The global Robotic Biopsy Devices Market is estimated to be valued at USD 79.02 million in 2025 and is projected to reach USD 181.9 million by 2035, registering a compound annual growth rate of 8.7% over the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 79.02 Million |

| Projected Market Size in 2035 | USD 181.9 million |

| CAGR (2025 to 2035) | 8.7% |

The Robotic Biopsy Devices Market is undergoing transformational growth, driven by rising demand for minimally invasive diagnostics and advancements in robotic precision technologies. Increased incidence of cancers and chronic conditions is pushing healthcare systems to adopt highly accurate biopsy solutions.

Companies are prioritizing compact, outpatient-friendly robotic systems to improve accessibility and procedural efficiency. Strategic partnerships and R&D investments are accelerating clinical validation and product innovation. Despite hurdles such as high costs and complex deployment in low-resource settings, the market is gaining traction across developed and emerging regions.

North America remains a leader due to early technology adoption, while Asia Pacific shows strong momentum with rising healthcare investments and disease burden. Future growth is anchored in technology refinement and broader clinical integration.

Robotic Biopsy Systems is projected to account for 55.0% of revenue in 2025, owing to its integration of real-time imaging, robotic precision, and AI-assisted navigation. This segment has been favored by hospitals and specialty centers where high procedural accuracy and reduced patient trauma are critical.

Strong clinical validation and regulatory approvals have further positioned robotic systems as indispensable in diagnostic workflows. Growth has been underpinned by a rising shift toward minimally invasive procedures and the increasing focus on oncology diagnostics, where robotic platforms significantly improve biopsy precision.

Technological convergence in robotics and imaging has also enabled scalable deployment across multiple specialties. Additionally, manufacturers have prioritized platform standardization, enabling multi-organ use with interchangeable tools. Market penetration has been supported by favorable physician feedback, workflow optimization, and improved patient outcomes. As procedural reproducibility and standardization gain importance in clinical settings, robotic biopsy systems are being increasingly adopted as a frontline diagnostic tool.

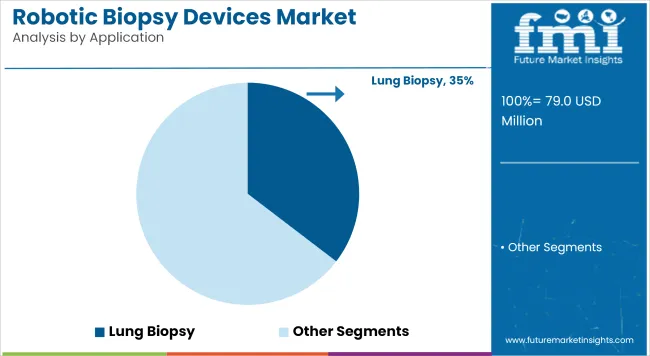

Lung biopsy is expected to contribute 35.4% of the market share in 2025, driven by the growing incidence of pulmonary malignancies and the rising demand for early detection. The segment has gained clinical preference due to the complexity of accessing peripheral lung nodules, which is addressed efficiently through robotic guidance systems.

Minimally invasive access to hard-to-reach lung regions has been facilitated by robotic-assisted bronchoscopy and CT-guided navigation technologies. Increasing awareness of low-dose CT screening programs and high false-positive rates have necessitated precise, targeted biopsies further fueling demand for robotic lung interventions.

Enhanced safety profiles and reduced complication rates have encouraged adoption in both high-volume hospitals and research-driven facilities. The segment has also benefited from growing clinical evidence supporting the accuracy of robotic systems in lung tissue sampling. With the rising burden of lung cancer, particularly in aging populations and smokers, this segment is expected to maintain a dominant position through 2030.

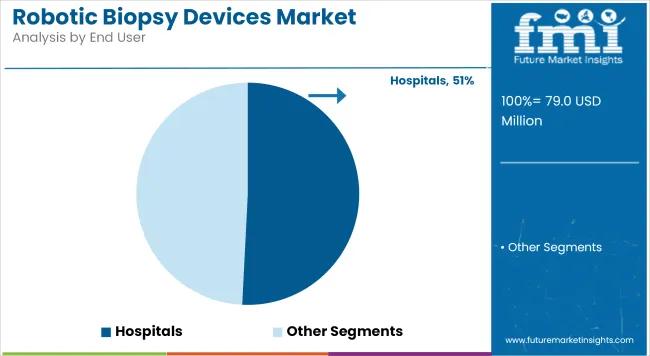

Hospitals are projected to account for 50.8% of the revenue share in 2025, as this end user segment has been the primary adopter of high-investment robotic biopsy systems. Favorable infrastructure, dedicated surgical teams, and comprehensive diagnostic capabilities have enabled hospitals to integrate these systems seamlessly into their clinical operations.

Centralized purchasing power and access to capital budgets have allowed hospitals to implement robotic solutions at scale. Demand has also been driven by the rising number of complex biopsy procedures being conducted in tertiary and quaternary care hospitals.

Clinical protocols increasingly emphasize minimally invasive approaches, and robotic systems have been positioned as essential for enhancing diagnostic yield. As hospitals continue to prioritize operational efficiency and patient outcomes, robotic biopsy devices are being embedded into standard diagnostic pathways, ensuring this segment remains the largest contributor to market.

High Capital Costs, Training Barriers, and Regulatory Complexity

High acquisition and maintenance costs are the major restraints in the robotic biopsy devices market as they do not build up business case for small and mid-sized hospitals or diagnostic centers to adopt these systems. Surgical scalability is also hampered by the requirement for highly trained radiologists and surgeons to operate robotic systems, particularly in rural or resource-constrained settings.

Precision Medicine, AI Integration, and Minimally Invasive Oncology Demand

The market is gaining robust traction due to the worldwide movement towards early cancer diagnosis, minimally-invasive surgery, and precision-guided diagnostics-contributing even in the face of challenges Through targeted biopsy methods, robotic biopsy devices increase the chances of obtaining adequate tissue samples under less trauma as well as improving the diagnostic yield-none more so than for deep-seated tumors (lung, prostate, liver, brain, etc.).

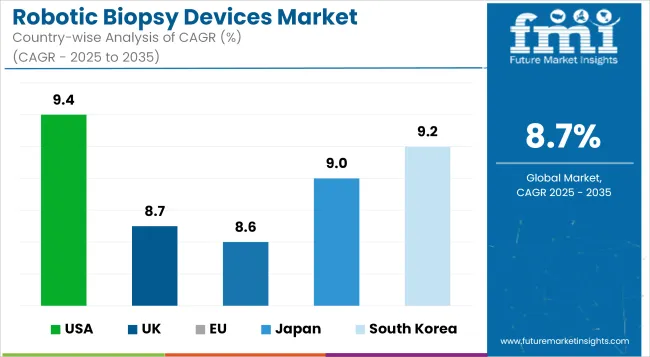

The Robotic Biopsy Devices market in the United States is escalating massively on account of early acceptance of robotic-aided surgical system, increasing cancer diagnostics and AI-guided imaging for accurate biopsy.

Savvy parts of the behemoth USA medical ecosystem have started investing in robotic biopsy systems for breast, prostate, lung and liver cancer, with the goal of making the procedures more accurate and less invasive. Advances in FDA clearances and reimbursement policies contribute to replacing manual systems with robotic systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.4% |

The UK Robotic Biopsy Devices market is on a stable growth track due to healthcare investments by NHS in robotic surgeries and diagnostic innovations. Robotic-assisted platforms are being used in laparoscopic-assisted thoracoscopic surgery or minimally invasive cancer biopsies, notably in urology and thoracic oncology in application.

There is growing collaboration between government, academic institutions, and med-tech companies, accelerating the development and clinical validation of robotic biopsy solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.7% |

The EU Robotic Biopsy Devices market is predicted to grow sharply in Germany, France, and the Netherlands where healthcare services are more advanced. The demand for precision diagnostics and personalized medicine, as well as the rise in the early detection of cancer, are also driving the adoption in oncology centers.

These factors, alongside an increase in med-tech R&D initiatives by the EU, the availability of CE-marked robotic platforms as well as AI-enabled navigation tools, are boosting the market. Hospitals are prioritizing procedures that have fewer complications and shorter recovery.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 8.6% |

The robotic biopsy devices market in Japan is on a consistent upward trajectory owing to its highly advanced robotics ecosystem and an aging population that necessitates early cancer diagnosis. Japanese hospitals are increasingly adopting robotic biopsy equipment in such specializations as gastroenterology, pulmonology, and neurosurgery to manage the diagnostic yield.

The market is benefitting from national policies favoring the adoption of minimally invasive technologies, as well as advances in miniaturized robotic arms, and integration with real-time imaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.0% |

The South Korean robotic biopsy devices market is growing rapidly owing to strong med-tech manufacturing industry, government investments in smart healthcare and the expansion of the private hospital network.

Robotic precision reduces tissue injury and enhances sample quality in areas with high demand for thoracic, hepatic, and breast cancer diagnosis. Adoption and innovation are powered by university-industry collaborations with international device companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.2% |

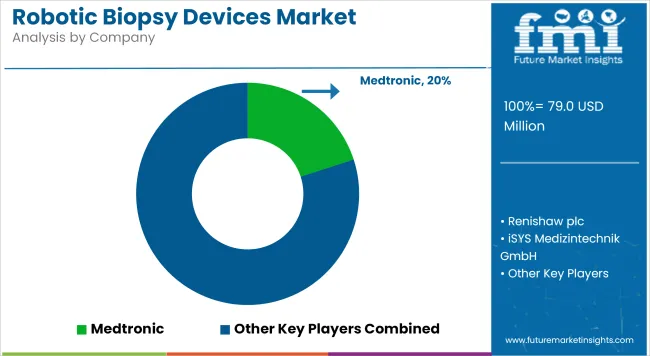

The robotic biopsy devices market is witnessing intensifying competition driven by rapid innovation and technological convergence. Companies are focusing on improving device precision, real-time imaging integration and AI-enabled targeting to enhance diagnostic outcomes. There is a strong shift toward developing compact, portable systems suitable for outpatient settings, which is expanding accessibility.

Players are also strengthening their clinical trial pipelines and pursuing regulatory approvals to diversify indications and market reach. Strategic collaborations with research institutions and licensing deals are accelerating innovation and product validation.

Additionally, competition is being influenced by surgical robotics firms entering the diagnostic biopsy space, leading to new standards in minimally invasive care. This dynamic ecosystem is fostering rapid technological advancement and adoption across healthcare settings.

Key Development

The overall market size for robotic biopsy devices market was USD 79.02 million in 2025.

The robotic biopsy devices market is expected to reach USD 181.9 million in 2035.

Rising number of cancer survivors undergoing radiation therapy, increasing research in anti-fibrotic drugs, and growing demand for effective post-radiation care solutions will drive market growth.

The top 5 countries which drives the development of robotic biopsy devices market are USA, European Union, Japan, South Korea and UK.

Software and services expected to grow to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotic Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Robotic Assisted Endovascular Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic Catheterization Systems Market Growth – Innovations, Trends & Forecast 2025-2035

Robotic Aseptic Syringe Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Robotic Vision Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

Robotic Palletizers & De-Palletizers Market Growth - Forecast 2025 to 2035

Robotic Vacuum Cleaners Market Growth - Trends & Demand from 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Robotics Prototyping Market Trends - Growth & Forecast 2025 to 2035

Robotic Process Automation Market by Component, Operation, Industry & Region Forecast till 2025 to 2035

Competitive Landscape of Robotic Vacuum Cleaner Providers

Robotic Grippers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA