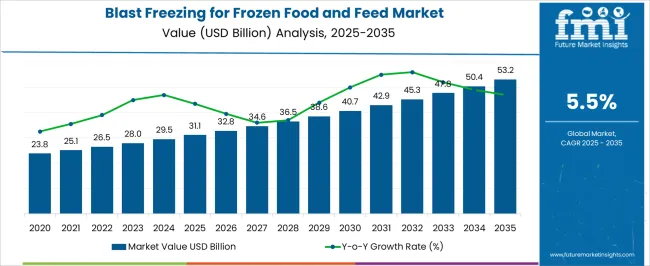

The blast freezing for frozen food and feed market is estimated to be valued at USD 31.1 billion in 2025 and is projected to reach USD 53.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

From 2025 to 2030, value is projected to rise from USD 31.1 billion to USD 40.7 billion, implying an absolute dollar addition of about USD 9.6 billion on a compounding base. Uptake is expected to remain strongest in poultry processing, seafood filleting, ready meals, bakery lines, and IQF fruits and vegetables, where drip loss reduction and glaze control protect texture integrity and product yield. Capacity is being anchored by tunnel and spiral freezers paired with carbon dioxide and ammonia systems, while HACCP and FSMA programs keep validation cycles tight. Energy management, belt sanitation, and uptime assurance are treated as non negotiable by retailers and commissaries that require repeatable throughput.

Blast freezing should be regarded as core cold storage infrastructure, not a discretionary add on, particularly for export oriented processors that target consistent shelf life. From 2030 to 2035, value is expected to widen to USD 53.2 billion, adding roughly USD 12.5 billion and holding trajectory near a 5.5 percent CAGR. A larger incremental pool is anticipated as installed bases mature and swap outs, retrofits, and aftermarket services claim a higher share of spend. Feed applications are set to contribute as aquafeed pellets and pet nutrition require rapid core temperature pull down to lock fat coatings and limit microbial risk. Regional dynamics should split between stable replacement cycles in North America and Europe and greenfield freezer rooms in Asia and the Middle East. Specifications emphasize airflow uniformity, faster pull down curves, clean in place routines, and hygienic design that reduces downtime. With disciplined maintenance and operator training, asset life is extended and payback windows remain defendable even where power tariffs vary by region.

| Metric | Value |

|---|---|

| Blast Freezing for Frozen Food and Feed Market Estimated Value in (2025 E) | USD 31.1 billion |

| Blast Freezing for Frozen Food and Feed Market Forecast Value in (2035 F) | USD 53.2 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

Within the overall frozen food market, blast freezing holds just over half of the freezing technology share, at about 53.2 %, reflecting its dominant role in that subcategory. In the frozen food processing machinery market, which covers equipment used across the sector, blast freezing contributes an estimated 60 % of the blast freezer-type machinery segment, showing its prominence among freezing equipment types.

Within the frozen food production market, which includes all production activities, the blast freezing component represents a smaller but important fraction, given its role in preserving a portion of frozen output. As for the individual quick freezing (IQF) market, blast freezing occupies a lesser share compared to IQF methods, meaning its percentage is notably lower than the IQF majority presence in that parent market. Finally, in the broader blast chillers and blast freezers market, blast freezing is a substantial par, but not all, accounting for a sizeable portion of that combined market. Collectively, these shares illustrate that blast freezing is central within freezing technology subsets and machinery categories but occupies a lesser share when compared to broader production and alternative rapid-freezing methods, highlighting its technical importance yet relatively modest footprint across all parent markets.

The market is experiencing significant growth, supported by the rising demand for rapid and efficient freezing technologies that preserve nutritional value and extend shelf life. Increasing consumer preference for high-quality frozen food products and the expansion of cold chain logistics have accelerated the adoption of blast freezing systems across various sectors.

In the food and feed industry, the ability to quickly freeze large volumes without compromising texture or taste has positioned this technology as a vital solution. Growing regulatory emphasis on food safety, alongside advancements in freezing equipment that enable energy efficiency and cost savings, is also shaping the market’s future trajectory.

Investments from manufacturers to integrate automation and real-time monitoring into freezing operations are further enhancing operational efficiency As global consumption of frozen products increases and businesses seek ways to reduce spoilage, blast freezing is expected to remain a cornerstone technology, driving continued expansion across both developed and emerging economies.

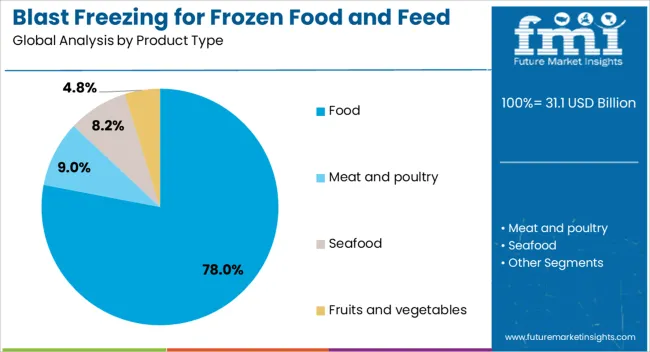

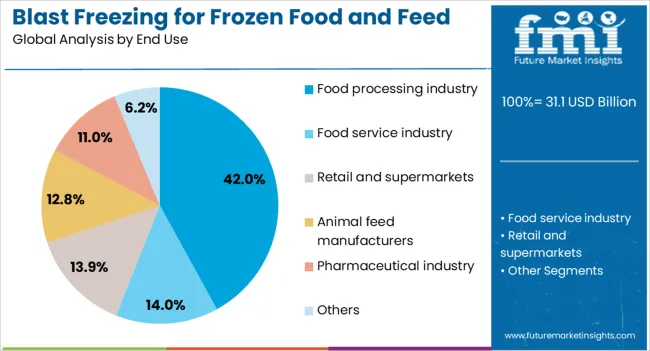

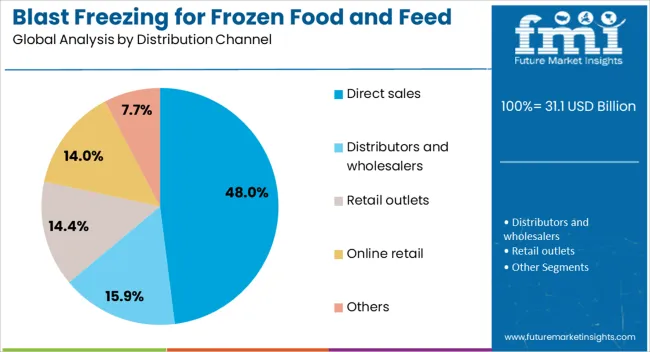

The blast freezing for frozen food and feed market is segmented by product type, end use, distribution channel, applications, and geographic regions. By product type, blast freezing for frozen food and feed market is divided into food, meat and poultry, seafood, fruits and vegetables, bakery products, dairy products, ready meals and convenience foods, others, and feed. In terms of end use, blast freezing for frozen food and feed market is classified into food processing industry, food service industry, retail and supermarkets, animal feed manufacturers, pharmaceutical industry, and others. Based on distribution channel, blast freezing for frozen food and feed market is segmented into direct sales, distributors and wholesalers, retail outlets, online retail, and others. By applications, blast freezing for frozen food and feed market is segmented into human consumption, animal consumption, and industrial applications. Regionally, the blast freezing for frozen food and feed industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food product type segment is estimated to hold 78% of the market revenue share in 2025, making it the dominant product category. This leadership position has been driven by the growing need to preserve the freshness, flavor, and nutritional profile of food items during storage and distribution.

Blast freezing technology enables the rapid lowering of temperature, which minimizes ice crystal formation and prevents cell damage, ensuring superior product quality upon thawing. The segment’s growth has been further reinforced by the rising global consumption of frozen meals, seafood, meat products, and bakery items that rely heavily on quick-freezing methods.

Food processors have increasingly adopted blast freezing systems to meet stringent safety regulations and quality standards The scalability of these systems allows both large-scale manufacturers and mid-sized producers to efficiently handle fluctuating demand while maintaining consistent quality, ensuring that the food segment continues to hold its dominant share in the overall market.

The food processing industry end use segment is projected to account for 42% of the market revenue share in 2025, positioning it as the leading end-use sector. This dominance has been attributed to the critical role blast freezing plays in industrial-scale production where large volumes of perishable goods require rapid preservation.

The technology’s ability to maintain product integrity during extended storage and transportation has made it indispensable for processors handling meat, seafood, dairy, and ready-to-eat products. Rising demand for convenient and long-lasting food products has prompted investments in advanced freezing equipment that offers higher throughput and energy efficiency.

Regulatory compliance requirements for food safety and hygiene have also accelerated adoption in processing plants The capability to integrate blast freezing systems with automated handling and packaging lines has further enhanced operational efficiency, supporting the segment’s leading position in the market and enabling consistent supply to domestic and international markets.

The direct sales distribution channel segment is anticipated to secure 48% of the market revenue share in 2025, establishing it as the top channel. This leadership has been driven by the preference among industrial buyers and large-scale processors for direct procurement from manufacturers, ensuring tailored solutions, after-sales support, and equipment customization.

Direct sales enable close collaboration between suppliers and end users, allowing for the integration of advanced features and maintenance services that align with specific operational requirements. The ability to negotiate favorable terms, receive prompt technical assistance, and benefit from long-term service agreements has further strengthened this channel’s appeal.

In addition, direct engagement with manufacturers fosters faster adoption of innovations such as energy-efficient designs and IoT-enabled monitoring systems As competition in the frozen food and feed industry intensifies, the reliability and operational assurance offered through direct sales are expected to sustain its dominance in the market.

The blast freezing for frozen food and feed market is expanding as industries prioritize quality preservation, longer shelf life, and compliance with international trade standards. Opportunities are strong in seafood, meat, and bakery exports, while trends emphasize automation, energy efficiency, and integration with packaging solutions. High installation costs, energy consumption, and competition from alternative freezing methods remain major hurdles. In my opinion, the most competitive players will be those able to deliver scalable, efficient, and cost-effective blast freezing systems that meet evolving global food and feed supply chain demands.

Demand for blast freezing in frozen food and feed has been accelerated by the need to preserve nutritional value, texture, and flavor over longer storage durations. This method ensures rapid temperature reduction, preventing large ice crystal formation that can damage cellular structure. Food producers, aquaculture firms, and meat processors are increasingly relying on blast freezers to maintain product integrity across extended supply chains. In my opinion, demand will remain strong as global trade and cold storage distribution networks continue to expand, making blast freezing an essential process for both premium and mass-market frozen goods.

Opportunities for blast freezing have become more pronounced in export-driven industries where product freshness is critical. Seafood, meat, and bakery segments are embracing the technology to meet international quality standards and regulatory compliance. Feed manufacturers are also finding opportunities in ensuring long shelf life and stable nutrient profiles through blast freezing. Regions with growing seafood exports, such as Asia-Pacific, are especially promising. I believe opportunities will be best captured by equipment manufacturers and processors that offer scalable, energy-efficient systems capable of meeting strict export requirements while ensuring cost competitiveness for diverse end users.

Trends in blast freezing highlight strong movement toward automation, energy efficiency, and integration with advanced cold storage solutions. Food processors are investing in tunnel and spiral freezers to handle larger volumes while minimizing energy use. Another trend is the combination of blast freezing with innovative packaging solutions that reduce thawing losses and improve consumer convenience. In my opinion, these patterns underscore the growing emphasis on efficiency and differentiation, with companies increasingly adopting process upgrades not only to reduce costs but also to build stronger trust in product quality across global retail and foodservice channels.

Challenges facing blast freezing adoption include high installation costs, significant energy requirements, and ongoing maintenance expenses. Smaller producers often struggle with the capital investment needed to upgrade facilities, limiting adoption to larger players. Rising energy costs can also reduce profitability, while compliance with strict food safety regulations adds operational complexity. Competition from alternative freezing methods such as plate or cryogenic systems creates additional market pressure. In my assessment, overcoming these challenges requires innovative equipment design, financial models that support smaller businesses, and long-term focus on optimizing operational efficiency in diverse production environments.

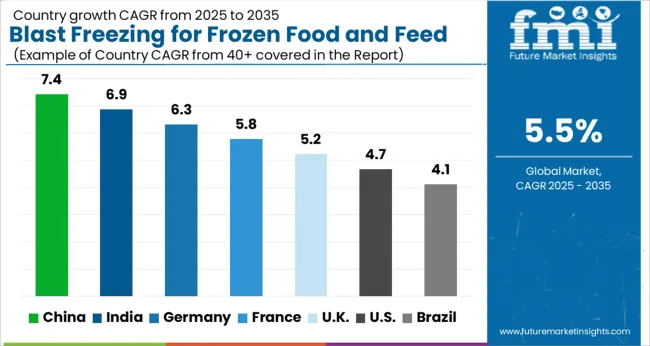

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global blast freezing for frozen food and feed market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China leads with a growth rate of 7.4%, followed by India at 6.9%, and France at 5.8%. The United Kingdom records a growth rate of 5.2%, while the United States shows the slowest growth at 4.7%. Growth in emerging markets is fueled by increasing industrial-scale food processing, rising demand for frozen and ready-to-eat products, and expanding cold chain infrastructure. Mature markets like the UK and USA maintain steady growth driven by technological upgrades, regulatory compliance, and rising consumer preference for high-quality frozen foods. Insights cover over 40+ countries, highlighting the leading markets.

The blast freezing market in China is projected to grow at a CAGR of 7.4%. Rapid expansion of the food processing industry and increasing demand for frozen seafood, meat, and convenience foods are primary growth drivers. Investments in cold storage and supply chain infrastructure improve product preservation and quality, accelerating adoption of blast freezing equipment. Government policies supporting modernization of food manufacturing units further enhance market growth. Rising consumer preference for safe, high-quality frozen food products and increasing exports of frozen food contribute to sustained demand for advanced freezing technologies.

The blast freezing market in India is expected to grow at a CAGR of 6.9%. Rising consumption of frozen food products, increasing industrial food processing, and growing cold chain networks are key factors supporting demand. Technological upgrades in freezing equipment and increasing awareness of food safety standards encourage adoption among manufacturers. The expanding organized retail sector and e-commerce platforms facilitate distribution and accessibility of frozen food products. Rising exports of frozen seafood and poultry products also drive the need for efficient blast freezing technologies, ensuring high-quality preservation during storage and transportation.

The blast freezing market in France is projected to grow at a CAGR of 5.8%. Demand is driven by consumer preference for frozen ready-to-eat meals, seafood, and meat products. Stringent food safety regulations and emphasis on quality preservation encourage manufacturers to adopt advanced freezing technologies. Retail expansion, including supermarkets and hypermarkets, and the rise of e-commerce enhance product distribution. Additionally, the increasing focus on minimizing food wastage and maintaining nutritional value through rapid freezing supports adoption. Ongoing investments in industrial-scale freezing infrastructure continue to create growth opportunities in the French market.

The blast freezing market in the United Kingdom is expected to grow at a CAGR of 5.2%. Increasing consumer demand for frozen meals, seafood, and bakery products drives adoption. Technological upgrades in freezing equipment ensure better preservation of texture, flavor, and nutritional content, encouraging manufacturers to implement advanced blast freezing systems. The expansion of modern retail chains and cold storage facilities improves distribution efficiency. Export demand for high-quality frozen food products further supports market growth. Ongoing focus on reducing spoilage and improving supply chain efficiency provides opportunities for manufacturers and service providers in the UK market.

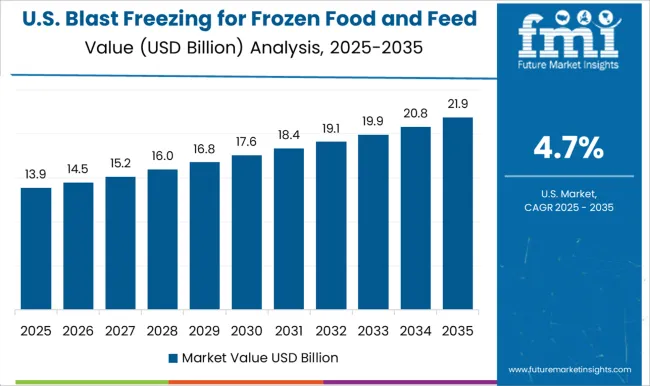

The blast freezing market in the United States is projected to grow at a CAGR of 4.7%. Steady demand for frozen food products, including meat, seafood, and bakery items, drives growth. Adoption of modern blast freezing technologies ensures product quality, shelf-life extension, and compliance with food safety regulations. Investments in cold chain logistics and automated freezing systems enhance operational efficiency in food processing facilities. Rising consumer awareness of convenience foods, coupled with the expansion of retail and foodservice channels, continues to support market expansion. While growth is slower than in emerging markets, stable demand ensures consistent adoption of blast freezing solutions in the USA

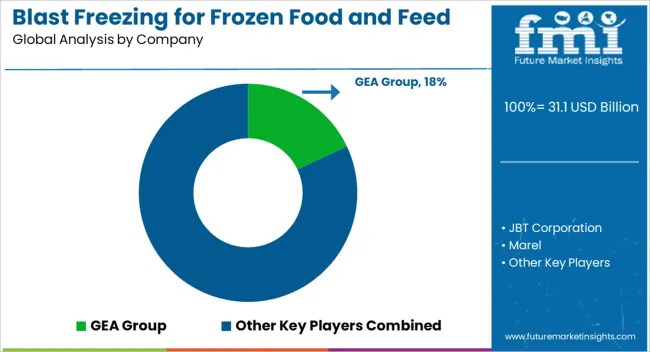

Competition in the blast freezing market for frozen food and feed has been shaped by leading equipment manufacturers that focus on precision engineering, throughput efficiency, and product quality. GEA Group has been recognized for its advanced refrigeration systems that integrate seamlessly with food processing lines, building a reputation for consistency and operational reliability. JBT Corporation has been directing its strategy toward modular blast freezers, giving processors flexibility in scaling operations without disrupting existing infrastructure. Marel has been gaining ground through automated freezing solutions tailored for poultry, seafood, and meat industries, where hygiene and consistency are paramount. BAADER Group has been positioning itself with integrated processing and freezing systems that appeal strongly to fish and seafood processors seeking end-to-end solutions. Alfa Laval has been applying its strength in thermal transfer equipment, offering highly efficient freezing systems supported by a wide network of service capabilities. Ali Group, through brands such as Friulinox and Hiber, has been delivering commercial blast freezing systems focused on catering and retail sectors, making inroads in smaller-scale applications. OctoFrost has been distinguishing itself through innovative airflow technology that ensures uniform freezing, gaining recognition from processors aiming to preserve product texture and reduce dehydration losses.

Competitive strategies among these players have been influenced by product differentiation, sector-specific expertise, and global distribution reach. GEA and JBT have been leveraging their engineering legacy to dominate large industrial freezing installations, while Marel and BAADER have been intensifying their focus on protein processing industries where integrated freezing systems provide measurable efficiency gains. Alfa Laval has been strengthening its presence by offering adaptable freezing solutions backed by strong after-sales support, ensuring reliability across multiple regions. Ali Group has been carving a distinct space by addressing the needs of hospitality and foodservice operators with smaller-scale but highly efficient blast freezers. OctoFrost has been building authority by marketing its energy efficiency and superior freezing quality as core differentiators, positioning itself as a specialized player rather than a broad-based equipment supplier. This dynamic competitive landscape has been shaped by technical performance, application-specific expertise, and customer preference for suppliers that deliver consistent quality with reliable service networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.1 Billion |

| Product Type | Food, Meat and poultry, Seafood, Fruits and vegetables, Bakery products, Dairy products, Ready meals and convenience foods, Others, and Feed |

| End Use | Food processing industry, Food service industry, Retail and supermarkets, Animal feed manufacturers, Pharmaceutical industry, and Others |

| Distribution Channel | Direct sales, Distributors and wholesalers, Retail outlets, Online retail, and Others |

| Applications | Human consumption, Animal consumption, and Industrial applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GEA Group, JBT Corporation, Marel, BAADER Group, Alfa Laval, Ali Group (brands: Friulinox, Hiber, etc.), and OctoFrost |

| Additional Attributes | Dollar sales by product type (batch vs continuous systems), Dollar sales by application (meat, seafood, bakery, pet feed), Trends in energy-efficient freezing and extended shelf life, Use in export-grade frozen logistics and cold chains, Growth in ready-to-eat meals and processed feed, Regional adoption patterns across Europe, North America, and Asia-Pacific. |

The global blast freezing for frozen food and feed market is estimated to be valued at USD 31.1 billion in 2025.

The market size for the blast freezing for frozen food and feed market is projected to reach USD 53.2 billion by 2035.

The blast freezing for frozen food and feed market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in blast freezing for frozen food and feed market are food, meat and poultry, _red meat (beef, pork, lamb), _poultry (chicken, turkey, duck), _processed meat products, seafood, _fish (whole, fillets, portions), _shellfish (shrimp, crab, lobster), _mollusks (squid, octopus, mussels), fruits and vegetables, _berries and fruits, _leafy vegetables, _root vegetables, _mixed vegetables, bakery products, _bread and rolls, _pastries and desserts, _pizza bases and dough, dairy products, _ice cream and frozen desserts, _cheese products, _other dairy products, ready meals and convenience foods, _complete meals, _appetizers and snacks, _ethnic and specialty foods, others, _herbs and spices, _sauces and condiments and feed.

In terms of end use, food processing industry segment to command 42.0% share in the blast freezing for frozen food and feed market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blasthole Drills Market Size and Share Forecast Outlook 2025 to 2035

Blast Chillers Market Size and Share Forecast Outlook 2025 to 2035

Glioblastoma Treatment Drugs Market Size and Share Forecast Outlook 2025 to 2035

Sandblasting Media Market Size and Share Forecast Outlook 2025 to 2035

Global Fibroblast-Derived Protein Market Size and Share Forecast Outlook 2025 to 2035

Shot Blasting Machine Market - Size, Share, and Forecast 2025 to 2035

Fibroblast Growth Factor Receptor (FGFR) Inhibitor Market - Growth & Forecast 2025 to 2035

Sand Blasting Machines Market Size and Share Forecast Outlook 2025 to 2035

Retinoblastoma Treatment Market Size and Share Forecast Outlook 2025 to 2035

Nephroblastoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Vapour Blasting Equipment Market Growth - Trends & Forecast 2025 to 2035

Abrasive Blasting Nozzles Market

Countertop Blast Chiller Market Size and Share Forecast Outlook 2025 to 2035

Human Osteoblasts Market – Growth & Forecast 2024-2034

Cell Freezing Media Market Size and Share Forecast Outlook 2025 to 2035

Brine Freezing Market Size and Share Forecast Outlook 2025 to 2035

Individual Quick Freezing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Individual Quick Freezing Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA