With increasing investments in smart building technologies and green-certified structures, modular and prefabricated construction is poised to capture a greater share across these markets, redefining efficiency standards in the construction industry.

The modular and prefabricated construction market is undergoing significant growth, fueled by increasing demand for faster project delivery, cost efficiency, and reduced environmental impact. Rising urbanization and pressure on housing and infrastructure have encouraged adoption of offsite construction methods that minimize waste and optimize resources.

Innovations in design flexibility, improved structural integrity, and enhanced quality control in factory settings are further driving preference for modular solutions. Regulatory support for green building practices and sustainability targets are also encouraging developers to adopt prefabricated methods.

The future outlook appears strong as advancements in automation, digital twin technologies, and sustainable materials continue to reshape construction practices, creating new opportunities for scalability and efficiency across residential and commercial projects.

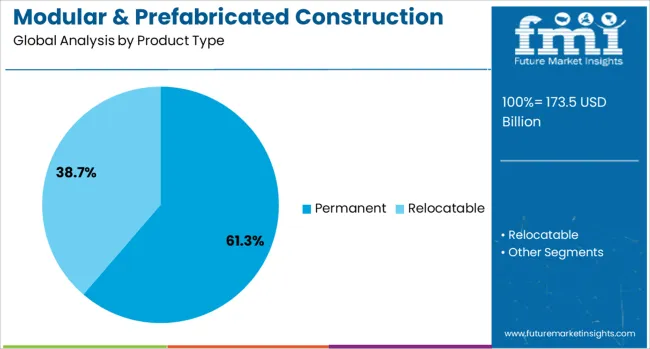

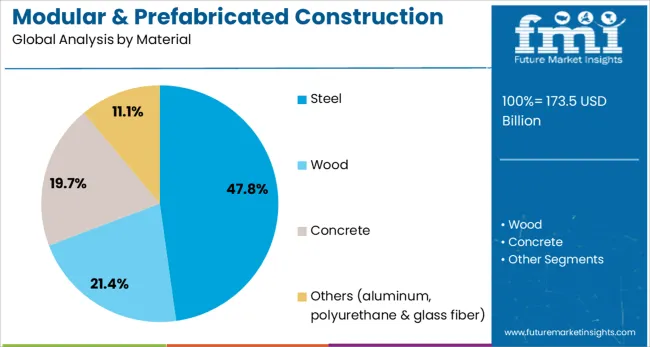

The modular & prefabricated construction market is segmented by product type, material, application, and geographic regions. The modular & prefabricated construction market is divided by product type into Permanent and Relocatable. The modular & prefabricated construction market is classified into Steel, Wood, Concrete, and Others (aluminum, polyurethane & glass fiber).

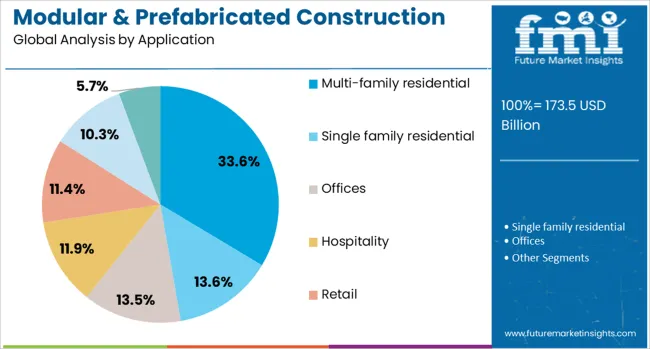

Based on the application of the modular & prefabricated construction market, it is segmented into Multi-family residential, Single-family residential, Offices, Hospitality, Retail, Healthcare, and Others (educational buildings, data centers, etc.). Regionally, the modular & prefabricated construction industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, the permanent segment is anticipated to hold 61.3% of the total market revenue in 2025, establishing itself as the dominant segment. This position has been strengthened by growing acceptance of permanent modular structures as viable alternatives to traditional buildings, offering comparable durability and compliance with building codes.

Increased confidence among developers and regulators in the structural and aesthetic quality of permanent solutions has contributed to wider adoption in both residential and institutional projects. Cost savings achieved through repeatable designs, reduced construction timelines, and minimized on-site disruptions have further solidified the preference for permanent installations.

Additionally, the ability to deliver high-performance buildings that meet energy efficiency standards has reinforced the attractiveness of this segment in long-term projects.

Segmented by material, steel is projected to capture 47.8% of the market revenue in 2025, maintaining its leadership among material choices. This prominence is supported by steel’s superior strength-to-weight ratio, durability, and recyclability, making it particularly suitable for modular applications where precision and resilience are critical.

Its ability to support larger spans and withstand environmental stress while remaining lightweight has made it the preferred choice for both high-rise and complex modular designs. Moreover, advances in steel fabrication and finishing have enhanced design flexibility and reduced production costs, further driving its adoption.

The material’s compatibility with modern manufacturing techniques and sustainability credentials has ensured its sustained relevance in the prefabricated construction market.

When segmented by application, the multi-family residential segment is forecast to account for 33.6% of the market revenue in 2025, positioning it as the leading application segment. This leadership is underpinned by rising demand for affordable and efficient housing in urban areas where land scarcity and population density challenge traditional construction methods.

Developers have increasingly favored modular approaches to deliver high-quality, cost-effective, and scalable housing solutions within compressed timelines. The ability to achieve economies of scale, reduce construction-related disruptions in populated neighborhoods, and meet regulatory requirements for sustainable housing has further elevated the multi-family residential segment.

Growing investor interest in rental and shared housing developments has also contributed to the robust performance of this application area.

The modular and prefabricated construction market is expanding as industries adopt off-site building techniques to reduce timelines and improve cost control. In 2024, large-scale residential and commercial projects embraced modular solutions to address labor shortages and accelerate delivery.

By 2025, demand extended to healthcare, education, and infrastructure sectors, favoring prefabricated units that ensure quality consistency and design flexibility. Manufacturers offering integrated building systems with structural integrity and rapid assembly capabilities are well positioned to lead in this evolving sector.

Growing emphasis on speed and cost predictability in construction has propelled the demand for modular solutions. In 2024, real estate developers integrated prefabricated modules into mid-rise housing and office projects to reduce delays linked to labor shortages. In 2025, government-backed housing programs prioritized modular structures to meet delivery targets for affordable homes and public facilities. These shifts confirm that reduced project timelines—not just material savings—are influencing adoption. Providers delivering pre-engineered modules with structural reliability, precise fitment, and compliance with building codes are expected to secure significant market share.

The evolution of hybrid modular construction systems combining steel, concrete, and composite materials is opening new possibilities for high-rise and mixed-use developments. In 2024, developers began piloting multi-story modular designs incorporating prefabricated mechanical, electrical, and plumbing systems for faster installation. By 2025, these systems gained traction in urban commercial complexes, reducing on-site labor requirements and safety risks. This trend indicates that modular design is transitioning from low-rise housing to more complex vertical structures. Companies offering modular solutions tailored for high-density projects with integrated utilities and sustainable material options are likely to capture long-term growth opportunities.

In 2024 and 2025, modular and prefabricated construction faced major hurdles linked to transportation and assembly logistics. Prefabricated modules require specialized handling and oversized transport vehicles, resulting in higher operational costs. Regional examples showed that delays in obtaining road permits for large modules caused project timelines to extend in the United States and parts of Europe. Moreover, inadequate site access in dense urban zones added extra equipment and labor requirements, eroding the cost advantage associated with prefabrication. These logistical limitations reduced efficiency and created reluctance among contractors who prioritize predictable delivery schedules. Without streamlined transport solutions, expansion faces significant barriers.

The sector in 2024 and 2025 observed a sharp increase in hybrid methodologies, combining modular elements with traditional on-site construction. This approach enabled improved design flexibility while maintaining speed advantages. Developers in Asia-Pacific launched residential and mixed-use projects using partial prefabrication for structural components while incorporating on-site customization. This trend gained traction because it mitigated aesthetic limitations historically associated with prefabricated models. Hybrid execution methods offered greater adaptability for projects requiring architectural uniqueness, leading to stronger acceptance among premium property builders. Market evidence suggested that hybrid strategies positioned prefabricated solutions as a practical option beyond budget housing applications.

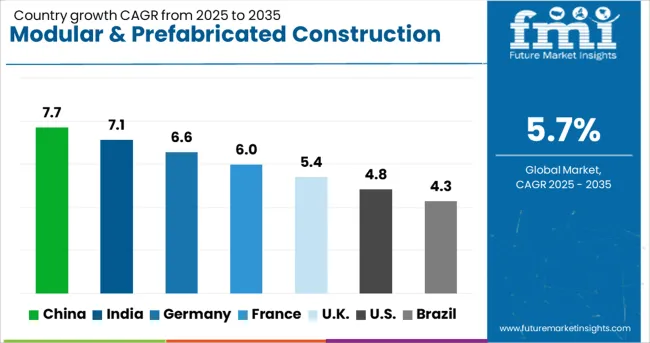

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The global modular and prefabricated construction market is projected to grow at a CAGR of 5.7% from 2025 to 2035. China leads with 7.7%, followed by India at 7.1% and Germany at 6.6%. France records 6.0%, while the United Kingdom posts 5.4%. Growth is driven by rising urban housing demand, need for cost-efficient building solutions, and increased adoption of offsite construction methods. China and India dominate due to government-backed affordable housing initiatives, while Germany focuses on sustainability-driven modular solutions. France and the UK prioritize energy-efficient, compact designs to meet modern housing and green building requirements.

China is forecast to grow at 7.7%, supported by large-scale urbanization projects and government mandates promoting prefabrication. Steel and concrete-based modular units dominate residential and commercial developments. Manufacturers integrate smart building components to enhance construction speed and quality. Expansion in e-commerce warehousing projects further accelerates modular construction adoption.

India is expected to grow at 7.1%, driven by infrastructure expansion and government schemes such as Pradhan Mantri Awas Yojana. Affordable modular units dominate urban housing projects. Manufacturers invest in cost-efficient designs and integrate sustainable materials to meet environmental norms. Rapid growth in the hospitality and healthcare sectors strengthens the adoption of prefabricated solutions.

Germany is projected to grow at 6.6%, driven by energy efficiency mandates and strong demand for green buildings. Cross-laminated timber (CLT) modular systems dominate sustainable construction. Manufacturers invest in automation technologies for off-site fabrication to enhance productivity. Adoption of Building Information Modeling (BIM) accelerates design precision and project efficiency.

France is forecast to grow at 6.0%, supported by modernization of residential infrastructure and eco-friendly housing programs. Lightweight modular units dominate adoption in urban areas with space constraints. Manufacturers develop hybrid modular systems combining steel and timber for strength and sustainability. Government incentives for energy-efficient buildings accelerate market penetration.

The UK is projected to grow at 5.4%, driven by affordable housing needs and initiatives to reduce construction timelines. Plug-and-play modular solutions dominate urban redevelopment projects. Manufacturers leverage 3D printing and advanced composites to enhance durability. Increased use of modular classrooms and healthcare units further expands the application scope.

The modular and prefabricated construction market is moderately consolidated, with Skanska recognized as a leading player for its advanced project delivery models, strong sustainability initiatives, and large-scale modular housing and commercial infrastructure projects. The company’s expertise in off-site fabrication and integration with digital technologies such as BIM enhances its market position.

Key players include ACS Group, Algeco (Modulaire Group), Berkeley Modular Limited, Bouygues Construction, DUBOX, Guerdon LLC, Hickory Group, Kiewit Corporation, Kleusberg GmbH, Laing O’Rourke, Larsen & Toubro Limited, Lendlease Corporation, Red Sea International, Riko Group, Satellite Shelters, Sekisui House Ltd., Taisei Corporation, and VINCI Construction — each offering modular building solutions for residential, commercial, healthcare, and industrial sectors.

These firms focus on speed, cost efficiency, and quality control through off-site manufacturing processes combined with on-site assembly. Market growth is fueled by rising demand for faster construction timelines, labor shortage challenges, and the push for standardized yet customizable building designs. Companies are investing in automation, robotics, and digital design tools to enhance precision and reduce waste.

Hybrid construction models combining traditional and modular elements are gaining traction for large infrastructure projects. Growing urban redevelopment and disaster-relief housing initiatives are also creating opportunities for prefabricated solutions across both developed and emerging markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 173.5 Billion |

| Product Type | Permanent and Relocatable |

| Material | Steel, Wood, Concrete, and Others (aluminum, polyurethane & glass fiber) |

| Application | Multi-family residential, Single family residential, Offices, Hospitality, Retail, Healthcare, and Others (educational buildings, data centers, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Skanska, ACS Group, Algeco (Modulaire Group), Berkeley Modular Limited, Bouygues Construction, DUB0X, Guerdon, LLC, Hickory Group, Kiewit Corporation, Kleusberg GmbH, Laing O’Rourke, Larsen & Toubro Limited, Lendlease Corporation, Red Sea International, Riko Group, Satellite Shelters, Sekisui House, Ltd., Taisei Corporation, and VINCI Construction |

| Additional Attributes | Dollar sales growth by building type and delivery model, regional demand trends, competitive landscape, customer preferences for green & rapid construction, integration with digital/BIM platforms, innovations in AI-driven modular manufacturing and sustainable materials. |

The global modular & prefabricated construction market is estimated to be valued at USD 173.5 billion in 2025.

The market size for the modular & prefabricated construction market is projected to reach USD 302.0 billion by 2035.

The modular & prefabricated construction market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in modular & prefabricated construction market are permanent and relocatable.

In terms of material, steel segment to command 47.8% share in the modular & prefabricated construction market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular Rolling Mill Market Size and Share Forecast Outlook 2025 to 2035

Modular Fiber Optical Spectrometers Market Size and Share Forecast Outlook 2025 to 2035

Modular Process Skid Packages Market Forecast and Outlook 2025 to 2035

Modular Robotic Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Modular Substation Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Fitness Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Data Center Market Analysis - Size, Share, and Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Modular Energy Control System Market Growth – Trends & Forecast 2025 to 2035

Modular Instruments Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA