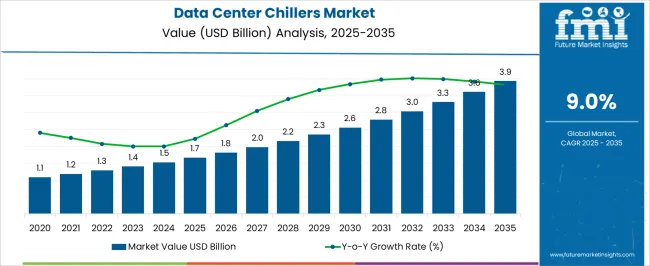

The data center chillers market, valued at USD 1.7 billion in 2025 and projected to reach USD 3.9 billion by 2035 at a CAGR of 9.0%, is strongly influenced by technology contributions across different cooling systems. The rising data traffic, expansion of hyperscale facilities, and higher energy efficiency demands are shaping the contribution of chiller technologies.

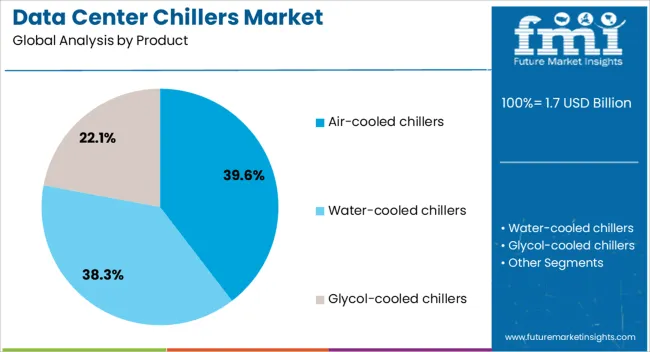

Traditional air-cooled chillers continue to hold a significant share due to their simpler installation, lower maintenance requirements, and adaptability in small to mid-sized facilities. Their cost-effectiveness ensures steady adoption, particularly in regions with limited water availability. The water-cooled chillers are contributing increasingly to the market, driven by their superior energy efficiency and suitability for large-scale and hyperscale data centers.

Their ability to handle high loads while maintaining consistent cooling performance makes them essential in dense server environments. Absorption chillers, though a smaller segment, are contributing niche value by leveraging waste heat recovery, appealing to operators seeking sustainable solutions. The contribution of technologies indicates a gradual shift from conventional air-cooled units toward water-cooled systems in advanced markets. Hybrid and modular chiller technologies, offering both scalability and energy efficiency, are expected to contribute more prominently over the forecast period, reflecting the industry’s transition toward environmentally efficient and performance-optimized cooling infrastructures.

| Metric | Value |

|---|---|

| Data Center Chillers Market Estimated Value in (2025 E) | USD 1.7 billion |

| Data Center Chillers Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The data center chillers market is viewed as an integral subset of thermal management solutions for digital infrastructure. It accounts for around 18.6% of the global data center cooling market, driven by the high cooling requirements of hyperscale and colocation facilities. In the precision air conditioning systems segment, a 7.9% share is assessed due to the need for consistent temperature regulation.

The wider HVAC equipment industry sees about 2.7% linked to data center chillers, while 3.2% is recognized in the IT infrastructure equipment market. Within industrial refrigeration, a 2.1% share is calculated, highlighting its overlap with specialized process cooling needs. Recent industry trends emphasize the transition toward liquid cooling and hybrid cooling systems that improve efficiency and reduce water consumption.

Groundbreaking developments have included magnetic bearing compressors, low-GWP refrigerants, and AI-controlled chiller optimization systems. Key players are adopting strategies centered on modular deployment for hyperscale expansion, alongside partnerships with cloud service providers to co-develop efficient thermal infrastructure. Energy reuse initiatives, such as using chiller waste heat for district heating, are gaining adoption in advanced markets. Furthermore, sustainability goals are pushing companies to integrate free cooling techniques and advanced heat recovery solutions to minimize their carbon footprint.

The data center chillers market is expanding steadily, driven by the rapid growth of global data traffic, rising cloud computing adoption, and the continuous establishment of hyperscale and colocation facilities. Increasing rack densities and higher computing loads are generating greater heat output, prompting the need for reliable, energy-efficient cooling systems to maintain optimal server performance and prevent downtime.

Market demand is being shaped by stringent environmental regulations, encouraging the deployment of chillers with lower global warming potential (GWP) refrigerants and advanced energy-saving features. Technological innovations in smart monitoring, variable speed compressors, and modular configurations are enhancing efficiency, scalability, and operational control.

Government-backed digital infrastructure initiatives and increased investments in edge data centers support regional growth. Over the forecast period, market expansion will be reinforced by the adoption of sustainable cooling technologies, integration with renewable energy sources, and the prioritization of operational resilience in mission-critical environments.

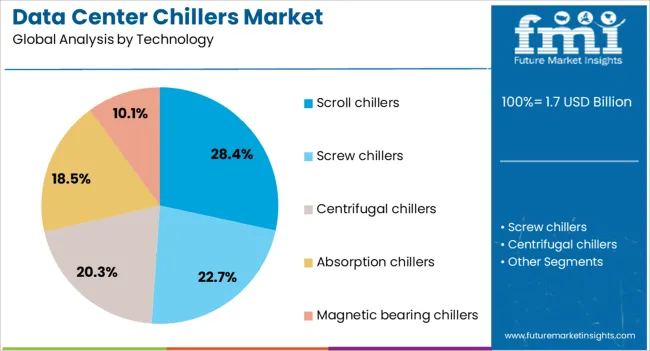

The data center chillers market is segmented by product, technology, power, and geographic regions. By product, data center chillers market is divided into Air-cooled chillers, Water-cooled chillers, and Glycol-cooled chillers. In terms of technology, data center chillers market is classified into Scroll chillers, Screw chillers, Centrifugal chillers, Absorption chillers, and Magnetic bearing chillers.

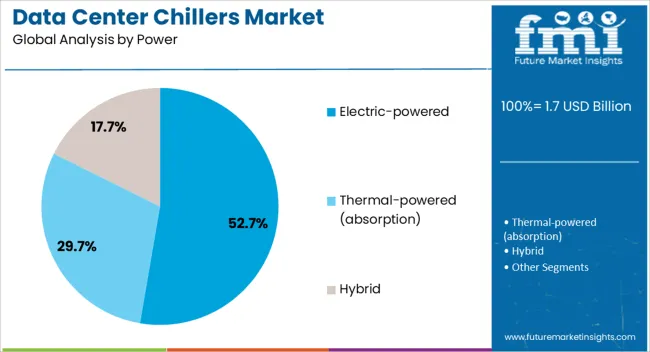

Based on power, data center chillers market is segmented into Electric-powered, Thermal-powered (absorption), and Hybrid. Regionally, the data center chillers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The air-cooled chillers segment, holding 39.60% of the product category, leads due to its simplified installation, lower water usage, and adaptability to diverse climatic conditions. This design eliminates the need for complex cooling tower systems, making it a preferred choice for data centers located in water-scarce regions or facilities seeking reduced maintenance requirements.

The segment’s dominance is supported by technological advancements such as variable-speed fan systems, free cooling capabilities, and improved heat exchanger designs that enhance energy efficiency. Furthermore, the ability to operate effectively in both small-scale and large-scale facilities has widened its adoption across different tiers of data centers.

Growing emphasis on sustainable cooling solutions is expected to strengthen the air-cooled chiller’s market position further.

The scroll chillers segment, accounting for 28.40% of the technology category, dominates due to its compact design, low noise levels, and suitability for small to medium-capacity cooling applications. These chillers offer high energy efficiency, especially under partial load conditions, and require less maintenance compared to some other compressor technologies.

Their modular design supports scalability, allowing operators to expand cooling capacity as data center demands grow. Enhanced refrigerant control systems and integrated digital monitoring tools are improving reliability and operational oversight.

The segment’s growth is reinforced by the rising adoption of distributed data center architectures, where multiple smaller cooling units are deployed to serve localized facilities.

The electric-powered segment, representing 52.70% of the power category, leads due to its alignment with the electricity-dependent infrastructure of data centers and compatibility with renewable energy integration. Electric-powered chillers offer precise temperature control, high operational efficiency, and reduced direct emissions compared to fossil fuel-powered alternatives.

Their dominance is bolstered by the global shift toward decarbonization and the increasing use of grid and on-site renewable power sources to run mission-critical equipment. Continuous advancements in electric motor efficiency, coupled with smart energy management systems, are enhancing performance while lowering operational costs.

The growing emphasis on green data center certification and energy efficiency compliance is expected to sustain this segment’s leadership in the market.

The market has developed into a critical enabler of modern computing infrastructure due to its role in maintaining optimal operating conditions for servers and networking equipment. With the exponential growth of cloud computing, hyperscale facilities, edge data centers, and AI workloads, the need for efficient cooling has become central to data center design.

Rising power densities, sustainability targets, energy efficiency regulations, and technological innovations in thermal management have shaped the market. Strategic importance has been placed on chillers that balance cooling capacity, reliability, and environmental performance, making them indispensable in global data infrastructure.

Stringent energy efficiency standards and sustainability goals are influencing the development of advanced data center chillers. Environmental regulations regarding greenhouse gas emissions and refrigerant usage have encouraged manufacturers to adopt ecofriendly refrigerants, variable speed compressors, and free cooling technologies. Operators are under pressure to reduce power usage effectiveness (PUE), and chillers with high energy efficiency ratings are gaining prominence. Demand for systems that integrate with renewable energy sources and water-saving cooling methods has also grown. The regulatory environment has therefore acted as a catalyst for innovation, prompting rapid adoption of low-impact and future-ready chiller solutions.

Continuous technological advancements are strengthening the market, with chillers now equipped with digital monitoring, smart controls, and predictive maintenance capabilities. Integration of IoT and AI-based analytics has enabled real-time adjustments for optimizing energy consumption and ensuring consistent cooling delivery. Liquid cooling compatibility and modular chiller designs are increasingly deployed to address varying data center sizes and operational requirements. These innovations have allowed operators to manage rising workloads efficiently while ensuring uptime. Advanced automation in chiller systems has improved reliability, minimized risk of thermal failures, and provided flexibility for scaling infrastructure in response to demand growth.

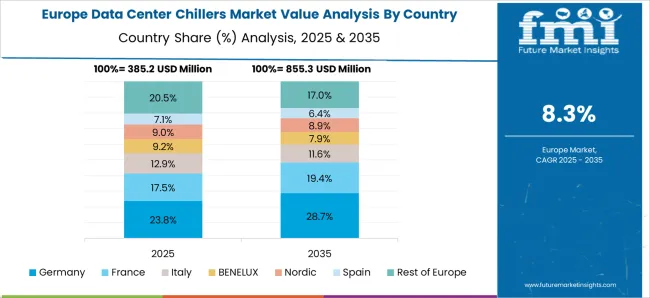

Global expansion of hyperscale facilities by major cloud providers and increasing deployment of edge data centers have created substantial demand for data center chillers. Hyperscale campuses require massive cooling capacities to sustain uninterrupted operations, while edge centers need compact and efficient cooling systems suitable for distributed networks. This dual growth trend has widened the product portfolio requirements, with manufacturers offering both high-capacity and compact modular units. Geographically, North America, Europe, and the Asia Pacific remain strong demand centers due to ongoing investments in digital infrastructure. This expansion has reinforced chillers as core assets for enabling modern data ecosystems.

Despite strong demand, the market faces challenges linked to high initial investment, operating costs, and competition among regional and global players. Raw material volatility and the complexity of chiller installation add to cost burdens. To address these challenges, companies are focusing on modular solutions, service contracts, and integration of energy-saving technologies to optimize the total cost of ownership. Competitive differentiation is increasingly based on lifecycle performance, customization, and energy savings rather than only upfront cost. Providers who combine advanced design, efficiency, and robust after-sales service are gaining a competitive advantage in this high-growth but cost-sensitive market.

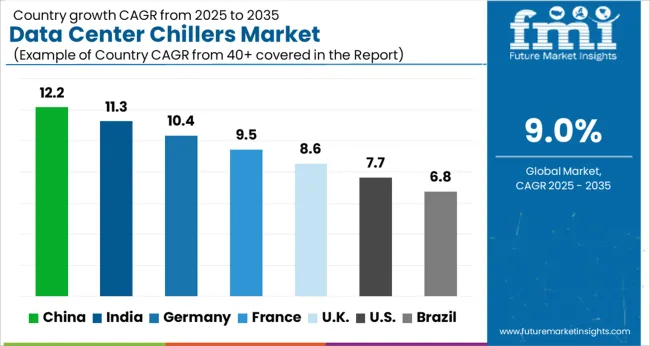

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

China recorded the highest growth in the market with a forecast CAGR of 12.2%, supported by large scale investments in hyperscale data centers and expansion of cloud computing services. India followed with 11.3%, where rising internet penetration and increasing deployment of colocation facilities boosted adoption. Germany accounted for 10.4%, driven by strict efficiency regulations and strong data security infrastructure requirements. The United Kingdom registered 8.6%, with demand influenced by edge data center development and digital transformation initiatives. The United States stood at 7.7%, sustained by modernization of existing facilities and increasing reliance on high performance computing. Together, these countries illustrate the central role of advanced cooling technologies in ensuring reliability and efficiency in global data center operations. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 12.2% in the market, supported by the rapid expansion of hyperscale facilities and government-backed digital infrastructure projects. With cloud adoption and AI-driven applications on the rise, data centers are scaling up, requiring efficient thermal management systems. Cooling efficiency has become a critical investment area as operators focus on minimizing energy consumption. Local manufacturers are introducing innovative chiller technologies with improved automation and IoT integration to meet operational demands. The country’s growing emphasis on green data centers is creating opportunities for liquid cooling and advanced chiller solutions.

India is forecasted to expand at a CAGR of 11.3% in the market, fueled by growing cloud service adoption, increased internet usage, and supportive government policies. Rising investments from global players in colocation and hyperscale facilities are intensifying demand for efficient cooling solutions. Operators are focusing on energy-efficient systems to manage costs while adhering to sustainability guidelines. Local climatic conditions with high ambient temperatures make reliable cooling infrastructure critical for operational continuity. With edge computing projects expanding in Tier II and Tier III cities, the adoption of modular and scalable chiller systems is expected to grow further.

Germany is expected to register a CAGR of 10.4% in the market, driven by rising data processing needs, strong digital transformation programs, and increasing cloud adoption. Stringent EU energy regulations are pushing operators to integrate advanced cooling technologies that ensure efficiency and compliance. Colocation facilities around Frankfurt and Berlin are expanding, creating strong opportunities for innovative chiller systems. Adoption of free cooling and hybrid technologies is gaining momentum, aimed at reducing power usage effectiveness (PUE). The German market outlook is supported by strong regulatory pressure, technological innovation, and the country’s position as a leading European data hub.

The United Kingdom is projected to grow at a CAGR of 8.6% in the market, shaped by rising demand for colocation services, financial sector digitalization, and cloud adoption. London continues to be a major hub, with data center construction fueling strong cooling system requirements. Operators are exploring energy-efficient and environmentally friendly solutions to align with sustainability goals. Integration of AI-enabled monitoring in chillers is becoming more common to optimize energy consumption. The UK market benefits from regulatory focus on efficiency, expansion of edge computing, and rising demand from banking and fintech-driven data processing needs.

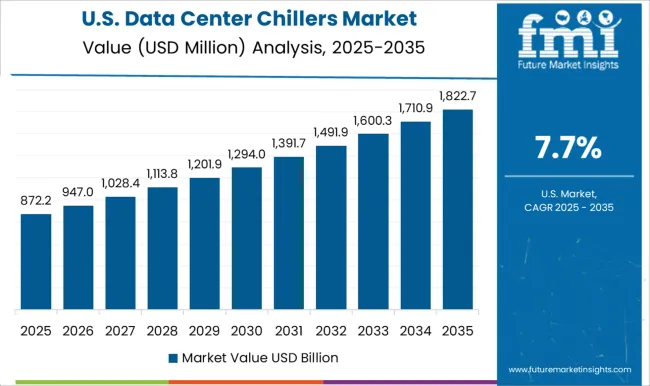

The United States is anticipated to record a CAGR of 7.7% in the market, supported by expansion in hyperscale projects, AI applications, and cloud service adoption. Colocation and enterprise facilities are investing in advanced cooling systems to handle rising workloads. Sustainability initiatives are pushing adoption of energy-efficient chillers and liquid cooling alternatives. The USA market is witnessing a shift toward modular cooling solutions to enhance scalability and reduce operational costs. Strong investments by technology giants and a competitive colocation ecosystem are expected to maintain steady demand growth for advanced chiller systems across the country.

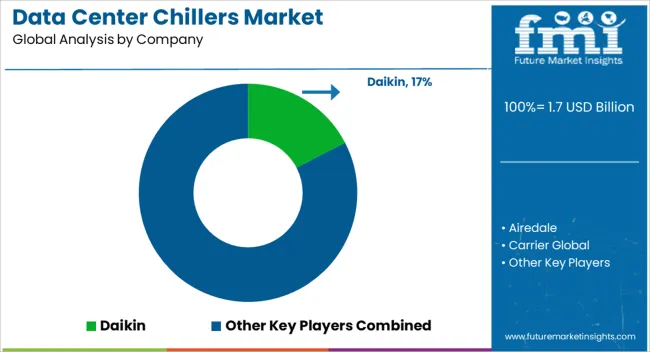

The market has gained notable attention as global data generation, cloud adoption, and digital transformation have created immense pressure on IT facilities to operate at higher efficiency levels. Chillers play a crucial role in maintaining optimal operating temperatures, reducing downtime risk, and ensuring the stable performance of servers and networking equipment. Daikin has been a dominant force in offering advanced chiller systems with energy-efficient designs that are widely deployed in hyperscale and colocation facilities. Airedale specializes in precision cooling solutions and modular systems that are increasingly preferred for edge computing environments. Carrier Global remains a well-recognized provider with a diversified portfolio of industrial-grade chillers designed to meet varying thermal loads in data centers.

Johnson Controls continues to drive adoption with integrated cooling and building management solutions aimed at maximizing operational efficiency. Mitsubishi Electric contributes by developing scalable cooling technologies that combine innovation with environmental efficiency, meeting the growing demand for sustainable infrastructure. Rittal has enhanced its position with integrated IT enclosures and cooling solutions that align with evolving data center architectures. Schneider Electric’s strong focus on infrastructure integration enables its chillers to work with power and management systems seamlessly. Stulz GmbH is widely respected for its expertise in precision climate control, particularly for mission-critical applications. Trane offers highly reliable cooling systems optimized for digital workloads, while Vertiv delivers thermal management solutions that integrate with power systems, reinforcing its stronghold in the data center ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Product | Air-cooled chillers, Water-cooled chillers, and Glycol-cooled chillers |

| Technology | Scroll chillers, Screw chillers, Centrifugal chillers, Absorption chillers, and Magnetic bearing chillers |

| Power | Electric-powered, Thermal-powered (absorption), and Hybrid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daikin, Airedale, Carrier Global, Johnson Controls, Mitsubishi, Rittal, Schneider, Stulz GmbH, Trane, and Vertiv |

| Additional Attributes | Dollar sales by chiller type and capacity, demand dynamics across hyperscale, colocation, and enterprise data centers, regional trends in digital infrastructure expansion, innovation in energy efficiency, liquid cooling, and modular design, environmental impact of power consumption and refrigerant use, and emerging use cases in edge computing and high-performance data centers. |

The global data center chillers market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the data center chillers market is projected to reach USD 3.9 billion by 2035.

The data center chillers market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in data center chillers market are air-cooled chillers, water-cooled chillers and glycol-cooled chillers.

In terms of technology, scroll chillers segment to command 28.4% share in the data center chillers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA