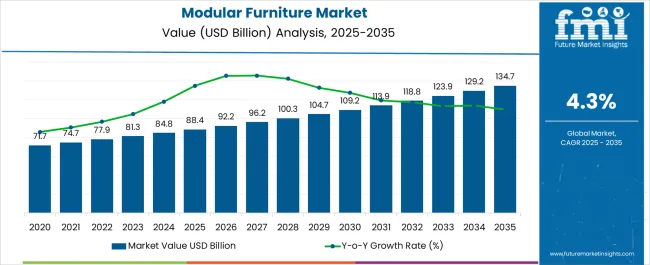

The modular furniture market is estimated to be valued at USD 88.4 billion in 2025 and is projected to reach USD 134.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. The modular furniture market is projected to generate an absolute gain of USD 46.3 billion and a growth multiplier of 1.52x over the decade. Supported by a CAGR of 4.3%, this growth is driven by increasing consumer demand for customizable, space-efficient furniture in both residential and commercial spaces.

During the first five years (2025–2030), the market will expand from USD 88.4 billion to USD 109.2 billion, adding USD 20.8 billion, which accounts for 44.9% of the total incremental growth, with a 5-year multiplier of 1.24x. The second phase (2030–2035) contributes USD 25.5 billion, representing 55.1% of the total growth, driven by strong demand in urban areas, office spaces, and co-working environments. Annual increments rise from USD 3.4 billion in early years to USD 5.3 billion by 2035, reflecting accelerated growth fueled by innovation in furniture designs, sustainable materials, and evolving consumer preferences. Manufacturers focusing on modularity, functionality, and eco-friendly materials will capture the largest share of this USD 46.3 billion opportunity.

| Metric | Value |

|---|---|

| Modular Furniture Market Estimated Value in (2025 E) | USD 88.4 billion |

| Modular Furniture Market Forecast Value in (2035 F) | USD 134.7 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The shift in consumer preferences toward flexible living solutions has influenced manufacturers to focus on modular formats that can be adapted to varied spaces without structural alteration. Increasing urbanization, rising disposable incomes, and a growing middle-class population have contributed to the steady consumption of modular furniture in both developed and developing economies.

The trend of compact homes and co-living spaces has further elevated the need for furniture that can be rearranged, scaled, or upgraded based on user needs. Enhanced logistics networks and the growth of e-commerce platforms have also played a crucial role in improving product accessibility.

The future outlook remains strong, supported by sustainable manufacturing practices, product innovation, and design flexibility that appeals to a broad range of consumer segments. As consumers continue to prioritize personalization, modular furniture is positioned as a key segment in the broader home and office furnishing landscape.

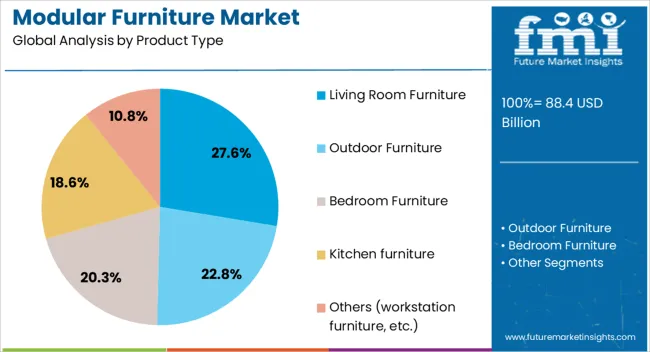

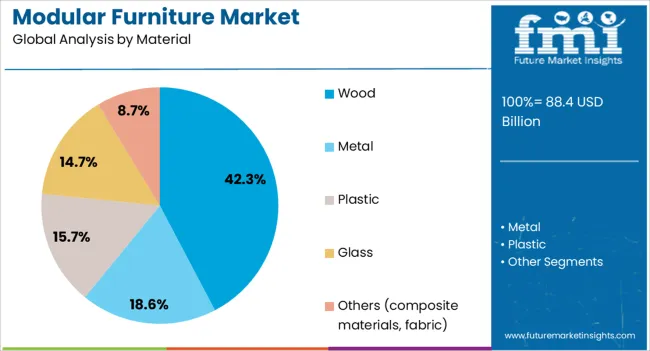

The modular furniture market is segmented by product type, material, price range, application, distribution channel, and geographic regions. By product type, the modular furniture market is divided into Living Room Furniture, Outdoor Furniture, Bedroom Furniture, Kitchen Furniture, and Others (workstation furniture, etc.). In terms of material, the modular furniture market is classified into Wood, Metal, Plastic, Glass, and Others (composite materials, fabric).

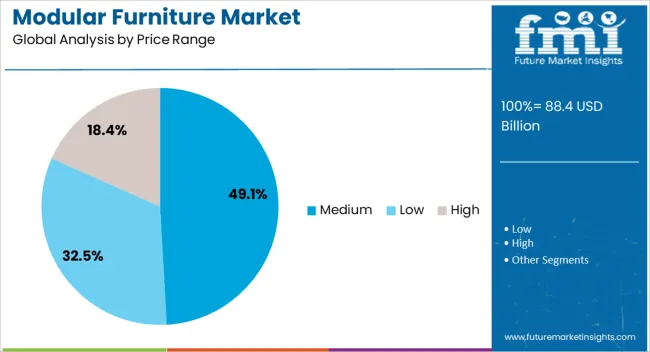

Based on price range, the modular furniture market is segmented into Medium, Low, and High. By application, the modular furniture market is segmented into Residential, Commercial, and Industrial. By distribution channel, the modular furniture market is segmented into Offline and Online. Regionally, the modular furniture industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The living room furniture segment is anticipated to hold 27.6% of the Modular Furniture market revenue share in 2025, emerging as the leading product type. This growth is being driven by consumer demand for adaptive and aesthetically pleasing furniture solutions in shared residential spaces.

The living room serves as the central area for entertainment and family gatherings, leading to higher investment in modular sofas, entertainment units, and shelving systems. Increased focus on interior design, influenced by digital platforms and home décor trends, has encouraged buyers to opt for configurable furniture that offers both style and utility.

Manufacturers are introducing systems that allow easy reconfiguration, expansion, or reduction based on available space, which supports their long-term usability. As residential designs increasingly emphasize openness and minimalism, modular living room furniture continues to gain preference due to its ability to blend functionality with visual appeal.

The wood material segment is expected to account for 42.3% of the total Modular Furniture market revenue in 2025, positioning it as the dominant material choice. This preference is being attributed to the visual warmth, structural integrity, and design versatility offered by wood in modular furniture construction.

Consumers value wood for its premium finish, durability, and compatibility with various interior aesthetics ranging from modern to traditional. In addition, the use of engineered wood, plywood, and eco-certified timber has gained traction as manufacturers align with sustainability goals while maintaining cost efficiency.

The segment has further benefited from advancements in surface treatments and joinery methods, enabling high-precision modular fittings. As demand for durable, long-lasting, and environmentally conscious products grows, wood continues to be favored across both residential and commercial modular furniture applications.

The medium price range segment is projected to hold 49.1% of the Modular Furniture market revenue share in 2025, marking it as the most significant contributor by pricing tier. This leadership is being driven by strong demand from urban middle-income consumers seeking a balance between quality, design, and affordability.

The segment appeals to a broad demographic that prioritizes cost-effective solutions without compromising on aesthetics or durability. Manufacturers operating in this range are offering modular furniture with customizable options, decent material quality, and attractive finishes that meet everyday functionality needs.

The expansion of online retail channels has also enabled buyers in this segment to access a variety of modular configurations at competitive pricing. As consumer behavior shifts toward practical and scalable investments in home and office décor, the medium price range remains the preferred choice due to its value proposition and widespread availability.

The modular furniture market is driven by growing demand for flexible, space-saving solutions, particularly in residential and commercial spaces. Opportunities in expanding markets and emerging trends toward customization and multi-purpose designs are shaping the future. However, high initial costs and complex assembly processes remain obstacles. By 2025, overcoming these challenges with affordable, easy-to-assemble solutions will be key for continued market expansion and adoption across various sectors.

The modular furniture market is growing due to the increasing demand for flexible, space-saving furniture solutions, especially in urban living spaces. Modular furniture allows for customization and easy reconfiguration to suit various needs, making it ideal for small apartments, offices, and co-working spaces. As consumers seek multifunctional and adaptable designs, the market for modular furniture continues to expand. By 2025, this demand will increase as more people prioritize convenience and functionality in their living and working environments.

Opportunities in the modular furniture market are rising with the expansion of the residential and commercial sectors. Modular solutions are increasingly popular in modern residential design, where space optimization is key, and in commercial spaces such as offices and co-working hubs. These markets are looking for adaptable furniture systems that can easily change as their needs evolve. By 2025, this expansion will create substantial opportunities for manufacturers to cater to diverse customer requirements across various segments.

Emerging trends in the modular furniture market include the increasing demand for customization and multi-purpose designs. Consumers are looking for furniture that can be tailored to their specific needs, such as pieces that transform from seating to storage or from dining to working spaces. This trend reflects a broader desire for versatile products that maximize functionality in compact spaces. By 2025, modular furniture designs that offer customizable and multi-functional features will continue to gain traction in both residential and commercial sectors.

Despite growth, challenges related to high initial costs and complex assembly processes persist in the modular furniture market. While modular systems offer long-term value, the upfront cost can be higher than traditional furniture. Additionally, the complexity of assembling some modular designs may deter certain consumers, particularly those seeking quick, hassle-free solutions. By 2025, addressing these challenges through cost-effective designs and simplified assembly instructions will be essential for broader market adoption.

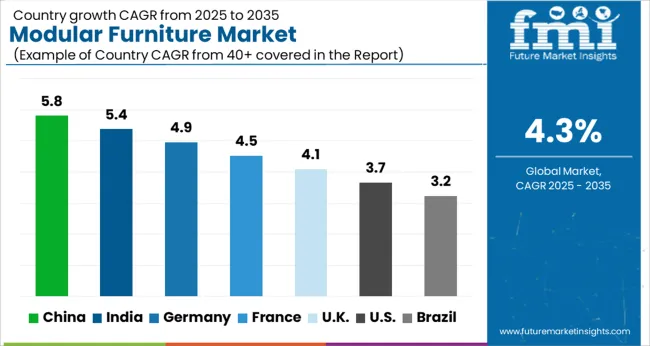

The global modular furniture market is projected to grow at a 4.3% CAGR from 2025 to 2035. China leads with a growth rate of 5.8%, followed by India at 5.4%, and France at 4.5%. The United Kingdom records a growth rate of 4.1%, while the United States shows the slowest growth at 3.7%. These varying growth rates are driven by factors such as increasing demand for space-efficient and customizable furniture solutions, rising urbanization, and growing disposable incomes. Emerging markets like China and India are experiencing higher growth due to rapid urbanization, expanding middle-class populations, and increased demand for functional and affordable furniture. In contrast, more mature markets like the USA and the UK see steady growth, driven by trends in sustainable living, home renovation, and demand for stylish, space-saving furniture. This report includes insights on 40+ countries; the top markets are shown here for reference.

The modular furniture market in China is growing rapidly, with a projected CAGR of 5.8%. China’s expanding urban population, along with the rising demand for functional and customizable furniture, is driving market growth. The country’s increasing disposable incomes, rapid urbanization, and growing middle class are contributing significantly to the demand for modular furniture solutions. Additionally, China’s focus on promoting space-efficient, affordable, and versatile furniture, coupled with the growing popularity of online furniture retail, further accelerates the market expansion.

The modular furniture market in India is projected to grow at a CAGR of 5.4%. India’s increasing urbanization, rising middle-class population, and growing demand for stylish, functional, and affordable furniture are driving market expansion. The country’s expanding real estate sector, combined with the growing interest in home renovations and interior design, is further fueling the demand for modular furniture solutions. Additionally, India’s increasing adoption of space-saving furniture and the popularity of online retail platforms contribute to the steady growth of the modular furniture market.

The modular furniture market in France is projected to grow at a CAGR of 4.5%. France’s focus on space efficiency, sustainability, and modern design in homes and offices is driving steady demand for modular furniture. The country’s growing real estate and home renovation sectors, combined with the increasing preference for flexible and customizable furniture, are contributing to market growth. Additionally, France’s strong interest in environmentally friendly products and sustainable living is further boosting the demand for modular furniture made from eco-friendly materials.

The modular furniture market in the United Kingdom is projected to grow at a CAGR of 4.1%. The UK market is driven by increasing demand for multifunctional and space-saving furniture solutions, particularly in urban areas with smaller living spaces. The growing popularity of home office setups, coupled with the rising interest in sustainable and customizable furniture, supports the steady growth of the modular furniture market. Additionally, the UK market benefits from the increasing trend of DIY home renovations and the shift towards online furniture shopping.

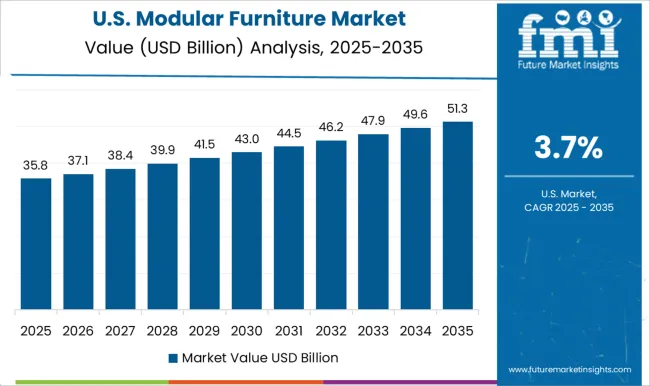

The modular furniture market in the United States is expected to grow at a CAGR of 3.7%. The USA market remains steady, driven by increasing consumer demand for versatile, functional, and aesthetically pleasing furniture. The rising popularity of space-saving and customizable furniture, combined with growing interest in eco-friendly and sustainable materials, is contributing to steady market growth. Additionally, the USA market benefits from the increasing trend of online shopping and the growing importance of home décor and interior design.

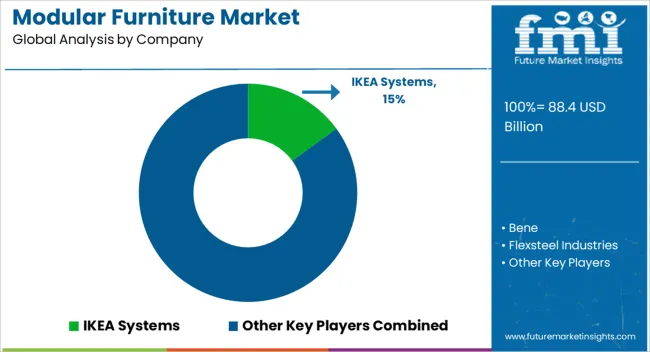

The modular furniture market is dominated by IKEA Systems, which leads with its wide range of customizable, affordable, and functional modular furniture solutions that cater to both residential and commercial needs. IKEA’s dominance is supported by its strong global presence, innovative designs, and commitment to offering versatile, space-saving solutions that allow customers to personalize their living and working spaces. Key players such as Herman Miller, Haworth, and Steelcase maintain significant market shares by offering high-quality modular office furniture systems designed to enhance collaboration, improve workspace efficiency, and promote employee well-being. These companies focus on integrating ergonomics, sustainability, and innovative design into their products to meet the growing demand for flexible work environments.

Emerging players like Bene, Kimball International, and Teknion Corporation are expanding their market presence by offering specialized modular furniture solutions for niche applications, such as corporate offices, educational institutions, and healthcare settings. Their strategies include enhancing customization options, providing sustainable materials, and incorporating smart technology for adaptable workspaces. Market growth is driven by the increasing demand for flexible office designs, the rise of remote and hybrid working models, and growing consumer preference for multifunctional furniture. Innovations in design, modularity, and eco-friendly materials are expected to continue shaping competitive dynamics and drive further growth in the global modular furniture market.

| Item | Value |

|---|---|

| Quantitative Units | USD 88.4 Billion |

| Product Type | Living Room Furniture, Outdoor Furniture, Bedroom Furniture, Kitchen furniture, and Others (workstation furniture, etc.) |

| Material | Wood, Metal, Plastic, Glass, and Others (composite materials, fabric) |

| Price Range | Medium, Low, and High |

| Application | Residential, Commercial, and Industrial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IKEA Systems, Bene, Flexsteel Industries, Haworth, Hay, Herman Miller, HNI Corporation, Kimball International, Kinnarps, Knoll, La-Z-Boy Incorporated, Steelcase, Teknion Corporation, USM U. Schärer Söhne, and Vitra International |

| Additional Attributes | Dollar sales by furniture type and application, demand dynamics across residential, commercial, and office sectors, regional trends in modular furniture adoption, innovation in space-saving designs and customization options, impact of regulatory standards on material safety and sustainability, and emerging use cases in flexible workspaces and smart home integration. |

The global modular furniture market is estimated to be valued at USD 88.4 billion in 2025.

The market size for the modular furniture market is projected to reach USD 134.7 billion by 2035.

The modular furniture market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in modular furniture market are living room furniture, outdoor furniture, bedroom furniture, kitchen furniture and others (workstation furniture, etc.).

In terms of material, wood segment to command 42.3% share in the modular furniture market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular Fitness Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Data Center Market Analysis - Size, Share, and Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Modular Energy Control System Market Growth – Trends & Forecast 2025 to 2035

Modular Construction Market Growth – Trends & Forecast 2025 to 2035

Modular Instruments Market Growth – Trends & Forecast 2025 to 2035

Modular Trailer Market Growth – Trends & Forecast 2024-2034

Modular Substation Market Analysis – Growth & Demand 2024-2034

Modular Robotics Market Growth – Trends & Forecast 2024-2034

Modular Plating Systems Market

Modular Conveyor System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA