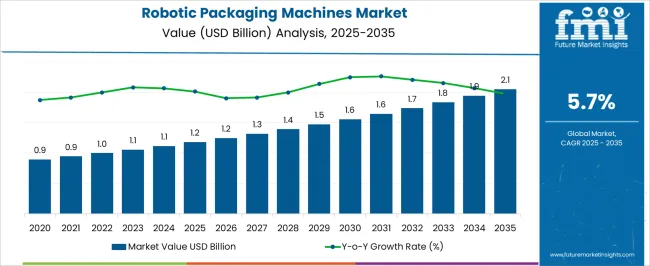

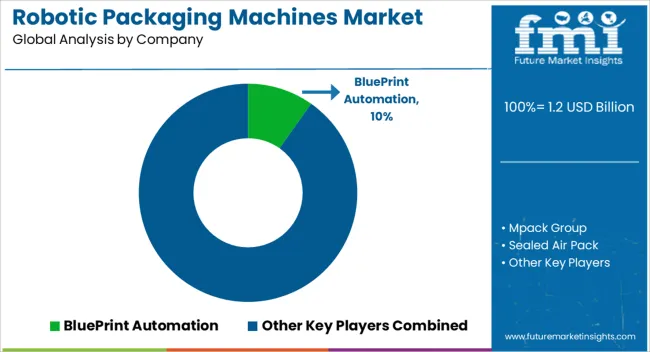

The Robotic Packaging Machines Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Robotic Packaging Machines Market Estimated Value in (2025 E) | USD 1.2 billion |

| Robotic Packaging Machines Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The robotic packaging machines market is advancing steadily, driven by the increasing adoption of automation across the packaging industry. Manufacturing companies have prioritized robotic systems to achieve higher precision, reduce labor dependency, and improve production efficiency. Industry publications and company press releases have highlighted growing investments in robotics for packaging lines, particularly as consumer demand for flexible packaging formats rises. Food and beverage manufacturers have been among the largest adopters, seeking to enhance throughput and maintain stringent hygiene standards.

Additionally, the integration of advanced vision systems, AI-based motion control, and predictive maintenance features has made robotic packaging machines more reliable and adaptable to diverse product categories. Investor reports have indicated strong capital allocation toward automation in response to workforce shortages and rising labor costs.

Looking ahead, market growth is expected to accelerate with continued advancements in collaborative robots, modular packaging systems, and IoT-enabled monitoring, ensuring operational agility. The expansion of the snacks category, high-speed packaging capacities, and multi-robot systems will be central to driving segmental leadership in the years ahead.

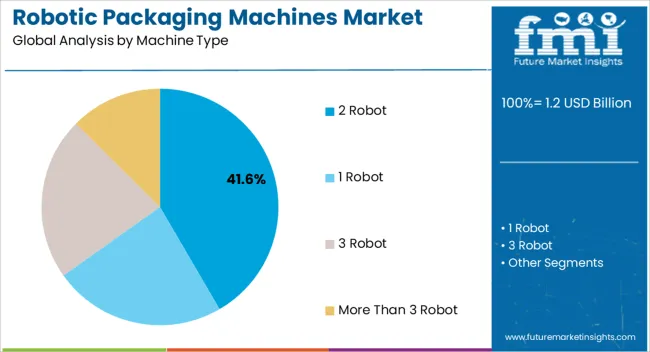

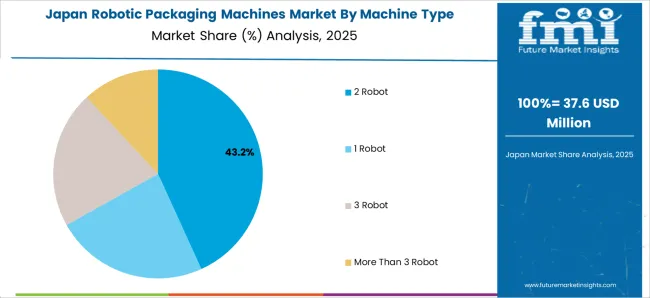

The 2 Robot segment is projected to account for 41.60% of the robotic packaging machines market revenue in 2025, sustaining its leadership in machine type adoption. This growth has been supported by the segment’s ability to balance speed, flexibility, and cost efficiency. Packaging lines with 2 robots have been favored by manufacturers as they provide optimized performance for mid-to-high volume operations without the complexity of multi-robot configurations.

Reports from automation system suppliers have underscored that 2 robot setups offer enhanced synchronization and allow parallel operations such as picking, placing, and sealing, thereby improving cycle times. Additionally, the modular nature of these systems has enabled easier integration into existing production lines.

With industries increasingly requiring versatility in handling different package sizes and materials, the 2 Robot segment has maintained strong demand, ensuring a competitive balance between scalability and affordability.

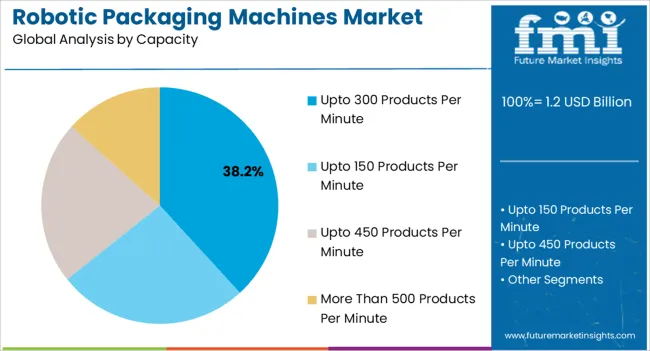

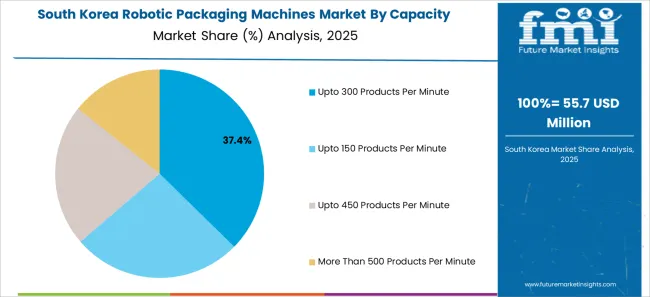

The Upto 300 Products Per Minute segment is projected to capture 38.20% of the robotic packaging machines market revenue in 2025, establishing itself as the preferred capacity range. This dominance has been driven by its suitability for medium-to-large scale operations, particularly in the food and beverage sector where consistent, high-speed packaging is critical. Industry reports have indicated that machines in this capacity range achieve strong throughput while maintaining accuracy in product handling and packaging.

Manufacturers have chosen this category to optimize production without incurring the higher costs associated with ultra-high-speed systems. Furthermore, technological improvements in robotic arms, sensors, and vision-guided systems have enhanced the precision and reliability of packaging at this speed range.

The segment’s position has also been reinforced by its alignment with the operational requirements of companies balancing volume efficiency with cost control, ensuring steady adoption across diverse packaging applications.

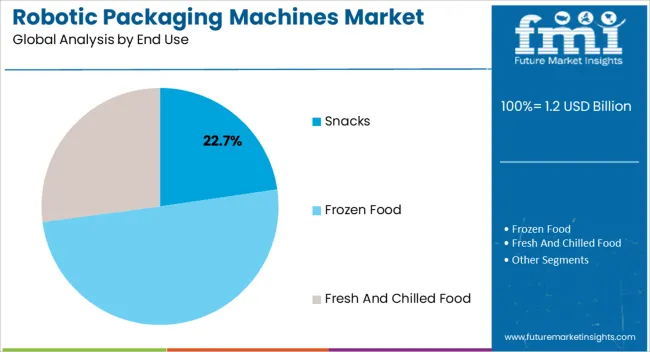

The Snacks segment is projected to account for 22.70% of the robotic packaging machines market revenue in 2025, positioning itself as the leading end-use category. Growth in this segment has been supported by the rising consumption of packaged snack products worldwide, driven by lifestyle changes and demand for convenient, ready-to-eat foods. Snack manufacturers have prioritized robotic packaging systems to manage high-volume production, ensure consistent packaging quality, and meet strict hygiene requirements.

Press releases and industry journals have noted that robotics has been particularly effective in handling lightweight and varied snack products, which require precision and gentle product handling. Additionally, the increasing product diversification within the snack industry, including portion-controlled packs and resealable formats, has necessitated flexible robotic solutions.

With global snacking trends continuing to grow and companies investing in faster, more adaptable packaging systems, the Snacks segment is expected to sustain its leadership in end-use adoption of robotic packaging machines.

As per Future Market Insights (FMI), global sales of robotic packaging machines increased at around 4.2% CAGR during the historic period between 2020 and 2025. Total market value grew from USD 0.9 million in 2020 to USD 1.2 million in 2025.

The worldwide robotic packaging machines industry is set to progress at 6.0% CAGR during the assessment period. By 2035, the global robotic packaging machines market size is projected to reach USD 1,888 million.

| Historical CAGR (2020 to 2025) | 4.2% |

|---|---|

| Forecast CAGR (2025 to 2035) | 6.0% |

The global robotic packaging machines industry is expected to thrive rapidly during assessment. This is due to growing adoption of automation in packaging and other sectors.

In recent years, automation has gained momentum in various sectors, including packaging. As businesses seek to improve efficiency, reduce labor costs, and enhance product quality, robotic packaging machines have become a preferred solution to streamline packaging processes.

Robotic packaging machines use robotic arms to perform a variety of packaging tasks. These include picking and placing products, palletizing, loading and unloading, and labeling.

Robotic packaging machines are gaining immense traction across food & beverage, pharmaceutical, logistics, and other industries. This is because they offer benefits like increased productivity, improved safety, reduced labor costs, and improved accuracy. High adoption in these industries will boost the market.

Advances in robotics technology, including sensors, AI, machine learning, and human-robot collaboration capabilities, are significantly improving the performance and versatility of robotic packaging machines. These advancements are opening up new possibilities for automation in packaging operations.

The packaging sector is experiencing consistent growth due to rising consumer demands and the expansion of food & beverage, pharmaceuticals, cosmetics, and e-commerce sectors. As the need for efficient and reliable packaging solutions increases, so will the demand for robotic packaging machines.

Growing environmental concerns are prompting companies to seek more sustainable packaging solutions like robotic packaging machines. These machines optimize material usage, reduce waste, and support eco-friendly packaging materials.

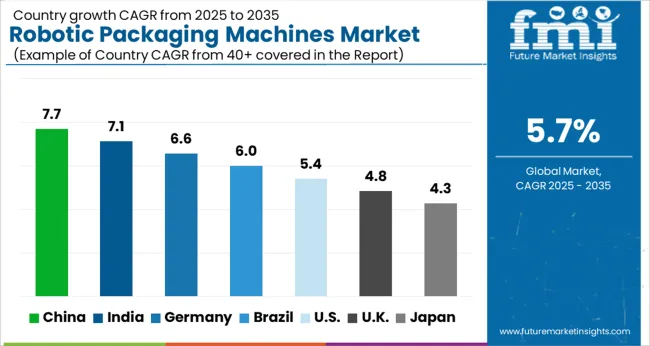

The table below highlights key countries’ market value. The United States, China, and Japan are the three key markets for robotic packaging machines, with projected valuations of USD 2.1 million, USD 176.76 million, and USD 170.60 million, respectively, in 2035.

Countries United States United Kingdom ASEAN China Japan South Korea

| Countries | Market Value (2035) |

|---|---|

| United States | USD 2.1 million |

| United Kingdom | USD 107 million |

| ASEAN | USD 92.9 million |

| China | USD 176.76 million |

| Japan | USD 170.60 million |

| South Korea | USD 90.77 million |

Below table shows the expected robotic packaging machines market shares of five countries. The United States, China, and Japan are set to hold prominent shares of 16.2%, 9.4%, and 9.0%, respectively, by 2035.

| Countries | Market Share (2035) |

|---|---|

| United States | 16.2% |

| Brazil | 3.3% |

| China | 9.4% |

| ASEAN | 4.9% |

| Germany | 5.7% |

| United Kingdom | 5.7% |

| Russia | 2.7% |

| Japan | 9.0% |

Below table shows the estimated robotic packaging machines market growth rates of top five countries. The United Kingdom, Japan, and the United States are set to experience higher CAGRs of 9.9%, 7.4%, and 6.0%, respectively, through 2035.

| Countries | Projected Robotic Packaging Machines Market CAGR (2025 to 2035) |

|---|---|

| United States | 6.0% |

| United Kingdom | 9.9% |

| China | 5.7% |

| Japan | 7.4% |

| South Korea | 4.1% |

The United States robotic packaging machines market size is projected to reach USD 2.1 million by 2035. Over the forecast period, robotic packaging machine market demand in the country is set to increase at 6.0% CAGR.

As per the latest analysis, the United States will likely lead the global robotic packaging machines market during the forecast period. This is attributable to rising adoption of automation and robotics and growing focus of industries on improving productivity.

Industries across the United States, such as food & beverages and pharmaceuticals, increasingly employ robotic packaging machines due to their high speeds and precision. These machines can significantly increase production throughput and efficiency.

The booming manufacturing sector is expected to improve the market share of the United States robotic packaging machines through 2035. This is because these automated packaging machines are often used in manufacturing.

Japan robotic packaging machines market is anticipated to thrive at 7.4% CAGR through 2035. It is set to reach a valuation of USD 170.60 million by 2035. This is attributable to increasing adoption of automation and robotics in Japan.

Japan has been a pioneer in developing and deploying collaborative packaging robots, which are designed to work safely alongside human operators. Cobots can handle tasks like pick-and-place, sorting, and packing in the packaging sector, enhancing overall efficiency and flexibility.

Robotics in Japan has been increasingly incorporating artificial intelligence (AI) and advanced vision systems. AI-driven robotic packaging machines can optimize processes, adapt to changing conditions, and handle complex tasks more precisely. Vision systems enable robots to identify and manipulate items accurately, even in challenging environments.

The United Kingdom is set to hold a prominent share of the Europe robotic packaging machines market. This is due to increasing adoption of robotic packaging machines in the thriving packaging sector.

As per the latest analysis, the United Kingdom robotic packaging machines market is expected to total a valuation of USD 107 million by 2035. Over the forecast period, sales of robotic packaging machines in the country will likely soar at 9.9% CAGR.

Collaborative robots have been gaining popularity in the United Kingdom's packaging sector due to their ability to work safely alongside human operators. Cobots can handle tasks like pick-and-place, palletizing, and quality inspection, contributing to increased efficiency and worker safety.

The United Kingdom's packaging sector is diverse, catering to various products and market segments. Robotic packaging machines are becoming more flexible and customizable to accommodate different packaging formats and sizes, allowing manufacturers to respond to market demands more effectively.

China robotics packaging market value is predicted to total USD 176.76 million by 2035. Overall sales of robotic packaging machines in China will likely rise at 5.7% CAGR through 2035. This is attributable to rising adoption of robotics across industries.

China-based industries are rapidly installing robots and other automated machines, and this trend is expected to escalate further through 2035. For instance, robots are estimated to replace around 14 million in China alone, as per Oxford Economics. This will create lucrative growth opportunities for robotic packaging machine manufacturers.

The robust growth of e-commerce is another key factor fueling robotic packaging machine demand in China. E-commerce companies are using these machines to increase speed and efficiency of packaging operations significantly.

The e-commerce sector propels sales of FMCG packaging across China. This, in turn, is expected to create growth prospects for the robotic packaging machines industry in the country.

South Korea is forecast to experience a CAGR of 4.1% during the assessment period. Total market valuation in the country is anticipated to reach USD 90.77 million by the end of 2035. This is attributable to rising adoption of robotic packaging machines across several industries due to their flexibility.

Robotic packaging machines can be easily programmed to perform different packaging tasks. Their flexibility allows companies to quickly adapt to changing consumer demand. This primary factor drives their demand across China, and the trend will likely continue through 2035.

Below section shows the three robot segments dominating the market based on machine type. It is projected to progress at 8.5% CAGR between 2025 and 2035.

Based on end use, frozen food segment is set to hold a prominent market share. It will likely exhibit a CAGR of 6.6% during the forecast period.

| Top Segment (Machine Type) | 3 Robot |

|---|---|

| Projected CAGR (2025 to 2035) | 8.5% |

Based on machine type, the 3-robot machine segment is expected to thrive at a robust CAGR of 8.5% during the forecast period. This is due to rising adoption of 3 robot machine types across diverse industries.

3 robot machine systems enable a higher level of automation and throughput than single or dual-robot setups. With three robots working in tandem, the production line can handle multiple tasks simultaneously, such as picking, placing, and packaging different items. This increased automation leads to higher production rates and shorter cycle times.

Three-robot machine systems offer greater flexibility and versatility in handling various food products. Each robot can be programmed to perform specific tasks. This allows the production line to accommodate different product sizes, shapes, and packaging requirements without significant reconfiguration.

| Top Segment (End Use) | Frozen Food |

|---|---|

| Projected CAGR (2025 to 2035) | 6.6% |

Based on end-use, the frozen food segment is expected to hold a prominent market share of 17.0% by 2035. It is poised to exhibit a CAGR of 6.6% over the forecast period, creating a higher demand for robotic packaging machines.

Robotic packaging machines are designed to work at high speeds and can handle repetitive tasks with consistent precision. Robotic systems can significantly improve production efficiency and throughput in the fast-paced frozen food sector, where large quantities of products need to be processed and packaged quickly.

Frozen food products are often delicate and can be easily damaged during handling. Robotic packaging machines utilize advanced sensors and programming to handle products gently, minimizing damage risk and preserving frozen items' quality and appearance.

Robotic packaging machines integrated with inventory management systems can accurately track and manage frozen food inventory. This helps manufacturers maintain optimal stock levels and reduces the risk of overstocking or stockouts.

Leading manufacturers of robotic packaging machines are innovating to introduce advanced packaging solutions with enhanced features. They also implement facility expansions, mergers, collaborations, partnerships, agreements, and acquisitions to expand their customer base and global footprint.

Recent Developments in Robotic Packaging Machines Market

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 1,050 million |

| Projected Market Value (2035) | USD 1,888 million |

| Anticipated Growth Rate (2025 to 2035) | 6.0% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Units and CAGR from 2025 to 2035 |

| Segments Covered |

Machine Type, Capacity, End Use, Region |

| Key Countries Covered |

United States, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, GCC Countries, China, India, Australia |

| Key Companies Profiled | Mpack Group; Sealed Air Pack; Ishida Europe; GERHARD SCHUBERT GMBH; Theegarten-Pactec GmbH & Co. KG; Bradman Lake; Pattyn; IWK Verpackungstechnik GmbH; Cavanna Packaging USA Inc.; FUJI MACHINERY CO.,LTD.; Royal Houdijk; Delkor Systems, Inc; IMA Group; FOCKE & CO; Sacmi Group; ABRIGO SPA.; Cama Group; Clearpack |

The global robotic packaging machines market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the robotic packaging machines market is projected to reach USD 2.1 billion by 2035.

The robotic packaging machines market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in robotic packaging machines market are 2 robot, 1 robot, 3 robot and more than 3 robot.

In terms of capacity, upto 300 products per minute segment to command 38.2% share in the robotic packaging machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotic Assisted Endovascular Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic Catheterization Systems Market Growth – Innovations, Trends & Forecast 2025-2035

Robotic Aseptic Syringe Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Robotic Vision Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

Robotic Biopsy Devices Market Insights - Trends & Forecast 2025 to 2035

Robotic Palletizers & De-Palletizers Market Growth - Forecast 2025 to 2035

Robotic Vacuum Cleaners Market Growth - Trends & Demand from 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Robotics Prototyping Market Trends - Growth & Forecast 2025 to 2035

Robotic Process Automation Market by Component, Operation, Industry & Region Forecast till 2025 to 2035

Competitive Landscape of Robotic Vacuum Cleaner Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA