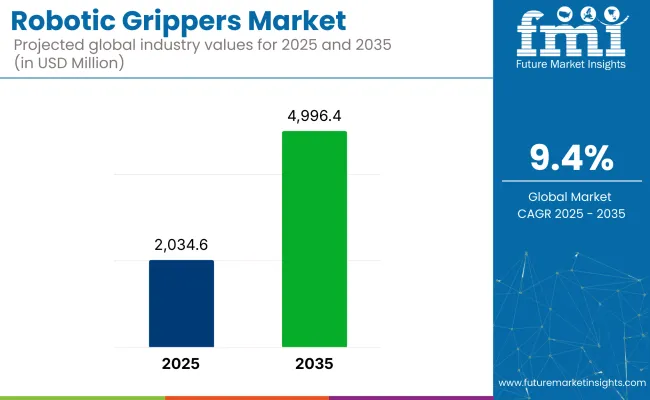

The robotic grippers market is set to experience significant growth between 2025 and 2035, driven by increasing demand for automation, precision handling, and advanced robotics across industries such as manufacturing, logistics, healthcare, and e-commerce. The market is expected to expand from USD 2,034.6 million in 2025 to USD 4,996.4 million by 2035, reflecting a CAGR of 9.4% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,034.6 million |

| Industry Value (2035F) | USD 4,996.4 million |

| CAGR (2025 to 2035) | 9.4% |

Robotic grippers are an essential part of robotic arms and production lines, enabling machines to take hold of, manipulate and place objects with high precision and efficiency. Increasing adoption of cobots (collaborative robots), AI-integrated robotic solutions, and soft grippers for gentle handling are driving the overall market growth.

Moreover, innovations in material science, sensor integration, and AI-powered adaptive gripping technologies are revolutionizing the efficiency, flexibility, and capability of robotic grippers rendering them a pivotal element in smart factories, automated warehouses, and medical robotics.

The increasing development of robotic systems across logistics, automotive assembly, food processing, and medical applications is creating a demand for intelligent grippers that provide increasing dexterity, force control, and multi-object handling. Advancements in soft robotics, AI-driven vision systems, and sensor-based feedback loops are likely to improve the precision, adaptability, and safety of grip.

Aiming to make manufacturing systems more adaptable and flexible for the production of large varieties of products, governments and industries around the world increasingly invest in industrial automation, smart manufacturing, and AI-driven robotics, thus expediting the deployment of next-generation robotic grippers with machine learning, real-time response, and Internet of Things (IoT) connectivity.

North America is a prominent market for robotic grippers due to higher manufacturing automation, advanced robotics development, and a high need for AI-powered robotic handling solutions. Operations across the United States and Canada are witnessing a quick embrace of collaborative robots, AI-based picking systems, and robotic grippers for e-commerce, aerospace, and automotive use cases.

As factories transition to smart factories and logistics automated, the need for multi-purpose adaptive robotic grippers with integrated force sensors and self-learning is at an all-time high. The growing adoption of robotic gripping systems in healthcare for surgery, rehabilitation, and pharmaceuticals handling is projected to create lucrative market opportunities.

Strong growth covers Europe as well, with Germany, France, the UK, and Italy leading the way as robotic automation, Industry 4.0 initiatives, and high-tech manufacturing are increasingly driving the demand for advanced gripping solutions. With the European Union focused on sustainable automation and precision engineering with the help of AI integrated robotic systems, smart gripping technologies are being developed to perform high precision tasks in an industrial environment.

Germany is a pioneer in robotics and industrial automation that drives evolution for next-generation robotic grippers in automotive production, semiconductor packaging, and heavy industry. Countries like the UK and France with medical robotics, AI-powered automation, and robotic-assisted surgeries focus on creating opportunities for intelligent, self-adaptive gripping solutions.

The Asia-Pacific region is the fastest-growing market during the forecast period because countries such as China, Japan, India, and South Korea are one of the largest manufacturers of robots in terms of supply and demand, logistics automation, and the establishment of smart factories. Demand for innovative robotic gripping solutions is fuelled by the region's increasing industrial base, growing investment in AI-enabled robotics, and the rapid adoption of warehouse automation.

As China invests in everything from industrial automation to e-commerce fulfillment centers to AI-powered robotic systems, demand is rapidly accelerating for high-speed, adaptive robotic grippers. The market is further being spurred on by growth in logistics, pharmaceuticals, and food packaging in India.

Robotic also collaborated with high-tech nations such as Japan and South Korea to hone their advanced manufacturing skills at precision robotics, machine vision, AI-driven automation, and semiconductor assembly-all of which are further connected to robotic grippers that can learn on their own using intelligent feedback control and improved object recognition.

Emerging markets such as Brazil, Mexico, Saudi Arabia, and South Africa are gradually expanding their industrial automation capabilities, leading to higher adoption of robotic grippers in logistics, food processing, and assembly lines. Demand for high-performance gripping solutions is fueled by the Middle East’s focus on smart manufacturing, robotics in oil & gas, and AI-driven industrial processes.

Trends in the growing e-commerce markets of Latin America, especially Brazil and Mexico, are contributing to the adoption of robotic picking and packing systems, creating the need for fast, accurate robotic grippers. Industrial automation, mining, and energy solution growth in Africa is also increasing the demand for robust high-load gripping solutions for robotics.

Challenges

High Costs of Advanced Robotic Systems

Advanced robotic grippers employing AI-based force control, sensors, and dynamic adaptation must invest heavily in R&D, high-end materials, and complex code. For small and medium-sized enterprises (SMEs) seeking to implement robotic gripping technologies, initial installation costs, programming needs, and maintenance costs present financial obstacles.

Furthermore, connecting robotic grippers to current automation systems demands custom integration and interoperability solutions and operator training, leading to a higher time and cost investment.

Limited Dexterity & Handling Flexibility

Despite advancements, robotic grippers still face challenges in handling objects of varying sizes, textures, and fragility with human-like dexterity. While soft robotics and AI-powered gripping technologies support enhanced adaptability, achieving precision motor control and fine adjustments in real-time is challenging in mass production and delicate object handling.

Sectors such as surgical robotics, semiconductor handling, and food processing that necessitate customized, sensitive gripping capabilities continue to drive demand for highly engineered gripping solutions.

Opportunities

Advancements in the technology of AI, Machine Learning & Sensor Integration

AI-enabled machine learning, sophisticated force sensors, and real-time computer vision are revitalizing robotic gripping capabilities. AI-enabled grippers assess the shapes, textures, and weights of an object in real-time, adapting their grip for optimal efficiency and minimal damage.

A smart, self-learning gripper with AI-based adaptability, cloud connectivity, and real-time process optimization will give these manufacturers the edge in precision automation.

Growth in E-Commerce & Warehouse Automation

Robotic gripper systems that are fast, efficient, and intelligent are in demand due to the rapid growth of e-commerce, automated fulfillment centers, and logistics robotics. In warehouses using artificial intelligence for sorting, robotic picking and packing, and automated distribution centers, multi-object gripping systems must perform quickly while detecting errors.

As contactless fulfillment, drone deliveries, and robotic parcel sorting have taken off, the demand for ultra-fast, adaptive gripping technologies is soaring throughout global supply chains.

Expansion of Robotics in Healthcare & Food Processing

Robotic grippers are playing an increasing role in medical applications, from robotic-assisted surgeries and prosthetics to automated drug handling and rehabilitation systems. Soft robotic grippers with biocompatibility and delicate force control are in growing demand in the fields of healthcare and pharmaceuticals.

In food processing, robotic grippers use hygienic, FDA-compliant materials and advanced texture recognition capabilities to improve automated food packaging, quality control, and portioning processes.

The robotic grippers market experienced significant growth from 2020 to 2024, fueled by increasing automation in the manufacturing, logistics, healthcare, and e-commerce industries. This led to the widespread adoption of advanced robotic systems, which could handle more complex materials with speed and precision.

Moreover, advances in soft robotics, AI-based gripping mechanisms, and increased adoption of collaborative robots (cobots) further stimulated market growth. The COVID-19 pandemic spurred automation in several different sectors, driving further growth in the market.

Looking ahead to 2025 to 2035, trends like gripping technologies integrated with adaptive and AI systems, material innovations focusing on sustainability, and expansion into emerging markets like food processing, pharmaceuticals, and space exploration are anticipated to revolutionize the collaborative robotics market. The merging of smart sensors, cloud computing, and predictive analytics will enable new capabilities and enhance efficiency in robotic gripping solutions.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Standards for safety of robotic systems in non-industrial applications. |

| Technological Advancements | Introduction of soft robotics and AI-driven force-sensitive grippers. |

| Industry-Specific Demand | Very strong demand in the automotive, electronics and logistics. |

| Sustainability & Circular Economy | Transition to energy-efficient and recyclable gripping materials. |

| Market Growth Drivers | Growing labor shortages, need of accurate material handling and automation rise |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Tougher governance of AI, data privacy, and sustainability and stricter workplace safety standards for human-robot collaboration. |

| Technological Advancements | AI-based self-learning grippers and cloud-based analytics implement operational intelligence. |

| Industry-Specific Demand | Expansion into food processing, pharmaceuticals, aerospace, and space automation requiring specialized gripping solutions. |

| Sustainability & Circular Economy | Mass usage of compostable materials and energy-absorbing technologies, minimizing carbon footprints and material waste. |

| Market Growth Drivers | Factory is getting smarter, everyone is collaborating with everyone (humans with robots and vice versa), and next-gen AI-based robotics create a need for a gripper. |

The United States robotic grippers market is witnessing stable growth with investments in industrial automation, warehouse robotics, and smart manufacturing. The adoption of robotics in logistics and supply chain management, along with the push towards Industry 4.0, are major factors driving the market.

A major commercial force in the USA is the automotive sector, where manufacturers are introducing robotic grippers into their assembly lines to increase precision and improve factory productivity. Moreover, the growth of e-commerce is driving up the demand for robotic grippers in automated warehouses for picking, packing, and material handling. Market growth is further fueled by government support for advanced manufacturing technologies and research initiatives on AI-driven robotic solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

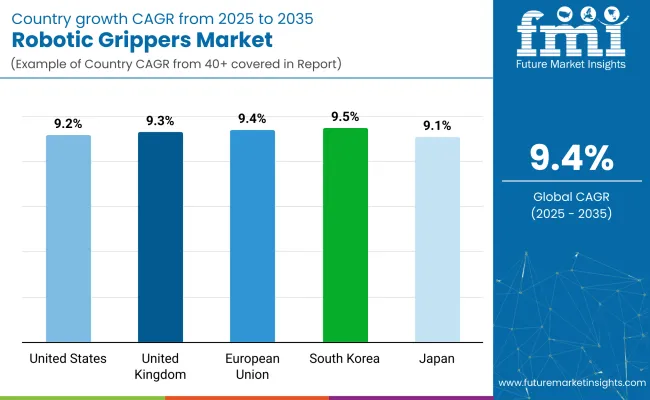

| United States | 9.2% |

UK robotic grippers market is anticipated to grow steadily in the coming years due to increasing demand for automation in manufacturing, logistics and healthcare. The need to develop more productive and efficient processes in industry has led organizations to robotize production processes.

The deployment of advanced robotic systems is being stimulated by the UK government’s focus on digital transformation and smart factories. The mating of collaborative robots (cobots) in small and medium-sized enterprises (SMEs) additionally supports market growth. Moreover, the growing precedence of programmable and adaptable grippers, particularly in food processing and pharmaceutical sectors, is also propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 9.3% |

Industrial automation, automotive and electronics manufacturing, and the presence of the main players in these industries are boosting the European Union robotic grippers market. Countries leading the charge on (largely fixed) robotics include Germany, France, and Italy, which have outfitted their advanced production facilities with grippers.

The region's shift towards sustainability and energy efficiency is fueling the demand for lightweight, low-energy-consumption robotic grippers. Moreover, the surge of robotic artificial intelligence and the various partnerships between research bodies and key market players are poised to encourage the development of gripping solutions. The increasing application of robotics in agriculture, healthcare, and precision manufacturing propels market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 9.4% |

Japan’s robotic grippers market is experiencing strong growth due to the country’s leadership in robotics, precision engineering, and industrial automation. Japan is still trendsetting in robotic gripping tech with a keen focus on both AI-driven automation and humanoid robotics.

High precision and adaptive grippers are increasingly sought after in the electronics, semiconductor, and automotive sectors. In Japan, investment in research and development of soft robotics, bio-inspired grippers, and intelligent material handling solutions is paving the way for innovation. Furthermore, growing market expansion is also attributed to the increasing use of robotic grippers in elder care and medical applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.1% |

South Korean robotic grippers market, backed by the country's strong foothold in electronics, semiconductor manufacturing, and smart factories, is anticipated to grow significantly. The industrial automation and AI-based robotics age is gearing up keeping the intelligent gripping solutions demand high.

The country’s automotive and electronics industries are the top adopters of robotic grippers, integrating them throughout highly automated production lines. Government initiatives undertaken by South Korea to foster smart manufacturing and automation technologies are additionally playing a role in transitioning the market. Furthermore, the increasing deployment of collaborative robots in the manufacturing and logistics sector is propelling the demand for dexterous and flexible robotic grippers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.5% |

Jaw grippers, including parallel and angular designs, dominate the robotic grippers market due to their adaptability in handling objects of varying shapes and sizes. These grippers have wide applications in industrial automation, including CNC machining, assembly lines, and packaging. These grippers that exhibit high repeatability, high grip force and good control are most suitable for the automotive, electronics and general manufacturing industries. Integrating smart sensors and machine learning algorithms is also improving the adaptability and safety of jaw grippers, enabling them to perform complex tasks in collaborative robotic environments.

Pressure grip sensing technology has kept driving demand in high-precision applications, including semiconductor manufacturing and aerospace engineering, among others, as it can detect and adjust gripping pressure, depending on the properties of the object. Automation has so far also reached art, and jaw grippers can be made even faster and more energy efficient with modularized and lightweight materials used in production lines.

Vacuum cup grippers are commonly used in industries where gentle handling of fragile and irregularly shaped objects is needed, including food processing, pharmaceuticals and electronics. Such grippers use suction to pick up and move items without being in contact with the device and, therefore, reduce the contact force while picking up objects, which minimizes the risk of damaging them. Improvements in vacuum technology, such as multi-zone and adaptive suction, are also helping make handling lightweight and eyeglass-fit fragile parts more efficient.

As e-commerce continues to grow and automated warehousing becomes prevalent, vacuum cup grippers enable rapid and dependable picking, packing, and sorting operations in material handling and order fulfillment operations. Moreover, vacuum grippers are also integrated with robotic arms at the end-user industries for handling the packages of varying sizes and weights in the logistics industries, assisting in the automation of supply chains. Meanwhile, new discoveries in soft robotics are now impacting vacuum gripper design so that they better adjust to a variety of materials, from soft, flexible objects to porous surfaces.

Robotic grippers have a top application segment in material handling, covering picking, placing, sorting, and transporting objects in both industrial and logistics environments. Industries are also increasingly adopting automated material handling solutions to improve productivity, decrease labor expenses, and increase workplace safety. From robotic grippers widely deployed in warehouses, manufacturing plants, and distribution centers that handle everything from raw materials to components to finished goods.

So, dynamic aerospace vehicles are open to consider evolving with smart factories featuring Industry 4.0 advancements leading to further developments in robotic grippers. AI-based vision systems and force-sensitive grippers also play an important integrating designer role for adaptability and precision. Moreover, it is increasingly being designed with predictive maintenance capabilities to minimize downtime and enhance operational efficiency in material handling applications.

Demand for automated gripping systems that can pick and pack thousands of items per hour with little error is also being driven by the growing demand for high-speed sorting and packing solutions in e-commerce fulfillment centers.

Applications in the general assembly, automotive manufacturing, electronics production, and consumer goods assembly industries rely on robotic grippers to interact with a wide range of components with accuracy and repeatability. Force and torque sensors allow grippers to manipulate fragile, complex, different-sized parts along assembly lines with fewer errors, making them more efficient.

The trend in lighter and more modular robotic grippers is further fuelling adoption in collaborative robot (cobot) applications, enabling human-robot interaction in dynamic production environments. As manufacturers continue to gravitate towards increased automation and product customization, robotic grippers are emerging as a linchpin in improving flexibility and operational efficiency in general assembly operations.

Moreover, industries are embedding the grippers with energy-efficient actuators and recyclable raw materials because sustainability has become the priority in modern industry, complying with the Increased production of electric vehicles and medical devices is contributing to the growing demand for highly specialized robotic gripping solutions.

The Robotic Grippers market is experiencing significant growth, driven by the increasing adoption of automation across industries such as manufacturing, logistics, healthcare, and e-commerce. Robotic grippers are the fingers of a robotic arm used to grip, hold, and manipulate objects. Growing adoption of artificial intelligence (AI), machine learning (ML), and collaborative robotics (cobots) to increase productivity and lower operational costs is expected to fuel demand for robotic grippers.

However, these companies are working on incredibly flexible, adaptable, and smart grippers capable of picking and placing great production materials and product shapes. Smart sensors and soft robotics technology are also revolutionizing the industry as robots can now handle complex and delicate tasks. Moreover, there is a growing demand for robotic solutions in warehouses and fulfillment centers to kick off investment in next-gen grippers for high throughout picking and packing applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SCHUNK GmbH & Co. KG | 18-22% |

| PIAB AB | 15-18% |

| Zimmer Group | 10-14% |

| OnRobot | 8-12% |

| Festo SE & Co. KG | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| SCHUNK GmbH & Co. KG | Provider of high-performance, precision robotic grippers adaptive, electric, and pneumatic robot grippers for industrial automation. |

| PIAB AB | Focuses on vacuum-based gripping solutions for packaging, logistics, and automotive markets. |

| Zimmer Group | Offers high-performance grippers featuring intelligent sensors and Internet of Things (IoT) connectivity for smart automation. |

| OnRobot | Centers on the collaborative robotic grippers, which can be used as a plug-and-play module, allowing seamless integration with existing systems. |

| Festo SE & Co. KG | Develops new soft robotic grippers and bionic gripping technology for delicate handling applications. |

Key Company Insights

SCHUNK GmbH & Co. KG

SCHUNK is a global leader in robotic grippers, offering advanced solutions for industrial automation. The company specializes in adaptive grippers, including electric and pneumatic models, which provide precision handling for a range of applications. SCHUNK continues to innovate with smart grippers that incorporate AI-driven force control, enhancing efficiency in high-speed manufacturing and assembly operations. The company is also expanding its portfolio to include modular gripping systems that offer greater flexibility for dynamic production environments.

PIAB AB

PIAB AB is one of the world's leading manufacturers within the vacuum-based gripping technology, PIAB develops high-performance products for industries including logistics, packaging, and automotive. Its vacuum grippers are commonly used in robotic pick-and-place applications, supporting companies in increasing productivity and lowering the cost of manual labor.

The grippers from PIAB use advanced sensor technology to minimize energy and power consumption. The firm is looking at AI predictive maintenance tools that can improve the reliability and uptime of automated handling systems.

Zimmer Group

Zimmer Group develops smart gripping systems while offering IoT connectivity and real-time observation potential. The company’s grippers are made for high-precision automation jobs, such as machining, assembly, and material handling.

Smart sensors are being integrated into Zimmer Group's grippers, letting robots tailor gripping forces to the characteristics of the object being gripped. Reinforcing automation without sacrificing sustainability Zimmer Group is looking to improve industry automation whilst maintaining sustainability through innovative solutions which are energy-efficient and durable in their grasping systems.

OnRobot

OnRobot specializes in collaborative robotic grippers that make automation easier for small and medium-sized enterprises (SMEs). The company's grippers are also known for their plug-and-play functionality, making them easy to integrate with a broad range of robotic systems. OnRobot’s product line features electric and vacuum grippers for pick-and-place, assembly and quality inspection applications. Its user-friendly designs and fast deployment have made the company a top supplier in cobot applications in many sectors.

Festo SE & Co. KG

Festo specializes in soft robotic gripping tech with bionic grippers that replicate the movements of human and animal features. These grippers are best suited for fragile goods like food items, pharmaceuticals, and electronics. Festo also has been pioneering bio-mechatronics research to develop flexible gripping solutions that conform to the shape and size of objects with little programming needed. The company remains, however, exploring novel material and design approaches to improve the versatility and dexterity of robotic gripping systems.

In terms of Product Type, the industry is divided into Jaw Grippers, Angular & 3-Jaw Grippers, Ring Grippers, Needle Grippers, Vacuum Cups, Magnetic Grippers, Special Purpose Grippers, and Others.

In terms of Application, the industry is divided into Material Handling, General Assembly, Inspection and Others.

In terms of End Use, the industry is divided into Automotive & Transportation, Electronics & Semiconductors, Food & Beverages, Chemicals & Pharmaceuticals, Logistics, Healthcare, and Others.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global robotic grippers market is projected to reach USD 2,034.6 million by the end of 2025.

The market is anticipated to grow at a CAGR of 9.4% over the forecast period.

By 2035, the robotic grippers market is expected to reach USD 4,996.4 million.

The Material Handling segment is expected to hold a significant share due to the growing automation in manufacturing industries, increasing demand for efficient pick-and-place systems, and advancements in robotic technology improving precision and adaptability.

Key players in the robotic grippers market include Schunk GmbH & Co. KG, Zimmer Group, SMC Corporation, OnRobot, Festo AG & Co. KG, Piab AB, PHD Inc., Weiss Robotics, Yaskawa Electric Corporation, and ABB Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotic Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Robotic Assisted Endovascular Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic Catheterization Systems Market Growth – Innovations, Trends & Forecast 2025-2035

Robotic Aseptic Syringe Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Robotic Vision Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

Robotic Biopsy Devices Market Insights - Trends & Forecast 2025 to 2035

Robotic Palletizers & De-Palletizers Market Growth - Forecast 2025 to 2035

Robotic Vacuum Cleaners Market Growth - Trends & Demand from 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Robotics Prototyping Market Trends - Growth & Forecast 2025 to 2035

Robotic Process Automation Market by Component, Operation, Industry & Region Forecast till 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA