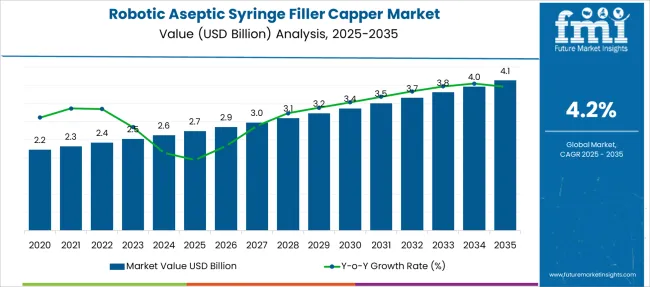

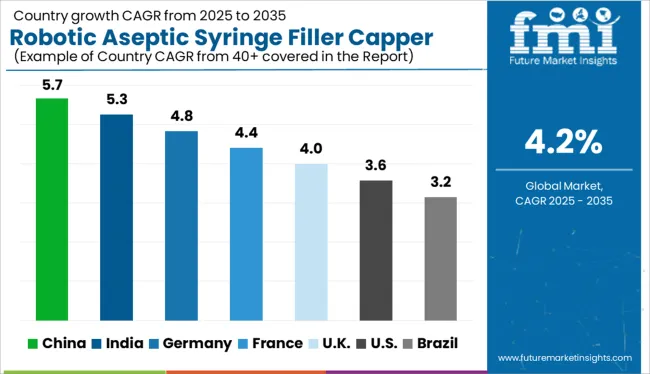

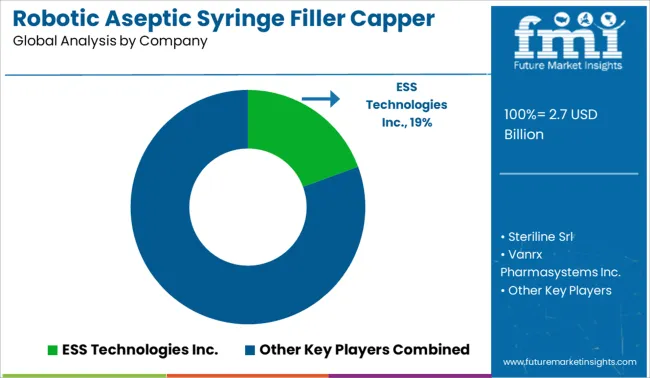

The Robotic Aseptic Syringe Filler Capper Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 4.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Robotic Aseptic Syringe Filler Capper Market Estimated Value in (2025 E) | USD 2.7 billion |

| Robotic Aseptic Syringe Filler Capper Market Forecast Value in (2035 F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The robotic aseptic syringe filler capper market is expanding as pharmaceutical manufacturers focus on improving production efficiency and sterility in injectable drug packaging. The demand for automation has increased due to stringent regulatory requirements and the need to reduce contamination risks in aseptic filling processes.

Industry advancements have enabled robotic systems to handle complex syringe filling and capping operations with high precision and consistency. The growing production of biologics and specialty drugs has further driven the adoption of these automated solutions.

Additionally, pharmaceutical companies are investing in technologies that support faster throughput and lower operational costs while maintaining compliance with global standards. Future growth is expected to be fueled by the rising volume of injectable drugs and the shift toward personalized medicine. The Pharmaceuticals Market is leading the end-user demand, Drug Manufacturing is the primary application area, and Primary Packaging is the dominant packaging type segment.

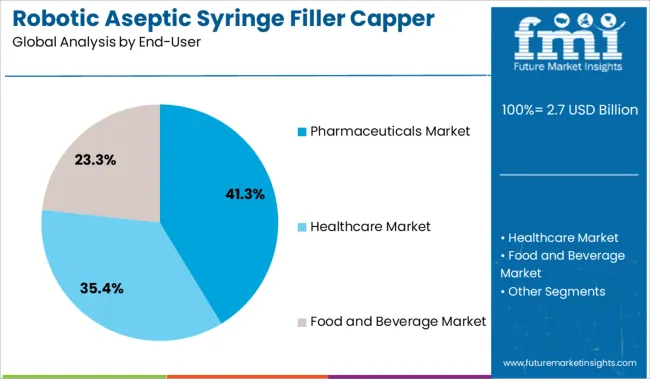

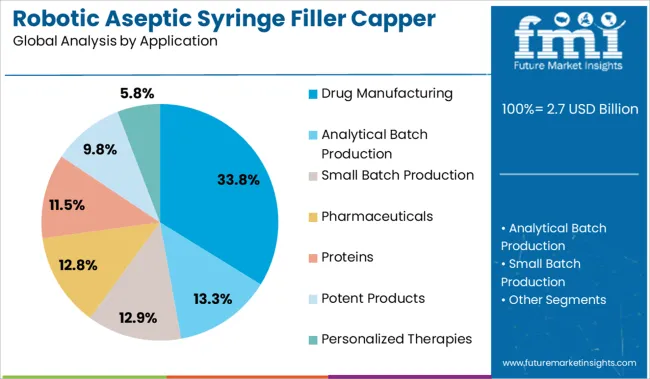

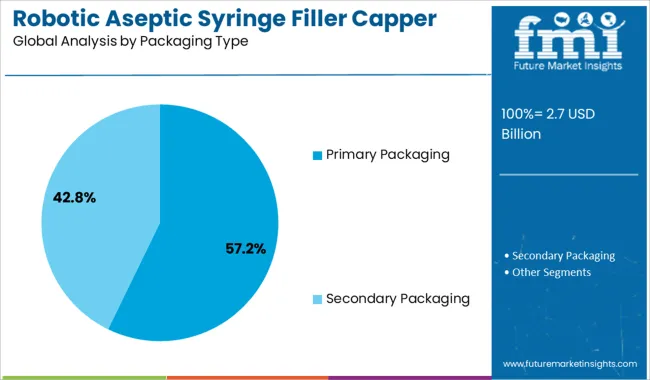

The market is segmented by End-User, Application, and Packaging Type and region. By End-User, the market is divided into Pharmaceuticals Market, Healthcare Market, and Food and Beverage Market. In terms of Application, the market is classified into Drug Manufacturing, Analytical Batch Production, Small Batch Production, Pharmaceuticals, Proteins, Potent Products, and Personalized Therapies. Based on Packaging Type, the market is segmented into Primary Packaging and Secondary Packaging. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Pharmaceuticals Market segment is projected to account for 41.3% of the robotic aseptic syringe filler capper market revenue in 2025, leading end-user adoption. Growth in this segment is driven by the pharmaceutical industry's emphasis on aseptic processing to meet quality and safety standards.

Increased demand for injectable medications, including vaccines and biologics, has made automated filling and capping essential to reduce contamination risks. Manufacturers are prioritizing automation to improve production reliability and scalability.

Regulatory agencies continue to enforce strict aseptic guidelines, prompting pharmaceutical companies to upgrade their filling lines with robotic solutions. As the pharmaceutical sector expands its injectable drug portfolio, the Pharmaceuticals Market segment is expected to maintain its leadership.

The Drug Manufacturing segment is anticipated to hold 33.8% of the market revenue in 2025, establishing itself as the key application area. This segment’s growth is supported by the increasing complexity and volume of sterile injectable drugs produced globally.

Automated syringe filling and capping systems are preferred to ensure precise dosing and maintain sterility throughout the manufacturing process. The push toward high-volume production combined with the need for regulatory compliance has accelerated the adoption of robotic aseptic technologies.

Furthermore, drug manufacturers are investing in flexible and scalable solutions to address a variety of syringe sizes and formulations. With continuous innovation in sterile drug production, the Drug Manufacturing segment is poised to drive significant demand.

The Primary Packaging segment is projected to contribute 57.2% of the market revenue in 2025, dominating the packaging type category. This segment’s growth is largely due to the critical role primary packaging plays in protecting injectable drugs and maintaining sterility.

Robotic aseptic fillers and cappers are integral to the primary packaging process, enabling accurate filling and sealing of syringes to prevent contamination and ensure drug stability. Pharmaceutical companies have focused on enhancing packaging integrity and traceability as part of overall drug safety strategies.

Innovations in primary packaging materials and formats have further increased the complexity of filling and capping operations, making robotic automation a necessity. As primary packaging standards evolve, the segment is expected to sustain its leading position in the market.

The robotic aseptic syringe filler capper market has received a lot of traction in the industry. It has been long anticipated that robotics will be introduced in packaging lines due to the flexibility, affordability, and adaptability offered by robotics systems.

Since pharmaceutical and medical manufacturers require complex equipment, robotics provides more prominent adaptability, minimizes human interaction with packaging machines, improvements in quality control, and efficient operations, and improved operator safety.

A major driving factor of the robotic aseptic syringe filling and capping market is the increased need for highly repeatable and reproducible packaging systems that prevent contamination. Furthermore, minimizing safety hazards for patients and operators is also driving the demand for robotic aseptic syringe fillers/cappers, along with sterile drug requirements and easy programmability of the robots.

Despite the initial production cost being comparatively higher than the traditional system of filling syringes, there is potential for growth in the robotic aseptic syringe filler/capper market due to the growing demand for highly sterile and less error-prone systems.

The integration of robotics into the packaging system is itself a trend in this market, as many industries are incorporating robot systems into their packaging lines to improve efficiency.

Among the five regions, North America dominates the global robotic aseptic syringe fillers/cappers market in terms of demand generation, capturing 23% of the market share, followed by Europe, which accounted for 36%.

In the Asia Pacific region, the market for robotic aseptic syringe fillers is still in its niche stage, but it is expected to expand in the forecast period due to a growing working population in the Indian and Chinese economies. In the USA, demand for robotic aseptic syringe fillers/cappers is expected to gradually rise over the forecast period.

Startups in the global membrane filter cartridge market are adopting new techniques to boost efficiency to ensure the equipment's stable operation. Automation and control technologies are always evolving and startups are trying to keep up with this trend. The availability of new technologies for detecting and acquiring parts creates new opportunities for product handling and allows systems to run more efficiently.

For example, It has been announced ESS Technology, the industry leader in audio converters and analogue design, will launch the ES8018 SABRE® Smart Power-Amplifier (SPA), a device designed to improve the audio quality and efficiency of smartphones, tablets, Bluetooth speakers, and watches. With a voltage-tripling capacitive boost that generates three times the battery supply without using an inductor, the ES8018 combines major advances in amplifier design with advanced speaker-protection algorithms.

Some of the leading companies operating in the global robotic aseptic syringe filler capper market include ESS Technologies Inc. (USA), Steriline Srl (Italy), Vanrx Pharmasystems Inc. (Canada), AST Inc. (USA) and Staubli Corporation (USA), Marchesini Group SpA (Italy).

There have been many industries that have incorporated robot systems into their packaging systems to maximize efficiency in the packaging process. This is itself a trend for this market as a number of industries are incorporating robot systems into their packaging lines to maximize output.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

End-User, Application, Packaging Type, Region |

| Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; Asia-Pacific; Japan; Middle East and Africa |

| Key Countries Profiled |

United States of America, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, Poland, Australia, New Zealand, China, India, Japan, GCC Countries, South Africa, North Africa |

| Key Companies Profiled |

ESS Technologies Inc. (USA); Steriline Srl (Italy); Vanrx Pharmasystems Inc. (Canada); AST Inc. (USA); Staubli Corporation (USA); Marchesini Group SpA (Italy) |

| Customization | Available Upon Request |

The global robotic aseptic syringe filler capper market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the robotic aseptic syringe filler capper market is projected to reach USD 4.1 billion by 2035.

The robotic aseptic syringe filler capper market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in robotic aseptic syringe filler capper market are pharmaceuticals market, healthcare market and food and beverage market.

In terms of application, drug manufacturing segment to command 33.8% share in the robotic aseptic syringe filler capper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotic Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Robotic Assisted Endovascular Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic Catheterization Systems Market Growth – Innovations, Trends & Forecast 2025-2035

Robotic Vision Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

Robotic Biopsy Devices Market Insights - Trends & Forecast 2025 to 2035

Robotic Palletizers & De-Palletizers Market Growth - Forecast 2025 to 2035

Robotic Vacuum Cleaners Market Growth - Trends & Demand from 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Robotics Prototyping Market Trends - Growth & Forecast 2025 to 2035

Robotic Process Automation Market by Component, Operation, Industry & Region Forecast till 2025 to 2035

Competitive Landscape of Robotic Vacuum Cleaner Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA